The USA pulses market is projected to reach a value of USD 8,295.9 Million in 2025, growing at a CAGR of 5.0% over the next decade to an estimated value of USD 13,513.2 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 8,295.9 million |

| Projected USA Industry Value in 2035 | USD 13,513.2 million |

| Value-based CAGR from 2025 to 2035 | 5.0% |

This gradual rise is the outcome of the consumers' preference for plant protein sources and the new usages of pulses in the manufacturing of food, drinks, and dietary supplements. Due to their high protein content, they are gaining popularity among the people who prefer to eat healthy, as well as the vegetarians and vegans, and they are contributing to the environmental concerns in the case of agriculture.

The most common pulses are chickpeas, lentils, yellow peas, and pigeon peas, and these are sometimes used in food products such as soups and snacks along with other protein-rich flours and meat substitutes.

The health of their functional benefits, such as high protein and fiber, low fat, and gluten-free are the key advances making them a suitable solution for the developers of modern food. The consumers' increasing knowledge about the health issues of eating pulses leads to the manufacturers' decamping of their product lines to include such pulses as a main ingredient in value-added and convenience-oriented products.

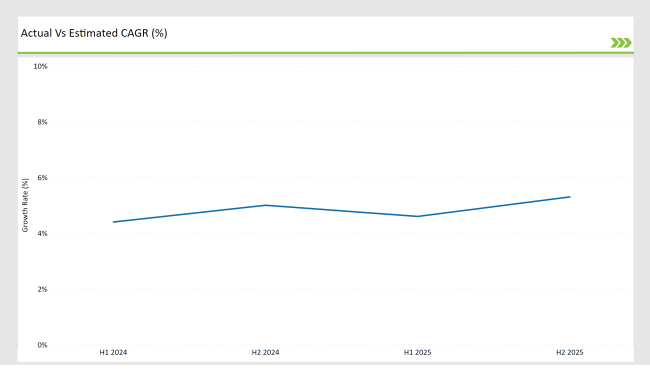

The table below shows the semi-annual growth trends for the USA pulses market, which has been steadily increasing in CAGR over the years. This analysis points out the market's resilience in the face of changing consumer preferences and global food trends.

H1 signifies period from January to June, H2 Signifies period from July to December

Semi-annual growth rates are due to increasing the uptake of pulses in mainstream diets and growing demand for clean-label, plant-based products. Innovation in applications of pulses in ready-to-eat meals, snacks, and beverages drive the market's steady expansion.

| Date | Development/M&A Activity & Details |

|---|---|

| February 25 | New Non-Dairy Creamer Line by Nestlé: Nestlé launched a new line of plant-based Pulses, featuring oat and almond bases, targeting health-conscious consumers seeking dairy alternatives. |

| March 24 | Danone's Acquisition of a Vegan Brand: Danone acquired a popular vegan brand to expand its non-dairy creamer portfolio, enhancing its offerings in the growing plant-based market segment. |

| April 24 | Califia Farms Introduces Functional Creamers: Califia Farms introduced a new range of functional Pulses infused with adaptogens and superfoods, catering to wellness-focused consumers looking for health benefits. |

| May 24 | Nutpods Expands Flavor Options: Nutpods expanded its product line by launching new seasonal flavors of Pulses, appealing to consumers seeking unique taste experiences in their beverages. |

| June 24 | Laird Superfood's New Creamer Blend: Laird Superfood launched a new non-dairy creamer blend featuring coconut milk and functional ingredients, targeting the health-conscious coffee drinker market. |

Growing Popularity of Plant-Based Protein Sources

As more people adopt plant-based diets, pulses have emerged as a remarkable ingredient in creating plant-derived proteins and meat alternatives. Chickpeas, lentils, and yellow peas are utilized in plant-based patties, nuggets, and protein powders, for example, consumed freely while protecting the planet from the detrimental impacts of animal-derived proteins. The consumption of pulses is still mainly the factor driving the anticipated further development of the pulses market.

Advancements in Pulse Processing Technologies

The introduction of new processing technologies has caused proper order and higher functionality and usability of pulses in many fields. Extrusion, fractionation, and micro-objects are some of the techniques that are being used to improve the texture, taste, and nutrition of pulse-based products.

These breakthroughs have allowed suppliers to produce browner flour, protein isolates, and very fiber-rich materials reaped from pulses, thus, they can be applied across various food categories.

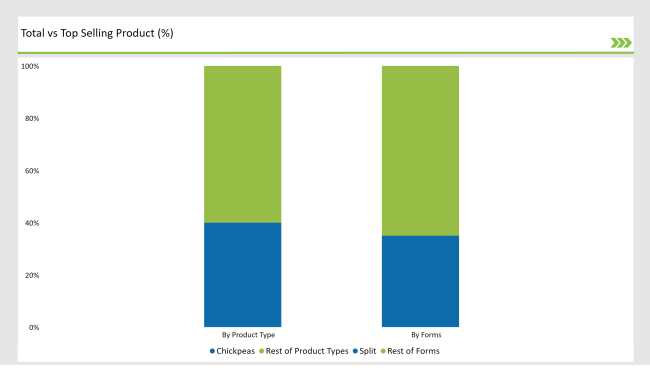

% share of Individual categories by Product Type and Forms in 2025

The most significant part of the product segment belongs to chickpeas, which will be 40% of the market in 2025. Chickpeas are multifunctional and can be used in many different applications, from traditional foods, e.g., gluten-free pasta and plant-based snacks.

They are a major food component because of their high protein and fiber content, as well as the fact that they are gluten-free and low in fat. Furthermore, chickpeas can be used in a number of cuisines and by different food processing methods, which is one of the points that make them popular ingredients in food production and cooking at home.

The rise in demand for a sustainable and plant-based protein source has as a secondary effect the making of the chickpeas stronger in the market of pulses.

Statistics demonstrate that split pulses will control a 35% market share within the form segment during 2025. Due to their simpler preparation logistics and shorter cooking times, split pulses remain the first choice in domestic residences alongside food service operations.

Split pulses serve consumers through multiple specialties, starting from soups to curries and dal while fulfilling the current demand for fast yet healthy meals. Due to their easy-to-digest nature and sustained nutritional content after cooking, split pulses find extensive use in contemporary as well as traditional recipes.

Today's consumers seek easy-to-prepare, high-protein foods that have minimal processing, and split pulses satisfy both needs at once. Market forecast indicates split pulses will sustain their dominant position because food companies introduce pre-packaged along with ready-to-cook options.

Note: above chart is indicative in nature

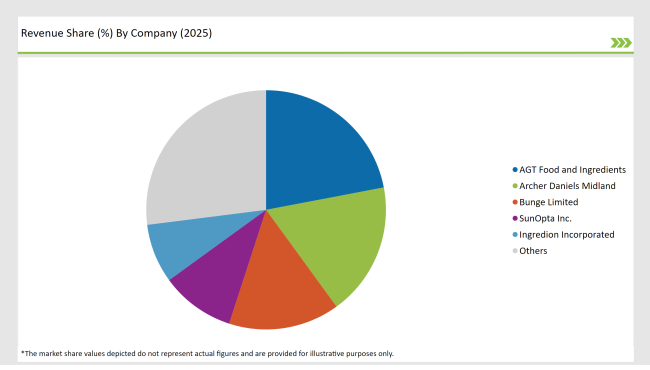

The mix of global suppliers, regional producers, and niche players mainly drives the pulsing dynamics of the USA pulses market. Top players such as AGT Food and Ingredients, Archer Daniels Midland, and Bunge Limited maintain a tight grip in the market because of their strong sourcing abilities, robustly developed distribution networks, and innovative product portfolio offerings.

Companies allocate considerable research funding to develop pulse-based products that fulfill current market requirements including gluten-free flour and plant-based protein concentrates.

Local pulse crops need specific processing in regional manufacturing plants alongside local requirement fulfillment. The market has seen growth of organic along with non-GMO pulse manufacturers who cater to consumers seeking ethical sustainable products.

The market received additional concentration from strategic partnerships that connect manufacturers with foodservice providers to deliver restaurant-specific solutions to both restaurant and institutional food operations.

By product type, the market is segmented into chickpeas, lentils, yellow peas, and pigeon peas.

By form, the industry is divided into whole, split, flour, grits, and flakes.

By end-use application, the market covers business-to-business, household retail, foodservice, and institutional applications.

The market is expected to grow at a CAGR of 5.0% from 2025 to 2035.

The USA pulses market is projected to reach USD 13,513.2 Million by 2035.

Key drivers include increasing demand for plant-based protein, innovations in pulse-based products, and growing consumer interest in health and sustainability.

Chickpeas dominate by product type, while split pulses lead by form in 2025.

Top manufacturers include AGT Food and Ingredients, Archer Daniels Midland, Bunge Limited, SunOpta Inc., and Ingredion Incorporated.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Pulses Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA