The USA food emulsifier market is projected to reach a value of USD 1,114.3 Million in 2025, growing at a CAGR of 7.2% over the next decade to an estimated value of USD 2221.7 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 1,114.3 Million |

| Projected USA Value in 2035 | USD 2221.7 Million |

| Value-based CAGR from 2025 to 2035 | 7.2% |

Market growth is being propelled by the boost in the demand for processed foods, functional ingredients, and long-shelf-life products. Food emulsifiers are the key ingredients in obtaining the desired mouthfeel, stability, and consistency in the formulation of various food products.

The plant-derived emulsifiers segment has obtained the lion's share of the market with the sole realization of the change in consumer preference towards natural, clean-label, and plant-based ingredients. Meanwhile, lecithin holds the top share (40%) of emulsifiers, which are mostly used in baking, confectionery, and dairy products.

The bakery sector is a major player in the application segment that is with 30% of the market share, as emulsifiers are the ones that help with dough stability, moisture retention, and texture. Furthermore, the rising trend of using functional foods and dairy-emulsified products is also ca cause for market growth. Manufacturing companies now manufacture emulsifiers which are safe while being non-GMO and allergen-free because customer preferences have evolved.

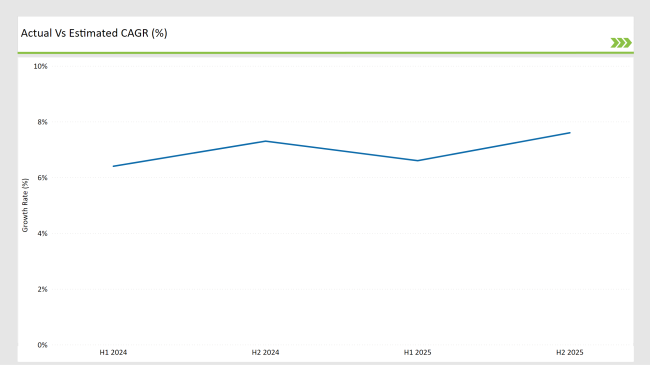

The enclosed table demonstrates USA Food Emulsifier market performance through semi-annual growth rates which have demonstrated increasing CAGR throughout the years. The study emphasizes how the market has been able to adjust to changes in consumer preferences, with the major one being the higher demand for clean-label and natural ingredients.

H1 signifies period from January to June, H2 Signifies period from July to December

The introduction of new product formulas and the specific sales arrangement have offered the means to meet customer craving for diversity in food products. Moreover, the emulsifier infrastructure is being advanced such as its stability and functionality being improved which has made the product's performance better, thus promoting the use of such products in all market segments.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Ingredion Incorporated: Expanded its plant-based emulsifier portfolio, introducing a new clean-label lecithin. |

| March 2024 | Archer Daniels Midland (ADM): Partnered with bakeries to launch next-generation emulsifiers enhancing texture and shelf stability. |

| May 2024 | Cargill: Developed an organic soy lecithin emulsifier targeting the dairy and functional food segments. |

| July 2024 | DuPont (IFF): Invested in enzyme-modified emulsifiers, improving the efficiency of food formulations. |

| September 2024 | Kerry Group: Introduced a sustainable emulsification solution for plant-based dairy alternatives. |

Expansion of Plant-Based Emulsifiers in Clean-Label Food Formulations

The market demands plant-derived emulsifiers because consumers prefer natural sustainable components alongside minimal processing. Plant-derived emulsifiers based on soy sunflower and rapeseed compounds now function as replacements for synthetic ingredients while following two clean-label market requirements.

Industrial producers work to develop organic lecithin along with enzyme-modified emulsifiers that benefit the stability and procedural abilities of bakery products as well as dairy products and plant-based foods. The adoption of fermentation methods in emulsion applications leads to better ingredient efficiency alongside improved texture outcomes.

Technological Advancements in Emulsifier Performance and Sustainability

Advanced emulsifier development involving multiple functions and enhanced dispersion along with extended shelf life controls the market direction. Microencapsulation with enzymatic emulsification methods improves both emulsifier potency and production efficiency.

The market is increasingly interested in sustainable emulsification solutions because of the rising demand for biodegradable environmentally pleasant emulsifiers. Organizations implement renewable materials from feedstock sources together with plant waste materials to create efficient ingredients and minimize environmental effects.

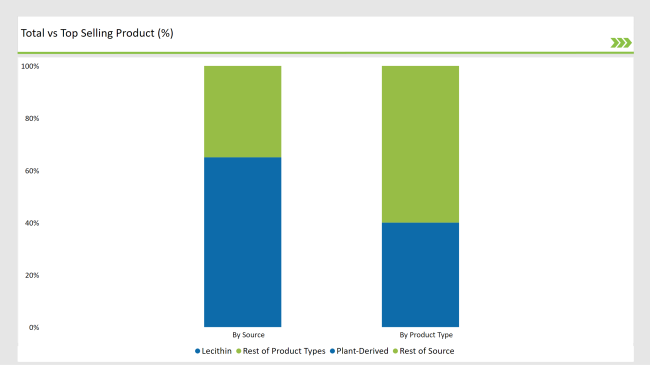

% share of Individual categories by Product Type and Source in 2025

Plant-based emulsifiers are the market leaders on the wave their share is 65%, which will be fueled by the increase in the demand for sustainable, allergen-free, and natural emulsifiers. Plant ingredients such as soy lecithin and sunflower lecithin are frequently used in clean-label bakery, confectionery, and dairy products.

The trend toward the use of insect vegetable oils is a shift in the formulation and food processing technology as manufacturers use more sustainable and healthier food products. The focus on natural components has become a leading driver of innovation, as the food industry is offered cleaner labels, concomitantly keeping product quality and performance. Plant-based emulsifiers will remain the preferred choice, given their company culture.

Lecithin evaporates out of the emulsifier market by occupying a 40% share, majorly due to being a naturally occurring substance and its functional versatility in different foodstuffs. Food manufacturers include lecithin because it functions as a stabilizer along with hydrator and emulsifier properties to make baked products and dairy emulsions and confectioneries.

Manufacturers focus on developing sustainable supply chains along with improved lecithin processes because customers increasingly demand non-GMO and organic products. The consistent investment in quality reflects the industry's stance on delivering what the end-users want, healthier products made with the latest technologies.

Lecithin's ability to adjust and its high efficiency ensure it will always find its place in the emulsifier market and with its multifarious applications and customer service will be in demand.

The USA food emulsifier market is extremely competitive with major manufacturers concentrating on the areas of product innovation, clean-label emulsifiers, and sustainability. Key players like Ingredion Incorporated, ADM, Cargill, DuPont (IFF), and Kerry have generally led the industry by means of the modern formulas and effective distribution networks.

The transition to plant-based emulsifiers, allergen-free combinations, and GMO-free components has inspired the brands to change their mixing methods. On the other hand, the functional food industry has been carrying out more emulsifiers in the development of high-protein, reduced-fat, and fortified food formulas.

Due to the e-commerce ascent expanding ingredients availability, the manufacturers are more actively involved in direct-to-consumer emulsifier supply chains making the food production more transparent and more efficient in the process of formulation.

2025 Market share of USA Food Emulsifier Market suppliers

Note: above chart is indicative in nature

By product type, the market is segmented into lecithin, mono & di-glycerides, sorbitan esters, polyglycerol esters, stearoyllactylates, and others.

By source, the market includes plant-derived and animal-derived emulsifiers.

By application, the market consists of bakeries, confectioneries, dairy products, functional foods, and others

The market is expected to grow at a CAGR of 7.2% from 2025 to 2035.

The USA food emulsifier market is projected to reach USD 2221.7 Million by 2035.

Key drivers include increasing demand for processed food, clean-label emulsifiers, and sustainable ingredient innovations.

Plant-derived emulsifiers lead by source, while lecithin dominates the product type segment in 2025.

Top manufacturers include Ingredion Incorporated, ADM, Cargill, DuPont (IFF), and Kerry Group.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA