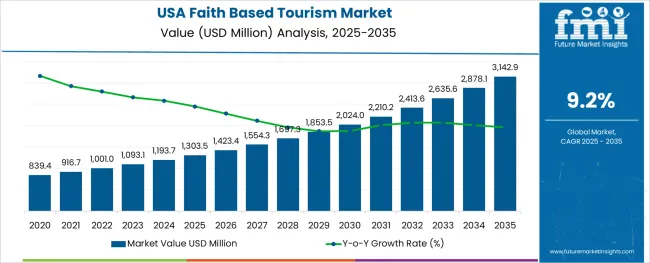

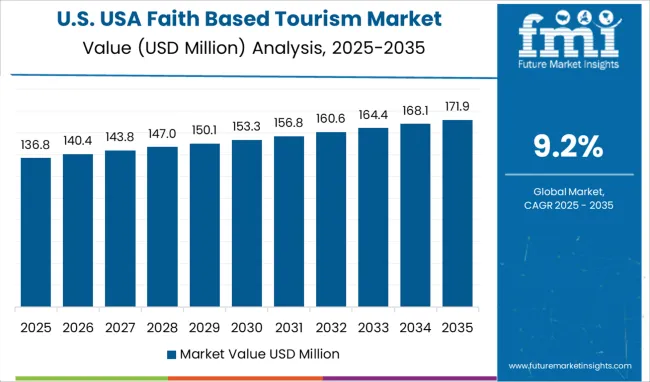

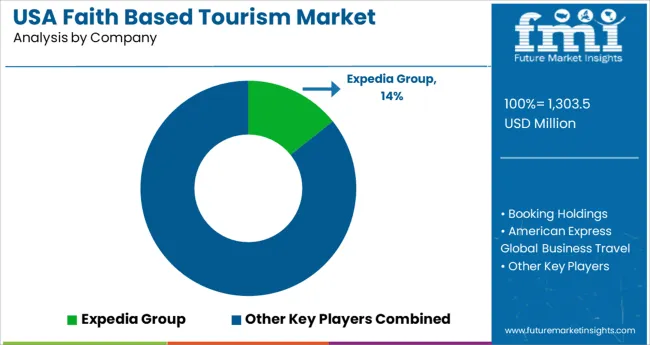

The USA Faith Based Tourism Market is estimated to be valued at USD 1303.5 million in 2025 and is projected to reach USD 3142.9 million by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

The USA faith based tourism market is witnessing a resurgence as spiritual engagement combines with cultural exploration, particularly among older age groups and returning travelers. Religious sites, pilgrimage routes, and historic churches are receiving renewed attention, supported by regional tourism boards and religious organizations that are revitalizing heritage landmarks and spiritual retreats.

The post-pandemic shift toward meaningful, values-driven travel has spurred demand for experiences that foster reflection, community, and spiritual growth. Online platforms have played a critical role in democratizing access to faith based tour packages, enabling customized itineraries, real-time bookings, and group coordination.

Additionally, increased domestic travel incentives and infrastructure upgrades are encouraging visitation to local religious sites and cultural events. As aging populations seek emotionally fulfilling travel options, and as digital ecosystems expand reach and engagement, the faith based tourism market in the USA is expected to evolve with multigenerational appeal, sustainable development initiatives, and diversified experiential offerings rooted in spiritual narratives.

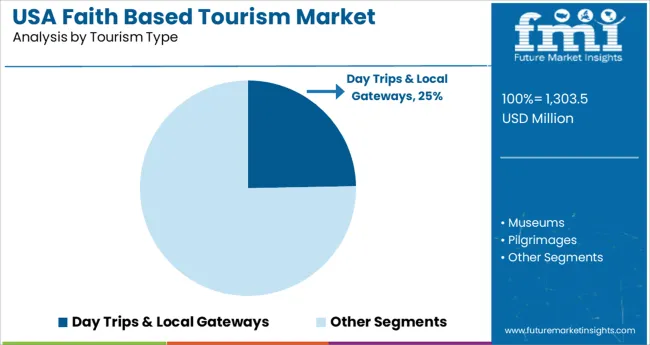

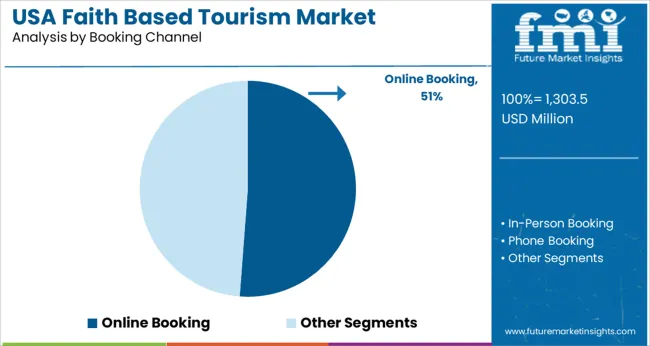

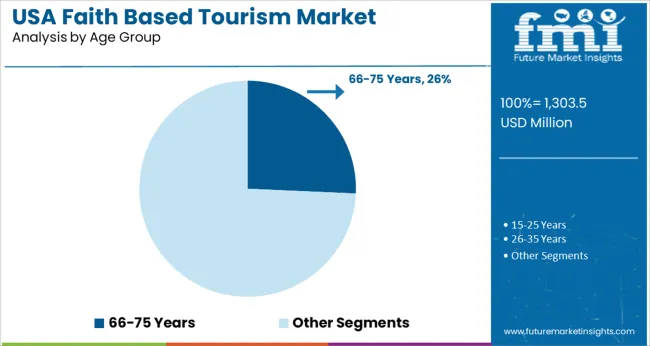

The market is segmented by Tourism Type, Booking Channel, Age Group, Consumer Orientation, and Tour Type and region. By Tourism Type, the market is divided into Day Trips & Local Gateways, Museums, Pilgrimages, Religious and Heritage Tours, and Others. In terms of Booking Channel, the market is classified into Online Booking, In-Person Booking, and Phone Booking. Based on Age Group, the market is segmented into 66-75 Years, 15-25 Years, 26-35 Years, 36-45 Years, and 46-55 Years. By Consumer Orientation, the market is divided into Women, Children, and Men. By Tour Type, the market is segmented into Independent Traveller, Tour Group, and Package Traveller. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Tourism Type, Booking Channel, Age Group, Consumer Orientation, and Tour Type and region. By Tourism Type, the market is divided into Day Trips & Local Gateways, Museums, Pilgrimages, Religious and Heritage Tours, and Others. In terms of Booking Channel, the market is classified into Online Booking, In-Person Booking, and Phone Booking. Based on Age Group, the market is segmented into 66-75 Years, 15-25 Years, 26-35 Years, 36-45 Years, and 46-55 Years. By Consumer Orientation, the market is divided into Women, Children, and Men. By Tour Type, the market is segmented into Independent Traveller, Tour Group, and Package Traveller. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Day trips and local gateways are expected to contribute 24.70% of the tourism type segment revenue in 2025, establishing them as a core growth driver in faith based tourism. Their prominence is being fueled by rising domestic travel behavior, cost-conscious planning, and the accessibility of regional spiritual sites.

These short-duration trips cater to a wide audience including senior citizens, families, and faith groups seeking meaningful experiences without the need for extended travel. Convenience, minimal planning requirements, and the ability to incorporate worship, learning, and reflection within a single day have made this format increasingly attractive.

Religious institutions and local communities are actively collaborating to curate local pilgrimages, thematic events, and cultural immersion programs that align with the expectations of modern travelers. With a growing preference for local experiences and reduced logistical complexity, this segment is expected to maintain consistent traction within the broader faith based tourism market.

Online booking is projected to account for 51.20% of total revenue under the booking channel category in 2025, positioning it as the dominant mode of engagement. This leadership stems from the rapid digitization of travel planning, with faith based travelers increasingly relying on websites, mobile apps, and curated platforms to explore, compare, and secure travel experiences.

Online interfaces have enabled seamless booking of group tours, personalized itineraries, and seasonal pilgrimage packages while offering flexible cancellation and digital customer support. The integration of multimedia storytelling, user reviews, and virtual tours has made spiritual destinations more discoverable and engaging.

Furthermore, religious tour operators are investing in online presence, content marketing, and influencer collaborations to capture demand from tech-savvy travelers. The ability to access faith based travel offerings from anywhere and customize according to spiritual needs has firmly positioned online booking as the preferred channel in this market.

The 66 to 75 years age group is forecast to represent 25.70% of total market revenue by 2025 within the age group segmentation, underscoring its influential role in shaping the USA faith based tourism landscape. This demographic is actively participating in travel that blends spirituality, leisure, and social bonding, often with a focus on heritage, healing, and life reflection.

With increased financial stability and more leisure time post-retirement, individuals in this group are seeking journeys that offer emotional connection and spiritual renewal. Health-conscious tour designs, accessible itineraries, and group-friendly arrangements have enabled greater participation from this cohort.

Religious organizations and travel agencies are curating age-appropriate experiences including guided pilgrimages, interfaith dialogues, and wellness retreats rooted in spiritual traditions. The segment’s consistent engagement and preference for meaningful travel continue to make it a vital pillar in the ongoing expansion of faith based tourism services across the country.

Although the Americas hold third rank in the world in terms of tourist destinations, followed by Europe and Asia Pacific, tourism in the Americas is nevertheless an important phenomenon, with 18.5 million tourists arriving for faith-based tourism. It represents nearly 16% of the global tourist arrivals.

The tourism industry in the past couple of decades has attracted a large number of investments in various tourist spots in the USA Subsequently, the increasing number of tourist arrivals at religious destinations has boosted the US spiritual tourism industry.

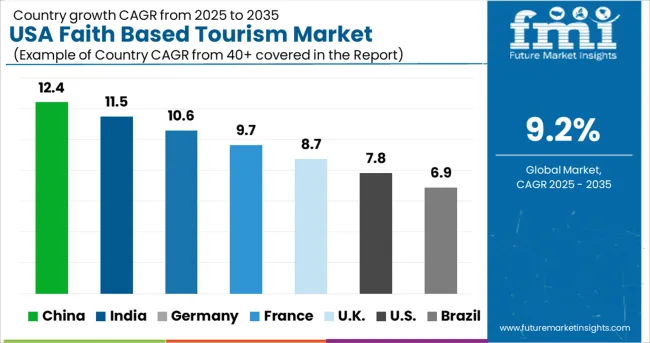

As per FMI, the USA faith-based tourism market exhibited a CAGR of 8.8% in the historical period of 2020 to 2024.

Rising Preference for Authentic Experiences:

As per a recently conducted survey, more than 35 percent of outbound visitors from the USA are interested in faith-based tourism, with around 17 percent expressing a strong desire to do so over the next five years.

These numbers are expected to surge at a fast pace in the evaluation period owing to an increasing preference for more authentic experiences, including exploration of cultural and spiritual traditions related to specific pilgrimage sites and religions.

The emergence of Travel Shows and News:

Tourism as an industry uses media to spread information about various vacation packages to a wider audience. People who are preparing to travel get influenced by news and reviews about places through the media.

Perceptions of tourist places throughout the world are often shaped by television news and films. News coverage and popular television shows, which are strongly rooted in everyday life, may convey a wealth of knowledge about a specific location in a very short amount of time. Consumers regard this type of information as impartial since it is perceived as more authentic, as compared to traditional advertising.

In order to plan their excursions, a large number of travelers look for detailed information from other travelers who have already been to a particular place and then share their experiences when they return from their trips. The information generated by other travelers is much more significant and impactful in terms of search and decision-making processes than when evaluating other sources.

Tourists Prefer Online Reservations for Religious Pilgrimage Tours

Based on booking channels, the online booking segment is anticipated to dominate the USA faith-based tourism market in terms of share. Tourists often prefer online platforms or mobile applications for booking their tickets and accommodations as these provide a simple and hassle-free way to transfer money digitally.

Besides, these applications enable users to get real-time tracking of their booking status, as well as offer enhanced security. Tourists can also utilize various online platforms to read and compare prices of restaurants, hotels, monument tickets, and similar other factors.

Religious Tourism is Popular among People Belonging to the Age Group of 46-55 Years

In terms of age group, the 46-55 years segment is anticipated to lead the USA faith-based tourism market in the next decade. People of this particular age group are more interested in visiting religious places and getting to know more about the art, culture, traditions, and architecture of a place.

Operators Are Providing Religious Pilgrimage Tourism Packages

In terms of tour type, the package travelers segment is likely to remain at the forefront in the USA faith-based tourism market. Tourists often choose travel packages as various tour operators offer personalized packages. Operators also provide additional features, including accommodation, flight tickets, meals, sightseeing, and transportation in customized packages.

Religious and Heritage Tourist Destinations Are Gaining Popularity

According to FMI, religious and heritage tours are gaining immense popularity among tourists as these enable them to learn more about a place’s customs, beliefs, history, and spiritual enlightenment. In addition, the increasing preference among tourists to explore untapped heritage sites across the USA is set to drive the segment.

Leading players operating in the USA faith-based tourism market are focusing on expanding their distribution network and launching new tour packages to attract a large customer base.

Travel websites like Trip Advisor, Expedia, and booking.com, as well as social networking platforms (Facebook and Twitter) are currently playing a key role in attracting more tourists from various parts of the world to the USA

Apart from that, government agencies are taking various initiatives to launch new organizations that would solely be responsible for accelerating pilgrimage and religious tourism in the USA

For instance:

| Attribute | Details |

|---|---|

| Projected Market Valuation (2025) | USD 1303.5 million |

| Value-based CAGR (2025 to 2035) | 9.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (million) |

| Key Region Covered | North America |

| Key Country Covered | United States of America |

| Key Segments Covered | Tourism Type, Booking Channel, Tourist Type, Tour Type, Age Group, Consumer Orientation, and Region |

| Key Companies Profiled | Expedia Group; Booking Holdings; American Express Global Business Travel; BCD Travel; CWT; Flight Centre; Travel Leaders Group; American Express; Direct Travel; Corporate Travel Management North America; Fareportal; American Automobile Association; Travel and Transport; Frosch; Omega World Travel |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global usa faith based tourism market is estimated to be valued at USD 1,303.5 million in 2025.

It is projected to reach USD 3,142.9 million by 2035.

The market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types are day trips & local gateways, museums, pilgrimages, religious and heritage tours and others.

online booking segment is expected to dominate with a 51.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

United States Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA