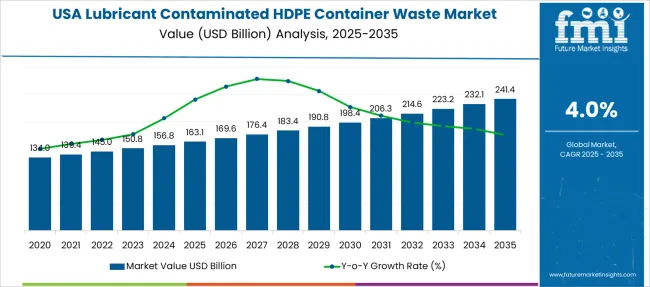

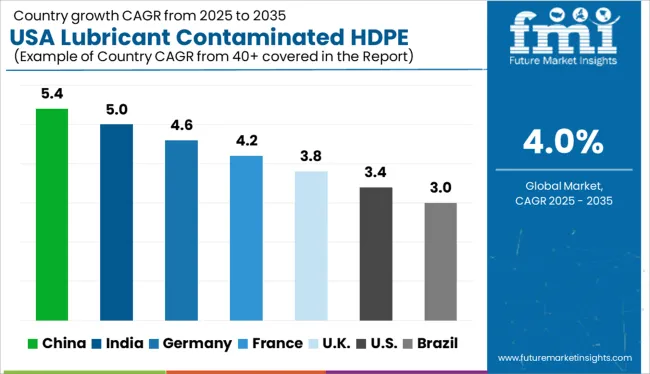

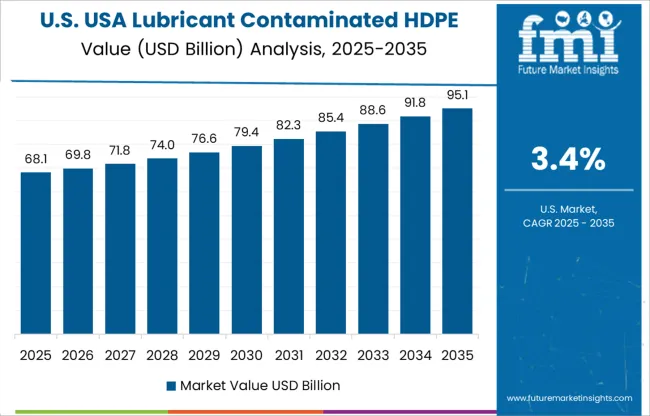

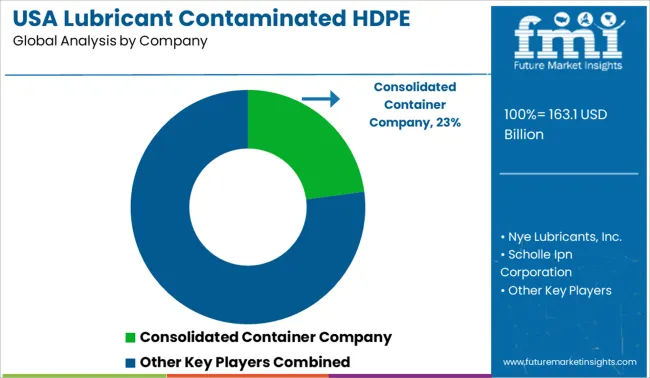

The USA Lubricant Contaminated HDPE Container Waste Market is estimated to be valued at USD 163.1 billion in 2025 and is projected to reach USD 241.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| USA Lubricant Contaminated HDPE Container Waste Market Estimated Value in (2025 E) | USD 163.1 billion |

| USA Lubricant Contaminated HDPE Container Waste Market Forecast Value in (2035 F) | USD 241.4 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The USA lubricant contaminated HDPE container waste market is expanding due to rising environmental concerns, stricter disposal regulations, and increased emphasis on circular economy practices within the lubricant and plastic packaging industries. The widespread use of high density polyethylene containers in industrial lubricant applications has contributed to a substantial volume of post consumer waste requiring proper handling and treatment.

Regulatory bodies and waste management agencies are driving initiatives for segregation, reprocessing, and controlled reuse of these containers to minimize environmental contamination and plastic leakage. Technological advancements in decontamination and sorting processes are improving recycling efficiency, while growing collaboration between lubricant manufacturers and recyclers is streamlining collection and recovery operations.

The future outlook for the market remains positive as industries adopt closed loop solutions and sustainability driven approaches to reduce landfill reliance and maximize plastic value recovery.

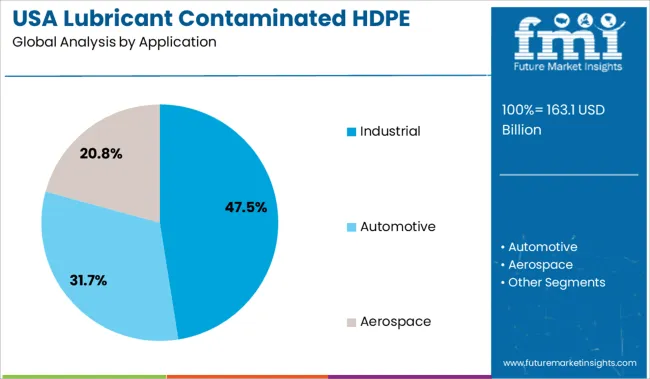

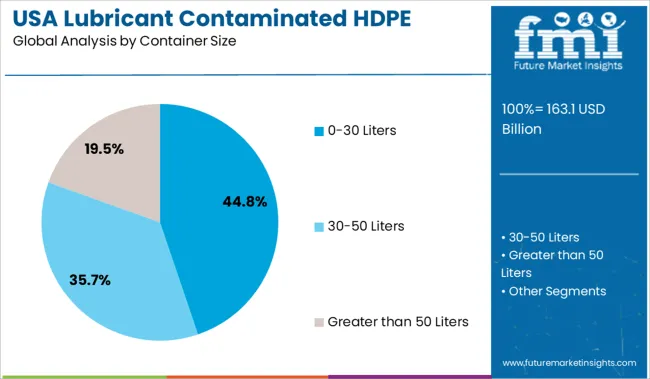

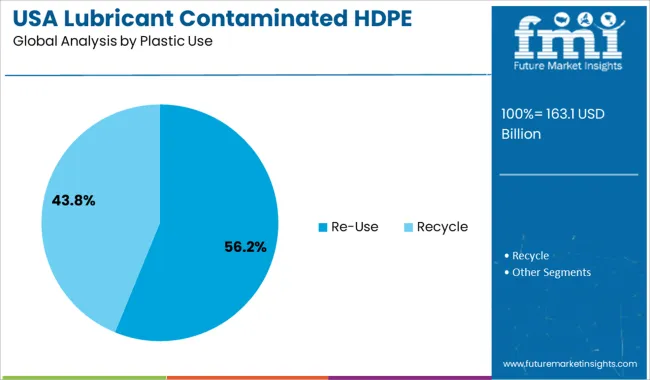

The market is segmented by Application, Container Size, and Plastic Use and region. By Application, the market is divided into Industrial, Automotive, and Aerospace. In terms of Container Size, the market is classified into 0-30 Liters, 30-50 Liters, and Greater than 50 Liters. Based on Plastic Use, the market is segmented into Re-Use and Recycle. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial segment is expected to hold 47.50% of total market revenue by 2025 within the application category, establishing itself as the leading segment. This is driven by the heavy consumption of lubricants across manufacturing, machinery, and automotive operations which predominantly utilize HDPE containers.

These applications generate consistent volumes of contaminated waste that require stringent handling and recovery protocols. The increased use of centralized maintenance systems and industrial bulk packaging has further added to the waste volume from this sector.

As regulatory scrutiny intensifies around waste traceability and proper disposal, industrial users are investing in specialized collection and cleaning systems that align with environmental standards. This operational scale and compliance priority have strengthened the dominance of the industrial segment in the market.

The 0 to 30 liters container size segment is projected to account for 44.80% of the overall market share by 2025. This prominence is attributed to its widespread use across industrial and commercial lubricant packaging, which balances cost efficiency with portability.

Containers in this size range are commonly used for engine oils, hydraulic fluids, and gear oils, generating a high volume of contaminated waste. Their manageable size simplifies collection, transportation, and decontamination processes, making them favorable for recycling and reuse systems.

Additionally, standardization of this container range supports better tracking and processing within regulated waste programs. The combination of operational practicality and recyclability has led this container size segment to maintain a dominant position in the market.

The re use category is anticipated to represent 56.20% of total market share by 2025 within the plastic use segment, positioning it as the most significant reuse path. This growth is supported by increasing investments in container reconditioning facilities and industry initiatives that encourage repeated use of HDPE packaging after thorough cleaning and testing.

Re use models provide cost advantages and environmental benefits, reducing the demand for virgin plastic and the burden on landfill systems. Industry stakeholders are aligning with sustainability targets by incorporating standardized processes for cleaning and certifying containers for secondary use.

The reliable performance and structural integrity of HDPE make it a suitable candidate for reuse in non critical lubricant applications, reinforcing its leading share in the plastic use category.

According to market research and competitive intelligence provider FMI, the USA lubricant contaminated HDPE container waste industry grew at a CAGR of 3.8% from 2020 to 2025.From the industrial and household sectors, every individual plays an important role in reducing the quantity and type of lubricant container waste in the United States.

In the circular economy, plastics renewal and recycling through chemical recycling will help the USA preserve its natural resources while reducing fossil fuel extraction and GHC emissions.

As part of ongoing efforts to redesign the economy of lubricant containers after they have been used by consumers, the National Lubricant Recycling Coalition (NLCRC) is also looking into developing an initiative that recycles and recovers plastic packaging used for shipping lubricants to consumers and businesses.

NLCRC is working hard to establish a market for these materials by developing partnerships with service providers and retailers in order to demonstrate a good understanding of market dynamics by launching a pilot project in a USA market through partnerships with service providers and retailers.

To scale recycling solutions to lubricant containers and other critical stakeholders, incorporating chemical recycling as a strategy for recycling lubricant containers into post-consumer recycled content, collecting companies, recycling companies, and other critical stakeholders will scale recycling solutions to lubricant containers.

According to forecasts, the USA lubricant contaminated HDPE container waste market will grow at a 4% CAGR between 2025 and 2035.

Automobile production has increased greatly over the past few decades, and as a result, the demand for maintenance products such as lubricants, engine oil, grease, and deep penetrant lubricants has increased dramatically in the market. With the growth of the automobile market, the demand for lubricant contaminated HDPE containers is expected to exacerbate over the forecast period, thus increasing the demand for the recycling of lubricant contaminated HDPE containers.

The economy can be supported through improved resource use, infrastructure investment, and employment opportunities through the creation of an environment for the market pull-through of the collected material.

The environmentally friendly nature of HDPE and its recyclability make it a popular choice for a wide range of packaging applications. A very large amount of HDPE containers are recycled around the world. Among all of the thermoplastic containers on the market, HDPE containers hold an enormous market share in the worldwide market.

A significant increase in the number of infrastructure projects in various parts of the world has led to an increase in demand for high-density polyethylene resins over the last few years. Due to its great performance advantages over alternative packaging formats, HDPE containers are one of the major drivers of the plastic container industry.

In addition, the growing demand for aerospace lubricants is expected to drive the market for lubricant contaminated HDPE container waste market. Increasing market demand for lubricants to minimize friction and prevent overheating in aerospace industries will drive market growth in the next few years.

Changing market demand for high-performing and better-quality oils will improve the performance aspects of aircraft and will result in increased safety for passengers during the flight.

Technology and innovation are continuously catering to the needs of the aviation and automotive industries, including extending the life of turbines and engines, minimizing greenhouse gas emissions, enhancing fuel efficiency, lubricants with a low viscosity for aviation, and maintaining emission levels according to government and non-government standards.

Moreover, construction activities in the USA are increasing, which is resulting in an increase in sales of construction equipment, such as bulldozers, cranes, and concrete mixers, as well as increasing demand for heavy-duty automotive lubricants.

Growing concern over CO2 emissions and greenhouse gases has led the country to eliminate plastics and other materials from the environment. A good deal of effort has been made in the country to develop alternative materials for industrial, chemical, and other applications in order to conserve and protect fossil fuels.

As Efforts are being made by industries to impose greater ecological awareness on their operations, and there have been great strides made in the area of lubricant management and disposal over the past few years. A wide range of lubricants are now available that comply with even the strictest environmental regulations in order to meet customer needs. Several factors are considered when choosing lubricants for certain environments, including biodegradability.

Numerous regulations have been passed by the federal government aiming to improve the way lubricants are stored and handled at the domestic level in order to protect the environment. Under section 6002 of the Resource Conservation and Recovery Act (RCRA), the Environmental Protection Agency (EPA) launched a procurement code of ethics program in June 2025.

Over the life cycle of the materials, this program reduces their use and impacts on the environment.

Lubricants used in industrial and aerospace applications can be contaminated, which can negatively affect their operations. Plastics that contain high-density polyethylene take hundreds of years to decompose in the environment.

A rapid shift towards the adoption of packaging solutions made of bioplastics is occurring as a result of rising environmental concerns and strict regulatory measures across the USA and other nations. A combination of these factors, along with fluctuating HDPE container prices and the availability of polypropylene alternatives, is estimated to hamper the market's demand for HDPE containers.

Lubricant properties may change over time, affecting the performance of automobiles. The mixing of lubricants from different sources also contributes to the degradation of oils, components, and machinery (cross-contamination). The contamination of lubricants can also speed up the rate at which engines and mechanical parts wear out, leading to accidents and damage to the engine.

In addition to more hazardous waste and harder-to-degrade materials, such as lubricant oil containers, being dumped in landfills, a growing number of these containers makes waste disposal even more difficult for the USA.

During the last few decades, the USA has seen an increase in passenger car production and commercial vehicle production, including commercial trucks and buses. According to estimates, the total production reached 134 million units in 2020, marking a 30% increase from 10 years ago.

In addition to an increase in vehicle production, lubricant oil consumption has also increased in recent years. Hence the market for lubricant contaminated HDPE container waste is expected to grow in the USA.

As Research and Development activities and government and non-governmental organization funding increase, the market for lubricant contaminated HDPE container waste is expected to flourish.

Moreover, the increasing presence of key market players in various sectors such as industrial, aerospace, and automobiles are also expected to add to the market's growth. The USA is one of the most important automotive markets in the world.

With increasing awareness among consumers regarding the benefits of vehicle maintenance and increasing demand for recycled oil containers, the HDPE-based oil container recycling market is predicted to witness significant growth over the forecast period.

Based on application type the USA lubricant contaminated HDPE container waste market is segmented into industrial, aerospace, and automotive. According to the forecast, automotive will hold the largest revenue share of 80%. Increasing consumer demand for vehicles and auto parts will result in growth in the market for these products.

The ever-increasing sales of passenger cars and commercial vehicles are expected to grow demand for the USA lubricant contaminated HDPE container waste market.

A combination of economic growth in the USA and concern about pollution regarding the pollution caused by an ever-increasing number of vehicles on the streets has resulted in the improvement of public transportation services in the country.

Furthermore, as disposable incomes rise and consumer demand increases for high-quality maintenance of vehicles, the need for HDPE-based oil containers will increase, increasing the need to recycle HDPE that has been contaminated by lubricants.

Based on the adoption of plastics in the market, the market is segmented into re-use, and recycled USA lubricant contaminated HDPE container waste. Recycled plastic use is expected to hold the largest market during the forecast period. The market is expected to grow at a CAGR of 4.8% during the forecast period.

A lubricant contaminated HDPE container can be recycled at an economic and beneficial cost than being reused. Considering the high costs of cleaning and maintaining reused materials, as well as the fact that they produce additional waste, consumers are increasingly turning to the recycled plastics available on the market to eliminate such waste and costs.

In addition, the property of the product can also be enhanced by adding additives through the recycling process, enabling manufacturers to easily remold the product in any size as per their demand. Due to these factors, manufacturers prefer recycling over reusing plastics in the market.

As part of the various recycling program, manufacturers will actively participate to ensure that the recycling program adheres to industry standards and is continually improved so that effective product sustainability can be achieved.

Manufacturers ensure that best practices are continually improved to ensure that equipment is designed to recycle lubricant containers in an efficient and cost-effective manner. Furthermore, companies promote a fair and consistent approach by taking appropriate action regarding end-of-life lubricant containers.

Moreover, they facilitate the correct management of lubricant packaging at end-of-life by engaging with key stakeholders and parties involved. All these factors have stimulated market growth for the recycled lubricant contaminated HDPE container waste market.

What is the Impact of the New Entrant on the USA Lubricant Contaminated HDPE Container Waste Market?

As startup companies enter the automotive market, they are increasingly using lubricant-contaminated HDPE containers to meet consumer demands. With the advent of innovative technologies in the market, recycling products are incorporating USA lubricant contaminated HDPE container waste and becoming increasingly innovative.

Startup companies have started to offer recycled solutions for lubricant contaminated HDPE container waste for various applications.

Some of the start-ups in the USA lubricant contaminated HDPE container waste market include-

USA lubricant contaminated HDPE container waste manufacturers are aiming to meet changing consumer demands by offering innovative product designs. Leading manufacturers are working with reputed brands to launch new products that target a wider audience.

HDPE container manufacturers are continuously developing innovative pallet stretch wrapping solutions for specific end uses, and are committed to research and development. Companies in the recycled HDPE container market are launching new products and expanding their market reach.

North American manufacturers begin mass production of the Doosan DD100 in the third quarter. The first Doosan dozer model DD100, a 9-metric-ton dozer marketed for the North American market, has been shipped by Hyundai Doosan Infracore (HDI), a subsidiary of Hyundai Motor Company. This dozer was launched by HDI in an effort to create a synergy between its existing excavator and wheel loader models and the new dozer.

The Waste Management company has taken over Avangard Innovative's USA division, which will increase recycling programs, especially for plastics and wraps used in commercial applications. It is expected that Natura PCR will be able to recycle 400 million pounds of post-consumer resin per year within five years of the acquisition. As well as stretch wraps and furniture film, it will manufacture circularly shaped plastic wraps. In addition to the recycling deal, the company plans to include shrink wrap for cosmetics and food containers as part of the deal.

| Report Attributes | Details |

|---|---|

| Growth Rate (2025 to 2035) | 4% |

| Expected Market Value (2025) | USD 163.1 billion |

| ProjectedForecast Value (2035) | USD 241.4 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Application, Container Size, Plastic Use |

| Key Companies Profiled | Consolidated Container Company; Nye Lubricants, Inc.; Scholle Ipn Corporation; Greif, Inc.; Mauser Group B.V.; Milford Barrel; BWAY Corporation; Rahway Steel Drum Company, Inc.; Container Distributors, Inc.; Jakacki Bag & Barrel, Inc.; KSCI Container Services; CKS Packaging, Inc.; Polycon Industries, Inc.; Trico Corporation; Encore Container; SCHÜ TZ Container Systems |

| Customization | Available Upon Request |

The global USA lubricant contaminated HDPE container waste market is estimated to be valued at USD 163.1 billion in 2025.

The market size for the USA lubricant contaminated HDPE container waste market is projected to reach USD 241.4 billion by 2035.

The USA lubricant contaminated HDPE container waste market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in USA lubricant contaminated HDPE container waste market are industrial, automotive and aerospace.

In terms of container size, 0-30 liters segment to command 44.8% share in the USA lubricant contaminated HDPE container waste market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA