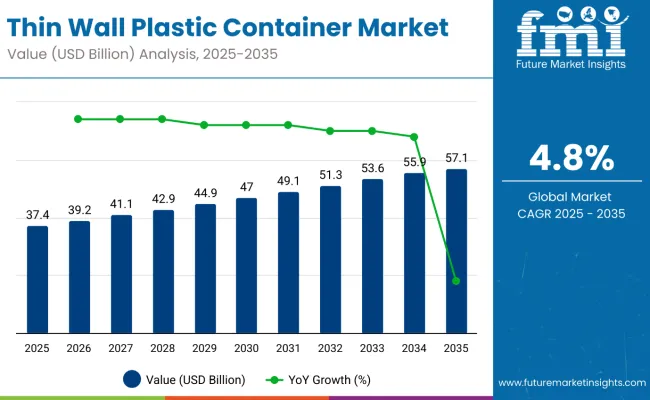

The global thin wall plastic container market is projected to grow from USD 37.44 billion in 2025 to approximately USD 57.08 billion by 2035, registering a CAGR of 4.8% over the forecast period. In 2024, the market was valued at USD 35.73 billion, with growth being driven by increased demand across the food packaging, logistics, and retail sectors.

Lightweight structures, reduced material consumption, and rapid injection molding cycle times have been prioritized by manufacturers to improve efficiency and sustainability in production. These advantages have allowed thin-walled containers to be adopted in fast-paced industrial environments.

| Attributes | Key Insights |

|---|---|

| Estimated Global Thin Wall Plastic Container Market Size (2025E) | USD 37.44 billion |

| Projected Thin Wall Plastic Container Market Value (2035F) | USD 57.08 billion |

| Value-based CAGR (2025 to 2035) | 4.8% |

By 2025, higher adoption rates are being observed in ready-to-eat meals, dairy, and takeaway segments due to rising urbanization and shifting consumption habits. Product shelf life and hygiene are being enhanced through tamper-evident features and sealing compatibility.

Thin-wall containers are being selected for their rigidity, clarity, and stackability, allowing ease of handling during logistics and retail display. Increased compatibility with automated filling lines has also supported their use in high-speed manufacturing systems. In parallel, container formats that require minimal storage space and reduce shipping costs are being introduced by packaging suppliers.

Recent industry trends have been characterized by a strong emphasis on sustainability and technological innovation. Lightweight designs are being prioritized to reduce plastic usage and transportation energy costs, offering eco-friendly alternatives. The rise of e-commerce is pushing the demand for thin wall packaging, focusing on cost-effectiveness, protection, and sustainability during shipping.

Asia Pacific, especially China and India, is leading in thin wall packaging demand, contributing significantly to global plastic production. Major companies like Berry Global, Amcor, and Greiner Packaging are leading the market through innovation, acquisitions, and global expansion. Companies are investing in sustainable packaging solutions, such as bio-sourced in-mould labelling and collaborative recycling initiatives.

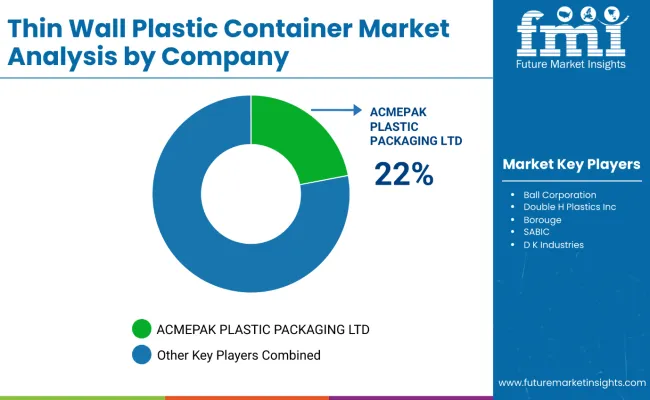

Key companies are actively driving innovation and market expansion. Berry Global Inc., Amcor Plc, Greiner Packaging International GmbH, DS Smith Plc, Huhtamaki Oyj, and Sonoco Products Company are among the major players in the thin wall plastic container market.

These companies are focusing on sustainability by using eco-friendly materials and adopting sustainable production processes. They are also investing in research and development to cater to the evolving needs of customers. The competitive landscape is highly fragmented, with several major players and a large number of small and medium-sized enterprises striving to gain a competitive edge by expanding their product portfolios and forming strategic partnerships.

The global trade of thin wall plastic containers is influenced by factors such as demand for lightweight, cost-effective packaging, advancements in polymer technologies, and rising demand for sustainable packaging solutions. The market is driven by the food and beverage, consumer goods, and healthcare industries, which prioritize convenience, hygiene, and durability in packaging.

Thin wall plastic containers are governed by several regulations aimed at ensuring safety, quality, and environmental sustainability. These standards are enforced by various national and international authorities, particularly in sectors like food packaging, pharmaceuticals, and consumer goods. Regulatory compliance is essential for manufacturers to meet consumer demands, safety concerns, and environmental goals.

The table presents the expected CAGR for the thin wall plastic container market over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) of the decade from 2024 to 2034, the market is predicted to surge at a CAGR of 4.4%, followed by a lower growth rate of 3.7% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.3% in the first half and to expand at 4.1% in the second half.

| Particular | Value CAGR |

|---|---|

| H1 | 4.4% (2024 to 2034) |

| H2 | 3.7% (2024 to 2034) |

| H1 | 3.3% (2025 to 2035) |

| H2 | 4.1% (2025 to 2035) |

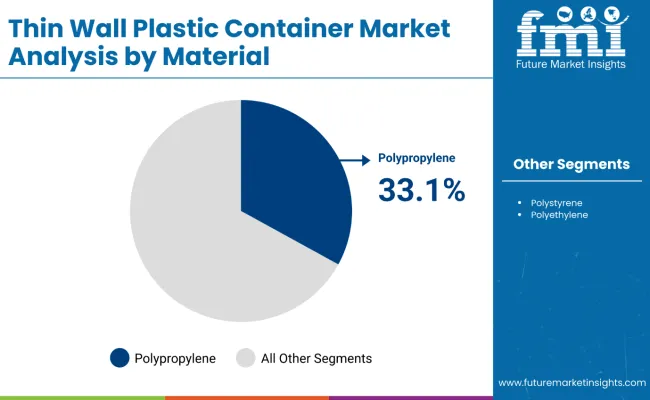

Polypropylene is projected to account for 33.1% of the thin-wall plastic containers market in 2025, maintaining its dominance with a strong CAGR of 4.4% through 2034. Known for its lightweight composition and impressive mechanical properties, polypropylene offers high stiffness and strength, making it a go-to material for rigid packaging. It is widely used in dairy cups, deli containers, margarine tubs, takeaway food trays, and microwaveable packaging due to its excellent heat and chemical resistance.

Polypropylene is also recyclable and compliant with global food contact regulations, aligning with consumer preferences for sustainable packaging. Its ability to be injection-molded into thin, yet durable shapes allows brands to minimize material use while retaining strength and product integrity. For example, yogurt brands like Yoplait and Danone use polypropylene-based single-serve containers that are both lightweight and tamper-proof. In the ready-to-eat sector, polypropylene containers are used for meal prep kits and frozen entrees due to their resistance to temperature variation.

With increasing adoption of mono-material packaging and push from food manufacturers for cost-effective, sustainable materials, polypropylene continues to attract long-term investment across food, beverage, and household product segments.

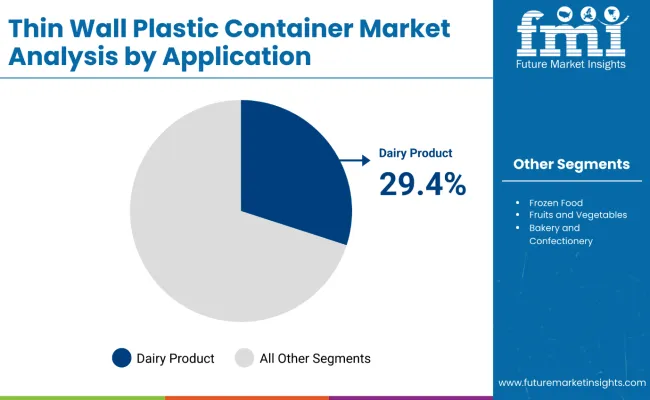

Dairy products are expected to command a 29.4% share of the thin-wall plastic container market by 2025, expanding steadily at a 4.5% CAGR through 2034. The segment’s growth is fueled by surging demand for convenience-driven packaging formats, particularly in urban areas where on-the-go consumption is rising. Products like yogurt, sour cream, cheese spreads, and flavored milk drinks increasingly rely on thin-wall containers for their lightweight design, product protection, and ease of use.

Major brands such as Amul, Müller, and Chobani package their offerings in thermoformed or injection-molded containers made from polypropylene or PET, which provide excellent shelf visibility and durability. These containers are often designed with features like resealable lids, tamper-evident bands, and high-definition printing to enhance shelf appeal and consumer trust.

With growing health consciousness, consumers are leaning toward fresh dairy snacks in single-serve formats, increasing demand for packaging that maintains freshness and extends shelf life. Manufacturers are responding by investing in high-speed production lines, regional facilities, and sustainable packaging technologies, making dairy a critical focus area for thin-wall container suppliers worldwide.

The global market for thin-walled plastic containers recorded a CAGR of 4.2% from 2020 to 2024. The market was valued at USD 35.73 billion in 2024 from USD 28,994 million in 2020.

Over the past several years, there has been a significant increase in the market for thin-wall plastic containers. The food & beverage industry has been putting more market demand on thin-walled plastic containers. End-user companies in this industry prefer them because of their outstanding barrier qualities and hygienic sealing.

The plastic packaging sector, which includes thin-wall plastic containers, has made sustainability a key priority. Recyclable and biodegradable plastics are examples of sustainable materials that manufacturers have begun investigating and using to meet consumer demands and address environmental issues.

The efficiency and economics of making thin-walled plastic containers have increased due to developments in injection molding technology and other manufacturing techniques. The use of robotics and automation to improve manufacturing capacities has grown.

The exceptional features of thin-wall plastic containers, such as temperature resistance, impact resistance, transparency, lightweight, and affordability, make them an ideal choice for packaging applications. Spurred by the expansion of the bakery, retail, and ready-to-eat food industries, the demand for thin-walled plastic containers is expected to witness substantial growth over the forecast period.

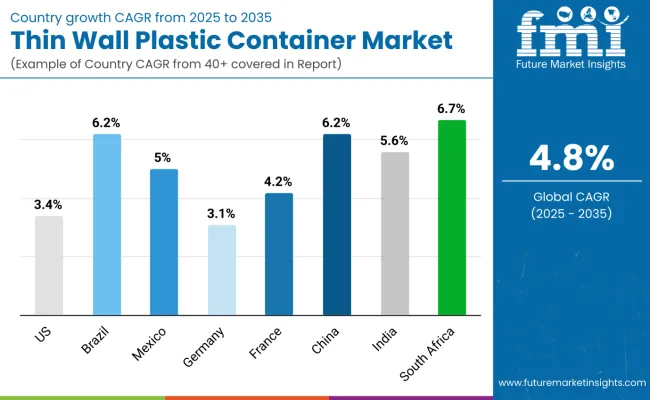

The below table shows the estimated growth rates of the leading countries. Brazil, China, and South Africa are set to record high CAGRs of 6.2%, 6.2%, and 6.7%, respectively, through 2035.

| Country | Value (CAGR) |

|---|---|

| United States | 3.4% |

| Brazil | 6.2% |

| Mexico | 5.0% |

| Germany | 3.1% |

| France | 4.2% |

| China | 6.2% |

| India | 5.6% |

| South Africa | 6.7% |

In China, food and beverage packaging is done using thin-walled plastic containers. These containers are set to be widely used because of their ease of use, portability, and suitability for several products.

The production of thin-walled plastic containers reflects China's reputation for technological innovation. Automation and injection molding technologies have been continuously improving, which has increased productivity and improved product quality.

China boasts an extremely complex and modern packaging sector, which includes thin-walled plastic containers. Superior manufacturing technology, strict quality controls, and a focus on new product development are advantageous to the market.

China has seen a rise in the emphasis on sustainability, in line with general trends. Producers are exploring and implementing eco-friendly materials & recycling activities to address environmental concerns, which is influencing the thin-wall plastic container industry.

Brazil is known for its stringent quality standards and regulations, particularly in sectors such as medicines and food. Producers of thin-walled plastic containers follow these guidelines to guarantee the security and compatibility of their goods for several uses.

Brazil's retail environment, which is typified by a high concentration of convenience stores, is shaping consumer preferences for packaging. Plastic containers with thin walls are preferred as they are convenient, look good on shelves, and can be consumed on the go.

As the population ages, there is an increasing need for packaging solutions that meet the needs of senior citizens. This movement is set to influence thin-wall plastic container designs and operations in demographics in Brazil.

The packaging sector in the United States prioritizes innovation, which also applies to plastic containers with thin walls. Manufacturers are always experimenting with novel materials, designs, and technologies to satisfy consumer expectations for ease of use, sustainability, and product uniqueness.

The United States packaging sector is paying increasing attention to sustainability, in line with general global trends. Using recyclable materials, lessening the impact on the environment, and catering to customer preferences for eco-friendly packaging are all included in this.

In the United States, the food and beverage sector significantly uses thin-wall plastic containers. Their large market share results from the packaging of goods, including dairy products, ready-to-eat meals, snacks, and beverages for which these containers are used.

Thin-wall plastic container manufacturers are developing innovative designs catering to specific products or applications. Leading players in the market are expanding their presence and manufacturing capabilities. They are moving toward adopting and offering sustainable solutions to customers.

Companies are further expanding by integrating with diverse forms and collaborating to develop designs and products.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 37.44 billion |

| Projected Market Size (2035) | USD 57.08 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and billion units for volume |

| Products Analyzed (Segment 1) | Boxes and Bins, Trays, Cups, Lids, Thin Wall Pails, Bowls |

| Materials Analyzed (Segment 2) | Polypropylene (PP), Polystyrene (PS), Polyethylene (PE), High-density Polyethylene (HDPE), Low-density Polyethylene (LDPE), Polyethylene Terephthalate (PET) |

| Manufacturing Technologies (Segment 3) | Thermoformed, Vacuum Formed Technology, Injection Molded Technology, Others |

| Applications Analyzed (Segment 4) | Dairy Products, Frozen Food, Fruits and Vegetables, Bakery and Confectionery, Juices and Soups, Meat, Seafood and Poultry, Ready-to-eat Meals, Pharmaceuticals, Personal Care and Cosmetics, Paints, Lubricants, and Adhesives |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | Ball Corporation, Double H Plastics Inc., ACMEPAK PLASTIC PACKAGING LTD., Sem Plastik, RPC Group plc, Mold-Tek Packaging Ltd. (MTPL), ENGEL AUSTRIA GmbH, D K Industries, Metro Valves, Insta Polypack, Zhejiang Shenghui Kitchenware Co. Ltd., Taizhou Kaiji Plastic Mould Co. Ltd., Guangdong Happy Home Plastic Co. Ltd., Shantou Gepai Environmental Technology Co. Ltd., Dongguan Invotive Plastic Products Co. Ltd., Sunrise Plastics Ltd., Borouge, SABIC, Exxon Mobil Corporation, The Dow Chemical Company |

| Additional Attributes | Surge in convenience packaging, Sustainability driving thin wall alternatives, Adoption of injection molding and recyclable polymers |

| Customization and Pricing | Customization and Pricing Available on Request |

The market is set to reach USD 37.44 billion in 2025.

Demand for thin wall plastic containers is slated to expand at a 4.8% CAGR by 2035.

The market is set to reach USD 57.08 billion by 2035.

Ball Corporation, Double H Plastics, Inc., and Sem Plastik are the key players.

Polypropylene segment is estimated to lead the market in 2025.

Table 01: Global Market Value (US$ million) and Volume (million Units) Forecast, by Region, 2024(A) to 2034(F)

Table 02: Global Market Value (US$ million) and Volume (million Units) Forecast, By Product Type, 2024(A) to 2034(F)

Table 03: Global Market Value (US$ million) and Volume (million Units) Forecast, by Material Type, 2024(A) to 2034(F)

Table 04: Global Market Value (US$ million) and Volume (million Units) Forecast, by Manufacturing Technology 2024(A) to 2034(F)

Table 05: Global Market Value (US$ million) and Volume (million Units) Forecast, by Application Type, 2024(A) to 2034(F)

Table 06: North America Market Value (US$ million) and Volume (million Units) Forecast, by Country, 2024(A) to 2034(F)

Table 07: North America Market Value (US$ million) and Volume (million Units) Forecast, by Product Type, 2024(A) to 2034(F)

Table 08: North America Market Value (US$ million) and Volume (million Units) Forecast, by Material Type 2024(A) to 2034(F)

Table 09: North America Market Value (US$ million) and Volume (million Units) Forecast, by material type, Polyethylene (PE), 2024(A) to 2034(F)

Table 10: North America Market Value (US$ million) and Volume (million Units) Forecast, by Manufacturing Technology, 2024(A) to 2034(F)

Table 11: North America Market Value (US$ million) and Volume (million Units) Forecast, by Application Type, 2024(A) to 2034(F)

Table 12: Asia Pacific excluding Japan Market Value (US$ million) and Volume (million Units) Forecast, by Country, 2024(A) to 2034(F)

Table 13: Asia Pacific excluding Japan Market Value (US$ million) and Volume (million Units) Forecast, by Product Type, 2024(A) to 2034(F)

Table 14: Asia Pacific excluding Japan Market Value (US$ million) and Volume (million Units) Forecast, by Material Type 2024(A) to 2034(F)

Table 15: Asia Pacific excluding Japan Market Value (US$ million) and Volume (million Units) Forecast, by material type, Polyethylene (PE), 2024(A) to 2034(F)

Table 16: Asia Pacific excluding Japan Market Value (US$ million) and Volume (million Units) Forecast, by Manufacturing Technology, 2024(A) to 2034(F)

Table 17: Asia Pacific excluding Japan Market Value (US$ million) and Volume (million Units) Forecast, by Application Type, 2024(A) to 2034(F)

Table 18: Western Europe Market Value (US$ million) and Volume (million Units) Forecast, by Country, 2024(A) to 2034(F)

Table 19: Western Europe Market Value (US$ million) and Volume (million Units) Forecast, by Product Type, 2024(A) to 2034(F)

Table 20: Western Europe Market Value (US$ million) and Volume (million Units) Forecast, by Material Type 2024(A) to 2034(F)

Table 21: Western Europe Market Value (US$ million) and Volume (million Units) Forecast, by material type, Polyethylene (PE), 2024(A) to 2034(F)

Table 22: Western Europe Market Value (US$ million) and Volume (million Units) Forecast, by Manufacturing Technology, 2024(A) to 2034(F)

Table 23: Western Europe Market Value (US$ million) and Volume (million Units) Forecast, by Application Type, 2024(A) to 2034(F)

Table 24: Eastern Europe Market Value (US$ million) and Volume (million Units) Forecast, by Country, 2024(A) to 2034(F)

Table 25: Eastern Europe Market Value (US$ million) and Volume (million Units) Forecast, by Product Type, 2024(A) to 2034(F)

Table 26: Eastern Europe Market Value (US$ million) and Volume (million Units) Forecast, by Material Type 2024(A) to 2034(F)

Table 27: Eastern Europe Market Value (US$ million) and Volume (million Units) Forecast, by material type, Polyethylene (PE), 2024(A) to 2034(F)

Table 28: Eastern Europe Market Value (US$ million) and Volume (million Units) Forecast, by Manufacturing Technology, 2024(A) to 2034(F)

Table 29: Eastern Europe Market Value (US$ million) and Volume (million Units) Forecast, by Application Type, 2024(A) to 2034(F)

Table 30: Latin America Market Value (US$ million) and Volume (million Units) Forecast, by Country, 2024(A) to 2034(F)

Table 31: Latin America Market Value (US$ million) and Volume (million Units) Forecast, by Product Type, 2024(A) to 2034(F)

Table 32: Latin America Market Value (US$ million) and Volume (million Units) Forecast, by Material Type 2024(A) to 2034(F)

Table 33: Latin America Market Value (US$ million) and Volume (million Units) Forecast, by material type, Polyethylene (PE), 2024(A) to 2034(F)

Table 34: Latin America Market Value (US$ million) and Volume (million Units) Forecast, by Manufacturing Technology, 2024(A) to 2034(F)

Table 35: Latin America Market Value (US$ million) and Volume (million Units) Forecast, by Application Type, 2024(A) to 2034(F)

Table 36: Middle East and Africa Market Value (US$ million) and Volume (million Units) Forecast, by Country, 2024(A) to 2034(F)

Table 37: Middle East and Africa Market Value (US$ million) and Volume (million Units) Forecast, by Product Type, 2024(A) to 2034(F)

Table 38: Middle East and Africa Market Value (US$ million) and Volume (million Units) Forecast, by Material Type 2024(A) to 2034(F)

Table 39: Middle East and Africa Market Value (US$ million) and Volume (million Units) Forecast, by material type, Polyethylene (PE), 2024(A) to 2034(F)

Table 40: Middle East and Africa Market Value (US$ million) and Volume (million Units) Forecast, by Manufacturing Technology, 2024(A) to 2034(F)

Table 41: Middle East and Africa Market Value (US$ million) and Volume (million Units) Forecast, by Application Type, 2024(A) to 2034(F)

Table 42: Japan Market Value (US$ million) and Volume (million Units) Forecast, by Product Type, 2024(A) to 2034(F)

Table 43: Japan Market Value (US$ million) and Volume (million Units) Forecast, by Material Type 2024(A) to 2034(F)

Table 44: Japan Market Value (US$ million) and Volume (million Units) Forecast, by material type, Polyethylene (PE), 2024(A) to 2034(F)

Table 45: Japan Market Value (US$ million) and Volume (million Units) Forecast, by Manufacturing Technology, 2024(A) to 2034(F)

Table 46: Japan Market Value (US$ million) and Volume (million Units) Forecast, by Application Type, 2024(A) to 2034(F)

Figure 01: Global Market, BPS Analysis, by Region, 2019 (E) to 2034(F)

Figure 02: Global Market Attractiveness Index, by Region, 2024(A) to 2034(F)

Figure 03: Global Market Value (US$ million) and Volume (million Units) analysis, 2024 to 2034

Figure 04: Global Market Value (US$ million) and Volume (million Units) Forecast, 2024 to 2034

Figure 05: Global Market, BPS Analysis, by Product Type, 2019 (E) to 2034(F)

Figure 06: Global Market Attractiveness Index, by Product Type, 2024(A) to 2034(F)

Figure 07: Global Market Value (US$ million) and Volume (million Units) analysis, by Boxes and Bins, 2024 to 2034

Figure 08: Global Market Value (US$ million) and Volume (million Units) Forecast, by Boxes and Bins, 2024 to 2034

Figure 09: Global Market Value (US$ million) and Volume (million Units) analysis, by Trays , 2024 to 2034

Figure 10: Global Market Value (US$ million) and Volume (million Units) Forecast, by Trays , 2024 to 2034

Figure 11: Global Market Value (US$ million) and Volume (million Units) analysis, by Cups, 2024 to 2034

Figure 12: Global Market Value (US$ million) and Volume (million Units) Forecast, by Cups 2024 to 2034

Figure 13: Global Market Value (US$ million) and Volume (million Units) analysis, by Lids 2024 to 2034

Figure 14: Global Market Value (US$ million) and Volume (million Units) Forecast, by Lids , 2024 to 2034

Figure 15: Global Market Value (US$ million) and Volume (million Units) analysis, by Thin Wall Pails , 2024 to 2034

Figure 16: Global Market Value (US$ million) and Volume (million Units) Forecast, by Thin Wall Pails , 2024 to 2034

Figure 17: Global Market Value (US$ million) and Volume (million Units) analysis, by Bowls , 2024 to 2034

Figure 18: Global Market Value (US$ million) and Volume (million Units) Forecast, by Bowls , 2024 to 2034

Figure 19: Global Market, BPS Analysis, by Material Type, 2019(E) and 2034(F)

Figure 20: Global Market Attractiveness Index, by Material Type, 2024(A) to 2034(F)

Figure 21: Global Market Value (US$ million) and Volume (million Units) analysis by Polypropylene (PP) , 2024 to 2034

Figure 22: Global Market Value (US$ million) and Volume (million Units) Forecast analysis by Polypropylene (PP) , 2024 to 2034

Figure 23: Global Market Value (US$ million) and Volume (million Units) analysis by Polystyrene (PS) , 2024 to 2034

Figure 24: Global Market Value (US$ million) and Volume (million Units) Forecast analysis by Polystyrene (PS) , 2024 to 2034

Figure 25: Global Market Value (US$ million) and Volume (million Units) analysis by Polyethylene (PE) , 2024 to 2034

Figure 26: Global Market Value (US$ million) and Volume (million Units) Forecast analysis by Polyethylene (PE) , 2024 to 2034

Figure 27: Global Market Value (US$ million) by material type, Polyethylene (PE), 2024 to 2034

Figure 28: Global Market Volume (million Units) by material type, Polyethylene (PE), 2024 to 2034

Figure 29: Global Market Value (US$ million) and Volume (million Units) analysis by Polyethylene terephthalate (PET) , 2024 to 2034

Figure 30: Global Market Value (US$ million) and Volume (million Units) Forecast analysis by Polyethylene terephthalate (PET) , 2024 to 2034

Figure 31: Global Market, BPS Analysis, by Manufacturing Technology, 2019 (E) to 2034(F)

Figure 32: Global Market Attractiveness Index, by Manufacturing Technology, 2024(A) to 2034(F)

Figure 33: Global Market Value (US$ million) and Volume (million Units) analysis, by Thermoformed , 2024 to 2034

Figure 34: Global Market Value (US$ million) and Volume (million Units) Forecast, by Thermoformed , 2024 to 2034

Figure 35: Global Market Value (US$ million) and Volume (million Units) analysis, by Vacuum technology , 2024 to 2034

Figure 36: Global Market Value (US$ million) and Volume (million Units) Forecast, by Vacuum technology , 2024 to 2034

Figure 37: Global Market Value (US$ million) and Volume (million Units) analysis, by Injection molded technology , 2024 to 2034

Figure 38: Global Market Value (US$ million) and Volume (million Units) Forecast, by Injection molded technology , 2024 to 2034

Figure 39: Global Market Value (US$ million) and Volume (million Units) analysis, by Others , 2024 to 2034

Figure 40: Global Market Value (US$ million) and Volume (million Units) Forecast, by Others , 2024 to 2034

Figure 41: Global Market, BPS Analysis, By Application Type, 2019 (E) to 2034(F)

Figure 42: Global Market Attractiveness Index, By Application Type, 2024(A) to 2034(F)

Figure 43: Global Market Value (US$ million) and Volume (million Units) , By Dairy Products Application Type analysis, 2024 to 2034

Figure 44: Global Market Value (US$ million) and Volume (million Units) , By Dairy Products Application Type Forecast, 2024 to 2034

Figure 45: Global Market Value (US$ million) and Volume (million Units) , By Frozen Food Application Type analysis, 2024 to 2034

Figure 46: Global Market Value (US$ million) and Volume (million Units) , By Frozen Food Application Type Forecast, 2024 to 2034

Figure 47: Global Market Value (US$ million) and Volume (million Units) , By Fruit and Vegetables Application Type analysis, 2024 to 2034

Figure 48: Global Market Value (US$ million) and Volume (million Units) , By Dairy Products Application Type Forecast, 2024 to 2034

Figure 49: Global Market Value (US$ million) and Volume (million Units) , By Bakery and Confectionery Application Type analysis, 2024 to 2034

Figure 50: Global Market Value (US$ million) and Volume (million Units) , By Bakery and Confectionery Application Type Forecast, 2024 to 2034

Figure 51: Global Market Value (US$ million) and Volume (million Units) , By Juices and Soups Application Type analysis, 2024 to 2034

Figure 52: Global Market Value (US$ million) and Volume (million Units) , By Juices and Soups Application Type Forecast, 2024 to 2034

Figure 53: Global Market Value (US$ million) and Volume (million Units), By Meat, Seafood and Poultry Application Type analysis, 2024 to 2034

Figure 54: Global Market Value (US$ million) and Volume (million Units) , By Meat, Seafood and Poultry Application Type Forecast, 2024 to 2034

Figure 55: Global Market Value (US$ million) and Volume (million Units) , By Ready-to-Eat Meals Application Type analysis, 2024 to 2034

Figure 56: Global Market Value (US$ million) and Volume (million Units) , By Ready-to-Eat Meals Application Type Forecast, 2024 to 2034

Figure 57: Global Market Value (US$ million) and Volume (million Units) , By Pharmaceuticals Application Type analysis, 2024 to 2034

Figure 58: Global Market Value (US$ million) and Volume (million Units) , By Pharmaceuticals Application Type Forecast, 2024 to 2034

Figure 59: Global Market Value (US$ million) and Volume (million Units), By Personal Care and Cosmetics Application Type analysis, 2024 to 2034

Figure 60: Global Market Value (US$ million) and Volume (million Units) , By Personal Care and Cosmetics Application Type Forecast, 2024 to 2034

Figure 61: Global Market Value (US$ million) and Volume (million Units) , By Paints, Lubricants and Adhesives Application Type analysis, 2024 to 2034

Figure 62: Global Market Value (US$ million) and Volume (million Units) , By Paints, Lubricants and Adhesives Application Type Forecast, 2024 to 2034

Figure 63: North America Market Value (US$ million) and Volume (million Units) analysis, 2024 to 2034

Figure 64: North America Market Value (US$ million) and Volume (million Units) Forecast, 2024 to 2034

Figure 65: North America Market, BPS Analysis, by country, 2024, 2019 to 2034

Figure 66: North America Market, Y-o-Y growth, by country, 2019(E) to 2034(F)

Figure 67: North America Market Value (US$ million) by country, 2024 to 2034

Figure 68: North America Market Volume (million Units) by country, 2024 to 2034

Figure 69: North America Market Value (US$ million) by country, 2019(E) to 2034(F)

Figure 70: North America Market Value (US$ million) by product type, 2024 to 2034

Figure 71: North America Market Volume (million Units) by product type, 2024 to 2034

Figure 72: North America Market attractiveness analysis, by product type, 2024 to 2034

Figure 73: North America Y-o-Y growth (2019(E) to 2034(F)), by product type

Figure 74: North America Market Value (US$ million) by Material Type , 2024 to 2034

Figure 75: North America Market Volume (million Units) by Material Type , 2024 to 2034

Figure 76: North America Y-o-Y growth (2019(E) to 2034(F)), by Material Type

Figure 77: North America Market attractiveness analysis, by Material Type , 2024 to 2034

Figure 78: North America Market Value (US$ million) by material type, Polyethylene (PE), 2024 to 2034

Figure 79: North America Market Volume (million Units) by material type, Polyethylene (PE), 2024 to 2034

Figure 80: North America Market attractiveness analysis, by material type, Polyethylene (PE), 2024 to 2034

Figure 81: North America Market Y-o-Y growth (2019(E) to 2034(F)), by material type, Polyethylene (PE)

Figure 82: North America Market Value (US$ million) by Manufacturing Technology, 2024 to 2034

Figure 83: North America Market Volume (million Units) by Manufacturing Technology, 2024 to 2034

Figure 84: North America Market attractiveness analysis, by Manufacturing Technology, 2024 to 2034

Figure 85: North America Y-o-Y growth (2019(E) to 2034(F)), by Manufacturing Technology

Figure 86: North America Market Value (US$ million) by Application Type, 2024 to 2034

Figure 87: North America Market Volume (million Units) by Application Type, 2024 to 2034

Figure 88: North America Y-o-Y growth (2019(E) to 2034(F)), by Application Type

Figure 89: North America Market attractiveness analysis, by Application Type, 2024 to 2034

Figure 90: Asia Pacific excluding Japan Market Value (US$ million) and Volume (million Units) analysis, 2024 to 2034

Figure 91: Asia Pacific excluding Japan Market Value (US$ million) and Volume (million Units) Forecast, 2024 to 2034

Figure 92: Asia Pacific excluding Japan Market, BPS Analysis, by country, 2024, 2019 to 2034

Figure 93: Asia Pacific excluding Japan Market, Y-o-Y growth, by country, 2019(E) to 2034(F)

Figure 94: Asia Pacific excluding Japan Market Value (US$ million) by country, 2024 to 2034

Figure 95: Asia Pacific excluding Japan Market Volume (million Units) by country, 2024 to 2034

Figure 96: Asia Pacific excluding Japan Market Value (US$ million) by country, 2019(E) to 2034(F)

Figure 97: Asia Pacific excluding Japan Market Value (US$ million) by product type, 2024 to 2034

Figure 98: Asia Pacific excluding Japan Market Volume (million Units) by product type, 2024 to 2034

Figure 99: Asia Pacific excluding Japan Market attractiveness analysis, by product type, 2024 to 2034

Figure 100: Asia Pacific excluding Japan Y-o-Y growth (2019(E) to 2034(F)), by product type

Figure 101: Asia Pacific excluding Japan Market Value (US$ million) by Material Type , 2024 to 2034

Figure 102: Asia Pacific excluding Japan Market Volume (million Units) by Material Type , 2024 to 2034

Figure 103: Asia Pacific excluding Japan Y-o-Y growth (2019(E) to 2034(F)), by Material Type

Figure 104: Asia Pacific excluding Japan Market attractiveness analysis, by Material Type , 2024 to 2034

Figure 105: Asia Pacific excluding Japan Market Value (US$ million) by material type, Polyethylene (PE), 2024 to 2034

Figure 106: Asia Pacific excluding Japan Market Volume (million Units) by material type, Polyethylene (PE), 2024 to 2034

Figure 107: Asia Pacific excluding Japan Market attractiveness analysis, by material type, Polyethylene (PE), 2024 to 2034

Figure 108: Asia Pacific excluding Japan Market Y-o-Y growth (2019(E) to 2034(F)), by material type, Polyethylene (PE)

Figure 109: Asia Pacific excluding Japan Market Value (US$ million) by Manufacturing Technology, 2024 to 2034

Figure 110: Asia Pacific excluding Japan Market Volume (million Units) by Manufacturing Technology, 2024 to 2034

Figure 111: Asia Pacific excluding Japan Market attractiveness analysis, by Manufacturing Technology, 2024 to 2034

Figure 112: Asia Pacific excluding Japan Y-o-Y growth (2019(E) to 2034(F)), by Manufacturing Technology

Figure 113: Asia Pacific excluding Japan Market Value (US$ million) by Application Type, 2024 to 2034

Figure 114: Asia Pacific excluding Japan Market Volume (million Units) by Application Type, 2024 to 2034

Figure 115: Asia Pacific excluding Japan Y-o-Y growth (2019(E) to 2034(F)), by Application Type

Figure 116: Asia Pacific excluding Japan Market attractiveness analysis, by Application Type, 2024 to 2034

Figure 117: Western Europe Market Value (US$ million) and Volume (million Units) analysis, 2024 to 2034

Figure 118: Western Europe Market Value (US$ million) and Volume (million Units) Forecast, 2024 to 2034

Figure 119: Western Europe Market, BPS Analysis, by country, 2024, 2019 to 2034

Figure 120: Western Europe Market, Y-o-Y growth, by country, 2019(E) to 2034(F)

Figure 121: Western Europe Market Value (US$ million) by country, 2024 to 2034

Figure 122: Western Europe Market Volume (million Units) by country, 2024 to 2034

Figure 123: Western Europe Market Value (US$ million) by country, 2019(E) to 2034(F)

Figure 124: Western Europe Market Value (US$ million) by product type, 2024 to 2034

Figure 125: Western Europe Market Volume (million Units) by product type, 2024 to 2034

Figure 126: Western Europe Market attractiveness analysis, by product type, 2024 to 2034

Figure 127: Western Europe Y-o-Y growth (2019(E) to 2034(F)), by product type

Figure 128: Western Europe Market Value (US$ million) by Material Type , 2024 to 2034

Figure 129: Western Europe Market Volume (million Units) by Material Type , 2024 to 2034

Figure 130: Western Europe Y-o-Y growth (2019(E) to 2034(F)), by Material Type

Figure 131: Western Europe Market attractiveness analysis, by Material Type , 2024 to 2034

Figure 132: Western Europe Market Value (US$ million) by material type, Polyethylene (PE), 2024 to 2034

Figure 133: Western Europe Market Volume (million Units) by material type, Polyethylene (PE), 2024 to 2034

Figure 134: Western Europe Market attractiveness analysis, by material type, Polyethylene (PE), 2024 to 2034

Figure 135: Western Europe Market Y-o-Y growth (2019(E) to 2034(F)), by material type, Polyethylene (PE)

Figure 136: Western Europe Market Value (US$ million) by Manufacturing Technology, 2024 to 2034

Figure 137: Western Europe Market Volume (million Units) by Manufacturing Technology, 2024 to 2034

Figure 138: Western Europe Market attractiveness analysis, by Manufacturing Technology, 2024 to 2034

Figure 139: Western Europe Y-o-Y growth (2019(E) to 2034(F)), by Manufacturing Technology

Figure 140: Western Europe Market Value (US$ million) by Application Type, 2024 to 2034

Figure 141: Western Europe Market Volume (million Units) by Application Type, 2024 to 2034

Figure 142: Western Europe Y-o-Y growth (2019(E) to 2034(F)), by Application Type

Figure 143: Western Europe Market attractiveness analysis, by Application Type, 2024 to 2034

Figure 144: Eastern Europe Market Value (US$ million) and Volume (million Units) analysis, 2024 to 2034

Figure 145: Eastern Europe Market Value (US$ million) and Volume (million Units) Forecast, 2024 to 2034

Figure 146: Eastern Europe Market, BPS Analysis, by country, 2024, 2019 to 2034

Figure 147: Eastern Europe Market, Y-o-Y growth, by country, 2019(E) to 2034(F)

Figure 148: Eastern Europe Market Value (US$ million) by country, 2024 to 2034

Figure 149: Eastern Europe Market Volume (million Units) by country, 2024 to 2034

Figure 150: Eastern Europe Market Value (US$ million) by country, 2019(E) to 2034(F)

Figure 151: Eastern Europe Market Value (US$ million) by product type, 2024 to 2034

Figure 152: Eastern Europe Market Volume (million Units) by product type, 2024 to 2034

Figure 153: Eastern Europe Market attractiveness analysis, by product type, 2024 to 2034

Figure 154: Eastern Europe Y-o-Y growth (2019(E) to 2034(F)), by product type

Figure 155: Eastern Europe Market Value (US$ million) by Material Type , 2024 to 2034

Figure 156: Eastern Europe Market Volume (million Units) by Material Type , 2024 to 2034

Figure 157: Eastern Europe Y-o-Y growth (2019(E) to 2034(F)), by Material Type

Figure 158: Eastern Europe Market attractiveness analysis, by Material Type , 2024 to 2034

Figure 159: Eastern Europe Market Value (US$ million) by material type, Polyethylene (PE), 2024 to 2034

Figure 160: Eastern Europe Market Volume (million Units) by material type, Polyethylene (PE), 2024 to 2034

Figure 161: Eastern Europe Market attractiveness analysis, by material type, Polyethylene (PE), 2024 to 2034

Figure 162: Eastern Europe Market Y-o-Y growth (2019(E) to 2034(F)), by material type, Polyethylene (PE)

Figure 163: Eastern Europe Market Value (US$ million) by Manufacturing Technology, 2024 to 2034

Figure 164: Eastern Europe Market Volume (million Units) by Manufacturing Technology, 2024 to 2034

Figure 165: Eastern Europe Market attractiveness analysis, by Manufacturing Technology, 2024 to 2034

Figure 166: Eastern Europe Y-o-Y growth (2019(E) to 2034(F)), by Manufacturing Technology

Figure 167: Eastern Europe Market Value (US$ million) by Application Type, 2024 to 2034

Figure 168: Eastern Europe Market Volume (million Units) by Application Type, 2024 to 2034

Figure 169: Eastern Europe Y-o-Y growth (2019(E) to 2034(F)), by Application Type

Figure 170: Eastern Europe Market attractiveness analysis, by Application Type, 2024 to 2034

Figure 171: Latin America Market Value (US$ million) and Volume (million Units) analysis, 2024 to 2034

Figure 172: Latin America Market Value (US$ million) and Volume (million Units) Forecast, 2024 to 2034

Figure 173: Latin America Market, BPS Analysis, by country, 2024, 2019 to 2034

Figure 174: Latin America Market, Y-o-Y growth, by country, 2019(E) to 2034(F)

Figure 175: Latin America Market Value (US$ million) by country, 2024 to 2034

Figure 176: Latin America Market Volume (million Units) by country, 2024 to 2034

Figure 177: Latin America Market Value (US$ million) by country, 2019(E) to 2034(F)

Figure 178: Latin America Market Value (US$ million) by product type, 2024 to 2034

Figure 179: Latin America Market Volume (million Units) by product type, 2024 to 2034

Figure 180: Latin America Market attractiveness analysis, by product type, 2024 to 2034

Figure 181: Latin America Y-o-Y growth (2019(E) to 2034(F)), by product type

Figure 182: Latin America Market Value (US$ million) by Material Type , 2024 to 2034

Figure 183: Latin America Market Volume (million Units) by Material Type , 2024 to 2034

Figure 184: Latin America Y-o-Y growth (2019(E) to 2034(F)), by Material Type

Figure 185: Latin America Market attractiveness analysis, by Material Type , 2024 to 2034

Figure 186: Latin America Market Value (US$ million) by material type, Polyethylene (PE), 2024 to 2034

Figure 187: Latin America Market Volume (million Units) by material type, Polyethylene (PE), 2024 to 2034

Figure 188: Latin America Market attractiveness analysis, by material type, Polyethylene (PE), 2024 to 2034

Figure 189: Latin America Market Y-o-Y growth (2019(E) to 2034(F)), by material type, Polyethylene (PE)

Figure 190: Latin America Market Value (US$ million) by Manufacturing Technology, 2024 to 2034

Figure 191: Latin America Market Volume (million Units) by Manufacturing Technology, 2024 to 2034

Figure 192: Latin America Market attractiveness analysis, by Manufacturing Technology, 2024 to 2034

Figure 193: Latin America Y-o-Y growth (2019(E) to 2034(F)), by Manufacturing Technology

Figure 194: Latin America Market Value (US$ million) by Application Type, 2024 to 2034

Figure 195: Latin America Market Volume (million Units) by Application Type, 2024 to 2034

Figure 196: Latin America Y-o-Y growth (2019(E) to 2034(F)), by Application Type

Figure 197: Latin America Market attractiveness analysis, by Application Type, 2024 to 2034

Figure 198: Middle East and Africa Market Value (US$ million) and Volume (million Units) analysis, 2024 to 2034

Figure 199: Middle East and Africa Market Value (US$ million) and Volume (million Units) Forecast, 2024 to 2034

Figure 200: Middle East and Africa Market, BPS Analysis, by country, 2024, 2019 to 2034

Figure 201: Middle East and Africa Market, Y-o-Y growth, by country, 2019(E) to 2034(F)

Figure 202: Middle East and Africa Market Value (US$ million) by country, 2024 to 2034

Figure 203: Middle East and Africa Market Volume (million Units) by country, 2024 to 2034

Figure 204: Middle East and Africa Market Value (US$ million) by country, 2019(E) to 2034(F)

Figure 205: Middle East and Africa Market Value (US$ million) by product type, 2024 to 2034

Figure 206: Middle East and Africa Market Volume (million Units) by product type, 2024 to 2034

Figure 207: Middle East and Africa Market attractiveness analysis, by product type, 2024 to 2034

Figure 208: Middle East and Africa Y-o-Y growth (2019(E) to 2034(F)), by product type

Figure 209: Middle East and Africa Market Value (US$ million) by Material Type , 2024 to 2034

Figure 210: Middle East and Africa Market Volume (million Units) by Material Type , 2024 to 2034

Figure 211: Middle East and Africa Y-o-Y growth (2019(E) to 2034(F)), by Material Type

Figure 212: Middle East and Africa Market attractiveness analysis, by Material Type , 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ million) by material type, Polyethylene (PE), 2024 to 2034

Figure 214: Middle East and Africa Market Volume (million Units) by material type, Polyethylene (PE), 2024 to 2034

Figure 215: Middle East and Africa Market attractiveness analysis, by material type, Polyethylene (PE), 2024 to 2034

Figure 216: Middle East and Africa Market Y-o-Y growth (2019(E) to 2034(F)), by material type, Polyethylene (PE)

Figure 217: Middle East and Africa Market Value (US$ million) by Manufacturing Technology, 2024 to 2034

Figure 218: Middle East and Africa Market Volume (million Units) by Manufacturing Technology, 2024 to 2034

Figure 219: Middle East and Africa Market attractiveness analysis, by Manufacturing Technology, 2024 to 2034

Figure 220: Middle East and Africa Y-o-Y growth (2019(E) to 2034(F)), by Manufacturing Technology

Figure 221: Middle East and Africa Market Value (US$ million) by Application Type, 2024 to 2034

Figure 222: Middle East and Africa Market Volume (million Units) by Application Type, 2024 to 2034

Figure 223: Middle East and Africa Y-o-Y growth (2019(E) to 2034(F)), by Application Type

Figure 224: Middle East and Africa Market attractiveness analysis, by Application Type, 2024 to 2034

Figure 225: Japan Market Value (US$ million) and Volume (million Units) analysis, 2024 to 2034

Figure 226: Japan Market Value (US$ million) and Volume (million Units) Forecast, 2024 to 2034

Figure 227: Japan Market Value (US$ million) by product type, 2024 to 2034

Figure 228: Japan Market Volume (million Units) by product type, 2024 to 2034

Figure 229: Japan Market attractiveness analysis, by product type, 2024 to 2034

Figure 230: Japan Y-o-Y growth (2019(E) to 2034(F)), by product type

Figure 231: Japan Market Value (US$ million) by Material Type , 2024 to 2034

Figure 232: Japan Market Volume (million Units) by Material Type , 2024 to 2034

Figure 233: Japan Y-o-Y growth (2019(E) to 2034(F)), by Material Type

Figure 234: Japan Market attractiveness analysis, by Material Type , 2024 to 2034

Figure 235: Japan Market Value (US$ million) by material type, Polyethylene (PE), 2024 to 2034

Figure 236: Japan Market Volume (million Units) by material type, Polyethylene (PE), 2024 to 2034

Figure 237: Japan Market attractiveness analysis, by material type, Polyethylene (PE), 2024 to 2034

Figure 238: Japan Market Y-o-Y growth (2019(E) to 2034(F)), by material type, Polyethylene (PE)

Figure 239: Japan Market Value (US$ million) by Manufacturing Technology, 2024 to 2034

Figure 240: Japan Market Volume (million Units) by Manufacturing Technology, 2024 to 2034

Figure 241: Japan Market attractiveness analysis, by Manufacturing Technology, 2024 to 2034

Figure 242: Japan Y-o-Y growth (2019(E) to 2034(F)), by Manufacturing Technology

Figure 243: Japan Market Value (US$ million) by Application Type, 2024 to 2034

Figure 244: Japan Market Volume (million Units) by Application Type, 2024 to 2034

Figure 245: Japan Y-o-Y growth (2019(E) to 2034(F)), by Application Type

Figure 246: Japan Market attractiveness analysis, by Application Type, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Wall Glass Container Market

Thin Wall Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Mould Market

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Wall Mounted Manifolds Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Wall Covering Product Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA