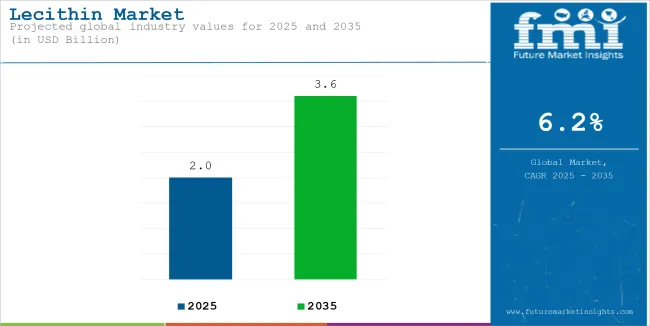

The global lecithin market is estimated to account for USD 2 billion in 2025. It is anticipated to grow at a CAGR of 6.2% during the assessment period and reach a value of USD 3.6 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Lecithin Market Size (2025E) | USD 2 billion |

| Projected Global Lecithin Market Value (2035F) | USD 3.6 billion |

| Value-based CAGR (2025 to 2035) | 6.2% |

Lecithin is the general term describing a collection of yellowish-brown greasy substances in both plant and animal tissues. They have amphiphilic properties, meaning they attract and can hold water and fat equally. Being hydrophilic and lipophilic, lecithin is widely applicable in the food industry through the functions of adding texture, emulsification, homogenizing liquid mixtures, and being an anti-adhesive materials.

High Demand for Lecithin’s Health and Wellness

The health and wellness trend also increases demand for lecithin. Lecithin benefits human health and is a supplement that enhances the function of brain tissue and lipid metabolism. It can be used in the nutraceutical and dietary supplement industry for functional ingredients concerning general well-being.

Its ability to be formulated into various healthy products makes lecithin an ideal component. There is an increasing demand for functional foods and beverages that provide specific health benefits beyond essential nutrition. Lecithin's versatility makes it a valuable ingredient in these products.

This trend is also reflected in the increasing demand for natural and clean-label products with minimal processing and recognizable ingredients. Lecithin, being a natural substance, falls well within this trend.

Rising Preference for Non-GMO

The growing demand for non-GMO and organic products is another big driver. People are getting more conscious about the origins of their food, thus fuelling demand for lecithin from non-GMO soybeans or sunflower seeds. It is prompting manufacturers to diversify their sourcing strategies and invest in certifications that ensure consumers know the product's non-GMO status. The increased demand for organic lecithin further supports this trend, particularly in premium food and personal care products.

The demand for natural emulsifiers, health and wellness trends, expansion of plant-based food, preference for non-GMO products, and the rise of the processed food industry further propels this rise in the market. These drivers are changing the market landscape, making lecithin an indispensable ingredient in many industries while providing opportunities for advancement and diversification.

Growth of Plant-Based Food

The fast growth of the plant-based food sector has also contributed to the market's growth. With the rising popularity of vegan and vegetarian diets, lecithin has become an essential ingredient for plant-based formulations. It is commonly used in plant-based dairy alternatives, meat substitutes, and other vegan products to improve texture, emulsify ingredients, and product stability. This increase in plant-based food production is anticipated to sustain the demand for lecithin in the coming years.

Additionally, there is a high demand for plant-based options for animal products due to the rising popularity of vegan and vegetarian diets. In many of these products, plant-based lecithin is a critical ingredient that acts as an emulsifier, stabilizer, and texturizer.

Moreover, natural and clean-label products with minimal processing and recognizable ingredients are increasingly sought out by consumers. Natural sources such as soya beans, rapeseeds, and sunflowers well align with plant-based lecithin.

Ethical Sourcing and Sustainability

Sustainability and ethical sourcing practices in the lecithin market are further driving changes. Manufacturers have been using eco-friendly production methods and sourcing strategies to reduce their environmental impact.

Such practices include less water and energy consumption during production and ensuring that the raw materials are farmed sustainably. Environmentally conscious consumers resonate with global sustainability initiatives sentimentally. Another reason is the increasing importance of ethical sourcing and sustainability for consumers and businesses.

Technological Innovation

The latest technological improvements in production processes give the market a new dimension. It has enabled strong-purity lecithin and de-oiled variants that have become very popular in functional foods, pharmaceuticals, and cosmetics. Improvements in product quality are helping expand the application base of lecithin for more specialized uses.

Technological progress in production has made the market experience a new level. Advanced refinement techniques allow lecithin to have intense purity and de-oiled forms, which has gained popularity in functional foods, drugs, and cosmetics. With this, advancements improve product quality and continue increasing the lecithin usage base for more technical applications.

Moreover, technological developments have been changing the lecithin industry by developing improved methods of production, quality of the products, and expansion in applications. Technological advancements include enzyme-assisted extraction, supercritical fluid extraction, and membrane filtration.

In this method, enzymes break the cell walls, quickly releasing lecithin; hence, yields are higher, and the quality is enhanced. Supercritical fluid extraction technology uses carbon dioxide under high pressure and temperature to extract lecithin, which makes the product purer and more environmentally friendly.

Rise in the Use of Pharmaceuticals

Usage in the pharmaceutical industry is increasing by leaps and bounds. Lecithin is an excellent emulsifier and stabilizer for numerous drug delivery systems. It can be used in the preparation of liposomes. These are tiny vesicles capable of entrapping drugs inside them and carrying them to particular cells. Such targeted delivery increases the drug efficacy while reducing side effects.

Furthermore, intravenous fat emulsions that contain lecithin as an active component to be administered nutrients orally in the form of essential fatty acids in patients. Furthermore, targeted therapies and personalized medicine continue to pressurize for innovative research in drug delivery systems.

Allergic Properties May Limit its Usage

Potential allergic reactions associated with soy lecithin push demand toward alternative sources. The primary concern with lecithin allergies stems from soy lecithin; individuals with soy allergies may experience allergic reactions to soy lecithin products. These reactions can range from mild skin rash and itching, to severe anaphylaxis.

Moreover, other sources, including less common allergic reactions, can also occur with lecithin derived from different sources, such as sunflower or rapeseed. However, these are generally less likely to cause allergies compared to soy lecithin.

Regulatory Challenges

The market faces many regulatory challenges, such as varying regulations across areas, evolving regulatory landscape, and compliance with food safety standards. Regulations regarding the use of lecithin in food, pharmaceuticals, and other industries vary in importance across different countries and regions. It can create complexities for manufacturers and distributors who operate in multiple markets.

Food safety and labeling regulations are constantly evolving, requiring manufacturers to stay informed and adapt their products and processes accordingly. For example, there’s growing scrutiny on genetically modified organisms and the need for clear allergen labeling.

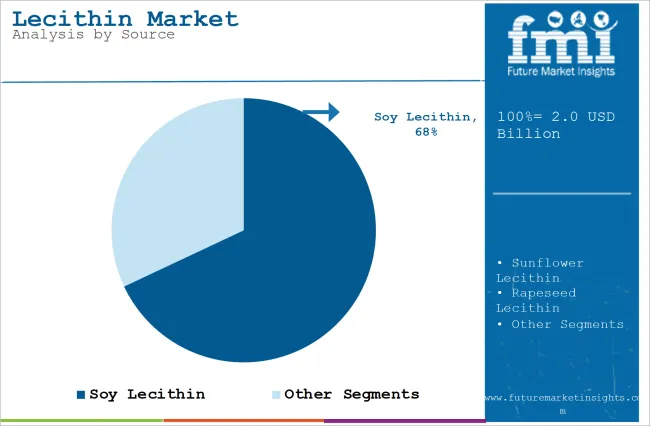

Importance of Soy Lecithin to Propel Market Growth

| Attributes | Details |

|---|---|

| Top Source | Soy Lecithin |

| Market Share in 2025 | 68% |

Based on the source, the market is divided into soy lecithin, sunflower lecithin, and rapeseed lecithin. The soy lecithin segment is expected to account for 68% market share in 2025. Soy lecithin are most common form and offers good flow ability and ease of handling. More convenient for dry blending and storage, but may require special handling to avoid clumping, granular provides a balance between flowability and ease of handling.

Additionally, the most abundant phospholipid in soy lecithin, known for its emulsifying properties, another significant phospholipid with emulsifying and antioxidant properties is phosphatidylethanolamine. They are widely used in chocolate, bakery products, margarine, and other food products. Enhance feed quality and animal health used in drug delivery systems and intravenous fat emulsions, used in skincare and haircare products, and also used in paints, coatings, and other industrial applications.

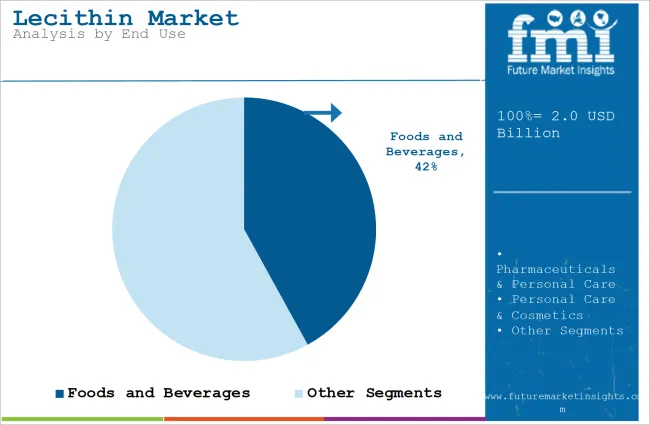

Increasing Demand for Food and Beverages Poised to Create Opportunities

| Attributes | Details |

|---|---|

| Top Application | Foods and Beverages |

| Market Share in 2025 | 42% |

Based on the application, the market is divided into foods and beverages, pharmaceuticals & personal care, personal care & cosmetics, animal feed, and industrial. The food and beverages segment is expected to account for 42% market share in 2025. Lecithin plays an important role in many food and beverage segments owing to its emulsifying, stabilizing, and texturizing properties such as confectionery, bakery products, dairy products, and sauces and dressing.

Moreover, lecithin enhances chocolate flow during processing, prevents fats bloom, and improves smoothness and gloss. Bakery products improve dough handling, increase volume, enhance shelf life, also improve flakiness and prevent sticking.

Furthermore, dairy products prevent ice crystal formation, enhance smoothness, and improve overrun. In sauces and dressings, mayonnaise acts as an emulsifier to prevent separation of oil and water, it stabilizes emulsions and prevents phase separation.

| Attributes | Details |

|---|---|

| Leading Form | Liquid Lecithin |

| Market Share in 2025 | 42% |

Based on the application, the market is divided into liquid, powdered, and granules. Liquid lecithin is the most widely used form in the lecithin market. Such as versatility, ease of handling and storage, and rising demand. Contains more oil components, primarily used in food processing, specifically in chocolate and confectionery. Versatility is suitable for various industries and applications. While ease of handling is convenient for transportation and storage.

Moreover, Improved stability, longer shelf life compared to liquid lecithin, and growing demand from various sectors, including food, pharmaceuticals, and personal care. While powdered and granular forms have their specific applications, liquid lecithin’s versatility and ease of use make it the preferred choice for many manufacturers.

India

India lecithin market is poised to grow at a CAGR of 8.3% from 2025 to 2035. India accounts for a moderate share in the global market. The growing demand for lecithin in food, animal feed, and pharmaceutical applications drives the industry growth here.

There is also a rising interest in health and wellness products, specifically plant-based and organic foods, as emulsifiers and stabilizers are used in lecithin. Lipoid and soya Lecithin India play an important role in the Indian market. A shift towards non-GMO lecithin, specifically soy lecithin, is noticeable owing to customer preferences for clean-label products.

China

The market in China is poised to grow at a CAGR of 7.8% from 2025 to 2035. China is driven by the booming food processing and nutritional supplement industries and is one of the fastest-expanding markets for lecithin. The market is growing due to rapid urbanization and changing lifestyles, health-conscious consumers, and expanding pharmaceutical industry.

In China BASF, Cargill, and Shandong Jinyuan are major players. Moreover, in China companies such as BASF are growing their production capacity, emphasizing developing strong quality sunflower lecithin products to cater to the increasing demand for clean-label and non-GMO ingredients.

Canada

The industry in Canada is poised to grow at a CAGR of 5.9% from 2025 to 2035. Canada's growing demand is driven by the food, dietary supplements, and pharmaceutical sectors and also holds a smaller but increasing share of the lecithin market. The market is increasing health and wellness trends and expansion of the processed food industry. In the Canadian market Lecico, Cargill, and Lipoid are active.

The USA

The USA industry is expanding to grow at a CAGR of 5.2% from 2025 to 2035. The USA is largely driven by the demand from the food and beverage industry, particularly in bakery products, processed foods, and chocolates, and has an important share of the global market. Technological innovation, growing demand for clean-label products, and health are significant growth drivers.

UK

UK is expanding to grow at a CAGR of 5.6% from 2025 to 2035. In Europe, the UK has a moderate share of the lecithin market, with demand driven primarily by the increasing food and beverages sector, such as bakery, dairy, and confectionery. This emphasis is on clean ingredients, plant-based and vegan, and cosmetics and pharmaceuticals. In the UK Bunge, Lipoid, and Cargill are important players.

| Region | Bulk Price (Approx.) |

|---|---|

| North America | Declined prices due to oversupply and reduced soybean costs. |

| Asia-Pacific | USD 1,250 per metric ton FOB Tianjin (average quarterly increase of 4.35%). |

| Europe | Prices increased due to supply chain dynamics and raw material cost hikes. |

| Global Average | Prices range from USD 1,100 to USD 1,500 per metric ton depending on source and quality. |

In North America prices have reduced due to excessive supply and decreased soybean cost. Asia Pacific average quarterly rise of 4.35%, USD 1,250 per metric ton FOB Tianjin. Also in Europe, prices rise due to supply chain dynamics and raw material cost hikes. The global average depending on source and quality prices ranges from USD 1,100 to USD 1,500 per metric ton.

| Category | Details |

|---|---|

| Total Shipments | Approximately 15,191 global lecithin export and import shipments (March 2023 - February 2024). |

| Top Exporters |

|

| Top Importers |

|

| China’s Exports | Volume: 3.2 million kg (October 2024), up from 2.6 million kg (September 2024). |

| USA Imports |

|

From March 2023 to February 2024 total shipments import and export reached approximately 15,191 global lecithin. For example, the total importers in India are 15,819 shipments, in the USA 12,612, in Russia 10,210 shipments. The total exports in October 2024 were 3.2 million kg, up from September 2024 2.6 million kg. In USA Imports organic sunflower and soy lecithin powder are product variants. Brazil and China are sources of countries. For example, In November 2024 Brazil imported 18,000 kg.

| Countries | Leading Lecithin Manufacturers |

|---|---|

| United States |

|

| Germany |

|

| Netherlands |

|

| Finland | Recital Oy |

| United Kingdom | Thew Arnott & Co. Ltd. |

| India |

|

| Spain | Lasenor Emul |

| Malaysia | Sime Darby Plantation Berhad |

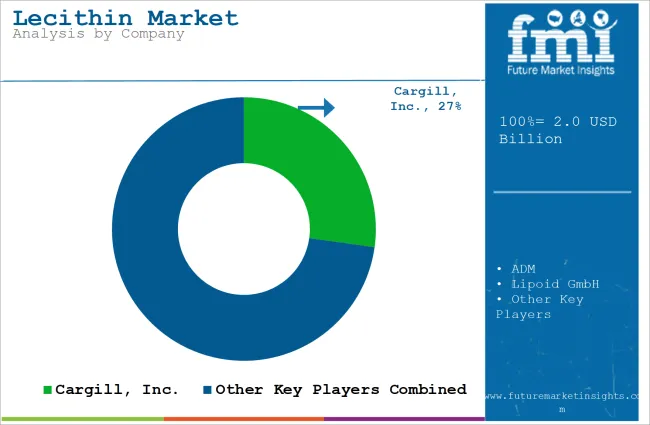

Companies such as Bunge Limited and Viterra Acquisition, Cargill, and Acquisition of Lecithin Supplier by AAK are adopting various growth strategies. In July 2024 Bunge Limited, a global agribusiness company, established approval from the Competition Commission of India to acquire Viterra a leading grain handler. By enhancing sourcing and distribution efficiency Bunge’s global supply chain capabilities, which could directly impact its lecithin operations.

Moreover, Cargill’s strategic investment in plant-based ingredients in April 2024 Cargill announced USD 100 million investment to grow its facilities producing plant-based ingredients, such as lecithin, to meet growing demand for clean-label and non-GMO products. Sunflower and soybeans expansion emphasis on scaling up lecithin production.

The influx of advancement startups has redefined to lecithin industry with novel perspectives and cutting-edge solutions. The emphasis on sustainability, niche applications, and using advanced technology to enhance the production and functionality of lecithin.

Efforts by new entrants expand the product range and make lecithin more accessible and adaptable to a variety of industries.

Many startups emphasize sustainable and non-GMO lecithin production as demand for clean-label and ethical products continues to grow. Some companies look at alternative raw materials, such as sunflower and canola, to provide non-GMO alternatives.

Moreover, startups in the lecithin market are fostering important innovations that address modern consumer demands for sustainability, advancements, and versatility. Their emphasis on tailored solutions and emerging applications is reshaping the market landscape and offering new growth opportunities. As these startups scale their operations and grow their footprints, they are likely to become major contributors to the industry's future.

In terms of source, the lecithin market is segmented into soy lecithin, sunflower lecithin, and rapeseed lecithin.

In terms of application, the market is segmented into foods and beverages, pharmaceuticals & personal care, personal care & cosmetics, animal feed, and industrial.

In terms of form, the market is segmented into liquid, powdered, and granules.

The report provides regional analysis across North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The market is predicted to reach a size of USD 3.6 billion by 2035.

The market size is poised to reach USD 2 billion in 2025.

The prominent companies in the lecithin market include ADM, DuPont de Nemours, Inc., and NOW Foods.

Food and Beverages is the leading application segment for the lecithin market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Function, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 22: North America Market Volume (MT) Forecast by Function, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 32: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 34: Latin America Market Volume (MT) Forecast by Function, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 42: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 46: Europe Market Volume (MT) Forecast by Function, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 56: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 57: East Asia Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 58: East Asia Market Volume (MT) Forecast by Function, 2018 to 2033

Table 59: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 61: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 65: South Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 66: South Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 67: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 68: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: South Asia Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 70: South Asia Market Volume (MT) Forecast by Function, 2018 to 2033

Table 71: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 72: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 73: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 75: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 77: Oceania Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 78: Oceania Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 79: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 80: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 81: Oceania Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 82: Oceania Market Volume (MT) Forecast by Function, 2018 to 2033

Table 83: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 84: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 88: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 90: Middle East and Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 92: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 94: Middle East and Africa Market Volume (MT) Forecast by Function, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 96: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Function, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 16: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 20: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 24: Global Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 28: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Nature, 2023 to 2033

Figure 33: Global Market Attractiveness by Form, 2023 to 2033

Figure 34: Global Market Attractiveness by Function, 2023 to 2033

Figure 35: Global Market Attractiveness by Application, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Function, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 52: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 56: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 60: North America Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 64: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Nature, 2023 to 2033

Figure 69: North America Market Attractiveness by Form, 2023 to 2033

Figure 70: North America Market Attractiveness by Function, 2023 to 2033

Figure 71: North America Market Attractiveness by Application, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Function, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 88: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 92: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 96: Latin America Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 100: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Function, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Function, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 124: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 128: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 132: Europe Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 136: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 139: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 141: Europe Market Attractiveness by Form, 2023 to 2033

Figure 142: Europe Market Attractiveness by Function, 2023 to 2033

Figure 143: Europe Market Attractiveness by Application, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Function, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 150: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 153: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 160: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 164: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 165: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 166: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 167: East Asia Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 168: East Asia Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 171: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 172: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Function, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: South Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 183: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 184: South Asia Market Value (US$ Million) by Function, 2023 to 2033

Figure 185: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 186: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 189: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 193: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: South Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 196: South Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 197: South Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 198: South Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 199: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 200: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 201: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 202: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 203: South Asia Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 204: South Asia Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 205: South Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 206: South Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 207: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 208: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 209: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 210: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 211: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 212: South Asia Market Attractiveness by Nature, 2023 to 2033

Figure 213: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 214: South Asia Market Attractiveness by Function, 2023 to 2033

Figure 215: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 216: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 217: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 218: Oceania Market Value (US$ Million) by Nature, 2023 to 2033

Figure 219: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 220: Oceania Market Value (US$ Million) by Function, 2023 to 2033

Figure 221: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 222: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 225: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 228: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 229: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 230: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 231: Oceania Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 232: Oceania Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 233: Oceania Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 234: Oceania Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 235: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 236: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 237: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 238: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 239: Oceania Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 240: Oceania Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 241: Oceania Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 242: Oceania Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 243: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 244: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 245: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 246: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 247: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 248: Oceania Market Attractiveness by Nature, 2023 to 2033

Figure 249: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 250: Oceania Market Attractiveness by Function, 2023 to 2033

Figure 251: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 252: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Function, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Function, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lecithin and Phospholipids Market Analysis by Product Type, Form, Nature, Function and Application Through 2035

Soy Lecithin Market Size and Share Forecast Outlook 2025 to 2035

Canola Lecithin Market Analysis by Form, Available Grades, Functionality, End Use, and Region through 2025 to 2035

De-oiled Lecithin Market Size and Share Forecast Outlook 2025 to 2035

Modified lecithin Market

Fractionated Lecithin Market Growth - Source & Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA