The worldwide clothing recycling market is expected to see significant growth from 2025 to 2035, driven by rising environmental awareness, government regulations promoting sustainable waste management, and the rising adoption of circular economy practices in the textile market.

Due to the fashion industry being one of the biggest contributors to global waste, the demand for garment recycling and sustainable clothing options is becoming urgent. As the manufacturers fight the sustainability war, consumers are also leaning towards second-hand clothing, up-cycling, and textile re-purposing, which also adds to the growth of the market. Also, big apparel brands and retailers are pouring money into take-back schemes and textile-to-textile recycling technologies, with a view to getting garments into fewer landfills and causing less reliance on virgin raw materials.

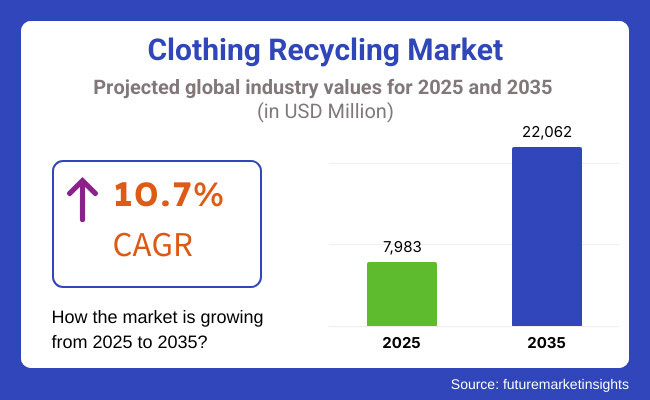

Technological advancements in the textile recycling processes, increasing consumer inclination towards eco-friendly apparel, and government initiatives to promote sustainable fashion will propel the growth of this sector, which is likely to grow at a 10.7% CAGR over 2025 and 2035. The mechanical and chemical recycling of expired garments and industrial textile waste to reclaim fibres is becoming more adopted and is likely to encourage innovation and efficiency in the recyclable market.

The clothing recycling market includes one or more textile types and its uses such as recycled cotton, polyester, wool and blended textiles that are further used in the new clothing, industrial rags, insulation materials, and automotive textiles. Recycled cotton is on the rise to create new clothes and home textiles; however, recycled polyester from plastic waste and used clothing is already popping up in active wear and sportswear.

The apparel & fashion industry’s growing commitment to sustainability has spawned innovations in chemical recycling, in which worn-out fabrics are broken down into their raw components and reprocessed into high-quality fibres. There is also growing consumer interest in upcycling initiatives, where old garments are transformed into new and distinctive fashion pieces, offering consumers another opportunity for sustainable and personalized clothing options. An increase in availability of thrift stores, online resale companies and corporate sustainability programs is also fuelling growth of the clothing recycling market.

North America Dating on a part, with consumers, government, and brand-led sustainability projects are getting more consumers in clothing recycling. In the United States and Canada, clothing waste collection programs and resale platforms whether thrift stores or online second-hand fashion marketplaces have grown.

Midsize clothing brands are widely participating in recycling efforts, providing trade in programs and collaborating with recycling companies to develop closed-loop production processes. Moreover, the increasing trend of sustainable fashion brands and eco-conscious consumers is driving the market growth.

However, Europe is still a front-runner in terms of the clothing recycling market with strict governmental rules towards environmental friendliness, EPR rules and the production of circular quarters. Germany, France and the United Kingdom are among nations that have had recycling infrastructures in place for a long time, often bolstered by government requirements for apparel labels to deal with post-consumer textile waste.

This is further contributing market expansion by the rising popularity of second-hand clothing, sustainable fashion collections, and textile recovery initiatives. The region is also seeing growing momentum around tech innovations for fibre-to-fibre recycling and chemical textile processing.

Strongest growth is anticipated in the Asia-Pacific region, driven by accelerated industrialization, rising textile waste, and increasing consumer demand for sustainable fashion. Countries such as China, India, and Japan are putting their money where their mouth is in terms of creating large-scale textile waste contending solutions and recycling framework to counter ecological issues caused by quick design.

The increasing use of recycled textiles in apparel manufacturing combined with growing government support for sustainability initiatives is driving the growth of the market. Furthermore, the growing presence of resale platforms and thrift stores is facilitating the turnover of second-hand clothing in the region.

The clothing recycling market is one of few sectors experiencing consistent growth across Latin America, with Brazil and Mexico at the forefront of textile waste reduction and circular fashion initiatives. This growth can largely be attributed to the increasing number of sustainable fashion brands and growing participation in textile donation and resale programs.

Of course, in the Middle East, the demand for recycled textiles is increasing owing to stronger awareness of sustainability and various government policies encouraging the reduction of waste. Growing interest in clothing recycling is also driven by the expansion of eco-friendly fashion start-ups and second-hand clothing markets across the region.

Challenges

Inefficiencies in Collection and Sorting Systems

The recycling of clothing has one of the biggest challenges in the form of the collection and sorting systems being not efficient. Textiles, unlike other recyclable materials, including plastics and metals, demand significant manual sorting thanks to the varying makeup of fabrics, colours and wear ability. Its standard collection methods are also limited; on top of that, most consumers do not know how to dispose of textiles correctly. As a result, recyclable clothing often sets the highest percentage into the landfill instead of back into the supply chain.

On top of that, blended fabrics are a huge challenge for recycling. Many clothes are made of blends of materials, such as cotton-polyester mixes, which are difficult to separate and process into new fibres. Current recycling technologies fail to effectively break down these materials, resulting in little reuse and the down cycling of textiles to lower-quality products like insulation or industrial rags rather than high-quality clothing.

Investments in technologies for automated sorting, chemical recycling processes, and public awareness campaigns are essential to overcome these challenges. At the same time, companies and governments need to partner to create more robust take-back programs, clarify labelling on textiles to help consumers recycle it more easily, and give brands incentives to work with mono-material fabrics that can then be processed without having to separate out high-consumption textile blends.

Opportunity

Rising Consumer Demand for Sustainable Fashion

A general outcry about environmental impact and sustainability and the emergence of recycled textiles and circular fashion initiatives. With consumers more focused on eco-design, fashion brands are now adding recycled fibres to their collections. Dozens of retailers are starting take-back programs that will let consumers bring worn garments back to stores to be recycled, or resold, in an effort to cut down on textile waste while boosting brand loyalty.

The clothing recycling market is also driven by regulatory support for sustainable practices. Governments globally are passing extended producer responsibility (EPR) laws, mandating that fashion companies be accountable for what happens to textile waste when consumers are done with the clothes. The EU, for example, has begun implementing regulations requiring separate collection of textiles by 2025, to ramp up separate collection in the various waste streams and drive innovation in recycling technology.

Improvements in fibre-to-fibre recycling technology are also creating fresh opportunities. We have a circular textile economy with advanced chemical recycling processes to get blended fabrics down to reusable raw materials. Overcoming any remaining quality barriers, companies that invest in these innovations can thus access a market for high-quality recycled fabrics that meets consumer demands for sustainability, but also for durability and attractiveness.

More big fashion brands and companies launched sustainable product lines and take-back initiatives. But constraints on the technology of textile recycling and the absence of infrastructure to process it at scale have been major barriers to widespread take up. Consumers started considering second-hand or upcycled fashion, propelling the growth of the resale market, next to recycling.

In all likelihood, this industry will feel different moving forward. The market will be reconfigured by advancements in fibre recycling technologies, enhanced sorting automation, and more stringent sustainability regulations. Circular fashion models, which include rental, resale and take-back programs, will go into wider use, and greater investment

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Introduction of textile waste reduction policies and voluntary sustainability commitments |

| Technological Advancements | Early adoption of chemical and mechanical recycling methods |

| Industry Adoption | Growth in resale and upcycled fashion markets |

| Supply Chain and Sourcing | Limited use of recycled fibres in new clothing |

| Market Competition | Sustainable fashion brands and resale platforms gain traction |

| Market Growth Drivers | Increasing consumer awareness of textile waste and sustainability |

| Sustainability and Energy Efficiency | Early investments in eco-friendly dyeing and reduced water usage |

| Integration of Smart Monitoring | RFID and digital tagging used for supply chain transparency |

| Advancements in Textile Composition | Gradual shift toward organic and recycled materials |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates on textile recycling, extended producer responsibility (EPR) laws, and landfill bans for clothing waste |

| Technological Advancements | Widespread use of fibre-to-fibre recycling and AI-driven sorting systems |

| Industry Adoption | Full-scale integration of circular economy models with take-back and closed-loop manufacturing |

| Supply Chain and Sourcing | Expansion of recycled and biodegradable textiles as primary raw materials |

| Market Competition | Mainstream fashion brands fully integrate recycling into their business models |

| Market Growth Drivers | Expansion of second-hand fashion, rental clothing, and recycling-focused business models |

| Sustainability and Energy Efficiency | Large-scale adoption of carbon-neutral and zero-waste production practices |

| Integration of Smart Monitoring | Block chain-based traceability for verifying recycled content and ethical sourcing |

| Advancements in Textile Composition | Full transition to mono-material fabrics and biodegradable alternatives for easier recycling |

Consumer promotion of sustainability and government initiatives towards minimizing textile waste have so far driven the clothing recycling market in the United States at a very rapid pace. Thanks to fast fashion, the USA produces millions of tons of textile waste every year, so recycling and upcycling practices are gradually taking over. Also, the presence of large-scale recycling organizations and retailer-led take-back programs is further propelling the market. Brands such as Patagonia, Levi’s and H&M are adopting circular economy practices to extend the life cycle of clothes by repairing, reselling and recycling.

Progress on fibre-to-fibre recycling technology is also making it easier to repurpose used clothing into new textiles. The USA Environmental Protection Agency (EPA) is also involved in establishing sustainable clothing disposal methods. Fashion brands are increasingly collaborating with recycling firms to deliver new and revolutionary textiles recovery solutions, diverting waste from landfills. Recycled apparel is also being driven by growing consumer interest in second-hand clothing and thrift stores.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.0% |

The UK has led the way in clothing recycling, with heavy weight environmental policies and a very public driven market. The UK government’s plans, like the Extended Producer Responsibility (EPR) scheme for textiles, challenge manufacturers and retailers to reduce the amount of clothing waste they produce. Initiatives such as the WRAP (Waste and Resources Action Programme) are also working with fashion brands to encourage textile reuse and recycling programmes.

The UK is having a consumer-behaviour shift towards second-hand fashion and sustainability, in addition to regulatory support. Online resale platforms, charity shops and textile collection programmes are being scaled up and creating healthy life-cycles for clothes. UK clothing recycling market is also driven by the increasing demand for more sustainable materials like recycled polyester and organic fabrics. The new technologies of sorting textiles and chemical recycling will improve garment repurposing to some extent.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.5% |

An overview of clothing recycling in the European Union: A high growth market in light of strict environmental policy in the EU & the Circular Economy Action Plan. Brands are being inspired to adopt sustainable production and waste management practices, with countries like Germany, France, and the Netherlands issuing mandates for textile recycling. New European legislation on textile waste reduction, in parallel with the broader EU Green Deal, only underlines this demand for more recycling.

European consumer preferences are also changing as the market embraces pre-owned fashion, with platforms such as Vented, Depop and Vestiaire Collective now taking hold. With sustainability goals being the new demands of the consumer, many luxury brands are now incorporating recycled materials in their product lines. It is also moving to develop new systems, such as innovations in chemical recycling and fiber regeneration technologies that can transform textiles at the end of their first life into high-performance high-quality yarns. By enhancing the processing efficiency of textile waste, several EU nations are also investing in automated sorting facilities, which is enhancing the clothing recycling market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.8% |

A "mountain of surplus clothing" Similar to Japan Clothing recycling in Japan is fuelled by a mixture of government policies, corporate initiatives and cultural sustainability values. The country has a number of programs in place to manage textile waste, such as collection points for used clothing at retail stores and municipal recycling centres. In Japan, key fashion brands and retailers are promoting the concept of circular economies by leveraging the use of recycled fibres in their products.

In Japan, technology enables chemical fibre recycling and automated textile sorting to improve the efficiency of clothing repurposing. In addition, the second-hand clothing industry, including the vintage fashion and thrift store boom, is also helping divert textiles from ending up in a landfill. As awareness of environmental conservation issues has grown, Japan's consumers have become increasingly engaged in clothing donation and repair programs, further driving growth in the recycling market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.6% |

The clothing recycling lines in South Korea are growing, driven by increasing environmental awareness and government initiatives to reduce waste. The country has also introduced harsh clothing disposal rates and established sustainable fashion campaigns. Second-hand clothing, upcycled garments, and eco-friendly textile have been embraced by South Korean consumers.

The government is committed to waste reduction, as evidenced by public education campaigns and textile collection programs. In addition, South Koreas core fabric regeneration technology allows used fibres such as textile waste to be converted directly into reusable materials. Global retailers, from major fashion brands to e-commerce platforms, are also rolling out resale programs in a bid to respond to rising interest in sustainable clothing. Because of the rising fashion K-wave impact worldwide, brands are starting to adopt recycled fabrics, which is enhancing the clothing recycling industry in Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.1% |

The textile recycling is segmented by textile waste source into post-consumer and post-industrial textile waste, with the post-consumer textile waste recycling segment global market leader because of the growing environmental consciousness, strict textile disposal regulations, and an increasing focus on circular fashion. Consumers and brands adopting sustainable practices, to drive collection of used garments, footwear and household textiles. Governments and private organizations are putting pressure on recycling programs to cut down on landfill use and increase resource efficiency, with an estimated 92 million tons of textile waste created globally each year.

Some brands engage in take-back schemes, incentivizing the return of worn clothes. Retail giants and fast-fashion brands are investing in post-consumer recycling plants that can turn discarded apparel back into reusable fibres. Second-hand clothing gathering and followed by redistribution through non-profit organizations and thrift stores is also a major contributor to a circular economy.

Post-consumer recycling has been growing, but it is still slowed by challenges including contamination from mixed fabrics, a lack of infrastructure to sort textiles and the expense of regenerating the fibres. Emerging technologies like automated sorting systems and chemical recycling and fibre-to-fibre innovation are already addressing all of these obstacles and improving market viability.

Pre-consumer textile waste recycling (which features factory offcuts, defective garments and excess inventory) however, is becoming increasingly relevant as manufacturers seek to eliminate waste and create sustainable production practices. Many manufacturing sectors have already begun adopting zero-waste policies, including the fashion industry, which uses its fabric scrap to produce new products, including building insulation, upholstery and industrial textiles.

Other brands are teaming up with textile recycling companies, turning pre-consumer waste into new fabric blends, thus minimizing their need for virgin materials. New approaches are also emerging in textile processing including mechanical and chemical recycling that allow manufacturers to feed fabric scraps back through the production cycle, reducing the amount of waste in the first place.

Pre-consumer recycling has its downsides as well, however, including contamination with dyes and the challenge of sorting blended fabrics. Nevertheless, continuing R&D activities regarding, for instance, textile-to-textile recycling technologies as well as enzymatic treatments and solvent-based fibre recovery, amongst others, shall certainly trigger future growth of this segment.

Cost Optimal Mechanical Recycling to Gain the Largest Market Share with Widespread Adoption

Mechanical recycling is the most common method used for clothing recycling, especially for cotton and wool textiles. This process entails shredding old clothes into fibres, which can then be spun out as new yarns or used for nonwoven applications, including automotive insulation, mattress stuffing and cleaning cloths.

Mechanical recycling's low cost and scalability have made it the go-to method for manufacturers working to include sustainable materials in their supply chains. Mechanically recycled fibres help several fashion brands achieve their sustainability goals, while also attracting environmentally friendly consumers.

Mechanical recycling has its drawbacks, however; for example, the fibres can weaken after multiple recycling cycles, and it can be challenged for processing synthetic-blended fabrics. Manufacturers are combining recycled fibres with virgin fibres to strengthen fabric durability and performance.

Chemical Recycling Gains Popularity for High-Quality Fibber Regeneration

Specifically, the recycling of polyester and blended fabrics would be a great contribution to alleviate textile waste through chemical recycling. This process degrades textiles on a molecular level, enabling extraction of performance fibres from the resulting soup, which can be used in new clothes without loss of quality.

Which is why leading companies are making investments in chemical recycling technologies to meet the rising demand in circular textiles. Processes like depolymerisation for polyester and cellulose regeneration for cotton are bringing the industry closer to a closed-loop recycling system.

While chemical recycling has the advantages of providing higher fibre quality and sustainable benefits, the high cost associated with it as well as it being energy-intensive poses questions to its large scale adoption. That said, ongoing studies and government incentives are expected to improve feasibility and penetration in the market.

As brands work toward the principles of a circular economy, the retail and fashion industry is the leading contributor to the clothing recycling market. Makers have released sustainable collections utilizing recycled textiles to reduce the impact on the earth while satisfying conscious consumers.

Textile recycling efforts are being undertaken by luxury brands, fast fashion retailers, and sportswear companies that are working directly with recyclers to find new solutions. Corporate pledges to cut carbon footprints and reduce wasted textiles drive investments in closed-loop recycling systems.

Nonetheless, barriers to widespread adoption include fragmented textile collection, consumer awareness, and high-cost recycling technologies. This segment will continue to grow due to education campaigns, policy support and advancements in sorting and processing technologies.

Sustainability Regulations and Consumer Awareness Propel Market Expansion

Across the world, governments are adopting policies to encourage clothing recycling, such as landfill bans on textile waste and extended producer responsibility (EPR) regulations. European, North American, and Asia-Pacific countries are announcing supranational targets of textile circularity, creating the infrastructure to involve brands and customers in sustainable practices.

Growing consumer awareness regarding environmental concerns related to fast fashion has also catalysed the market growth. The push for more ethical fashion, second-hand clothing and upcycled products is changing industry dynamics, with demand pressuring brands to incorporate more sustainable materials into their supply chains.

Although there are challenges in the clothing recycling market due to infrastructure bottlenecks and cost issues, there are some very promising innovations on the horizon for fibre regeneration, digital sorting technologies, and biodegradable textiles offering pathways for a more sustainable future. Long term prospect of the global textile industry in spurring forth the both resource efficient and eco-friendly global textile industry will drive the market for circular fashion clothing.

Both the clothing recycling market is on the rise attributed to a growing awareness of environmental issues, along with government regulations on the management of textile waste and higher consumer demand for sustainable fashion. Growing worries about landfill overflow, as well as carbon emissions from fast fashion, have forced companies to adopt circular economy models. Important areas of transformation involve fibre-to-fibre recycling improvements, chemical recycling for synthetic textiles, and take-back programs launched by major brands. Some companies are also investing in automation to sort and process used garments to speed up the sorting stage of the recycling process.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Renewcell | 18-22% |

| Worn Again Technologies | 14-18% |

| Lenzing AG | 12-16% |

| Birla Cellulose | 10-14% |

| Patagonia | 8-12% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Renewcell | A textile recycling pioneer, Circulose® is a material made of recycled cotton waste for the fashion industry. |

| Worn Again Technologies | Tech develops polymer recycling technology to recover usable raw materials from mixed-textile waste |

| Lenzing AG | Expert in wood-based and textile fibers recycling and TENCEL™ and Refibra™ manufacturing for fashion sustainability. |

| Birla Cellulose | Focuses on circular fiber solutions, integrating post-consumer and industrial textile waste into viscose production. |

| Patagonia | Pioneers in closed-loop recycling for outdoor apparel - using worn clothes to create new gear. |

Key Company Insights

Renewcell (18-22%)

A leader in textile-to-textile recycling, the company collaborates with global brands to replace virgin cotton with its Circulose® material in high-performance fabrics.

Worn Again Technologies (14-18%)

Developing scalable solutions for separating polyester and cellulose-based fibres, reducing dependency on virgin synthetic materials.

Lenzing AG (12-16%)

A major player in sustainable textiles, integrating pre- and post-consumer waste into high-quality regenerated fibres for global fashion brands.

Birla Cellulose (10-14%)

Enhancing circular economy initiatives by repurposing cotton waste into biodegradable viscose fibres, reducing environmental impact.

Patagonia (8-12%)

A frontrunner in sustainable apparel, advancing garment repair, resale, and recycling initiatives to minimize textile waste

Other Key Players (25-35% Combined)

Several companies contribute to the clothing recycling market with innovative solutions for textile waste management and fibre regeneration. These include:

The overall market size for the Clothing Recycling Market was USD 7,983 million in 2025.

The Clothing Recycling Market is expected to reach USD 22,062 million in 2035.

The increasing awareness of environmental sustainability, rising concerns over textile waste, and supportive government initiatives promoting circular economy practices fuel the Clothing Recycling Market during the forecast period. The growing adoption of recycled fibers in the fashion industry further accelerates market growth.

The top 5 countries driving the development of the Clothing Recycling Market are the United States, Germany, China, the United Kingdom, and France.

On the basis of application, Mechanical Recycling is expected to command a significant share over the forecast period, driven by its cost-effectiveness, lower energy consumption, and increasing use in producing sustainable textiles and apparel.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Waste Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Recycling Type, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Waste Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Recycling Type, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Waste Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Recycling Type, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Waste Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Recycling Type, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 28: Eastern Europe Market Value (US$ Million) Forecast by Waste Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Recycling Type, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 34: South Asia and Pacific Market Value (US$ Million) Forecast by Waste Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Recycling Type, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 40: East Asia Market Value (US$ Million) Forecast by Waste Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Recycling Type, 2018 to 2033

Table 42: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 46: Middle East and Africa Market Value (US$ Million) Forecast by Waste Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Recycling Type, 2018 to 2033

Table 48: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Waste Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Recycling Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Waste Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Waste Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Waste Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Recycling Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Recycling Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Recycling Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Type, 2023 to 2033

Figure 26: Global Market Attractiveness by End-use, 2023 to 2033

Figure 27: Global Market Attractiveness by Waste Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Recycling Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Waste Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Recycling Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Waste Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Waste Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Waste Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Recycling Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Recycling Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Recycling Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 55: North America Market Attractiveness by Type, 2023 to 2033

Figure 56: North America Market Attractiveness by End-use, 2023 to 2033

Figure 57: North America Market Attractiveness by Waste Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Recycling Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Waste Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Recycling Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Waste Type, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Waste Type, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Waste Type, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Recycling Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Recycling Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Recycling Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Waste Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Recycling Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Waste Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Recycling Type, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 102: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 103: Western Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 104: Western Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 105: Western Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) Analysis by Waste Type, 2018 to 2033

Figure 107: Western Europe Market Value Share (%) and BPS Analysis by Waste Type, 2023 to 2033

Figure 108: Western Europe Market Y-o-Y Growth (%) Projections by Waste Type, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) Analysis by Recycling Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Recycling Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Recycling Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 114: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by End-use, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Waste Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Recycling Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Waste Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Recycling Type, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: Eastern Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 134: Eastern Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 135: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 136: Eastern Europe Market Value (US$ Million) Analysis by Waste Type, 2018 to 2033

Figure 137: Eastern Europe Market Value Share (%) and BPS Analysis by Waste Type, 2023 to 2033

Figure 138: Eastern Europe Market Y-o-Y Growth (%) Projections by Waste Type, 2023 to 2033

Figure 139: Eastern Europe Market Value (US$ Million) Analysis by Recycling Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Recycling Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Recycling Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 144: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by End-use, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Waste Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Recycling Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by End-use, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Waste Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Recycling Type, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 162: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 164: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 165: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 166: South Asia and Pacific Market Value (US$ Million) Analysis by Waste Type, 2018 to 2033

Figure 167: South Asia and Pacific Market Value Share (%) and BPS Analysis by Waste Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Waste Type, 2023 to 2033

Figure 169: South Asia and Pacific Market Value (US$ Million) Analysis by Recycling Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Recycling Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Recycling Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 174: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by End-use, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Waste Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Recycling Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Waste Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Recycling Type, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 191: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 192: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 193: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 194: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 195: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 196: East Asia Market Value (US$ Million) Analysis by Waste Type, 2018 to 2033

Figure 197: East Asia Market Value Share (%) and BPS Analysis by Waste Type, 2023 to 2033

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by Waste Type, 2023 to 2033

Figure 199: East Asia Market Value (US$ Million) Analysis by Recycling Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Recycling Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Recycling Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 204: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Waste Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Recycling Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by End-use, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Waste Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Recycling Type, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ Million) Analysis by Waste Type, 2018 to 2033

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Waste Type, 2023 to 2033

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Waste Type, 2023 to 2033

Figure 229: Middle East and Africa Market Value (US$ Million) Analysis by Recycling Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Recycling Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Recycling Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by End-use, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Waste Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Recycling Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycling Trucks Market Size and Share Forecast Outlook 2025 to 2035

Clothing Fibers Market Size and Share Forecast Outlook 2025 to 2035

Recycling Equipment And Machinery Market Size and Share Forecast Outlook 2025 to 2035

Pet Clothing Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Clothing Market Analysis - Size, Share and Forecast 2025 to 2035

Waste Recycling Services Market by Application, Product Type, and Region - Growth, Trends, and Forecast 2025 to 2035

Smart Clothing Market – Wearable Tech & Health Insights

Online Clothing Rental Market Size and Share Forecast Outlook 2025 to 2035

Assessing Online Clothing Rental Market Share & Industry Insights

Solvent Recycling & Recovery Equipment Market Size and Share Forecast Outlook 2025 to 2035

On-Pack Recycling Labelling Solutions Market Size and Share Forecast Outlook 2025 to 2035

Braille Clothing Tags Market Size and Share Forecast Outlook 2025 to 2035

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Cosplay Clothing Market Trends - Growth & Forecast to 2025 to 2035

Industry Share Analysis for Braille Clothing Tags Companies

Plastic Recycling Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA