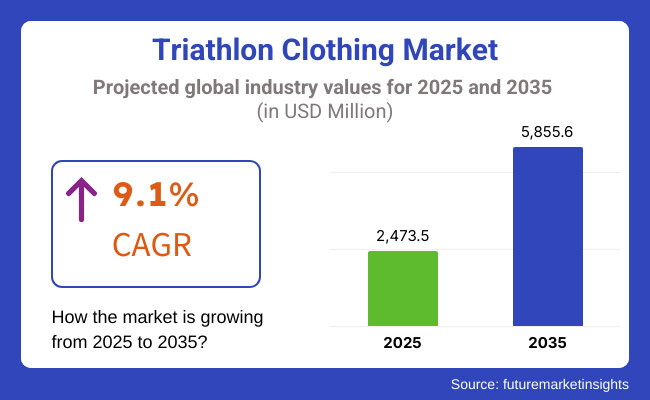

The triathlon clothing industry is set for significant growth between 2025 and 2035, driven by rising participation in endurance sports, increasing consumer awareness of performance apparel, and advancements in fabric technology. The market is projected to expand from USD 2,473.5 million in 2025 to USD 5,855.6 million by 2035, reflecting a CAGR of 9.1% during the forecast period.

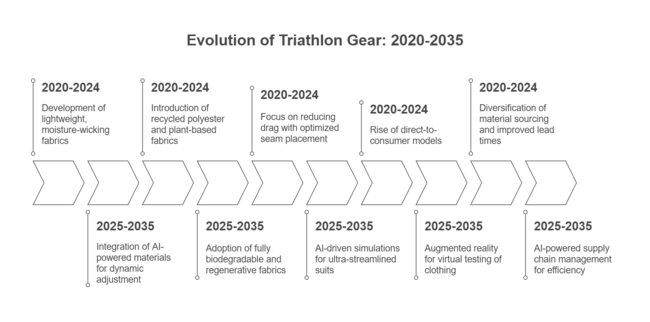

Key growth factors include a surge in triathlon participation, higher disposable income for sports apparel, and increasing demand for durable, aerodynamic, and water-resistant clothing. Athletes consistently seek apparel that enhances both comfort and performance. Additionally, sustainability will play a crucial role, prompting manufacturers to adopt eco-friendly fabrics and ethical production practices.

Regionally, North America will remain at the forefront of technological advancements, while Europe will lead in sustainability and innovation for athlete-centric apparel. Meanwhile, Asia-Pacific is poised for the fastest growth, fueled by rising sports participation. These trends collectively ensure a dynamic and expanding triathlon clothing market through 2035.

Australia (USD 26.62) and South Korea (USD 15.47) lead purchase behavior in the triathlon clothing on account of the vigorous sporting cultures present in those countries and a strong demand for high-level performance equipment. Australian athletes tend to wear premium, outing-proof triathlon apparel, while South Koreans care more for advanced fabric technology and lightweight gear.

Germany (USD 13.08), the UK (USD 13.91), and Japan (USD 10.55) are among active consumers of triathlon clothing. German and British triathletes want eco-friendly, durable sportswear, while triathletes from Japan want aerodynamic apparel that is precision fit but can also back sportswear technology developments.

China (USD 1.48) and India (USD 0.62) spend very little in per capita consumption, yet they hold greater growth potential. Increasing awareness of endurance sports, rising participation in the triathlon, and supporting infrastructure in sports retail are the market growth-inducing factors in these regions.

Our survey covered 500 respondents on purchasing behavior and pricing trends in various regions: the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East. The findings include,

| Countries | Details |

|---|---|

| United States | Largest triathlon market, high disposable income, strong brand presence, numerous races, and culture of endurance sports. |

| United Kingdom | Strong triathlon culture, high participation, good purchasing power, and established market for sports gear. |

| Germany | High sports participation, large consumer base, well-developed sports retail infrastructure. |

| France | Growing endurance sports scene, hosts major triathlon events, demand for high-quality sports apparel. |

| Japan | Growing interest in triathlons, premium market, preference for high-tech and performance wear. |

| Spain | Moderate disposable income but high sports participation; significant number of triathlons held annually. |

| Italy | More focused on cycling and running, lower triathlon participation than Spain, but good demand for sports fashion. |

| South Korea | Emerging endurance sports market, lower participation in triathlons, high price sensitivity. |

Participation Rates in Triathlons

Disposable Income & Consumer Willingness to Spend

Retail & E-Commerce Penetration

Endurance Sports Culture & Brand Awareness

Competition & Market Saturation

| Lucrative Segments | Non-Lucrative Segments |

|---|---|

| Tri Suits - Preferred by serious triathletes for seamless performance across all three disciplines. Higher price point and premium demand. | Tri Tops - Often bought separately but not as essential as tri suits. Lower market demand. |

| Men’s Segment - Larger consumer base, more established demand, and higher spending on triathlon gear. | Women’s Segment (Except USA & UK) - Growing but still smaller in most regions; less variety in high-end gear. |

| Online Sales - Dominates in the USA, UK, and Germany due to convenience, variety, and discounts. Strong growth in Japan and France. | Offline Sales in Emerging Markets - Limited accessibility in South Korea, Spain, and Italy; lower reach. |

| Tri Shorts - Preferred by casual triathletes and beginners who mix-and-match gear. Moderate demand. | Offline Specialty Stores (Small Cities) - High operational costs, lower foot traffic, and strong online competition. |

With the growth of endurance sports, the triathlon clothing market continues to grow. Athletes demand the best performance geared for speed, aerodynamics, and comfort during swimming, cycling, and running events.

Key players use advanced fabric technologies, compression benefits, and streamlined designs to fulfill these requirements. Material innovations, fit customization, and collaborations with elite athletes are factors that differentiate players in this space from each other in the market. Competition in the market requires brands to apply technology and research for performance apparel enhancement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Zone3 Ltd. | 16-22% |

| 2XU | 14-20% |

| Zoot Sports | 10-16% |

| Pearl Izumi | 8-12% |

| Orca | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Zone3 Ltd. | Specializes in high-performance triathlon wetsuits, compression wear, and aerodynamic race suits. Focuses on hydrodynamic efficiency and flexibility. |

| 2XU | Produces compression-based triathlon gear, enhancing endurance and muscle recovery. Leverages fabric technology for moisture-wicking and breathability. |

| Zoot Sports | Develops triathlon-specific apparel with innovative chamois padding and seamless construction. Invests in athlete-centered design and long-course endurance comfort. |

| Pearl Izumi | Designs lightweight and durable triathlon apparel with a focus on aerodynamics and temperature regulation. Expands sustainable product lines. |

| Orca | Offers advanced wetsuits and triathlon suits, emphasizing buoyancy and hydrodynamics. Incorporates eco-friendly materials and athlete-driven R&D. |

Zone3 Ltd. (16% to 22%)

Zone3 retains a leading position in the high-performance triathlon apparel market, with an emphasis on wetsuits, compression wear, and aerodynamic race suits. Its focus is on innovation regarding hydrodynamic efficiency and comfort to the athlete; as a general strategy, Zone3 partners with professional triathletes to refine product design and therefore ensure first-rate performance.

Sustainability efforts include the use of eco-friendly neoprene and biodegradable packaging. The brand enhances its market presence through expansion across borders and through e-commerce.

2XU (14% to 20%)

2XU dominates compression-based triathlon apparel, which aids athletes in improving endurance and muscle recovery. State-of-the-art fabric technologies, moisture-wicking materials, and thermoregulation are just a few of the technologies invested in by the company.

2XU then augments its presence through sponsorship deals with professional athletes and sporting institutions. The company has begun integrating digital measurement systems for custom-fitted triathlon suits, which will ensure an optimal performance fit for each individual athlete.

Zoot Sports (10% to 16%)

Zoot Sports designs triathlon-specific apparel for long-distance racing. The company emphasizes athlete-centered design that prioritizes comfort and efficiency over long hours of racing. Zoot's apparel incorporates seamless construction, advanced chamois padding, and fast-drying materials.

The brand seeks to expand through direct-to-consumer sales while simultaneously strengthening retail partnerships in North America and Europe.

Pearl Izumi (8% to 12%)

Pearl Izumi continues to compete in making lightweight and aerodynamic triathlon clothes. The company's emphasis on enhanced speed and endurance comes through integration of temperature-regulating fabrics and aerodynamic paneling.

Pearl Izumi's expansion into product lines made from sustainable and recycled materials further shows the brand's commitment to environmental responsibility. Digital marketing campaigns and interactive outreach to athletes further enhance brand loyalty.

Orca (6% to 10%)

Orca focuses on triathlon wetsuits and race suits, using research-driven design to elevate buoyancy, flexibility, and hydrodynamics. Eco-friendly materials are developed by the company to maintain a lesser environmental impact without compromising the products' high-performance standards.

Orca invests in product testing executed by elite triathletes with the aim of improving the design of its suits for optimum race conditions. The brand excels by getting involved in sponsorships throughout the world and into sales channels on the internet.

Several other companies continue to make a significant impact in the triathlon clothing market by providing niche products at alternative price points. These competing companies focus on niche innovations, affordability, and unique design tendencies.

The Global Triathlon Clothing industry is projected to witness a CAGR of 9.1% between 2025 and 2035.

Global Triathlon Clothing industry stood at USD 2,473.5 million in 2025.

The Global Triathlon Clothing industry is anticipated to reach USD 5,855.6 million by 2035 end.

North America is expected to record the highest CAGR, driven by increasing participation in triathlons and rising demand for high-performance apparel.

Zone3 Ltd., 2XU, Zoot Sports, Pearl Izumi, Orca, and many more signifying the key players operating in the Global Triathlon Clothing industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clothing Fibers Market Size and Share Forecast Outlook 2025 to 2035

Clothing Recycling Market Analysis – Growth & Trends 2025 to 2035

Pet Clothing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Clothing Market Analysis - Size, Share and Forecast 2025 to 2035

Smart Clothing Market – Wearable Tech & Health Insights

Online Clothing Rental Market Size, Growth, and Forecast 2025 to 2035

Assessing Online Clothing Rental Market Share & Industry Insights

Braille Clothing Tags Market Size and Share Forecast Outlook 2025 to 2035

Cosplay Clothing Market Trends - Growth & Forecast to 2025 to 2035

Industry Share Analysis for Braille Clothing Tags Companies

Plus-Size Clothing Market Growth - Demand & Forecast 2025 to 2035

Protective Clothing Market - Trends, Growth & Forecast 2025 to 2035

Sports Inspired Clothing Market Analysis – Trends, Growth & Forecast 2025-2035

High Visibility Clothing Market Growth – Demand & Forecast 2024-2034

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Industrial Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA