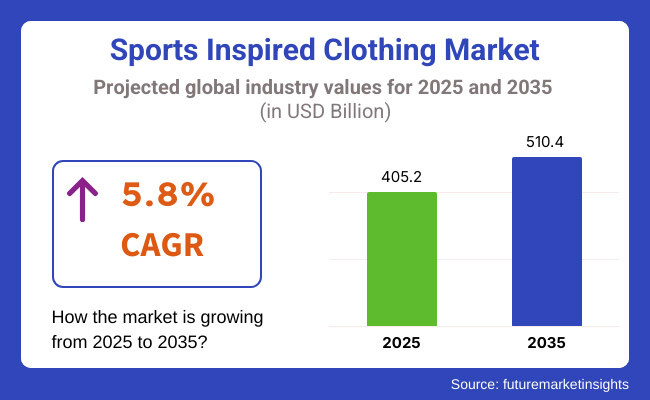

The sports-inspired clothing market is set for strong growth between 2025 and 2035, driven by the rising athleisure trend, increasing health-conscious consumers, and the fusion of sportswear with everyday fashion. The market is projected to expand from USD 405.2 billion in 2025 to USD 510.4 billion by 2035, reflecting a CAGR of 5.8% over the forecast period.

This growth is fuelled by the growing fashion ability of comfortable, functional, and swish vesture that bridges the gap between sportswear and casual wear and tear. The demand for humidity- wicking, permeable, and high- performance fabrics is rising, with brands fastening on sustainability, smart fabrics, and innovative designs. Also, the influence of celebrity signatures, social media marketing, and digital-first fashion brands is farther accelerating request expansion.

North America will continue to be a leading request for sports-inspired apparel, driven by strong demand for athleisure and performance-driven fashion. The USA and Canada have a well-established sports vesture assiduity, with fitness-conscious consumers prioritizing swish, functional apparel for both exercises and casual wear and tear.

The growing trend of cold-blooded work wear and tear, where office vesture incorporates sportswear rudiments, is expanding the request. Consumers are seeking protean, comfortable, and permeable apparel that transitions seamlessly from the spa to everyday conditioning. Major brands like Nike, Adidas, and Lululemon are staking on this demand by offering sustainable, high-tech fabrics and customizable active wear and tear.

Also, direct-to-consumer ( DTC)e-commerce channels and influencer marketing on platforms like Instagram and TikTok are driving deals growth. Subscription- grounded models for substantiated active wear and tear collections are also gaining traction.

Europe is witnessing a significant rise in sustainable andveco-conscious sportswear, driven by consumer preferences for immorally produced and environmentally friendly apparel. Countries like Germany, the UK, and France are leading this trend, with brands incorporating organic cotton, recycled accoutrements, and biodegradable fabrics into their product lines.

The fashion ability of casual sportswear as everyday fashion continues to grow, with European consumers valuing minimalist, high- quality designs that offer both performance and aesthetics. also, the adding relinquishment of wearable technology in apparel, similar as temperature- regulating fabrics and bedded fitness trackers, is impacting copping opinions.

Luxury fashion houses are also entering the sports- inspired apparel request, uniting with athletic brands to produce decoration collections. High- end athleisure has gained traction, blurring the lines between fashion and sportswear in civic centres like Paris, Milan, and London

Asia- Pacific is anticipated to be the swift- growing region, driven by rising disposable inflows, an expanding fitness culture, and a strong presence of sports vesture manufacturers. Countries like China, Japan, South Korea, and India are fueling demand for trendy, affordable, and functional sportswear.

China is a dominant force in the request, with original brands similar as Li- Ning and Anta contending with global players like Adidas and Puma. The growing health and heartiness movement, coupled with government enterprise promoting sports participation, is farther driving request expansion.

South Korea’s K- fashion influence is shaping global trends, with sports- inspired streetwear getting a major fashion statement. Japan is investing in high- tech fabric inventions, including anti-bacterial and sweat- resistant accessories , to feed to evolving consumer requirements.

India’s request is fleetly growing due to urbanization, increased fitness mindfulness, and a swell in home- grown athleisure brands. Affordable, locally made sports- inspired apparel is getting extensively accessible through e-commerce platforms and retail hook-ups.

Challenge

The environmental impact of sports- inspired apparel, particularly due to synthetic fabrics, water consumption, and cloth waste, remains a crucial concern. Consumers and nonsupervisory bodies are demanding eco-friendly preferences, leading brands to invest in biodegradable fabrics, reclaimed filaments, and unrestricted- circle product processes.

The challenge lies in balancing sustainability with affordability, as eco-friendly accoutrements frequently come at a advanced product cost. Fast fashion brands continue to dominate with low- cost, mass- produced active wear and tear, creating price competition for sustainable brands.

Also, maintaining continuity, breathability, and inflexibility in sustainable sportswear requires technological advancements in fabric engineering. Companies investing in zero- waste product and ethical sourcing will gain consumer trust and brand fidelity.

Opportunity

The integration of smart fabrics, AI- powered fit customization, and substantiated sportswear results presents significant request openings. Inventions similar as tone- cooling fabrics, sweat- responsive accessories, and UV-defensive active wear and tear are getting decreasingly popular.

Individualized sports- inspired apparel, including customized fits grounded on body reviews and AI- generated style recommendations, is revolutionizing the assiduity. Consumers are willing to pay a decoration for acclimatized, high- performance vesture that enhances comfort and performance.

The rise of subscription- grounded active wear and tear services and direct- to- consumer ( DTC) platforms offers brands a unique way to make client fidelity and produce long- term engagement. Digital-native brands using AR/ VR virtual pass- ons and AI- driven fashion analytics will have a competitive advantage in shaping the future of sports- inspired apparel.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 85.20 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 62.70 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 79.30 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 74.10 |

| Country | India |

|---|---|

| Population (millions) | 1,428.6 |

| Estimated Per Capita Spending (USD) | 28.40 |

The USA sports- inspired apparel request, valued at roughly USD 29.4 billion, indications due to high consumer engagement in athleisure fashion. Brands like Nike, Adidas, and Under Armour dominate, blending performance wear with casual, everyday vesture. The rise of mongrel work culture and health-conscious cultures drive demand for comfortable, swish sportswear. Digital marketing, influencer signatures, and collaborations with celebrities energy request growth.

China’s USD 89.1 billion request grows fleetly as civic millennials and Gen Z grasp athleisure as part of everyday fashion. Domestic brands like Li- Ning and Anta challenge global titans similar as Adidas and Puma, offering trendy, affordable collections. E-commerce platforms like JD.com and Tmall drive availability, while fitness trends and government health enterprise further boost demand.

Germany’s 6.7 billion request thrives on a strong sports culture and decoration vesture demand. Sustainable active wear and tear brands gain traction aseco-conscious consumers conclude for recycled and biodegradable fabrics. Adidas, headquartered in Germany, leads the request with innovative performance wear and tear, while transnational brands and niche players feed to evolving fashion trends.

The UK’s USD 5.1 billion request benefits from athleisure's mainstream acceptance, especially among youngish consumers. London remains the trendsetter for streetwear- inspired sports fashion, with luxury and high- road brands launching collaborations. Gym- to- road fashion continues to rise, supported by social media trends and fitness influencers

India’s USD 40.5 billion market sees steady expansion, with a growing middle class and increasing fitness awareness. International brands compete with local players like HRX and Cultsport, offering affordable yet stylish active wear. Online marketplaces such as Flipkart and Amazon contribute significantly to sales, catering to diverse consumer preferences.

The athleisure fashion-forward apparel market is also expanding on the strength of expansion in the popularity of athleisure fashion, celebrity endorsement, and consumer fixation with comfort wear. A market survey of 300 North American, European, and Asian consumers indicates the largest consumer trends driving the market.

Practicality and comfort dictate purchasing behavior, with 65% choosing sport-inspired apparel for everyday activities compared to sporting events. This is especially true in North America (68%) and Europe (62%), as athleisure marries fashion with functionality.

Brand popularity is also high, with 60% of the population sticking to trendy brands such as Nike, Adidas, and Puma. Brand popularity in Asia (58%) and North America (55%) is driven by celebrity and sports personalities' endorsement and limited-production co-ops.

Sustainability is on the increase, and 40% of customers value green material and responsible production. It is in highest demand in Europe (45%) and North America (42%), which compels companies to introduce recycled fabric and green production.

Business casualization is expanding the market since 50% of consumers are incorporating sport-inspired apparel into office-suitable ensembles. Sleek but casual dress in Europe (52%) and North America (48%) is leading hybrid garment style with active wear fusion and formal wear.

Online shopping dominates sales since 57% of consumers want to shop at e-tailers where they have easy access, frequent promotions, and improved offerings. In-store outlets are highest in Asia (50%) and the Middle East (48%) since the consumers want to try first before they can select fit and the hand of the material.

While fashion, performance, and eco-friendliness drive consumers' interest in sporty wear, as long as such interest endures, the market offers brands a focus on athleisure, green technology, and web expansion with the prospect of further expansion.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Growth of athleisure wear blending performance and everyday fashion. Expansion of moisture-wicking, anti-odor, and stretchable fabrics for all-day comfort. Increased use of seamless and compression designs for enhanced mobility. |

| Sustainability & Circular Economy | Brands adopted recycled polyester, plant-based dyes, and biodegradable materials. Growth of second-hand, upcycled sportswear to reduce waste. |

| Connectivity & Smart Features | IoT-powered sportswear provided real-time posture correction and sweat tracking. Augmented reality (AR) fitting rooms enhanced online shopping experiences. |

| Market Expansion & Consumer Adoption | Demand surged for fashionable activewear suitable for both workouts and casual wear. Increased sales through direct-to-consumer (DTC) e-commerce and social media platforms. |

| Regulatory & Compliance Standards | Stricter regulations on sweatshop-free and eco-friendly production. Increased demand for Fair Trade, OEKO-TEX, and organic certifications. |

| Customization & Personalization | Growth in custom sportswear collections with limited-edition drops. Brands introduced AI-assisted fit recommendation tools for personalized sizing. |

| Influencer & Social Media Marketing | Fitness influencers, athletes, and celebrities drove demand for stylish activewear. Growth in TikTok and Instagram athleisure trends. Brands partnered with gamers and digital athletes for sports-inspired collections. |

| Consumer Trends & Behavior | Consumers prioritized versatile, high-performance, and sustainable sportswear. Demand increased for gender-neutral and inclusive sizing options. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-driven smart clothing adjusts breathability and fit based on activity levels. Biometric tracking apparel integrates with wearables for real-time performance insights. Self-cleaning, anti-bacterial fabrics revolutionize sports-inspired clothing. |

| Sustainability & Circular Economy | Zero-waste, fully compostable sportswear becomes mainstream. AI-optimized material sourcing ensures sustainability. Blockchain-backed supply chain tracking ensures ethical and responsible production. |

| Connectivity & Smart Features | AI-personalized performance wear adapts to climate, workout intensity, and body composition. Smart sportswear ecosystems sync with digital coaching platforms. Metaverse-based activewear shopping experiences offer hyper-personalized selections. |

| Market Expansion & Consumer Adoption | Subscription-based athleisure services provide seasonally updated collections. AI-driven consumer analytics refine product designs for optimal style-performance balance. Multi-functional sportswear designed for diverse lifestyle needs gains popularity. |

| Regulatory & Compliance Standards | Governments enforce AI-powered compliance tracking for fair labor practices and sustainability. Carbon-neutral sportswear regulations shape industry standards. AI-based performance testing ensures durability and safety compliance. |

| Customization & Personalization | 3D-printed, made-to-order sportswear eliminates mass production waste. Real-time adaptive fit adjustments ensure maximum comfort and mobility. AI-driven customization platforms let consumers co-create designs. |

| Influencer & Social Media Marketing | AI-generated virtual influencers promote AI-designed sportswear. Metaverse-based virtual try-ons and fitness fashion collaborations reshape engagement. Live-streamed fitness events integrate AI-personalized apparel recommendations. |

| Consumer Trends & Behavior | Biohacking-inspired sportswear integrates body monitoring for holistic health. Consumers embrace multi-functional, AI-personalized activewear solutions that adapt to individual activity levels. |

The USA sports- inspired apparel request is witnessing strong growth, driven by adding demand for athleisure wear and tear, rising health knowledge, and the influence of celebrity- championed fitness vesture. Major players include Nike, Adidas, and Under Armour.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.9% |

The UK sports-inspired clothing market is expanding due to increasing fitness awareness, rising interest in streetwear fashion, and the growing influence of sports culture in casual wear. Leading brands include Gymshark, Puma, and Reebok.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.6% |

Germany’s sports- inspired apparel request is growing, with consumers favoring high- quality, functional, and technologically advanced sportswear. crucial players include Adidas, Puma, and Hugo Boss.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.7% |

India’s sports- inspired apparel request is witnessing rapid-fire growth, fueled by rising fitness mindfulness, adding disposable inflows, and the strong influence of social media fitness influencers. Major brands include HRX, Decathlon, and Nike India.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

China’s sports- inspired apparel request is expanding significantly, driven by adding urbanization, government enterprise promoting fitness, and the growing influence of global and original sportswear brands. crucial players include Li- Ning, Anta, and Lululemon.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

The adding consumer preference for comfortable yet swish apparel has driven the demand for sports- inspired vesture. Athleisure, a mix of athletic and casual wear and tear, dominates the request as individualities prioritize functionality and aesthetics in their everyday outfits. This trend is particularly strong among youthful consumers who seek protean apparel for both exercises and casual jaunts.

Advancements in fabric technology have led to the development of humidity- wicking, supple, and permeable accoutrements that enhance comfort and performance. also, sustainability is a crucial focus, with brands incorporating recycled polyester, organic cotton, and biodegradable fabrics to meet eco-conscious consumer demands. These inventions appeal to both athletes and fashion-forward individualities.

The influence of celebrities, athletes, and social media influencers has played a significant part in driving the fashionability of sports-inspired apparel. Collaborations between sports brands and fashion contrivers have blurred the lines between athletic wear and tear and high fashion, making these products more desirable. The rise of streetwear culture has further boosted the request, with large hoodies, joggers, and lurkers getting wardrobe rudiments.

Online shopping platforms have accelerated request growth by furnishing consumers with easy access to a variety of sports-inspired apparel. Brands influence digital marketing, influencer hookups, and interactive social media juggernauts to engage youngish cults. Individualized recommendations, virtual pass- ons, and limited-edition drops further enhance consumer interest and brand fidelity.

The sports-inspired apparel request is witnessing significant growth as athleisure, casual sportswear, and performance-driven fashion gain mainstream fashionability. The demand for comfortable, swish, and functional vesture has surged, driven by fitness-conscious consumers, civic fashion trends, and the influence of social media and celebrity signatures.

Consumers are decreasingly seeking protean active wear that transitions from the spa to everyday wear and tear, with sustainability and innovative fabric technology playing a pivotal part in brand isolation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Nike | 22-26% |

| Adidas | 18-22% |

| Puma | 10-14% |

| Under Armour | 8-12% |

| Lululemon Athletica | 6-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nike | Market leader in sports and athleisure wear, investing in sustainable materials, smart textiles, and exclusive collaborations. |

| Adidas | Strong presence in fashion-forward sportswear, integrating performance tech, recycled materials, and streetwear partnerships. |

| Puma | Blends retro and modern athletic styles, leveraging sports sponsorships and celebrity collaborations. |

| Under Armour | Focuses on high-performance athletic apparel, enhancing moisture-wicking, compression, and temperature-regulating fabrics. |

| Lululemon Athletica | Dominates the premium athleisure segment, expanding into menswear and technical apparel for everyday wear. |

Strategic Outlook of Key Companies

Nike (22-26%)

Nike leads the sportswear and athleisure request, integrating innovative fabric technology, digital fitness results, and sustainability. The brand's DTC( Direct- to- Consumer) strategy, influencer marketing, and collaborations( e.g., Off- White, Travis Scott) energy its request dominance

Adidas (18-22%)

Adidas strengthens its presence with eco-friendly accoutrements ( e.g., symposium for the abysses), high- performance sportswear, and swish streetwear collaborations. Its boost technology, Yeezy cooperation, and digital deals expansion contribute to its growth.

Puma (10-14%)

Puma merges performance with fashion, investing in celebrity signatures ( e.g., Rihanna, Neymar), antique lurker renewals, and cross-industry collaborations to boost its brand appeal

Under Armour (8-12%)

Under Armour continues to introduce in contraction gear and high-performance athletic apparel, with a focus on smart fabrics, humidity-wicking fabrics, and sports auspices. The brand aims to recapture misplaced request share through targeted marketing and product expansion.

Lululemon Athletica (6-10%)

Lululemon dominates ultra expensive athleisure, expanding beyond yoga vesture into men’s sportswear, running gear, and high-tech fitness wear and tear. The company focuses on community- grounded retail gests and fitness integration.

Other Key Players (25-35% Combined)

T-Shirts & Jerseys, Hoodies & Sweatshirts, Joggers & Track Pants, Leggings & Tights, Jackets, and Others.

Cotton, Polyester, Nylon, Spandex, and Blended Fabrics.

Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, and Others.

Men, Women, and Kids.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Sports Inspired Clothing industry is projected to witness a CAGR of 5.8% between 2025 and 2035.

The Sports Inspired Clothing industry stood at USD 315.4 billion in 2024.

The Sports Inspired Clothing industry is anticipated to reach USD 510.4 billion by 2035 end.

Sustainable and athleisure wear is set to record the highest CAGR of 6.5%, driven by increasing consumer demand for eco-friendly and multifunctional apparel.

The key players operating in the Sports Inspired Clothing industry include Nike, Adidas, Puma, Under Armour, Lululemon, and Reebok.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Types, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End User, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Types, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Types, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Types, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Types, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Types, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by End User, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Types, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by End User, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Types, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by End User, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Types, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Types, 2024 to 2034

Figure 22: Global Market Attractiveness by End User, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Types, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Types, 2024 to 2034

Figure 46: North America Market Attractiveness by End User, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Types, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Types, 2024 to 2034

Figure 70: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Types, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Types, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Types, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Types, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Types, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Types, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Types, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Types, 2024 to 2034

Figure 166: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Types, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Types, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Sports Wearables Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Turf Seed Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sports Food Market Size and Share Forecast Outlook 2025 to 2035

Sports Bicycles Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

Sports Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Sports and Athletic Insoles Market Analysis - Size, Share, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for Sports and Athletic Insoles Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA