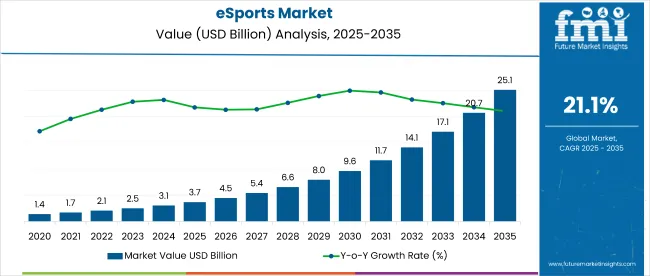

eSports market projection says that global sales will increase from USD 3.7 billion in 2025 to USD 25.4 billion in 2035, with a compound annual growth rate of 21.1%. This swift development is because of ongoing investments, worldwide acknowledgment, and people's obsession with competitive gaming.

eSports are electronic sports that are played when competitors demonstrate their skills in computer games like League of Legends, Counterstrike, Dota 2, and Call of Duty games. The sector has gone big by way of structured tournaments, franchise leagues, and live streaming on platforms like Twitch and YouTube Gaming, which attract millions of spectators from across the world. The ever-growing viewership has, in return, led to record-breaking sponsorship deals with the likes of Red Bull, Intel, and Nike, with major events like

The International (Dota 2) and the League of Legends World Championship are still breaking all-time viewership and prize pool records.

The market is moving beyond the game-play way, and institutions are also including eSports in their curriculum study for STEM and digital literacy. The new wave of universities is making eSports scholarships available, and schools are rallying behind gaming, which is instrumental in the development of the skills of strategic thinking, teamwork, and problem-solving. The marketing scope of eSports is also making great strides as brands look to in-game ads, influencer collaborations, and digital activations to engage younger audiences.

Brands ranging from BMW to Coca-Cola have come on board with the plan, sponsoring teams and tournaments in order to instill brand loyalty in the gaming community. Besides that, the arrival of esports betting platforms as the newest forms of revenue has also made the market more viable and, therefore, has clearly affected the growth of competitive gaming.

The advancement of technology is what is leading the eSports sector, with augmented reality (AR) and virtual reality (VR) being the recent breakthroughs that have greatly enhanced immersive gaming experiences. These are the new ideas that VR sports arenas and AI training tools are not only altering the training methods but also the player's training and competing differently. Cloud gaming platforms like NVIDIA GeForce Now and Xbox Cloud Gaming are also students’ choices, as they enable the participation of players in high-quality competitions without costly hardware. Moreover, the 5G technology is taking a heavy load off the real-time streaming and reducing the latency, which means smoother gaming for the audience and, hence, better engagement.

The sector of eSports is constantly growing due to the formation of regional leagues and the integration of competing gaming in new markets. Although North America and Europe still run the game in terms of infrastructure and investment, the dominant area is the Asia-Pacific area.

The countries that are making progress through established leagues, government support, and special eSports arenas are China, South Korea, and Japan. The Middle East and Latin America have been on a fast track to becoming high-potential markets with local tournament initiatives and increased participation. The dynamics of eSports fostering the overlap between traditional sports and digital entertainment have a ripple effect on pop culture, media, and technology realm whereby their growth rate is sharply rapid, therefore marking eSports as one of the most effervescent and profitable sectors in the gaming industry.

Records of Processing Activities (RoPA) compliance is a critical regulatory benchmark in the eSports market, particularly given the scale of personal data processed by tournament operators, platforms, and broadcasters. Comprehensive documentation supports legal accountability, operational transparency, and data protection readiness.

Spectrum licensing and unlicensed operation adherence is a key infrastructure compliance metric in the eSports market, where high-density wireless environments depend on interference-free connectivity. Regulatory alignment ensures network stability for live events, competitive play, and streaming quality.

Tencent Games (Riot Games) is cementing leadership by embedding AI-driven anti-cheat systems and GDPR-ready governance into tournament ecosystems, leveraging Tencent Cloud for secure, low-latency streaming. This positions Riot as a compliance-ready infrastructure partner for global leagues. Activision Blizzard strengthens engagement and regulatory assurance through Battle.net, integrating real-time cheat detection and content moderation APIs to meet evolving privacy mandates across jurisdictions.

Disruptors like FACEIT focus on integrity, deploying machine learning fraud analytics and automated match compliance dashboards to satisfy anti-cheat protocols while supporting high-speed tournament operations. Battlefy differentiates with cloud-native tournament orchestration, embedding GDPR RoPA automation and sponsor-facing compliance logs. This model appeals to mid-market organizers seeking scale without legal exposure.

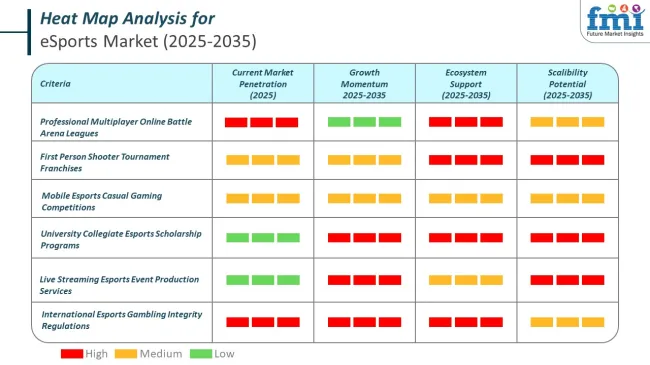

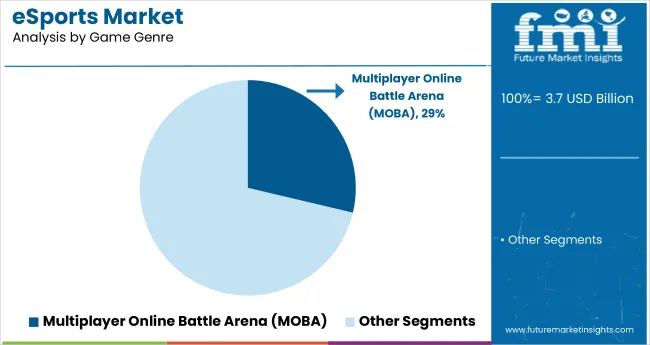

The global eSports market is comprehensively segmented to capture key growth dynamics and revenue streams. By game genre, the market includes Multiplayer Online Battle Arena (MOBA), First-Person Shooter (FPS), Battle Royale, Sports Simulation, Fighting Games, Real-Time Strategy (RTS), and Racing Games.

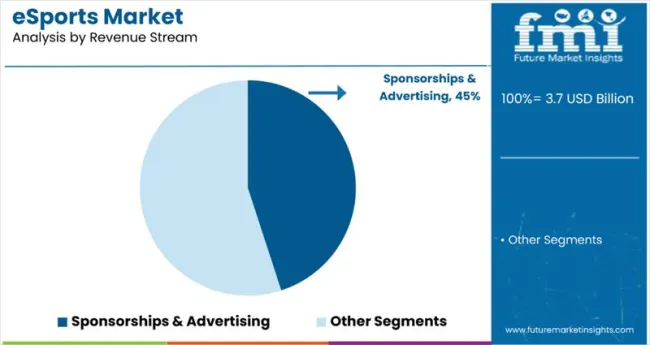

By platform, it is divided into PC-based eSports, Console-based eSports, and Mobile eSports. By revenue stream, segmentation covers Sponsorships & Advertising, Media Rights, Merchandise & Ticket Sales, Publisher Fees, Streaming Revenue, and Prize Pool & Wagering. By region, the market spans North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa.

| Game Genre Segment | Market Share |

|---|---|

| Multiplayer Online Battle Arena (MOBA) | 28.7% |

Among all eSports genres, Multiplayer Online Battle Arena (MOBA) games such as League of Legends and Dota 2 are likely to remain the most lucrative segment. This segment is expected to grow at a CAGR of 20.4% through 2035, maintaining a market share of 28.7% in 2025, making it the largest genre by revenue.

These titles attract immense viewership and sponsor interest due to their high skill ceiling, well-established tournament ecosystems, and deep community engagement. The global fanbase for MOBA titles continues to grow, driven by massive international events like the League of Legends World Championship. Furthermore, MOBA games dominate both collegiate and professional circuits, solidifying their role in mainstream digital competition.

Mobile eSports are projected to register the fastest growth among all platforms, driven by rising smartphone penetration, affordable internet plans, and popular mobile-first titles like PUBG Mobile, Arena of Valor, and Free Fire. The segment is poised to grow at a CAGR of 27.6% from 2025 to 2035, outpacing PC and console counterparts.

This platform is particularly gaining momentum in developing regions like India, Southeast Asia, and Latin America, where console and PC penetration remains relatively low. Increased investment from developers in optimizing mobile gameplay and tournament accessibility is expected to further expand its reach.

| Platform Segment | CAGR (2025 to 2035) |

|---|---|

| Mobile eSports | 27.6% |

| Revenue Stream Segment | CAGR (2025 to 2035) |

|---|---|

| Sponsorships & Advertising | 45% |

Sponsorships & advertising will continue to be the prominent revenue source in the eSports economy, fueled by brand partnerships, digital campaigns, and integrated in-game activations. This segment is expected to expand at a CAGR of 45%, remaining the cornerstone of the eSports monetization model.

Brands such as Red Bull, Nike, and BMW are heavily investing in team sponsorships and tournament branding. The growing trend of influencer collaborations and branded live streams has further increased advertising value. Moreover, the rise of programmatic ads and targeted digital marketing on platforms like Twitch and YouTube Gaming enhances revenue potential.

The global eSports ecosystem has seen phenomenal progress and is now one of the most sought-after industries. This was caused by the major increase in digital engagement, the expansion of the tournament infrastructure, and the growing sponsorship investments.

Game developers are particularly focused on the high quality of the graphics, innovative game features, and a hassle-free streaming experience to pull both casual and pro players. The sponsors and streamers mainly look for branding possibilities in the eSports tournaments and live streams, thus taking advantage of the highly engaged global audience.

Game developers and pro gamers are the two key consumers that lead the market. The former is due to their consumption of games, and the latter is due to their in-game transactions and interactions in competitive gaming communities.

Streaming platforms like Twitch and YouTube Gaming are getting more users, which has sparked market growth even further. With the appearance of new technologies such as virtual reality (VR) and blockchain gaming, eSports is ready for alterations, which will generate new ways of selling and digital entertainment on a global level.

| Company | Contract Value (USA USD Million) |

|---|---|

| Adidas and Esports World Cup Foundation | 10 - 15 |

| Pepsi and Esports World Cup | 12 - 18 |

| LG UltraGear and Esports World Cup | 8 - 12 |

| Porsche and ESL FACEIT Group | 5 - 10 |

| Rolling Stone and ESL FACEIT Group | 6 - 9 |

| MOONTON Games and Qiddiya | 10 - 14 |

| BLAST and Revolut | 7 - 10 |

| LEC and Marriott Bonvoy | 8 - 12 |

| PGL and Oddin.gg | 6 - 10 |

| Jaguar Land Rover and JD Gaming | 9 - 13 |

The primary risk in the global eSports market is generating revenue through sponsorship and advertising. A greater portion of the industry's income is generated by cooperation with brands. At the same time, economic slumps or reallocation of marketing budgets can affect the investment in eSports, which leads to financial concerns for teams, leagues, and event organizers.

Cybersecurity threats represent a serious risk, and online tournaments, streaming platforms, and player accounts are open to hacking, cheating, and data breaches. A serious cyberattack or integrity issues can destroy the industry's reputation, which may affect fan engagement and sponsorship deals.

Market saturation and competition are turning into major risks with the emergence of new leagues, teams, and games. Overcrowding in the industry can thin out sponsorship deals and split the audience. Developers and organizations need to focus on differentiating, engaging content, and developing stable business models to be efficient.

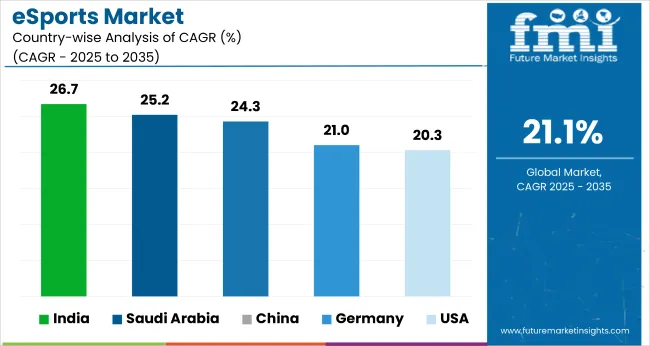

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 20.3% |

| Germany | 21.0% |

| China | 24.3% |

| India | 26.7% |

| Saudi Arabia | 25.2% |

The USA is still among the strongest markets for competitive gaming, driven by established gaming infrastructure, good internet penetration, and growing audiences. With over 215 million active gamers and a huge fan base of professional leagues such as the Call of Duty League and the Overwatch League, the USA remains a focal point for global gaming competitions.

The robust investment climate of the nation, with technology behemoth companies like Microsoft and Sony acquiring gaming companies, is cementing the industry's growth. Twitch and YouTube Gaming offer rich revenue opportunities for content creators and crews, enhancing viewer engagement - broadband internet and cloud-gaming services fuel market growth. FMI believes the USA market will record a 20.3% CAGR during the study period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Strong investment environment | Large corporations investing in partnerships and acquisitions |

| Successful gaming leagues | Availability of leagues such as Call of Duty League and Overwatch League |

| Advanced streaming platforms | Twitch, YouTube Gaming, and Facebook Gaming lead engagement |

| Uptake of high-speed internet | Fiber-optic and 5G networks growing |

Germany is a powerhouse of the European gaming industry, having a thriving market with government support and strong infrastructure. The country is home to Gamescom, a major world gaming convention, and famous studios like Crytek and Ubisoft Blue Byte. Germany has more than 44 million gamers, and its competitive gaming industry is also sustained by many professional teams and fan enthusiasm. Higher revenues are now from more international fixture games and better sponsorship contracts signed with foreign companies. Meanwhile, game production and online innovation are also getting a boost from state coffers. It also helps that there are localized streaming sites and professional leagues and that Germany is the largest European market. Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Government support | Digital gaming funds and industry incentives |

| Large gaming audience | Over 44 million active gamers |

| International events | Hosts Gamescom, among the most visited gaming events |

| Pioneering gaming studios | Crytek, Ubisoft Blue Byte, and others are available |

With a better gaming culture, an advanced infrastructure, and favorable government policies, China remains a world leader in the field of competitive gaming. Its top developers include Tencent and NetEase; it controls the gaming world with mega-hits like Honor of Kings, League of Legends, and CrossFire. The global government has now recognized Esports as a professional sport, and as such, there are now more investments in Arenas, Training Facilities, and player development. The country has over 500 million gamers, and the competitive gaming market is tied to the fortunes of live-streaming platforms like Huya, Douyu, and Bilibili. The franchised League of Legends Pro League (LPL) is the gold standard for big-money competition around the globe. Gaming management courses are now taught in universities, creating industry leaders. Cloud gaming and 5G technology also improve accessibility and game quality.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Government backing | Competitive gaming as a sport |

| Leading game developers | The international market dominated by Tencent and NetEase |

| Large fan base | Over 500 million players |

| Advanced digital ecosystem | Mass market cloud gaming and 5G adoption |

Also, mobile gaming smartphones and 5G connectivity launches positively impact the gaming industry. Government initiatives like Digital India and Startup India have propelled investments in digital sports complexes and gaming startups. The inclusion of competitive gaming in the Asian Games 2023 has brought added legitimacy and corporate sponsorship from companies such as Red Bull, Intel, and ASUS. Here, Action is being led by platforms like YouTube Gaming and Loco, which have the potential to earn some revenue for game players and content creators. As per the opinion of FMI, the Indian market is expected to grow at 26.7% CAGR during the forecast period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Growth in mobile gaming | Over 700 million smartphone users |

| Government initiatives | Programs like Digital India and Startup India |

| Sponsorship and investment | Red Bull, Intel, and ASUS sponsorship of competitive gaming |

| Increase in internet penetration | Affordable data plans and expanding 5G networks |

Saudi Arabia is also a quickly emerging high-level gaming market through its Vision 2030 initiative, which includes overspending on digital entertainment. The state has spent billions of dollars transforming the country into a world gaming destination, driven by the Saudi Esports Federation and events like the Gamers8 festival, which attract international competitions with purse payouts that reach record highs. The Saudi PIF has invested in companies such as Activision Blizzard, Electronic Arts, and Nintendo. Local outfits such as Team Falcons are attracting international attention. A tech-aware youth demographic coupled with growing internet penetration fuels grassroots gaming communities and professional Saudi Arabian leagues. The rollout of 5G networks and the corresponding investment in infrastructure enable high-quality streaming and cloud gaming.

Growth Drivers in Saudi Arabia

| Key Drivers | Details |

|---|---|

| Vision 2030 investments | Government-sponsored funding of digital entertainment |

| International firm acquisitions | PIF investment in Nintendo, Electronic Arts, and Activision Blizzard |

| Recruitment of local teams | Global Falcons team recognition |

| Rollout of 5G infrastructure and gaming schools | Expanding gaming ecosystem |

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.7 billion |

| Projected Market Size (2035) | USD 25.4 billion |

| CAGR (2025 to 2035) | 21.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2021 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion |

| By Game Genre | Multiplayer Online Battle Arena (MOBA), First-Person Shooter (FPS), Battle Royale, Sports Simulation, Fighting Games, Real-Time Strategy (RTS), Racing Games |

| By Platform | PC-based eSports, Console-based eSports, Mobile eSports |

| By Revenue Stream | Sponsorships & Advertising, Media Rights, Merchandise & Ticket Sales, Publisher Fees, Streaming Revenue, Prize Pool & Wagering |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Team SoloMid (TSM), 100 Thieves, Team Liquid, Cloud9, Fnatic, G2 eSports, FaZe Clan, NRG eSports, Gen.G eSports, Envy Gaming |

| Additional Attributes | Integration of AR/VR technologies, Cloud gaming platforms, 5G connectivity, AI-driven analytics, Esports in education |

| Customization and Pricing | Available upon request |

The global eSports industry is projected to witness CAGR of 21.1% between 2025 and 2035.

The global eSports industry stood at USD 3.7 billion in 2025.

The global eSports industry is anticipated to reach USD 25.4 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 23.4% in the assessment period.

The key players operating in the global eSports industry include Electronic Arts Inc., Riot Games, Tencent Holding Limited, Activision Blizzard, Inc., Microsoft, Google, Valve Corporation, Modern Times Group (MTG), NVIDIA Corporation & HTC Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Streaming Type, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Device Type , 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Revenue Stream, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Streaming Type, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Device Type , 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by Revenue Stream, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Streaming Type, 2019 to 2034

Table 14: Latin America Market Value (US$ Million) Forecast by Device Type , 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Revenue Stream, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Western Europe Market Value (US$ Million) Forecast by Streaming Type, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Device Type , 2019 to 2034

Table 20: Western Europe Market Value (US$ Million) Forecast by Revenue Stream, 2019 to 2034

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Streaming Type, 2019 to 2034

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Device Type , 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Revenue Stream, 2019 to 2034

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Streaming Type, 2019 to 2034

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Device Type , 2019 to 2034

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Revenue Stream, 2019 to 2034

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 33: East Asia Market Value (US$ Million) Forecast by Streaming Type, 2019 to 2034

Table 34: East Asia Market Value (US$ Million) Forecast by Device Type , 2019 to 2034

Table 35: East Asia Market Value (US$ Million) Forecast by Revenue Stream, 2019 to 2034

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Streaming Type, 2019 to 2034

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Device Type , 2019 to 2034

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Revenue Stream, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Streaming Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Device Type , 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Revenue Stream, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Streaming Type, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Streaming Type, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Streaming Type, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Device Type , 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Device Type , 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Device Type , 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Revenue Stream, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Revenue Stream, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Revenue Stream, 2024 to 2034

Figure 21: Global Market Attractiveness by Application, 2024 to 2034

Figure 22: Global Market Attractiveness by Streaming Type, 2024 to 2034

Figure 23: Global Market Attractiveness by Device Type , 2024 to 2034

Figure 24: Global Market Attractiveness by Revenue Stream, 2024 to 2034

Figure 25: Global Market Attractiveness by Region, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Streaming Type, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Device Type , 2024 to 2034

Figure 29: North America Market Value (US$ Million) by Revenue Stream, 2024 to 2034

Figure 30: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Streaming Type, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Streaming Type, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Streaming Type, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Device Type , 2019 to 2034

Figure 41: North America Market Value Share (%) and BPS Analysis by Device Type , 2024 to 2034

Figure 42: North America Market Y-o-Y Growth (%) Projections by Device Type , 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Revenue Stream, 2019 to 2034

Figure 44: North America Market Value Share (%) and BPS Analysis by Revenue Stream, 2024 to 2034

Figure 45: North America Market Y-o-Y Growth (%) Projections by Revenue Stream, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by Streaming Type, 2024 to 2034

Figure 48: North America Market Attractiveness by Device Type , 2024 to 2034

Figure 49: North America Market Attractiveness by Revenue Stream, 2024 to 2034

Figure 50: North America Market Attractiveness by Country, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Streaming Type, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) by Device Type , 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) by Revenue Stream, 2024 to 2034

Figure 55: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 59: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) Analysis by Streaming Type, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Streaming Type, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Streaming Type, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Device Type , 2019 to 2034

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Device Type , 2024 to 2034

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Device Type , 2024 to 2034

Figure 68: Latin America Market Value (US$ Million) Analysis by Revenue Stream, 2019 to 2034

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Revenue Stream, 2024 to 2034

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Revenue Stream, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Streaming Type, 2024 to 2034

Figure 73: Latin America Market Attractiveness by Device Type , 2024 to 2034

Figure 74: Latin America Market Attractiveness by Revenue Stream, 2024 to 2034

Figure 75: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) by Streaming Type, 2024 to 2034

Figure 78: Western Europe Market Value (US$ Million) by Device Type , 2024 to 2034

Figure 79: Western Europe Market Value (US$ Million) by Revenue Stream, 2024 to 2034

Figure 80: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 84: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 87: Western Europe Market Value (US$ Million) Analysis by Streaming Type, 2019 to 2034

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Streaming Type, 2024 to 2034

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Streaming Type, 2024 to 2034

Figure 90: Western Europe Market Value (US$ Million) Analysis by Device Type , 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Device Type , 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Device Type , 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) Analysis by Revenue Stream, 2019 to 2034

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Revenue Stream, 2024 to 2034

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Revenue Stream, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 97: Western Europe Market Attractiveness by Streaming Type, 2024 to 2034

Figure 98: Western Europe Market Attractiveness by Device Type , 2024 to 2034

Figure 99: Western Europe Market Attractiveness by Revenue Stream, 2024 to 2034

Figure 100: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 102: Eastern Europe Market Value (US$ Million) by Streaming Type, 2024 to 2034

Figure 103: Eastern Europe Market Value (US$ Million) by Device Type , 2024 to 2034

Figure 104: Eastern Europe Market Value (US$ Million) by Revenue Stream, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Streaming Type, 2019 to 2034

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Streaming Type, 2024 to 2034

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Streaming Type, 2024 to 2034

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Device Type , 2019 to 2034

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Device Type , 2024 to 2034

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Device Type , 2024 to 2034

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Revenue Stream, 2019 to 2034

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Revenue Stream, 2024 to 2034

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Revenue Stream, 2024 to 2034

Figure 121: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 122: Eastern Europe Market Attractiveness by Streaming Type, 2024 to 2034

Figure 123: Eastern Europe Market Attractiveness by Device Type , 2024 to 2034

Figure 124: Eastern Europe Market Attractiveness by Revenue Stream, 2024 to 2034

Figure 125: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 126: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 127: South Asia and Pacific Market Value (US$ Million) by Streaming Type, 2024 to 2034

Figure 128: South Asia and Pacific Market Value (US$ Million) by Device Type , 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) by Revenue Stream, 2024 to 2034

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Streaming Type, 2019 to 2034

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Streaming Type, 2024 to 2034

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Streaming Type, 2024 to 2034

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Device Type , 2019 to 2034

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Device Type , 2024 to 2034

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Device Type , 2024 to 2034

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Revenue Stream, 2019 to 2034

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Revenue Stream, 2024 to 2034

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Revenue Stream, 2024 to 2034

Figure 146: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 147: South Asia and Pacific Market Attractiveness by Streaming Type, 2024 to 2034

Figure 148: South Asia and Pacific Market Attractiveness by Device Type , 2024 to 2034

Figure 149: South Asia and Pacific Market Attractiveness by Revenue Stream, 2024 to 2034

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 151: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 152: East Asia Market Value (US$ Million) by Streaming Type, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) by Device Type , 2024 to 2034

Figure 154: East Asia Market Value (US$ Million) by Revenue Stream, 2024 to 2034

Figure 155: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 159: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 162: East Asia Market Value (US$ Million) Analysis by Streaming Type, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Streaming Type, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Streaming Type, 2024 to 2034

Figure 165: East Asia Market Value (US$ Million) Analysis by Device Type , 2019 to 2034

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Device Type , 2024 to 2034

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Device Type , 2024 to 2034

Figure 168: East Asia Market Value (US$ Million) Analysis by Revenue Stream, 2019 to 2034

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Revenue Stream, 2024 to 2034

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Revenue Stream, 2024 to 2034

Figure 171: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 172: East Asia Market Attractiveness by Streaming Type, 2024 to 2034

Figure 173: East Asia Market Attractiveness by Device Type , 2024 to 2034

Figure 174: East Asia Market Attractiveness by Revenue Stream, 2024 to 2034

Figure 175: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) by Streaming Type, 2024 to 2034

Figure 178: Middle East and Africa Market Value (US$ Million) by Device Type , 2024 to 2034

Figure 179: Middle East and Africa Market Value (US$ Million) by Revenue Stream, 2024 to 2034

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Streaming Type, 2019 to 2034

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Streaming Type, 2024 to 2034

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Streaming Type, 2024 to 2034

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Device Type , 2019 to 2034

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Device Type , 2024 to 2034

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Device Type , 2024 to 2034

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Revenue Stream, 2019 to 2034

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Revenue Stream, 2024 to 2034

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Revenue Stream, 2024 to 2034

Figure 196: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 197: Middle East and Africa Market Attractiveness by Streaming Type, 2024 to 2034

Figure 198: Middle East and Africa Market Attractiveness by Device Type , 2024 to 2034

Figure 199: Middle East and Africa Market Attractiveness by Revenue Stream, 2024 to 2034

Figure 200: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

eSports & Games Streaming Market – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA