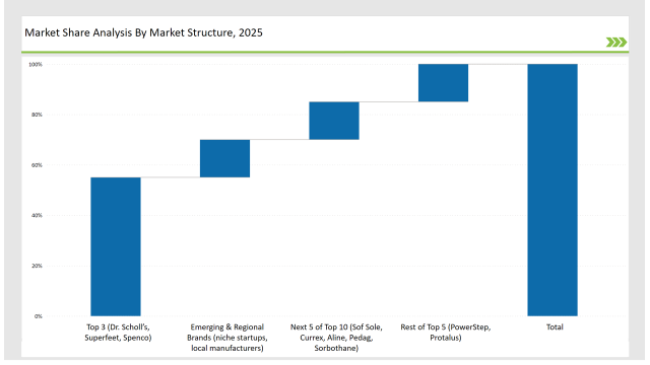

The global sports and athletic insoles market is growing fastly as the client is opting comfort, performance, and injury protection. Dr. Scholl's, Superfeet, and Spenco companies are leaders due to their high-quality innovative products and materials developed, thus 55% holds the market shares. The next 30% is accounted by regional brands that focus on special sports and their affordability, while other 15% is by companies that have risen recently and focus on being sustainable and tailoring for users.

| Global Market Share, 2025 | Industry Share (%) |

|---|---|

| Top 3 (Dr. Scholl’s, Superfeet, Spenco) | 55% |

| Rest of Top 5 (PowerStep, Protalus) | 15% |

| Next 5 of Top 10 (Sof Sole, Currex, Aline, Pedag, Sorbothane) | 15% |

| Emerging & Regional Brands (niche startups, local manufacturers) | 15% |

The sports & athletic insoles market in 2025 is moderately concentrated, with brands such as Superfeet, Dr. Scholl’s, and Sof Sole leading the segment. However, emerging brands and specialized insoles tailored for different sports introduce competition and product differentiation. The market continues to grow, driven by rising interest in performance-enhancing footwear solutions.

45% of the sales are held by e-commerce platforms and brand-owned websites, fueled by convenience and product descriptions. 35% retail stores with personal assistance and ready availability. Specialty sports stores capture 15%, which primarily thrive on technical competence and niche recommendations. Direct-to-consumer or DTC channels have the remaining 5% and thrive on bespoke-fit solutions and limited-edition designs.

The sports and athletic insoles market is segmented into comfort insoles, performance insoles, and orthotic insoles. Performance insoles have the highest share at 50% of the market, providing enhanced cushioning, arch support, and energy return. Orthotic insoles make up 30%, focusing on consumers who have specific foot issues such as plantar fasciitis. Comfort insoles account for 20%, which appeals to general use and affordability.

Innovation, customization, and eco-consciousness have characterized 2024 as a transformative year for the sports and athletic insoles market. Some of the key contributors include:

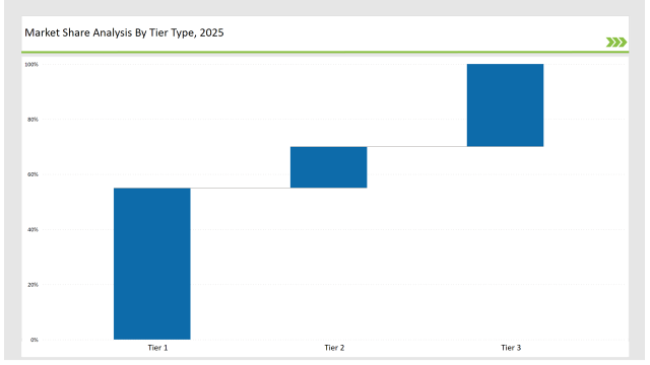

Tier-Wise Brand Classification, 2025

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Dr. Scholl’s, Superfeet, Spenco |

| Market share% | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | PowerStep, Protalus |

| Market share% | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, emerging startups |

| Market share% | 30% |

| Brand | Key Focus Areas |

|---|---|

| Dr. Scholl’s | Advanced gel technology and mass-market appeal |

| Superfeet | Lightweight performance insoles for athletes |

| Spenco | Recovery-focused and antimicrobial properties |

| PowerStep | Orthotic solutions for foot health |

| Sof Sole | Eco-friendly and sustainable insoles |

| Emerging Brands | Custom-fit and tech-enabled designs |

The sports and athletic insoles market is poised for tremendous growth, as the market continues to be influenced by technological advancement, sustainability, and awareness of foot health. Brands will be keen on hybrid models that combine comfort, performance, and eco-friendly materials. The brand credibility will be strengthened through partnerships with sports organizations and healthcare providers. E-commerce and DTC strategies will continue to dominate, providing consumers with personalized and innovative solutions.

Leading brands such as Dr. Scholl’s, Superfeet, and Spenco collectively account for 55% of the market.

Regional manufacturers and specialty sports retailers hold around 30% of the market.

Innovative startups focusing on 3D-printed and custom insoles hold about 15% of the market.

Private labels, including store-exclusive performance insoles, hold roughly 5% of the market.

High for companies controlling 60%+, medium for 40-60%, and low for those under 30%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Sports Wearables Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Turf Seed Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sports Food Market Size and Share Forecast Outlook 2025 to 2035

Sports Bicycles Market Size and Share Forecast Outlook 2025 to 2035

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

Sports Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Sports Inspired Clothing Market Analysis – Trends, Growth & Forecast 2025-2035

Sports Bottle Market Trends & Industry Growth Forecast 2024-2034

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA