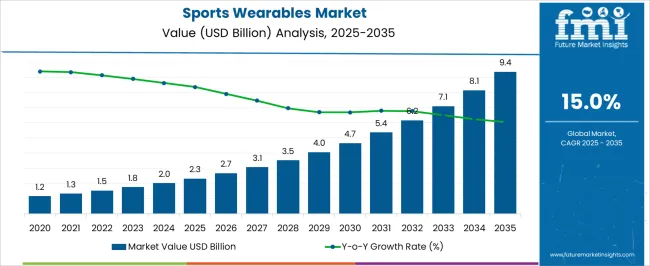

The sports wearables market is projected to grow from USD 2.3 billion in 2025 to USD 9.4 billion by 2035, registering a strong compound annual growth rate of 15.0%. This sharp expansion is underpinned by technological integration, increased health monitoring adoption, and rising consumer interest in connected fitness solutions. The cost structure of this market reveals significant weight on research and development, as constant innovation in sensors, connectivity, and data analytics drives product differentiation.

Component manufacturing, particularly semiconductors, display modules, and biometric sensors, forms another major cost layer, often impacted by global supply chain fluctuations. The value chain begins with raw material sourcing and component design, where firms rely on precision electronics and durable materials. This stage transitions into device assembly, where manufacturing efficiency and miniaturization remain critical to maintain margins. Distribution channels are split between direct-to-consumer platforms, sporting goods retailers, and partnerships with fitness service providers, each carrying varying cost implications. Post-sales value is derived through software ecosystems, subscription-based health data services, and integration with digital platforms, creating recurring revenue streams. With rising demand, value capture is shifting from hardware sales toward data-driven services, positioning software and analytics as long-term profitability centers within the overall value chain.

| Metric | Value |

|---|---|

| Sports Wearables Market Estimated Value in (2025 E) | USD 2.3 billion |

| Sports Wearables Market Forecast Value in (2035 F) | USD 9.4 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

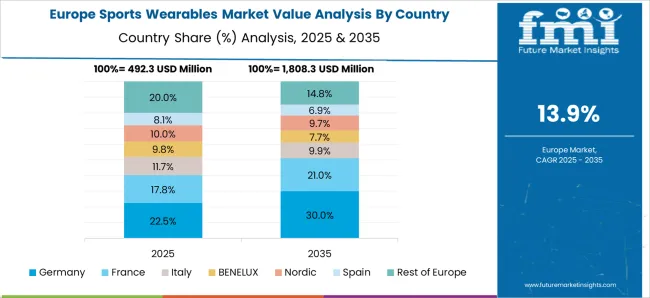

The sports wearables market represents a specialized segment within the consumer electronics and fitness technology industry, emphasizing performance tracking, health monitoring, and connected functionality. Within the overall wearable technology market, it accounts for about 7.2%, driven by rising demand for real-time data during training and sports activities. In the fitness and wellness devices segment, it holds nearly 6.4%, reflecting adoption among athletes and recreational users. Across the smart apparel and accessories market, the segment captures 4.7%, supporting embedded sensors and connected textiles. Within the mobile health and telemedicine category, it represents 3.5%, highlighting its role in linking athletic performance with healthcare insights. In the sports equipment and performance enhancement sector, it secures 4.1%, emphasizing integration with training regimes and professional sports programs. Recent developments in this market have focused on sensor innovation, AI-based analytics, and ecosystem integration. Advances include multi-sensor wearables capable of monitoring heart rate variability, oxygen saturation, hydration, and biomechanics. Key players are collaborating with sports teams, fitness platforms, and technology providers to refine predictive analytics and personalized training recommendations. The integration of GPS, cloud connectivity, and app-based dashboards has improved user experience and engagement. The sustainable materials and flexible electronics are gaining traction in smart apparel. Strategic partnerships with healthcare providers are expanding use cases beyond performance into injury prevention and rehabilitation. These advancements demonstrate how innovation, connectivity, and multifunctionality are shaping the market.

The sports wearables market is expanding rapidly, supported by advancements in sensor technologies, rising consumer interest in health monitoring, and the integration of wearable devices into daily fitness routines. Industry announcements and brand innovation updates highlight a surge in device functionalities, including continuous heart rate tracking, GPS-enabled activity mapping, and AI-driven performance analytics.

The market is further bolstered by the growing convergence of sports science and consumer electronics, with wearables playing a central role in training optimization and injury prevention. Healthcare applications have also driven adoption, as wearables provide early insights into health risks and support rehabilitation programs.

In addition, increased disposable incomes, growing fitness awareness, and product accessibility through both offline and online channels have accelerated market penetration. Future growth is expected to be shaped by connected ecosystems, seamless integration with mobile health platforms, and the introduction of advanced biosensors that provide medical-grade insights to both athletes and general consumers.

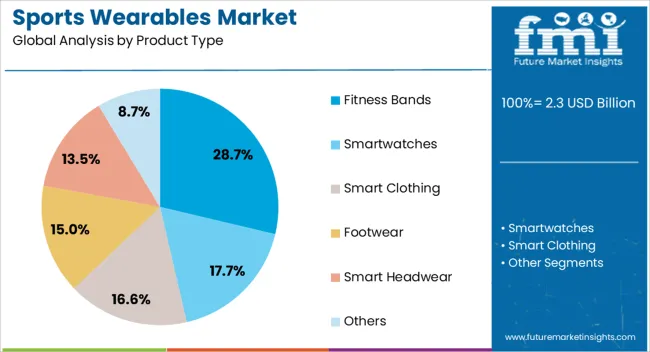

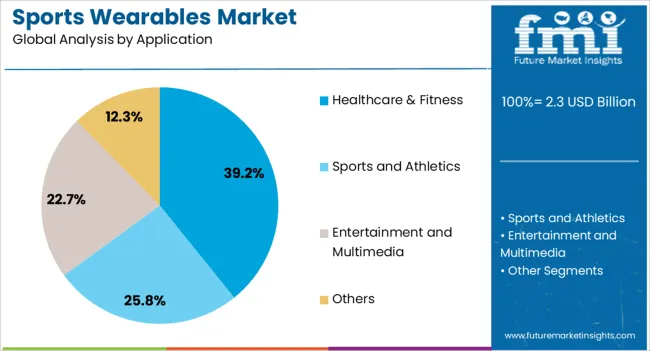

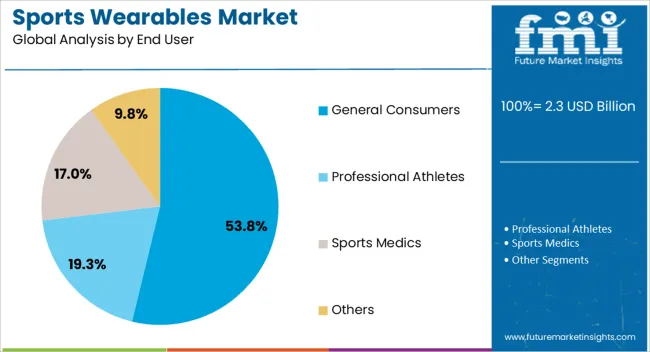

The sports wearables market is segmented by product type, application, end user, and geographic regions. By product type, sports wearables market is divided into Fitness Bands, Smartwatches, Smart Clothing, Footwear, Smart Headwear, and Others. In terms of application, sports wearables market is classified into Healthcare & Fitness, Sports and Athletics, Entertainment and Multimedia, and Others. Based on end user, sports wearables market is segmented into General Consumers, Professional Athletes, Sports Medics, and Others. Regionally, the sports wearables industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Fitness Bands segment is projected to contribute 28.7% of the sports wearables market revenue in 2025, establishing its role as a major product category. Growth in this segment has been supported by affordability, lightweight designs, and a strong focus on essential health tracking features such as step counts, calorie expenditure, and sleep quality analysis.

Fitness bands have been widely adopted by entry-level users due to their ease of use and extended battery life compared to more advanced smartwatches. Promotional campaigns by leading brands have positioned fitness bands as accessible yet reliable fitness companions, appealing to both casual exercisers and individuals seeking consistent health monitoring.

Furthermore, the integration of Bluetooth connectivity and compatibility with popular fitness apps has strengthened the segment’s appeal. As more consumers shift toward adopting wearables for everyday wellness tracking, the Fitness Bands segment is expected to sustain steady growth, particularly in emerging markets.

The Healthcare & Fitness segment is anticipated to account for 39.2% of the sports wearables market revenue in 2025, maintaining its leadership position in application areas. This dominance has been fueled by the increasing use of wearables to monitor vital signs, track physical activity, and provide data for preventive healthcare.

Consumers and healthcare providers alike have recognized the value of continuous health data in improving lifestyle choices and supporting early diagnosis. Wearable devices with features such as real-time heart rate monitoring, VO₂ max estimation, and sleep pattern analysis have become integral to personal health management.

Sports training programs and wellness initiatives have also embraced these devices for performance assessment and tailored workout planning. With healthcare systems worldwide promoting digital health tools, the Healthcare & Fitness segment is expected to benefit from growing integration with telemedicine platforms and corporate wellness programs.

The General Consumers segment is projected to hold 53.8% of the sports wearables market revenue in 2025, making it the largest end-user group. This segment’s expansion has been driven by widespread consumer interest in maintaining active lifestyles and adopting technology-driven wellness solutions.

Affordable product options, coupled with attractive designs and customizable features, have broadened appeal beyond athletes to the general population. Marketing strategies have targeted lifestyle enhancement, with wearables promoted as everyday accessories that blend health tracking with fashion.

E-commerce channels and retail partnerships have played a pivotal role in increasing accessibility, while social media-driven fitness challenges have encouraged product adoption. As consumers continue to seek convenient and engaging ways to monitor and improve their health, the General Consumers segment is expected to remain a cornerstone of market demand.

The market has been gaining momentum as athletes, fitness enthusiasts, and professionals increasingly integrate digital devices into their training and performance monitoring routines. Wearables such as smartwatches, fitness trackers, heart rate monitors, and smart apparel have become central to data-driven fitness. The technology combines sensors, connectivity, and analytics to provide real-time insights into health, performance, and recovery. Rising health awareness, growing adoption of connected devices, and the influence of smart sports ecosystems are shaping demand.

Performance tracking has been the cornerstone of sports wearables adoption, with devices designed to capture heart rate, oxygen levels, calorie burn, and distance metrics. Athletes and fitness enthusiasts rely on real-time data to optimize workouts, monitor intensity, and reduce risks of overtraining. Advanced wearables equipped with GPS, biometric sensors, and accelerometers allow precise monitoring of activities such as running, cycling, swimming, and strength training. Integration of AI-driven performance analytics enables customized recommendations and progress tracking, making these devices integral to both amateur and professional sports. Demand is further strengthened by an increasing focus on digital fitness platforms and personalized fitness programs.

Professional sports teams and organizations are adopting wearables to enhance athlete management, training efficiency, and injury prevention. Teams are using wearables for player monitoring, workload analysis, and predictive injury assessment to optimize performance outcomes. The technology is becoming central to data-driven coaching and scouting, particularly in football, basketball, cricket, and athletics. Partnerships between wearable manufacturers and sports organizations are driving the development of specialized devices that cater to elite-level requirements. Growing investments in sports science and technology-driven training facilities are ensuring sustained demand. This professional application is reinforcing the credibility of wearables and accelerating their acceptance across wider consumer groups.

Sports wearables are increasingly overlapping with health and wellness applications, expanding their relevance beyond athletic performance. Many devices now include features for sleep tracking, stress monitoring, blood oxygen measurement, and cardiovascular health insights. The convergence of healthcare and fitness tracking has encouraged broader adoption among general consumers who seek holistic well-being. With rising interest in preventive healthcare and lifestyle management, sports wearables have become important tools for maintaining daily health routines. Their ability to sync with smartphones and health apps has made them part of a connected digital lifestyle. This multi-functional appeal is ensuring growth across both consumer and professional markets.

Technological progress is shaping the future of sports wearables, with miniaturized sensors, advanced biometrics, and enhanced connectivity improving functionality. The introduction of smart fabrics and embedded sensors in apparel is creating a new wave of wearables that provide seamless monitoring without affecting user comfort. Cloud computing and AI integration are enabling personalized training recommendations and predictive analytics. Emerging innovations in battery efficiency and wireless charging are addressing consumer concerns about usability. The rollout of 5G is supporting real-time data transmission and live performance feedback. These advancements are positioning sports wearables as a critical element of connected fitness and digital health ecosystems.

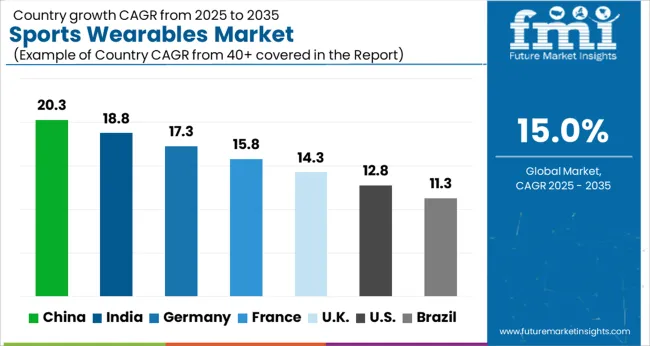

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| U.K. | 14.3% |

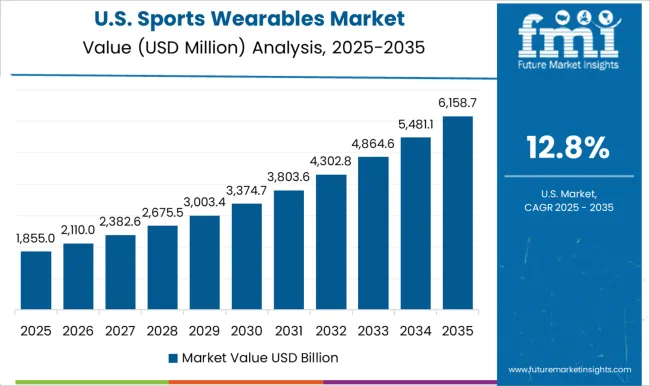

| U.S. | 12.8% |

| Brazil | 11.3% |

The market is experiencing rapid momentum as health monitoring, performance tracking, and connected devices become integral to fitness and professional sports. China leads with a projected growth rate of 20.3%, supported by strong consumer adoption and integration of AI-enabled features in smart devices. India follows at 18.8%, where rising fitness awareness and expanding digital infrastructure are fueling market uptake. Germany registers 17.3%, driven by innovations in sports science and wearable technology integration within athletics. The United Kingdom records 14.3%, benefitting from investments in connected fitness ecosystems and sports technology startups. The United States secures 12.8%, where leading brands and consumer demand for advanced health-tracking wearables strengthen growth. Collectively, these countries are setting benchmarks in design, adoption, and innovation that define the global sports wearables landscape. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 20.3%, driven by rising consumer interest in fitness, performance tracking, and connected technologies. Demand is being fueled by the increasing adoption of smartwatches, fitness bands, and specialized wearable devices for sports performance monitoring. The younger population is particularly inclined toward digital fitness solutions integrated with mobile applications. Manufacturers are focusing on improving product features such as advanced health tracking, durability, and compatibility with multiple platforms. Distribution channels include both online platforms and retail outlets, offering broad accessibility. Marketing campaigns led by sports influencers and fitness brands are significantly boosting awareness and acceptance. Collaborations with sports academies, gyms, and wellness providers are reinforcing growth prospects.

The market in India is forecasted to record a CAGR of 18.8%, with demand supported by expanding fitness awareness and increased use of digital health solutions. Smartwatches and fitness trackers are becoming essential for monitoring physical activity, sleep cycles, and overall health. Younger demographics, urban professionals, and sports enthusiasts are leading adoption. Manufacturers are targeting the market with affordable yet feature-rich products designed for durability and local preferences. Distribution through online marketplaces, sports stores, and electronics outlets is widening accessibility. Promotional activities highlighting health benefits, lifestyle improvement, and advanced features are driving consumer interest. Strategic partnerships with fitness clubs, wellness startups, and sports leagues are broadening the appeal and ensuring stronger market penetration.

Germany is expected to advance at a CAGR of 17.3%, supported by strong interest in performance optimization, health monitoring, and connected fitness ecosystems. Consumers are adopting smartwatches, wearable sensors, and advanced monitoring devices for daily fitness routines and professional sports. The focus on precise data collection and health tracking is strengthening product demand. Manufacturers are integrating AI-driven features and offering advanced designs suitable for endurance sports. Distribution networks through specialized sports retailers, electronic chains, and online platforms ensure wide market coverage. Marketing strategies emphasizing scientific accuracy, reliability, and long-term performance benefits are appealing to health-conscious users. Collaborations with sports organizations, healthcare institutions, and professional training centers are reinforcing product adoption.

The market in the United Kingdom is set to grow at a CAGR of 14.3%, influenced by growing awareness of health, wellness, and data-driven fitness. Consumers are increasingly using wearable devices such as smartwatches and fitness trackers to monitor exercise, calories, and heart rate. Sports enthusiasts and amateur athletes are integrating wearables into training routines for performance enhancement. Manufacturers are focusing on innovation in design, style, and digital integration. Distribution channels include e-commerce, electronics outlets, and fitness retailers, ensuring broad accessibility. Marketing campaigns often highlight lifestyle benefits and personalized performance insights, creating strong consumer engagement. Strategic partnerships with fitness centers, professional trainers, and healthcare providers are extending market opportunities.

The market in the United States is projected to register a CAGR of 12.8%, with demand influenced by the popularity of health-focused digital technologies. Adoption is being driven by consumers using smartwatches, connected bands, and advanced sports monitoring devices for personalized health tracking. Fitness enthusiasts and professional athletes are incorporating wearables into performance improvement programs. Manufacturers are enhancing features such as real-time data insights, biometric tracking, and mobile integration. Distribution networks through retail chains, sports outlets, and online platforms support wide availability. Marketing campaigns highlighting personalized health benefits, performance optimization, and lifestyle integration are resonating with consumers. Collaborations with sports teams, wellness brands, and healthcare providers are broadening usage across both fitness and medical applications.

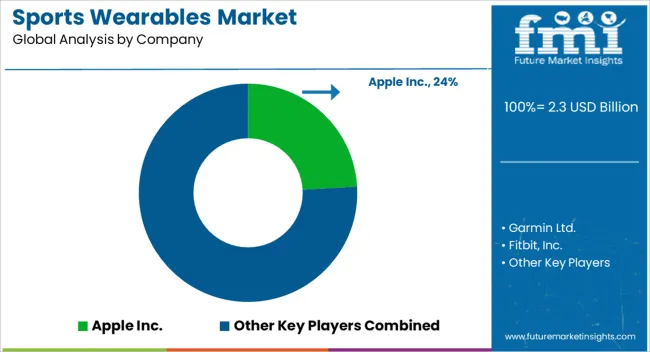

The market has been shaped by strong advancements in sensor technology, connectivity, and data-driven fitness insights, supported by major global players. Apple Inc. leads with its Apple Watch series that integrates health tracking, performance monitoring, and seamless iOS connectivity, making it a benchmark in premium wearables. Garmin Ltd. is well recognized for its specialization in GPS-enabled sports watches and advanced training devices, catering to athletes and outdoor enthusiasts. Fitbit, Inc., now part of Google, has a strong legacy in affordable yet feature-rich fitness trackers, which expanded accessibility to personalized health and wellness insights. Samsung Electronics Co., Ltd. strengthens the competitive environment with Galaxy smartwatches that combine fitness tracking with lifestyle and productivity features, appealing to a broad consumer base. Huawei Technologies Co., Ltd. continues to gain market traction with cost-effective wearables offering robust battery life, advanced biometric monitoring, and integration with its expanding ecosystem. The competitive dynamics of the sports wearables industry are influenced by innovation in biometric sensors, artificial intelligence applications, and real-time data analytics. Companies are focusing on expanding functionalities from fitness tracking toward holistic health monitoring, including heart rate variability, sleep analysis, and stress management. Demand is further driven by consumer preference for multi-functional devices that merge health, communication, and entertainment. Strategic partnerships, software ecosystem expansion, and consistent improvements in accuracy and design are shaping the market trajectory. As digital health adoption accelerates, the sports wearables sector is expected to remain central to personalized wellness and performance optimization worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Product Type | Fitness Bands, Smartwatches, Smart Clothing, Footwear, Smart Headwear, and Others |

| Application | Healthcare & Fitness, Sports and Athletics, Entertainment and Multimedia, and Others |

| End User | General Consumers, Professional Athletes, Sports Medics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Apple Inc., Garmin Ltd., Fitbit, Inc., Samsung Electronics Co., Ltd., and Huawei Technologies Co., Ltd. |

| Additional Attributes | Dollar sales by wearable type and functionality, demand dynamics across fitness, professional sports, and wellness sectors, regional trends in connected device adoption, innovation in biometric tracking, sensor accuracy, and AI integration, environmental impact of electronic component disposal, and emerging use cases in performance optimization, personalized training, and remote health monitoring. |

The global sports wearables market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the sports wearables market is projected to reach USD 9.4 billion by 2035.

The sports wearables market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in sports wearables market are fitness bands, smartwatches, smart clothing, footwear, smart headwear and others.

In terms of application, healthcare & fitness segment to command 39.2% share in the sports wearables market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sports Medicine Sutures Market Size and Share Forecast Outlook 2025 to 2035

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Turf Seed Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sports Food Market Size and Share Forecast Outlook 2025 to 2035

Sports Bicycles Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

Sports Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Sports Inspired Clothing Market Analysis – Trends, Growth & Forecast 2025-2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Sports and Athletic Insoles Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA