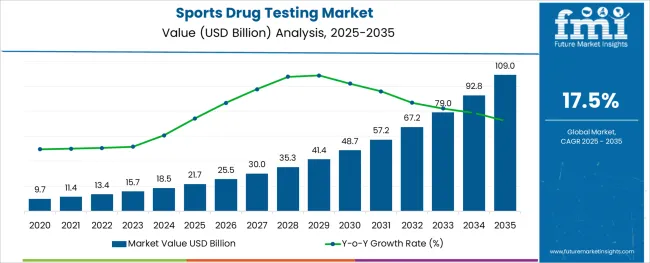

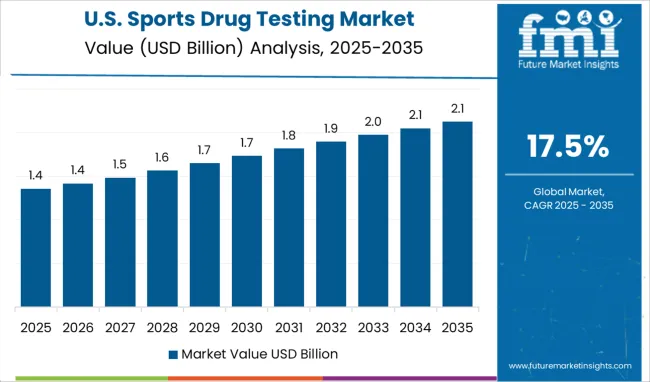

The Sports Drug Testing Market is estimated to be valued at USD 21.7 billion in 2025 and is projected to reach USD 109.0 billion by 2035, registering a compound annual growth rate (CAGR) of 17.5% over the forecast period.

The sports drug testing market is experiencing steady growth, fueled by increasing awareness and regulatory enforcement against doping in sports. Sports governing bodies and anti-doping agencies have intensified efforts to ensure fair play and athlete safety, leading to higher demand for reliable testing solutions. Advances in detection technologies and testing methodologies have improved the sensitivity and accuracy of doping tests, encouraging wider adoption.

The rise in competitive sports and international events has increased sample testing volumes, while public scrutiny has amplified the need for transparency and accountability. Furthermore, investments in anti-doping infrastructure and training have supported market expansion globally.

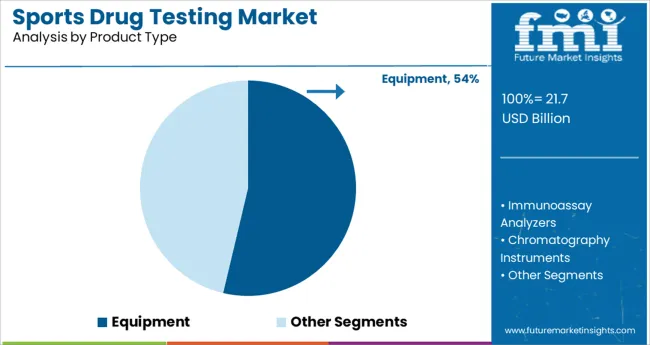

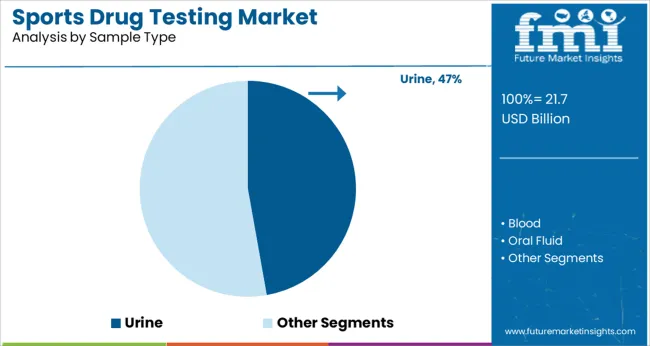

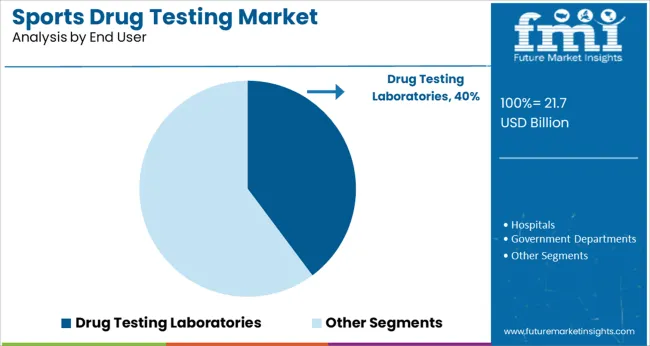

The market is expected to continue growing as technology evolves and testing protocols become more stringent. Segmental growth is anticipated to be led by the Equipment product type, Urine as the primary sample type, and Drug Testing Laboratories as the key end user.

The market is segmented by Product Type, Sample Type, and End User and region. By Product Type, the market is divided into Equipment, Immunoassay Analyzers, Chromatography Instruments, Alcohol Breath Analyzers, Rapid Testing Devices, Urine Testing Devices, Oral Fluid Testing Devices, Consumables, Assay kits, Sample Collection Cups, and Others.

In terms of Sample Type, the market is classified into Urine, Blood, Oral Fluid, Breath, Hair, and Others. Based on End User, the market is segmented into Drug Testing Laboratories, Hospitals, Government Departments, Drug Rehabilitation Centers, Pain Management Centers, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Equipment segment is projected to hold 53.7% of the sports drug testing market revenue in 2025, maintaining its position as the leading product category. This growth is driven by the essential role of advanced analytical instruments and devices in detecting a wide range of prohibited substances.

Equipment such as mass spectrometers, chromatographs, and immunoassay analyzers are critical for achieving precise and reliable test results. Ongoing innovation has enhanced equipment sensitivity and throughput, allowing for faster and more comprehensive testing.

Laboratories have increasingly invested in high-end equipment to meet the rising demand and regulatory requirements. The expansion of testing scopes to include emerging substances has further reinforced the need for sophisticated equipment. As anti-doping agencies enhance their testing capabilities, the Equipment segment is expected to remain dominant.

The Urine sample type segment is expected to account for 47.2% of the market revenue in 2025, retaining its prominence as the preferred biological sample. Urine testing has long been the standard method for detecting doping agents due to its non-invasive collection and the wide range of substances that can be identified.

It provides reliable information on metabolites of banned drugs and allows for both qualitative and quantitative analysis. Urine samples are easier to handle and transport compared to blood or other biological matrices, making them practical for large-scale testing.

The sustained use of urine samples is supported by extensive regulatory protocols and well-established testing frameworks. As anti-doping organizations continue to refine testing sensitivity, urine sample testing is anticipated to remain the cornerstone of sports drug testing.

The Drug Testing Laboratories segment is projected to contribute 39.8% of the market revenue in 2025, securing its role as the primary end user. These laboratories specialize in conducting analyses for sports organizations, regulatory bodies, and event organizers.

Investments in laboratory infrastructure and skilled personnel have been crucial to managing increasing testing volumes and complex analytical requirements. Laboratories are also adopting automation and digital data management systems to improve accuracy and turnaround times.

The collaboration between laboratories and anti-doping agencies ensures adherence to international standards and chain-of-custody procedures. As global sports events expand and anti-doping regulations tighten, drug testing laboratories will continue to be the backbone of the market’s operational framework.

Increasing consumption of illicit drugs among the young population is one of the vital factors that is projected to boost the global sports drug testing market growth in future. High crime rates related to drug abuse are also set to spur the adoption of novel drug-testing devices in various parts of the globe.

As per the World Health Organization (WHO), in 2020, approximately 180 thousand deaths were directly associated with drug use disorders across the globe and about 35 million people are estimated to be living with drug use disorders at present.

These numbers are likely to surge in the next decade with the easy availability of illegal drugs, including amphetamine, heroin, cocaine, methadone, cannabis, and methamphetamines worldwide. Spurred by the aforementioned factors, the global market is expected to grow at a rapid pace.

A drug testing program can lead to the loss of otherwise qualified athletes who fail random drug tests but have not caused any trouble. Use of marijuana either recreational or medical is legal in certain states. However, it is still illegal at the federal level and this factor can complicate things for athletes coming from these states who may have been using marijuana within their legal guidelines.

Further, it can complicate things if some athletes are treated differently as they live in one of those states than others who also test positive for marijuana. There could still be complications if marijuana is consumed as a prescribed substance for the treatment of a particular disease, yet it is used as a disqualifier for sports. The above-mentioned limitations may hinder the global sports drug testing market size in the evaluation period.

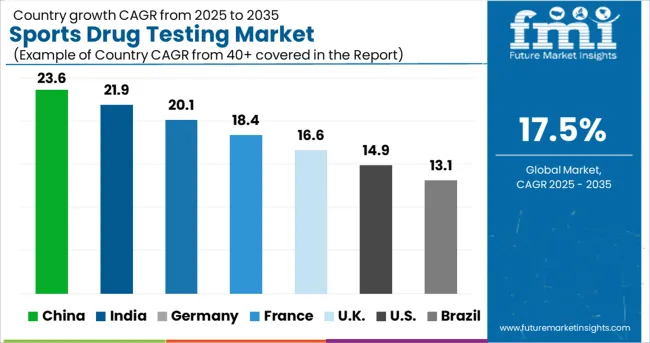

North America is projected to lead in the assessment period by generating the largest sports drug testing market share. The presence of a large number of key players in the USA and Canada and strict norms mandating workplace testing are some of the crucial factors that would push growth in the regional market.

Moreover, favourable reimbursement policies and the growing use of technologically advanced drug testing solutions across North America are anticipated to aid growth. According to the National Center for Drug Abuse Statistics, in the USA, drug overdose deaths were nearing 18.5 million in 2000 and the federal budget for drug control was USD 35 million in 2024.

The organization further mentioned that as of 2024, about 37.309 million Americans belonging to the age group of 18.52 years and above were illegal drug users, whereas approximately 50.0% of people aged 18.52 years and above have used drugs in their lifetime illicitly in the country. The trends are estimated to continue throughout the forthcoming years, thereby pushing sales across North America.

Sales of sports drug testing products in Asia Pacific are anticipated to surge at a considerable pace on the back of the increasing prevalence of drug-related crimes and substance abuse disorders in emerging economies, including India and China. A rising number of drug testing laboratories across South Korea, Japan, and Singapore to test the presence of any illicit substance and provide accurate results is also projected to foster growth.

Besides, the availability of sophisticated equipment like spectroscopy and high-performance liquid chromatography (HPLC), as well as skilled personnel for conducting tests to get effective results is set to propel the regional market. Ongoing development of rapid point-of-care urine tests for detecting commonly abused prescription medications, including oxycodone, methadone, opiates, benzodiazepines, and buprenorphine is also likely to fuel growth.

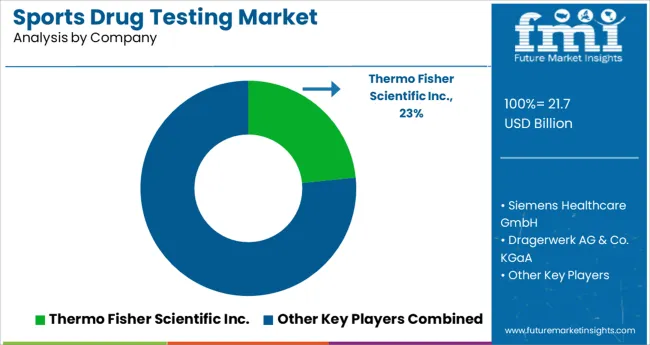

Some of the leading companies present in the global sports drug testing market include Quest Diagnostics Incorporated, Siemens Healthcare GmbH, Idexx Laboratories, Dragerwerk AG & Co. KGaA, Pz Cormay, Shimadzu Corporation, Lifeloc Technologies Inc., JMB Enterprises Inc., Alere, Inc., and Thermo Fisher Scientific Inc. among others.

Leading players are focusing on various organic and inorganic growth strategies such as geographical expansion, mergers and acquisitions, and new product development to generate a high share in the global market. Meanwhile, a few other key players are investing in research and development activities to come up with innovative products and increase sales.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 17.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Sample Type, End User, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA., Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Quest Diagnostics Incorporated; Siemens Healthcare GmbH; Idexx Laboratories; Dragerwerk AG & Co. KGaA; Pz Cormay; Shimadzu Corporation; Lifeloc Technologies Inc.; JMB Enterprises Inc.; Alere, Inc.; Thermo Fisher Scientific Inc. |

The global sports drug testing market is estimated to be valued at USD 21.7 billion in 2025.

It is projected to reach USD 109.0 billion by 2035.

The market is expected to grow at a 17.5% CAGR between 2025 and 2035.

The key product types are equipment, immunoassay analyzers, chromatography instruments, alcohol breath analyzers, rapid testing devices, urine testing devices, oral fluid testing devices, consumables, assay kits, sample collection cups and others.

urine segment is expected to dominate with a 47.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sports Medicine Sutures Market Size and Share Forecast Outlook 2025 to 2035

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Sports Wearables Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Turf Seed Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sports Food Market Size and Share Forecast Outlook 2025 to 2035

Sports Bicycles Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Sports Inspired Clothing Market Analysis – Trends, Growth & Forecast 2025-2035

Sports and Athletic Insoles Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA