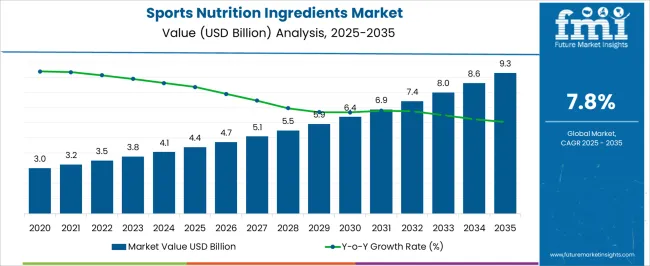

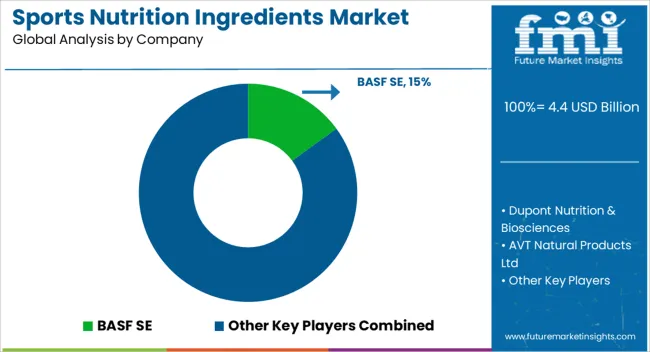

The sports nutrition ingredients market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 9.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period. A 10-year growth comparison reveals strong growth, with notable acceleration in the early years, followed by stable expansion in the later stages. Between 2025 and 2030, the market grows from USD 4.4 billion to USD 6.4 billion, contributing USD 2 billion in growth, with a CAGR of 8.4%. This early-phase growth is driven by increasing consumer awareness of sports nutrition benefits, particularly in health and fitness, as well as the rising demand for protein supplements, amino acids, and other performance-enhancing ingredients.

As the fitness culture expands globally, more athletes and fitness enthusiasts incorporate sports nutrition ingredients into their routines. From 2030 to 2035, the market continues to expand, moving from USD 6.4 billion to USD 9.3 billion, contributing USD 2.9 billion in growth, with a slightly lower CAGR of 6.4%. This deceleration reflects the market’s maturation, as widespread adoption and increased competition in established regions lead to more incremental growth. However, innovations in plant-based, clean-label, and functional sports nutrition ingredients, along with the rise of e-commerce, continue to drive demand, ensuring sustained expansion. The comparison shows rapid early growth, followed by more stable, incremental expansion as the market matures.

| Metric | Value |

|---|---|

| Sports Nutrition Ingredients Market Estimated Value in (2025 E) | USD 4.4 billion |

| Sports Nutrition Ingredients Market Forecast Value in (2035 F) | USD 9.3 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The current market landscape is being shaped by increased awareness around personalized nutrition and the growing popularity of functional foods, as highlighted in industry announcements, investor briefings, and health-focused publications. Manufacturers are actively reformulating products to meet clean-label, plant-based, and protein-rich preferences.

Innovation in ingredient sourcing and processing technologies is also enhancing the bioavailability and performance impact of sports nutrition ingredients. A favorable regulatory environment in developed regions, combined with expanding distribution in emerging markets, has further widened access to these products.

As more consumers embrace preventative health and wellness routines, the future outlook appears positive, with demand expected to grow steadily. Continued collaboration between ingredient manufacturers and sports nutrition brands, along with an increased focus on sustainability and transparency, is set to create long-term opportunities across global markets.

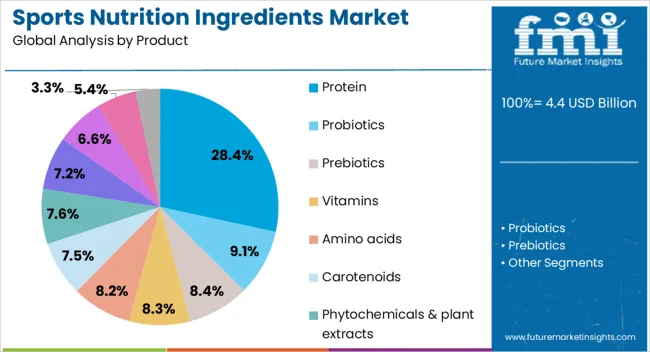

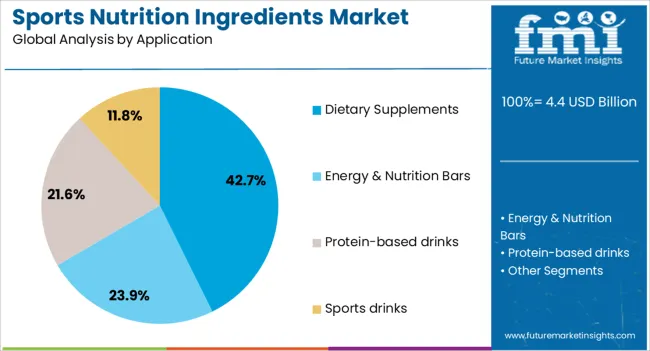

The sports nutrition ingredients market is segmented by product, application, form, end-use, age group, and geographic regions. By product, the sports nutrition ingredients market is divided into Protein, Probiotics, Prebiotics, Vitamins, Amino acids, Carotenoids, Phytochemicals & plant extracts, EPA/DHA, Minerals, Fiber & carbohydrates, and Others. In terms of application, the sports nutrition ingredients market is classified into Dietary Supplements, Energy & Nutrition Bars, Protein-based drinks, and Sports drinks.

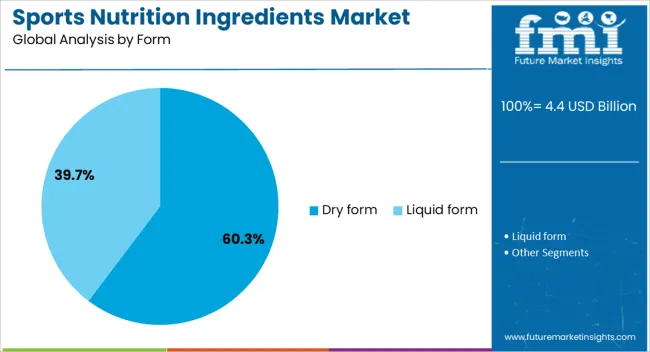

Based on form, the sports nutrition ingredients market is segmented into Dry form and Liquid form. By end-use, the sports nutrition ingredients market is segmented into Athletes and bodybuilders. By age group, the sports nutrition ingredients market is segmented into Millennials (1985-2000), Gen Z, Gen X, and Baby Boomers (1946-1964). Regionally, the sports nutrition ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The protein segment is expected to hold 28.4% of the Sports Nutrition Ingredients Market revenue share in 2025, establishing it as the leading product category. This dominance is being attributed to the essential role of protein in muscle recovery, endurance, and overall athletic performance, as emphasized in health journals and corporate product launches.

Protein ingredients have been widely adopted across multiple consumer groups, including professional athletes, fitness enthusiasts, and lifestyle users, supporting strong demand across retail and specialty channels. The growth of this segment has been supported by the availability of both animal and plant-based protein options, enabling brands to cater to evolving dietary preferences.

Moreover, advances in flavor masking, solubility, and protein extraction technologies have improved the palatability and functional application of protein ingredients in powders, bars, and ready-to-drink formulations.

The dietary supplements segment is projected to account for 42.7% of the Sports Nutrition Ingredients Market revenue share in 2025, making it the most prominent application area. This growth has been driven by increased consumer focus on preventative health and physical performance, as reported in pharmaceutical company updates and nutritional science publications. The convenience of supplements, particularly capsules, tablets, and powders, has appealed to both professional and recreational users seeking efficient ways to meet daily nutritional goals.

Supplement manufacturers have increasingly incorporated sports nutrition ingredients to address goals such as energy boost, recovery, hydration, and immunity. Regulatory support for nutritional claims, along with broader retail availability and online penetration, has also contributed to the segment’s growth.

Moreover, sustained marketing investments and influencer-driven brand promotion have made dietary supplements a mainstream part of fitness and wellness routines. These dynamics have established dietary supplements as the largest and fastest-growing application within the market.

The dry form segment is forecasted to lead the market with 60.3% of the Sports Nutrition Ingredients Market revenue share in 2025. This position has been reinforced by the versatility, stability, and cost-effectiveness of dry ingredients, which are favored for formulation in powders, tablets, and bars. Industry sources and product innovation bulletins have highlighted that dry forms are easier to transport, store, and incorporate into various delivery formats, making them attractive to manufacturers and consumers alike.

The extended shelf life and reduced need for refrigeration have further enhanced their logistical advantages across global supply chains. In addition, dry forms allow for higher concentrations of active ingredients, which is particularly important for performance-focused consumers requiring precise dosing.

With sustained consumer preference for powder-based pre-workout, recovery, and protein products, demand for dry form ingredients is expected to remain strong. These attributes have collectively supported the dominance of the dry form segment in the overall market.

The sports nutrition ingredients market is expanding as more consumers focus on health, fitness, and performance. The increasing popularity of fitness regimes, the rise in health-conscious consumers, and the growing awareness of the importance of proper nutrition are driving demand for sports nutrition products. Key ingredients like proteins, amino acids, carbohydrates, and vitamins are in high demand to support athletic performance, recovery, and overall wellness. Despite challenges like regulatory complexities and market fragmentation, opportunities exist through product innovation and the growing popularity of plant-based and clean-label ingredients.

The primary driver for the growth of the sports nutrition ingredients market is the rising health consciousness among consumers and the growing trend of fitness and wellness. As more people engage in regular physical activity, the demand for products that support athletic performance, recovery, and overall health is increasing. Sports nutrition ingredients, such as protein, amino acids, and electrolytes, are in high demand to meet the nutritional needs of active individuals. The shift towards healthier lifestyles, with a focus on maintaining physical fitness and improving muscle recovery, is fueling the growth of this market. Additionally, the increasing adoption of sports supplements by non-professional athletes and fitness enthusiasts further propels market expansion.

A significant challenge in the sports nutrition ingredients market is the complexity of regulations. Different regions have varying rules regarding the approval and labeling of sports supplements and ingredients. Compliance with these regulatory standards can be time-consuming and costly for manufacturers. Additionally, the market is highly fragmented, with a wide variety of ingredients, product types, and formulations available. This diversity can make it difficult for brands to differentiate themselves and establish strong market positions. Consumer skepticism about the efficacy of some ingredients, coupled with misleading marketing practices, can also pose a challenge in building trust and loyalty among consumers.

The sports nutrition ingredients market presents significant opportunities for innovation, especially with the growing consumer preference for plant-based, clean-label ingredients. As more individuals seek vegan and natural options in their diets, sports nutrition companies are increasingly formulating products with plant-based proteins, amino acids, and other organic ingredients. The rise in demand for clean-label products that are free from artificial additives and preservatives also presents an opportunity for brands to cater to a growing segment of health-conscious consumers. Furthermore, technological advancements in ingredient extraction and processing are making it possible to create more efficient, high-quality, and affordable sports nutrition products. Companies that can meet the evolving needs of consumers by offering transparent, natural, and effective ingredients stand to gain a competitive edge in the market.

A key trend in the sports nutrition ingredients market is the growing demand for personalized products tailored to individual fitness goals and dietary preferences. Consumers are increasingly looking for sports nutrition products that cater to specific needs, such as muscle gain, weight loss, or endurance. Personalization in sports supplements, such as custom protein blends and amino acid ratios, is gaining popularity. Another trend is the rise of functional ingredients that offer additional health benefits beyond basic nutritional support. Ingredients such as probiotics, adaptogens, and antioxidants are being integrated into sports nutrition products to support overall well-being and enhance recovery. The growing popularity of these functional, personalized, and all-encompassing products is shaping the future of the market.

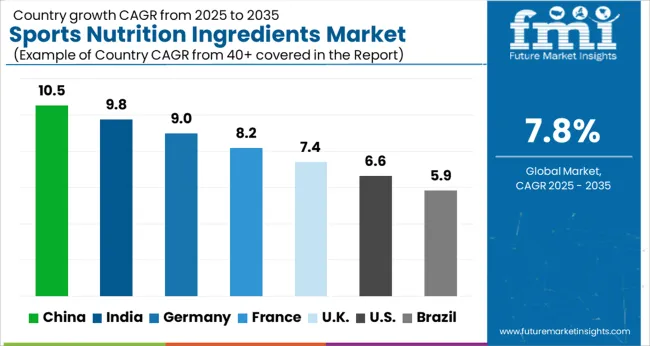

The sports nutrition ingredients market is projected to grow at a CAGR of 7.8% from 2025 to 2035. China leads at 10.5%, followed by India at 9.8%, and France at 8.2%, while the United Kingdom records 7.4% and the United States posts 6.6%. Divergence reflects local catalysts: increasing adoption of sports nutrition ingredients in the health and fitness sectors in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to established infrastructure. The analysis includes over 40+ countries, with the leading markets detailed below.

Demand for sports nutrition ingredients in China is growing at a 10.5% CAGR through 2035. The rapid growth of China’s fitness and wellness sectors is driving the increased demand for sports nutrition products. As more Chinese consumers adopt healthier lifestyles and engage in fitness activities, the demand for protein supplements, amino acids, and energy boosters is growing. Additionally, the rise of e-commerce and online retail platforms is further driving the accessibility of sports nutrition ingredients to a wider consumer base. With a strong interest in both traditional and Western-style fitness, China is poised to be a major market for sports nutrition ingredients.

Sale of sports nutrition ingredients in India is projected to grow at a 9.8% CAGR through 2035. India’s rapidly expanding fitness and health-conscious population is driving the demand for sports nutrition products, including protein powders, vitamins, and amino acids. The rise of fitness centers, gyms, and wellness activities is contributing to market growth. India’s increasing awareness of the benefits of protein supplementation and its growing middle-class population further accelerate the market. As disposable income rises, consumers are willing to invest in quality sports nutrition ingredients, particularly for fitness and recovery purposes.

The sports nutrition ingredients market in France is growing at an 8.2% CAGR through 2035. France’s expanding fitness and health sector, along with an increasing interest in healthy and active lifestyles, is driving the demand for sports nutrition products. The French market is characterized by high consumer interest in plant-based and organic nutrition ingredients. Additionally, growing awareness of the benefits of protein and amino acids in muscle recovery and athletic performance is contributing to market growth. The rise of wellness and sport-focused products, particularly among younger generations, further drives the adoption of sports nutrition ingredients in France.

Sale of sports nutrition ingredients in France is growing at an 8.2% CAGR through 2035. France’s expanding fitness and health sector, along with an increasing interest in healthy and active lifestyles, is driving the demand for sports nutrition products. The French market is characterized by high consumer interest in plant-based and organic nutrition ingredients. Additionally, growing awareness of the benefits of protein and amino acids in muscle recovery and athletic performance is contributing to market growth. The rise of wellness and sport-focused products, particularly among younger generations, further drives the adoption of sports nutrition ingredients in France.

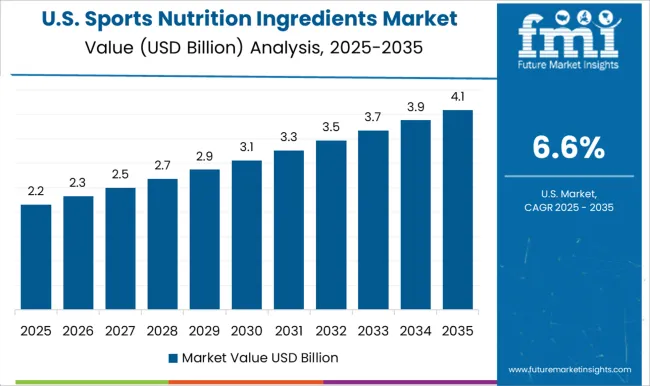

Demand for sports nutrition ingredients in the USA is projected to grow at a 6.6% CAGR through 2035. The USA is a well-established market for sports nutrition products, driven by the country’s strong fitness culture and the increasing adoption of healthy lifestyles. The growing interest in sports performance, bodybuilding, and muscle recovery is fueling demand for protein supplements, amino acids, and energy boosters. The USA market is also benefiting from an increasing number of gyms, fitness programs, and sports events, which contribute to the widespread use of sports nutrition ingredients.

BASF SE supplies vitamins, carotenoids, omega-3, choline, and nutrient premixes used to support energy metabolism and antioxidant defense. IFF Health, formerly DuPont Nutrition and Biosciences, provides probiotics, enzymes, dietary fibers, and cultures that target gut health and performance formulas. AVT Natural Products Ltd focuses on botanical extracts such as curcumin, capsicum, green tea, and natural caffeine for thermogenic and antioxidant roles.

Prinova Group LLC delivers amino acids, functional carbohydrates, flavor systems, and custom premixes tailored to sports and active nutrition. Innophos offers phosphate-based minerals and electrolyte systems, including calcium, magnesium, and potassium phosphates, for hydration and buffering capacity. BI Nutraceuticals, under Martin Bauer, provides plant-based powders and standardized botanicals used in endurance, recovery, and focus blends. Tate and Lyle supplies nutritive and non-nutritive sweeteners and soluble fibers for sugar reduction, mouthfeel, and energy drink or gel formulation.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Product | Protein, Probiotics, Prebiotics, Vitamins, Amino acids, Carotenoids, Phytochemicals & plant extracts, EPA/DHA, Minerals, Fiber & carbohydrates, and Others |

| Application | Dietary Supplements, Energy & Nutrition Bars, Protein-based drinks, and Sports drinks |

| Form | Dry form and Liquid form |

| End-Use | Athletes and Body Builders |

| Age Group | Millennial (1985-2000), Gen Z, Gen X, and baby Boomers (1946-1964) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Dupont Nutrition & Biosciences, AVT Natural Products Ltd, Prinova Group, LLC, Innophos, BI Nutraceuticals (Martin Bauer), and Tate & Lyle |

| Additional Attributes | Dollar sales by product type (amino acids, proteins, electrolytes, vitamins, minerals, carbohydrates) and end-use segments (sports drinks, protein powders, energy bars, supplements). Demand dynamics are influenced by the growing awareness of the importance of sports nutrition in improving athletic performance, the rising interest in fitness, and the increasing adoption of personalized nutrition. Regional trends show strong growth in North America and Europe, where fitness and wellness culture is dominant, while Asia-Pacific is expanding due to growing middle-class populations and increased sports participation. |

The global sports nutrition ingredients market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the sports nutrition ingredients market is projected to reach USD 9.3 billion by 2035.

The sports nutrition ingredients market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in sports nutrition ingredients market are protein, probiotics, prebiotics, vitamins, amino acids, carotenoids, phytochemicals & plant extracts, epa/dha, minerals, fiber & carbohydrates and others.

In terms of application, dietary supplements segment to command 42.7% share in the sports nutrition ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Sports Wearables Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Turf Seed Market Size and Share Forecast Outlook 2025 to 2035

Sports Food Market Size and Share Forecast Outlook 2025 to 2035

Sports Bicycles Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

Sports Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Sports Inspired Clothing Market Analysis – Trends, Growth & Forecast 2025-2035

Sports and Athletic Insoles Market Analysis - Size, Share, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for Sports and Athletic Insoles Market

Sports Bottle Market Trends & Industry Growth Forecast 2024-2034

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA