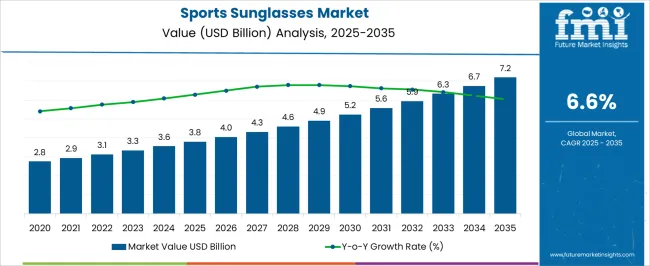

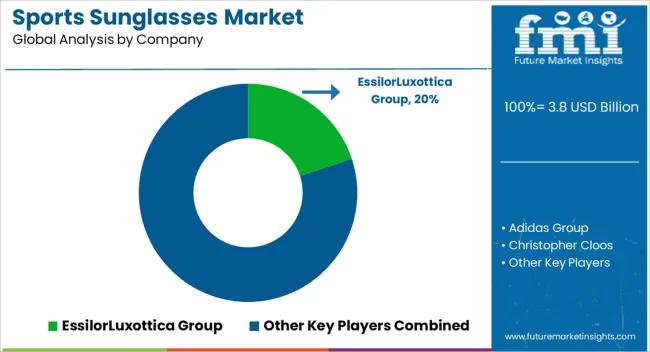

The sports sunglasses market, valued at USD 3.8 billion in 2025 and projected to reach USD 7.2 billion by 2035 at a CAGR of 6.6%, reflects a cost-structure and value-chain composition that directly influences market expansion. Raw material procurement, particularly high-performance polymers, polycarbonate lenses, and UV-protective coatings, constitutes a significant portion of the overall cost, accounting for both the optical quality and durability of products.

Lens technology and frame engineering contribute heavily to value addition, with precision manufacturing and specialized coatings enhancing performance for sports applications. Manufacturing operations, including injection molding, lens polishing, and assembly, represent the next critical cost tier, with efficiencies in automated production lines directly affecting margins. Distribution and logistics, encompassing regional warehouses, e-commerce channels, and retail partnerships, contribute to both operational costs and market reach, influencing the final retail price. Marketing and brand positioning further add value by driving consumer perception and demand, especially in high-end and performance-oriented segments.

Over the forecast period, incremental increases from USD 3.8 billion in 2025 to USD 5.2 billion by 2030 reflect growing adoption and incremental enhancements in lens and frame technologies. By 2035, the market is expected to reach USD 7.2 billion, driven by optimized value-chain integration and cost-effective sourcing of high-performance materials. The analysis highlights that raw material selection, manufacturing efficiency, and distribution strategy collectively define market competitiveness and growth sustainability.

| Metric | Value |

|---|---|

| Sports Sunglasses Market Estimated Value in (2025 E) | USD 3.8 billion |

| Sports Sunglasses Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The sports sunglasses market represents a specialized segment within the global eyewear and sports accessories industry, emphasizing performance, eye protection, and durability. Within the broader sports equipment and accessories market, it accounts for about 5.2%, driven by adoption across outdoor sports, cycling, running, and water sports activities. In the global eyewear and optical products sector, it holds nearly 4.6%, reflecting demand for high-quality lenses, UV protection, and impact-resistant frames.

Across the active lifestyle and fitness accessories market, the share is 4.1%, supporting consumer preferences for comfort, style, and functionality. Within the performance gear and sporting goods segment, it represents 3.8%, highlighting integration with apparel and protective equipment. In the professional sports and athlete equipment category, it secures 3.4%, emphasizing usage in competitive and endurance sports applications. Recent developments in this market have focused on lens technology, frame innovation, and digital integration. Innovations include polarized, photochromic, and anti-fog lenses, lightweight and flexible frames, and enhanced ventilation designs.

Key players are collaborating with sports brands, optical component manufacturers, and professional athletes to improve comfort, fit, and optical performance. Adoption of smart sunglasses with integrated sensors, heads-up displays, and connectivity features is gaining traction in endurance and extreme sports. The customization options, modular frames, and eco-friendly materials are being deployed to meet consumer demand.

The market is witnessing robust growth driven by increasing consumer focus on eye protection combined with enhanced visual clarity during physical activities. The current market scenario reflects strong demand from outdoor enthusiasts and athletes, supported by technological advancements in lens materials and coatings that improve durability and comfort.

Rising awareness regarding ultraviolet radiation hazards and growing participation in outdoor sports and recreational activities are shaping the future outlook. Investments in product innovation, including lightweight frames and impact-resistant lenses, are further fueling expansion.

The market is expected to benefit from expanding sports tourism and lifestyle trends promoting active and health-conscious living. As consumers seek multifunctional eyewear that enhances performance and protects vision, the Sports Sunglasses market is poised for sustained growth across various global regions.

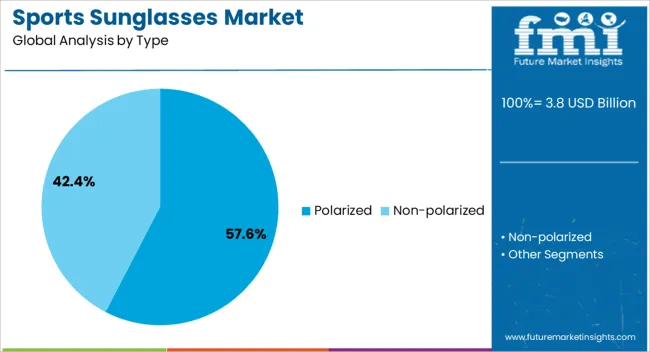

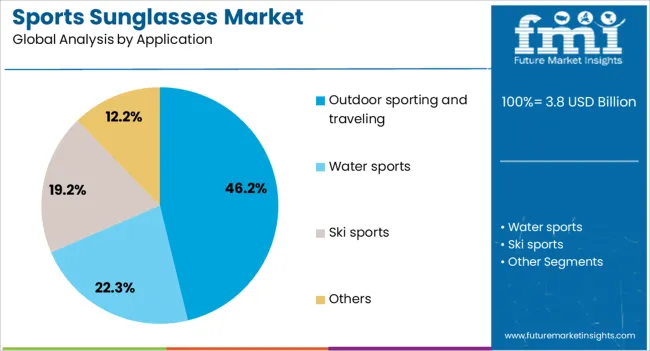

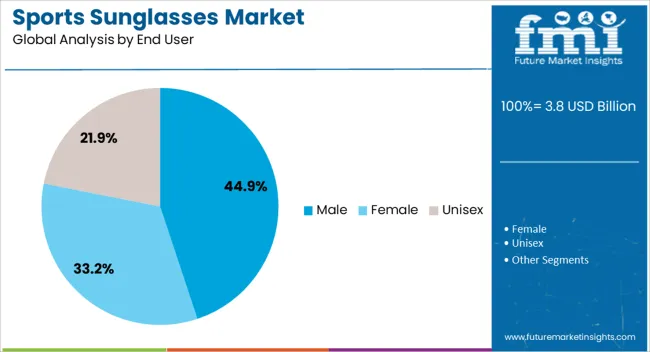

The sports sunglasses market is segmented by type, application, end user, distribution channel, and geographic regions. By type, sports sunglasses market is divided into Polarized and Non-polarized. In terms of application, sports sunglasses market is classified into Outdoor sporting and traveling, Water sports, Ski sports, and Others. Based on end user, sports sunglasses market is segmented into Male, Female, and Unisex.

By distribution channel, the sports sunglasses market is segmented into Specialty stores, hypermarkets/supermarkets, Brand outlets, and Online. Regionally, the sports sunglasses industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polarized type segment is projected to hold 57.6% of the Sports Sunglasses market revenue share in 2025, making it the leading segment by type. This prominence is being attributed to the superior glare reduction and improved visual comfort provided by polarized lenses, which are essential for outdoor sports and activities near reflective surfaces such as water and snow.

The demand for polarized sunglasses has been supported by their ability to enhance contrast and reduce eye strain during prolonged exposure to bright environments. The versatility of polarized lenses in different lighting conditions and their effectiveness in protecting against harmful UV rays have reinforced consumer preference.

Additionally, advancements in polarization technology that enhance lens clarity and durability have contributed to the segment’s growth. The ease of integrating polarized lenses into various frame designs further supports widespread adoption.

The Outdoor Sporting and Traveling application segment is expected to account for 46.2% of the Sports Sunglasses market revenue share in 2025, positioning it as the dominant application area. This leadership has been driven by increased participation in outdoor sports such as cycling, hiking, and water sports, as well as the growing popularity of travel and adventure tourism.

The need for effective eye protection that also improves visibility in varying weather and light conditions has accelerated adoption in this segment. Consumers in this category prioritize functionality alongside style, seeking sunglasses that offer durability, comfort, and performance enhancement.

The segment’s growth is also supported by rising disposable incomes and expanding consumer awareness of the benefits of specialized sports eyewear. Seasonal demand fluctuations linked to travel and outdoor activity cycles further influence market dynamics.

The Male end user segment is anticipated to hold 44.9% of the Sports Sunglasses market revenue share in 2025, establishing it as the largest end user group. This dominance is being driven by higher participation rates of males in outdoor and competitive sports activities, resulting in greater demand for performance-oriented eyewear.

The preference for rugged and functional designs that combine protection with aesthetics has encouraged manufacturers to develop product lines tailored to male consumers. Additionally, marketing strategies targeting male athletes and sports enthusiasts have contributed to segment growth.

Increased health awareness and lifestyle trends promoting active living have also boosted adoption in this segment. The availability of a wide range of polarized and impact-resistant sunglasses designed specifically for male users supports sustained demand and market leadership.

The market has witnessed significant growth as consumers increasingly prioritize eye protection, performance enhancement, and style in outdoor and athletic activities. These sunglasses are designed with impact resistant lenses, UV protection, anti-glare coatings, and aerodynamic frames suitable for running, cycling, skiing, and other sports. Rising participation in outdoor sports, adventure activities, and fitness routines has created strong demand. Technological developments such as polarized lenses, photochromic materials, and lightweight frames have improved functionality and comfort. Brand innovation, endorsements by athletes, and digital marketing have further stimulated consumer interest.

The growing popularity of outdoor sports and adventure activities has fueled demand for specialized sports sunglasses. Cyclists, runners, skiers, and water sport enthusiasts prefer sunglasses that provide UV protection, reduce glare, and withstand high impact conditions. Enhanced visibility, lightweight design, and adjustable fit have improved user comfort during prolonged activities. Adventure tourism and organized sports events have also expanded the potential consumer base. Retailers and online platforms are promoting sport specific models to cater to niche activities. Continuous innovation in lens technology, including anti scratch coatings and enhanced contrast lenses, has further strengthened adoption. Sports enthusiasts are increasingly choosing high performance sunglasses to improve safety, comfort, and overall activity experience.

Technological innovation has played a pivotal role in expanding the sports sunglasses market. Polarized lenses reduce glare from reflective surfaces such as water and snow, while photochromic lenses automatically adjust to varying light conditions. Lightweight and flexible frames improve wearability during high intensity activities. Anti-fog coatings, ventilation systems, and interchangeable lenses have enhanced performance in diverse weather and environmental conditions. Some advanced models incorporate smart features such as integrated sensors and fitness tracking. These technological improvements have not only increased consumer confidence in safety and durability but have also expanded the functional applications of sports sunglasses across multiple sports disciplines, driving market growth.

Sports sunglasses have increasingly become a style statement alongside performance gear, encouraging higher adoption among both athletes and casual users. Leading brands leverage endorsements from professional athletes, social media campaigns, and influencer partnerships to build brand appeal. Limited edition collections and customizable designs have attracted fashion conscious consumers. E commerce platforms, omnichannel retail, and experiential marketing events have made high performance sunglasses more accessible. The combination of style, brand credibility, and performance has strengthened consumer preference for premium and mid-tier products. As a result, marketing strategies emphasizing both functionality and aesthetics continue to play a crucial role in expanding the sports sunglasses market globally.

Despite growing demand, the sports sunglasses market faces challenges from price sensitivity, counterfeit products, and quality inconsistencies. High-performance and branded models often come at premium prices, limiting adoption among cost-conscious consumers.

Counterfeit sunglasses compromise UV protection, impact resistance, and lens quality, posing safety risks and affecting brand reputation. The low-cost imitations from unregulated sources create competitive pressure. Market growth is also constrained by consumers' lack of awareness regarding lens technology and protective features. Manufacturers are addressing these challenges by offering affordable variants, emphasizing certified quality, and investing in brand protection initiatives to maintain trust and ensure sustainable market growth.

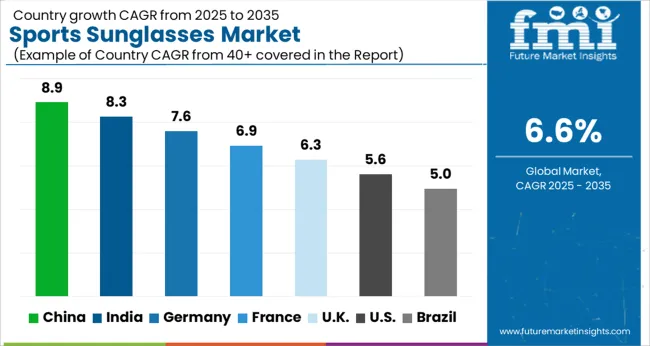

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The market is set to expand at a forecast CAGR of 6.6% from 2025 to 2035, reflecting rising adoption of protective eyewear in outdoor and athletic activities. Germany at 7.6% and the UK at 6.3% are experiencing gradual growth supported by premium sports and lifestyle segments. China leads with 8.9%, fueled by increasing participation in recreational and professional sports. India at 8.3% is witnessing steady uptake due to growing fitness awareness and urban sporting initiatives, while the USA at 5.6% continues moderate expansion driven by innovations in lens technology and consumer preferences. These nations represent diverse markets shaping global trends in performance eyewear. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 8.9%, supported by rising interest in outdoor activities, cycling, running, and water sports. Adoption has been reinforced by demand for UV protection, lightweight designs, and polarized lenses. Domestic manufacturers and international brands focus on durable frames, high contrast lenses, and sport specific designs. Growth in e commerce and organized sports events has further accelerated sales. The market outlook is expected to remain strong as Chinese consumers increasingly prioritize performance eyewear for both recreational and competitive sports activities.

India is expected to record a CAGR of 8.3%, driven by increasing participation in outdoor sports, fitness, and adventure activities. Adoption has been reinforced by demand for lightweight frames, UV protection, and durability suitable for cycling, running, and trekking. Both domestic and imported brands offer sport specific sunglasses with polarized or photochromic lenses. eCommerce growth and organized sports leagues have further enhanced distribution. The market is projected to expand as more urban and semi urban consumers invest in performance eyewear for recreation and professional sports use.

Germany is projected to grow at a CAGR of 7.6%, influenced by participation in cycling, running, skiing, and water sports. Adoption has been encouraged by demand for high quality lenses, lightweight frames, and sport specific designs. German manufacturers and distributors such as Julbo and Adidas Eyewear focus on performance, durability, and optical precision. Premium segments and outdoor sports communities are driving sales. Market expansion is also supported by e commerce platforms and organized sports events, ensuring consistent adoption across recreational and competitive users.

The United Kingdom market is projected to grow at a CAGR of 6.3%, influenced by outdoor activities such as cycling, running, and sailing. Adoption has been supported by demand for durable, lightweight, and UV protected lenses. Domestic distributors and imported brands from Europe and the U S have expanded the range of performance eyewear available. Increased participation in recreational and professional sports is expected to sustain market growth. The market outlook indicates steady expansion as sports enthusiasts seek functional and stylish sunglasses to enhance safety, visibility, and performance.

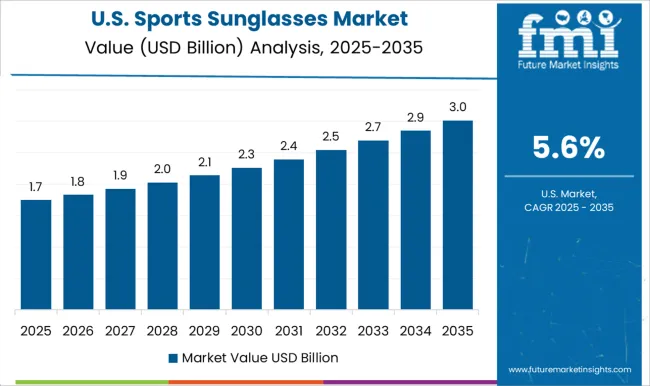

The United States market is expected to expand at a CAGR of 5.6%, supported by rising engagement in outdoor sports, recreational activities, and fitness programs. Adoption has been driven by demand for high quality lenses, polarized and photochromic options, and lightweight frames suitable for running, cycling, and water sports. Leading brands such as Oakley, Nike Vision, and Rudy Project focus on durability, lens clarity, and sport specific designs. Market growth is expected to continue as outdoor sports and fitness trends remain strong among US consumers.

The market is highly competitive, with major global eyewear conglomerates and specialized sports brands driving innovation and market growth. EssilorLuxottica Group and Safilo Group SpA lead the segment with strong brand portfolios and extensive distribution networks, offering high-performance lenses and advanced optical technologies. Nike Inc., Adidas Group, and Under Armour Inc. integrate sports science and athlete insights into their eyewear designs, providing products that optimize comfort, fit, and visual clarity during rigorous activities. Specialized players such as Rudy Project SpA, POC Sports, and Christopher Cloos focus on high-end, performance-driven eyewear, often targeting professional athletes and enthusiasts seeking precision optics, lightweight frames, and impact resistance.

Mass-market retailers like Decathlon Group and Columbia Sportswear Company leverage affordability and wide accessibility, catering to recreational users and amateur sports segments. Emerging players from Asia, including Taizhou Baiyu Eyewear Co. Ltd. and Yiwu Conchen Glasses Co. Ltd., are increasingly penetrating international markets with competitively priced alternatives. Key competitive strategies involve product innovation, technological differentiation in lens coatings, partnerships with sports teams and events, brand endorsements, and expansion of e-commerce and omnichannel presence. The market emphasizes durability, UV protection, and style as critical differentiators to attract diverse consumer segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Type | Polarized and Non-polarized |

| Application | Outdoor sporting and traveling, Water sports, Ski sports, and Others |

| End User | Male, Female, and Unisex |

| Distribution Channel | Specialty store, Hypermarket/Supermarket, Brand outlets, and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | EssilorLuxottica Group, Adidas Group, Christopher Cloos, Columbia Sportswear Company, Decathlon Group, Liberty Sports Inc., Nike Inc., Panda Optics, POC Sports, Rudy Project SpA, Safilo Group SpA, Taizhou Baiyu Eyewear Co. Ltd., Titan Company Limited, Under Armour Inc., and Yiwu Conchen Glasses Co. Ltd. |

| Additional Attributes | Dollar sales by sunglasses type and sport category, demand dynamics across professional, recreational, and outdoor activity segments, regional trends in protective eyewear adoption, innovation in lens technology, UV protection, and lightweight frame materials, environmental impact of plastic and lens manufacturing, and emerging use cases in performance optimization, augmented reality integration, and fashion-oriented sports accessories. |

The global sports sunglasses market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the sports sunglasses market is projected to reach USD 7.2 billion by 2035.

The sports sunglasses market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in sports sunglasses market are polarized and non-polarized.

In terms of application, outdoor sporting and traveling segment to command 46.2% share in the sports sunglasses market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Sports Wearables Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports Turf Seed Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sports Food Market Size and Share Forecast Outlook 2025 to 2035

Sports Bicycles Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

Sports Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Sports Inspired Clothing Market Analysis – Trends, Growth & Forecast 2025-2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Sports and Athletic Insoles Market Analysis - Size, Share, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for Sports and Athletic Insoles Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA