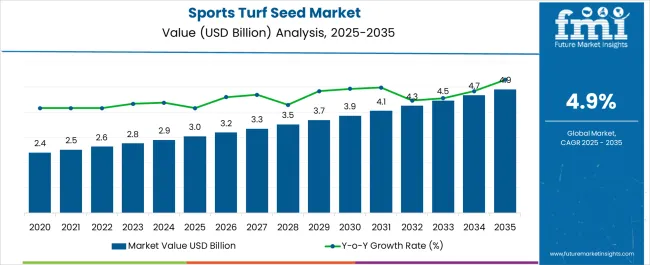

The sports turf seed market, valued at USD 3.0 billion in 2025 and projected to reach USD 4.9 billion by 2035, is set to grow at a CAGR of 4.9%. From 2020 to 2024, the market increased steadily from USD 2.4 billion to USD 2.9 billion, supported by rising adoption of high-performance turf solutions across sports facilities, stadiums, and recreational grounds.

Year-on-year growth was consistent, with USD 2.5 billion in 2021, USD 2.6 billion in 2022, USD 2.8 billion in 2023, and USD 2.9 billion in 2024, reflecting greater investment in professional and community-level sports infrastructure. From 2025 to 2030, the market advances from USD 3.0 billion to USD 3.9 billion, representing nearly 37% of the total projected growth. This phase is driven by expanding demand for drought-tolerant and disease-resistant seed varieties, alongside increased usage in golf courses, football fields, and multipurpose stadiums.

Innovations in seed genetics and advanced maintenance practices further strengthen adoption. Between 2031 and 2035, the market climbs from USD 4.1 billion to USD 4.9 billion, adding approximately 33% of the total growth. This period reflects sustained replacement demand, growing international sporting events, and broader adoption in landscaping for urban recreation.

| Metric | Value |

|---|---|

| Sports Turf Seed Market Estimated Value in (2025 E) | USD 3.0 billion |

| Sports Turf Seed Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The sports turf seed market represents a critical subset within the global seed and turf management industry, contributing an estimated 9–11% share of the overall turfgrass seed category. Within the specialized sports infrastructure segment, its presence is higher at nearly 15–17%, supported by strong adoption in stadiums, athletic fields, and golf courses requiring durable and high-performance grass varieties. In the broader landscaping and turf management ecosystem, sports turf seed accounts for around 6–8%, as ornamental and residential lawns dominate demand.

Within the premium seed segment, including drought-tolerant and wear-resistant grass blends, sports turf seed holds close to 12–14%, reflecting its use in professional sports facilities where performance and resilience are critical. In the global seed industry as a whole, its share is more modest at about 3–4%, as large-scale demand for food crops drives the majority of value. Growth is driven by increasing investments in sports infrastructure, rising popularity of recreational activities, and renovation of older stadiums to meet modern playing standards.

Seed producers are focusing on breeding programs that emphasize durability, disease resistance, and adaptability to varied climates. Strategic partnerships with sports authorities and turf management companies are strengthening adoption. Although the share is relatively niche compared to food and feed seeds, the sports turf seed market is consolidating its position as a specialized yet highly valuable segment due to its role in maintaining premium-quality playing surfaces across global sporting events.

The expansion of sports infrastructure globally, coupled with the increasing focus on player safety and field aesthetics, has accelerated the adoption of advanced turf seed varieties. Technological advancements in seed breeding have enabled the development of grass types with enhanced resistance to wear, drought, and disease, which is driving wider adoption across diverse climates. Growing investments by sports associations, municipalities, and private facility owners in maintaining premium quality playing surfaces have further strengthened market demand.

Environmental considerations, such as the shift toward sustainable and low-maintenance grass species, are also influencing procurement decisions. With the continuous rise in organized sports events and community sports participation, the market outlook remains optimistic, supported by ongoing research and innovation in turf seed genetics and turf management practices.

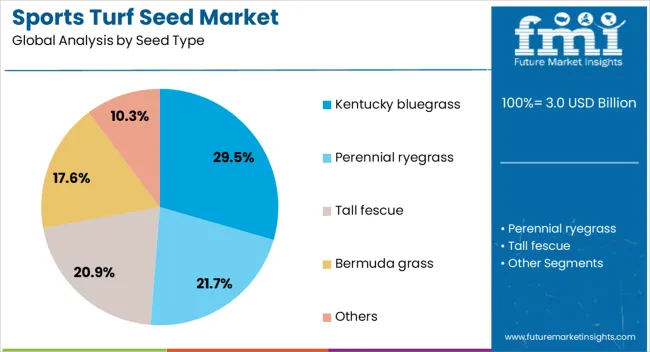

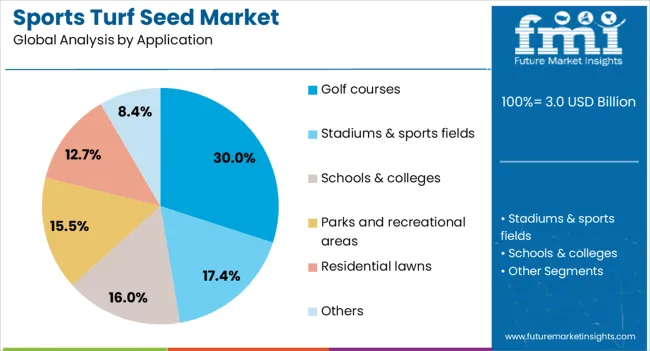

The sports turf seed market is segmented by seed type, application, and geographic regions. By seed type, sports turf seed market is divided into Kentucky bluegrass, Perennial ryegrass, Tall fescue, Bermuda grass, and Others. In terms of application, sports turf seed market is classified into Golf courses, Stadiums & sports fields, Schools & colleges, Parks and recreational areas, Residential lawns, and Others. Regionally, the sports turf seed industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Kentucky bluegrass seed type is projected to hold 29.50% of the Sports Turf Seed market revenue share in 2025, making it the leading seed type. Its growth has been driven by its dense, fine-textured turf quality, which is valued for both performance and visual appeal. The variety’s ability to recover quickly from heavy use and resist wear makes it ideal for high-traffic sports fields.

Its adaptability to various climates, coupled with strong disease resistance, has enhanced its suitability for diverse geographies. Kentucky bluegrass has also been favored for its consistent color retention throughout the growing season, which aligns with the aesthetic standards required in sports facilities.

With ongoing advancements in seed breeding, improved cultivars have been developed that enhance drought tolerance and germination rates, further increasing adoption. Facility managers prefer this seed type for its long-term performance and reduced need for frequent reseeding, which contributes to cost efficiency and operational reliability in sports turf maintenance.

The golf courses application segment is expected to account for 30% of the Sports Turf Seed market revenue share in 2025, positioning it as the leading application. This dominance has been supported by the continuous expansion of golf facilities and the emphasis on maintaining premium playing surfaces that meet international standards.

Golf course managers prioritize turf varieties that provide uniform texture, resilience under foot traffic, and consistent visual quality across fairways, greens, and tees. The segment’s growth has been reinforced by the adoption of specialized turf seed blends that can withstand frequent mowing, variable moisture conditions, and seasonal stress.

Advances in turfgrass genetics have enabled the creation of seed varieties that offer superior wear resistance and reduced maintenance requirements, aligning with cost and sustainability goals. As golf tourism and tournament hosting continue to grow globally, investments in top-quality turf have remained a strategic priority, driving sustained demand within this application segment.

The sports turf seed market is shaped by rising infrastructure demand, performance requirements, recreational adoption, and regulatory influence. Together, these dynamics ensure continued growth and wider application across professional and community sports fields

The demand for sports turf seed has been expanding due to increasing investments in stadium construction, athletic complexes, and training grounds. Governments and private clubs are upgrading facilities to meet international standards, driving consistent procurement of high-performance turf varieties. Sports such as football, cricket, rugby, and golf require durable turf that can withstand heavy usage while maintaining visual appeal. Events like World Cups and Olympics further boost consumption as they necessitate superior-quality playing fields. Turf managers prefer specialized grass blends offering wear tolerance and recovery capacity. This demand from large-scale infrastructure projects has positioned sports turf seed as a critical input for modern sports ecosystems globally.

Sports turf seed is gaining traction due to heightened performance expectations from players, spectators, and sports bodies. Playing surfaces are expected to maintain consistent ball bounce, grip, and resilience under varying weather conditions. High-quality seed varieties with disease resistance and improved germination rates are being prioritized. Professional sports venues invest in blends that ensure quick recovery after matches, minimizing downtime and maintaining playing schedules. Innovations in seed processing and blending techniques allow suppliers to offer products that cater to specific field conditions, from temperate to tropical climates. This performance-oriented approach reinforces trust in turf seed as an indispensable input for international sports events.

Demand for sports turf seed has grown significantly across recreational fields, schools, universities, and community parks. Rising participation in fitness and organized sports has led local authorities to improve playing surfaces with durable turf solutions. Grass seed blends suited for multipurpose fields are being introduced, catering to both high-intensity matches and casual recreational use. These projects require cost-efficient yet resilient turf that can manage heavy footfall. Seed companies have been targeting this segment with region-specific blends that balance performance and affordability. The growth of grassroots sports development programs has also reinforced adoption, making recreational and community fields a major contributor to overall turf seed demand.

Regulatory standards and turf management practices play a vital role in shaping sports turf seed usage. Guidelines on field safety, soil compatibility, and environmental resilience drive the selection of certified seed varieties. Sports governing bodies often mandate specific turf quality levels for sanctioned matches, ensuring consistent adoption of premium seed types. Turf maintenance regimes involving irrigation, mowing, and fertilization strategies also influence the type of seed purchased, as some blends adapt better to lower maintenance requirements. Partnerships between turf managers and seed producers enable tailored recommendations, improving both compliance and performance. This regulatory-driven adoption highlights the strategic role of seed selection in professional sports infrastructure.

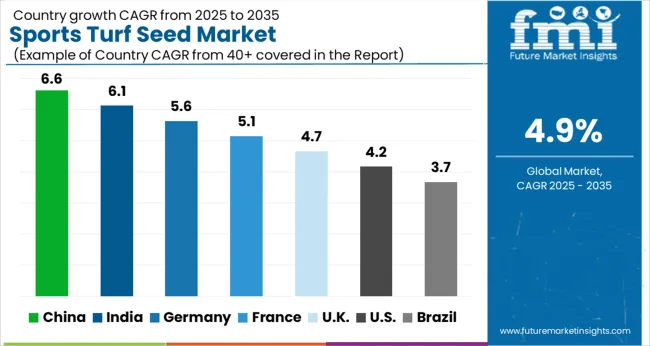

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

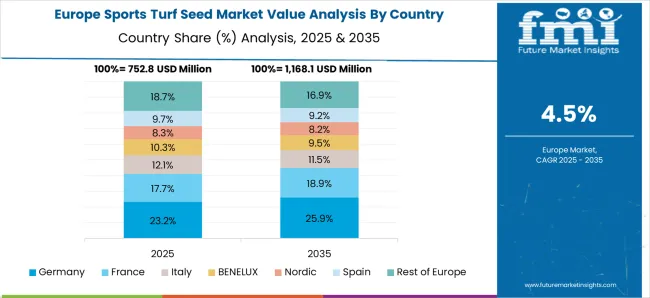

The sports turf seed market is projected to grow globally at a CAGR of 4.9% from 2025 to 2035, supported by rising investments in sports infrastructure, renovation of stadiums, and expansion of community sports facilities. China leads with a CAGR of 6.6%, driven by large-scale construction of athletic fields and significant demand from football and golf projects. India follows at 6.1%, supported by cricket ground development, urban recreational facilities, and increasing participation in organized sports. France grows at 5.1%, influenced by preparations for international sporting events and emphasis on community fields. The United Kingdom achieves 4.7%, with adoption driven by football and rugby demand, while the United States maintains 4.2%, supported by turf requirements in school, college, and professional sports complexes. This performance highlights Asia’s leading role in growth momentum, while Europe demonstrates steady adoption through established sports traditions, and North America sustains moderate but consistent demand.

China is projected to expand at a CAGR of 6.6% during 2025–2035, which remains higher than the global average of 4.9%. During 2020–2024, the CAGR was closer to 5.2%, reflecting moderate adoption led by regional football development programs and early-stage golf course construction. The significant increase in the next phase is supported by government-backed sports infrastructure projects, rising recreational participation, and preparations for global sporting events. Large-scale investments in stadiums, school sports fields, and athletic complexes are driving demand for durable turf seed varieties. Blends that offer high wear tolerance and climate adaptability are gaining traction in major Chinese cities.

India’s CAGR for the sports turf seed market is estimated at 6.1% during 2025–2035, compared to 4.8% in 2020–2024, showing clear upward momentum. In the earlier phase, growth was limited due to cost sensitivity and uneven infrastructure spending across regions. However, the following decade brings stronger prospects as cricket stadiums, school grounds, and recreational spaces integrate advanced turf solutions. Increasing popularity of football leagues and hockey also creates demand for specialized seed varieties. Supportive government policies and private investments in multipurpose grounds enhance adoption rates, making India one of the fastest-growing sports turf seed markets globally.

France is forecasted to grow at a CAGR of 5.1% during 2025–2035, an improvement from 4.3% recorded between 2020–2024. Earlier expansion was moderate, driven mainly by football grounds and localized demand from recreational parks. The later phase shows higher momentum as international sporting events and community-level field renovation programs boost consumption. Turf seed blends with enhanced resilience are being adopted by municipalities and clubs. Premium demand is supported by France’s luxury sporting culture, especially in golf and rugby, where performance-based surfaces are essential. This gradual rise highlights the country’s increasing emphasis on modernizing both professional and community sports facilities.

The CAGR for the sports turf seed market in the United Kingdom is projected at 4.7% between 2025–2035, compared to 3.9% in 2020–2024, highlighting a steady improvement. Early growth was modest due to slower investments in grassroots sports and limited focus on turf renovation outside professional leagues. The following decade brings stronger momentum, supported by football and rugby infrastructure upgrades, as well as community-level field investments. Partnerships between local councils and sports associations are creating new opportunities for turf adoption. With rising demand for climate-adapted and wear-resistant blends, the UK market is positioning itself for long-term resilience despite cost pressures.

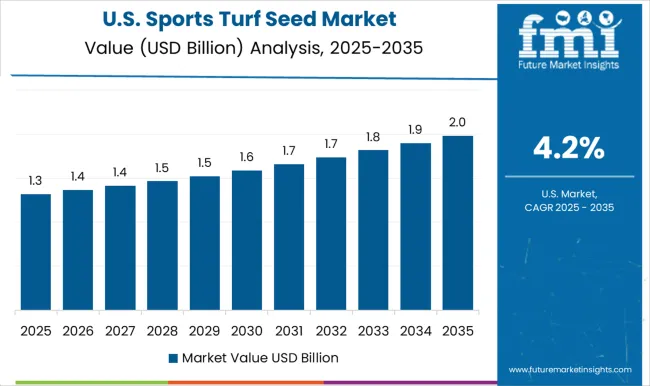

The sports turf seed market in the United States is forecasted to grow at a CAGR of 4.2% during 2025–2035, rising from 3.6% recorded in 2020–2024. Early progress was restricted by reliance on synthetic turf alternatives and slower investment in public school fields. The outlook for the next decade strengthens as universities, schools, and professional sports franchises show renewed preference for natural grass surfaces due to improved durability and aesthetics. Adoption of resilient turf seed varieties for multipurpose stadiums and training complexes provides further growth support. Though synthetic turf remains strong, demand for natural seed-based surfaces is gaining renewed attention.

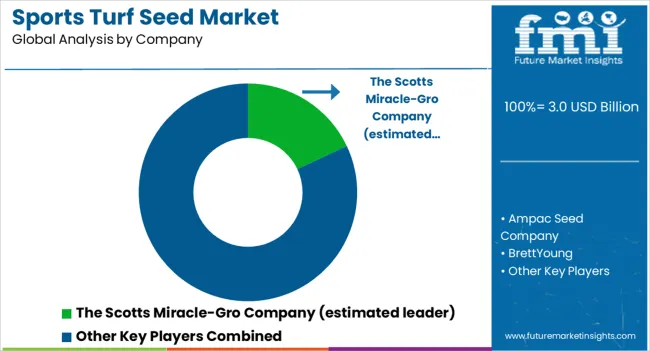

The sports turf seed market is highly competitive, with global seed producers and regional suppliers catering to both professional sports facilities and community-level demand. The Scotts Miracle-Gro Company is estimated to be the market leader, leveraging its strong retail presence, research-driven turf blends, and partnerships with sports organizations to maintain dominance. Ampac Seed Company specializes in turfgrass varieties tailored for resilience and adaptability, with a focus on multipurpose sports applications. BrettYoung plays a significant role in North America, offering performance-based seed varieties suited for golf courses, football grounds, and community sports complexes.

Columbia Seeds provides high-quality grass seed with strong distribution networks in the United States and a growing international presence. DLF-Pickseed / DLF Seeds stands as one of the largest global suppliers, backed by advanced breeding programs and an extensive distribution footprint. Barenbrug Group reinforces its position through innovation in grass genetics and a long-standing reputation in sports turf solutions worldwide. Pennington Seed, Hancock Seed, and Grassland Oregon collectively strengthen competitive intensity by addressing diverse market segments with tailored turf solutions for professional arenas and recreational fields. Competitive differentiation in this sector is shaped by advanced breeding for wear tolerance, adaptability to climate, and disease resistance. Strategic initiatives include collaborations with sports associations, localized breeding programs, and expanding retail and wholesale networks to secure stronger presence in emerging sports infrastructure markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Seed Type | Kentucky bluegrass, Perennial ryegrass, Tall fescue, Bermuda grass, and Others |

| Application | Golf courses, Stadiums & sports fields, Schools & colleges, Parks and recreational areas, Residential lawns, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Scotts Miracle-Gro Company (estimated leader), Ampac Seed Company, BrettYoung, Columbia Seeds, DLF-Pickseed / DLF Seeds, Barenbrug Group, and Pennington Seed / Hancock Seed / Grassland Oregon |

| Additional Attributes | Dollar sales, share by turf type and application, regional growth patterns, competitive landscape, breeding innovations, end-user preferences, regulatory impacts, and distribution strategies. |

The global sports turf seed market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the sports turf seed market is projected to reach USD 4.9 billion by 2035.

The sports turf seed market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in sports turf seed market are kentucky bluegrass, perennial ryegrass, tall fescue, bermuda grass and others.

In terms of application, golf courses segment to command 30.0% share in the sports turf seed market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Sports Wearables Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sports Food Market Size and Share Forecast Outlook 2025 to 2035

Sports Bicycles Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

Sports Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Sports Inspired Clothing Market Analysis – Trends, Growth & Forecast 2025-2035

Sports and Athletic Insoles Market Analysis - Size, Share, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for Sports and Athletic Insoles Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA