The chemical recycling service market is experiencing strong expansion. Growth is being driven by the rising emphasis on circular economy models, escalating plastic waste concerns, and the increasing demand for sustainable waste management solutions. Current market dynamics reflect the growing preference for advanced recycling technologies that can convert mixed or contaminated plastics into reusable raw materials.

Regulatory frameworks supporting waste reduction and corporate sustainability commitments are reinforcing industry adoption. Technological advancements in depolymerization, pyrolysis, and gasification are enhancing process efficiency and yield quality, creating scalable opportunities for large waste processors and petrochemical companies. The future outlook indicates steady growth as investments in chemical recycling facilities rise and partnerships between waste management firms and polymer manufacturers expand.

Market growth rationale is anchored in the ability of chemical recycling to complement mechanical recycling, reduce landfill dependency, and align with global carbon-neutral goals These factors collectively support long-term market stability and consistent capacity expansion across regions.

| Metric | Value |

|---|---|

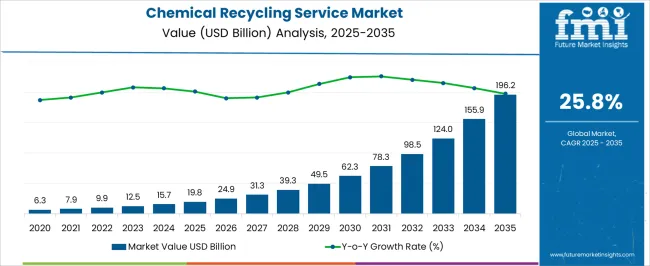

| Chemical Recycling Service Market Estimated Value in (2025 E) | USD 19.8 billion |

| Chemical Recycling Service Market Forecast Value in (2035 F) | USD 196.2 billion |

| Forecast CAGR (2025 to 2035) | 25.8% |

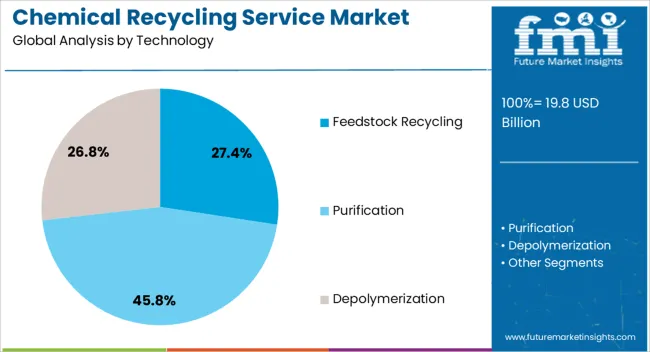

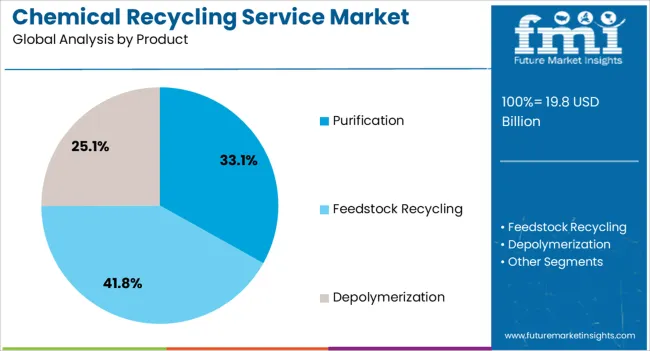

The market is segmented by Technology and Product and region. By Technology, the market is divided into Feedstock Recycling, Purification, and Depolymerization. In terms of Product, the market is classified into Purification, Feedstock Recycling, and Depolymerization. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The feedstock recycling segment, holding 27.40% of the technology category, has emerged as the leading process due to its ability to handle complex and heterogeneous plastic waste streams. Its technological flexibility enables conversion of polymers into high-value hydrocarbons, which are then reintroduced into the petrochemical production chain. This closed-loop approach supports material recovery at a molecular level, ensuring minimal quality degradation.

Demand has been strengthened by industry initiatives to achieve recycling targets and reduce carbon footprints. Infrastructure development and pilot-scale projects are further validating the commercial feasibility of feedstock recycling.

Process improvements focused on energy efficiency and reduced emissions are enhancing cost competitiveness Strategic investments by petrochemical firms and collaboration with waste management companies are expected to sustain growth momentum and ensure continued leadership of this technology in the chemical recycling service market.

The purification segment, accounting for 33.10% of the product category, has maintained dominance due to its effectiveness in improving the quality of recycled polymers and chemical intermediates. It plays a critical role in removing impurities and contaminants, thereby ensuring that recycled outputs meet the required specifications for reuse in high-performance applications. Advancements in solvent extraction and filtration technologies have improved operational reliability and product consistency.

Adoption has been reinforced by the increasing demand from packaging and automotive sectors that prioritize high-purity materials. Regulatory standards encouraging the use of recycled content in manufacturing have further supported market acceptance.

Continuous innovation in purification systems, combined with digital process control and automation, is expected to enhance throughput and yield These developments are positioning the purification segment as a key driver of product quality and value optimization within the chemical recycling service market.

Market to Expand Around 9.4X Through 2035

Europe to Remain at the Forefront of the Market

Depolymerization Technique Gains Traction with Demand for Premium Plastics

The global chemical recycling service market grew at a CAGR of 6.8% between 2020 and 2025. Total market revenue reached about USD 19.8 billion in 2025. In the forecast period, the worldwide chemical recycling service industry is set to thrive at a CAGR of 25.8%.

| Historical CAGR (2020 to 2025) | 6.8% |

|---|---|

| Forecast CAGR (2025 to 2035) | 25.8% |

Rising awareness of environmental issues and shifting preferences of consumers have become significant drivers for the adoption of chemical recycling services. As the world witnesses a growing population, climate change, and resource depletion, individuals are demanding a transition toward more sustainable practices.

Traditional plastic has limitations, such as contamination issues and the inability to recycle certain types of plastics effectively. Chemical recycling offers a hopeful alternative by breaking down plastics into their molecular components and creating new materials without sacrificing in quality.

This process not only redirects plastics from landfills and incineration but also decreases the need for virgin fossil fuels, thereby reducing the environmental impact of plastic production.

Consumer preferences have changed significantly, pushing the chemical reclamation service market. Modern consumers are becoming increasingly aware of the environmental impact of the products they buy. As a result, they are continually searching for more sustainable alternatives.

They prefer products and packaging that are recyclable, renewable, or biodegradable. As a result, companies face growing challenges in integrating sustainable practices throughout their supply chains, including the use of modern recycling technologies such as chemical recycling services.

Environmental awareness and shifting consumer preferences are significant factors driving the widespread use of chemical recycling services. Chemical recycling services have enormous potential to contribute to more sustainable plastic waste management and a circular economy. They are also expected to align with the preferences of environmentally conscious consumers.

Governments around the world are taking initiatives to make the switch to a circular economy. This united front is a leading driver of chemical recycling service adoption.

A circular economy model can help choose the efficiency of resources, lower waste generation, and encourage material reuse, recycling, and regeneration. Chemical recycling services are closely aligned with circular economy principles as these allow valuable resources to be recovered from waste materials that would otherwise be discarded.

One of the primary goals of government-led circular economy initiatives is to minimize the environmental impact of linear production and consumption patterns. Chemical recycling tackles the increasing problem of plastic pollution by offering a way for the reuse and recovery of plastic waste.

It also helps in lowering the need for virgin resources that come from oil and gas. This not only helps to slow the depletion of natural resources but also aims to reduce greenhouse gas emissions and relieve pressure on landfill capacity.

Governments are enacting regulatory frameworks and incentive programs to encourage the adoption of environmentally friendly procedures across industries. These policies frequently include recycling targets, extended producer responsibility programs, and financial incentives for companies that invest in innovative recycling technologies such as chemical recycling.

Governments can encourage industry players to give preference to sustainability and acquire technologies that help them shift to a circular economy by creating a supportive policy environment. Government-led efforts to transition to a circular economy are set to provide a compelling reason to adopt chemical recycling services.

By tackling environmental concerns, maneuvering regulatory changes, and allowing economic opportunities, these programs promote broad acceptance of groundbreaking recycling technologies and pave the way for a more sustainable future. Owing to the aforementioned factors, the global chemical recycling & disposal service market is anticipated to showcase steady growth.

Regardless of increasing awareness of the significance of sustainable waste management practices, several sectors still lack the infrastructure required to support the widespread adoption of modern recycling technologies such as chemical recycling. One of the primary challenges is the shortage of specialized facilities equipped to handle chemical recycling processes.

Chemical recycling services further necessitate advanced machinery and expertise to effectively degrade complex materials into constituent components for reuse or conversion into new products. However, investments required for the construction and maintenance of such facilities can be significant, discouraging potential investors and impeding the growth of chemical recycling capacity.

The absence of infrastructure for gathering and organizing recyclable materials complicates chemical recycling efforts. Effective waste collection systems are critical for providing a consistent supply of feedstock to recycling facilities.

In several areas, the present waste management infrastructure is not enough or unproductive, resulting in issues such as damage to recyclable materials and a scarcity of high-quality feedstock for chemical recycling processes. The economic viability of chemical recycling projects is heavily influenced by government incentives, regulatory frameworks, and demand for recycled materials.

Without adequate support from policymakers and stakeholders, the financial risks of investing in chemical recycling ventures may outweigh the potential benefits. It is anticipated to discourage private sector participation and slow chemical reclamation service market growth.

The table below shows the estimated growth rates of the top five countries. India, China, Germany, the United Kingdom, and Japan are set to record high CAGRs of 28.0%, 27.5%, 25%, 24%, and 23% respectively, through 2035.

| Countries | Projected Chemical Recycling Service Market CAGR (2025 to 2035) |

|---|---|

| India | 28.0% |

| China | 27.5% |

| Germany | 25% |

| United Kingdom | 24% |

| Japan | 23% |

India’s advanced recycling technology market is anticipated to witness a CAGR of 28.0% through 2035. This growth is attributed to the following factors:

China’s chemical recycling service market is expected to showcase a CAGR of 27.5% from 2025 to 2035. The country’s success rate is expected to depend on:

Germany’s chemical recycling service market is projected to exhibit a CAGR of around 25% in the assessment period. Growth is attributed to the following factors:

The section below shows the pyrolysis segment dominating based on technology. It is forecast to thrive at 17.2% CAGR between 2025 and 2035.

Based on products, the synthetic crude oil segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 16.9% during the forecast period.

| Top Segment (Technology) | Pyrolysis |

|---|---|

| Predicted CAGR (2025 to 2035) | 17.2% |

| Top Segment (Product) | Synthetic Crude Oil |

|---|---|

| Projected CAGR (2025 to 2035) | 16.9% |

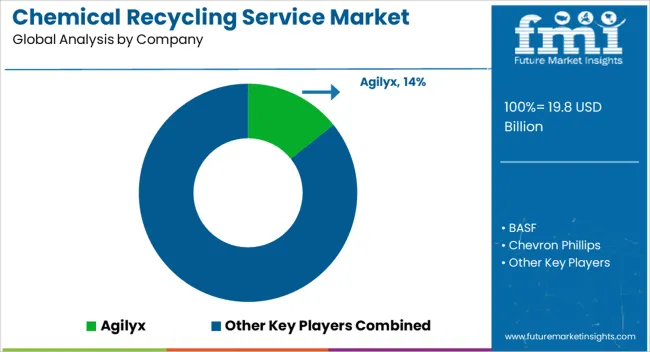

The global chemical recycling service market is fragmented, with leading players accounting for about 25% to 30% of the share. Agilyx, BASF, Chevron Phillips, ExxonMobil, Honeywell, Lyondellbasell, Dupont Teijin Films, Mitsubishi Chemical, Nova Chemicals, Shell, SK Global Chemical, Sumitomo Chemical, Arcus, BiologiQ, Braskem, Covestro, Eastman, Evonik, Forell Pomini, GreenMantra, Interseroh, Licella, Phigenesis, Quantafuel, and Renew ELP (UK) are the leading companies that provide chemical recycling services.

In order to meet end-user demand, key chemical recycling firms are growing their production capacity and making ongoing investments in research to produce new products. In order to increase their presence, they are also displaying a propensity to implement initiatives like collaborations, acquisitions, mergers, and facility expansions.

Recent Developments in the Chemical Recycling Service Market

| Attribute | Details |

|---|---|

| Estimated Chemical Recycling Service Market Size (2025) | USD 15.71 billion |

| Projected Chemical Recycling Service Market Size (2035) | USD 149.24 billion |

| Anticipated Growth Rate of the Chemical Recycling Service (2025 to 2035) | 25.8% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Chemical Recycling Service Market Segments Covered | Technology, Product, Region |

| Regions Covered in Chemical Recycling Service Market | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, BENELUX, NORDICS, Poland, Hungary, Balkan and Baltics, Russia, India, Association of Southeast Asian Nations, Australia and New Zealand, China, Japan, South Korea, Kingdom of Saudi Arabia, Other GCC Countries, Türkiye, Other African Union, South Africa, |

| Key Companies Profiled in Chemical Recycling Service Market | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East & Africa |

The global chemical recycling service market is estimated to be valued at USD 19.8 billion in 2025.

The market size for the chemical recycling service market is projected to reach USD 196.2 billion by 2035.

The chemical recycling service market is expected to grow at a 25.8% CAGR between 2025 and 2035.

The key product types in chemical recycling service market are feedstock recycling, _pyrolysis, _gasification, _hydrothermal treatment, purification, _polyvinyl chloride (pvc), _polystyrene (ps), _polythene (pe), _polypropylene (pp), depolymerization, _polyesters (pet), _polyamides (pa) and _polyurethanes (pu).

In terms of product, purification segment to command 33.1% share in the chemical recycling service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA