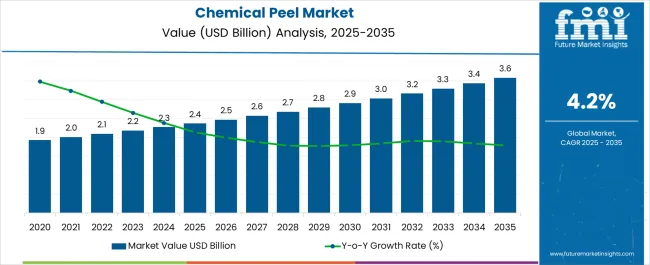

The Chemical Peel Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Chemical Peel Market Estimated Value in (2025 E) | USD 2.4 billion |

| Chemical Peel Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The chemical peel market is demonstrating strong growth momentum. Rising awareness of aesthetic procedures, increasing demand for minimally invasive treatments, and technological advancements in dermatology are supporting market expansion. Current dynamics are being influenced by higher patient acceptance, regulatory approval of advanced formulations, and growing accessibility of dermatology clinics and medical spas.

The future outlook is driven by urbanization, lifestyle shifts, and consumer inclination toward skin rejuvenation and corrective treatments. Additionally, increased disposable income and the influence of social media are boosting patient demand for procedures that provide visible results with shorter recovery times.

Growth rationale is anchored in the proven effectiveness of chemical peels in treating a wide spectrum of dermatological conditions, coupled with the ability of providers to introduce innovative formulations that minimize downtime and enhance safety Market expansion is expected to continue as adoption spreads across both mature and emerging economies, creating consistent revenue opportunities for manufacturers and service providers.

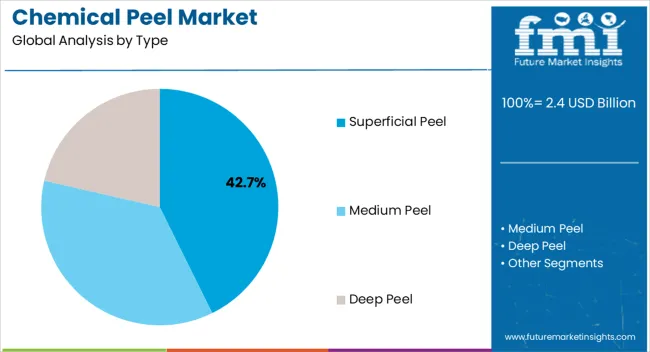

The superficial peel segment, holding 42.70% of the type category, has remained dominant due to its high patient acceptance and lower risk profile. Its effectiveness in treating mild skin conditions, combined with shorter recovery times, has strengthened its adoption across both clinical and aesthetic settings.

Widespread availability of products, coupled with cost-effectiveness compared to deeper procedures, has enhanced its accessibility. Demand stability has been reinforced by repeat usage, as superficial peels are often recommended as part of ongoing skincare regimens.

Dermatology professionals have increasingly preferred this type for first-line interventions, given its versatility in addressing pigmentation, texture irregularities, and early signs of aging Market growth is expected to remain strong, supported by increasing patient preference for treatments that balance efficacy, safety, and affordability.

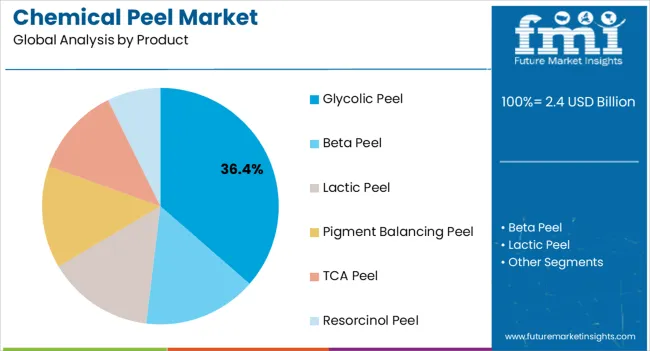

The glycolic peel segment, accounting for 36.40% of the product category, has emerged as the leading product owing to its proven efficacy and broad application across multiple skin types. Its ability to penetrate effectively while maintaining safety has reinforced clinical and aesthetic adoption.

Demand growth has been supported by the segment’s role in addressing hyperpigmentation, fine lines, and acne-related conditions. Consistent availability, regulatory approval, and extensive research backing have strengthened its positioning within the market.

The segment’s market share is further driven by strong consumer awareness and the wide range of branded formulations offered by manufacturers Ongoing product innovation, including enhanced concentration options and improved delivery systems, is expected to maintain its leadership position and expand its adoption globally.

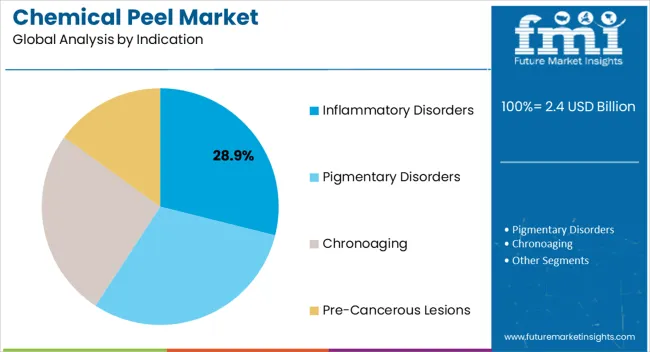

The inflammatory disorders segment, representing 28.90% of the indication category, has established its prominence due to the rising incidence of acne and related dermatological conditions. Chemical peels have been increasingly recognized as an effective adjunct therapy in the management of inflammatory skin issues, supporting their clinical relevance.

Demand has been reinforced by the ability of these procedures to reduce inflammation, improve skin texture, and enhance overall treatment outcomes. Strong endorsement by dermatologists and expanding access to outpatient dermatology services have further driven utilization.

Continued growth is expected as patient demand for non-systemic, locally effective treatments increases, particularly among younger demographics This segment is anticipated to play a significant role in sustaining the broader adoption of chemical peels within both therapeutic and aesthetic dermatology practices.

Chemical peels have been used for several years to rejuvenate skin. Their primary uses were for the treatment of sun-damaged skin and acne scars. Strong acids were frequently used in early chemical peels, which had adverse consequences and needed longer recovery times.

A trend toward creating formulas that are softer and more focused has emerged throughout time. As a result, the negative effects and recovery period linked to chemical peels have decreased. Treatments can now be made more individualized and flexible thanks to the development of new substances such as beta hydroxy acids (BHAs) and alpha hydroxy acids (AHAs).

The popularity of cosmetic operations, including chemical peels, surged in the early 21st century. The escalating demand was fueled by heightened media exposure, celebrity endorsements, and shifting public perceptions of cosmetic improvement.

There was a shift toward non-invasive cosmetic operations as technology developed. Patients started to favor therapies that involved less discomfort and little recovery time. In this context, chemical peels have become popular because they are less intrusive than surgical treatments.

Customizing chemical peel treatments to address specific skin types, issues, and goals has been popular in recent years. Professionals in skincare began customizing regimens to target certain problems, including acne, fine wrinkles, and hyperpigmentation.

Globally, there has been an increasing demand for cosmetic operations such as chemical peels. A growing number of emerging economies are showing interest in skincare and cosmetic procedures. This growth was fueled in part by the influence of social media and the globalization of beauty standards. Owing to the above-mentioned factors, the global market is expected to rise at a CAGR of 4.4% during the forecast period from 2025 to 2035.

| Attributes | Key Factors |

|---|---|

| Chemical Peel Market Trends |

|

| Growth Hindrances |

|

| Upcoming Opportunities |

|

In the table below, the CAGRs of the leading countries are given for the review period 2025 to 2035. The United States is expected to remain dominant by exhibiting a CAGR of 4.8%. The United Kingdom and Germany are anticipated to follow with CAGRs of 4.5% and 4.6%, respectively.

| Countries | Value-based CAGR (2035) |

|---|---|

| United States | 4.8% |

| China | 4.2% |

| United Kingdom | 4.5% |

| Japan | 4.0% |

| Germany | 4.6% |

| India | 3.4% |

India is expected to develop at a promising CAGR of 3.4% throughout the projection period. It is anticipated to hold a chemical peel market share of 22.5% in South Asia by 2025. The market for chemical peels is expanding rapidly in India due to factors such as high disposable income, rising beauty consciousness, availability of new procedures and surgeons, a growing number of private clinics, and the surging geriatric population.

Competition can result in product improvements, price tactics, and brand-differentiating marketing initiatives. India’s chemical peel industry is competitive, with several competitors offering a range of peel formulas addressing different skin issues. Consumer education on the advantages and safety of chemical peels is facilitated by skincare experts, beauty influencers, and marketing initiatives.

Workshops, events, and internet material all can help the target audience become more informed. The demand for cosmetic operations, such as chemical peels, can be influenced by several factors, such as economic conditions, consumer purchasing habits, and trends in disposable income.

With a share of 88.2% in North America’s chemical peel market generated in 2025, the United States currently dominates the region. It is anticipated to maintain its growth rate throughout the forecast period.

The United States has historically been a sizable market for aesthetic operations, such as chemical peels. The market has expanded as a result of rising skincare awareness, the desire for aesthetic improvements, and technical developments in cosmetic operations.

Organizations such as the Food and Drug Administration (FDA) are responsible for providing regulatory control over cosmetic treatments, including chemical peels. Several dermatological practices, medical spas, and aesthetic clinics that provide a variety of cosmetic treatments, including chemical peels, can be found across the United States. Customers at these places frequently consult experts in skincare.

The United Kingdom’s chemical peel market is estimated to expand at a CAGR of 4.5% in the evaluation period from 2025 to 2035. Innovations in cosmetic operations are often adopted and driven by the United Kingdom’s market. This covers developments in chemical peel compositions and methods of application.

Increasing consumer knowledge of chemical peels' advantages for revitalizing skin and treating particular skin issues would drive demand. The growing popularity of non-invasive cosmetic procedures, with chemical peel becoming a favorite among face treatment seekers, would also aid sales.

Market participants must adhere to regulatory criteria in order to guarantee the efficacy and safety of their products. With the proliferation of at-home chemical peel solutions, people can now include skincare treatments in their daily routines. Product instructions and educational initiatives would help address safety and correct usage concerns.

China's chemical peel market is poised to exhibit a CAGR of 4.2% during the assessment period. The demand for skincare products and cosmetic procedures such as chemical peels has increased significantly in China. An expanding middle class, rising disposable income, and greater emphasis on skincare & aesthetics are the drivers propelling the market.

Customers in China are prepared to spend money on non-invasive cosmetic procedures for face rejuvenation and are showing an increasing interest in skincare. The use of skincare treatments is expanding as people become more conscious of Western beauty standards.

The industry has expanded as a result of the opening of new medical spas, beauty salons, and aesthetic clinics that provide a variety of cosmetic procedures, including chemical peels. Customers frequently go to these facilities for expert advice and care. Technology breakthroughs in skin care and cosmetic procedures, including improved chemical peel formulas and application methods, have been embraced by China.

Chemical peel demand in Japan is anticipated to rise at a steady CAGR of 4.0% during the forecast period from 2025 to 2035. In Japan, cosmetic operations, including chemical peels, are governed by stringent regulations. To guarantee the efficacy and safety of their products, businesses must abide by all applicable laws.

Consumer tastes in Japan are influenced by cultural elements and beauty standards. It is critical to modify goods and advertising tactics to conform to regional standards of attractiveness.

In Japan, there is a sizable market for at-home skincare goods. Customers often include chemical peels and other skincare treatments in their regimens. Products for skin care are mainly distributed through e-commerce sites in the country.

The demand for cosmetic surgeries in Japan is influenced by several economic variables, such as shifts in consumer spending habits and disposable income. Global beauty trends have an impact on modern consumers, and the country's desire for cosmetic operations frequently indicates conformity to these norms.

The table below signifies leading sub-categories under type, product, and indication categories in the chemical peel market. A superficial peel is expected to dominate the chemical peel market by exhibiting a 4.7% CAGR in the evaluation period. Under the product category, the glycolic peel segment is projected to lead the global chemical peel market at a 4.6% CAGR.

| Category | Forecast CAGR (2025 to 2035) |

|---|---|

| Superficial Peel (Type) | 4.7% |

| Inflammatory Disorders (Indication) | 4.4% |

| Glycolic Peel (Product) | 4.6% |

Superficial peels are expected to witness high growth at a CAGR of 4.7% in the forecast period. It generated a chemical peel market share of about 45.0% in 2025.

For modest skin issues, including uneven skin tone, fine wrinkles, sun damage, and small acne scars, superficial peels are appropriate. They are frequently selected for overall skin renewal and texture enhancement.

Compared to deeper peels, superficial peels can be carried out regularly. People could have superficial peels as part of a regular skincare regimen or every few weeks.

The short recovery period following superficial peels is one of their main benefits. Soon after receiving therapy, most patients are able to return to their regular activities.

The negative effects of superficial peels are typically transient and less severe than those of deeper peels. Skincare specialists can do superficial peels in med spas, cosmetic clinics, or dermatology offices.

For those who would want to include superficial peels in their skincare regimen, there are other products that can be used at home that are made with softer acids. However, it is crucial to pay close attention to the product's directions.

Glycolic peels, in terms of product, held a market share of 40.0% in 2025. The segment is expected to display a gradual growth rate over the forecast period, with a CAGR of 4.6%.

Blackheads, whiteheads, and acne can be effectively removed from the skin with glycolic acid peels. Cystic lesions and acne scars on the skin can be effectively removed by using glycolic acid peels repeatedly and consistently. Owing to the aforementioned benefits, glycolic peels are anticipated to be highly demanded by millennials.

Inflammatory disorders are expected to showcase average growth at a CAGR of 4.4% by the end of the forecast period. It generated a market share of about 45.0% in the global market in 2025.

Inflammatory disorders often result in excessive inflammation, which can cause damage to healthy body tissues as well as chronic discomfort, redness, swelling, and stiffness. Chemical peels can make inflammatory skin conditions worse by exacerbating symptoms such as redness, irritation, and pain. For those suffering from illnesses such as rosacea, the heat produced during the peeling process can exacerbate symptoms and cause flare-ups.

After a chemical peel, those who have previously experienced inflammatory skin conditions can be more susceptible to post-inflammatory hyperpigmentation (PIH). For those who are prone to hyperpigmentation, post-inflammatory hyperpigmentation (PIH)-the darkening of the skin in reaction to inflammation-can be of concern.

Skincare specialists would need to use lower doses of peeling chemicals when customizing chemical peel treatments for those with inflammatory skin problems. Those with sensitive or inflammatory skin types will be able to handle lower-intensity peels more easily.

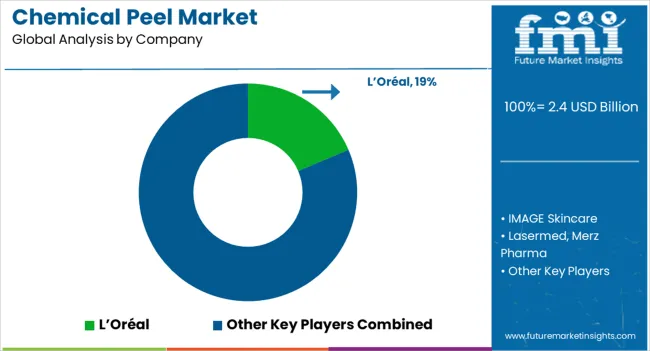

With a variety of international and local manufacturers, the market is fragmented. Key companies use mergers, acquisitions, and the expansion of their product ranges as marketing methods to gain market share. Manufacturers are focused on improving their revenue generation prospects by investing in building a strong pipeline and subsequent approvals & launches in several regions, which is expected to drive the market.

For instance,

The global chemical peel market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the chemical peel market is projected to reach USD 3.6 billion by 2035.

The chemical peel market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in chemical peel market are superficial peel, medium peel and deep peel.

In terms of product, glycolic peel segment to command 36.4% share in the chemical peel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AHA/BHA Chemical Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Peelable Lid Stock Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA