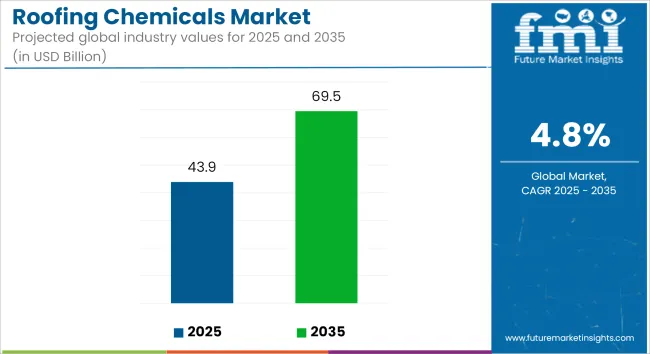

The global roofing chemicals market is projected to grow from USD 43.9 billion in 2025 to USD 69.5 billion by 2035, expanding at a CAGR of 4.8% over the forecast period. Market growth is being supported by increased demand for durable, weather-resistant, and energy-efficient roofing solutions across residential, commercial, and industrial construction segments.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 43.9 billion |

| Industry Value (2035F) | USD 69.5 billion |

| CAGR (2025 to 2035) | 4.8% |

Roofing chemicals are being formulated to enhance performance characteristics such as UV resistance, thermal insulation, waterproofing, and structural integrity. These formulations include acrylics, epoxy resins, styrene-based compounds, modified asphalts, and polymeric additives that improve adhesion, flexibility, and longevity of roofing systems. Their incorporation is being prioritized in both new roof installations and retrofit applications, contributing to the long-term durability of structures.

Rising infrastructure development, particularly in emerging economies, is contributing to the widespread adoption of roofing chemicals aimed at improving sustainability, thermal comfort, and maintenance efficiency. Increased urban construction activity is leading to higher usage of reflective and high-performance coatings in regions susceptible to extreme heat or precipitation.

Acrylic and elastomeric roofing chemicals are being selected for their crack-bridging capabilities, high solar reflectivity, and environmental flexibility. These properties are being utilized in membrane and elastomeric roofing systems to mitigate the effects of UV exposure and thermal cycling, particularly in densely populated urban heat zones.

Epoxy-based coatings and modified asphalt compounds are being deployed in metal and bituminous roofing systems, especially in industrial settings subject to mechanical stress and temperature variation. Their contribution to corrosion control and waterproofing is enhancing lifecycle value and supporting broader sustainability targets.

Growth in lightweight roofing panels made of plastics and composite materials is prompting the development of adhesion promoters, UV stabilizers, and chemical primers tailored for synthetic substrates. These innovations are improving compatibility with polymer surfaces and enabling broader adoption of composite roofing systems.

The roofing chemicals market is expected to maintain momentum through 2035, supported by construction modernization, regulatory emphasis on energy efficiency, and the rising preference for low-maintenance, long-lasting roofing materials across global infrastructure sectors.

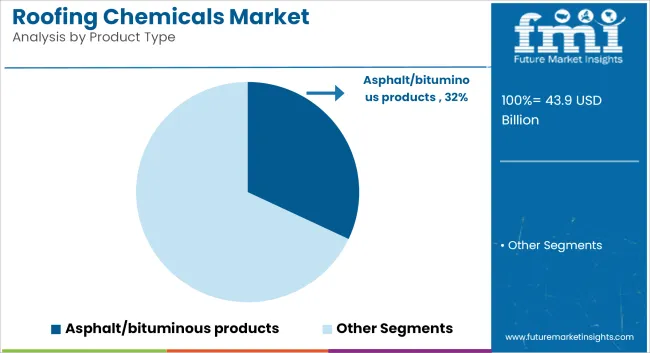

Asphalt/bituminous roofing chemicals are estimated to account for approximately 32% of the global roofing chemicals market share in 2025 and are projected to grow at a CAGR of 4.9% through 2035. These materials are extensively used for their strong adhesion, water resistance, and low cost across residential, commercial, and industrial roofing applications.

Modified bitumen solutions such as SBS (styrene-butadiene-styrene) and APP (atactic polypropylene) compounds offer enhanced flexibility and thermal stability, especially in climates with fluctuating temperatures. Suppliers are advancing formulations to improve UV resistance and elongation properties, while also integrating recycled content to support sustainability mandates.

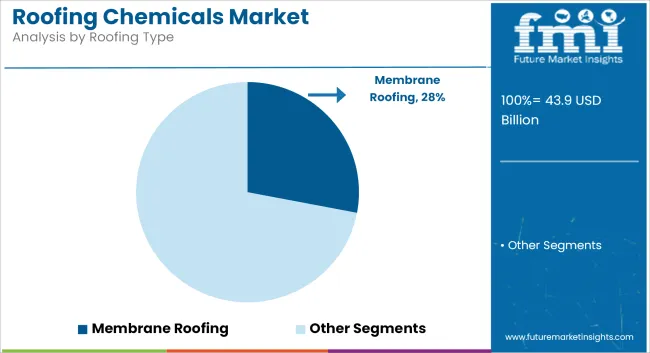

Membrane roofing is projected to account for approximately 28% of the global roofing chemicals market share in 2025 and is expected to grow at a CAGR of 5.0% through 2035. This segment includes materials such as thermoplastic polyolefin (TPO), ethylene propylene diene monomer (EPDM), and polyvinyl chloride (PVC), which are commonly used in single-ply roofing systems for commercial and industrial buildings.

Roofing chemicals including adhesives, sealants, and surface coatings are integrated to enhance reflectivity, waterproofing, and chemical resistance. The segment benefits from growing adoption in low-slope roofing projects, particularly in North America and Western Europe, where demand is rising for energy-saving and cool-roof technologies. As building owners seek longer-lasting, maintenance-friendly roofing systems, membrane-based installations are expected to drive sustained growth in demand for advanced chemical formulations.

Performance Degradation in Harsh Environmental Conditions

Roofing chemicals are subjected to extreme UV radiation, extreme heat, cyclic rain and freeze-thaw conditions, which can cause premature cracking, delamination or chemical breakdown. Industry assessments in 2023 single out an increased failure rate of low-grade elastomeric coatings in high-humidity areas, causing water infiltration and roof degeneration.

Asphalt based chemicals can be susceptible to UV degradation and becoming short brittle when topcoats are not applied. The need to ensure chemical compatibility of the installation with existing roofing substrates, as well as maintenance of long-term adhesion with metal ,plastic and membrane systems, continues to pose a challenge critical in nature. To help minimize lifecycle spend and service downtime, formulators must create products that deliver improved weatherability, elasticity retention, and multi-surface adhesion.

Regulatory Pressure on VOC Emissions and Hazardous Components

Stricter environmental regulations being introduced across the globe, the roofing chemicals market is under pressure to switch its use of high-VOC solvents, phthalates, and halogenated additives. Reformulated asphalt emulsions, solvent-based primers, and some polymers may be affected by stricter limits in VOC content in coatings from regional bodies in the USA and EU in 2023.

For formulators especially those who are R&D and compliance infrastructure-light manufacturers LEED, BREEAM and GHS labeling requirements represent cost and complexity. Moving to a waterborne or bio-based alternative without losing performance, shelf life, or cost would be very challenging. If suppliers are to compete on priceand performance across different geographies, they need to spend on greener formulations.

Cool Roofing and Reflective Coatings for Urban Heat Mitigation

Architects and engineers have long understood the ease of obtaining energy-efficient buildings and mitigation of urban heat islands, creating significant demand for solar reflective, high albedo roofing chemicals especially in acrylic and elastomeric grades.

Reflective roof coatings lower indoor temperatures as well as heating, ventilation and air conditioning (HVAC) loads and have become more commonly required or incentivized in commercial structures. Cities including Los Angeles and Singapore expanded subsides for cool roofing systems in 2023, spurring their adoption in schools, warehouses and retail properties. Manufacturers providing formulations compatible with ENERGY STAR® and CRRC ratings are poised to profit from government-assisted sustainable building programs.

Advanced Elastomeric Systems for Extreme Weather Resilience

The growing prevalence of climate-induced events: heatwaves, torrential rains and windstorms is raising the demand for roofing chemicals that provide elastic recovery, crack bridging and thermal flexibility. With the emergence of elastomeric formulations for gears stretching under structural movement and temperature fluctuations, elastomeric coatings are now the ideal solution for metal, bituminous and plastic roof systems.

A new generation of polyurethane-acrylic hybrid elastomers in the market in 2023 deliver extended recoat intervals and greater tensile strength. The coatings are particularly significant in areas with earthquake, hurricanes, and monsoon exposures. High-tensile, low-permeability elastomeric systems with self-healing characteristics will capture demand; enforced both on public and private infrastructure investment

Smart and Sustainable Roofing Solutions Driving Innovation

Multi-functional roofing chemical manufacturers have much more to promise than protection; now, these products also deliver sustainability, performance monitoring, and long-term savings. Smart coatings with thermal-chromatic or moisture-indicating properties and the emergence of bio-based and recycled-content polymer coatings are gaining traction in the roofing marketplace.

European building material companies introduced thermal sensor-equipped roof sealants in 2023, enabling real-time performance monitoring. On the green building side, bio-based asphalt modifiers and low-carbon resins are also gaining traction. Market transformation to smart, sustainable roof systems are set to be led by players investing in digitally specified, smart formulation capabilities and eco-labeled roofing additives.

USA roofing chemical market is expanding significantly owing to increasing investment towards replacement of commercial and residential roofs, energy-efficient infrastructure, and extreme weather resistance. Membrane and bituminous roofing systems are the predominant markets, although acrylic- and asphalt-based products rule there and epoxy resins are making inroads (metal, plastic) in the roofing chemicals market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.1% |

UK roofing chemicals market is witnessing steady growth, driven by green construction trends, retrofitting demand and building systems modernization. Currently, acrylic and styrene-based products dominate the market for bituminous and elastomeric roofing systems in both residential and public infrastructures.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.9% |

The European doors and windows market for roofing chemicals is growing as countries invest in energy-efficient buildings as well as smart construction materials. New construction and refurbishment routinely use asphalt and acrylic chemicals, even as epoxy resinsare being applied to metal and composite roofs.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.0% |

The roofing chemicals market in Japan is being bolstered by urban redevelopment which is consistent, frequent retrofits of the weather-exposed buildings and a need to waterproof humid conditions. Membrane and elastomeric roofing often relies on acrylic and styrene chemicals, but durable metal roofing systems turn to epoxy resins instead.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.8% |

The South Korean roofing chemicals market is fueled by government-sponsored creating of smart cities and focus on energy performance in structures. Membrane and bituminous roofing systems are booming with acrylic and asphalt-based roofing chemicals. Epoxy and styrene products are also becoming more popular in industrial and commercial roofing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.2% |

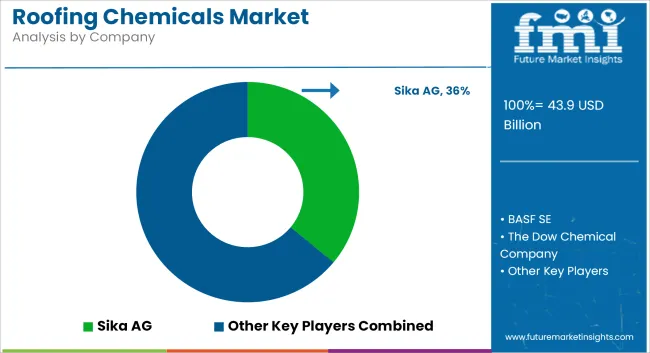

The roofing chemicals market is seeing increasing competition as players focus on sustainable innovation, performance optimization, and regional expansion. Key companies are investing in bio-based and recyclable roofing chemicals, in line with global green building mandates. Digitalization in roofing inspection and installation processes is encouraging chemical suppliers to offer compatible formulations for smart roof systems.

Partnerships with roofing contractors, distributors, and construction firms are strengthening go-to-market strategies. As demand for lightweight, durable, and environmentally compliant roofing systems rises, the market is expected to witness a surge in advanced product launches and M&A activity focused on specialty chemical technologies.

The overall market size for the Roofing Chemicals Market was USD 43.9 billion in 2025.

The Roofing Chemicals Market is expected to reach USD 69.5 billion in 2035.

Rising construction activity, climate-resilient infrastructure needs, and adoption of energy-efficient building materials will drive market demand.

The top 5 countries driving the development of the Roofing Chemicals Market are the USA, China, India, Germany, and Brazil.

Acrylic roofing chemicals are expected to lead due to their versatility, UV protection, and compatibility with membrane and metal roofing systems.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Waterproofing Chemicals in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Roofing Material Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Roofing Anchors Market Size and Share Forecast Outlook 2025 to 2035

Roofing Underlay Market Size and Share Forecast Outlook 2025 to 2035

Roofing & Tile Underlayment Market Size and Share Forecast Outlook 2025 to 2035

Roofing Shingles Market

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Holding and Proofing Cabinets Market - Temperature Control & Bakery Solutions 2025 to 2035

Automotive Sound Proofing Material Market

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fluorochemicals Market Size and Share Forecast Outlook 2025 to 2035

Paper Chemicals Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA