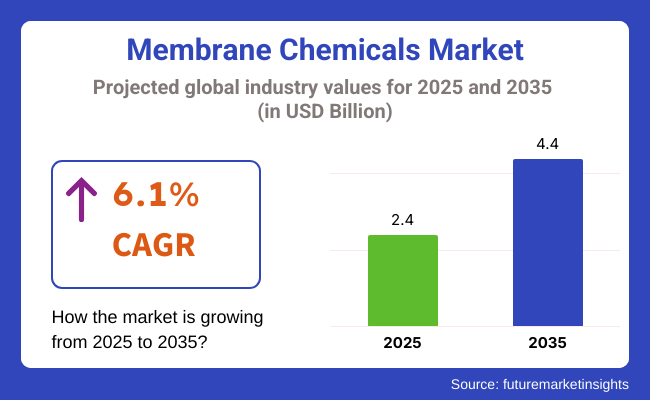

The global membrane chemicals market is estimated to be valued at USD 2.4 billion in 2025. A CAGR of 6.1% is forecast during the period from 2025 to 2035. By the end of this period, the market is projected to reach USD 4.4 billion. Growth is primarily driven by increasing demand for high-performance water treatment solutions across municipal, industrial, and power generation sectors.

Enhanced fouling resistance and operational efficiency have been achieved through membrane chemical formulations. Antiscalants, biocides, and cleaning agents are being adopted at a higher rate in reverse osmosis and nano-filtration systems.

In its 2025 quarterly disclosure, Kurita Water Industries Ltd. confirmed a strategic expansion in its membrane treatment product line, attributing it to increasing demand in Asia-Pacific and Middle Eastern markets. The company’s CEO noted that membrane chemical innovations are central to achieving “operational resilience under varying feedwater quality,” aligning with sustainability goals.

Membrane chemicals are increasingly utilized to mitigate biofouling and scaling in desalination facilities. According to a 2024 press release by Veolia Water Technologies, the firm’s new line of pre-treatment membrane solutions reduced chemical usage by 17% while increasing throughput in large-scale seawater reverse osmosis (SWRO) plants. This outcome was highlighted as a key milestone in its environmental roadmap.

Regulatory compliance and environmental performance mandates have encouraged membrane operators to adopt low-toxicity, biodegradable formulations. In 2024, SUEZ Water Technologies reported a 19% rise in membrane chemical sales across its North American operations, driven by stricter municipal discharge limits and the phase out of traditional phosphonate-based antiscalants. The company’s technical director stated that “reformulated blends, with higher threshold inhibition and improved biodegradability, are seeing higher acceptance among municipal customers.”

Rapid industrialization in India and Southeast Asia has led to increased wastewater reuse initiatives. As reported in a 2024 strategic review by Lanxess AG, their membrane chemical unit experienced double-digit growth in the Indian market. This was attributed to government-led zero liquid discharge mandates in the textile and dyeing industries. Lanxess’ vice president for Asia-Pacific operations emphasized that “regulatory intensity has converted optional treatment technologies into baseline operational standards.”

Despite the growth trajectory, membrane chemical suppliers face raw material price volatility and performance variability under complex feed conditions. These challenges are being addressed through collaborative R&D initiatives. In early 2025, Hydranautics unveiled a new cleaning formulation co-developed with industry partners to reduce cleaning frequency by 30%, enhancing membrane lifecycle performance.

The market is segmented based on chemical type, end use, and region. By chemical type, the membrane chemicals market is divided into antiscalants & antifoulants, biocides, pH adjusters, dechlorinants, and others.

Based on end use, it is categorized into waste water treatment, municipal, power, food & beverage, chemicals, desalination, and paper & pulp. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The antiscalants and antifoulants segment is projected to be the fastest-growing in the membrane chemicals market, registering a CAGR of 5.9% between 2025 and 2035, surpassing the overall market growth rate.

This growth is primarily driven by the increasing use of reverse osmosis and nanofiltration systems in industrial and municipal water treatment, where membrane scaling is a critical operational challenge. Antiscalants and antifoulants help reduce maintenance frequency, extend membrane life, and optimize overall plant efficiency.

Their role becomes even more significant in high-salinity and mineral-laden water environments, such as seawater desalination. Biocides, while not as fast-growing, remain essential for controlling biofouling in membrane systems, especially in food, beverage, and pharmaceutical sectors.

pH adjusters and dechlorinants serve as vital pre-treatment agents, protecting membranes from acidic damage and chlorine degradation, respectively. The “others” segment includes dispersants, coagulants, and enzyme-based cleaners that support niche applications requiring specialized fouling control or operational stability.

| Chemical Type | CAGR (2025 to 2035) |

|---|---|

| Antiscalants & Antifoulants | 5.9% |

The desalination segment is projected to be the fastest-growing end-use area in the membrane chemicals market, registering a CAGR of 6.2% between 2025 and 2035. This surge is fueled by rising freshwater scarcity and growing urban populations in water-stressed regions, particularly the Middle East, North Africa, and coastal South Asia.

With governments and private sectors investing heavily in seawater and brackish water desalination plants, demand for advanced membrane treatment solutions is on the rise. Chemicals such as antiscalants, biocides, and dispersants are essential for maintaining high system throughput and minimizing downtime in these large-scale facilities. The waste water treatment and municipal sectors continue to be foundational markets, driven by stricter water discharge regulations and water reuse mandates.

Other significant end uses include power generation, where ultrapure water is critical for boilers and turbines, as well as the food & beverage, paper & pulp, and chemical industries, all of which require consistent water quality to maintain production efficiency.

| End Use | CAGR (2025 to 2035) |

|---|---|

| Desalination | 6.2% |

Global demand for clean water continues to increase which is pushing the membrane chemical industry into the spotlight. The ability to remove contaminants and impurities by technologies, such as reverse osmosis and ultrafiltration is making them irreplaceable in water treatment methods.

Recently, global demand for clean water has significantly increased which has been pushing the membrane chemical industry into the spotlight.

The consistent use of membrane systems results in quick damage. This issue leads to a rise in the usage of chemicals in these systems to make them last longer while boosting their efficiency.

Global Move by Going Sustainable in Water Treatment Method to Surge Product Uptake

The membrane chemical industry is rising to promising heights in its application to eliminate contaminants from water. With the world facing clean drinking water issues, the use of filters and purifiers is increasing significantly. However, problems arise when the products used are harmful to nature. As a result, people are switching to eco-friendly water treatment products.

In several industries, effective water purification solutions are substantially needed, driving the demand for membrane chemicals. With strict laws in accordance with water quality, membrane-based technologies are being adopted at a high rate, driving industrial growth.

Additionally, the focus on resource efficiency plays a crucial role in increasing the performance which in turn reduces the downtime and maintenance costs.

Moreover, factors such as continuous research to advance membrane chemistry and materials are leading toward the development of more efficient and eco-friendly products, propelling market growth.

High Initial Costs and Significant Requirement for Research and Development Investment Hinders Market Growth

The membrane chemicals industry is held back due to the high initial investment costs, expensive research, development, production, and use of specific chemicals for specific membrane systems. These expenses make the product out of reach for small-scale companies and organizations with limited resources, decreasing their ability to compete successfully.

Moreover, the already present industries in the market that use membrane technology refrain from adopting new ways for the manufacturing of the product due to high initial costs, especially if the return on investments cannot be predicted. As a result, there is limited competition and already existing companies are avoiding innovative approaches due to additional costs.

The USA is one of the most lucrative markets in the world. It holds a market share of 15.6% as of 2025 (E). Water scarcity is more than just an environmental issue that is impacting every industry globally. This water crisis is caused by wasteful flush toilets, uninsulated pipes, and overly large showerheads.

The USA membrane chemicals market is experiencing significant growth, driven by several key factors. The need for effective and efficient membrane cleaning solutions has become more important, as the demand for water treatment solutions is increasing, specifically in the context of urbanization and industrialization.

The growing use of the rate of membrane technology to convert waste water to a usable form is another factor poised to drive the market over the forecast period. Additionally, the increase in the number of house water purification machinery based on this technology is pushing its use significantly.

The advancements in chemistry and materials and the constant growth in the adoption and the global demand for clean water are playing an important part in increasing the market value of membrane chemicals.

Brazil’s membrane chemicals market share is estimated to be 1.9% in the year 2025. The market is anticipated to grow significantly from 2025 to 2035 in reflection of evolving trends and market dynamics.

It is driven by factors such as technological advancements, growing customer demand, and increased investments in various sectors. Widely used in consumer goods, the market is expected to grow due to growing demand for household and personal care products.

Factors such as regional investment, development in the infrastructure, and industrial activities are building the market in these areas. The southeast region is a major place for industrial growth and technological advancements, home to major cities such as Sao Paulo and Rio de Janeiro.

Northeast is moving up its investments in agriculture and renewable energy, implying to be an important player in the market. South is known for its successful production sector contributing to the market expansion in different industries. As for the Midwest, the agricultural domain has taken a stance with its growing demand for membrane chemicals.

India

The Indian membrane chemical market share is estimated at over 11.5% in the year 2025. Urbanization and industrialization lead to more wastewater production, which necessitates effective treatment solutions, because of which growth is taking place.

Moreover, strict government regulations on discharge of the wastewater are compelling industries to adopt membrane chemicals technology for effective efficiency and reduce operational costs, which are attracting more installations across various areas.

Industries such as food and beverage, pharmaceuticals, and chemicals produce a lot of wastewater that is often contaminated with harmful pollutants. This situation creates an urgent need for effective treatment solutions to address these environmental challenges.

Government programs promoting sustainable practices and investing in infrastructure are motivating industries to embrace membrane chemical systems. This shift is helping to spur growth in this area.

China

Over the past two decades, China has seen remarkable growth in its chemicals sector, driven by significant investments and fierce competition across numerous segments. This growth has been particularly strong in areas where production technology is widely accessible and where raw materials and financing are readily available.

However, since mid-2018, economic challenges, stemming from a slowdown in China's economy and tensions in the USA-China trade, have introduced uncertainties in the market. Despite this, the Chinese economy continues to grow rapidly, fueled by rising industrial output, increased imports and exports, and higher consumer spending.

Increasing awareness of health and environmental issues, along with the urgent need for water desalination and wastewater treatment due to water scarcity, are significant factors driving demand for membrane technology.

Stringent environmental regulations are also pushing industries to adopt membranes to reduce pollution. In the Asia-Pacific region, China and India are the top consumers of membranes, with notable growth in the food & beverage, pharmaceutical, and medical sectors.

The rising rates of health issues such as diabetes and obesity, which can lead to kidney problems, are further boosting the demand for membranes in healthcare. While the initial costs for membrane systems can be high, their quick return on investment and payback periods make them a valuable choice for various applications, including water desalination and wastewater treatment.

The growing need for clean water technologies, effective wastewater treatment solutions, and industrial filtration applications is fueling market expansion. In Turkey, membrane manufacturers are focusing on producing PVDF membranes, crafting modules, and integrating membrane systems to cater to various industry needs.

Recent technological advancements have led to improvements in membrane pore sizes, surface modifications, and module designs, all of which boost filtration efficiency and reliability.

Additionally, government initiatives aimed at protecting the environment, conserving water, and promoting sustainable manufacturing are playing a crucial role in advancing the market.

As Turkey confronts issues such as water scarcity and environmental concerns, the demand for PVDF membranes is anticipated to rise, particularly driven by projects in industrial and municipal water treatment.

The market players are leveraging different strategies to gain a competitive edge. Some of them include Veolia Water Technology, Applied Membranes, Inc., H2O Innovation, and others. Moreover, Veolia Water Technology specializes in designing and delivering water treatment facilities for both commercial and municipal clients, focusing on solutions for drinking water and wastewater.

They also offer compact, standardized equipment tailored to various needs. In August 2022, the company launched Ecosim, an innovative and ultra-compact biological treatment solution. This system is designed for residential wastewater treatment and can accommodate between 50 and 2,000 people.

Furthermore, Applied Membranes, Inc. is committed to enhancing productivity and consistently exceeding customer expectations. Their team of Certified Water Experts and Engineers works diligently to create tailored solutions for a wide range of water treatment challenges.

In August 2020, as part of a strategic growth initiative, Applied Membranes, Inc. focused on enhancing its innovative membrane solutions specifically for the dairy industry in the USA This effort aims to address the unique needs of this sector and improve overall efficiency.

Moreover, other companies are also leveraging various growth strategies to outshine the competition. Some of the other strategies adopted by prominent companies include mergers & acquisitions, joint ventures, collaborations, and more.

| Company | Area of focus |

|---|---|

| Veolia Water Technology | Sustainable Wastewater Treatment Solutions |

| Applied Membranes, Inc. | Reverse Osmosis Membranes |

| Genesys International | Specialty Reverse Osmosis Membrane Chemicals |

| Startup | Description |

|---|---|

| SepPure Technologies | A Singapore-based company specializing in chemical-resistant hollow fiber membranes for organic solvent nanofiltration, aiming to reduce energy consumption in industrial chemical separation processes. |

| SiTration | A USA startup focusing on chemical-free, energy-efficient extraction and recycling of critical materials using advanced membrane technology. |

| Membrion | A ceramic desalination membrane startup accelerating cross-industry expansion with innovative membrane solutions for water treatment. |

| NX Filtration | A Dutch startup developing hollow fiber membranes and modules for ultrafiltration and nanofiltration, targeting water softening and purification applications. |

| Cerahelix | A USA-based company providing nanotech-based water treatment solutions, developing patented ceramic filters for removing dissolved solids in industrial applications. |

| SOLV8 Technology | A Singaporean startup specializing in innovative membrane technology for sustainable and energy-efficient solvent recovery within various industries. |

| Filtravate | A USA company developing and commercializing ultrafiltration membranes for bioprocessing and biopharmaceutical industries, focusing on building membranes from the ground up using the smallest building blocks. |

| 4Earth | A USA startup specializing in next-generation water treatment solutions, utilizing advanced processes such as ceramic membranes for consistent performance. |

| ECOFARIO | A German developer of a microparticle separation process based on hydrocyclone technology, installable as an end-of-pipe solution in municipal or industrial sewage treatment plants. |

| Novoreach Technologies | A developer of clean technology systems for environment and energy applications, providing separation solutions for organic dehydration, water purification, chemical separation, and food and beverage industries. |

In terms of chemical type, the market is divided into antiscalants & antifoulants, biocides, pH adjusters, dechlorinants, and others.

Based on end use, the membrane chemicals market is divided into waste water treatment, municipal, power, food & beverage, chemicals, desalination, and paper & pulp.

The market is predicted to reach a size of USD 4.4 billion by 2035.

The market is anticipated to be valued at USD 2.4 billion in 2025.

Some of the leading manufacturers include Kemira, GE Water & Process Technologies, Nalco, and others.

The USA is a promising country, with a market share of 15.6% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Membrane Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Technology Market Size and Share Forecast Outlook 2025 to 2035

Membrane Switch Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Membrane Microfiltration Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Membrane Boxes Market Size and Share Forecast Outlook 2025 to 2035

Membrane Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Market Leaders & Share in Membrane Boxes Manufacturing

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Geomembrane Market Strategic Growth 2024-2034

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Egg Membrane Powder Market

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

PTFE Membrane Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA