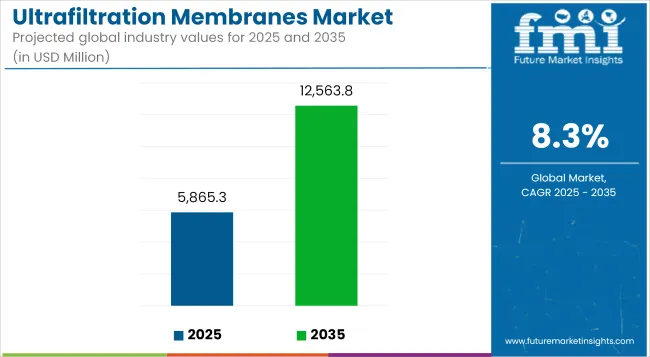

The global ultrafiltration membranes market is anticipated to reach USD 5,865.3 million in 2025 and is further projected to expand to USD 12,563.8 million by 2035, registering a compound annual growth rate (CAGR) of 8.3% during the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 5,865.3 million |

| Projected Market Size in 2035 | USD 12,563.8 million |

| CAGR (2025 to 2035) | 8.3% |

This growth is being supported by rising demand for clean water, increasing enforcement of wastewater treatment regulations, and expanding use in food processing, pharmaceutical, and municipal sectors.

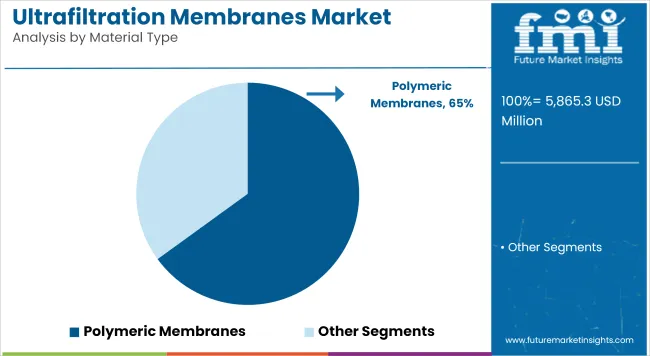

Ultrafiltration membranes are semipermeable materials used to remove suspended solids, bacteria, and high molecular weight compounds from liquids. Polymeric membrane materials such as polyvinylidene fluoride (PVDF), polyethersulfone (PES), and polyacrylonitrile (PAN) are expected to account for a significant share of the market in 2025. These materials are commonly selected due to their affordability, mechanical strength, and adaptability to conventional filtration systems.

The adoption of decentralized and modular ultrafiltration systems is becoming increasingly prevalent, particularly in regions with limited access to centralized water treatment infrastructure. Municipal utilities, industrial operators, and remote communities are turning to compact and mobile UF systems to treat water on-site. This helps reduce transportation costs, enables rapid deployment in emergencies, and facilitates compliance with environmental discharge norms.

Product development is focused on improving energy efficiency and addressing membrane fouling, which are key challenges in long-term ultrafiltration performance. Modified PVDF membranes and hydrophilic surface coatings are being used to reduce biofouling and scaling.

These innovations help extend membrane life, lower the frequency of cleaning, and reduce operating expenses. In addition, energy-efficient backwashing technologies and chemically enhanced cleaning protocols are gaining adoption in critical industries such as pharmaceuticals and food production, where consistent filtration quality is required.

A key trend in the market is the integration of digital monitoring and smart maintenance systems. Ultrafiltration systems are increasingly being equipped with sensors that track flow rate, pressure, and membrane performance in real time. These data streams support predictive maintenance through artificial intelligence-based analysis, helping operators reduce downtime and optimize replacement schedules. The transition to data-driven water infrastructure is enabling improved reliability and efficiency while aligning with stricter water quality and environmental compliance standards.

Polymeric ultrafiltration membranes are expected to hold the largest share of the global market in 2025, accounting for approximately 65%, and are projected to grow at a CAGR of 7.6% through 2035. Materials such as polyvinylidene fluoride (PVDF), polyethersulfone (PES), and polysulfone (PS) are widely used due to their cost-effectiveness, ease of fabrication, chemical resistance, and high permeability.

These membranes are extensively deployed across municipal water treatment, industrial effluent management, food & beverage filtration, and healthcare sectors. In contrast, ceramic membranes (~20-25% share) are used in niche, high-temperature or aggressive environments due to their durability and fouling resistance, while other materials account for a minor share focused on specialized or emerging applications.

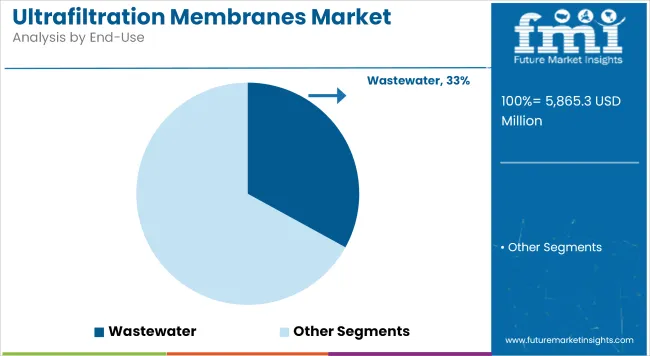

Wastewater treatment is projected to hold the largest share of the global ultrafiltration membranes market in 2025, accounting for approximately 33%, and is expected to grow at a CAGR of 7.9% through 2035. The rising global emphasis on water reuse, industrial discharge regulations, and zero-liquid discharge (ZLD) policies is driving large-scale adoption of ultrafiltration systems in municipal and industrial wastewater treatment.

Ultrafiltration membranes offer superior removal of suspended solids, bacteria, and viruses, making them ideal for tertiary treatment and reuse applications. Asia-Pacific and the Middle East are leading in investment due to water scarcity and growing urban populations, while developed regions focus on upgrading aging water infrastructure with membrane technologies.

The ultrafiltration membranes market is driven by several factors affecting water treatment plants, industrial customers, municipalities, and equipment manufacturers. Filtration performance and longevity are of great concern in all segments, highlighting the demand for dependable and long-lasting membrane products. Cost and value are a medium concern, indicating the trade-off between price and quality. Energy efficiency is a top priority for industrial customers and water treatment facilities, where operating expenses need to be minimized.

Operation and maintenance simplicity is important to all parties, providing seamless operation and little downtime. Compliance with regulations is an area of utmost importance, especially for municipalities and water treatment plants, due to strict environmental laws requiring high-performing filtration systems. Equipment suppliers face medium-level issues in the majority of the criteria, which mirrors the need for innovation in low-cost and environmentally friendly filtration technology. As markets advance, efficiency, durability, and compliance are at the top of industry innovations, driving investments in high-performing membrane technologies.

Dependency on raw materials is one of the major threats in the ultrafiltration (UF) membrane business. UF membranes are made from polymeric materials such as polyethersulfone (PES), polyvinylidene fluoride (PVDF), and polysulfone (PS), as well as ceramic alternatives. Disruptions in the supply chain, geopolitical tensions, or fluctuations in the cost of petrochemical-based raw materials can lead to increased production costs and supply shortages.

Technological risks related to future advances and product innovation need to be adequately addressed. The UF membranes domain is experiencing rapid advances, mainly due to regular improvements in membrane permeability, fouling resistance, and durability. Thus, firms that don’t invest in the development of new technology may find it hard to hold ground against their competitors, who offer better performances, prolonged operational life, and more efficient energy use.

The industry faces strong competition, as the global and regional players are offering both polymeric and ceramic UF membranes. Price wars, mainly in sectors that are sensitive to cost, such as municipal water treatment, can take a toll on profit margins. Companies that do not have the right differentiation strategies might see a fall in their industry share.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

| UK | 9.2% |

| China | 8.8% |

| Japan | 9.4% |

| South Korea | 9.7% |

The ultrafiltration membrane market in the USA is being driven by the demand for clean and safe water owing to surging industrialization, increasing levels of water pollution, and growing government regulations. The expanding application of advanced water treatment technologies in municipal and industrial sectors is influencing the growth rate of the industry.

The rising utilization of ultrafiltration membranes across healthcare, food & beverage, and pharmaceutical industries is also contributing toward augmenting demand. Emphasis on wastewater recycling and desalination ventures, alongside technological improvement in the shape of membrane filtration, also aids the growth of the industry. The increasing demand for sustainable and energy-efficient water purification solutions also drives growth. The USA ultrafiltration membrane market is expected to expand at 8.3% CAGR during the forecast period, according to FMI.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| The Trade Demand for Clean & Safe Water | Rising water pollution and contamination concerns are creating the need for advanced filtration systems. |

| Strict government regulations | Rigorous Environmental Laws on Water Treatment and Industrial Discharge |

The UK ultrafiltration membrane market is growing owing to rising worries regarding water contamination, higher demand for improved water treatment technologies, and stringent government regulations on water quality. Industrial and municipal sectors are increasingly adopting sustainable and energy-efficient filtration technologies, driving growth.

Also, the growing need for wastewater recycling and desalination projects and growth in the pharmaceutical, food, and healthcare industries are further supporting industry demand. Membrane filtration system advancements and the growing transition toward more eco-sustainable water purification methods also help expedite industry growth. The UK industry will grow at a 9.2% CAGR during the forecast period, according to FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Growing Concerns About Water Pollution | Increasing contamination levels increase demand for permeable membrane technologies. |

| Strict Government Regulations | Strict laws on water quality and treatment of wastewater. |

Chinese ultrafiltration membranes market is growing significantly because of fast industrialization, urbanization, and increasing water pollution threats. The need for stringent government regulations associated with water treatment and the aspect of environmental sustainability are fueling the demand for advanced filtration techniques.

The growing number of industrial and municipal water treatment facilities combined with the increasing use of wastewater recycling and desalination projects are acting as drivers for the industry. Also, rapidly growing pharmaceutical, food, and beverage sectors are driving the demand for good-quality water filtration. Industry expansion is also aided by technological advancements in membrane filtration systems and a move toward energy-efficient, sustainable water purification solutions. FMI anticipates China's industry to grow at an 8.8% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Fast Industrialization & Urbanization | Rising industrial activities and increasing population are other factors. |

| Tight Environmental Regulations | Government policies require strict water quality and wastewater treatment standards. |

Growing concerns regarding water pollution, stringent government regulations on the quality of water, and advancements in water treatment technologies are driving the ultrafiltration membrane market in Japan. The leading focus on environmental protection and sustainability in Japan has driven the country's adoption of ultrafiltration membrane systems in wastewater recycling and desalination projects.

Furthermore, the rising demand for high-purity water in the pharmaceutical, food & beverage, and healthcare industries, among others, is also contributing to the industry's growth. The expansion of the industry further extends due to technological innovations in energy-efficient and high-performance filtration systems as well as investments in municipal and industrial water treatment. FMI anticipates Japan’s industry to grow at 9.4% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Several Strict Water Quality Regulations | Low government regulations establish stringent criteria for water treatment and waste management policies. |

| Growing Concerns About Water Pollution | Growing need for high-level filtration systems to remove contamination. |

The country’s emphasis on the sustainable management of water resources has led to the implementation of advanced membrane filtration technologies. Moreover, the growing pharmaceutical, biotechnology, and food & beverage sectors relying on high-purity water are also impacting demand. Growing government investments in modernized water infrastructure and desirable continuous developments of energy-efficient and high-performance filtration systems by the technological vendors are expected to boost the industry over the stipulated period. The South Korean industry will expand at 9.7% CAGR during the study period, according to FMI.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Strict Water Quality Rules | Waste water management and water purification-government regulations |

| Emerging Water Pollution Threats | Expansion in innovation in zones, for example, nanotechnology or biomedicine |

The global ultrafiltration membranes market is increasingly technology-driven and highly competitive, with manufacturers emphasizing innovations in modular system design, process automation, and high-recovery membrane configurations. There is a growing focus on developing low-energy, high-selectivity ultrafiltration modules to enhance operational efficiency while meeting the evolving demands of industries such as food processing, pharmaceutical water purification, and industrial brine treatment. The increasing demand for decentralized, sustainable water treatment infrastructure is creating significant opportunities across developing economies and industrial sectors seeking reliable, long-term filtration solutions.

The segmentation is as ceramics, polymers, and other material types.

The segmentation is as hemodialysis, industrial processes, food & beverage, potable water, biopharmaceuticals, and wastewater.

The market is divided into North America, Europe, the Middle East & Africa, Latin America, and Asia Pacific.

The industry is set to hit USD 5.8 billion in 2025.

The market is projected to reach USD 12.5 billion by 2035.

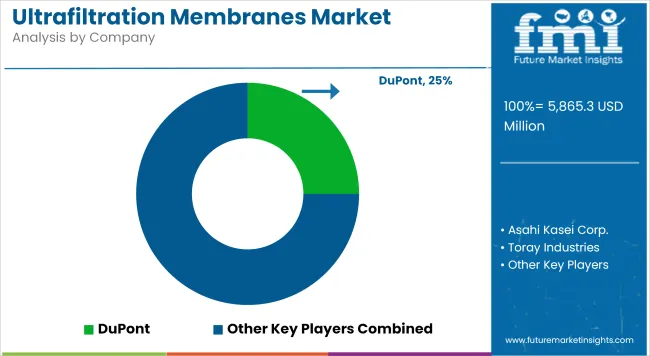

Key companies include DuPont, Asahi Kasei Corp., Toray Industries Inc., Alfa Laval, Pentair, 3M, BASF SE (Inge AG), Baxter International, Dow Chemical Co., Fresenius Medical Care, GE, Cantel Medical, Entegris Inc., Corning Inc., and GEA Westfalia Separator Inc.

South Korean industry, set to witness 9.7% CAGR during the study period, is slated to experience fastest growth.

Polymers are being widely used.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Hollow Fiber Membranes Market Size and Share Forecast Outlook 2025 to 2035

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Architectural Membranes Market Size and Share Forecast Outlook 2025 to 2035

Hollow Fiber Ceramic Membranes Market Analysis by Application, End Use, and Region Forecast Through 2035

Demand for Gas Separation Membranes in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA