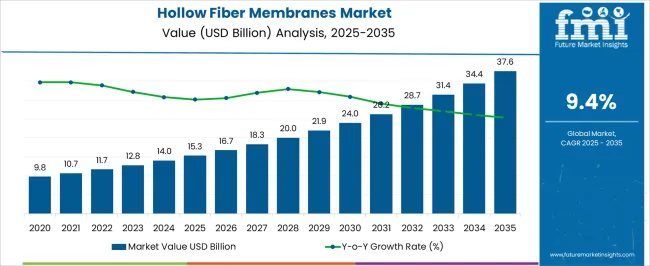

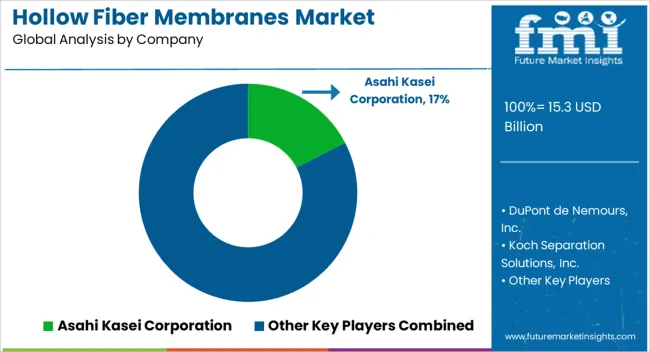

The hollow fiber membranes market is valued at USD 15.3 billion in 2025 and is projected to reach USD 37.6 billion by 2035, advancing at a CAGR of 9.4%. Growth is supported by increasing adoption in water and wastewater treatment, biotechnology, pharmaceuticals, and food processing. Their high surface area, energy efficiency, and selective permeability make them ideal for microfiltration, ultrafiltration, and hemodialysis applications. Rising urban water demand, stricter environmental regulations, and expansion of advanced medical treatments are reinforcing adoption. Manufacturers are focusing on durable polymer blends, nanostructured membranes, and modular system designs to enhance performance, scalability, and cost-effectiveness across industries.

| Metric | Value |

|---|---|

| Hollow Fiber Membranes Market Estimated Value in (2025 E) | USD 15.3 billion |

| Hollow Fiber Membranes Market Forecast Value in (2035 F) | USD 37.6 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

The hollow fiber membranes market is witnessing accelerated adoption due to growing global demand for efficient water filtration, rising awareness of environmental compliance, and advancements in membrane technology. Urbanization, industrial expansion, and regulatory emphasis on water reuse have pushed utilities and manufacturers toward high-performance, compact filtration systems.

Hollow fiber membranes offer superior surface-area-to-volume ratio, modular integration, and ease of maintenance, making them ideal for decentralized and scalable applications.

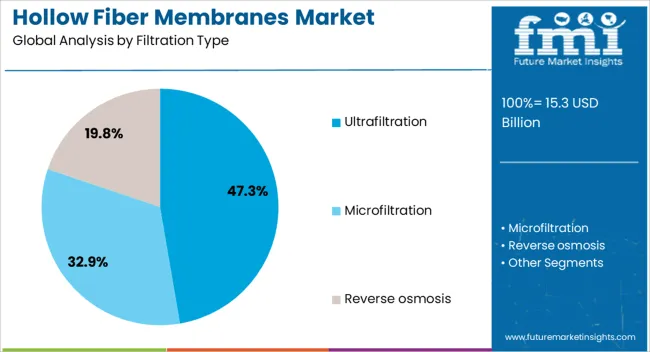

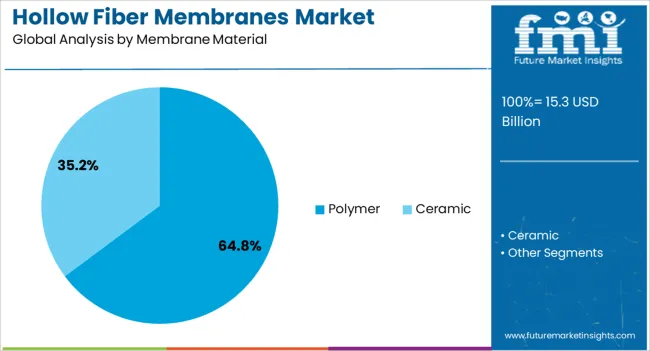

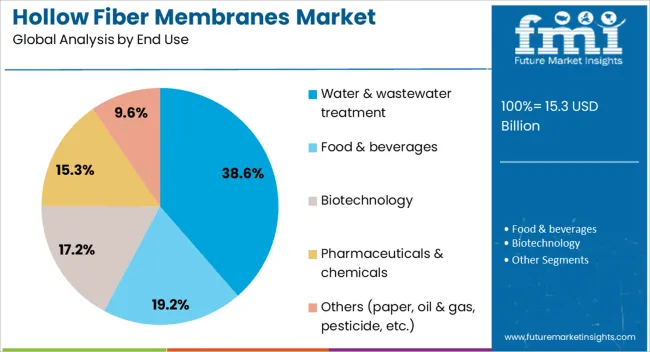

The hollow fiber membranes market is segmented by filtration type, membrane material, end use, and geographic regions. By filtration type, hollow fiber membranes market is divided into Ultrafiltration, Microfiltration, and Reverse osmosis. In terms of membrane material, hollow fiber membranes market is classified into Polymer and Ceramic. Based on end use, hollow fiber membranes market is segmented into Water & wastewater treatment, Food & beverages, Biotechnology, Pharmaceuticals & chemicals, and Others (paper, oil & gas, pesticide, etc.). Regionally, the hollow fiber membranes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ultrafiltration is expected to dominate the market with a 47.30% share by 2025. This segment’s leadership is driven by its broad application in removing bacteria, viruses, and macromolecules without the need for chemical pretreatment.

Ultrafiltration membranes are increasingly used across municipal water treatment, beverage manufacturing, and pharmaceutical sectors due to their reliability, energy efficiency, and compact footprint.

Polymer-based membranes are forecast to lead the market with a 64.80% share in 2025, supported by their cost-effectiveness, mechanical flexibility, and ease of fabrication. The segment’s growth is underpinned by continuous innovation in polymer chemistry, enabling membranes with enhanced fouling resistance, permeability, and longevity.

Polymers such as polysulfone, polyethersulfone, and PVDF are widely used due to their compatibility with various feed waters and cleaning agents.

Water and wastewater treatment is projected to account for 38.60% of the market share in 2025, making it the leading end-use segment. The growth is primarily driven by rising investments in urban water infrastructure, industrial effluent treatment, and zero-liquid discharge systems.

Hollow fiber membranes enable compact and efficient filtration solutions suitable for both municipal utilities and industrial plants.

The hollow fiber membranes market is advancing rapidly as industries seek highly efficient filtration technologies for water purification, pharmaceuticals, and biotechnology. Their structure enables a large surface area for separation, supporting applications in microfiltration, ultrafiltration, and dialysis. Rising water scarcity, stricter regulatory standards, and the growing need for clean and safe water have positioned hollow fiber membranes as critical components in treatment facilities. Demand is further supported by medical and food industries where sterile processing and product safety are priorities. Ongoing developments in advanced polymers, nanostructured materials, and energy-efficient systems are strengthening adoption, making hollow fiber membranes a preferred choice for diverse industrial and healthcare applications.

Water treatment plants increasingly deploy hollow fiber membranes due to their efficiency in removing bacteria, viruses, and suspended solids. They are preferred over conventional filtration systems because of lower energy consumption and compact design. Rising investments in municipal water infrastructure and growing industrial wastewater regulations are accelerating adoption. Membranes with longer lifespans and lower fouling tendencies are being developed to reduce operational costs. The ability to support high-capacity desalination and reuse projects further enhances their importance in addressing global water scarcity. This expansion in water-focused applications is a major driver supporting long-term growth in the market.

Healthcare and pharmaceutical industries are turning to hollow fiber membranes for critical applications such as hemodialysis, plasma separation, and drug manufacturing. Their biocompatibility and selective permeability enable safe and precise processing, which is vital for patient safety and pharmaceutical quality. Hemodialysis centers rely heavily on these membranes, supported by the growing prevalence of chronic kidney disease. Biopharmaceutical manufacturers use them for protein purification and virus filtration, ensuring product safety. With medical technology advancing and regulatory frameworks emphasizing high standards, hollow fiber membranes are set to expand further in healthcare, reinforcing their role in advanced medical solutions.

Despite their efficiency, hollow fiber membranes face restraints in terms of high installation and replacement costs, especially for large-scale plants. Membrane fouling remains a technical challenge, requiring periodic cleaning and replacement that increases operational expenses. Small and medium-scale enterprises may hesitate to adopt advanced hollow fiber systems due to budget limitations. Technical complexity in system integration and limited awareness in developing regions also restrict penetration. Addressing these cost and operational barriers through affordable solutions and advanced antifouling technologies will be critical for expanding adoption in broader industrial and municipal sectors.

Material innovation is emerging as a key trend, with manufacturers developing membranes from advanced polymers and composites to improve durability, chemical resistance, and permeability. Energy-efficient designs are being prioritized to reduce overall system costs, particularly in desalination and high-volume wastewater treatment. Nanotechnology-based hollow fiber membranes with enhanced selectivity and antifouling characteristics are being explored to increase efficiency and service life. Modular systems that support easy scaling are becoming popular in both industrial and municipal setups. These innovations are shaping the competitive landscape, ensuring that hollow fiber membranes continue evolving as next-generation solutions for global water and healthcare challenges.

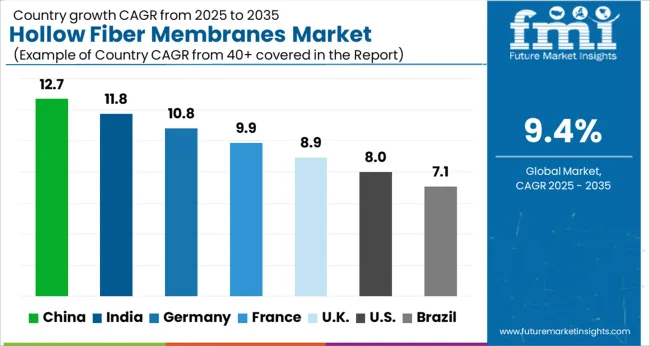

| Country | CAGR |

|---|---|

| China | 12.7% |

| India | 11.8% |

| Germany | 10.8% |

| France | 9.9% |

| UK | 8.9% |

| USA | 8.0% |

| Brazil | 7.1% |

The hollow fiber membranes market in China is advancing at a CAGR of 12.7%, supported by rapid expansion in municipal water treatment, desalination, and industrial wastewater recycling projects. Local manufacturers are scaling production with advanced polymeric and composite membranes to meet rising demand for efficient separation. Healthcare and dialysis centers are increasingly sourcing hollow fiber systems for plasma and blood filtration. The government’s focus on clean water and stricter discharge regulations has accelerated adoption across provinces. Pilot projects in biopharmaceutical processing are also expanding, supported by collaborations between research institutes and domestic suppliers. Industrial clusters are integrating modular membrane units to reduce operating costs and improve process efficiency.

Rapid adoption in desalination and wastewater reuse

Dialysis and plasma filtration driving healthcare uptake

Modular membrane systems integrated into industrial clusters

India’s hollow fiber membranes market is recording a CAGR of 11.8%, fueled by rising investment in water purification and growing dependence on dialysis centers. Municipal authorities are increasingly adopting hollow fiber membranes for large-scale drinking water projects to address shortages. Pharmaceutical companies have begun expanding their use of membranes for protein purification and virus removal. Domestic suppliers are scaling up low-cost variants to compete with imports, focusing on rural water supply programs. Industrial demand is growing in sectors such as textiles and chemicals, where effluent management is critical. Government-backed clean water initiatives and public-private partnerships are enhancing adoption.

Large-scale use in municipal drinking water projects

Strong role in dialysis and pharmaceutical filtration

Public-private partnerships expand rural access

Germany’s hollow fiber membranes market is growing at a CAGR of 10.8%, with a strong base in industrial wastewater management and biopharmaceutical applications. Pharmaceutical companies use hollow fiber membranes extensively in protein separation and viral clearance. Environmental regulations drive adoption in chemical and textile effluent treatment. Advanced polymeric and ceramic-based membranes are being developed through research collaborations. Healthcare adoption is supported by the prevalence of dialysis centers nationwide. Industrial producers are investing in energy-efficient modules to reduce long-term costs. German engineering firms are also pioneering in modular system design, enhancing scalability and export opportunities.

Adoption in biopharmaceutical viral clearance and protein separation

Energy-efficient modules reduce long-term operational costs

Strong research collaborations developing advanced membranes

France’s hollow fiber membranes market is expanding at a CAGR of 9.9%, supported by municipal water treatment upgrades and healthcare reliance on dialysis. Local manufacturers provide specialized variants for sterile food and beverage processing, ensuring compliance with EU safety standards. Small-scale industries are adopting hollow fiber units to meet wastewater discharge requirements. Research organizations are collaborating with producers to expand nanostructured hollow fiber membranes with higher efficiency. Healthcare applications remain a core contributor, especially for chronic kidney care. Industrial adoption in food packaging sterilization is also gaining momentum, complementing environmental initiatives.

Healthcare dialysis adoption continues as core driver

Use in food and beverage sterilization expanding

EU regulations push wastewater treatment adoption

The hollow fiber membranes market in the United Kingdom is progressing at a CAGR of 8.9%, with demand concentrated in healthcare and municipal water treatment. Hospitals and dialysis centers are leading adopters, relying on biocompatible membranes for patient care. Industrial adoption is increasing in breweries and food processing, where sterile filtration is critical. Municipalities have upgraded plants with hollow fiber units to improve water quality compliance under stricter EU-aligned standards. Domestic suppliers are exploring partnerships with academic research institutions to expand advanced variants. Adoption in niche biotechnology applications is gradually increasing, supporting specialized protein separation and viral filtration.

Biocompatible dialysis membranes widely used in healthcare

Breweries and food processing adopt sterile filtration

Municipal plants upgraded for EU-compliant water quality

The hollow fiber membranes market in the United States is expanding at a CAGR of 8.0%, supported by strong demand from healthcare, municipal utilities, and biotech sectors. Hemodialysis remains the largest contributor, with steady replacement cycles across treatment centers. Biopharmaceutical companies have expanded use for large-scale protein purification, vaccine production, and viral clearance. Municipalities invest in hollow fiber units to support wastewater reuse projects, especially in water-stressed states like California and Texas. Industrial adoption is strong in electronics manufacturing for ultrapure water. Domestic producers are investing in advanced antifouling membranes to address operational cost barriers.

Hemodialysis remains a primary healthcare contributor

Biopharmaceutical adoption in protein purification rising

Wastewater reuse projects drive municipal investments

The hollow fiber membranes market features a competitive mix of global leaders, regional specialists, and niche innovators. Companies such as Toray Industries, Asahi Kasei, and DuPont dominate with extensive portfolios in water treatment and medical filtration, leveraging scale and strong R&D pipelines. Mitsubishi Chemical and SUEZ advance polymer and composite variants suited for municipal and industrial water management. In healthcare, Fresenius Medical Care and Baxter lead dialysis applications with specialized biocompatible membranes. Regional suppliers in China and India focus on cost-efficient, high-volume products for drinking water and effluent treatment, addressing local infrastructure needs. Differentiation revolves around durability, fouling resistance, and modular designs, with ongoing innovation in nanostructured and antifouling coatings enhancing efficiency and expanding adoption across industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.3 Billion |

| Filtration Type | Ultrafiltration, Microfiltration, and Reverse osmosis |

| Membrane Material | Polymer and Ceramic |

| End Use | Water & wastewater treatment, Food & beverages, Biotechnology, Pharmaceuticals & chemicals, and Others (paper, oil & gas, pesticide, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Asahi Kasei Corporation, DuPont de Nemours, Inc., Koch Separation Solutions, Inc., Lenntech B.V., Microdyn-Nadir GmbH (Mann+Hummel Group), Mitsubishi Chemical Corporation, Polymem France, Pentair, Inc., Toray Industries, Inc., and Toyobo Co., Ltd. |

| Additional Attributes | Dollar sales by type including polymeric and ceramic membranes, application across water treatment, medical dialysis, and industrial separation processes, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for clean water, increasing medical applications, and technological advancements in filtration and separation solutions. |

The global hollow fiber membranes market is estimated to be valued at USD 15.3 billion in 2025.

The market size for the hollow fiber membranes market is projected to reach USD 37.6 billion by 2035.

The hollow fiber membranes market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in hollow fiber membranes market are ultrafiltration, microfiltration and reverse osmosis.

In terms of membrane material, polymer segment to command 64.8% share in the hollow fiber membranes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hollow Fiber Ceramic Membranes Market Analysis by Application, End Use, and Region Forecast Through 2035

Hollow Core Slab Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Insights for Hollow Concrete Blocks Providers

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA