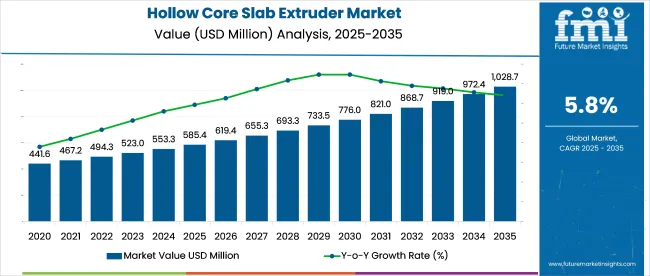

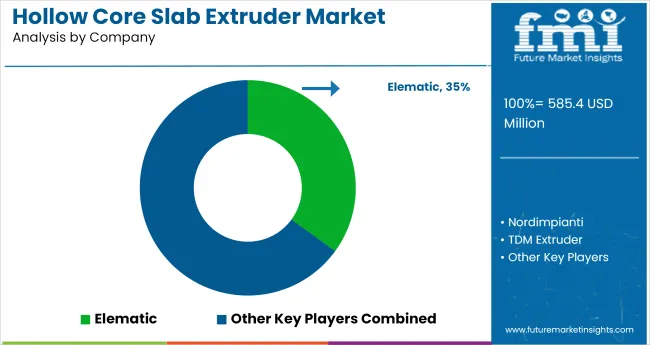

The hollow core slab extruder market is expected to grow from USD 585.4 million in 2025 to around USD 1,028.7 million by 2035, at a CAGR of 5.8% during the assessment period.

Growth is being supported by increased infrastructure development, especially in residential and commercial construction across urbanizing regions. Manufacturers are shifting toward modular extruders that allow rapid transitions between slab heights ranging from 80 mm to 600 mm. This adaptability is improving throughput in pre-stressed floor production for multi-story residential and commercial buildings.

In emerging markets, producers adopting shear-compaction extruders have reported over 30% reductions in cement consumption while maintaining uniform density across large volumes. Automation upgrades such as integrated oil heating, compaction pressure sensors, and inline cutting systems are enabling 24/7 operation with minimal manual intervention.

In regions like Eastern Europe and Southeast Asia, new factories built around multi-strand beds are scaling up with single-line setups capable of delivering 400 slabs per day. On-site recycling of concrete residues and off-cuts is also being adopted, reinforcing the role of extrusion-based systems in low-waste, high-speed construction environments.

As of 2025, the hollow core slab extruder market is positioned as a critical niche within the broader construction and precast industries. Within the global precast concrete equipment market, around 6-8% of machinery value is represented by hollow core slab extruders, due to their efficiency in producing load‑bearing slabs. Within the wider construction machinery market, their share is estimated at 2-3%, reflecting their specialized use.

The concrete and cement equipment sector sees 3-4% of its value driven by these extruders, particularly in industrial precast plants. In the infrastructure construction equipment market, 1-2% of machinery demand is attributed to hollow core systems, as infrastructure projects increasingly adopt precast methods. Within the building automation and precast automation market, a 2-3% share is held by slab extruders, as process standardization gains importance.

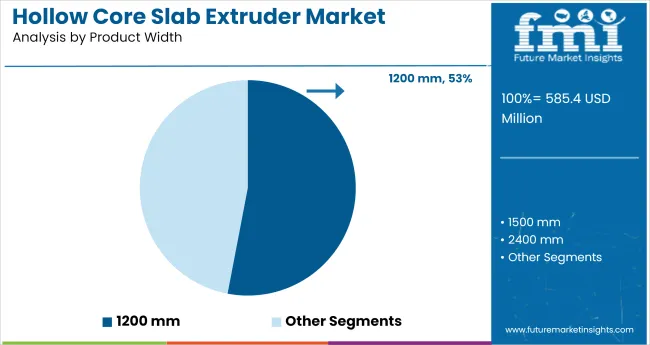

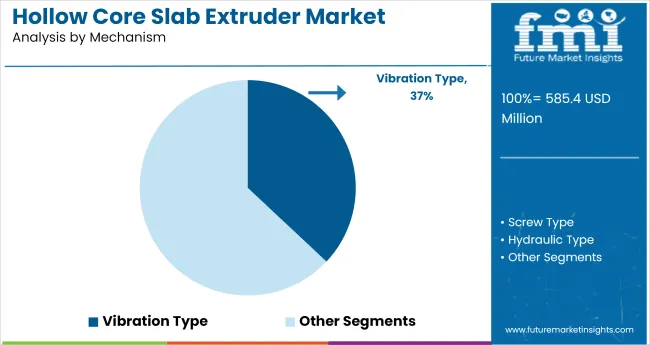

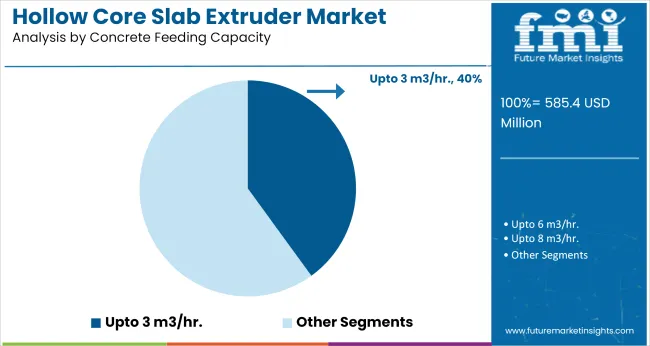

The market is expanding rapidly, driven by surging demand for precast construction, cost-efficient floor systems, and modern mechanized building methods. High-performing segments such as 1200 mm product width, vibration mechanism, and low-volume concrete feeding systems are attracting investor attention due to operational efficiency and structural flexibility.

The 1200 mm product width segment is expected to command 53% of the market by 2025. Its widespread use in industrial, commercial, and multi-story residential construction makes it the most versatile format. Builders favor this width for delivering optimal load distribution while maintaining speed of installation.

Vibration-type hollow core slab extruders are forecasted to represent 37% of the market by 2025. This mechanism ensures higher compaction efficiency, better surface finishes, and superior bonding in prestressed elements. Its compatibility with varied concrete grades makes it a preferred choice across mid- to large-scale projects.

Extruders with a concrete feeding capacity of up to 3 m³/hr are expected to capture 40% of the market by 2025. They serve small- and mid-sized production units focused on localized demand, fast mobility, and cost-effective batching. Their compact design is well-suited for portable operations and emerging markets.

Growth in the market is supported by surging demand for precast concrete in multi-story construction and infrastructure. In 2024, global sales grew by 8.6%, driven by productivity gains and labor cost reductions.

Automation and Concrete Optimization Enhancing Efficiency

Manufacturers are integrating digital controls and vibration systems for improved compaction and strand tension. In 2024, nearly 52% of machines shipped featured programmable logic controllers (PLCs). Concrete flow sensors, mix consistency systems, and automated strand threading are improving structural integrity and reducing waste.

Government-Backed Infrastructure Projects Supporting Expansion

Government-led smart city and infrastructure programs are creating sustained demand for precast concrete systems. In 2024, India, Saudi Arabia, and Indonesia accounted for 35% of new extruder orders. Budget allocations toward road overpasses, public buildings, and metro systems are accelerating deployment.

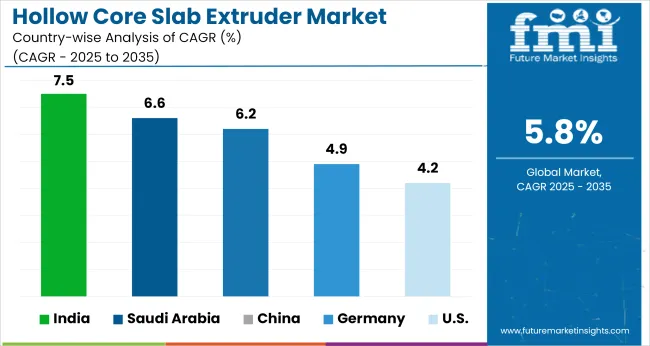

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

| Saudi Arabia | 6.6% |

| China | 6.2% |

| Germany | 4.9% |

| United States | 4.2% |

The global market is anticipated to register a 5.8% CAGR between 2025 and 2035. India leads the cohort with 7.5% growth, exceeding the global average by 29%. Saudi Arabia follows at 6.6%, or 14% above baseline. China posts a 6.2% CAGR, slightly outperforming the global mark. In contrast, Germany records a 4.9% growth rate, falling behind by 16%, while the United States trails further with 4.2%, a gap of 28%.

This disparity stems from regional differences in precast concrete adoption, government-backed housing initiatives, and export-driven manufacturing strategies. India’s expansion reflects strong demand from infrastructure modernization projects. Saudi Arabia is benefitting from national construction targets under Vision 2030. The growth in the USA and Germany is limited by slower adoption of high-output automated casting systems and mature real estate cycles that restrain large-scale public-sector buildouts. These trends signal divergent pathways for market penetration.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Registering a CAGR of 7.5% from 2025 to 2035, India is positioned as the fastest-growing market for hollow core slab extruders. The nation’s booming infrastructure sector, driven by urbanization and government-led housing missions, is fostering rapid adoption of precast technologies. Hollow core slabs are increasingly deployed to meet cost-efficiency and structural durability targets in high-rise developments. Equipment manufacturers are localizing operations to cater to escalating demand across metro cities and emerging towns.

Saudi Arabia is projected to grow at a CAGR of 6.6% during the forecast period, bolstered by major urban transformation programs. The country's ongoing mega-projects demand time-efficient and scalable construction systems, making hollow core slab extrusion equipment a strategic necessity. Developers involved in Vision 2030 projects are integrating precast solutions to meet strict delivery timelines and structural standards.

China’s market is set to register a CAGR of 6.2% from 2025 to 2035, as large-scale public infrastructure and green construction projects dominate the landscape. Provincial-level governments are promoting the adoption of prefabricated components to reduce waste and improve project timelines. Hollow core slabs are now standard in new transportation hubs and multi-residential buildings. Manufacturers are scaling up capacity with automated extrusion lines.

Posting a CAGR of 4.9% from 2025 to 2035, Germany continues to be a steady performer in the European precast sector. As demand rises for energy-efficient buildings and industrial halls, builders are leaning toward durable and lightweight structural components like hollow core slabs. Technological precision and strict quality codes have made German firms early adopters of advanced extruder systems.

The USA is projected to expand at a CAGR of 4.2% over the next decade, driven by mounting interest in prefabricated solutions for commercial and institutional projects. Hollow core slabs are now widely preferred for their acoustic insulation, fire resistance, and load-bearing efficiency. Labor shortages are prompting greater investment in automation, with contractors exploring turnkey extrusion solutions for on-site or factory use.

Elematic leads the hollow core slab extruder market with over 35% share globally, driven by its high-output EL900e series and advanced automation capabilities favored across Europe and the Middle East. Nordimpianti holds a strong 20% market share, particularly in Eastern Europe and South America, where its Extruder Evolution series is recognized for energy efficiency and low maintenance.

TDM Engineering Oy and its TDM Extruder line serve niche customers in Scandinavia and Central Asia, offering modular production lines. Henan Wishes (HNP Precast) and NingjinShuangli are expanding in Southeast Asia and Africa by offering low-cost machines with localized support. Concore and Excodo BV focus on turnkey precast solutions, competing on integration and aftermarket services in mature EU markets.

Recent Hollow Core Slab Extruder Industry News

In April 2025, TDM introduced its new hollow core slab extruder, capable of producing slabs ranging from 120-600 mm in thickness and adjustable for track widths of 1200, 1500, or 2400 mm. The modular design supports different fire-resistance classes and insulation layer compatibility, enhancing manufacturing efficiency and flexibility.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 585.4 million |

| Projected Market Size (2035) | USD 1,028.7 million |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Product Widths Analyzed (Segment 1) | 1200 mm, 1500 mm, 2400 mm |

| Mechanisms Analyzed (Segment 2) | Screw Type, Vibration Type, Hydraulic Type, Hybrid Type |

| Concrete Feeding Capacities (Segment 3) | Up to 3 m³/ hr, Up to 6 m³/ hr, Up to 8 m³/ hr |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Elematic, Nordimpianti, TDM Extruder, THISO Industrial Automation, Henan Wishes Machinery Equipment Co., Ltd. (HNP Precast), Ningjin Shuangli Building Materials Equipment Co., Ltd., Concore, Excodo BV, TDM Engineering Oy |

| Additional Attributes | Dollar sales by mechanism and width, expanding precast infrastructure projects, rising adoption of hybrid and vibration systems, and growing demand for automation in concrete extrusion operations. |

The market is segmented based on product width into 1200 mm, 1500 mm, and 2400 mm variants, addressing a range of paving applications across infrastructure projects.

Concrete pavers are classified by operational mechanism into screw type, vibration type, hydraulic type, and hybrid type systems, each offering different efficiency and compaction capabilities.

Concrete feeding capacity segments include up to 3 m³/hr., up to 6 m³/hr., and up to 8 m³/hr., catering to light-duty, medium-duty, and high-volume concrete laying requirements.

Regional analysis spans North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, and the Middle East & Africa, reflecting varying levels of infrastructure investment and urban development.

The market is valued at USD 585.4 million in 2025.

The market is forecast to reach USD 1,028.7 million by 2035.

The market is projected to grow at a CAGR of 5.8% during the forecast period.

The 1200 mm segment holds the largest share with 53% in 2025.

India is the fastest growing country, with a projected CAGR of 7.5% from 2025 to 2035.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA