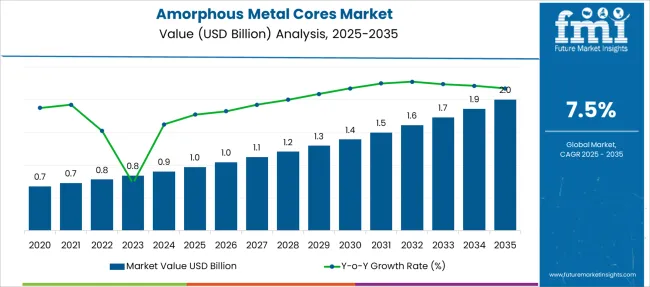

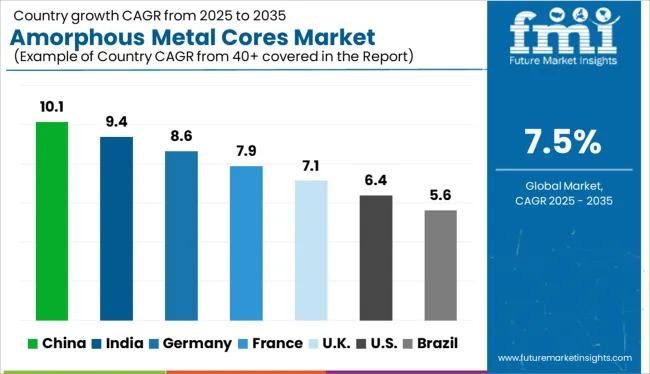

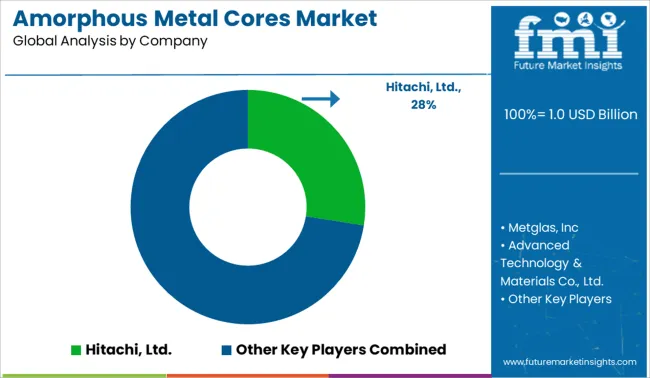

The Amorphous Metal Cores Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Amorphous Metal Cores Market Estimated Value in (2025 E) | USD 1.0 billion |

| Amorphous Metal Cores Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The amorphous metal cores market is witnessing steady growth, driven by increasing demand for energy-efficient components in electrical equipment. The shift toward reducing power losses in transformers and inductors has accelerated the adoption of amorphous metal technology due to its superior magnetic properties. Advances in manufacturing processes have enabled larger-scale production of high-quality cores with consistent performance.

Industry trends indicate a focus on improving energy efficiency and meeting stricter regulatory standards aimed at reducing environmental impact. Growing investments in power distribution infrastructure, especially in developing regions, have supported the need for efficient transformer components.

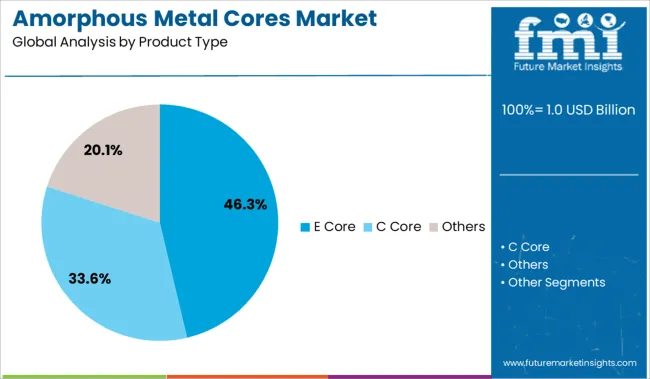

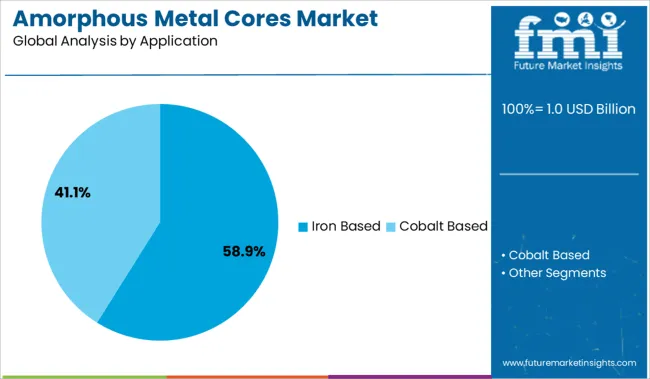

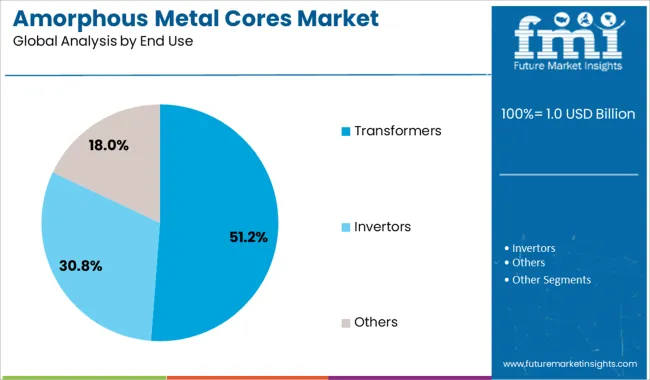

The expanding use of renewable energy systems and smart grids further contributes to market growth. The market is expected to be led by E Core product types due to their adaptability and performance. Iron-based applications are anticipated to dominate given their magnetic efficiency. The transformer sector remains the primary end use driven by infrastructure modernization.

The market is segmented by Product Type, Application, and End Use and region. By Product Type, the market is divided into E Core, C Core, and Others. In terms of Application, the market is classified into Iron Based and Cobalt Based. Based on End Use, the market is segmented into Transformers, Invertors, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The E Core segment is forecasted to contribute 46.3% of the amorphous metal cores market revenue in 2025. This segment is favored for its versatile design and ease of assembly, which makes it suitable for a wide range of electrical devices. The shape of the E Core allows efficient magnetic flux handling, resulting in reduced core losses and improved performance.

Its compatibility with various winding techniques and sizes has also supported its popularity in transformer manufacturing.

The segment benefits from the balance of manufacturing cost and functional efficiency, making it a preferred choice among manufacturers focusing on energy savings.

The Iron Based segment is expected to hold 58.9% of the market revenue in 2025, maintaining its dominance in applications. This material is valued for its excellent magnetic permeability and low core losses, critical factors in enhancing transformer efficiency.

The widespread availability and relative cost-effectiveness of iron-based amorphous metals contribute to their extensive use.

Furthermore, iron-based cores have proven reliability in both conventional and emerging power systems, including renewable energy integration. As energy efficiency standards tighten globally, the demand for iron-based amorphous cores is projected to grow steadily.

The Transformers segment is projected to represent 51.2% of the amorphous metal cores market revenue in 2025, making it the leading end-use sector. Transformer manufacturers have prioritized amorphous metal cores for their ability to significantly reduce no-load losses and improve operational efficiency.

The ongoing upgrade of aging electrical grids and the installation of smart grid technologies have created increased demand for transformers with energy-saving cores.

Additionally, regulations promoting environmentally friendly energy solutions have encouraged the adoption of amorphous metal cores in transformers. The segment’s growth is expected to continue as infrastructure investments increase globally.

The amorphous alloy in the iron core of the transformer significantly reduces energy costs and helps increase electrical characteristics while reducing the level of CO2 emissions. Power transmission equipment manufacturers today are searching for a technology that saves energy and decreases their operating costs.

This has encouraged amorphous metal cores manufacturers to develop optimized and energy-efficient products for use in distribution transformers. Normally, 10% of the total electricity generated by an electric company is lost during the distribution and transmission process.

Thus, distribution transformers consisting of amorphous metal cores help save a significant amount of energy and cost. Other uses that benefit from amorphous metal cores include output filter chokes in large Switched-Mode Power Supply (SMPS), power factor correction chokes in UPS systems, and high-power lamp ballasts.

The initial costs of amorphous metal cores are relatively higher as compared to crystalline silicon steel owing to certain beneficial properties such as lower saturation magnetic flux density of amorphous steel than that of silicon steel, which is mostly preferred by transformer manufacturers.

This results in a high cost per unit of large-sized amorphous core transformers. Although, its increased energy efficiency and low operational costs throughout the lifetime of the transformer could help compensate for its substantial initial costs. Therefore, despite high costs, the above-mentioned factors are estimated to boost the market demand for amorphous metal cores in the coming years.

On the other hand, amorphous metal cores have various limitations which may curb the market growth. Hardness, along with reduced thickness, makes slitting and shearing difficult. Moreover, the brittleness property of amorphous metal cores has also made them un-friendly to transformer manufacturers. Due to these limitations, the amorphous metal core technology has been limited at present to very few customers across geographies.

In North America, the global amorphous metal cores market is projected to witness lucrative growth opportunities owing to the USA agreeing to expand the production of amorphous metal core transformers for efficient distribution & transmission of electricity.

The amorphous metal cores market is expected to grow at a rapid pace during the forecast period, due to the high per capita electricity consumption in the USA Governments and utilities are taking various initiatives to introduce energy-efficient transforming solutions, which is anticipated to drive revenue growth.

Moreover, regions such as East Asia and South Asia are also estimated to witness lackluster growth driven by major installations of amorphous metal core transformers in India and China. The recent electrification projects are heavily investing in energy-efficient technology which is expected to drive growth for the amorphous metal cores market over the slated time period.

The European countries are also facing an upsurge in the amorphous metal cores market. For instance, Spanish utility companies have started to import the amorphous metal core transformers and are also promoting in-house manufacturing of the same with local manufacturers.

Since amorphous metal cores do not have anisotropic properties, it shows excellent magnetic behavior such as minimum iron loss while having high-saturation magnetic flux density with high permeability. Amorphous metal cores are generally used in distribution transformers.

In terms of the end-use sector, Amorphous metal cores are commonly preferred in renewable energy systems such as solar power and wind energy, as they typically operate with 20 - 40% low load conditions. Amorphous metal cores have been used in liquid-filled transformers for over 20 years, and now this technology is trending in dry-type transformers as well.

The global amorphous metal cores market has numerous small-scale and international manufacturers at the regional level. Few industry players are identified across the value chain of the global amorphous metal cores market, which are Hitachi, Ltd., Advanced Technology & Materials Co., Ltd., Zhaojing Incorporated, Qingdao Yunlu New Energy Technology Co., Ltd., China Amorphous Technology Co.,Ltd, ENPAY, Mangal Electrical Industries Pvt. Ltd., KOTSONS Pvt. Ltd., Usha Amorphous Metals Ltd., and Ti-Electronic.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 7.5% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD Million/ Billion and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Product Type, Application, End Use & Region |

| Regional scope | North America (USA, Canada); Latin America (Mexico, Brazil); North America (USA, Canada); Latin America (Mexico, Brazil); Western Europe (Germany, Italy, France, UK, Spain); Eastern Europe (Poland, Russia); Asia Pacific (China, India, ASEAN, Australia & New Zealand); Japan; Middle East and Africa (GCC Countries, S. Africa, Northern Africa) |

| Country scope | USA, Canada, Mexico, Brazil, USA, Canada, Mexico, Brazil, Germany, Italy, France, UK, Spain, Poland, Russia, China, India, ASEAN, Australia & New Zealand, Japan, GCC Countries, S. Africa, Northern Africa |

| Key companies profiled | Hitachi, Ltd., Advanced Technology & Materials Co., Ltd., Zhaojing Incorporated, Qingdao Yunlu New Energy Technology Co., Ltd., China Amorphous Technology Co.,Ltd, ENPAY, Mangal Electrical Industries Pvt. Ltd., KOTSONS Pvt. Ltd., Usha Amorphous Metals Ltd., Ti-Electronic |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global amorphous metal cores market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the amorphous metal cores market is projected to reach USD 2.0 billion by 2035.

The amorphous metal cores market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in amorphous metal cores market are e core, c core and others.

In terms of application, iron based segment to command 58.9% share in the amorphous metal cores market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA