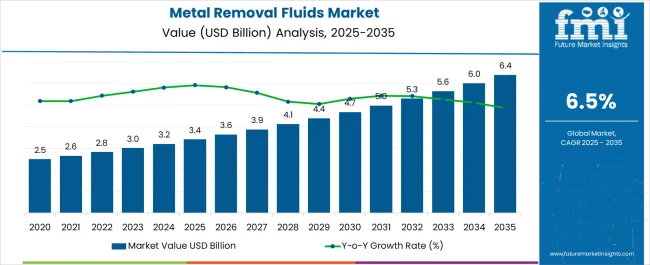

The Metal Removal Fluids Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Metal Removal Fluids Market Estimated Value in (2025 E) | USD 3.4 billion |

| Metal Removal Fluids Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Metal Removal Fluids market is witnessing steady growth, driven by the increasing demand for efficient and precise machining operations across automotive, aerospace, and industrial manufacturing sectors. The adoption of advanced fluids is being fueled by their ability to improve tool life, enhance surface finish, and reduce friction and heat generation during metal cutting processes. Continuous innovations in fluid formulations, including the integration of additives for corrosion protection, lubricity enhancement, and microbial stability, are further supporting market expansion.

The growing need to maintain compliance with environmental and safety regulations has prompted the development of eco-friendly and water-miscible fluid variants. Manufacturers are increasingly focusing on optimizing fluid performance to support high-speed machining and precision engineering applications.

Rising production volumes, coupled with the push for automation and advanced manufacturing technologies, are accelerating adoption As industries prioritize cost efficiency, operational reliability, and sustainability in metalworking processes, the Metal Removal Fluids market is expected to maintain robust growth over the coming decade.

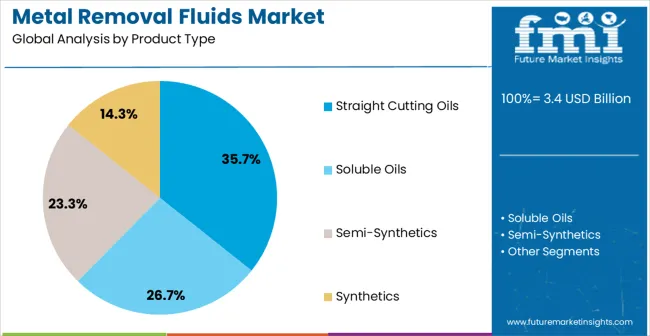

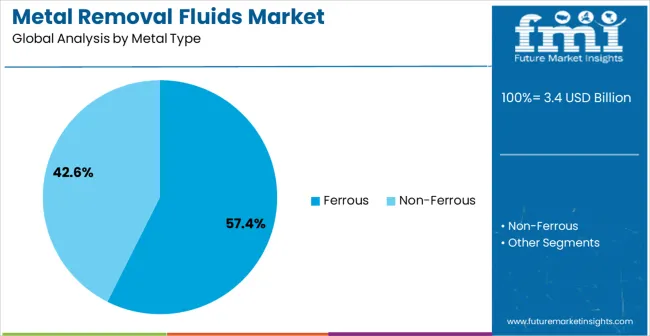

The metal removal fluids market is segmented by product type, metal type, and geographic regions. By product type, metal removal fluids market is divided into Straight Cutting Oils, Soluble Oils, Semi-Synthetics, and Synthetics. In terms of metal type, metal removal fluids market is classified into Ferrous and Non-Ferrous. Regionally, the metal removal fluids industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The straight cutting oils segment is projected to hold 35.7% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is being driven by its superior lubricity and high-pressure performance, which reduce friction, tool wear, and heat generation during cutting and machining operations. Straight oils are particularly favored for heavy-duty applications and hard-to-machine metals, providing enhanced surface finish and dimensional accuracy.

Their stability under high temperatures and load conditions further supports widespread adoption in industrial manufacturing and automotive sectors. The ability to extend tool life and improve productivity contributes to cost efficiency for end users.

Continuous advancements in additive technologies and formulations have enhanced corrosion resistance, microbial stability, and environmental compliance, further reinforcing the segment’s market leadership As demand for precision machining and high-efficiency operations continues to grow globally, the straight cutting oils segment is expected to maintain its dominant position.

The ferrous segment is anticipated to account for 57.4% of the market revenue in 2025, making it the leading metal type category. Growth in this segment is being driven by the extensive use of ferrous metals, including steel and cast iron, across automotive, construction, and heavy machinery industries. Metal removal fluids designed for ferrous applications provide superior cooling, lubrication, and chip removal, which reduce wear on cutting tools and improve operational efficiency.

The ability to maintain dimensional accuracy and surface finish during machining of high-hardness ferrous metals enhances productivity and quality standards. Increasing industrial automation, higher production volumes, and the need for precision engineering are further supporting adoption.

Regulatory requirements for safe handling and environmentally compliant fluid formulations also play a role in shaping demand As ferrous metals remain a staple in industrial manufacturing, the segment is expected to maintain its market dominance, driven by performance advantages and ongoing technological improvements in fluid formulations.

Metal Removal Fluids are generally used in the metal working processes involving use of industrial milling and grinding operations. During the cutting process, significant amount of heat is generated in both, metalworking tools and in the machined parts. This is likely to impact the physical properties of the end product and may also result in tool damage.

Metal removal fluids enable cooling of the metal tool and machined parts during the metal working operation. Also, the metal removal fluid enhance workability at relatively higher pressure and temperatures, this helps in reducing heat and friction in ferrous and non-ferrous metals and further provides ability to operate for relatively longer time period.

During metalworking operations in high temperature and high pressure conditions, damages such as gouging and tearing to the surface are likely to arise. In order to ensure that such complications are avoided, metal removal liquid is formulated in such a way that it exhibits relatively lower coefficient of friction and enhanced flow-ability.

Commercially metal removal fluids are available in to two types, water miscible oils and non-water miscible oils. Water miscible oils is further segmented into soluble, synthetic and semi-synthetic oils which are find relatively higher application in machinery segment and metal fabricated products.

These oils are synthesized in a way which enables them to provide extensive range of performance abilities for different applications and also meeting all the industrial requirements.

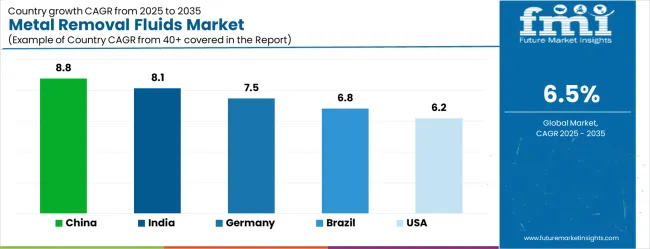

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK | 5.5% |

| Japan | 4.9% |

The Metal Removal Fluids Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.9%, yet still underscores a broadly positive trajectory for the global Metal Removal Fluids Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Metal Removal Fluids Market is estimated to be valued at USD 1.3 billion in 2025 and is anticipated to reach a valuation of USD 1.3 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 161.5 million and USD 85.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Product Type | Straight Cutting Oils, Soluble Oils, Semi-Synthetics, and Synthetics |

| Metal Type | Ferrous and Non-Ferrous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

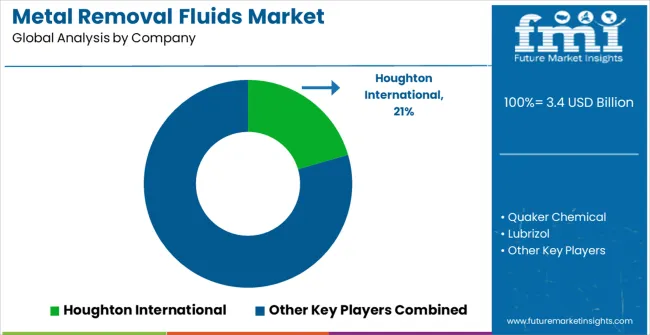

| Key Companies Profiled | Houghton International, Quaker Chemical, Lubrizol, Precision Fluids, J&S Chemical, Optimum Oils, and Schaeffer |

The global metal removal fluids market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the metal removal fluids market is projected to reach USD 6.4 billion by 2035.

The metal removal fluids market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in metal removal fluids market are straight cutting oils, soluble oils, semi-synthetics and synthetics.

In terms of metal type, ferrous segment to command 57.4% share in the metal removal fluids market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metalworking Fluids Market Growth - Trends & Forecast 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA