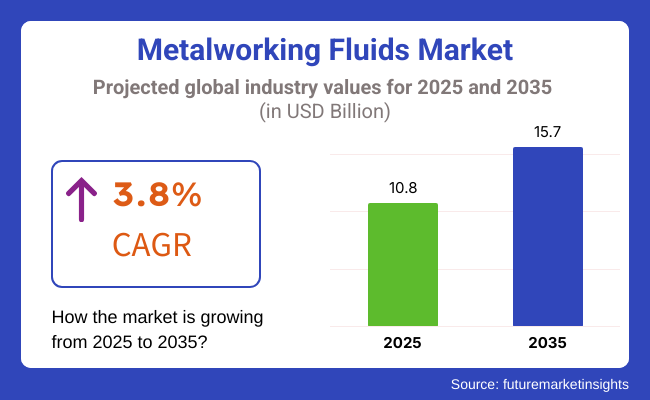

The global metalworking fluids market is projected to grow from USD 10.8 billion in 2025 to USD 15.7 billion by 2035, advancing at a CAGR of 3.8% during the forecast period. This growth is being shaped by increasing industrial activity, particularly in automotive, aerospace, and heavy equipment manufacturing, where high-performance machining and component precision are critical. As manufacturers continue to push for improved output quality and tool life, the demand for advanced metalworking fluids that enhance cooling, lubrication, and chip removal efficiency is rising.

The expanding adoption of automation and precision manufacturing technologies is reinforcing the importance of reliable and thermally stable fluid formulations. Applications involving high-speed cutting, deep drilling, and complex alloy processing are requiring fluids with enhanced lubricity and reduced foam generation. In this context, synthetic and semi-synthetic fluids are gaining preference due to their performance stability, extended service life, and lower residue accumulation.

Stricter regulatory frameworks related to waste management, volatile organic compound (VOC) emissions, and occupational health have placed pressure on manufacturers to innovate in safer, more sustainable solutions. Demand is shifting toward water-soluble, biodegradable, and low-toxicity formulations that align with evolving environmental and workplace safety standards. Compliance with frameworks such as REACH in Europe and OSHA regulations in North America is pushing the market toward next-generation fluid chemistries.

Metalworking fluids are also being increasingly tailored for compatibility with lightweight alloys, composites, and high-strength metals used in electric vehicle (EV) platforms and aerospace structures. These materials require specialized cooling and lubrication strategies, further supporting the development of high-performance, additive-rich fluid blends.

Forming fluids are projected to represent approximately 29% of the global metalworking fluid market share in 2025 and are expected to grow at a CAGR of 3.2% through 2035. These fluids are used in applications such as forging, rolling, drawing, and stamping, where they provide lubrication, cooling, and friction reduction during metal shaping processes.

Demand is sustained by expanding automotive and industrial manufacturing across Asia-Pacific, where large-scale metal forming operations are concentrated. Manufacturers are focusing on developing forming fluids with enhanced extreme pressure resistance, oxidation stability, and environmental compliance to support high-speed operations and tool longevity.

Synthetic fluids are estimated to hold approximately 16% of the global metalworking fluid market share in 2025 and are forecast to grow at a CAGR of 4.0% through 2035. These fluids, composed entirely of chemical compounds and free from mineral oil, are widely used in high-precision machining, aerospace part manufacturing, and CNC operations.

Their advantages include improved cooling efficiency, lower bacterial growth, and compatibility with a wide range of alloys. With manufacturers increasingly prioritizing clean machining environments, sustainability goals, and lower total cost of ownership, synthetic fluids are gaining momentum as the preferred choice over traditional soluble oils and emulsions. The category continues to benefit from R&D focused on low-foam, bio-stable, and additive-enhanced formulations.

Environmental Regulation and Fluid Disposal Concerns

Some of the challenges facing the Metalworking Fluids Market include shifts in market dynamics as the industry evolves and increasing regulatory scrutiny for the management of metalworking fluids with evolving empathetic design patterns.

It has prompted governments across the world to establish stringent guidelines on the disposal and formulation of metalworking fluids, which includes limiting the use of hazardous chemicals and maintaining proper waste management. The industry will need to pivot and create new bio-based alternatives of plastics, in addition to moving to new forms of recycling.

How effectively you comply with these regulations will resultantly increase your production cost, since companies have to invest in environmentally friendly formulations and to dispose of waste sustainably. However, meeting compliance requirements with account for cost-effective solutions without sacrificing fluid efficiency, and machine performance is key for manufacturers to stay competitive in the marketplace.

Moreover, companies have to build extensive R&D to develop high performance formulations which are aligned to global environmental policies. Education and training programs for manufacturers and end-users regarding the best practices for the handling and disposal of metalworking fluids will likewise be at the forefront of navigating changing regulatory landscapes.

Potential Breakthrough Developments in Synthetic and Bio-Based Metalworking Fluids

With the increasing trend for synthetic and bio-based metalworking fluids, the market has a major opportunity to grow. Manufacturers are turning to sophisticated formulations that provide superior lubrication and cooling properties, improved fluid life and reduced environmental impact. Within automotive, aerospace and heavy machinery segments, high-performance fluids that enhance efficiency of machining processes and minimize downtime are being sought after.

Nanotechnology and additives as well as new innovation provide better stability of the fluid, less bacteria contamination, and better durability of the tools. Market participants are increasingly focusing on the development of next-generation metalworking fluids which may include features such as improved sustainability, cost-effectiveness, and performance.

In addition, it is anticipated that the development of custom formulations designed for specific machining processes will drive additional revenue streams. Working alongside organizations and research institutions focused on sustainability will enable the creation of next-generation, environmentally conscious lubricants that boost industrial efficiency and support global sustainability targets.

United States metalworking fluids marketplace continues developing steadily with increasing requirement from automotive, plane, and general production industries. The United States represents a worldwide pioneer in metallic machining and fabrication, with sectors depending mainly on high-performance lubricants and coolants for maximizing machining performance and instrument lifetime.

The protection and aviation business is a significant user of custom-made metallic functioning fluids, since high-tolerance manufacture and exactness machining tasks necessitate sophisticated lubrication products. The automotive sector's transfer towards electric automobiles (EVs) and light-weight materials is also propelling requirement for future-generation metallic functioning fluids.

Precision and complexity characterize operations throughout many manufacturing sectors in the USA, driving the continuing evolution of sophisticated fluids that facilitate optimized product quality and output.

With strict OSHA directives on disclosure to harmful fluids in the workplace and increasing usage of bio-based and synthetic MWFs, the evolving USA marketplace will keep growing steadily on the whole as innovative solutions address evolving industrial and environmental needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

UK metalworking fluids market has grown steadily due to increasing demand from precision engineering and aerospace sectors that require high-performing cutting and grinding fluids. BAE Systems and Rolls-Royce have fueled consumption in their aerospace operations.

Environmental regulations have also motivated use of less toxic, sustainable fluids. Beyond this, automakers transitioning to electric powertrains and lightweight materials increasingly turn to hybrid and synthetic metalworking options. While European REACH rules tighten oversight of industrial materials, the need for compliant fluids in the UK means its market remains primed for stable expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

The markets for metalworking fluids within the European Union have demonstrated stable increases in recent times owing to rises in automation initiatives within industry and strong manufacturing levels for vehicles and aircraft.

Germany has developed as the largest customer of these fluids in the block, with demand driven particularly by its engineering and automotive sectors that depend seriously on sophisticated metalworking fluids for intricate precision work. Italy has also become a substantial customer.

The EU's long-held concentration on sustainability and occupational safety has led fluid producers to invent innovative, less hazardous solutions that efficiently lubricate and cool intricate metal forming procedures while protecting both employees and the environment.

Policies at both the national and EU levels, such as REACH and the Industrial Emissions Directive, have necessarily pushed for alternatives like bio-based and low-VOC fluids intended to reinforce protections for workers and decrease environmental impacts.

Continuing investment in advanced production techniques for instance 3D metal printing and computer numeric control, combined with expanding execution of water-soluble synthetic fluids, implies steady growth in metalworking fluid intake across the EU for the foreseeable future. This growth will be reinforced by the bloc's emphasis on accountable utilization of resources and stringent standards that prioritize worker safety and protection of the environment throughout intricate manufacturing operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

The metalworking fluid market in Japan is growing gradually with precision manufacturing in the automotive, electronics, and machine sectors. The local motor vehicle sector, including auto producers such as Toyota, Honda, and Nissan in Japan, is one of the leading consumers of high-performance MWFs for metal working and machining operations.

Electronics is also the leading driving industry, requiring ultra-clean metalworking fluids in the manufacture of semiconductors and precision parts. To that end, Japan's evolving technologies in the automation and smart manufacturing sector are also spreading the demand to low-maintenance and high-efficiency metalworking fluids.

With the growing demand for low-emission and environmentally friendly industrial lubricants, the Japanese market for metalworking fluids is bound to grow on a continuous basis.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

South Korean metalworking fluid industry is expanding with rapid industrialization, strong demand in automotive and electronics manufacturing, and rapidly expanding investments in precision engineering. South Korea's automotive industry, led by Hyundai and Kia, is one of the biggest consumers of high-performance forming and cutting fluids.

The electronics and semiconductor industries, dominated by Samsung and SK Hynix, are the leading growth drivers for ultra-pure metalworking fluids applied in precision machining operations. Government initiatives toward environmentally friendly manufacturing processes also continue to fuel the demand for synthetic and bio-based lubricants.

Since there is ongoing technological innovation in industrial automation and growing investment in high-technology lubricants, South Korean metalworking fluids will experience ongoing growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Companies are developing advanced semi-synthetic and high-performance cutting fluids aimed at improving tool life, surface finish, and sump life, even in demanding conditions. These products focus on essential features like lubricity, biostability, low foam generation, and user safety, responding to the increasing need for efficiency and eco-friendly solutions. Manufacturers are also catering to specialized markets, such as aerospace alloys and high-strength metals, by offering fluids designed to perform effectively under high-pressure and high-speed cutting conditions.

The overall market size for Metalworking Fluids Market was USD 10.8 Billion in 2025.

The Metalworking Fluids Market expected to reach USD 15.7 Billion in 2035.

The demand for the Metalworking Fluids Market will be driven by the growing automotive and manufacturing industries, increased demand for high-performance machinery, and advancements in machining technologies. Rising awareness of product quality, efficiency, and sustainability will also propel market growth during the forecast period.

The top 5 countries which drives the development of Metalworking Fluids Market are USA, UK, Europe Union, Japan and South Korea.

Semi-Synthetic Oils and Synthetic Oils Drive Market Growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Emulsifiable Metalworking Fluid Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Fracking Fluids And Chemicals Market Size and Share Forecast Outlook 2025 to 2035

EDM Oils/Fluids Market

Quenching Fluids & Salts Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Fluids Market Analysis - Size, Share, and Forecast 2025 to 2035

Hydraulic Fluids & Process Oil Market Size 2025 to 2035

Technical Fluids Market

Clear Brine Fluids Market

Transmission Fluids Market Trends & Demand 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Power Steering Fluids Market

Fire Resistant Fluids Market

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Immersion Cooling Fluids Market Size and Share Forecast Outlook 2025 to 2035

Drilling and Completion Fluids Market Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Non-Flammable Hydraulic Fluids Market

Synthetic Lubricants and Functional Fluids Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA