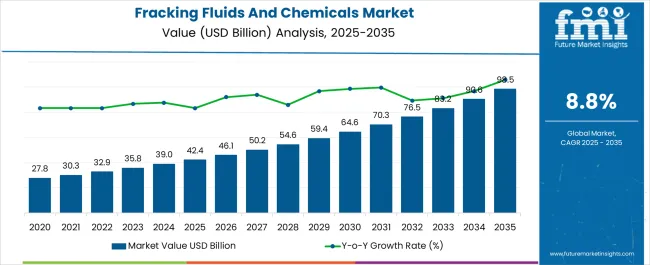

The Fracking Fluids And Chemicals Market is estimated to be valued at USD 42.4 billion in 2025 and is projected to reach USD 98.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

| Metric | Value |

|---|---|

| Fracking Fluids And Chemicals Market Estimated Value in (2025 E) | USD 42.4 billion |

| Fracking Fluids And Chemicals Market Forecast Value in (2035 F) | USD 98.5 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The fracking fluids and chemicals market is experiencing significant growth, supported by the expansion of shale gas exploration and the increasing reliance on unconventional oil and gas resources. Rising global energy demand, particularly from industrial and power generation sectors, is driving the deployment of hydraulic fracturing technologies that require advanced fluid formulations. The market is benefiting from innovations that improve fluid efficiency, reduce water consumption, and minimize environmental impacts through biodegradable and low-toxicity additives.

Regulatory pressure regarding water usage and chemical disposal is encouraging the development of eco-friendly alternatives, further stimulating product innovation. Investment in upstream oil and gas exploration activities across North America, Asia-Pacific, and parts of the Middle East is reinforcing long-term demand.

Enhanced recovery rates and improved operational efficiency offered by optimized fluid chemistries are strengthening market adoption As energy companies aim to maximize well productivity while adhering to stricter environmental standards, the fracking fluids and chemicals market is positioned to grow steadily, with technological advancements paving the way for sustainable and cost-effective solutions.

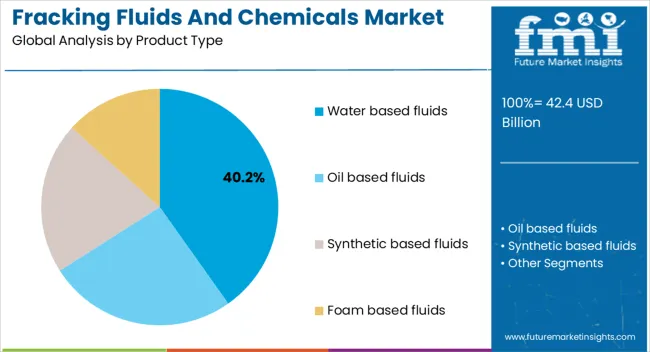

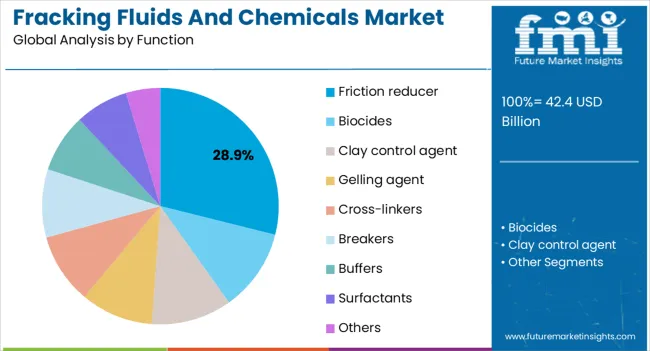

The fracking fluids and chemicals market is segmented by product type, function, and geographic regions. By product type, fracking fluids and chemicals market is divided into Water based fluids, Oil based fluids, Synthetic based fluids, and Foam based fluids. In terms of function, fracking fluids and chemicals market is classified into Friction reducer, Biocides, Clay control agent, Gelling agent, Cross-linkers, Breakers, Buffers, Surfactants, and Others. Regionally, the fracking fluids and chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The water based fluids segment is projected to hold 40.2% of the fracking fluids and chemicals market revenue share in 2025, making it the leading product type. Its leadership is being driven by widespread availability, lower cost compared to alternative fluid systems, and ease of handling in field operations. Water based formulations provide high compatibility with various additives and proppants, ensuring consistent performance across diverse geological formations.

The segment is also being supported by the rising emphasis on reducing environmental impact, as these fluids can be designed with biodegradable and less toxic components. Their adaptability to large-scale hydraulic fracturing operations has reinforced their adoption in shale gas extraction, particularly in regions with abundant water resources.

Continuous improvements in water treatment and recycling technologies are further strengthening the sustainability of this segment, enabling operators to reduce freshwater consumption With the ability to balance cost efficiency, environmental compliance, and operational performance, water based fluids are expected to retain their dominant position in the global market.

The friction reducer segment is anticipated to account for 28.9% of the fracking fluids and chemicals market revenue share in 2025, making it the dominant functional category. This leadership is being supported by the critical role friction reducers play in lowering pumping pressure, reducing energy consumption, and enabling higher fluid injection rates during hydraulic fracturing operations. Their effectiveness in improving operational efficiency and minimizing mechanical wear on equipment has established them as an indispensable component of modern fracking fluids.

The segment is benefiting from advancements in polymer-based chemistries that enhance solubility, reduce formation damage, and improve performance under varying geological and temperature conditions. Growing shale exploration activity across key regions, combined with the demand for higher productivity wells, is further boosting adoption.

Additionally, efforts to develop environmentally friendly and cost-effective friction reducer formulations are supporting long-term market growth With their proven ability to optimize operational performance and support sustainable fracturing practices, friction reducers are expected to maintain a leading role in the global market.

Fracking fluids and chemicals are a cluster of chemicals used in hydraulic fracturing. Hydraulic fracturing is a breaking process of underground rock carried out by injecting fluid along with sand and additives at high pressure to release natural gas and oil. This hydraulic fracturing has provided access to more clean energy.

The fracturing fluids and chemicals are used to minimize the pressure loss due to friction, for creation of wide fracture by generating enough pressure drop, to maintain well stability etc. In hydraulic fracturing, fluids and chemical additives serve many functions such as preventing corrosion, dissolving minerals, stabilizing the product, preventing scale deposition and maintaining the viscosity of fluid among the others.

The changing trend of drilling wells towards horizontal drilling is expected to drive the growth of global market for fracking fluids and chemicals. Over the recent past, there has been a significant increase in horizontal fracking activity. This activity necessitates a relatively larger amount of fracking fluids and chemicals.

As such, the demand for fracking fluids and chemical has witnessed a steady growth. The trend is expected to continue over the forecast period. The increasing demand for energy needs more exploration which in turn results in increasing demand for fracking fluids and chemicals. Backflow of the water or fracking fluid to the surface contaminates the surface and ground water.

Thus, strict environmental regulations and alternatives to fracking fluids are major factors that are expected to restrain the growth of fracking fluids and chemicals market during the forecast period.

The global fracking fluids and chemical market is segmented into seven geographical regions namely North America, Latin America, Western Europe, Eastern Europe, Middle East & Africa, Asia-Pacific (excluding Japan) and Japan. Increasing oil & gas exploration activity in North America has resulted in the region accounting for a largest share in global fracking fluid and chemical market.

Although hydraulic fracturing activity is relatively slower in Asia Pacific region, the region is expected to register a robust growth over the forecast period.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

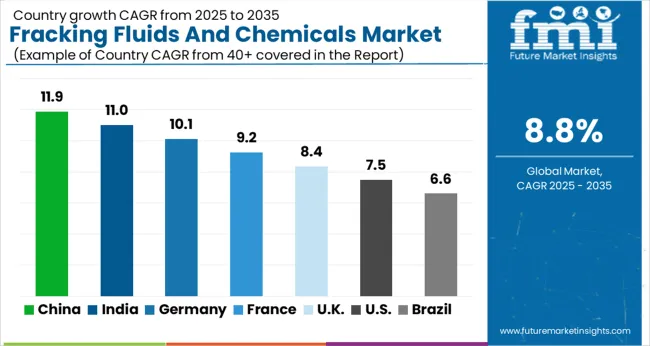

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

The Fracking Fluids And Chemicals Market is expected to register a CAGR of 8.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.9%, followed by India at 11.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.6%, yet still underscores a broadly positive trajectory for the global Fracking Fluids And Chemicals Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.1%. The USA Fracking Fluids And Chemicals Market is estimated to be valued at USD 14.4 billion in 2025 and is anticipated to reach a valuation of USD 29.7 billion by 2035. Sales are projected to rise at a CAGR of 7.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.0 billion and USD 1.2 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 42.4 Billion |

| Product Type | Water based fluids, Oil based fluids, Synthetic based fluids, and Foam based fluids |

| Function | Friction reducer, Biocides, Clay control agent, Gelling agent, Cross-linkers, Breakers, Buffers, Surfactants, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

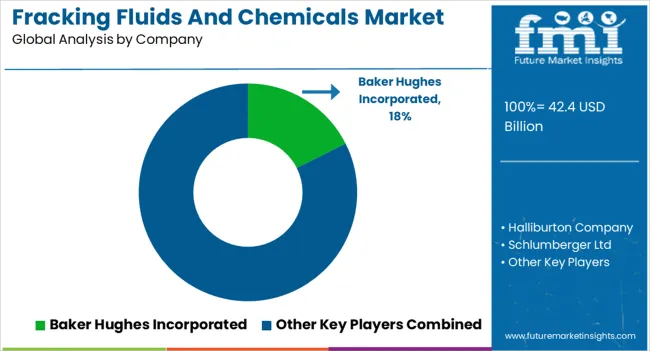

| Key Companies Profiled | Baker Hughes Incorporated, Halliburton Company, Schlumberger Ltd, E. I. du Pont de Nemours and Company, Pioneer Engineering Services, BASF SE, The Dow Chemical Company, and Akzo Nobel N.V. |

The global fracking fluids and chemicals market is estimated to be valued at USD 42.4 billion in 2025.

The market size for the fracking fluids and chemicals market is projected to reach USD 98.5 billion by 2035.

The fracking fluids and chemicals market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in fracking fluids and chemicals market are water based fluids, oil based fluids, synthetic based fluids and foam based fluids.

In terms of function, friction reducer segment to command 28.9% share in the fracking fluids and chemicals market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA