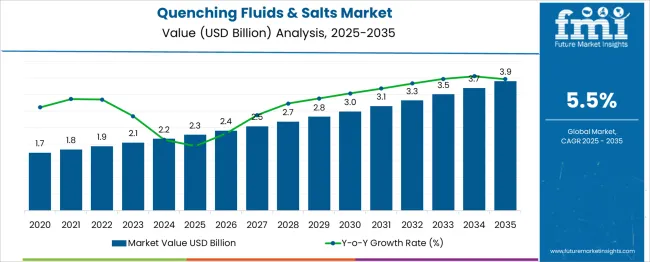

The Quenching Fluids & Salts Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. Disruption risk assessment for this market indicates moderate vulnerability due to evolving environmental regulations, shifts in metallurgical processes, and the adoption of alternative heat-treatment technologies.

Regulatory constraints on chemical formulations and disposal protocols could impose compliance costs that affect margins, particularly for traditional oil- and salt-based quenching media. These factors could slow adoption of legacy products while accelerating demand for environmentally compliant or bio-based substitutes. Technological disruption also poses a moderate risk.

Emerging induction and laser-based quenching techniques, offering faster processing and reduced energy consumption, have the potential to replace conventional quenching fluids in high-precision applications partially. However, the market’s annual growth trajectory, from USD 2.3 billion in 2025 to USD 2.8 billion by 2030 and reaching USD 3.9 billion in 2035, reflects continued reliance on traditional fluid and salt formulations across standard heat-treatment operations, suggesting a gradual adoption curve rather than abrupt displacement.

Supply chain disruptions, including raw material price fluctuations and dependency on key chemical intermediates, constitute a secondary risk, potentially impacting cost structures and production schedules. The market demonstrates resilience, with incremental annual growth indicating that while technological and regulatory disruptions exist, the overall expansion trajectory remains stable, allowing players to mitigate risks through process innovation, compliance alignment, and portfolio diversification.

| Metric | Value |

|---|---|

| Quenching Fluids & Salts Market Estimated Value in (2025 E) | USD 2.3 billion |

| Quenching Fluids & Salts Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Quenching Fluids & Salts market is demonstrating steady expansion, supported by the growing demand for efficient heat treatment processes in metalworking industries. Rising investments in manufacturing infrastructure and advancements in metallurgy have been contributing to the market’s growth. Increased emphasis on improving the durability and strength of metal components has encouraged the adoption of specialized quenching solutions.

Press releases and corporate updates indicate that stricter quality standards in automotive, aerospace, and heavy machinery sectors are driving the need for high-performance quenching fluids and salts. Sustainability initiatives and the shift toward environmentally responsible formulations have also been influencing market dynamics positively.

The future outlook appears robust, as technological innovations and the trend toward automation in heat treatment are expected to open new opportunities. Ongoing research into extending the life cycle of quenching media and improving process efficiency further supports the potential for continued growth in both established and emerging economies.

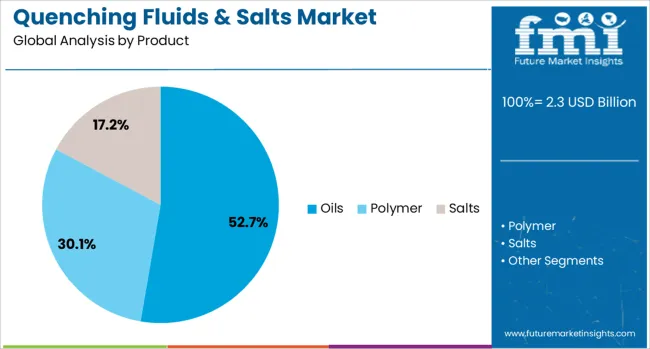

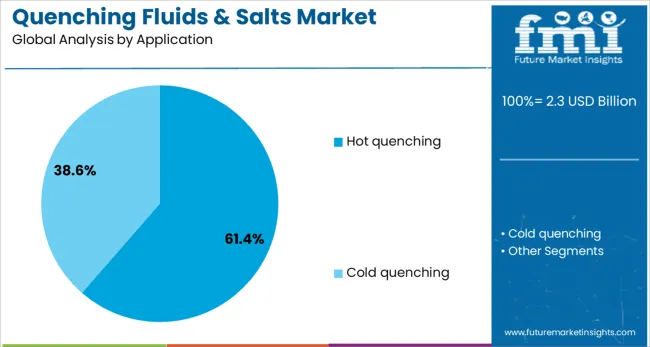

The quenching fluids & salts market is segmented by product, application, end-user industry, and geographic regions. The product of the quenching fluids & salts market is divided into Oils and Polymer Salts. In terms of application, the quenching fluids & salts market is classified into Hot quenching and Cold quenching.

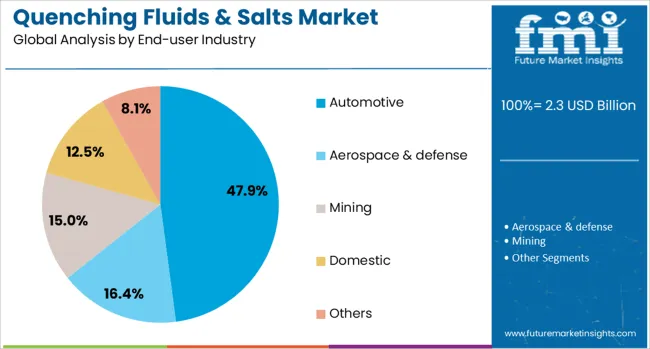

The end-user industry of the quenching fluids & salts market is segmented into Automotive, Aerospace & defense, Mining, Domestic, and others. Regionally, the quenching fluids & salts industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil product segment is projected to hold 52.7% of the Quenching Fluids & Salts market revenue share in 2025, establishing itself as the leading product type. This leadership has been attributed to its proven effectiveness in achieving uniform cooling rates and minimizing distortions in metal components. Oils have been widely preferred due to their ability to deliver consistent results across a variety of metals and heat treatment processes.

Industry publications and technical datasheets highlight that the segment benefits from its relatively lower cost, ease of application, and compatibility with existing equipment. Moreover, oils are known for offering superior surface finish and reduced cracking risk, which are critical in meeting stringent quality requirements.

The widespread availability of formulated oil-based solutions with enhanced thermal stability and oxidation resistance has further strengthened their position in the market. These advantages have collectively supported the dominance of oils as the preferred quenching medium in 2025.

The hot quenching application segment is anticipated to account for 61.4% of the Quenching Fluids & Salts market revenue share in 2025, making it the leading application segment. This prominence has been driven by its ability to deliver controlled cooling and reduce internal stresses in complex metal parts. Reports from industry forums and corporate updates emphasize that hot quenching is increasingly adopted in applications where precise metallurgical properties are required.

Its effectiveness in improving toughness and minimizing distortions has made it highly suitable for critical components in automotive and aerospace manufacturing. The segment’s growth has also been reinforced by its compatibility with advanced steel grades and its ability to meet evolving quality standards.

Furthermore, hot quenching’s contribution to extending tool life and ensuring uniform hardness profiles has elevated its importance in modern manufacturing environments. These factors have consolidated its leading role in the overall market in 2025.

The automotive end-user industry segment is expected to hold 47.9% of the Quenching Fluids & Salts market revenue share in 2025, securing its position as the largest end-use segment. This dominance has been supported by the automotive industry’s continuous focus on producing high-strength, lightweight, and durable metal components. Investor presentations and annual reports highlight that the segment benefits from the growing vehicle production and stringent performance standards for automotive parts.

The need for precise heat treatment to enhance fatigue resistance and ensure safety compliance has led to increased adoption of specialized quenching solutions. In addition, the trend toward electric vehicles and advanced drivetrains has driven demand for high-performance materials treated with reliable quenching processes.

The automotive sector’s investment in automation and advanced manufacturing technologies has further supported the use of efficient and environmentally friendly quenching fluids and salts. These factors have ensured the sustained leadership of the automotive segment in the market in 2025.

The market has been growing steadily due to the increasing demand for controlled cooling processes in metal heat treatment. These solutions have been used to enhance the hardness, strength, and wear resistance of steel, aluminum, and other alloys across automotive, aerospace, and heavy machinery sectors. Advancements in chemical formulations, improved thermal stability, and safer handling properties have supported adoption. Rising industrialization, infrastructure development, and the need for efficient metallurgical processes have further strengthened market growth globally.

The automotive and aerospace sectors have been key drivers of the quenching fluids and salts market due to stringent requirements for component strength, durability, and fatigue resistance. Heat-treated parts such as gears, shafts, and turbine components have required precise quenching to achieve optimal mechanical properties. The use of specialized quenching fluids and salts has enabled uniform cooling, minimizing distortion and improving metallurgical quality. Advanced alloys used in modern vehicles and aircraft have necessitated the development of high-performance quenching solutions capable of handling higher temperatures and complex geometries. The increasing production of passenger vehicles, commercial aircraft, and defense platforms has amplified demand for reliable quenching media. The adoption of precision engineering practices has led to enhanced process control and material performance, reinforcing the reliance on advanced quenching fluids and salts in critical industrial applications.

Innovations in chemical formulation and process design have significantly influenced the quenching fluids and salts market. Modern quenching solutions have been engineered to provide superior thermal conductivity, reduced oxidation, and controlled cooling rates. Additives such as corrosion inhibitors, surfactants, and stabilizers have enhanced fluid performance, safety, and lifespan. Salt-based quenching media have been optimized for improved solubility, temperature uniformity, and reduced environmental impact. Automation of quenching processes, combined with digital temperature monitoring and flow control systems, has improved repeatability and quality assurance in heat treatment operations. These technological enhancements have allowed manufacturers to maintain consistent hardness, tensile strength, and surface finish in treated components. The development of eco-friendly and biodegradable quenching fluids has also broadened market acceptance, especially in regions with strict environmental regulations, supporting sustainable metallurgical practices.

Heavy machinery, construction equipment, and industrial maintenance operations have driven demand for quenching fluids and salts due to the need for extending component life and performance under rigorous operating conditions. Quenching has been critical for tools, dies, and metal parts subjected to repeated stress, wear, and temperature fluctuations. Regular replacement and replenishment of quenching media have been performed to maintain consistent cooling efficiency and avoid defects in heat-treated materials. Industries such as mining, shipbuilding, and steel production have relied on high-quality quenching solutions to ensure reliability and reduce equipment downtime. Additionally, repair workshops and aftermarket services have increasingly adopted portable and easy-to-use quenching fluids to support in-field metallurgical operations. This sustained demand from maintenance-intensive sectors has reinforced the role of quenching media as an essential component in metal treatment processes worldwide.

The rising focus on sustainability and environmental compliance has created new opportunities for the quenching fluids and salts market. Water-based, biodegradable, and low-toxicity quenching fluids have been developed to reduce chemical hazards and improve workplace safety. Specialty salts and polymer-based media have been formulated to provide controlled cooling rates, minimal oxidation, and enhanced component surface quality. Emerging applications in additive manufacturing and advanced alloy treatments have further increased the need for tailored quenching solutions. Manufacturers have invested in research and development to produce versatile quenching media that balance performance, safety, and environmental compliance. Growing regulatory pressure and demand for green manufacturing practices in Europe, North America, and Asia-Pacific have accelerated the adoption of eco-friendly quenching fluids and salts. As metallurgical processes evolve, the focus on efficient, safe, and environmentally responsible quenching solutions is expected to strengthen market expansion.

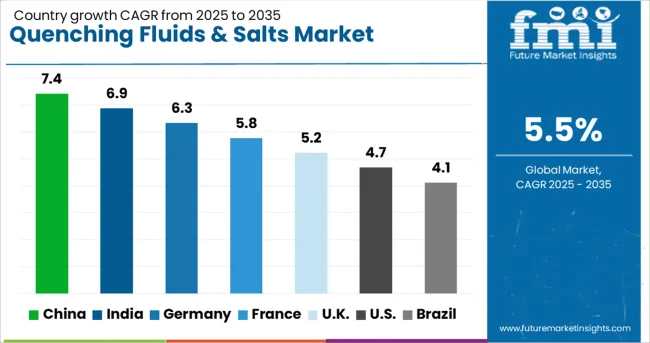

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The market is expected to expand at a CAGR of 5.5% between 2025 and 2035, supported by increased use in heat treatment processes, industrial metalworking, and alloy manufacturing. China leads with a 7.4% CAGR, driven by growing automotive, steel, and machinery production. India follows at 6.9%, with demand rising from manufacturing sectors modernizing metal treatment processes. Germany, at 6.3%, benefits from advanced industrial facilities and precision heat treatment adoption. The UK, with a 5.2% CAGR, experiences steady growth due to metal processing innovations. The USA, at 4.7%, sees gradual expansion fueled by modernization of industrial heat treatment operations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is projected to grow at a CAGR of 7.4% from 2025 to 2035, driven by expanding metallurgical operations and automotive component manufacturing. Domestic chemical manufacturers have focused on optimizing fluid composition for high-temperature durability and corrosion resistance. Industrial clusters in Jiangsu and Guangdong have increasingly adopted automated heat treatment systems, enhancing production efficiency. Collaborative research initiatives between fluid suppliers and steel producers are improving quenching performance and reducing energy consumption. Regulatory guidelines on industrial effluents are encouraging the development of environmentally efficient salts, while demand for specialized quenching solutions is rising across heavy machinery and automotive sectors.

India is expected to expand at a CAGR of 6.9% in the quenching fluids and salts industry over the forecast period, supported by growing steel production and automotive part manufacturing. Key players have been developing alloys and salts tailored for high-performance automotive components. Industrial regions such as Maharashtra and Gujarat are investing in automated heat treatment lines, while demand for high-efficiency quenching fluids has increased among foundries. Domestic research initiatives are focused on reducing operational energy consumption and improving fluid recyclability. Government policies on industrial chemical standards are encouraging adoption of optimized salts.

Germany’s industry is projected to grow at a CAGR of 6.3% between 2025 and 2035, led by the automotive and machinery sectors. Leading chemical suppliers are enhancing fluid formulations for precision heat treatment processes. Industrial adoption is focused on energy-efficient and environmentally compliant quenching technologies. German foundries have implemented advanced control systems for temperature and fluid circulation, improving metallurgical outcomes. Collaborative innovation with OEMs is fostering development of customized quenching solutions for high-strength steel and aluminum alloys.

The industry in the United Kingdom is forecast to expand at a CAGR of 5.2% during 2025 to 2035, driven by demand in aerospace and automotive components. UK manufacturers are focusing on environmentally optimized salts and fluids to comply with emissions and effluent regulations. Adoption of digital heat treatment monitoring systems is enhancing efficiency in foundries and machining plants. Demand is increasing for specialty solutions capable of handling high-strength steels and aluminum alloys used in advanced engineering applications.

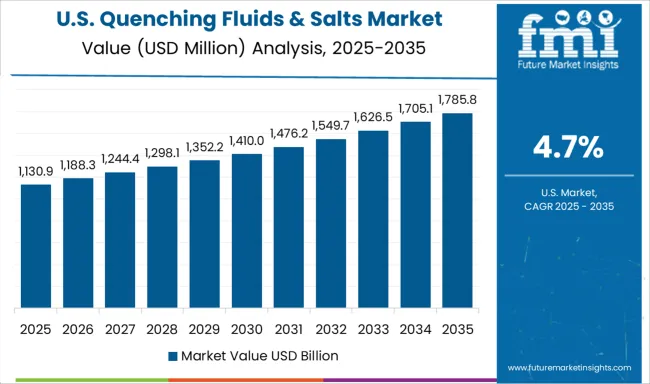

In the United States, the quenching fluids and salts industry is anticipated to grow at a CAGR of 4.7% from 2025 to 2035, driven by demand in automotive, aerospace, and heavy machinery sectors. Suppliers are introducing environmentally friendly salts and high-performance fluids capable of handling modern alloy compositions. Industrial facilities in the Midwest and Southern states are adopting automated heat treatment processes for efficiency and consistency. Demand for high-temperature and corrosion-resistant fluids is increasing across precision engineering and automotive manufacturing. Collaborative innovation between fluid producers and end-users is fostering development of customized solutions.

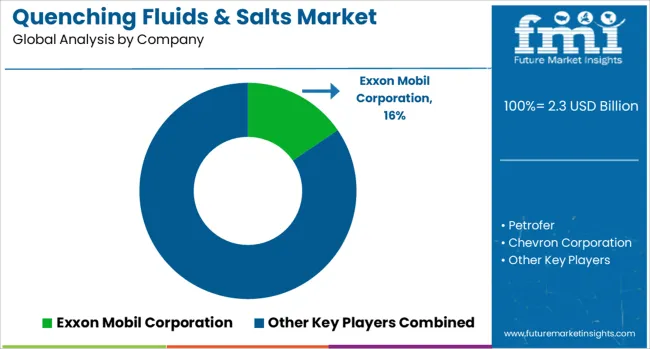

The market is characterized by the presence of global chemical and specialty lubricant suppliers offering high-performance thermal management solutions for metal processing industries. Exxon Mobil Corporation provides advanced quenching oils with optimized cooling rates for automotive and industrial steel applications. Petrofer focuses on synthetic and mineral-based quenchants, delivering products that enhance hardness uniformity and reduce distortion during heat treatment processes.

Chevron Corporation and Chemtool Incorporated Leverage R&D to develop environmentally compliant formulations with improved thermal stability. Quaker Chemical Corporation combines quenching fluids with corrosion inhibitors, catering to precision engineering and steel manufacturing needs. Croda International Plc and Metal Heat Treatment Solutions emphasize bio-based and sustainable fluid alternatives while maintaining performance standards.

CONDAT and FUCHS supply quenching salts and specialty oils with controlled cooling characteristics, ensuring process repeatability for high-value components. Park Thermal International and Castrol Ltd provide turnkey solutions integrating quenchants with process support and metallurgical expertise. Idemitsu Kosan Co., Ltd and Total S.A. offer product lines optimized for both conventional and vacuum heat treatment applications.

Entry barriers remain high due to stringent quality standards, safety compliance, and the need for specialized chemical formulation expertise. Companies prioritizing continuous innovation, targeted R&D, and strategic partnerships with heat treatment facilities maintain a competitive edge in this technically demanding market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Product | Oils, Polymer, and Salts |

| Application | Hot quenching and Cold quenching |

| End-user Industry | Automotive, Aerospace & defense, Mining, Domestic, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Exxon Mobil Corporation, Petrofer, Chevron Corporation, Chemtool Incorporated, Quaker Chemical Corporation, Croda International Plc, Metal Heat Treatment Solutions, CONDAT, FUCHS, Park Thermal International, Castrol Ltd, Idemitsu Kosan Co., Ltd, and Total S.A |

| Additional Attributes | Dollar sales by fluid and salt type and application segment, demand dynamics across automotive, aerospace, and industrial heat treatment processes, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in biodegradable and low-viscosity formulations, corrosion inhibitors, and temperature control technologies, environmental impact of waste disposal, chemical handling, and energy consumption, and emerging use cases in precision quenching, high-strength alloy processing, and additive-enhanced metal treatment processes. |

The global quenching fluids & salts market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the quenching fluids & salts market is projected to reach USD 3.9 billion by 2035.

The quenching fluids & salts market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in quenching fluids & salts market are oils, polymer and salts.

In terms of application, hot quenching segment to command 61.4% share in the quenching fluids & salts market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Quenching Oil Market

Fracking Fluids And Chemicals Market Size and Share Forecast Outlook 2025 to 2035

EDM Oils/Fluids Market

Hydraulic Fluids Market Analysis - Size, Share, and Forecast 2025 to 2035

Hydraulic Fluids & Process Oil Market Size 2025 to 2035

Technical Fluids Market

Clear Brine Fluids Market

Transmission Fluids Market Trends & Demand 2025 to 2035

Metalworking Fluids Market Growth - Trends & Forecast 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Power Steering Fluids Market

Fire Resistant Fluids Market

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Immersion Cooling Fluids Market Size and Share Forecast Outlook 2025 to 2035

Drilling and Completion Fluids Market Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Non-Flammable Hydraulic Fluids Market

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Lubricants and Functional Fluids Market - Growth & Demand 2025 to 2035

Demand for Welding Consumables in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA