The global drilling and completion fluids market is estimated at USD 10.3 billion in 2025 and forecast to reach USD 15 billion by 2035, growing at a CAGR of 3.8%. Growth is driven by increasing global energy demand, rising E&P activities in shale and deep-water reserves, and the adoption of eco-friendly fluid systems.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 10.3 billion |

| Industry Value (2035F) | USD 15 billion |

| CAGR (2025 to 2035) | 3.8% |

The drilling and completion fluids market is undergoing a transformation shaped by evolving regulatory requirements, technological advancements, and operational challenges. Environmental compliance has become a central concern for drilling operations, leading to significant changes in fluid formulation and usage patterns. Countries are increasingly adopting regulations that discourage or ban traditional oil-based fluids, prompting investment in research and development of alternative systems.

From 2020 to 2024, operators focused on transitioning from conventional fluids to lower-toxicity, water-based and synthetic-based systems. These alternatives were developed to reduce ecological impact while maintaining thermal and chemical performance under operational stress. For example, Total Energies and Equinor implemented low-toxicity fluids for their North Sea operations in response to zero-discharge mandates.

The integration of AI and IoT in fluid management allows real-time monitoring of parameters such as viscosity, pH, and temperature, improving well control and reducing fluid wastage. Companies such as Baker Hughes and Halliburton have introduced digital platforms that support dynamic mud property adjustment based on downhole conditions. These technologies are being used in deepwater wells in the Gulf of Mexico, where automated fluid systems reduce non-productive time.

Managed Pressure Drilling (MPD) and extended-reach drilling (ERD) have increased the need for fluids with specific rheological and lubricating properties. In the UAE and offshore West Africa, MPD operations using low-solids water-based muds have improved pressure control and minimized formation damage.

Nanotechnology is emerging as a key area of development. Nanoparticles are being incorporated into drilling fluids to enhance filtration control and thermal stability. Researchers in Brazil and China have documented improved performance of nanoparticle-enhanced muds in HPHT environments, offering better wellbore stability and lower filtration loss.

Sustainability practices such as fluid recycling and closed-loop systems are becoming integral. In Canada’s Montney Shale, operators have begun reusing drilling fluids across multiple wells, reducing water usage and disposal costs. These practices align with circular economy objectives and contribute to long-term operational efficiency.

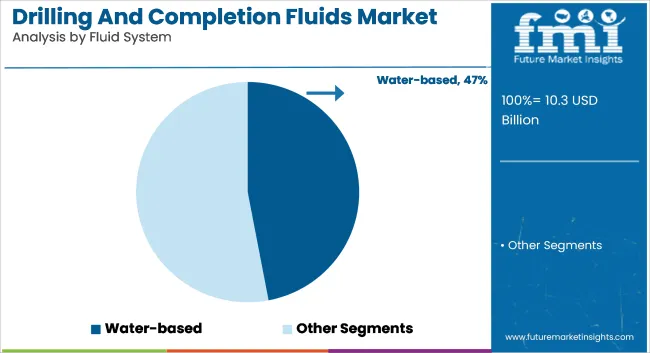

Water-based fluids (WBFs) are expected to account for approximately 47% of the global market in 2025, expanding at a CAGR of 3.6% through 2035. Their dominance is attributed to cost advantages, ease of disposal, and environmental compatibility, especially in onshore and shallow well operations. These fluids are used extensively in Asia Pacific and North America where land-based drilling continues to dominate.

For instance, in India’s Rajasthan fields and the USA Marcellus shale play, WBFs remain the primary drilling fluid due to lower operational costs and availability of freshwater resources. Innovations such as encapsulated polymers and enhanced viscosities are improving their performance in high-angle and horizontal wells.

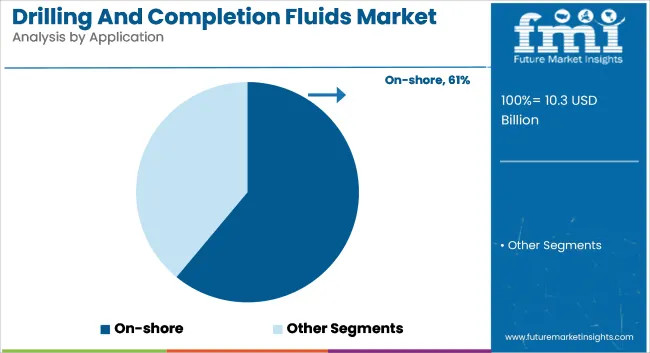

Onshore applications are projected to represent 61% of total demand in 2025, growing at a CAGR of 3.5% through 2035. This growth is underpinned by active drilling campaigns in North America, the Middle East, and parts of Asia. For example, Saudi Arabia’s rig count expansion under Vision 2030 has increased the use of both oil- and water-based drilling fluids for its onshore reserves.

Similarly, the USA Energy Information Administration forecasts sustained shale output requiring continuous fluid circulation and completion fluid systems. Onshore wells offer lower drilling costs, enabling broader adoption of performance-enhancing additives and real-time fluid analytics platforms to optimize mud properties and reduce downtime.

| Key Factors | Details |

|---|---|

| Trend toward Argon and Non Circular Fluids | Trend towards low-toxicity, biodegradable, and water-based fluids supporting ESG objectives and mitigating environmental impact. |

| Requirements for Customization & Compatibility | With high-pressure, high-temperature (HPHT) and unconventional reservoirs, operators are asking for tailored-to-well fluid formulations. |

| Effect of Regulatory Compliance | Regulatory changes in fluid disposal, emissions, and how much chemical is used, drive purchasing decisions and demand for sustainable alternatives. |

| Fluid Management Technology & Digital Integration | Real-time monitoring and AI-driven fluid optimization and automated mud systems adoption are also increasing efficiency and limiting unnecessary fluid waste. |

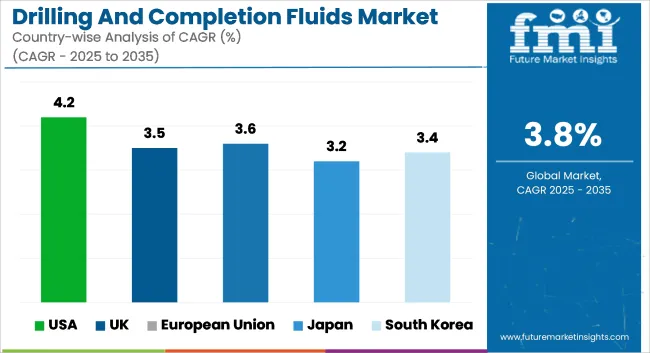

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| UK | 3.5% |

| European Union | 3.6% |

| Japan | 3.2% |

| South Korea | 3.4% |

The USA is the largest market for drilling and completion fluids, driven by its well-established oil & gas sector, particularly in shale exploration and offshore deepwater drilling in the Gulf of Mexico. The growing adoption of environmentally friendly water-based fluids is reshaping the industry as companies comply with strict EPA regulations.

The USA industry would continue to show stable growth following ongoing investments in hydraulic fracturing, well completions, and the growing employment of sophisticated synthetic-based fluids. FMI is of the opinion that the USA drilling and completion fluids market is set to witness 4.2% CAGR during the study period.

Growth Factors in USA

| Key Factors | Details |

|---|---|

| Shale Boom | Increased shale oil and gas exploration, especially in the Permian Basin. |

| Regulatory Support | Favorable policies supporting offshore and onshore drilling activities. |

| Technological Advancements | Development of eco-friendly drilling fluids to meet sustainability targets. |

| Increased Energy Demand | Rising domestic and industrial energy consumption driving drilling activities. |

The UK drilling and completion fluids market is driven by offshore exploration in North Sea, with severe conditions needing high-performance fluid solutions. Energy security through the government's grant of extended licenses for drilling also fuels demand for innovative completion fluids. Environmental initiatives like net-zero carbon goals also encourage operators to adopt more environment-friendly alternatives. FMI is of the opinion that the UK market is set to witness 3.5% CAGR during the study period.

Growth Factors in UK

| Key Factors | Details |

|---|---|

| North Sea Exploration | Ongoing investments in offshore drilling projects in the North Sea. |

| Government Policies | Supportive tax policies for oil & gas exploration companies. |

| Sustainability Trends | Shift towards biodegradable and water-based drilling fluids. |

| Energy Security Concerns | Efforts to reduce reliance on imported energy. |

The European Union has a blend of onshore and offshore drilling operations, and robust environmental controls influence market trends. Norway, Germany, and the Netherlands are spending on environmentally friendly drilling fluids to ensure REACH compliance. Conventional drilling operations are declining, but the increase in geothermal energy ventures is driving new demand for niche drilling fluids. FMI is of the opinion that the market in European Union is set to witness 3.6% CAGR during the study period.

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| LNG and Natural Gas Expansion | Growth in liquefied natural gas (LNG) projects and natural gas exploration. |

| Stricter Environmental Norms | High adoption of low-toxicity drilling fluids. |

| Offshore Investments | Increased offshore exploration, especially in the North and Baltic Seas. |

| Green Energy Transition | Regulations pushing for eco-friendly and sustainable drilling solutions. |

Japan’s drilling and completion fluids market is relatively niche but is gaining traction due to investments in geothermal energy and offshore methane hydrate extraction. The government’s push for energy self-sufficiency has resulted in the adoption of high-tech drilling fluids designed for deep-sea exploration. Japan’s market remains highly regulated, emphasizing eco-friendly and low-toxicity drilling solutions. FMI is of the opinion that the Japanese market is set to witness 3.2% CAGR during the study period.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Limited Domestic Reserves | Heavy investment in deep-sea drilling and gas hydrate exploration. |

| Technological Innovations | Advanced drilling techniques and fluid technologies. |

| Energy Diversification | Strategic shift towards domestic oil & gas sources. |

| Government Support | Policies promoting local energy security and exploration. |

South Korean market is expanding, supported by offshore energy projects and the government's interest in deep-sea natural gas hydrates exploration. The country is advancing LNG import alternatives by developing its own energy resources, leading to an increased need for high-performance drilling fluids.

Additionally, offshore wind farm foundation drilling presents a new market segment for specialized completion fluids. FMI is of the opinion that the South Korean drilling and completion fluids market is set to witness 3.4% CAGR during the study period.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Offshore Exploration | Expanding deep-sea oil & gas projects. |

| LNG and Gas Hydrate Projects | Government-backed initiatives for unconventional energy sources. |

| Industrial Demand | High demand for energy from manufacturing and heavy industries. |

| Technological Advancements | Investments in high-performance drilling fluids. |

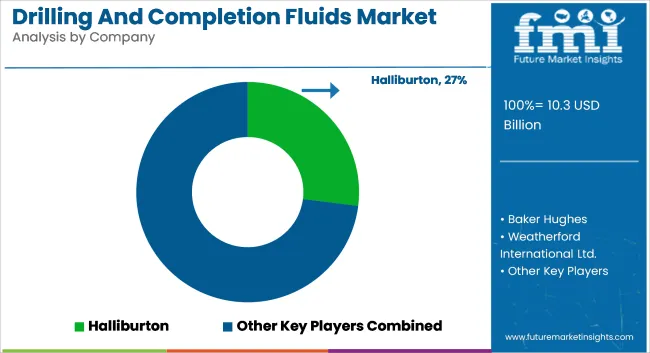

The drilling and completion fluids market is characterized by a mix of global oilfield service providers and regional fluid technology specialists. Companies such as Halliburton, Schlumberger, Baker Hughes, Weatherford, and Newpark Resources dominate through integrated service offerings, proprietary fluid systems, and digital support tools.

Their competitive positioning is shaped by long-term contracts with national oil companies (NOCs) and international oil companies (IOCs), as well as investment in real-time monitoring systems and environmentally compliant formulations. In parallel, regional players in Latin America, the Middle East, and Asia-Pacific compete through cost-effective offerings and localized support, often forming alliances with international firms to strengthen project execution capabilities in offshore and unconventional drilling projects.

By fluid system, the segmentation is as water-based, oil-based, synthetic-based, and other fluid systems.

By application, the segmentation is as on-shore and off-shore.

By region, the market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

The sales are poised to be worth USD 10.3 billion in 2025.

The market is predicted to reach a size of USD 15 billion by 2035.

Some of the key companies include Baker Hughes, CES Energy Solutions Corp., Global Drilling Fluids & Chemicals Limited (GDFCL), Halliburton, National Oilwell Varco, Inc., Newpark Resources, Inc., Q'Max Solutions Inc., Sagemines, Schlumberger Ltd., Scomi Group Bhd, Secure Energy Services Inc., Tetra Technologies, Inc., and Weatherford International Ltd.

The USA is set to expand at 4.2% CAGR during the study period and is expected to generate lucrative opportunities for companies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Drilling Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Crawler Drilling Machine Market

Surface Drilling Rigs Market

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Multi Pad Drilling Market Size and Share Forecast Outlook 2025 to 2035

Directional Drilling Service Market Growth – Trends & Forecast 2024-2034

Diamond Core Drilling Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Diamond Core Drilling Market Share

Multi-Axis PCB Drilling Machine Market Size and Share Forecast Outlook 2025 to 2035

Mining & Construction Drilling Tools Market Growth – Trends & Forecast 2024-2034

Containment and Handling Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA