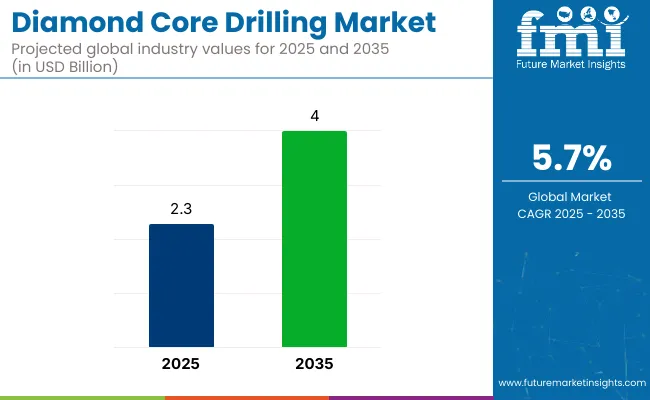

The global diamond core drilling market is expected to rise from USD 2.3 billion in 2025 to USD 4 billion by 2035. This represents a CAGR of 5.7% over the forecast period.

The technique primarily used to extract cylindrical samples from concrete, rock, and other hard materials, has found growing relevance across several sectors, especially in construction, mining, and infrastructure development. This consistent growth reflects an increasing global demand for more precise, efficient, and less disruptive drilling technologies that cater to both new and renovation-based projects.

The industry is significantly driven by the expansion of global infrastructure development. Urbanization, particularly in emerging economies, has led to increased investment in roads, bridges, high-rise buildings, tunnels, and smart city projects. Governments across Asia-Pacific, the Middle East, and Latin America are boosting public infrastructure budgets, contributing directly to the demand for reliable drilling tools.

In a recent update, David Greenway, CEO of Giant Mining Corp., expressed excitement about the company’s diamond core drilling program at Majuba Hill, stating, “We are excited to commence the core drilling program at Majuba Hill. This phase of drilling is pivotal for expanding our understanding of the deposit and enhancing the resource potential. We believe the drill data collected will be instrumental in advancing the project and driving value for our shareholders.”

The industry represents a specialized segment within its parent markets. Within the mining equipment market, diamond core drilling is estimated to hold around 5-7% of the market share, as it is just one of many tools used in mining operations. In the construction and infrastructure market, its share is smaller, at approximately 2-3%, since core drilling is only one of several techniques used for structural applications.

In the oil and gas drilling market, diamond core drilling holds a notable share of 10-12%, particularly in exploration and geological sampling. In the geotechnical and environmental testing market, its contribution is around 5-6%, as core drilling is essential for soil and rock analysis. In the drilling tools and equipment market, it accounts for around 3-5%, representing a niche within this broad category.

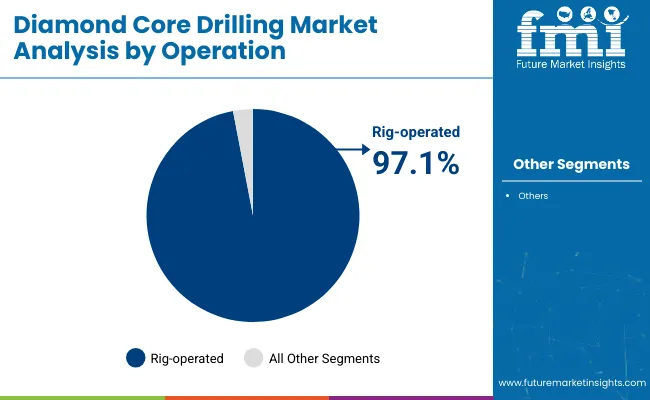

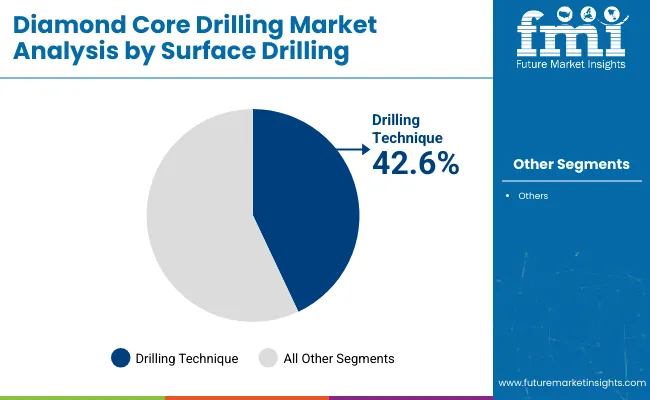

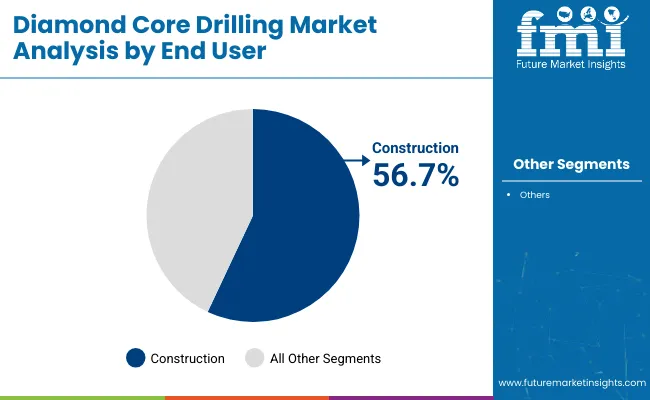

The industry is driven by the rig-operated segment, which dominates due to its efficiency in large-scale, deep drilling operations. Surface drilling remains the preferred technique for its versatility in construction and exploration. The construction industry is the primary end-user, supported by the growing need for precise and non-destructive drilling methods in urban infrastructure projects.

The rig-operated segment is set to dominate the industry, capturing 97.1% of the industry share by 2025. Rig-operated systems are preferred due to their superior performance in handling complex, large-scale, and deep drilling projects.

These machines offer higher drilling power, better depth control, and faster penetration rates, which are crucial for demanding applications like mining exploration, long infrastructure projects, and geotechnical investigations. Moreover, advancements in automation, AI-driven monitoring, and real-time data analytics are increasingly integrated into rig-based machines, improving operational efficiency and safety while reducing wear and tear.

Surface drilling is expected to dominate with a 42.6% industry share in 2025. This technique is preferred due to its accessibility, affordability, and versatility in various applications, including construction, infrastructure, and mineral exploration. Surface drilling is commonly used in urban and rural areas because it doesn’t require specialized underground access, making it highly adaptable across different geological conditions.

Additionally, surface drilling is efficient with minimal operational risks, allowing for ease of equipment monitoring and maintenance. With the growth in international infrastructure projects and exploration activities, the surface drilling segment will continue to maintain its dominant position.

The construction industry is expected to dominate the industry, capturing 56.7% of the industry share in 2025. The demand for precision drilling in new construction and renovation projects is a primary driver. With the rise in global urbanization and the increasing need for infrastructure such as high-rise buildings, bridges, and tunnels, diamond core drilling provides a non-destructive, accurate method for drilling.

It is essential for creating precise holes in materials without damaging surrounding structures, making it ideal for utility installations. As smart cities practices rise, diamond core drilling will continue to be a key technology.

Technological advancements, including automation and IoT integration, are improving efficiency, safety, and broadening applications across industries.

Infrastructure Growth and Urbanization

Investments in smart cities, transportation, high-rise buildings, and renewable energy projects are increasing demand for precise, low-impact drilling solutions. Diamond core drilling is essential for meeting the accuracy and efficiency required in modern construction and renovation.

Technological Advancements and Equipment Innovation

Automation, AI-based monitoring, and IoT integration are improving equipment efficiency, safety, and reducing downtime. Features like brushless motors, smart torque control, and cordless mobility are enhancing both rig-operated and handheld systems, enabling diamond core drilling applications to expand across industries like construction, mining, and geotechnical engineering.

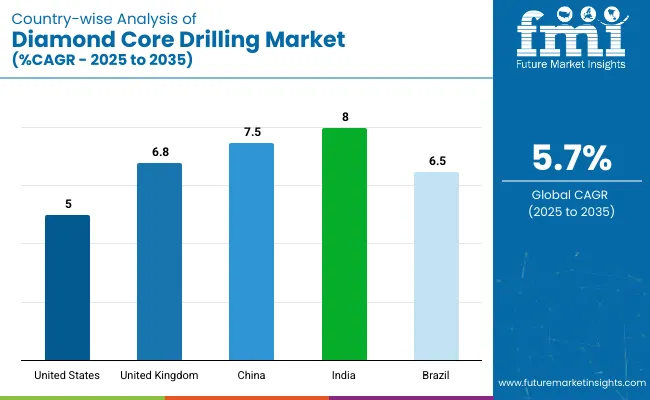

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5% |

| United Kingdom | 6.8% |

| China | 7.5% |

| India | 8% |

| Brazil | 6.5% |

The global industry is projected to grow at a CAGR of 5.7% from 2025 to 2035. The United States, with a CAGR of 5%, shows steady growth, driven by a stable demand for core drilling in the mining and construction sectors. The United Kingdom, at 6.8%, experiences slightly stronger growth, supported by increasing investment in mining operations and infrastructure development. China, with a CAGR of 7.5%, demonstrates a more rapid expansion, driven by significant demand for drilling services in the country’s vast mining industry and ongoing infrastructure projects.

India, with an 8% CAGR, leads the pack in growth potential, fueled by the country’s expanding mining sector, infrastructure development, and rising demand for exploration and drilling services. Brazil, at 6.5%, shows solid growth, benefiting from its extensive mining operations and growing demand for core drilling in the natural resource extraction industry.

While developed industries such as the USA and the UK show steady growth, India and China emerge as the fastest-growing industries, indicating a shift toward emerging economies as key drivers of the global industry's expansion.

The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

The United States industry is projected to grow at a 5% CAGR from 2025 to 2035. The industry growth is fueled by increasing demand for natural resources in the mining and energy sectors. As exploration activities expand into remote areas, the demand for advanced equipment increases.

Technological innovation focusing on automation and efficiency is key to meeting the rising exploration needs. Additionally, government investments in infrastructure and mining projects will continue to support growth in the sector. The USA remains a dominant player in the global industry, leading innovation and production.

The United Kingdom industry is expected to grow at a CAGR of 6.8% from 2025 to 2035. This growth is driven by increasing demand for geotechnical applications and mineral exploration in the country. The UK benefits from a well-established mining industry, with continuous investments in resource exploration and infrastructure.

The focus on ecological drilling techniques and the adoption of eco-friendly practices further contribute to the industry’s expansion. The country’s growing need for advanced drilling solutions in mining and construction projects ensures steady growth in the industry in the coming years.

The China Industry is expected to grow at a 7.5% CAGR from 2025 to 2035. This growth is primarily driven by increasing demand for mineral resources and precious metals from both domestic and international industries. China continues to make large investments in mining and infrastructure development, especially in remote and previously unexplored regions.

The industry is also benefiting from the country’s growing focus on technological innovation in drilling, with advanced equipment driving exploration efficiency. The rise of eco-friendly drilling practices further supports China’s position as a leading industry globally.

The industry in India is projected to grow at an 8% CAGR from 2025 to 2035. The country’s expanding mining industry is driving this growth, particularly in the exploration of coal, copper, and precious metals. India is increasingly adopting automated and advanced drilling technologies to meet the rising demand for high-quality drilling solutions.

The growth of mining infrastructure and resource exploration projects further propels the industry. Additionally, efforts to improve mining practices and increase exploration activities across India’s vast mineral reserves are expected to solidify the country’s position as a fast-growing industry.

The industry in Brazil is expected to grow at a 6.5% CAGR from 2025 to 2035. The growth is primarily driven by the country’s robust mining industry, especially in iron ore and precious metal exploration. Brazil is investing heavily in mineral reserves and exploration, particularly in the Amazon region.

The growing need for high-efficiency drilling equipment and environmentally friendly technologies plays a critical role in the sector’s growth. Additionally, Brazil’s increasing focus on adopting cost-effective and eco-friendly drilling solutions positions it as a key player in the global industry.

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Hilti Corporation, Atlas Copco, and Epiroc lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across mining, construction, and infrastructure sectors.

Key players including Robert Bosch GmbH, WEKA Elektrowerkzeuge KG, and BoartLongyear offer specialized drilling solutions tailored to specific applications and regional industries. Emerging players, such as Elektrowerkzeuge GmbH Eibenstock, MASSENZA Drilling Rigs Srl, and Milwaukee Tool, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Industry Size (2025) | USD 2.3 billion |

| Projected Industry Size (2035) | USD 4 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in units |

| Operation Type Analyzed (Segment 1) | Hand Held And Rig Operated |

| Drilling Technique Analyzed (Segment 2) | Stitch Drilling, Underwater Diamond Drilling, Surface Drilling, And Underground Drilling. |

| End Use Covered (Segment 3) | Construction Industry and Mining Industry. |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Netherlands; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Industry | Hilti Corporation, Atlas Copco, WEKA Elektrowerkzeuge KG, Robert Bosch GmbH, Boart Longyear, Elektrowerkzeuge GmbH Eibenstock, MASSENZA Drilling Rigs Srl, Milwaukee Tool, Controls S.p.A, and Epiroc Mining. |

| Additional Attributes | Dollar sales, regional demand trends, key end-user industries, competitor strategies, product innovations, pricing trends, industry share, regulatory landscape. |

The industry is segmented into hand held and rig operated.

The industry covers stitch drilling, underwater diamond drilling, surface drilling, and underground drilling.

The industry is categorized into construction industry and mining industry.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The industry is expected to reach USD 4 billion by 2035.

The industry size is projected to be USD 2.3 billion in 2025.

The industry is expected to grow at a CAGR of 5.7% from 2025 to 2035.

The UK is expected to be the fastest growing with a CAGR of 6.8%.

Rig-operated, accounting for over 97.1% of the industry in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Diamond Core Drilling Market Share

Diamond and CBN Micron Powder Market Size and Share Forecast Outlook 2025 to 2035

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Core Plate Varnishes Market Size and Share Forecast Outlook 2025 to 2035

Diamond Tool Grinding Machine Market Size and Share Forecast Outlook 2025 to 2035

Drilling Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Diamond Wall Saw Market Size and Share Forecast Outlook 2025 to 2035

Diamond-like Carbon Coatings market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Diamond Like Carbon (DLC) Coating Market Size and Share Forecast Outlook 2025 to 2035

Diamond Jewelry Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Drilling and Completion Fluids Market Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Diamond-Blackfan Anemia (DBA) Syndrome Therapeutics Market - Growth & Innovations 2025 to 2035

Core Drill Automatic Feeding Machine Market

Core Banking Solution Market Report – Growth & Forecast 2017-2027

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Air Core Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA