CVD Lab-grown Diamond Market Size and Share Forecast Outlook 2025 to 2035

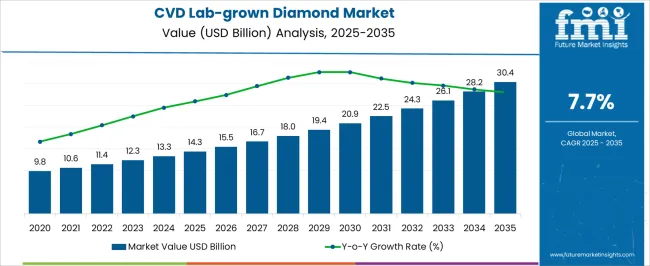

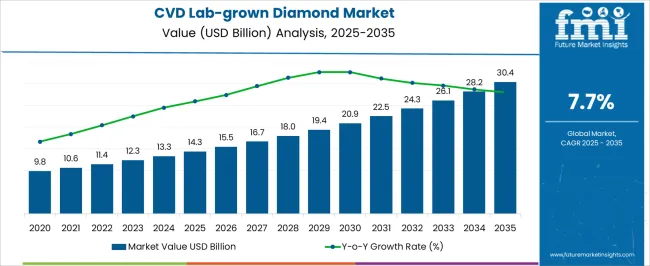

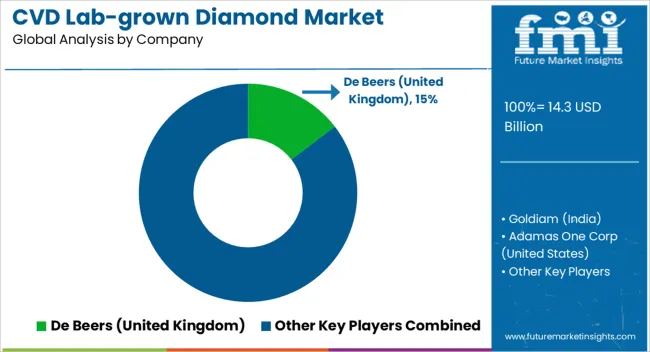

The CVD Lab-grown Diamond Market is estimated to be valued at USD 14.3 billion in 2025 and is projected to reach USD 30.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

Quick Stats for CVD Lab-grown Diamond Market

- CVD Lab-grown Diamond Market Industry Value (2025): USD 14.3 billion

- CVD Lab-grown Diamond Market Forecast Value (2035): USD 30.4 billion

- CVD Lab-grown Diamond Market Forecast CAGR: 7.7%

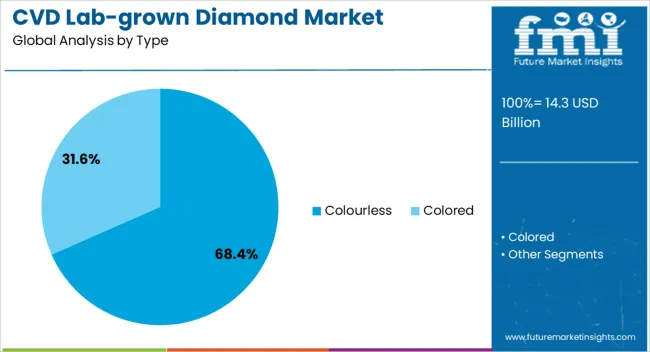

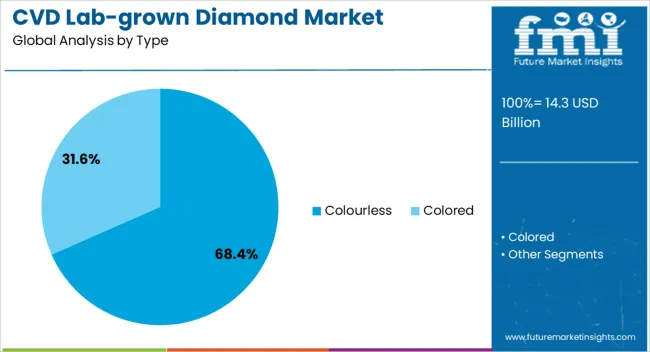

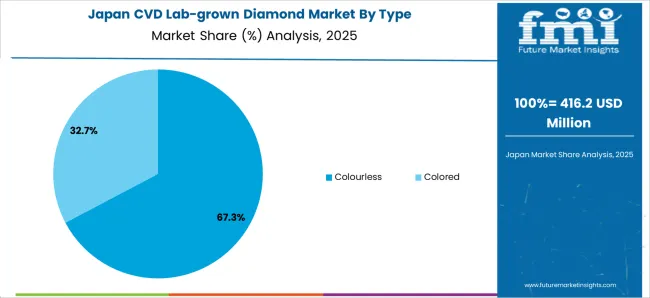

- Leading Segment in CVD Lab-grown Diamond Market in 2025: Colourless (68.4%)

- Key Growth Region in CVD Lab-grown Diamond Market: North America, Asia-Pacific, Europe

- Top Key Players in CVD Lab-grown Diamond Market: De Beers (United Kingdom), Goldiam (India), Adamas One Corp (United States), Sumitomo Electric Industries Ltd., Bhanderi Lab-grown Diamonds LLP (India), Hebei Plasma Diamond Technology Co., Ltd. (China), SP3 Diamond Technologies, Delaware Diamond Knives

| Metric |

Value |

| CVD Lab-grown Diamond Market Estimated Value in (2025 E) |

USD 14.3 billion |

| CVD Lab-grown Diamond Market Forecast Value in (2035 F) |

USD 30.4 billion |

| Forecast CAGR (2025 to 2035) |

7.7% |

Rationale for Segmental Growth in the CVD Lab-Grown Diamond Market

The CVD lab-grown diamond market is expanding steadily, driven by advancements in chemical vapor deposition technology and the growing acceptance of synthetic diamonds in industrial and gem-quality applications. Rising demand for sustainable and cost-efficient alternatives to natural diamonds has accelerated the adoption of lab-grown variants.

The current landscape reflects increasing utilization of CVD diamonds in high-tech applications, including electronics, optics, and thermal management systems, owing to their superior hardness, thermal conductivity, and chemical stability. Additionally, the jewelry industry is gradually embracing lab-grown diamonds due to consumer awareness of ethical sourcing and lower environmental impact.

Future growth is expected to be reinforced by innovation in color and quality control, as well as the scalability of production processes that reduce costs. With robust demand across both industrial and consumer markets, the CVD lab-grown diamond sector is set to expand significantly in the years ahead.

Segmental Analysis

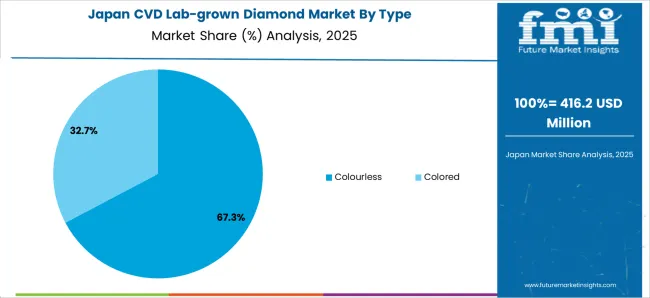

Insights into the Colourless Segment

The colourless segment leads the type category with approximately 68.4% share, reflecting its strong adoption in both industrial and gem-related applications. Colourless CVD diamonds closely replicate the physical and chemical properties of natural diamonds, making them highly attractive to consumers and industries alike.

Their clarity and brilliance support growing demand in the jewelry sector, while their superior mechanical and thermal properties position them well for industrial applications. Production advances have improved consistency in achieving colourless quality at scale, further driving growth.

With consumer acceptance rising and industrial demand strengthening, the colourless segment is expected to maintain its leadership in the CVD lab-grown diamond market.

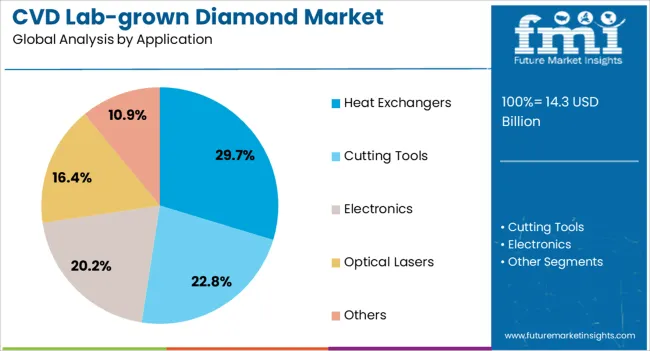

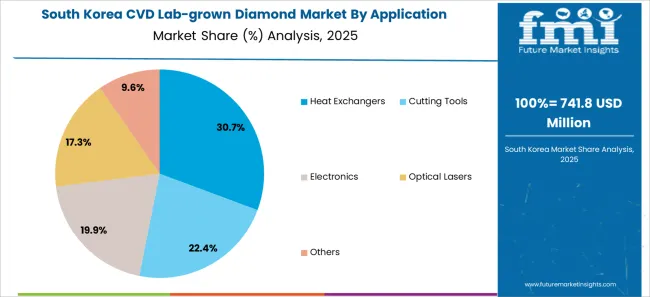

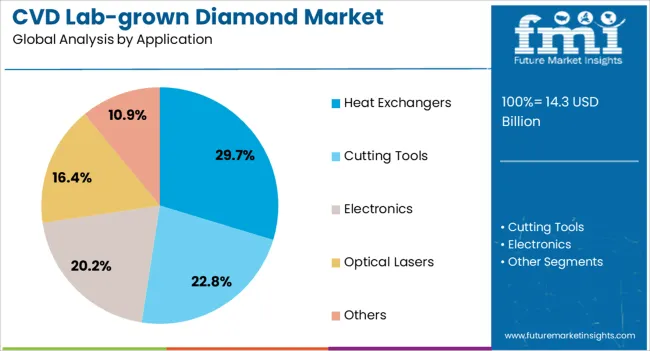

Insights into the Heat Exchangers Segment:

The heat exchangers segment accounts for approximately 29.7% share in the application category, underscoring its importance within the CVD lab-grown diamond market. Diamonds’ exceptional thermal conductivity makes them highly effective in dissipating heat in advanced cooling systems.

This segment benefits from increasing adoption in electronics, semiconductors, and aerospace applications, where efficient heat management is critical. CVD diamonds provide durability, resistance to wear, and enhanced operational lifespans, which are valued in high-performance industrial settings.

Rising investment in high-power electronics and data center infrastructure is expected to further boost demand. With ongoing innovation in thermal management solutions, the heat exchangers segment is positioned for sustained growth.

Consumption Trends in the CVD Lab-grown Diamond Sector

- The market for lab-grown diamonds is experiencing a surge in demand due to a growing consumer preference for sustainable and ethically sourced diamonds.

- Consumers increasingly choose diamonds that align with their values, favoring lab-grown diamonds free from the ethical concerns associated with traditional diamond mining.

- Manufacturers and retailers are incorporating lab-grown diamonds into their product offerings, meeting the growing consumer demand for sustainable and affordable alternatives.

- As consumers become more aware of the technological advancements in diamond production, the consistent quality of lab-grown diamonds, and the reduction of environmental impact, they recognize and embrace these diamonds as a desirable choice for their jewelry.

- Lab-grown diamonds are produced under controlled conditions that ensure consistent quality and purity. This quality assurance is highly attractive to consumers who want to ensure they get a high-quality product.

- CVD lab-grown diamonds have a significantly lower environmental impact than traditionally mined diamonds.

Key Restraints Limiting Growth in the CVD Lab-grown Diamond Industry

The CVD lab-grown diamond market is anticipated to surpass a global valuation of USD 30.4 billion by 2035, with a growth rate of 7.8%.

While the CVD lab-grown diamond market is experiencing growth, several restraining factors can adversely affect its development and expansion.

- Lab-grown diamonds are gaining acceptance in the market; however, some consumers still associate higher value and prestige with natural diamonds. Overcoming these perceptions about the rarity and uniqueness of natural diamonds remains a challenge.

- Limited awareness among consumers about the existence and benefits of lab-grown diamonds is a significant restraint that requires education campaigns to address misconceptions and enhance consumer understanding.

- Persistent misconceptions in the market, such as the belief that lab-grown diamonds are inferior or less valuable, hinder their broader acceptance. This requires targeted efforts from industry players to educate consumers and change perceptions.

- Skepticism about the authenticity of lab-grown diamonds, driven by concerns about disclosure and transparency in the industry, may impede consumer trust.

- The availability of larger and rarer diamonds in natural form remains a challenge for lab-grown diamonds.

CVD Lab-grown Diamond Industry Analysis by Top Investment Segments

Exceptional Quality, Customization Options, and Ethical Appeal of Colored CVD Lab-grown Diamonds

Based on the type, colored CVD lab-grown diamonds dominate the market with a healthy growth of 7.6%. This rising popularity is attributed to:

- Colored CVD lab-grown diamonds are gaining popularity due to their exceptional quality, customization options, and ethical appeal.

- Consumers seeking specific hues in diamonds find the predictability of lab-grown colored diamonds appealing.

- The personalization trend in the jewelry industry further reinforces the dominance of colored CVD lab-grown diamonds.

- Consumers value unique and customized pieces, and the diverse range of colors offers a wide spectrum of options for creating unique jewelry.

| Attributes |

Details |

| Type |

Colored |

| CAGR (2025 to 2035) |

7.6% |

Remarkable Thermal Conductivity and Durability of Heat Exchangers

Based on the application, heat exchangers dominate the global market with a CAGR of 7.4%. This rising popularity is attributed to:

- These diamonds' high thermal conductivity makes them ideal for heat exchanger applications where efficient heat transfer is crucial. This attribute contributes to increased energy efficiency and reduced thermal management challenges.

- CVD lab-grown diamonds offer customization and scalability, making them suitable for intricate designs and diverse heat exchanger configurations.

- Manufacturers can engineer diamonds with tailored specifications to meet the specific thermal requirements of different applications.

| Attributes |

Details |

| Application |

Heat Exchangers |

| CAGR (2025 to 2035) |

7.6% |

Analysis of Top Countries Manufacturing and Using Lab-grown Diamonds

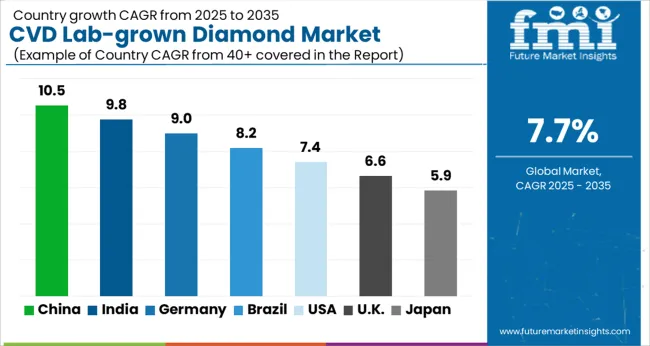

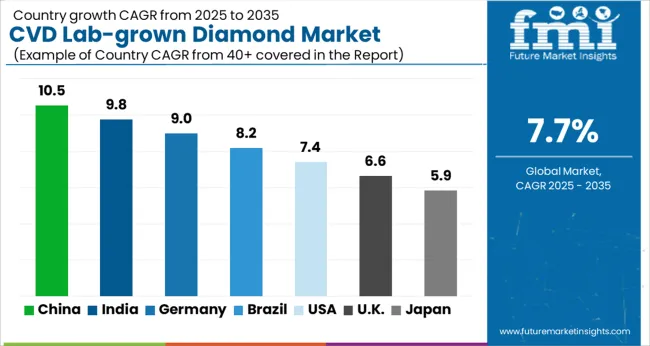

The section analyzes the CVD lab-grown diamonds market by country, including the United States, the United Kingdom, China, Japan, and South Korea. The table presents the CAGR for each country, indicating the expected market growth in that country through 2035.

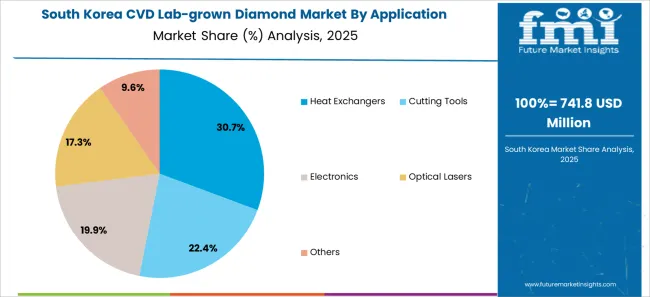

South Korean Technological Advancements and Customizable Nature

South Korea is the leading Asian country in the CVD lab-grown diamonds market. The South Korea CVD lab-grown diamonds market is expected to register a CAGR of 10.0% until 2035.

- South Korean consumers, particularly the younger generation, are drawn to the modern and unique aspects of lab-grown diamonds, which aligns with their fashion-forward and innovative preferences.

- South Korea's focus on ethical consumerism contributes to the growing dominance of lab-grown diamonds in the market.

Sustainability and the Growing Trend of Responsible Consumerism in the United Kingdom

The United Kingdom is a leading country in the CVD lab-grown diamonds market in Europe. Its demand is predicted to register a compound annual growth rate of 9.0% during the forecast period.

- British consumers emphasize ethical and eco-friendly products, and lab-grown diamonds are a perfect fit.

- The transparent supply chain of lab-grown diamonds appeals to the United Kingdom market's demand for ethically sourced gems. At the same time, their customizable nature caters to British consumers' desire for unique and personalized jewelry.

Transparent and Sustainable Production Process of CVD Lab-grown Diamonds in the United States

The United States dominates the CVD lab-grown diamonds market in the North American region. The United States CVD lab-grown diamonds industry is expected to exhibit a compound annual growth rate of 8.1% until 2035.

- The country’s culture values technological innovation and modern solutions, and lab-grown diamonds are becoming increasingly popular for jewelry and industrial applications.

- The choice of CVD lab-grown diamonds aligns well with American consumers' ethical and environmental concerns, especially those of young people.

Japanese History of Valuing Precise Engineering and Craftsmanship in Jewelry

Japan is another Asian country in the CVD lab-grown diamonds market, which is anticipated to register a CAGR of 9.3% through 2035.

- CVD lab-grown diamonds are gaining dominance in Japan due to the country's appreciation for meticulous craftsmanship, evolving consumer preferences, and commitment to environmental sustainability.

- As consumer preferences evolve, there is growing interest in sustainable and ethical choices, and lab-grown diamonds meet these demands.

An Increased Demand for Luxury Products, including Diamonds, as the Chinese Middle-Class Expands

China is another Asian country in the CVD lab-grown diamonds market, which is anticipated to register a CAGR of 8.6% through 2035.

- Due to their affordability, high quality, and customizable nature, CVD lab-grown diamonds are an attractive option for Chinese consumers.

- Chinese consumers value technological advancements and innovative products, making lab-grown diamonds popular.

- The sustainable and eco-friendly production process of lab-grown diamonds also aligns with the country's focus on environmental sustainability.

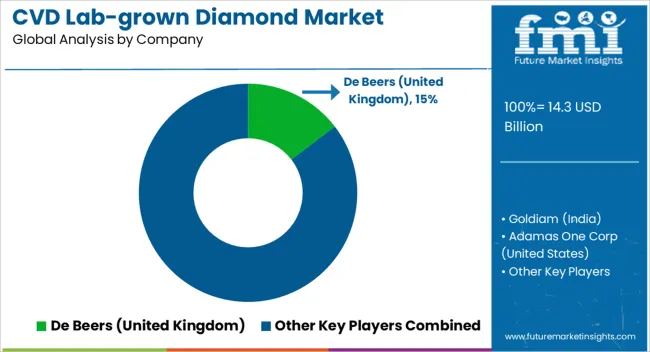

Competitive Landscape of the CVD Lab-grown Diamond Market

The CVD lab-grown diamonds market is highly fragmented, with key players such as De Beers (United Kingdom), Goldiam (India), Adamas One Corp (United States), Sumitomo Electric Industries Ltd., and Bhanderi Lab-grown Diamonds LLP (India).

- De Beers, a leading player in the diamond industry, has entered the lab-grown diamond sector with its Lightbox brand, offering affordable and fashion-oriented lab-grown diamonds.

- Goldiam, based in India, is leveraging its expertise in diamond manufacturing to produce high-quality CVD lab-grown diamonds for domestic and international markets.

- In the United States, Adamas One Corp focuses on technological advancements and innovations to create high-performance CVD lab-grown diamonds that meet the demands of various industries.

- Sumitomo Electric Industries Ltd., a Japanese conglomerate, is investing in research and development to enhance the efficiency and scalability of CVD diamond production, thereby contributing to the market's growth.

- Bhanderi Lab-grown Diamonds LLP in India is expanding its market presence by offering a diverse range of lab-grown diamonds, including colored diamonds and large-sized stones, catering to the preferences of different consumer segments.

Recent Developments:

- On September 27, 2025, South Korea's only lab-grown diamond producer, KDT Diamond Co., announced the construction of its inaugural international production facility in India. This strategic move aimed to cater to the escalating demand in the burgeoning market and extend the company's sales reach beyond its domestic focus.

- On August 10, 2025, United States-based lab-grown diamond manufacturer Adamas One finalized a letter of intent to acquire Indian cutting and polishing company Flawless Allure Grown Diamonds, marking a strategic move in the synthetic diamond industry.

Leading Companies in the CVD Lab-grown Diamond Industry

- De Beers (United Kingdom)

- Goldiam (India)

- Adamas One Corp (United States)

- Sumitomo Electric Industries Ltd.

- Bhanderi Lab-grown Diamonds LLP (India)

- Hebei Plasma Diamond Technology Co., Ltd. (China)

- SP3 Diamond Technologies

- Delaware Diamond Knives

Top Segments Studied in the CVD Lab-grown Diamond Market

By Type:

By Application:

- Heat Exchangers

- Cutting Tools

- Electronics

- Optical Lasers

- Others

By Region:

- Asia Pacific

- Europe

- North America

- The Middle East & Africa

- Latin America

Frequently Asked Questions

How big is the CVD lab-grown diamond market in 2025?

The global CVD lab-grown diamond market is estimated to be valued at USD 14.3 billion in 2025.

What will be the size of CVD lab-grown diamond market in 2035?

The market size for the CVD lab-grown diamond market is projected to reach USD 30.4 billion by 2035.

How much will be the CVD lab-grown diamond market growth between 2025 and 2035?

The CVD lab-grown diamond market is expected to grow at a 7.7% CAGR between 2025 and 2035.

What are the key product types in the CVD lab-grown diamond market?

The key product types in CVD lab-grown diamond market are colourless and colored.

Which application segment to contribute significant share in the CVD lab-grown diamond market in 2025?

In terms of application, heat exchangers segment to command 29.7% share in the CVD lab-grown diamond market in 2025.