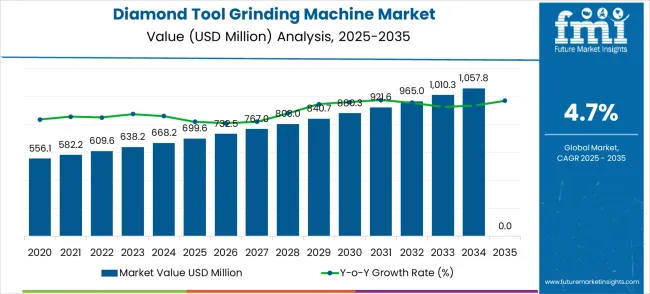

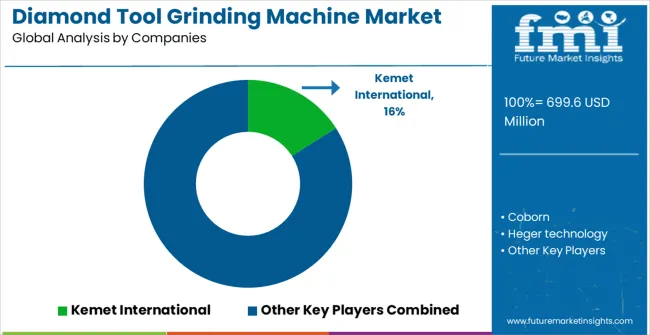

The diamond tool grinding machine market is expected to grow from USD 699.6 million in 2025 to USD 1,107.5 million by 2035, advancing at a CAGR of 4.7%. Market share dynamics indicate a gradual redistribution among key players, driven by technological differentiation, geographic expansion, and strategic partnerships. Established manufacturers with strong brand recognition and advanced machine capabilities are likely to maintain or increase their market share, particularly in regions with high demand for precision grinding in automotive, aerospace, and construction applications. Companies that invest in automation, high-speed grinding, and energy-efficient solutions are positioned to capture incremental share from smaller or less technologically advanced competitors.

Smaller manufacturers and regional players may experience market share erosion unless they adopt niche strategies, such as customizing machines for specialized materials, offering value-added services, or targeting emerging markets. Growth in emerging regions, particularly in the Asia-Pacific and South America, presents opportunities for both new entrants and existing players to expand their footprint, thereby mitigating potential losses elsewhere. Over the past 10 years, the market has exhibited a mix of consolidation and incremental share gain, with leaders leveraging innovation, service networks, and localized production to strengthen their positions. Stakeholders can use this analysis to align product development, marketing, and distribution strategies with evolving competitive dynamics and capture value from high-growth segments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 699.6 million |

| Forecast Value in (2035F) | USD 1,107.5 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

Key trends include CNC-controlled grinding machines, high-speed spindles, and automated tool handling systems. Manufacturers are innovating with multi-axis precision, vibration-dampening technologies, and energy-efficient designs. Growth is driven by infrastructure projects, industrial automation, and precision engineering needs. Collaborations between machine producers and tooling manufacturers enable customized, high-accuracy, and durable grinding solutions, fostering sustained global market expansion.

The diamond tool grinding machine market is segmented across construction and concrete tool manufacturing (38%), metalworking and precision engineering (26%), automotive component production (16%), electronics and semiconductor tooling (12%), and specialty applications including jewelry and gemstone processing (8%). Construction and concrete tool manufacturers lead adoption due to demand for high-precision cutting and durable grinding of diamond-tipped blades and core bits. Metalworking industries utilize these machines for sharpening and profiling precision tools. Automotive component producers rely on them for high-tolerance machining and surface finishing. Electronic and semiconductor tooling benefits from micro-precision grinding, while specialty applications include cutting, polishing, and shaping of jewelry and gemstones.

The diamond tool grinding machine market presents compelling growth opportunities as global manufacturing evolves toward precision-centric applications and Industry 4.0 integration. With the market projected to expand from USD 699.6 million in 2025 to USD 1,107.5 million by 2035 at a 4.7% CAGR, manufacturers and technology providers are positioned to capitalize on structural shifts toward ultra-precision manufacturing, semiconductor industry expansion, and automated grinding solutions.

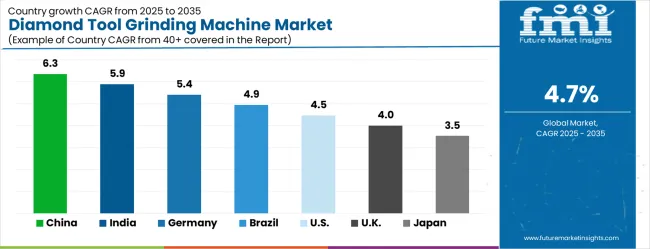

The convergence of miniaturization trends in electronics, aerospace component precision requirements, and automotive industry quality standards creates sustained demand for advanced grinding technologies. Geographic expansion opportunities are particularly pronounced in high-growth markets like China (6.3% CAGR) and India (5.9% CAGR), where industrial modernization and manufacturing capability development drive substantial market potential.

Technology integration pathways around automation, real-time monitoring, and connectivity solutions offer differentiation opportunities, while specialized applications in emerging sectors promise premium positioning. Surface grinding dominance and precision machinery manufacturing leadership indicate established market foundations for strategic expansion.

Market expansion is being supported by the increasing global demand for precision manufacturing solutions and the corresponding shift toward advanced grinding technologies that can deliver superior surface finishes while meeting stringent quality requirements across semiconductor, optics, and aerospace applications. Modern manufacturing companies are increasingly focused on incorporating diamond grinding machines to enhance production capabilities while satisfying demands for dimensional accuracy and surface quality excellence. Diamond grinding technology's proven ability to deliver superior material removal rates, extended tool life, and exceptional surface integrity makes it an essential solution for precision manufacturing and high-tech industrial applications.

The growing emphasis on miniaturization and precision in semiconductor manufacturing is driving demand for high-quality diamond grinding machines that can support ultra-precise component fabrication and advanced material processing across electronics, optics, and medical device manufacturing. Manufacturer preference for grinding solutions that combine precision excellence with operational efficiency is creating opportunities for innovative diamond grinding implementations in both traditional and emerging manufacturing applications. The rising influence of Industry 4.0 and smart manufacturing trends is also contributing to increased adoption of advanced grinding machines that can provide automated process control and real-time quality monitoring capabilities.

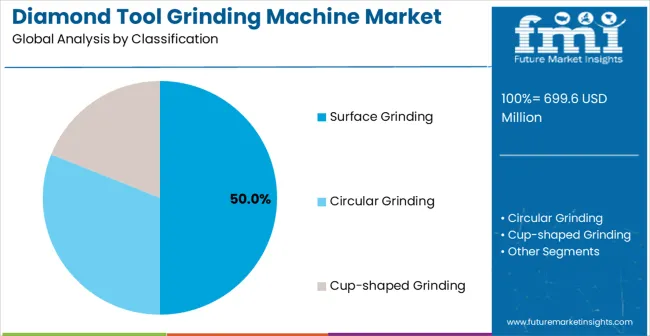

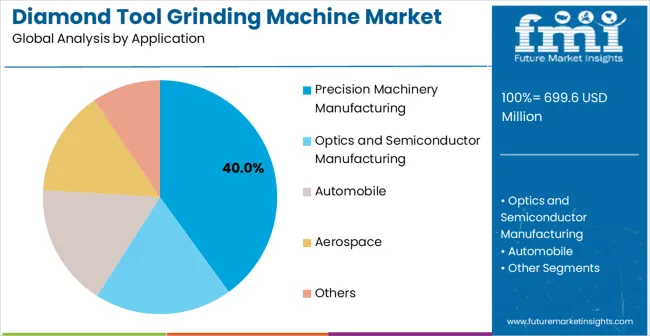

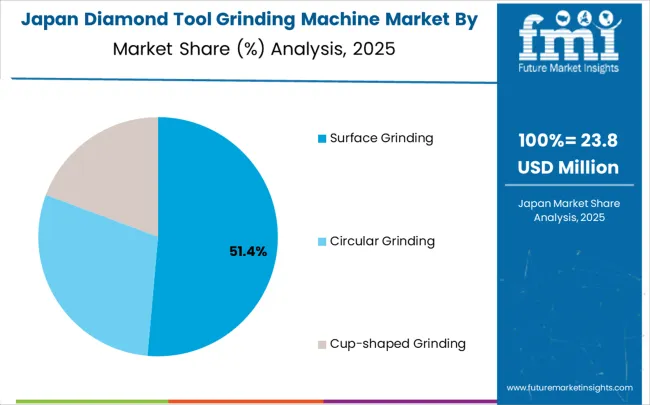

The global diamond tool grinding machine market is projected to grow from USD 699.6 million in 2025 to USD 1,107.5 million by 2035, reflecting a CAGR of 4.7%. Surface grinding dominates the grinding type segment with approximately 50% of the market share, offering high material removal rates, precise surface finishes, and compatibility with various diamond tool geometries. In terms of application, precision machinery manufacturing leads with around 40% of the market, driven by demand for accurate cutting tools, mold components, and high-tolerance industrial equipment. Growth is fueled by rising industrial automation, expansion of precision manufacturing, and increasing demand for high-performance diamond tools.

Surface grinding holds roughly 50% of the grinding type segment, making it the most widely adopted method for diamond tool processing. These machines provide surface finishes within 0.1–1 µm tolerance, material removal rates of 2–10 mm³/s, and compatibility with a wide range of diamond tool shapes, including blades, drills, and inserts. Key manufacturers include Danobat, JUNKER Group, ANCA, and Rollomatic. Surface grinding is preferred for its precision, repeatability, and ability to maintain tool geometry during high-speed operations, ensuring high-quality output for industrial applications.

Precision machinery manufacturing accounts for approximately 40% of the application segment, representing the largest end-use. Diamond tool grinding machines are widely used for producing molds, cutting tools, and high-tolerance machine components. Leading suppliers such as Danobat, JUNKER Group, ANCA, and Rollomatic provide machines with CNC control, multi-axis grinding capabilities, and adaptive feed systems. Segment growth is driven by rising demand for accurate, high-performance tools, increased industrial automation, and expansion of sectors like automotive, aerospace, and electronics that rely on precision machining.

The diamond tool grinding machine market is advancing steadily due to increasing demand for precision manufacturing solutions and growing requirements for superior surface finishing capabilities that emphasize quality excellence across semiconductor, optics, and aerospace applications. The market faces challenges, including high initial investment costs, specialized operator training requirements, and competition from alternative grinding technologies. Innovation in automation technologies and process optimization continues to influence market development and expansion patterns.

The growing adoption of diamond grinding machines in semiconductor and optics manufacturing is enabling companies to achieve ultra-precise component fabrication that provides superior performance characteristics while commanding premium pricing and enhanced market positioning. Semiconductor applications provide exceptional precision requirements while allowing more sophisticated manufacturing processes across various high-tech industries and specialized applications. Manufacturers are increasingly recognizing the competitive advantages of diamond grinding technology for advanced component production and precision manufacturing market penetration.

Modern diamond grinding machine manufacturers are incorporating automated process control, real-time monitoring systems, and connectivity solutions to enhance manufacturing efficiency, improve quality consistency, and meet demands for smart manufacturing practices. These technologies improve operational effectiveness while enabling new applications, including uncrewed grinding operations and predictive maintenance programs. Advanced automation integration also allows manufacturers to support precision manufacturing, positioning, and operational excellence beyond traditional manual grinding operations.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| Brazil | 4.9% |

| USA | 4.5% |

| UK | 4.0% |

| Japan | 3.5% |

The diamond tool grinding machine market is experiencing robust growth globally, with China leading at a 6.3% CAGR through 2035, driven by the expanding semiconductor manufacturing industry, growing precision machinery production, and increasing adoption of advanced manufacturing technologies. India follows at 5.9%, supported by rapid industrialization, rising manufacturing capabilities, and increasing demand for precision engineering solutions. Germany shows growth at 5.4%, emphasizing advanced manufacturing excellence and export market development. Brazil records 4.9%, focusing on the automotive and aerospace industry expansion. The USA demonstrates 4.5% growth, prioritizing high-tech manufacturing and aerospace applications. The UK exhibits 4.0% growth, supported by precision engineering heritage and advanced manufacturing initiatives. Japan shows 3.5% growth, emphasizing technological innovation and manufacturing sophistication.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The diamond tool grinding machine market in China is expanding at a CAGR of 6.3%, above the global average of 4.7%. Growth is fueled by the expanding industrial and manufacturing sectors, particularly automotive, construction, and precision tooling industries. Enterprises deploy advanced grinding machines to enhance surface finish, increase production efficiency, and reduce tool wear. Industrial clusters implement high-speed and automated grinding systems to handle large volumes of diamond cutting and polishing tools. Pilot programs demonstrate reduced cycle times and improved dimensional accuracy. Suppliers focus on energy-efficient, durable, and scalable systems to meet domestic and export demand. Government programs supporting industrial automation and smart manufacturing further drive market adoption.

India is projected to grow at a CAGR of 5.9%, above the global average. Growth is driven by the construction, automotive, and machinery manufacturing sectors requiring high-precision diamond tools. Grinding machines are deployed to reduce tool wear, improve surface finishing, and maintain tolerances. Industrial clusters implement both manual and automated systems to improve productivity. Pilot programs demonstrate enhanced efficiency and longer tool life. Suppliers provide cost-effective, durable machines for medium and large-scale operations. Rising demand for processed industrial components and infrastructural projects further supports market expansion.

Germany grows at a CAGR of 5.4%, above the global average. Adoption is driven by high-precision manufacturing, including automotive, aerospace, and industrial machinery sectors. Diamond tool grinding machines are integrated into production lines for accurate cutting, polishing, and finishing of hard materials. Suppliers focus on automation, energy efficiency, and reliability. Pilot programs demonstrate improved production efficiency and reduced downtime. Industrial clusters utilize high-speed CNC grinding systems to maintain tight tolerances. Research initiatives aim to enhance diamond grinding efficiency and extend tool life. Consumer demand for high-quality machinery and precision components accelerates adoption.

The Brazilian market grows at a CAGR of 4.9%, slightly above the global average. Growth is supported by construction, mining, and machinery manufacturing sectors requiring high-durability tools. Diamond tool grinding machines are used to improve surface quality, reduce wear, and enhance precision. Industrial clusters deploy mid-sized automated machines for consistent output. Pilot programs demonstrate shorter production cycles and lower operational costs. Suppliers provide durable, energy-efficient machines suitable for tropical environments. Increasing investment in industrial infrastructure and mining activities drives adoption of advanced grinding systems.

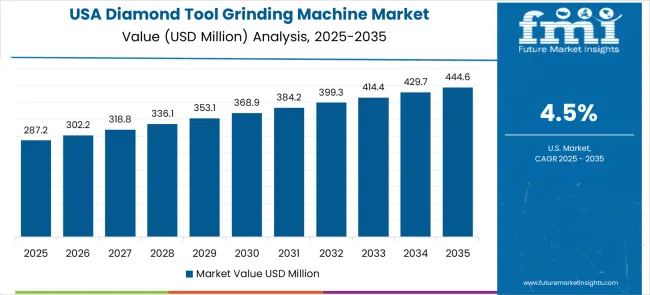

The United States grows at a CAGR of 4.5%, slightly below the global average. Slower growth is influenced by a mature manufacturing sector with existing high-efficiency grinding solutions. Machines are used in automotive, aerospace, and precision manufacturing for high-quality cutting and polishing. Suppliers provide energy-efficient, automated systems capable of handling high-volume production. Pilot programs demonstrate improved tool longevity and reduced production errors. Industrial hubs integrate CNC grinding machines for specialized applications. R&D initiatives focus on extending tool life, optimizing speed, and reducing energy consumption.

The UK market grows at a CAGR of 4.0%, below the global average. Growth is moderated by a mature tool manufacturing industry and reliance on imported high-performance systems. Diamond tool grinding machines are deployed in automotive, construction, and machinery manufacturing for precision cutting and finishing. Suppliers provide compact, reliable, and energy-efficient machines. Pilot programs show improved surface finish and reduced rework. Industrial clusters gradually adopt automated systems for specialized operations. Demand for durable tools and high-quality output supports steady market growth.

Japan grows at a CAGR of 3.5%, below the global average. Slower growth is influenced by a mature manufacturing sector with advanced existing grinding technologies. Machines are deployed in automotive, electronics, and precision industrial sectors for high-accuracy cutting and polishing. Suppliers provide reliable, compact, and energy-efficient systems. Pilot projects demonstrate reduced wear, better surface quality, and consistent output. Industrial clusters integrate CNC and automated grinding systems for precision operations. R&D efforts focus on improving energy efficiency, tool longevity, and high-speed grinding performance.

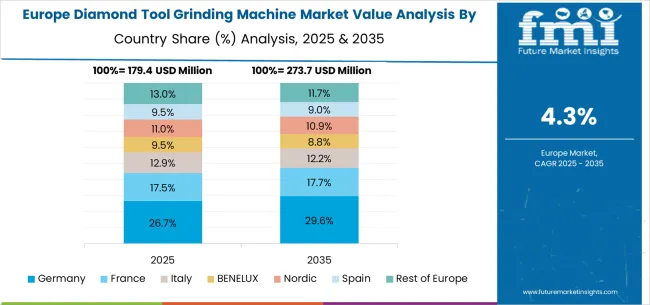

The diamond tool grinding machine market in Europe is projected to grow from USD 239.0 million in 2025 to USD 378.4 million by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced precision manufacturing sector, automotive industry excellence, and comprehensive export capabilities serving European and international markets.

The United Kingdom follows with a 22.3% share in 2025, projected to reach 22.1% by 2035, driven by precision engineering heritage, aerospace manufacturing demand, and established technological expertise traditions. France holds an 18.7% share in 2025, expected to maintain 18.9% by 2035, supported by strong automotive and aerospace industries and growing adoption of precision manufacturing technologies. Italy commands a 15.2% share in 2025, projected to reach 15.4% by 2035, while Spain accounts for 8.8% in 2025, expected to reach 9.1% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, the Netherlands, Belgium, Switzerland, and Austria, is anticipated to hold 6.5% in 2025, growing to 6.7% by 2035, attributed to increasing adoption of precision manufacturing technologies and growing investment in advanced grinding solutions across emerging manufacturing markets.

The diamond tool grinding machine market is characterized by competition among established precision manufacturing equipment companies, specialized grinding technology providers, and integrated industrial automation suppliers. Companies are investing in automation technologies, precision enhancement systems, Industry 4.0 integration, and comprehensive service capabilities to deliver consistent, high-performance, and technologically advanced grinding solutions. Innovation in grinding wheel technology, process automation, and digital connectivity is central to strengthening market position and customer satisfaction.

Kemet International leads the market with a strong focus on precision grinding innovation and comprehensive solution offerings, providing advanced grinding systems that emphasize quality assurance and technical support. Coborn provides specialized diamond grinding capabilities with a focus on optics and semiconductor applications and global service networks. Heger Technology delivers precision grinding solutions with a focus on automotive and aerospace applications and manufacturing excellence. IMAHASHI MFG specializes in advanced grinding technologies with emphasis on Japanese quality standards and precision manufacturing. Best Diamond Industrial focuses on diamond tool expertise and comprehensive grinding solutions. More SuperHard Products emphasizes specialized grinding applications, focusing on advanced materials and precision requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 699.6 million |

| Grinding Type | Surface Grinding, Circular Grinding, Cup-shaped Grinding, Others |

| Application | Precision Machinery Manufacturing, Optics and Semiconductor Manufacturing, Automobile, Aerospace, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Kemet International, Coborn, Heger Technology, IMAHASHI MFG, Best Diamond Industrial, More SuperHard Products, Millner-Haufen, Goodlord Industrial, TDC MYTECH, and GEMtool |

| Additional Attributes | Dollar sales by grinding type and application, regional demand trends, competitive landscape, technological advancements in grinding technologies, automation integration initiatives, precision enhancement programs, and Industry 4.0 implementation strategies |

The global diamond tool grinding machine market is estimated to be valued at USD 699.6 million in 2025.

The market size for the diamond tool grinding machine market is projected to reach USD 1,107.5 million by 2035.

The diamond tool grinding machine market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in diamond tool grinding machine market are surface grinding, circular grinding and cup-shaped grinding.

In terms of application, precision machinery manufacturing segment to command 40.0% share in the diamond tool grinding machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Floor Grinding Machine Market

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Center-less Grinding Machines Market Size and Share Forecast Outlook 2025 to 2035

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Diamond and CBN Micron Powder Market Size and Share Forecast Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Diamond Wall Saw Market Size and Share Forecast Outlook 2025 to 2035

Grinding Mill Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA