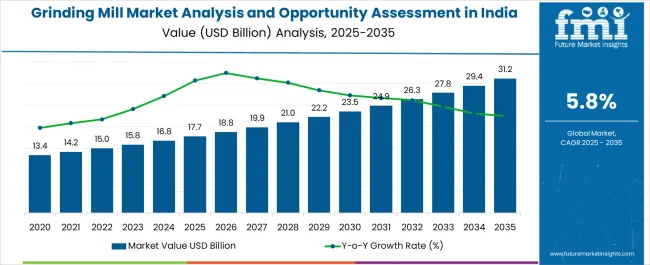

The Grinding Mill Market Analysis and Opportunity Assessment in India is estimated to be valued at USD 17.7 billion in 2025 and is projected to reach USD 31.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Grinding Mill Market Analysis and Opportunity Assessment in India Estimated Value in (2025 E) | USD 17.7 billion |

| Grinding Mill Market Analysis and Opportunity Assessment in India Forecast Value in (2035 F) | USD 31.2 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The grinding mill market in India is witnessing steady expansion. Rising industrialization, growing demand in mining and metallurgical sectors, and increasing construction activities are driving the adoption of advanced milling solutions. Current market dynamics are characterized by a focus on efficiency, precision, and durability in grinding operations.

Technological advancements in automation, energy efficiency, and material handling are enhancing operational performance. The future outlook is shaped by increasing investments in mineral processing, infrastructure projects, and the establishment of large-scale manufacturing facilities. Regulatory frameworks and quality standards are promoting the adoption of reliable and safe milling equipment.

Growth rationale is anchored on the rising need for optimized material size reduction, enhanced productivity, and reduced operational costs Continued innovation in mill design, coupled with the expansion of industrial applications, is expected to strengthen market penetration and support sustained demand across India’s mining, metallurgy, and construction industries.

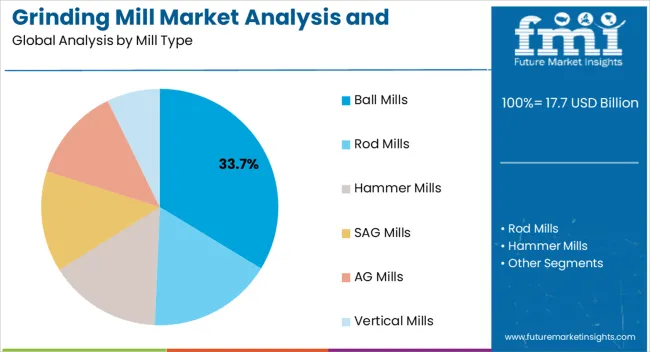

The ball mills segment, holding 33.70% of the mill type category, has been leading due to its high efficiency and adaptability in grinding a wide range of materials. Its dominance has been supported by robust design features, consistent performance, and ability to handle variable feed materials. Demand has been reinforced by the requirement for fine and uniform particle size in industrial applications.

Operational reliability, ease of maintenance, and scalability have contributed to sustained market preference. Technological improvements, such as enhanced liners and energy-efficient motors, have increased productivity and reduced operational costs.

Adoption has been further strengthened by integration into automated and process-optimized plants The segment is expected to maintain its market share due to continued industrial expansion, high adaptability, and strong user confidence in performance and durability.

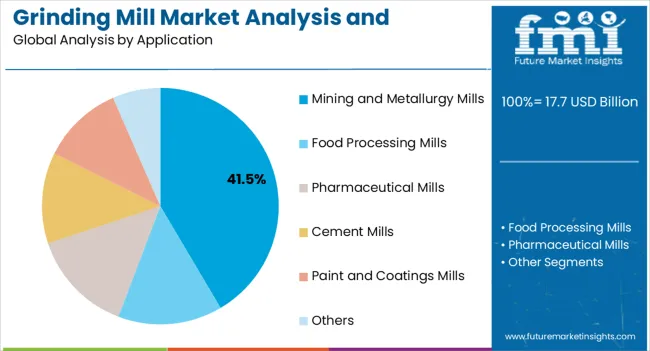

The mining and metallurgy mills segment, representing 41.50% of the application category, has maintained prominence owing to its critical role in processing ores and metallurgical products. Adoption has been driven by increasing demand for mineral extraction, metal production, and raw material processing.

Efficiency in handling abrasive and hard materials, consistent output quality, and operational reliability have reinforced its preference. Technological enhancements in wear-resistant components, automation, and process optimization have improved throughput and energy efficiency.

Demand has been stabilized through long-term contracts and strategic investments in mining infrastructure The segment is expected to sustain its market share due to ongoing industrialization, expanding mining operations, and the need for high-performance milling solutions that meet stringent quality standards.

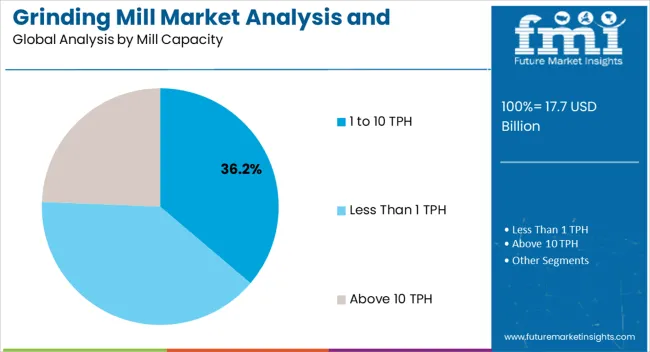

The 1 to 10 TPH capacity segment, accounting for 36.20% of the mill capacity category, has emerged as the leading choice due to its suitability for small to medium-scale operations. Adoption has been driven by operational flexibility, cost-effectiveness, and ease of installation.

Reliability in continuous operation, ease of maintenance, and adaptability to diverse material types have strengthened market acceptance. Demand has been supported by industries seeking moderate-scale production with efficient throughput.

Technological improvements in power consumption, process control, and structural design have enhanced performance and safety The segment is expected to maintain its market share as small and medium enterprises, mining contractors, and specialized metallurgical units continue to require scalable and efficient milling solutions.

Revenue to Expand Over 1.8X through 2035

The grinding mill industry is forecast to expand over 1.8X through 2035, amid a 5.6% rise in anticipated CAGR compared to the historical one. This is due to the growing demand for advanced grinding technologies and robust industrial growth.

The continuous evolution of manufacturing processes is prompting industries worldwide to invest in efficient and innovative grinding mill solutions for enhanced productivity and sustainable production practices. This is expected to bolster sales of grinding mills.

The increasing emphasis on automation and the adoption of innovative materials in manufacturing processes further contribute to the surge in the grinding mill industry. By 2035, the total revenue is set to reach USD 28,547.8 million.

As per the latest analysis, East Asia is expected to rise during the forecast period. It is set to hold a value share of around 37.4% in 2035. This is attributed to the following factors:

As per the report, mining and metallurgy mills are expected to dominate the target market, with a volume share of about 29.5% in 2025. This is attributable to rising adoption of grinding mills in mining and metallurgy industries and the ever-increasing demand for finely ground materials.

The precision and efficiency offered by mining and metallurgy mills are paramount in optimizing production and ensuring resource recovery. These mills help in meeting the rigorous specifications of downstream industries.

The food processing mills segment is anticipated to witness higher demand, with a projected 7.0% CAGR during the forecast period. This accelerated growth is primarily due to the evolving global food industry landscape, where heightened consumer preferences for processed and convenience foods are steering the demand for advanced food processing technologies.

The rising urbanization, changing lifestyles, and increasing disposable incomes contribute to the surge in demand for a diverse range of processed food products. Food processing mills play a pivotal role in this scenario, providing efficient means to grind, blend, and refine raw food materials into the desired forms for various culinary applications.

Stringent quality standards and the emphasis on food safety are driving the adoption of modern and hygienic grinding technologies within the food processing sector. This will further fuel demand for food processing mills. The continuous innovation in these mills, catering to the specific needs of the food industry, also contributes to their increasing prominence in the industry.

Grinding mills represent indispensable industrial machinery designed to disintegrate and meticulously process raw materials into finely ground particles. Growing adoption of these machines across several industries is expected to propel their demand.

Serving as paramount equipment across an array of sectors, including mining, food processing, and pharmaceuticals, grinding mills operate by harnessing mechanical force and energy. They facilitate the crushing, grinding, and pulverization of raw materials through a precise amalgamation of grinding media and rotating components.

The transformative process creates smaller, more manageable particles, rendering them apt for subsequent processing stages or final applications. The pivotal role of grinding mills in material refinement underscores their significance in various industrial processes, contributing to the production of diverse end products.

The ability to tailor grinding mills to meet specific industry needs and applications is a critical success factor. Manufacturers that offer customization options, taking into account variations in materials, particle size requirements, and industry regulations, position themselves as valuable partners for diverse industries.

Expertise in understanding and addressing the unique challenges of different applications, such as pharmaceuticals, mining, or food processing, enhances market competitiveness. Reliable and low-maintenance operation is fundamental for success in the grinding mill industry.

Mills that demonstrate high operational reliability and minimize downtime and maintenance requirements are preferred by industries aiming for continuous and efficient production. Providing easy-to-maintain solutions, preventive maintenance guidance, and responsive customer support contribute significantly to market success.

The construction boom and infrastructure development in India drive the demand for construction materials, fueling the need for grinding mills in cement and aggregate production. This factor anticipates sustained sales growth as economic investments spur demand for mills that contribute to efficient material processing in the construction and infrastructure sectors.

Compliance with quality and safety standards in pharmaceutical processing demands precise and controlled material reduction, driving the adoption of advanced grinding mills. Pharmaceutical companies prioritize mills that adhere to regulatory requirements, ensuring precision in particle size reduction for drug formulations.

Fluctuations in raw material prices, especially metals and alloys, impact manufacturing costs for grinding mills. This factor anticipates market sensitivity to raw material dynamics, with manufacturers navigating pricing challenges to ensure cost-effective production and maintain competitiveness in the grinding mills landscape.

Sales of grinding mills grew at a sluggish CAGR of 0.2% between 2020 and 2025. Total revenue reached about USD 14,910.7 million in 2025. In the assessment period, the grinding mill industry is set to thrive at a CAGR of 6.1%.

| Historical CAGR (2020 to 2025) | 0.2% |

|---|---|

| Forecast CAGR (2025 to 2035) | 6.1% |

The grinding mill industry witnessed slow growth between 2020 and 2025. This was due to several factors, including geopolitical tensions, economic uncertainties, and the impact of the COVID-19 pandemic, which led to disruptions in supply chains and delayed projects across multiple industries.

During this period, businesses took a cautious approach towards capital expenditures. This resulted in deferred investments in new grinding mill technologies and upgrades as companies prioritized cost-cutting measures and focused on maintaining operational stability in the face of unprecedented challenges.

The uncertain economic landscape and widespread disruptions prompted a temporary slowdown in the adoption of grinding mills. As a result, the target industry registered slow growth during the historical period.

Future Scope of the Grinding Mill Market

The worldwide grinding mill market is poised to exhibit robust growth during the forecast period, reaching a valuation of USD 28,547.8 million by 2035. This is due to sustained industrialization and rising demand for efficient material processing in diverse mining, food processing, and metallurgy sectors.

Continuous advancements in grinding mill technologies and increasing global investments in infrastructure projects are expected to boost the target industry. Similarly, integration of automation in grinding mills will likely foster market growth.

Grinding machines have become indispensable tools across several industries, including metallurgy, food, cement, and pharmaceuticals. These machines are widely used to pulverize or grind solid materials into fine particles.

The expanding applications of grinding mills across various industries will likely fuel sales growth. Another prominent factor expected to fuel market expansion is the growing emphasis on sustainable and eco-friendly manufacturing practices.

Innovations Propelling Efficiency in Ball and Rod Mill Operations

A pivotal driver shaping the landscape of grinding mills, particularly ball and rod mills, is the continuous surge in technological advancements. These innovations are revolutionizing grinding mills' efficiency, performance, and applicability across various industries.

Manufacturers are integrating state-of-the-art technologies, including advanced materials for grinding media, smart control systems, and real-time monitoring capabilities. The implementation of these technologies enhances precision and control in grinding processes, optimizes particle size reduction, and improves overall operational efficiency.

In the context of ball and rod mills, advancements also extend to the design and materials used, contributing to increased durability and reduced maintenance requirements. These technological strides are not only streamlining production processes but also addressing industry demands for higher throughput, improved reliability, and energy efficiency.

Need for Efficient Material Processing Solutions in Mining and Metallurgy

An overarching driver propelling the grinding mill market, especially in the mining and metallurgy, is the escalating demand for efficient material processing solutions. Top mining and metallurgy companies are inclined towards installing advanced grinding machines in their facilities.

As the mining and metallurgy sectors expand to meet the burgeoning demand for raw materials, the need for advanced grinding mills becomes paramount. Grinding mills play a pivotal role in extracting, refining, and processing minerals and ores essential for the production of metals and alloys.

The driver is fueled by the constant exploration and extraction activities globally, driven by industrialization, infrastructure development, and technological advancements. With a growing emphasis on sustainability, the mining and metallurgy industries are seeking grinding mills that not only enhance processing efficiency but also adhere to environmental standards.

Hammer Mills Evolving for Optimal Material Pulverization

A significant driver influencing the grinding mills landscape is the continual evolution and performance enhancements observed in hammer mills. These mills, equipped with rapidly rotating hammers or beaters, are witnessing advancements in design, materials, and operational features.

Manufacturers are incorporating innovative materials for hammers and optimizing their shapes for improved impact. They are also integrating advanced control systems for precise and efficient material pulverization. This driver is marked by a focus on rapid size reduction, making hammer mills ideal for applications requiring swift and effective grinding.

The evolving technologies contribute to enhanced durability, reduced maintenance, and increased versatility. They allow hammer mills to address a broader range of materials and industrial applications. As industries seek efficient and adaptable solutions, the evolving performance of hammer mills positions them as key drivers in the ever-changing landscape of material processing.

Electric Mills Paving the Way for Sustainable Material Processing

An influential driver steering the grinding mill industry is the increasing adoption of electric mills, heralding a paradigm shift toward sustainability and efficiency. Electric mills are gaining prominence as industries prioritize eco-friendly practices and seek to minimize their carbon footprint.

Several industries are shifting their preference towards using electric grinding mills. This is due to the inherent advantages of electric mills, including precision in grinding, reduced reliance on fossil fuels, and the potential for incorporating renewable energy sources.

The demand for electric mills aligns with the broader push for energy efficiency and sustainable industrial practices. As industries transition towards cleaner and greener operations, electric mills emerge as a strategic choice, offering not only operational benefits but also contributing to environmental conservation.

Growing popularity of electric mills reflects the market's responsiveness to the imperative of electrification. It is transforming grinding mills into more sustainable and environmentally responsible components of material processing systems.

Economic Hurdles with Scaling, Cost Challenges in Larger Capacity Mills

A substantial restraint influencing the grinding mill industry is the economic challenge associated with scaling up capacities, particularly in larger mills. As the capacity of grinding mills increases to meet the demands of high-throughput operations, the investment required in machinery, infrastructure, and operational costs proportionally escalates. This poses a significant barrier for industries, especially those with budget constraints or seeking cost-effective solutions.

The restraint is notable in industries where large-scale material processing is essential, such as mining, cement production, and heavy manufacturing. The heavy price tag linked to acquiring, installing, and maintaining larger capacity mills may deter some businesses, impacting the widespread adoption of these mills.

The economic hurdle necessitates a careful balance between capacity expansion and cost-effectiveness. It poses a challenge for industries aspiring to enhance production capabilities while managing financial considerations.

Training Conundrum and Lack of Skilled Labor for Advanced Mills

A distinctive restraint within the grinding mill market pertains to the skill gap associated with the operation of high-end mills, particularly in the pharmaceutical and food & beverage applications. The advanced features and intricate controls integrated into cutting-edge mills demand specialized knowledge and expertise for optimal utilization.

The restraint is particularly pronounced in industries where stringent regulations govern processes. These include industries such as pharmaceuticals and food & beverages. The requirement for trained personnel capable of operating and maintaining these high-end mills poses challenges for industries seeking to adopt the latest technologies.

The scarcity of skilled labor may hinder the seamless integration of advanced grinding mills into pharmaceutical and F&B production lines. Addressing this restraint entails investing in comprehensive training programs to bridge the skill gap.

The table below predicts the grinding mill industry revenues in prominent Indian states. Gujarat, Maharashtra, and Rajasthan are expected to remain the top three consumers of grinding mills across India, with expected valuations of USD 31.2 million, USD 256.5 million, and USD 146.9 million, respectively, in 2035.

| States | Grinding Mill Industry Revenue (2035) |

|---|---|

| Gujarat | USD 31.2 million |

| Maharashtra | USD 256.5 million |

| Rajasthan | USD 146.9 million |

| Uttar Pradesh | USD 134.9 million |

| West Bengal | USD 103.6 million |

The below table shows the estimated growth rates of the top five states. Tamil Nadu, Bihar, and Karnataka are set to record higher CAGRs of 7.8%, 7.8%, and 7.2%, respectively, through 2035.

| States | Projected Grinding Mill CAGR (2025 to 2035) |

|---|---|

| Tamil Nadu | 7.8% |

| Bihar | 7.8% |

| Karnataka | 7.2% |

| Goa | 7.2% |

| Jharkhand | 7.0% |

Gujarat’s grinding mill industry is set to witness a positive growth trajectory, with overall sales totaling USD 31.2 million in 2035. The expanding mining & metallurgy sectors will serve as potent catalysts, driving demand for these grinding mills at a 5.7% CAGR during the assessment period.

A key driving force behind this growth is the burgeoning mining activities in Gujarat, fueled by the state's rich mineral reserves and increasing exploration and extraction operations. The surge in demand for grinding mills is propelled by their critical role in the mining process, facilitating efficient extraction and processing of minerals.

Gujarat's rich mineral wealth, encompassing deposits of limestone, bauxite, lignite, and various industrial minerals has intensified mining operations, necessitating advanced grinding mills for optimal ore refinement. These mills play a critical role in breaking down raw materials into finely ground particles, enhancing mineral extraction yields.

As Gujarat solidifies its position as a key player in the mining and metallurgy sectors, demand for innovative and efficient grinding solutions is poised to rise significantly. This will likely improve Gujarat’s grinding mill industry share.

Maharashtra grinding mill industry is poised to register strong growth, propelled by several factors. The state's robust industrial landscape, encompassing diverse sectors such as manufacturing, food processing, and construction, fuels the demand for efficient material processing technologies, including grinding mills.

Maharashtra's strategic geographical location and well-developed infrastructure enhance its role as a key hub for grinding mill applications. Proactive government policies supporting industrial development and a burgeoning construction sector will likely foster growth of the grinding mill industry in Maharashtra.

Sales of grinding mills in Maharashtra are projected to soar at a CAGR of around 6.9% during the assessment period. Total valuation in the state is anticipated to reach USD 256.5 million by 2035.

Rajasthan stands as a prominent hub for grinding mill manufacturers. The state’s mineral-rich landscape, boasting extensive deposits of limestone, marble, and various industrial minerals, positions it as a pivotal player in shaping the grinding mill landscape.

The demand for grinding mills is notably influenced by the flourishing mining and processing activities in the states, with these mills serving as essential tools in refining raw materials for diverse industries. Rajasthan's proactive initiatives in promoting mineral-based industries and the ease of doing business contribute to the attractiveness of the state for grinding mill manufacturers.

Rajasthan's prominence is accentuated by its rich mineral deposits, including limestone, marble, talc, and silica. These minerals serve as vital components in the paint and coatings industry, with limestone providing pigments and fillers and silica acting as a key component in coatings for improved durability and resistance.

The grinding mill industry value in Rajasthan is anticipated to total USD 146.9 million by 2035. Over the forecast period, grinding mill demand in the state is set to increase at a robust CAGR of 6.4%.

The below section shows the ball mills segment dominating the industry based on mill type. It is forecast to thrive at a 6.3% CAGR between 2025 and 2035. Based on mill capacity, the 1 to 10 TPH segment is set to exhibit a CAGR of 6.5% during the forecast period.

| Top Segment (Mill Type) | Ball Mills |

|---|---|

| Predicted CAGR (2025 to 2035) | 6.3% |

As per the latest analysis, demand is predicted to remain high for ball mills during the forecast period, rising at a CAGR of 6.3%. By 2025, the target segment is estimated to reach USD 6,859.4 million.

The dominance of ball mills stems from their versatile applications, adaptability to various materials, and efficiency in achieving fine and ultrafine particle sizes. These mills can handle a wide variety of materials, from soft ores like gypsum and limestone to tougher substances like quartz.

Ball mills find extensive use in diverse industries such as mining, cement, pharmaceuticals, and chemical processing. This is due to their ability to handle both wet and dry grinding processes. The design flexibility and relatively lower operational costs of ball mills contribute to their widespread adoption.

Technological advancements in ball mill design, materials, and control systems further enhance their performance and reliability, sustaining their dominance. The capacity to process large volumes, ease of installation, and the ability to scale operations make ball mills indispensable in various industrial contexts.

High adoption of ball mills is expected to play a key role in boosting the target industry during the forecast period. To gain maximum benefits, key grinding mill manufacturers must constantly upgrade their ball mill portfolios.

| Top Segment (Mill Capacity) | 1 to 10 TPH |

|---|---|

| Projected CAGR (2025 to 2035) | 6.5% |

Based on mill capacity, the industry is segmented into less than 1 TPH, 1 to 10 TPH, and above 10 TPH. Among these, end-users mostly prefer grinding mills with a capacity ranging from 1 to 10 TPH.

The 1 to 10 TPH mid-range capacity segment strikes a balance between operational efficiency and versatility. These grinding mills cater to diverse industries with varying throughput requirements.

Industries such as mining, cement, and food processing often find the 1 to 10 TPH capacity grinding mills well-suited for their production needs. This is because these mills offer the flexibility to handle moderate to large-scale operations.

The economic viability of mills within this capacity range, coupled with their ability to efficiently process a wide range of materials, contributes to their popularity. The 1 to 10 TPH capacity segment is thus at the forefront, meeting the demand for grinding mills that combine optimal performance with adaptability across a spectrum of industrial applications.

As per the latest grinding mill industry analysis, the 1 to 10 TPH segment is projected to thrive at a 6.5% CAGR during the forecast period. It is set to attain a valuation of USD 19,376.9 million by 2035.

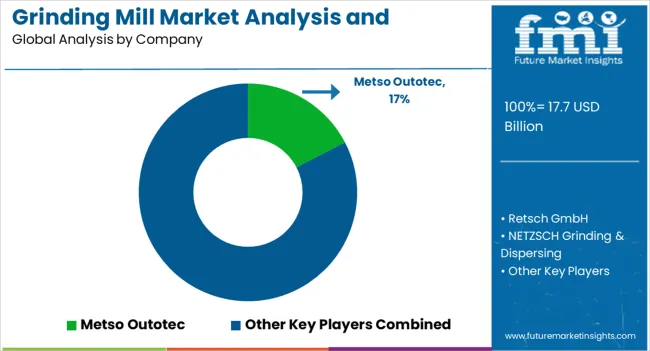

The grinding mill industry is moderately consolidated, with leading players accounting for about 30% to 35% share. Metso Outotec, Retsch GmbH, NETZSCH Grinding & Dispersing, FLSmidth & Co. A/S, ThyssenKrupp Industrial Solutions AG, Fives Group, KHD Humboldt Wedag International AG, Kawasaki Heavy Industries, Ltd., CITICHL Heavy Industries Co., Ltd., and Eirich Machines, Inc. are the leading manufacturers of grinding mill profiled in the report.

Key grinding mill companies are investing in continuous research to produce new products and increase their production capacity to meet end-user demand. They also adopt strategies, such as partnerships, facility expansions, collaborations, and acquisitions, to strengthen their footprint.

Recent Developments in the Grinding Mill Industry:

| Attribute | Details |

|---|---|

| Estimated Value (2025) | USD 17.7 billion |

| Projected Value (2035) | USD 31.2 billion |

| Anticipated Growth Rate (2025 to 2035) | 5.8% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (Units) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Key Segments Covered | Mill Type, Application, Mill Capacity, Drive Type, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East & Africa; North India; East India; West India; South India |

| Key States Covered | Goa, Tamil Nadu, Bihar, Maharashtra, Rest of East India, Karnataka, Rajasthan, Jharkhand, Andhra Pradesh, Punjab, West Bengal, Rest of North India, Gujarat, Telangana, Haryana, Uttar Pradesh, Rest of South India |

| Key Companies Profiled | Metso Outotec; Retsch GmbH; NETZSCH Grinding & Dispersing; FLSmidth & Co. A/S; ThyssenKrupp Industrial Solutions AG; Fives Group; KHD Humboldt Wedag International AG; Kawasaki Heavy Industries, Ltd.; CITICHL Heavy Industries Co., Ltd.; Eirich Machines, Inc.; Quadro Engineering Corp.; Vermeer Corporation; Bradley Pulverizer Company; Hosokawa Alpine AG; Union Process, Inc.; Bühler Group; Bharath Industrial Works; Laxmi Engineers; Precious MechTech; Techno Designs; Ultra Febtech Pvt. Ltd.; McNally Sayaji |

The global grinding mill market analysis and opportunity assessment in India is estimated to be valued at USD 17.7 billion in 2025.

The market size for the grinding mill market analysis and opportunity assessment in India is projected to reach USD 31.3 billion by 2035.

The grinding mill market analysis and opportunity assessment in India is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in grinding mill market analysis and opportunity assessment in India are ball mills, rod mills, hammer mills, sag mills, ag mills and vertical mills.

In terms of application, mining and metallurgy mills segment to command 41.5% share in the grinding mill market analysis and opportunity assessment in India in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Wet Mix Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Vibrating Screen Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Asphalt Mixing Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Millet Starch Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Casino Tourism Market Forecast and Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

Millet Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

Mill Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Mill Mixer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA