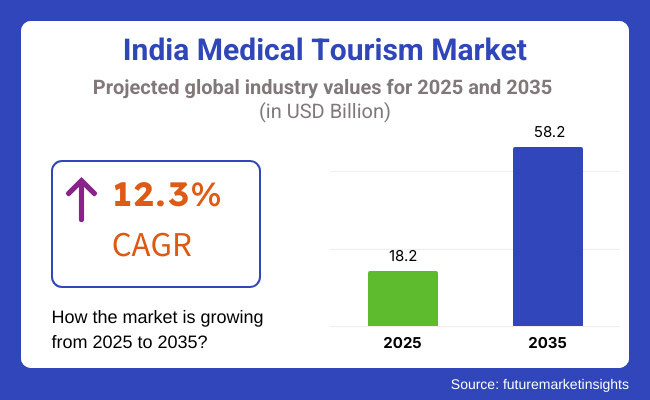

India's medical tourism industry is poised for substantial growth, with projections indicating an increase from an estimated USD 18.2 billion in 2025 to USD 58.2 billion by 2035, at a CAGR of 12.3% during the forecast period. This surge in growth is driven by India's reputation for high-quality healthcare services at a fraction of the cost compared to Western countries, along with the availability of cutting-edge technology and internationally trained medical professionals.

The demand for healthcare services such as cosmetic surgery, orthopedics, fertility treatments, and organ transplants is contributing significantly to the growth of India’s medical tourism market. In addition, the existence of internationally accredited hospitals and clinics in urban centers such as Delhi, Bangalore, and Mumbai is propelling India into a position of a top medical tourism destination globally. Low-cost medical interventions along with advanced technology and reduced waiting times relative to other areas are vital determinants driving the industry's growth.

The following chart presents the projected CAGR for India’s medical tourism market, comparing growth patterns between 2024 and 2025.

CAGR Values for India Medical Tourism Industry (2024 to 2025)

It is projected that India’s medical tourism market will grow at a CAGR of 11.3% in the first half of 2024, with a slight increase to 11.8% in the second half. In 2025, the growth rate is expected to rise to 12%, driven by increasing demand for specialized surgeries, cosmetic procedures, and fertility treatments.

| Category | Details |

|---|---|

| Market Value | The Indian medical tourism industry is expected to generate USD 10.2 billion in 2024, capturing 25% of Asia’s medical tourism market. |

| Domestic Market Share | Domestic patients account for 45% of the market, with key destinations like Delhi, Bangalore, and Mumbai offering specialized treatments. |

| International Market Share | International patients make up 55%, with major source countries including the Middle East, Africa, the US, and Europe. They seek a wide range of services including orthopedic surgery, dental work, and cosmetic treatments. |

| Key Destinations | Popular destinations include Delhi’s Apollo Hospital for cancer treatments, Mumbai’s Nanavati Hospital for cardiac surgery, and Bangalore’s Sakra Premium Clinic for fertility treatments. |

| Economic Impact | The medical tourism sector generates billions annually, benefiting hospitals, clinics, and medical facilities such as Fortis Healthcare and Medanta. |

| Key Trends | Surge in the adoption of minimally invasive surgeries, rapid advancements in robotic surgery, and the rise of wellness tourism with Ayurvedic treatments. |

| Top Treatment Seasons | Winter and spring are peak seasons, especially for patients seeking cosmetic procedures, fertility treatments, and dental surgeries. |

India is fast emerging as one of the most popular medical tourism destinations, with Delhi, Mumbai, and Bangalore being the main hubs for quality healthcare. Global patients, particularly from the Middle East, Africa, and the US, are attracted by India's low cost, combined with high-tech medical equipment and professional healthcare professionals. Hospitals like Fortis Healthcare, Medanta, and the Apollo Group are leading the way in delivering high-quality treatments to propel India to a position of medical tourism leadership.

| Date | Development & Details |

|---|---|

| Jan 2025 | Launch of Robotic Surgery Unit: The Medanta Medicity Hospital in Gurgaon launched a state-of-the-art robotic surgery unit for advanced procedures in orthopedics and urology, attracting patients from the Middle East. |

| Dec 2024 | Fertility Treatment Expansion: Sakra Premium Clinic in Bangalore introduced an innovative package for IVF and fertility treatments, including egg freezing and surrogacy, drawing international patients from the US and Europe. |

| Nov 2024 | Opening of Advanced Cancer Treatment Center: The Apollo Hospital in Chennai opened a new center for cancer treatment, offering cutting-edge radiation therapy and immunotherapy for patients from Africa and Southeast Asia. |

| Oct 2024 | Ayurvedic Wellness Packages: Kerala Ayurvedic Resort launched exclusive wellness tourism packages, combining traditional Ayurvedic treatments with luxury accommodations, appealing to patients from Europe and North America seeking holistic health solutions. |

| Sept 2024 | Stem Cell Therapy Clinic Expansion: A leading stem cell clinic in Mumbai expanded its facilities, providing advanced treatments for orthopedic injuries, stroke rehabilitation, and chronic diseases, attracting international patients. |

Cosmetic Treatments Lead the Market

Cosmetic procedures will lead the way in India's medical tourism industry in 2025, holding around 30% of the entire market share. This is propelled by a rising demand worldwide for quality cosmetic surgery, such as rhinoplasty, facelift, liposuction, and dental implants. India's attraction is that it can provide these procedures at one-tenth of the price in Western nations while ensuring international levels of care. To this effect, medical tourists from the Middle East, Southeast Asia, and even the US are flocking to India for cosmetic enhancements.

Indian metropolises such as Mumbai, Delhi, and Hyderabad have become leading places for cosmetic surgeries. These metropolises are equipped with high-tech healthcare centers and surgeons who have been trained internationally, and therefore, these places are the first choice of people looking for specialized treatments. Mumbai, specifically, is very famous for specialized cosmetic clinics providing the latest services like facelifts, facial surgeries, and breast enhancements. Most of these clinics are headed by renowned surgeons from across the globe who provide a personal touch to every treatment, providing the best possible results.

One of the distinguishing features of India's cosmetic surgery medical tourism is that patients can mix their procedure with a vacation. Many medical tourists utilize the fact that they can enjoy India's rich cultural history, fast-paced cities, and natural landscapes while recovering from treatment. The combination of aesthetic improvement and tourism makes India an even more appealing choice for those who want to balance medical treatment with a recovery vacation.

In addition, India's well-established wellness industry, such as Ayurveda and heritage treatments, delivers a holistic rehabilitation experience to patients. This blend of low-cost, high-grade cosmetic procedures and cross-cultural experiences further establishes India as a global destination for health tourism, particularly in cosmetic surgery.

Independent Travelers Dominate the Market

By 2025, independent travelers will account for about 65% of all Indian medical tourists, reflecting a trend towards increasingly personalized and self-directed medical care experiences. This trend represents a rising patient preference for exercising direct control over the process of healthcare decision-making, from choosing the appropriate treatment and facility to handling the whole travel experience themselves. The presence of vast online resources has been instrumental in this revolution, enabling medical tourists to study hospitals, read reviews from patients, compare prices, and communicate directly with healthcare professionals prior to making a decision.

Growth of independent medical tourism in India is also supported by the availability of information that is on the rise. Now, patients have easy access to information regarding hospitals, their accreditations, the treatments being provided, and the success of procedures through widely established online networks. This ease of access to open information provides people with an opportunity to take more informed decisions and provides them with the strength to avoid middlemen like medical tourism companies. Most patients nowadays like to arrange their treatment, accommodation, and even excursions according to their personal liking and budget.

On top of this, India's open pricing systems and low-cost healthcare have made it even more appealing to independent medical travelers. The price for each procedure can be compared simply and easily across hospitals, guaranteeing high levels of care without the strain of high fees. The nature of this system permits patients to combine their treatment with vacation, being able to stay longer after a procedure to recover or even for tourist activities.

This transition towards independent travel is also made easy by the increased number of medical tourism platforms offering end-to-end solutions. Such platforms provide complete services, from assisting patients in selecting the appropriate clinics and doctors to arranging logistics such as visas and local travel, further allowing patients to gain control over their medical travel. This increasing sector is likely to continue propelling the Indian medical tourism sector forward in the next few years.

The India Medical Tourism Industry is highly competitive, with a blend of top-tier hospitals, specialized medical centers, and smaller boutique clinics offering niche treatments.

2025 Market Share of India Medical Tourism Players

Leading players with significant market shares include Fortis Healthcare, Medanta, and Apollo Hospitals, followed by a variety of regional hospitals and specialized clinics offering services like dental treatments, organ transplants, and cosmetic surgeries.

The industry is segmented into Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopedic Treatment, Infertility Treatment, Ophthalmic Treatment, and Other Treatments.

The market is analyzed by age groups (Less than 15 years, 15 - 25 years, 26 - 35 years, 36 - 45 years, 46 - 55 years, Over 55 years).

Segmentation includes Domestic and International tourists.

The industry includes Public Provider, Private Provider.

Independent Traveler, Tour Group, Package Traveler

The market is analyzed by gender (Men, Women) and age (Children).

The industry is segmented into Phone Booking, Online Booking, and In-person Booking.

India's Medical Tourism Industry is expected to grow at a CAGR of 12.3% from 2025 to 2035.

The market is projected to reach USD 58.2 billion by 2035.

Key drivers include high-quality healthcare, affordability, availability of advanced medical procedures, and the growing influx of international patients seeking specialized treatments in India.

Key players include Fortis Healthcare, Medanta, Apollo Hospitals, and other prominent Indian hospitals offering world-class medical care and innovative treatments.

Table 1: Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Market Value (US$ Million) Forecast by Treatment Type, 2019 to 2034

Table 3: Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 4: Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 5: Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 6: Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 7: Market Value (US$ Million) Forecast by Booking Channel, 2019 to 2034

Table 8: North Market Value (US$ Million) Forecast by Treatment Type, 2019 to 2034

Table 9: North Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 10: North Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 11: North Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 12: North Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 13: North Market Value (US$ Million) Forecast by Booking Channel, 2019 to 2034

Table 14: East Market Value (US$ Million) Forecast by Treatment Type, 2019 to 2034

Table 15: East Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 16: East Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 17: East Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 18: East Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 19: East Market Value (US$ Million) Forecast by Booking Channel, 2019 to 2034

Table 20: West Market Value (US$ Million) Forecast by Treatment Type, 2019 to 2034

Table 21: West Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 22: West Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 23: West Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 24: West Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 25: West Market Value (US$ Million) Forecast by Booking Channel, 2019 to 2034

Table 26: South Market Value (US$ Million) Forecast by Treatment Type, 2019 to 2034

Table 27: South Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 28: South Market Value (US$ Million) Forecast by Tour Type, 2019 to 2034

Table 29: South Market Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 30: South Market Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 31: South Market Value (US$ Million) Forecast by Booking Channel, 2019 to 2034

Figure 1: Market Value (US$ Million) by Treatment Type, 2024 to 2034

Figure 2: Market Value (US$ Million) by Services, 2024 to 2034

Figure 3: Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 4: Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 5: Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 6: Market Value (US$ Million) by Booking Channel, 2024 to 2034

Figure 7: Market Value (US$ Million) by Region, 2024 to 2034

Figure 8: Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 9: Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 10: Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 11: Market Value (US$ Million) Analysis by Treatment Type, 2019 to 2034

Figure 12: Market Value Share (%) and BPS Analysis by Treatment Type, 2024 to 2034

Figure 13: Market Y-o-Y Growth (%) Projections by Treatment Type, 2024 to 2034

Figure 14: Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 15: Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 16: Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 17: Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 18: Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 19: Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 20: Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 21: Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 22: Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 23: Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 24: Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 25: Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 26: Market Value (US$ Million) Analysis by Booking Channel, 2019 to 2034

Figure 27: Market Value Share (%) and BPS Analysis by Booking Channel, 2024 to 2034

Figure 28: Market Y-o-Y Growth (%) Projections by Booking Channel, 2024 to 2034

Figure 29: Market Attractiveness by Treatment Type, 2024 to 2034

Figure 30: Market Attractiveness by Services, 2024 to 2034

Figure 31: Market Attractiveness by Tour Type, 2024 to 2034

Figure 32: Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 33: Market Attractiveness by Age Group, 2024 to 2034

Figure 34: Market Attractiveness by Booking Channel, 2024 to 2034

Figure 35: Market Attractiveness by Region, 2024 to 2034

Figure 36: North Market Value (US$ Million) by Treatment Type, 2024 to 2034

Figure 37: North Market Value (US$ Million) by Services, 2024 to 2034

Figure 38: North Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 39: North Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 40: North Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 41: North Market Value (US$ Million) by Booking Channel, 2024 to 2034

Figure 42: North Market Value (US$ Million) Analysis by Treatment Type, 2019 to 2034

Figure 43: North Market Value Share (%) and BPS Analysis by Treatment Type, 2024 to 2034

Figure 44: North Market Y-o-Y Growth (%) Projections by Treatment Type, 2024 to 2034

Figure 45: North Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 46: North Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 47: North Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 48: North Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 49: North Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 50: North Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 51: North Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 52: North Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 53: North Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 54: North Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 55: North Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 56: North Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 57: North Market Value (US$ Million) Analysis by Booking Channel, 2019 to 2034

Figure 58: North Market Value Share (%) and BPS Analysis by Booking Channel, 2024 to 2034

Figure 59: North Market Y-o-Y Growth (%) Projections by Booking Channel, 2024 to 2034

Figure 60: North Market Attractiveness by Treatment Type, 2024 to 2034

Figure 61: North Market Attractiveness by Services, 2024 to 2034

Figure 62: North Market Attractiveness by Tour Type, 2024 to 2034

Figure 63: North Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 64: North Market Attractiveness by Age Group, 2024 to 2034

Figure 65: North Market Attractiveness by Booking Channel, 2024 to 2034

Figure 66: East Market Value (US$ Million) by Treatment Type, 2024 to 2034

Figure 67: East Market Value (US$ Million) by Services, 2024 to 2034

Figure 68: East Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 69: East Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 70: East Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 71: East Market Value (US$ Million) by Booking Channel, 2024 to 2034

Figure 72: East Market Value (US$ Million) Analysis by Treatment Type, 2019 to 2034

Figure 73: East Market Value Share (%) and BPS Analysis by Treatment Type, 2024 to 2034

Figure 74: East Market Y-o-Y Growth (%) Projections by Treatment Type, 2024 to 2034

Figure 75: East Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 76: East Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 77: East Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 78: East Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 79: East Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 80: East Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 81: East Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 82: East Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 83: East Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 84: East Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 85: East Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 86: East Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 87: East Market Value (US$ Million) Analysis by Booking Channel, 2019 to 2034

Figure 88: East Market Value Share (%) and BPS Analysis by Booking Channel, 2024 to 2034

Figure 89: East Market Y-o-Y Growth (%) Projections by Booking Channel, 2024 to 2034

Figure 90: East Market Attractiveness by Treatment Type, 2024 to 2034

Figure 91: East Market Attractiveness by Services, 2024 to 2034

Figure 92: East Market Attractiveness by Tour Type, 2024 to 2034

Figure 93: East Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 94: East Market Attractiveness by Age Group, 2024 to 2034

Figure 95: East Market Attractiveness by Booking Channel, 2024 to 2034

Figure 96: West Market Value (US$ Million) by Treatment Type, 2024 to 2034

Figure 97: West Market Value (US$ Million) by Services, 2024 to 2034

Figure 98: West Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 99: West Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 100: West Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 101: West Market Value (US$ Million) by Booking Channel, 2024 to 2034

Figure 102: West Market Value (US$ Million) Analysis by Treatment Type, 2019 to 2034

Figure 103: West Market Value Share (%) and BPS Analysis by Treatment Type, 2024 to 2034

Figure 104: West Market Y-o-Y Growth (%) Projections by Treatment Type, 2024 to 2034

Figure 105: West Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 106: West Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 107: West Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 108: West Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 109: West Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 110: West Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 111: West Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 112: West Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 113: West Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 114: West Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 115: West Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 116: West Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 117: West Market Value (US$ Million) Analysis by Booking Channel, 2019 to 2034

Figure 118: West Market Value Share (%) and BPS Analysis by Booking Channel, 2024 to 2034

Figure 119: West Market Y-o-Y Growth (%) Projections by Booking Channel, 2024 to 2034

Figure 120: West Market Attractiveness by Treatment Type, 2024 to 2034

Figure 121: West Market Attractiveness by Services, 2024 to 2034

Figure 122: West Market Attractiveness by Tour Type, 2024 to 2034

Figure 123: West Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 124: West Market Attractiveness by Age Group, 2024 to 2034

Figure 125: West Market Attractiveness by Booking Channel, 2024 to 2034

Figure 126: South Market Value (US$ Million) by Treatment Type, 2024 to 2034

Figure 127: South Market Value (US$ Million) by Services, 2024 to 2034

Figure 128: South Market Value (US$ Million) by Tour Type, 2024 to 2034

Figure 129: South Market Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 130: South Market Value (US$ Million) by Age Group, 2024 to 2034

Figure 131: South Market Value (US$ Million) by Booking Channel, 2024 to 2034

Figure 132: South Market Value (US$ Million) Analysis by Treatment Type, 2019 to 2034

Figure 133: South Market Value Share (%) and BPS Analysis by Treatment Type, 2024 to 2034

Figure 134: South Market Y-o-Y Growth (%) Projections by Treatment Type, 2024 to 2034

Figure 135: South Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 136: South Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 137: South Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 138: South Market Value (US$ Million) Analysis by Tour Type, 2019 to 2034

Figure 139: South Market Value Share (%) and BPS Analysis by Tour Type, 2024 to 2034

Figure 140: South Market Y-o-Y Growth (%) Projections by Tour Type, 2024 to 2034

Figure 141: South Market Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 142: South Market Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 143: South Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 144: South Market Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 145: South Market Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 146: South Market Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 147: South Market Value (US$ Million) Analysis by Booking Channel, 2019 to 2034

Figure 148: South Market Value Share (%) and BPS Analysis by Booking Channel, 2024 to 2034

Figure 149: South Market Y-o-Y Growth (%) Projections by Booking Channel, 2024 to 2034

Figure 150: South Market Attractiveness by Treatment Type, 2024 to 2034

Figure 151: South Market Attractiveness by Services, 2024 to 2034

Figure 152: South Market Attractiveness by Tour Type, 2024 to 2034

Figure 153: South Market Attractiveness by Consumer Orientation, 2024 to 2034

Figure 154: South Market Attractiveness by Age Group, 2024 to 2034

Figure 155: South Market Attractiveness by Booking Channel, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Tourism Market Analysis by Treatment Type, by Age Group, by Tourist Type, by Service Provider, Traveler Type, by Demography, by Booking, and by Region – Forecast for 2025-2035

Competitive Overview of Medical Tourism Companies

India Ecotourism Market Analysis – Demand, Growth & Forecast 2025-2035

India Casino Tourism Market Forecast and Outlook 2025 to 2035

India Safari Tourism Market Trends – Demand, Growth & Forecast 2025-2035

India Sports Tourism Market Insights - Growth & Forecast 2025 to 2035

UK Medical Tourism Market Trends – Demand, Growth & Forecast 2025-2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Culinary Tourism Market Trends - Growth & Forecast 2025 to 2035

USA Medical Tourism Market Analysis – Size, Share & Forecast 2025-2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Faith-Based Tourism Market Trends - Growth & Forecast 2025 to 2035

India Preclinical Medical Device Testing Services Market Report – Trends & Innovations 2025-2035

Italy Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

China Medical Tourism Industry Analysis from 2025 to 2035

France Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

Turkey Medical Tourism Market Analysis - Size, Share, and Forecast 2024 to 2034

Germany Medical Tourism Market Insights – Size, Trends & Forecast 2025-2035

Inbound Medical Tourism Market is segmented by Treatment Type, Service Type, Customer Orientation, Age Group, and Booking Channel from 2025 to 2035

Outbound Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA