The India loyalty program market is very rapidly growing as brands are investing in customer retention strategies to drive long-term engagement and revenue growth. With increasing digital adoption, spending by consumers, and competition across industries, companies are focusing on more sophisticated data-driven rewards programs to enhance customer relationships.

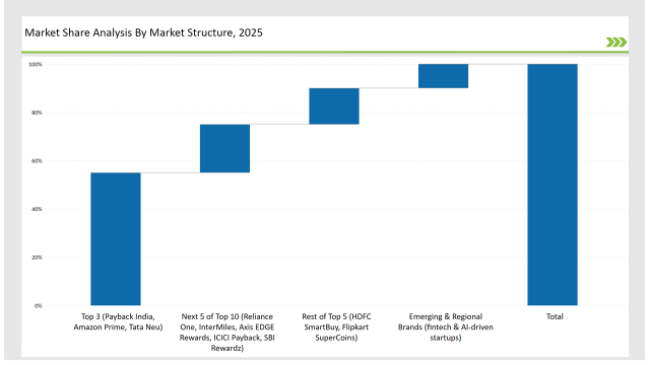

Advancements in AI, blockchain, and mobile-first solutions are further upscaling the sector. With major market share commanding brands including Payback India, Amazon Prime, and Tata Neu that have reached wider audiences and provide data-driven loyalty solutions, the market currently is held at 55%.

Regional brands and industry-specific programs account for 30%, while emerging fintech and AI-powered startups contribute the remaining 15%.

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Payback India, Amazon Prime, Tata Neu) | 55% |

| Rest of Top 5 (HDFC SmartBuy, Flipkart SuperCoins) | 15% |

| Next 5 of Top 10 (Reliance One, InterMiles, Axis EDGE Rewards, ICICI Payback, SBI Rewardz) | 20% |

| Emerging & Regional Brands (fintech & AI-driven startups) | 10% |

The India loyalty program market in 2025 is moderately concentrated, with the top players accounting for 50% to 60% of the total market share. Leading brands such as Payback India, Amazon Prime, and Tata Neu dominate the segment, while startup-driven digital loyalty platforms and retailer-specific programs add competitive diversity.

This market structure reflects strong brand influence while allowing space for data-driven personalization and innovative reward structures.

The India loyalty program operates through a channel that involves digital platforms and mobile applications, which comprise 60% of the market. App-based rewards and e-commerce integrations attract consumers.

Retail and offline programs form 25%, which emphasize point-based incentives and deals with particular partners. Co-branded credit card programs remain at 10% with reward-based advantages in spending. Direct corporate loyalty programs form 5%, providing both employee retention and business-to-business (B2B) incentives.

It has classified the loyalty program market in India into retail loyalty programs, travel and hospitality rewards, financial services loyalty, and subscription-based membership programs. Retail loyalty programs lead the market with 45% on account of wide-scale adoption in markets such as supermarkets, online marketplaces, and lifestyle brands.

Travel and hospitality rewards account for 25%, catering to frequent travelers and premium members. Financial services account for 20%, mainly through the use of reward-based credit cards and banking rewards. Subscription-based membership is at 10%, increasing with the growth of streaming services and premium shopping memberships.

2024 has been a transformative year for the India loyalty program market, which is marked by AI-driven personalization, digital rewards, and omnichannel engagement. Key players include:

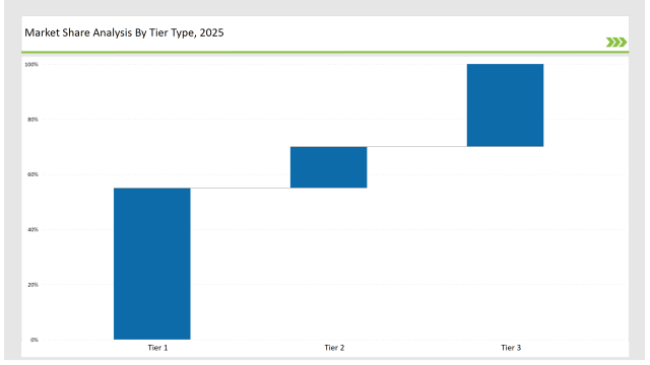

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Payback India, Amazon Prime, Tata Neu |

| Market Share (%) | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | HDFC SmartBuy, Flipkart SuperCoins |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, fintech startups |

| Market Share (%) | 30% |

| Brand | Key Focus Areas |

|---|---|

| Payback India | Cross-category rewards & retail partnerships |

| Amazon Prime | Subscription-based loyalty with exclusive benefits |

| Tata Neu | Super-app loyalty integration across Tata brands |

| HDFC SmartBuy | Co-branded credit card cashback & travel rewards |

| Flipkart SuperCoins | Gamified loyalty experiences & tier-based benefits |

| Emerging Brands | AI-driven rewards & seamless multi-merchant point conversions |

India's loyalty program market will be one of sustained growth through data-driven personalization, fintech collaborations, and omnichannel customer engagement. Brands will focus on AI-powered predictive analytics, blockchain-backed reward security, and gamification to enhance customer retention. Consumer preferences are shifting, making loyalty programs more interactive, with immersive experiences and seamless digital integrations. Innovation, data-driven engagement, and ethical consumer incentives form the nucleus of India's future loyalty market.

Leading players such as Payback India, Amazon Prime, and Tata Neu collectively hold around 55% of the market.

Regional brands and industry-specific loyalty programs contribute approximately 30% of the market by offering customized rewards for local businesses.

Startups focusing on AI-based rewards, digital wallets, and blockchain-backed loyalty solutions hold about 10% of the market.

Private labels from retail and banking sectors hold around 5% of the market, focusing on co-branded credit card rewards and brand-specific incentives.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

India Safari Tourism Market Trends – Demand, Growth & Forecast 2025-2035

India Yoga and Meditation Service Market Trends – Size, Share & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA