The residential solar inverter market in India will see good growth, as the penetration of rooftop solar, the rising cost of electricity, and the drive at the country level to transition towards cleaner energy pick up momentum. As consumers in urban and semi-urban India are switching towards solar power for autonomy and savings, demand is growing for smart, efficient, and reliable inverter systems.

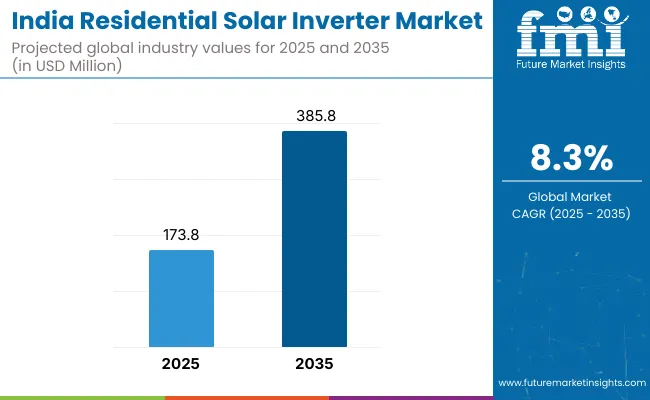

The market was valued about USD 173.8 million in 2025 and it is projected to be USD 385.8 million in 2035, at a CAGR of 8.3% during the forecasted period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 173.8 Million |

| Industry Value (2035F) | USD 385.8 Million |

| CAGR (2025 to 2035) | 8.3% |

Solar inverters are critical appliances that turn direct current (DC) power from solar panels into usable alternating current (AC) electricity are the key component of all solar power systems.

While changing customer needs and technological innovations drive the industry ahead, the market is trending towards hybrid and intelligent inverters that can communicate with the grid, interact with batteries, and be remotely monitored. Government regulations, net metering policies, and increasing energy security worries are also enhancing market penetration in urban homes and rural residences.

Government policy initiatives towards dispersed renewable energy, specifically through initiatives like PM-KUSUM, state-level solar policies, and smart city missions, are driving the demand for solar homes solution.

To this end, inverter companies are localizing manufacturing, improving product reliability to suit Indian grid conditions, and establishing improved after-sales service networks to meet higher demand.

North India, which comprises Delhi, Punjab, Uttar Pradesh, and Haryana, is a growth driver as it has a high density of urban agglomeration and high electricity charges. The business for grid-connect and hybrid inverters is growing steadily due to an extraordinary increase in solar rooftop installations in housing colonies, apartment complexes and gated communities. Frequent power fluctuations in that region also demand stable inverter solutions especially for near-summer peak load conditions.

South India, is a front-runner in the residential solar revolution with good policy backing, increasing solar awareness, and high sunshine availability. Demand for solar inverters is especially robust in tier-1 and tier-2 cities, where rooftop solar is rapidly becoming the preference for standalone housing as well as residential buildings. Customers here are early movers to battery-integrated and Wi-Fi-enabled smart inverters.

East India, comprising West Bengal, Odisha, Jharkhand, and Bihar, is witnessing increased takeoff of solar inverters, especially off-grid and semi-urban segments. Home consumers are going for solar as a reliable alternative to unpredictable grid supply at negligible cost, and hybrid and off-grid inverters are gaining popularity. State solar programs and government-sponsored rural electrification are actively contributing to easing access and awareness.

West India comprising Maharashtra, Gujarat, and Rajasthan is a solar hub and fast-emerging residential inverter market. Favorable pro-net metering policies, high solar irradiance, and robust state policies are driving the market towards large-scale deployment of residential solar installations. Urban consumers especially demand high-efficiency inverters with battery readiness and long warranty support.

In Central India, Madhya Pradesh and Chhattisgarh are becoming a solar hotbed as state-level policy and awareness drives pick up pace. Home inverter installations are picking up pace, especially in urban and rural areas with spiking energy rates and power reliability concerns. Demand is skewed toward tough inverters with voltage ride-through capability and connectivity to battery storage systems to back during outages.

Fragmented Rooftop Market and Limited Standardization

India's residential solar market is highly heterogeneous, with disparate installer capability, system size, and site. This heterogeneity poses challenges to inverter manufacturers in the standardization of products at scale. Roof orientation, shading, and local grid behavior variability requires customized inverter configurations, heightening design and installation complexity for both string and micro inverter systems.

Grid Instability and Voltage Fluctuations in Semi-Urban Areas

Although metro cities enjoy the advantage of fairly stable electricity supply, most tier-2 and tier-3 cities in India continue to have grid fluctuations, low voltage, or frequent shutdowns. These situations can impair inverter efficiency, lead to early system failures, or refrain from net metering from being used at maximum efficiency. Such areas require household inverters to have more protective features, grid-tie control, and battery-ready designs all increasing end-users' costs.

Cost Sensitivity and Informal Installer Ecosystem

Affordability is of particular interest for Indian residential homebuyers making an investment in solar. Competition on prices from local brands of inverters is usually a game of lowering standards on quality, after-sales support, or guarantee services. Local market dominance by unorganized or semi-trained installers results in sub-optimal system design, incorrect sizing of inverters, and less system reliability discrediting consumers' faith in long-term investment in solar.

Government Incentives and State-Level Subsidy Programs

India's Ministry of New and Renewable Energy (MNRE) is aggressively driving rooftop solar installation through capital subsidies on residential usage under the Solar Rooftop Programme Phase-II. Together with net metering regulations and state-level incentives, this has hugely boosted demand for residential installations and, by the same token, inverters. With improvement in the implementation of these policies, acceptance of approved and efficient inverter systems is likely to spike.

Emergence of Smart, Hybrid, and Battery-Ready Inverters

As the cost of energy storage drops and power backup becomes a domestic imperative, hybrid inverters with built-in battery backup are increasing in popularity. Solar and battery configurations are increasingly being chosen by homeowners to cope with peak loads, safeguard against outages, and optimize solar self-consumption. This trend is driving inverter manufacturers to provide smarter systems with remote monitoring, Wi-Fi/Bluetooth connectivity, and mobile app connectivity.

Urban Rooftop Projects and Green Building Regulations Growth

Urban property developers and gated societies increasingly incorporate rooftop solar into building designs, following green building regulations and sustainability credentials (such as GRIHA and IGBC). Bulk residential developments generate a high-volume, mass market for inverter makers, particularly for small multi-string inverters and micro inverter systems with modularity and flexibility.

Make-in-India Drive and Potential for Domestic Manufacturing

Under India's Make-in-India and Production Linked Incentive (PLI) programs, local production of solar components such as inverters is being supported by the government. This should lower dependence on imports, decrease costs, and improve supply chain stability for residential solar projects. It also offers a chance for Indian brands to become global providers of affordable, feature-rich residential inverter solutions.

From 2020 to 2024, India's residential solar inverter market increased progressively, with support from urban take up, decreasing panel costs, and increasing awareness of solar advantages. But limitations such as irregular installation practices, grid instability, and inadequate standardized procurement limited maximum system performance in most regions.

Between 2025 and 2035, the market will pick up pace with enhanced financing models, increasing demand for energy autonomy, and rooftop solar system digitization. A new generation of smart inverters, hybrid systems, and AI-based energy management solutions will transform residential solar experiences in urban and semi-urban areas. With policy frameworks stabilizing and user confidence increasing, residential inverters will transition from simple grid-tie devices to smart, home energy ecosystem enablers.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Sourcing Strategy | Mix of imported and locally assembled inverters from China, Europe, and Indian SMEs |

| End-Use Dominance | Small rooftop systems (1-3 kW) with standalone string inverters |

| Production Trends | Fragmented supplier base with limited quality control in the sub-5 kW segment |

| Price Trends | Highly price-sensitive market; intense competition from low-cost imports |

| Technology Integration | Basic MPPT string inverters with limited remote control features |

| Environmental Focus | Primarily driven by savings and grid dependency reduction |

| Supply Chain Risks | Vulnerable to import duties, foreign currency volatility, and shipping delays |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Sourcing Strategy | Strong growth in domestic manufacturing and backward integration under PLI and Make-in-India schemes |

| End-Use Dominance | Growth in hybrid, battery-ready, and modular inverter systems with advanced monitoring and grid feedback capabilities |

| Production Trends | Consolidation of manufacturers offering BIS-certified, export-grade residential inverters |

| Price Trends | Gradual price stabilization through economies of scale, local R&D, and premiumization of smart inverter offerings |

| Technology Integration | Smart inverters with mobile apps, energy management dashboards, and AI-powered consumption optimization |

| Environmental Focus | Stronger alignment with carbon footprint reduction, home energy efficiency, and ESG goals for residential buildings |

| Supply Chain Risks | Resilience built through local manufacturing ecosystems and digital distribution platforms |

It leads India's residential solar inverter market owing to peak power demand, urban population boom, and progressive renewable energy policies. Pune and Mumbai, urban city hubs, are seeing a rooftop solar boom, especially in high-rise societies and gated communities.

Inverters act as the core PMC (power management unit) in residential solar systems, which continually engage with the state's net metering policy and incentives. With awareness rising and grid reliability being an issue, the demand for smart, hybrid solar inverters in Maharashtra is growing steadily.

| State | CAGR (2025 to 2035) |

|---|---|

| Maharashtra | 8.6% |

Delhi’s nascent residential solar inverter market is expanding rapidly, spurred by strong state incentives, rising electricity costs and climate mitigation objectives in the city. Over the years, solar rooftop has become increasingly popular among individual houses and apartment blocks, maintaining steady demand for smaller and grid-compliant solar inverters.

The Delhi Solar Policy and incentives for net metering schemes are further propelling the genesis of cleaner, renewable energy, he added. With limited opportunity to acquire land and a inherent trend to decentralized power supply, Delhi is undergoing a transformation into high-efficiency, remote-monitoring enabled inverter systems.

| State | CAGR (2025 to 2035) |

|---|---|

| Delhi | 8.5% |

Karnataka, particularly urban cities such as Bengaluru, is currently a southern Indian residential solar hub. Technophile consumers, frequent power outages in suburban belts, and eco-friendly citizens have driven residential solar inverters to rocket at lightning speed.

Government measures to promote grid-connected and off-grid solar systems and easy finance facilities have enhanced the viability of solar. Hybrid and battery-compatible inverters are gaining traction with increasing demand for energy autonomy and home automation systems.

| State | CAGR (2025 to 2035) |

|---|---|

| Karnataka | 8.4% |

West Bengal is gradually increasing its share in the residential solar inverter space, backed by strong policy support under the West Bengal Renewable Energy Development Agency (WBREDA). The city of Kolkata and the surrounding urban zone are experiencing increasing rooftop solar penetration, bolstered by superior inverter technology, rising power tariffs, and central scheme benefits.

Space-constrained installations are particularly sought after for string inverters and micro inverters. The growing demand for backup power requirements and clean energy is motivating growing numbers of consumers to look towards solar as a viable alternative.

| State | CAGR (2025 to 2035) |

|---|---|

| West Bengal | 7.9% |

Gujarat is one of the sunniest developed states in India, and mass residential rooftop solar penetration is aided by state-level initiatives and constant DISCOM support. Ahmedabad, Surat, and Rajkot are major demand drivers for inverter, especially in net-metered solar houses.

The state Solar Rooftop Programme and simple installation procedure made it simple to adopt inverters. Inverter system demand for real-time energy management and battery integration is increasing.

| State | CAGR (2025 to 2035) |

|---|---|

| Gujarat | 8.2% |

In India's fast-changing residential solar industry, on-grid solar inverters are the most widely accepted and strategically vital product type. This leadership is testament not only to the rapidly growing adoption of rooftop solar installations across urban and semi-urban areas but also to the policy context that has ripened to forcefully promote grid-connected renewable energy generation. With householders seeking to cut electricity expenses, improve energy security, and advance the country's clean energy vision, on-grid inverters have emerged as the center stage for India's residential solar transformation.

On-grid or grid-tied inverters work by synchronizing with the local utility grid and feeding back excess solar power into it, allowing consumers to avail themselves of net metering or gross metering regulations, as applicable under their state mandates. This setup has gained considerable traction in Indian states, especially those with good compensation offered by utilities for solar units exported.

This policy push towards rooftop solar, especially under programs like the Ministry of New and Renewable Energy's (MNRE) Grid Connected Rooftop Solar Programme Phase-II, has been instrumental in stimulating market growth for on-grid inverters focused on residential installations.

Residential rooftop installations have been increasing in major urban metropolitan cities like Delhi, Bengaluru, Pune, Ahmedabad, and Hyderabad. There are on-grid inverters as well, which helps with the seamless integration of solar energy to the grid, and one can run on solar power on sunny days and grid power on cloudy days without the need for battery backup.

The financial logic is compelling: people can balance out daytime use and earn credits on the electricity bill by selling surplus power. One of the major drivers of the success of on-grid inverters in India is the decline in inverter and module prices in the past decade.

This has been accompanied by rising grid electricity tariffs, especially among upper-middle-class urban customers. Solar has emerged as a more cost-effective investment. The on-grid inverter has also been a beneficiary of the trend since their price is relatively lower compared to hybrid systems where additional storage batteries are required. For price-sensitive yet quality-conscious Indian households, the reliability and cost-effectiveness of new on-grid inverter systems offer strong value.

Technology firms have reacted to growing demand by launching smart, IoT-enabled on-grid inverters that provide real-time performance data, remote diagnosis, and app-based system monitoring. These specifications resonate with digitally empowered Indian consumers who hope for easy monitoring and control over their energy networks. Companies such as Growatt, Sungrow, Luminous, and Waaree have introduced state-of-the-art single-phase and three-phase grid-tied inverters tailored for the Indian market with surge protection, heat-durability properties, and regional grid code features.

The input of the DISCOMs and local system integrators cannot be discounted. Such stakeholders have increasingly teamed up with inverter producers to make the commissioning and installation process easier, such as the provision of grid connection and meter installation approvals. As a result, the consumer onboarding time and installation timeline have improved, facilitating confidence in on-grid systems.

The regulatory framework has continued to develop favorably for on-grid systems. Several Indian states have mandated DISCOMs to offer net metering to domestic customers up to 10 kW, and the government has put standardized guidelines in place to facilitate interconnection procedures. Even in those jurisdictions that have caps or restrictions on net metering, the overall direction of policy by and large encourages on-grid rooftop systems, creating a predictable and scalable climate for residential solar growth.

In the upcoming future, on-grid inverters will remain the top dog in the Indian residential solar market for several more years to come. With DISCOMs upgrading the infrastructure, net metering getting more of an international standard, and digital platforms increasing trust and transparency, on-grid systems will become even more mainstream. Besides, with shifting electricity consumption patterns in the wake of electric vehicles, smart homes, and home businesses, the offer of selling solar power through on-grid inverters will only increase.

The 2 to 5 kW capacity range has firmly cemented its position as the most powerful and most versatile range in India's residential solar inverter market. The size addresses the sweet spot for Indian residential energy needs, with enough generation capacity to meet a significant portion of daily consumption without overloading roof space or family budgets.

Thus, the 2 to 5 kW range has become the default choice among urban residents and middle-class families who want to adopt solar to save money, reduce carbon footprints, and be self-sufficient. Under a typical Indian residential setup specifically in the scenario of nuclear families living in freestanding homes or apartment communities average daily energy consumption between 8 and 20 units.

A optimally configured solar rooftop system with 3 kW to 4 kW power along with a matching 2 to 5 kW inverter can easily supply loads in day time like lighting, fans, air conditioners, kitchen appliances, and minimal electronics. This alignment of consumption and capacity implies that families consume the highest solar self-consumption and lowest grid dependency.

Rooftop subsidy programs instituted at the state level have also enabled a high take-up within this capacity range. Domestic consumers are eligible to get up to 40% capital subsidy on systems with capacity up to 3 kW and 20% on systems with capacity between 3 and 10 kW under the MNRE's Phase-II rooftop solar scheme. These incentives have rendered 2 to 5 kW installations highly sought after, with quicker return on investment and reduced capital expenditure. In Gujarat, Kerala, Maharashtra, and Haryana states, the combination of state-specific incentives and central subsidies has resulted in a very strong market for residential systems in this category.

Installers and EPC providers have surfed this wave by delivering standardized packages, commonly with inverters, panels, mounting frames, and system monitoring applications, all tailored to 2 to 5 kW installations. Plug-and-play solutions simplify the buying decision for householders and reduce site-specific variability and complexity of installations.

Besides, DISCOMs and system aggregators have made net metering approvals and inspection more streamlined for this capacity segment, which allows quicker commissioning and billing integration. Technically, 2 to 5 kW inverters have developed very quickly in India to address environmental and grid compatibility issues.

Inverters now incorporate anti-islanding protection, intelligent load management, and remote monitoring capabilities to comply with the recent BIS (Bureau of Indian Standards) and IEC (International Electro Technical Commission) regulations. Inverter factory designs have localized to cater to high ambient temperatures that are common in India, voltage variations, and dust exposure, with the promise of stable operation in diverse regional conditions.

Accessibility of rooftop space has also aided the growth in this segment. A 3 to 5 kW system will take up approximately 250 to 400 square feet of roof area an achievable footprint for most low-rise structures and single-family homes. In densely populated cities where land is scarce and vertical living is common, apartment resident welfare associations and residential welfare organizations have similarly welcomed group solar systems of 2 to 5 kW per equivalent household, creating economies of scale as well as community ownership of solar energy.

Consumer research shows that households choosing systems between 2 and 5 kW are environmentally aware, technologically advanced, and financially mature. These customers are likely to compare product details, monitor system performance, and advocate solar uptake within peer networks. Their positive post-installation experience largely shared across social media or community forums has contributed to organic growth and peer-to-peer influence in residential solar uptake.

In the long term, the 2 to 5 kW category will continue to be a staple of the Indian residential solar inverter market. As solar panel efficiencies improve and installation costs fall, the payback for systems of this capacity range will become increasingly attractive. Additionally, with the installation of residential time-of-day tariffs, smart meters, and grid-interactive home energy systems, 2 to 5 kW inverters will increasingly become combined with energy storage, EV charging, and demand response.

The dominance of on-grid inverters and the strong performance of the 2 to 5 kW segment reveal a growing and maturing market. These segments reveal India's unique nexus of policy direction, consumer demand, technical innovation, and environmental awareness a nexus that will shape the future of Indian residential solar.

India's residential solar inverter market is witnessing strong growth as rooftop solar uptake speeds up, led by government subsidies, increasing electricity prices, and growing consumer knowledge of energy autonomy. The market is extremely competitive, with a combination of global inverter companies, strong local brands, and low-cost assemblers competing for market share across grid-connected, hybrid, and off-grid residential applications.

Advances in inverter efficiency, smart energy management, remote monitoring, and battery storage integration are driving the market. State-level net metering policies, DISCOM incentives, and quality certification mandates are also impacting brand positioning and procurement strategies.

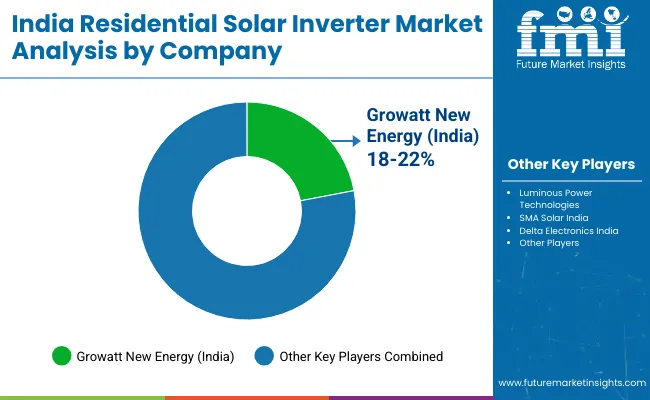

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Growatt New Energy (India) | 18-22% |

| Luminous Power Technologies | 14-18% |

| SMA Solar India | 12-16% |

| Delta Electronics India | 8-12% |

| Other Players | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Growatt New Energy | Offers single-phase and three-phase inverters for residential rooftops. Known for Wi-Fi-enabled smart inverters, fast service support, and high cost-efficiency across Tier 1 and Tier 2 cities. |

| Luminous Power Technologies | A leading domestic player offering hybrid solar inverters with integrated battery management systems. Strong dealer presence in rural and semi-urban regions. Recently expanded manufacturing capacity in Uttarakhand. |

| SMA Solar India | Supplies premium German-designed inverters with remote monitoring, AFCI (arc fault circuit interrupter) features, and high performance under extreme Indian weather conditions. |

| Delta Electronics India | Offers high-efficiency string inverters with MPPT (Maximum Power Point Tracking) capabilities. Focused on premium urban markets with compact designs and energy analytics software. |

On the basis of product type, the India Residential Solar Inverter Market is categorized into On Grid, Off-grid, and Hybrid.

On the basis of capacity, the India Residential Solar Inverter Market is categorized into Up to 2 kW, 2 to 5 kW, 5 to 7 kW, and 7 to 10 kW.

On the basis of phase, the India Residential Solar Inverter Market is categorized into Single-Phase and Multi-phase.

On the basis of region, the India Residential Solar Inverter Market is categorized into North India, West India, South India, and East India.

The overall market size for the Residential Solar Inverter Market in India was USD 173.8 Million in 2025.

The India Residential Solar Inverter Market is projected to reach USD 385.8 Million by 2035.

Increasing adoption of rooftop solar systems, favorable government subsidies and net metering policies, along with rising electricity costs in urban and semi-urban areas, will drive demand for residential solar inverters across India.

The top 5 states supporting growth in India’s Residential Solar Inverter Market are Maharashtra, Delhi, Karnataka, West Bengal and Gujarat.

On Grid and 2 to 5 kW segments are expected to lead the Indian market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Casino Tourism Market Forecast and Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

Analyzing India Loyalty Program Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA