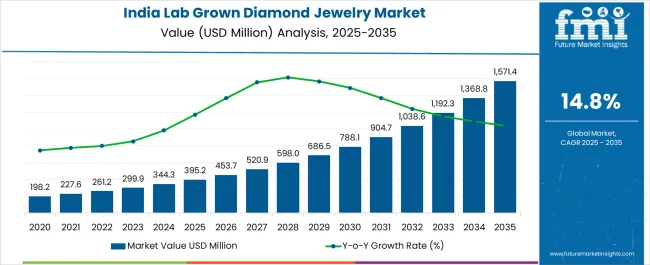

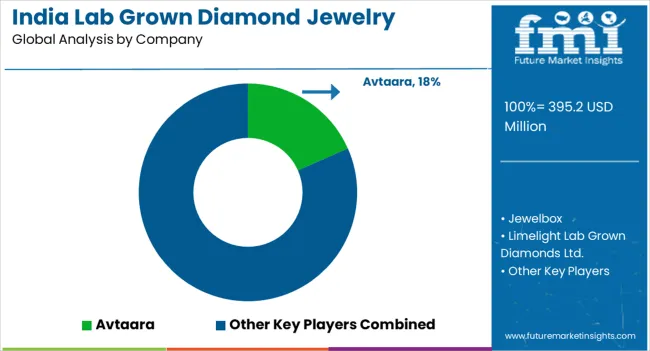

The India Lab Grown Diamond Jewelry Market is estimated to be valued at USD 395.2 million in 2025 and is projected to reach USD 1571.4 million by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period.

| Metric | Value |

|---|---|

| India Lab Grown Diamond Jewelry Market Estimated Value in (2025 E) | USD 395.2 million |

| India Lab Grown Diamond Jewelry Market Forecast Value in (2035 F) | USD 1571.4 million |

| Forecast CAGR (2025 to 2035) | 14.8% |

The India lab grown diamond jewelry market is experiencing robust growth driven by rising consumer acceptance of sustainable and affordable diamond alternatives. Increasing awareness about the ethical and environmental advantages of lab grown diamonds compared to mined stones has significantly boosted demand across urban and semi urban markets.

Advancements in production technologies have improved the quality, clarity, and variety of lab grown diamonds, enabling manufacturers to meet diverse consumer preferences. Marketing strategies emphasizing transparency, value for money, and eco friendliness are further supporting adoption.

Regulatory recognition and acceptance in global trade have also enhanced confidence in lab grown diamond jewelry. The outlook for the Indian market remains positive as younger demographics prioritize sustainable luxury, retailers expand offerings, and production scalability continues to lower costs while maintaining high aesthetic appeal.

The bangles segment is projected to account for 32.70% of total market revenue by 2025, making it a leading application category. Growth is being influenced by cultural affinity for bangles in India combined with increasing demand for modern, sustainable, and premium jewelry designs.

The appeal of lab grown diamond studded bangles lies in their affordability and ethical sourcing, aligning with shifting consumer values. Enhanced design flexibility and customization options have further contributed to their prominence.

This application continues to strengthen its market position as consumers increasingly view bangles as both traditional and fashion forward jewelry choices.

The chemical vapour deposition segment is expected to hold 54.60% of total market revenue by 2025 under the technique category, establishing it as the dominant production method. This technique is valued for its ability to produce high quality diamonds with fewer impurities and greater consistency.

It enables manufacturers to create larger, gem quality stones at scale, meeting the growing demand from jewelry retailers and consumers seeking premium finishes. The cost efficiency of this technique compared to alternatives has further reinforced its adoption.

Continuous advancements in process optimization are strengthening the role of chemical vapour deposition as the preferred technology in India’s lab grown diamond jewelry sector.

The faceted style segment is anticipated to contribute 68.20% of total revenue by 2025 within the cut type category, reflecting its dominance in the market. The popularity of this style is attributed to its ability to maximize brilliance, light reflection, and aesthetic appeal, making it highly desirable for jewelry applications.

Consumers associate faceted cuts with elegance and timelessness, driving their strong presence in rings, earrings, bangles, and pendants. The versatility of faceted cuts across both traditional and contemporary jewelry designs has elevated their adoption.

As demand continues to rise for visually striking and durable diamond jewelry, the faceted style maintains its leadership in the cut type segment.

India lab grown diamond jewelry sales grew at 10.6% CAGR from 2020 to 2024. For the next ten years (2025 to 2035), demand for lab grown diamonds in India is set to surge at 14.8% CAGR.

Changing preference towards lab grown diamonds across India will drive the market forward. Besides this, rise in trade of lab grown diamond jewelry is likely to boost sales across India.

Since there is a moderately fragmented market, players across the nation are focusing on strengthening their partnerships with local players. They are strategically deploying prime distributors in local regions.

Rising integration of smart and high-end technology to manufacture complex and luxurious jewelry items is likely to remain a prevailing trait during the forecast period. Diamond jewelry in India is considered a prominent sales category with increasing demand from the women population. This is attributed to the increase in occasional activities, events, and festivities in the country.

Further, increase in disposable income and rising millennial population will propel lab grown diamond jewelry sales. In addition, growing popularity of polished lab grown diamonds will fuel sales across India.

Growing Focus on Limiting Environmental Exploitation and Increasing Sustainability Boosting Market

People are becoming more aware of environmentally friendly methods in jewelry making. They are realizing the importance of lab grown diamond jewelry when it comes to sustainability.

Lab grown diamond jewelry causes very less harm to the environment as compared to mined ones. This is attracting environmentally friendly consumers towards lab grown diamonds and jewelry.

Thanks to sustainability and cost-effective advantages, lab grown diamond jewelry market is giving tough competition to the natural diamond market. Purchasers are gradually seeking eco-friendly items. Hence, they favor lab grown diamonds due to the negligible environmental effect.

Nowadays, buyers in the target market are highly curated for sustainable and environment-friendly products. As a result, there is an increase in the demand and growing potential for lab grown diamond in the country.

Further, such products also boost the welfare and cater to a brand’s responsibility for the sustainable manufacturing approach which is aiding in the expansion of the brand.

Changing Lifestyles of Working Women Fueling Demand for Lab Grown Diamond Jewelry

Women are increasingly venturing into starting companies and becoming independent, in addition to those entering the workforce. Working women are a vital consumer segment contributing significantly towards the growth India lab grown diamond jewelry market.

Lab grown diamond jewelry is becoming a more affordable and preferred choice for women. The women are getting attracted to new and creative designs and are inclined towards purchasing jewelry matching their outfits.

High-profile and high-paying jobs translate into higher levels of disposable income. Another factor driving the demand for lab grown diamond jewelry is the growing importance of appearance at work and the desire to look and feel good.

Apart from that, the trend of wearing expensive jewelry at marriages, functions, and other festivals has been popular for ages and with the new generation it is growing significantly. This will positively influence lab grown diamond jewelry sales.

Lab Grown Diamond Promising to Become an Important Value Added Product

Processing is the most significant stage in the diamond distribution network. This is because it is here that the most value is added. Processing facilities in Belgium, Israel, India, China, South Africa, New York, and Thailand compete for supplies of high-quality diamonds.

Today, diamond producers process their high-quality rough diamonds across worldwide markets. But India can simply position itself as a developed diamond processing base, serving consumer and commercial markets. It can move its cutting and polishing industry up the value chain, therefore increasing revenues.

Surge in Export of Polished Lab grown Diamonds from India Boosting Sales:

There is a huge surge in lab grown diamond exports where India alone has witnessed exports worth USD 443 million. As per Future Market Insights’ analysis, lab grown diamond exports increased by 60% y-o-y growth while there was a sharp decrease in natural diamond exports by 40% y-o-y.

Lab grown diamonds, however, hold a very lesser share in the market. But the Finance Department in India is focusing on promoting exports and simultaneously reducing custom duty on the diamond seeds used for manufacturing. This will bode well for India lab grown diamond jewelry industry.

Cost-effective Feature of Lab Grown Diamond Jewelry Making it More Affordable

Lab grown diamonds are more affordable when it comes to jewelry. There have been multiple research setups for encouraging the production of seeds and machines which will reduce dependency on imports.

There have also been technological advancements in lab grown diamonds which are encouraging new people to join the LGD business. These advancements are making the process easier and cost-effective.

As per the recent observation, it is established that there is a growing awareness about lab grown diamonds having similar characteristics to natural diamonds. Due to their cheaper cost, lab grown diamonds are not only restricted to high-end consumers.

Necklaces and Rings Generating Most Revenues in India Lab Grown Diamond Jewelry Industry

In recent years, there has been an increase in demand for lab grown diamonds grown across India. There are several jewelry merchants providing varieties of designs and settings in lab grown diamond jewelry.

Lab grown diamond jewelry can be a preference as these are morally superior and has a distinctive range in terms of product offerings. This type of jewelry doesn’t cause issues as they are produced in the laboratory.

By application, necklaces and rings are the most preferred jewelry type each with a share of 26% out of all its application types. Compared to regular diamonds they require less maintenance as they are environmentally friendly. Thus, necklaces and rings obtained from lab grown diamonds are preferred as these come under the category of favorite jewelry as well.

Manufacturers Prefer Chemical Vapor Deposition Technique

There are two main techniques used for making lab grown diamond jewelry. This includes high pressure and high temperature (HPHT) and chemical vapor deposition (CVD).

Nowadays, diamonds are made by CVD as a part of newer development. The process imitates diamond formation through interstellar gas clouds. The reason why CVD is preferred is that because low temperature is required for its processing thus, the manufacturing process is simplified. Nearly 56% of the time, CVD technique is preferred for lab grown diamond formation.

Chemical vapor deposition technique allows companies to create high-quality and high-performance diamond jewelry. Hence, it is becoming quite popular across India.

Faceted Style Diamond is Mostly Used for Making Diamond Jewelry

Diamond jewelry these days is becoming more of a trend and style statement as it looks glamorous and symbolizes a person’s unique taste and style. Faceted diamond is more preferred by customers as it gives a sophisticated look to the jewelry and has proper finishing.

Although both cut types hold special significance, faceted diamond jewelry is preferred more, and nearly 56% of preference is for faceted type. This is because they are encrusted with gems, precious stones, crystals, and gemstones and have a proper finish.

The entrance of new rivals in the lab grown diamond jewelry market has caused an abundance of retailers for the suppliers. The market is a highly competitive retailing industry. This rivalry has an impact on the overall long-term profitability of companies in the market. Collaborating with rivals to enhance market size rather than competing for a smaller market can help address this issue. Existing competitors compete fiercely in the market.

For instance:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 395.2 million |

| Projected Market Size (2035) | USD 1571.4 million |

| Anticipated Growth Rate (2025 to 2035) | 14.8% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million/Billion for Value and (‘000 Carat) for Volume |

| Key Regions Covered | South Asia |

| Key Countries Covered | India |

| Key Segments Covered | Application, Technique, Cut Type, Size, Region |

| Key Companies Profiled | Avtaara; Jewelbox; Limelight Lab Grown Diamonds Ltd.; SYNDIORA; Fiona Diamonds; Ananta; DiAi Designs; Maiora Diamond; Wondr Diamonds; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global india lab grown diamond jewelry market is estimated to be valued at USD 395.2 million in 2025.

The market size for the india lab grown diamond jewelry market is projected to reach USD 1,571.4 million by 2035.

The india lab grown diamond jewelry market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in india lab grown diamond jewelry market are bangles, necklaces, pendant, earrings, rings, anklet and broaches.

In terms of technique, chemical vapour deposition segment to command 54.6% share in the india lab grown diamond jewelry market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Casino Tourism Market Forecast and Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA