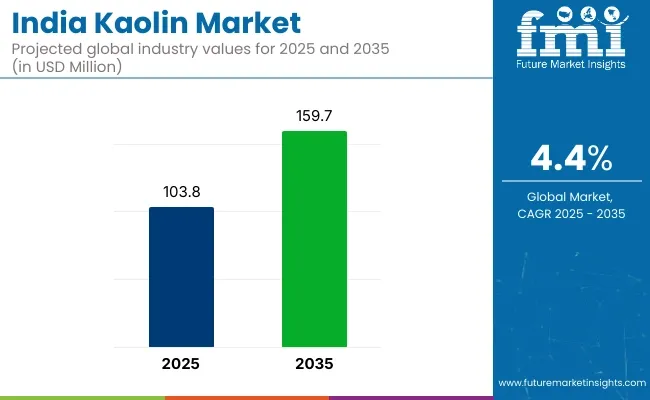

The India kaolin market has been observed to grow steadily in recent years, propelled by increasing demand across various end-use industries such as ceramics, paper, paint, and rubber. In 2024, the market was estimated to be valued at approximately USD 99.4 million, and it is projected to reach USD 103.8 million by 2025. This upward trend is expected to continue, with the market anticipated to expand to USD 159.7 million by 2035, registering a CAGR of 4.4% over the forecast period from 2025 to 2035.

The growth of the market is primarily driven by the rising consumption of kaolin in ceramics and sanitaryware manufacturing, owing to the expanding construction and housing sectors in India. Kaolin’s unique physical properties such as whiteness, brightness, and fine particle size make it an essential raw material in the production of high-quality ceramic products. Additionally, innovations in processing technology have improved the purity and performance of kaolin, further expanding its applications.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 103.8 Million |

| Projected Market Size in 2035 | USD 159.7 Million |

| CAGR (2025 to 2035) | 4.4% |

Industry developments also indicate a shift toward environmentally sustainable mining practices and increased focus on value-added kaolin products that meet stricter quality standards. The Indian government’s initiatives to promote industrial growth and infrastructure development are further stimulating demand.

Key players operating in the India kaolin market include Brenntag Specialties India Pvt Ltd, Kaolin India Ltd., Saurashtra Minerals Ltd.,and Raj Petro Speciality Chemicals. These companies are investing in research and development to improve product quality and expand their product portfolios. Their strategic partnerships and collaborations are aimed at enhancing their market presence and meeting the growing demand in the ceramics, paper, and paint industries.

India’s kaolin mining and processing sector is regulated by a combination of central and state laws designed to ensure sustainable mining, environmental protection, and worker safety. These regulations govern licensing, environmental clearances, land use, and community welfare.

India exports and imports kaolin to and from several countries, driven by demand in industries such as paper, ceramics, rubber, paints, and cosmetics. Trade relationships are influenced by factors like quality, pricing, and logistical advantages.

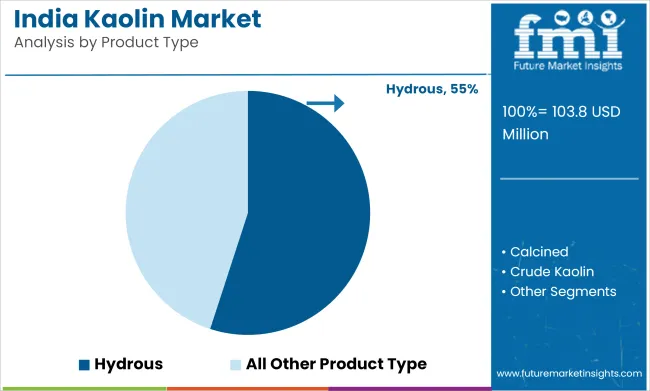

The India kaolin market is poised for steady growth, with key segments such as hydrous kaolin and the ceramics & sanitaryware segment expected to drive the market. Hydrous kaolin, due to its superior properties and widespread industrial use, is projected to dominate the market. Similarly, the growth of infrastructure and residential construction is expected to support the continued demand for ceramics and sanitaryware products, further strengthening the kaolin market.

Hydrous kaolin is projected to account for around 55% of the India kaolin market share by 2025. This form of kaolin is prized for its high plasticity, ease of dispersion, and water solubility, which make it highly suitable for use in various industries. The increased demand for smooth texture and enhanced processing capabilities in applications like ceramics, paper coating, rubber compounding, and paint production are driving the adoption of hydrous kaolin in India.

The ceramics industry, in particular, benefits from the superior whiteness and strength that hydrous kaolin provides, which are essential in the production of fine china and sanitaryware. Hydrous kaolin’s ease of processing also contributes to reduced energy consumption during manufacturing, aligning with India’s growing sustainability goals.

Leading companies like Imerys, Ashapura Minechem, and China Clay Co. Ltd. are major suppliers of hydrous kaolin in India, offering kaolin products that cater to different industries. Recent technological advancements in kaolin beneficiation processes, which improve purity and reduce impurities, are further boosting the performance and demand for hydrous kaolin. The steady growth in demand from end-use sectors, combined with continuous improvements in mining and processing technologies, is expected to solidify hydrous kaolin’s dominance in the India kaolin market.

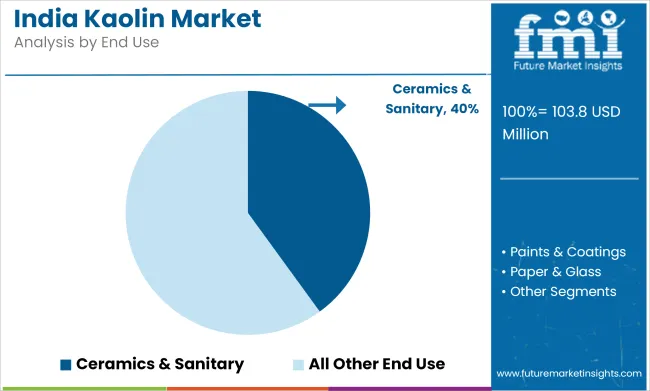

The ceramics and sanitaryware application segment is expected to capture 40% of the India kaolin market share by 2025. This growth is primarily driven by the rapid expansion of residential and commercial construction projects across India. The demand for high-quality ceramic tiles, sanitary fixtures, and tableware is on the rise, further fueling the consumption of kaolin in this segment.

Kaolin’s fine particle size, whiteness, and chemical inertness are crucial for enhancing the mechanical strength, thermal stability, and surface smoothness of ceramic products. India’s major ceramic manufacturers, including Kajaria Ceramics, Somany Ceramics, and HSIL Limited, are increasingly relying on kaolin to meet international quality standards, enabling them to remain competitive in global markets.

Additionally, the rise in government infrastructure projects and ongoing urbanization trends are expected to sustain the demand for ceramics and sanitaryware products. Recent innovations in kaolin, such as nano-kaolin and modified kaolin, have improved the glaze adhesion and durability of sanitaryware products, making them more desirable in the market.

As the demand for construction and ceramic products continues to grow, along with ongoing investments in processing technologies and supply chain optimization, the ceramics and sanitary segment is expected to maintain robust growth throughout the forecast period, continuing to dominate the India kaolin market.

India Kaolin Market is also faced with several challenges since most of the kaolin mining is unorganized and fragmented, particularly in Gujarat, Rajasthan, and Kerala states. This leads to poor quality of the product, low beneficiation levels, and poor utilization of resources. Additionally, outdated extraction methods and lack of sophisticated processing facilities limit competitiveness on a global scale.

Logistics and infrastructure limitations, such as poor connectivity by roads to mines and transportation expenses, also adversely affect seamless supply chain functioning. Land acquisition, environmental laws, and also community resistance constrain expansion on the part of local players as well as foreign investors. Opportunities

Despite these challenges, the Indian kaolin market is likely to benefit from strong demand in ceramic, paints & coatings, rubber, paper, and construction sectors. With government investment in Smart Cities, infrastructure development, and housing, ceramic tile and sanitary ware manufacturers principal consumers of kaolin are building scale.

Also, higher demand for water-based paints, ink, adhesives, and packaging paper creates expanding application opportunity for processed kaolin. There is also an emerging export market opportunity for calcined and washed kaolin, especially to the Middle East and Southeast Asia. Technological advancements in beneficiation, particle-size refining, and brightness optimization will enable Indian players to shift up the value chain.

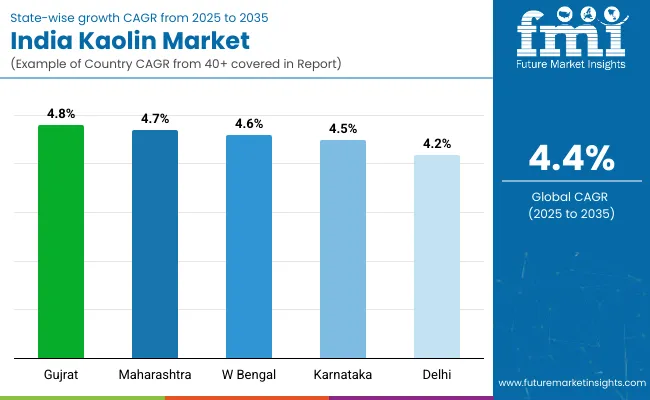

Due to the extensive and strong industrial base of Maharashtra, it is a very active market for kaolin in India. The state’s dominant position in the production of paper, paint, rubber and ceramics has ensured that demand for processed kaolin is steadily maintained at elevated levels.

Various end-user industries where kaolin acts as a filler, coating ingredient, and functional additive in metros such as Mumbai, Pune, and Nashik. Infrastructure construction and high-end manufacturing projects in Maharashtra will ensure demand for high-purity and calcined grades of kaolin going forward over the coming decade.

| State | CAGR (2025 to 2035) |

|---|---|

| Maharashtra | 4.7% |

The volume of kaolin in paint, coating, cosmetic, and specialty applications make up aesthetics of kaolin usage, since the capital, Delhi, has a limited production capacity but is a high demand area for kaolin's value-added products.

The indirect demand for kaolin is driven by the city's dynamic building and real estate sector and high consumer spending on personal care and home improvement products. Furthermore, rising preference towards mineral-based and sustainable formulation in the products in Delhi NCR has spurred the use of kaolin by small and medium formulators.

| State | CAGR (2025 to 2035) |

|---|---|

| Delhi | 4.2% |

Owing to expanding ceramics industry, increasing construction activities and growing modern infrastructure in Bengaluru and Mangalore, Karnataka is projected to work as a potential kaolin market. Demand for premium Kaolin for insulation and specialty ceramics shelves are opened by thrust of clean energy and electronics industries by the state.

The systematic rise in market development through the use of alternative products such as kaolin for paint, adhesives, and composites is guaranteed by Karnataka's favorable business climate that supports start-ups.

| State | CAGR (2025 to 2035) |

|---|---|

| Karnataka | 4.5% |

West Bengal has been a prominent player in the Indian kaolin industry for a long time, backed by favorable natural deposits and highly organized processing systems in Birbhum and Purulia districts. Not just do the supplies of kaolin from the state fulfil the demands of rest of India but they also cater to local demands in the applications of paper, rubber and ceramics as well.

The demand of value building materials and processed industrial inputs by Kolkata is likely to drive the kaolin market in the reason. In addition, efforts for local kaolin processing technology upgradation will improve competitiveness and augment export potential.

| State | CAGR (2025 to 2035) |

|---|---|

| West Bengal | 4.6% |

Gujarat being an industrial nerve center and a regular consumer of industrial minerals such as kaolin. Strong demand for high-grade kaolin in ceramics tiles, sanitary ware and tableware segment in the state contributes to demand pull and Morbi and surrounding districts of Gujarat are home to a large ceramics industry.

Regular consumption also comes from Gujarat’s chemical and paint industries. Then again, the state offers a conducive setting for the growth of kaolin processing and distributing networks due to its pro-industry policies, and export oriented infrastructure and hence it is a strategic market, set for future growth.

| State | CAGR (2025 to 2035) |

|---|---|

| Gujrat | 4.8% |

India Kaolin Market is growing in good stead in the wake of fast growth in paper & packaging, ceramics, paints & coatings, rubber, and pharma segments. As increasing demands for good quality, cost-effective raw materials in these segments, kaolin or China clay is increasingly becoming more significant.

Natural comparative advantage of the reserves and possession of organized producers and local operators functioning across different end-use markets in India do exist. The quest for local supply chains, export drive, and technological innovation in the technology of beneficiation is benefiting Indian kaolin manufacturers to grow.

There is also a clear trend towards value-added grades of kaolin such as calcined kaolin, especially in coatings and plastics. Besides, policy reforms and the "Make in India" initiative are stimulating local manufacturers to upgrade mining and processing plants.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 103.8 million |

| Projected Market Size (2035) | USD 159.7 million |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand tons for volume |

| Product Types Analyzed (Segment 1) | Crude Kaolin, Calcined, Hydrous, Surface Modified, Delaminated, Levigated |

| End Uses Analyzed (Segment 2) | Cement, Ceramics & Sanitary, Paints & Coatings, Paper & Glass, Pesticide & Refractory, Others |

| Regions Covered | East India, West India, South India, and North India |

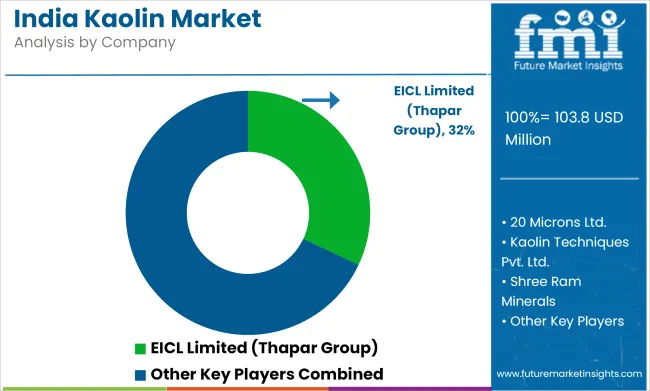

| Key Players influencing the India Kaolin Market | EICL Limited (Thapar Group), Ashapura Group, 20 Microns Ltd., Kaolin Techniques Pvt. Ltd., Shree Ram Minerals, Gujarat Mineral Development Corporation (GMDC), JLD Minerals, Imerys India Pvt. Ltd., Sibelco India, Mahavir Minerals Ltd. |

| Additional Attributes | Growing demand in construction and packaging, Technological improvements in kaolin processing, Regional mining expansion initiatives |

| Customization and Pricing | Customization and Pricing Available on Request |

On the basis of Product Type, the Indian kaolin market is categorized into Crude Kaolin, Calcined, Hydrous, Surface Modified, Delaminated and Levigated.

On the basis of End Use, the Indian kaolin market is categorized into Cement, Ceramics & Sanitary, Paints & Coatings, Paper & Glass, Pesticide & Refractory and Others.

The overall market size for Indian kaolin market was USD 103.8 Million in 2025.

The Indian kaolin market is expected to reach USD 159.7 Million in 2035.

Increasing industries including ceramics, paper & packaging, paints & coatings, rubber, plastics and pharmaceuticals sectors will drive the demand for Indian kaolin market.

The top 5 states which drive the development of kaolin market in India are Maharashtra, Delhi, Karnataka, West Bengal, and Gujarat.

Hydrous Kaolin and Ceramics & Sanitary are the leading segment in the Indian kaolin market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Decorative Veneer Industry - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

Analyzing India Loyalty Program Market Share & Industry Leaders

India Safari Tourism Market Trends – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA