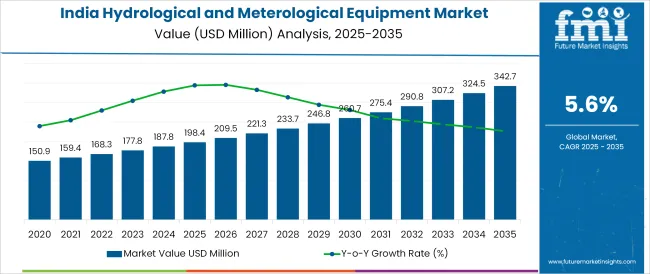

The India Hydrological and Meterological Equipment Market is estimated to be valued at USD 198.4 million in 2025 and is projected to reach USD 342.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 198.4 million |

| Market Size in 2035 | USD 342.7 million |

| CAGR (2025 to 2035) | 5.6% |

The India hydrological and meteorological equipment market is witnessing sustained growth, supported by increasing government investments in water resource management, climate monitoring, and disaster preparedness infrastructure. Rising incidences of extreme weather events, growing concerns over water scarcity, and regulatory emphasis on sustainable water usage are driving adoption of advanced monitoring solutions.

Public sector agencies are prioritizing the modernization of legacy systems to enable real-time data collection and predictive analytics, which is enhancing operational efficiency and resource planning.

Future expansion is expected to be underpinned by the integration of IoT, automation, and satellite communication technologies into monitoring networks, fostering improved data accuracy and faster response times. Opportunities are being unlocked through public-private partnerships and initiatives to strengthen early warning systems, ensuring long-term resilience and informed decision-making across water and weather management domains.

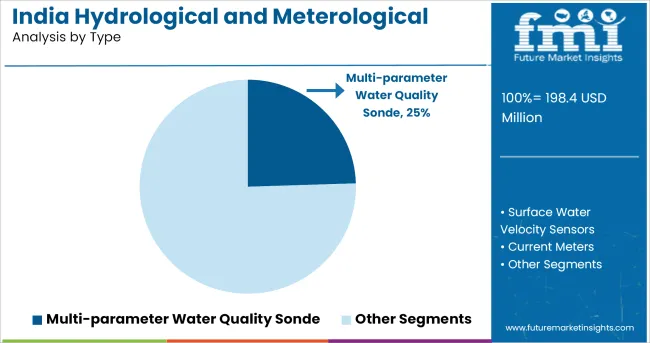

The market is segmented by Type, End User, and Meteorological Equipment Type and region. By Type, the market is divided into Multi-parameter Water Quality Sonde, Surface Water Velocity Sensors, Current Meters, Groundwater Level Logger, Radar Water Level Sensors, Compact Bubblers, Pressure Level Sensors, Contact Gauge, Side Looking Dopplers, Data Loggers, and Data Loggers. In terms of End User, the market is classified into Central Water Resources Management Department, Irrigation Department, Agriculture, Water Utility Companies, Hydropower Plants, National Hydrological Projects, and Research and Academia.

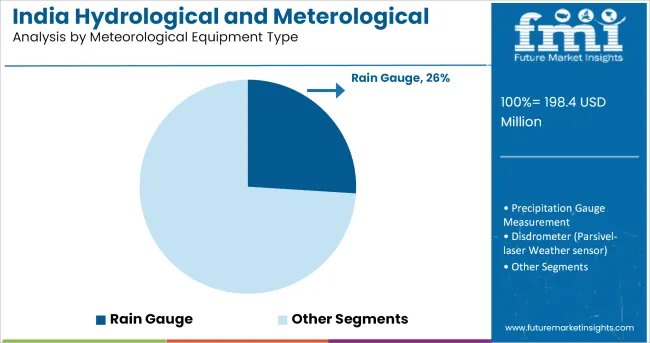

Based on Meteorological Equipment Type, the market is segmented into Rain Gauge, Precipitation Gauge Measurement, Disdrometer (Parsivel- laser Weather sensor), Wind Speed and Direction Sensor, Ceilometers, AT/RH Sensor, Snow Depth Sensors, Snow Gauge, and Data Loggers.

By End User, the market is divided into Indian Meteorological Department, Space Research & Sciences (ISRO, NESAC), Environmental Engineering & Audit Agencies (NEERI, TERI, etc.), Marine & Coastal Security, and Research Institutes Laboratories (SASE, IISER, NIOT). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the multi-parameter water quality sonde is projected to hold 24.5% of the total market revenue in 2025, establishing itself as the leading equipment type segment. This leadership has been supported by the growing requirement for comprehensive water quality assessment tools capable of simultaneously measuring multiple parameters such as pH, turbidity, dissolved oxygen, and conductivity.

Annual reports from equipment manufacturers and government tenders indicate that these sondes are increasingly deployed in river basins, reservoirs, and urban water bodies to meet regulatory monitoring standards and support sustainability initiatives.

Their ability to deliver high-resolution, real-time data while minimizing the need for multiple instruments has enhanced operational efficiency and reduced maintenance costs. Furthermore, the robustness of these devices and their adaptability to diverse field conditions have reinforced their adoption across water quality monitoring programs nationwide.

Segmented by end user, the central water resources management department is expected to account for 28.00% of the market revenue in 2025, maintaining its leading position. This dominance has been driven by the department’s pivotal role in planning, managing, and regulating India’s water resources at a national level.

Budgetary allocations and policy documents from the Ministry of Jal Shakti have emphasized strengthening hydrological monitoring networks, improving water accounting, and enhancing flood forecasting capabilities, which have fueled equipment procurement.

The department’s mandate to support inter-state water management, assess climate impact on water availability, and maintain water quality standards has necessitated large-scale deployment of advanced instruments. Additionally, the department’s institutional capacity to manage long-term projects and implement standardized monitoring protocols has ensured sustained investment in reliable and scalable equipment solutions.

When segmented by meteorological equipment type, the rain gauge is forecast to capture 26.0% of the market revenue in 2025, securing its position as the leading segment. This prominence has been underpinned by the critical role rain gauges play in monitoring precipitation patterns, essential for water resource planning, flood risk assessment, and agricultural advisory services.

Government programs and state disaster management plans have increasingly prioritized upgrading dense networks of rain gauges to improve data granularity and support early warning systems.

Technological enhancements such as automated tipping-bucket designs, wireless telemetry, and solar-powered units have improved measurement accuracy and operational reliability, enabling broader deployment even in remote areas. The cost-effectiveness and ease of integration of rain gauges into existing meteorological stations have further reinforced their continued adoption as a cornerstone of India’s climate monitoring and water management strategies.

Meteorological equipment is being employed widely across various research organizations as well as chemical manufacturing plants. The demand for such equipment has always been higher, as various chemicals are produced on distinct and precise parameters. Additionally, meteorological equipment is highly utilized by airports, gaining immense popularity in last few years.

Weather is an essential factor accountable for the proper functioning of all businesses. Companies are increasing their focus on predicting climatic conditions to minimize the risk of losses by taking actionable decisions, such as the aviation industry which use these devices to charter flight paths to save jet stream and avoid turbulence.

Consequently, the demand for hydrological and meteorological equipment is likely to rise significantly between 2024 to 2035. FMI expects the market to grow at a CAGR of 5.8% during the forecast period.

India has immense climate diversity wherein nearly 80% of the annual precipitation is confined to a brief monsoon period. Even though the country experiences a seasonal rainfall of 1170 mm on average, complicated monsoon winds and diffused orientation of mountains induce scant rainfall in some regions, causing water scarcity.

On the other hand, other parts receive heavy rainfall which results in flooding. Annually, India experiences extensive devastation in the form of damages to crops, houses, and public utilities, and human lives. Consequently, government bodies such as the Central Water Resources Management Department are developing rural infrastructure to minimize losses.

Owing to this, there has been a rise in the demand for equipment, such as surface water velocity sensors, that measure flow in rivers during floods or periods of high concentrations of suspended sediments. Hence, the market is benefitting from disaster management.

Hydropower plants are often regarded as man's response to nature's vagaries, to mitigate flood and drought by holding water and discharging it as per demand and supply. Several dams such as Hirakud dam, Bhakra dam, Ukai dam and Nagarjunasagar have contributed enormously in lessening flood damage along the rivers.

Spurred by the rising construction of dams coupled with increasing water levels, the market for hydrological and meteorological equipment is growing notably. For instance, according to the Karnataka State Natural Disaster Monitoring Centre (KSNDMC), the water levels in the reservoirs are at alarming levels in the state.

To keep losses at the minimum, the KSNDMC is practicing the Integrated Dam Management system, where all district authorities and gram panchayat members along with the reservoir level officials are asked to give alerts of the rising water levels. The KSNDMC has placed 6,800 rain gauges in the reservoirs for this.

The India hydrological and meteorological equipment market is witnessing surging demand from the defense industry. The Indian government is consistently increasing defense budget which is supporting growth of the market. On February 1, 2024, the Parliament earmarked USD 66.9 Billion for the Ministry of Defense, representing a 7% increase.

The presence of a large armed forces and troops that needs protection and future weather prediction to ensure survivability is one of the key factors behind the rise in demand for hydrological and meteorological equipment.

For instance, in October 2024, the Indian defense industry imported cold-weather equipment. This is chiefly for checking the survivability of those troops that are deployed in high-altitude areas where there is a lack of viable indigenous solutions.

Unmanned aerial vehicles’ (UAVs), aircrafts and helicopters operations need precise and timely weather information for efficient flight preparations, take-offs and landings. As they fly at low altitudes, small and medium-sized UAVs are directly affected by weather.

Since UAV are an imperative element for the defense system, accurate knowledge of take-off and landing weather conditions is critical. Besides, atmospheric conditions also affect the accuracy of artillery fire. Availability of precise meteorological information is a prerequisite for correct predicted fire.

Large scale industries are adopting climate forecasts on a higher scale. However, small and medium scale industries in India still do not calculate climatic risk while exercising business activities. This is one of the major factors that are projected to hinder the growth of the market.

The process of weather forecasting becomes complicated due to the intrinsic nonlinearity of these equipment. Also, the accurate integration and examination of a huge amount of data make the process more complex. Furthermore, this equipment can detect long scale weather patterns efficiently, but for short term, there is no proper way. These factors are likely to restrain the growth of the market.

Based on hydrological equipment type, multi-parameter water quality sonde is leading the market. They are used in various processes such as groundwater interaction, saltwater intrusion, reservoir, and lake monitoring, estuary monitoring, watershed and source water protection, beach monitoring, and stormwater runoff.

Besides, making the most of the opportunity, players are developing and launching cost effective and better-performance products. This is also benefitting the market. For instance, Xylem launched YSI 6820 V2-2, which is a cost-effective data sonde. Perfect for harsh and fouling environments, the V2 sondes is a certified generation of multi-parameter sondes from YSI.

Similarly, T.R Product’s optical sensors are equipped with replaceable seals as well as an integrated wiper offering protection from impacts of biofouling, and a corrosion-resistant titanium wiper shaft.

Demand for hydrological equipment is concentrated in national hydrological projects. These ongoing and upcoming projects are likely to augment the installation of hydrological equipment in India. For instance, the National Hydrology Project aims at enhancing the extent, quality, and approachability of water resource information.

Thus, generating demand for various equipment such as data loggers, rain gauge, wind speed and direction sensor. The project furthers aims at improving the decision support system for floods and strengthening the capacity of targeted water resources and management institutions in India.

At present, wind speed and direction sensors are leading the market. However, FMI estimates the AT/RH sensor to emerge as lead by the end of 2035. These sensors are used to measure temperature in order to determine relative humidity.

As a result, they uncover a wide array of applications such as HVAC systems, printers and fax machines, weather stations, automobiles, food processing, refrigerators, ovens and dryers. Owing to this, this segment is expected to register notable growth with a remarkable CAGR during the forecast period.

The Indian Meteorological Department is leading the market by meteorological equipment end users. It is an agency of the Ministry of Earth Sciences of the Government of India that is accountable for meteorological observations, weather forecasting, and seismology.

As it is a national-level agency, demand for meteorological equipment is highest from the Indian Meteorological Department (IMD). The agency is implementing some of the major national projects. For instance, the Hydrology Project, a World Bank-aided and a 6-year period project is under implementation by IMD.

Apart from this, the research institutes laboratories (SASE, IISER and NOIT) segment is also projected to record a significant growth rate during the forecast period.

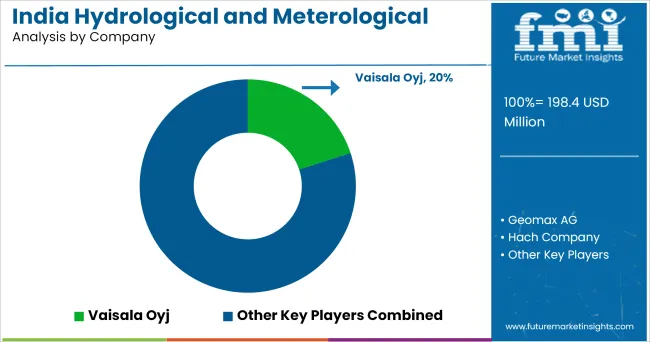

As both big and small companies are converging towards predicting climatic change for better functioning of businesses, demand for hydrological and meteorological devices is growing consistently in India. As a result, more and more newcomers are marking their entry into the market making it more competitive.

Additionally, players are also focusing on the development of better-performance equipment. For instance, K.R Instruments developed Ultrasonic Flow Meter that uses HydroVision's proven acoustic profiling technology to measure the flow, velocity, and water level. The company manufactures high quality, cost-effective, innovative equipment for global clients.

Moreover, players are also concentrating on key market strategies such as mergers and acquisitions and collaborations to extend their presence globally. For instance, in 2020, Gill Instruments acquired Labcal, a United Kingdom Accreditation Service (UKAS) accredited calibration service company.

Some of the leading players operating in the hydrological and meteorological market include

The list is only indicative - a full list of India hydrological and meteorological equipment market key players is available upon request

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Growth Rate (2024 to 2035) | 5.8% CAGR |

| Market Analysis | USD Million for Market Value and Units for Volume |

| Key Segments Covered | Base Material Type, Consumer Orientation, Sales Channel |

| Key Companies Profiled | Geomax AG; Hach Company; Gill Instruments Limited; SEBA Hydrometrie GmbH & Co. KG; Vaisala Oyj; In-Situ Inc.; Virtual Hydromet; K. R. Instruments; Kaizen Imperial; Aveli Global Engineering Solutions Pvt. Ltd.; Info Electronics Systems India Pvt. Ltd.; R.K. Engineering Corporation; Encardio Rite; Astra Microwave Products Limited; Mechatronics Systems Pvt. Ltd.; Swan Environmental Private Limited; Obel Systems Private Limited |

| Report Coverage | Market Forecast, Competitive Landscape, and Category-wise Insights,Key Trends, Key Challenges |

| Customization & Pricing | Available upon Request |

The global india hydrological and meterological equipment market is estimated to be valued at USD 198.4 million in 2025.

The market size for the india hydrological and meterological equipment market is projected to reach USD 342.7 million by 2035.

The india hydrological and meterological equipment market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in india hydrological and meterological equipment market are multi-parameter water quality sonde, surface water velocity sensors, current meters, groundwater level logger, radar water level sensors, compact bubblers, pressure level sensors, contact gauge, side looking dopplers, data loggers and data loggers.

In terms of end user, central water resources management department segment to command 28.0% share in the india hydrological and meterological equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Casino Tourism Market Forecast and Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

Analyzing India Loyalty Program Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA