Due to religious heritages, increasing domestic and international pilgrimages, and government efforts to promote religious tourism; India religious tourism sector can be expected to witness substantial growth between 2025 and 2035. India has temples, Hindu temples, Buddhist monasteries, Sikh gurdwaras and Islamic mosques, which means the country is one of the best places for travellers for the road for faith.

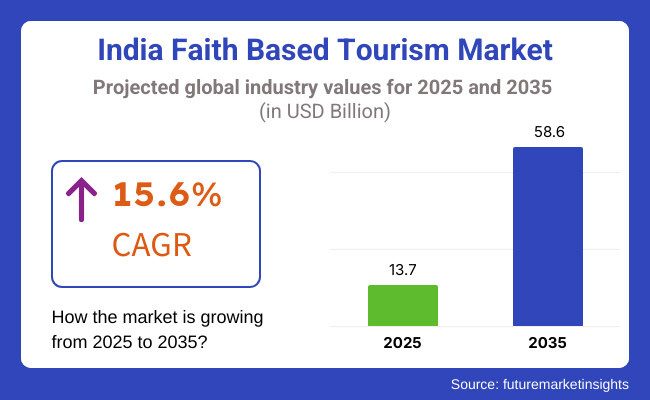

The industry is approximated to garner a revenue of USD 58.6 billion by the end of the year 2035 with a CAGR of 15.6% during the forecast period.

Dictionary. According to touropedia.com, faith-based tourism is gaining importance, with the increasing popularity of spiritual journeys, yoga retreats, Kombu Meal, Amaranth Yorta and Ajmer Uris among several such religious celebrations in India cited as a reason for the subtle rise of the sector. In addition, the government is enhancing the overall building pilgrimage infrastructure through schemes like Char Dham Yatra and PRASAD Scheme (Pilgrimage Rejuvenation and Spiritual Augmentation Drive) which will undoubtedly grow the market.

Even better, social media and digital platforms have been catalysts in pushing India’s faith-based tourism; faith spiritualists and devotees can take their trips and expeditions to religious places to the next level.

The India faith based tourism market is expected to grow tremendously owing to factors such as increase in religious diversity, best in class tourism, increasing inclination towards pilgrimages and various initiatives undertaken by the government to ensure a flawless spiritual tourism experience.

North India is the hub of faith-based tourism, with millions of devotees travelling every year. Varanasi, the oldest living city, is revered for its ghats by the Ganges River, while Ayodhya, the birthplace of Lord Rama, is of deep Hindu significance. Haridwar and Rishikesh, both located in the Himalayas, are the epicenters of spiritual seekers. Examples: The Golden Temple in Amritsar is open to all Sikhs globally, and Char Dham circuit (Yamunotri, Gangotri, Kedarnath, and Badrinath) is a pilgrimage in the sacred state of Uttarakhand.

Western Indian also has diverse religions experiences and Ajmer Sharif Dargah, which is one of the largest Sufi shrines. Dwarka in Gujarat, part of the Char Dham circuit, is a well known Krishna temple. Palitana’s Shatrunjaya hill and Mount Abu’s Dilwara Temples attract Jain devotees. Hindu devotees visit Maharashtra to see Shirdi Sai Baba Temple, Siddhivinayak Temple and Trimbakeshwar Jyotirlinga respectively. Basilica of Bom Jesus, one of Goa’s many churches, adds Christian spiritual importance.

Temples and Spiritual Retreats, South India Tamil Nadu’s Meenakshi Temple and Rameswaram are wonders of Hindu architecture. Hampi temples of Karnataka show traditions of Vijayanagara. The Tirupati Balaji in Andhra Pradesh is among the world’s richest temples. As the heartland of Ayurvedic and yoga retreats, Sabarimala Temple attracts millions.

East India is known for its multiple Hindu and Buddhist pilgrimages. Odisha’s Jagannath Temple at Puri which forms part of the Char Dham overseers the grand Rath Yatra. Buddhist sacred sites include Bihar’s Bodh Gaya, where Buddha achieved enlightenment; Rajgir; and Sarnath. Kalighat Temple of Kolkata, a Shakti Peetha. In Jammu, the Vaishno Devi shrine is a holy pilgrimage for Hindus. Sikkim has Buddhist monasteries Example Rumtek, Pemayangtse.

Central India has a deep religious history. Mahakaleshwar in Ujjain and Omkareshwar are 2 of Lord Shiva’s Jyotirlinga and there are a total of 12. Sanchi’s Buddhist stupas, which were constructed by Emperor Ashoka, are UNESCO sites. Chitrakoot temples are correlated with Ramayana At Sangh Ranapur and Bawangaja temples, Jain heritage flourishes. Temples like the sacred 10th-century Bhoramdeo Temple echo Chhattisgarh's spiritual heritage, while Bastar's tribal customs add color and cultural significance.

Challenges

Infrastructure Development and Managing Pilgrim Influx

Growth of India Faith Based Tourism Industry The Indian Tourism sector across cities and pilgrimage spots is expected to expand by the end of 2030, and this growth will introduce practical challenges pertaining to pilgrimage infrastructure development and managing the retention and influx of pilgrims visiting the country. The Father of the Nation wanted pilgrims to have a pleasant experience while visiting the most revered religious destinations in India, whether it is Varanasi, Tirupati, Golden Temple or any temple in India but it was not a sprouting innovation India standing any where from transportation availability, bathroom hygiene, accommodation availability and crowd management issues. There are also operational challenges due to differing regional policies, environmental concerns around sacred sites, and unregulated tourism services. Tourism organizations can act as facilitators in this scenario, giving insight to susceptible groups of pilgrims and encouraging sustainable tourism practices that follows proper health standards.

Opportunity

Growth in Pilgrimage Tourism and Spiritual Retreats

The segments of spiritual travel, heritage pilgrimage, and wellness tourism are gaining increasing traction and provide considerable scope for the growth of this India Faith-Based Tourism Market. Millions of pilgrims also visit domestically and internationally for religious and cultural tourism, such as Char Dham Yatra, Kumbh Mela and Sufi shrines. Keen to shake things up, the industry is being transformed by the rise of spiritual retreats, temple-based accommodations and guided faith tourism packages. Also, collaborations between tour operators, religious bodies, and hospitality providers are making pilgrim convenience smarter. The key area of growth will be in structured faith-based tourism, building sustainable pilgrimage infrastructure and providing personalized spiritual experiences.

The India Faith-Based Tourism Market remained steady between 2020 & 2024 on account of rising domestic religious journeys, enhanced pilgrimage infrastructure and government-backed initiatives to promote spiritual tourism. There was huge investment in connectivity, accommodations and pilgrim services in places like Ayodhya, Bodh Gaya and Shirdi. However, issues like concurrent crowd, variable travel comfort, and absence of organized tour system prevented the absolute strength of the segment. In response, businesses began to offer guided pilgrimage experiences, organized tour packages, and improved hospitality services in the vicinity of major religious sites.

When we look to the future, specifically the time frame between 2025 to 2035, market transformations will be seen through the development of faith-based travel circuits, heritage conservation programs, and eco-friendly pilgrim tours. The new era of the industry will be marked by the implementation of well-structured itineraries for religious tourism, projects dedicated to temple restoration, and accessibility solutions for senior citizens and differently-abled devotees. Moreover, the subsequent increase of wellness tourism associated with spiritual customs (like Ayurveda retreats and meditation hubs) would go well with conventional pilgrimage travel. The India Faith-Based Tourism Market will be driven by sustainable tourism companies, infrastructure modernization, and immersive spiritual experiences.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with religious site management regulations and local tourism policies |

| Faith-Based Tourism Growth | Growth in domestic pilgrimage tourism and religious site refurbishments |

| Industry Adoption | Increased demand for guided temple tours, Sufi trail experiences, and monastery visits |

| Supply Chain and Sourcing | Dependence on traditional hospitality services and local transportation |

| Market Competition | Presence of local tour operators and religious institutions offering pilgrimage services |

| Market Growth Drivers | Demand for spiritual experiences, cultural heritage visits, and temple tourism |

| Sustainability and Energy Efficiency | Initial adoption of eco-conscious pilgrimage practices and green temple initiatives |

| Integration of Cultural Storytelling | Limited focus on historical narratives of religious sites |

| Advancements in Faith Tourism | Use of traditional pilgrimage routes, temple visits, and religious site tours |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of structured pilgrimage routes, enhanced site preservation laws, and sustainable faith-based tourism policies. |

| Faith-Based Tourism Growth | Expansion into international pilgrimage tourism, structured faith-tour circuits, and enhanced heritage site experiences. |

| Industry Adoption | Growth in personalized spiritual retreats, eco-friendly pilgrimage stays, and multi-faith tourism initiatives. |

| Supply Chain and Sourcing | Shift toward temple-run accommodations, sustainable lodging, and structured pilgrim travel services. |

| Market Competition | Expansion of faith-based travel agencies, customized pilgrimage tour providers, and wellness-integrated spiritual travel experiences. |

| Market Growth Drivers | Increased investment in structured pilgrimage circuits, heritage conservation programs, and government-backed religious tourism initiatives. |

| Sustainability and Energy Efficiency | Large-scale implementation of sustainable pilgrimage routes, solar-powered religious accommodations, and carbon-neutral travel options. |

| Integration of Cultural Storytelling | Increased emphasis on faith-based storytelling, heritage site documentation, and immersive pilgrimage experiences. |

| Advancements in Faith Tourism | Evolution of structured multi-faith travel, wellness-spiritual tourism, and heritage conservation-led religious tourism. |

North India is home to most of the faith-based tourism in India and attracts millions of pilgrims and spiritual seekers every year. It comprises sacred Hindu, Sikh, Buddhist, and Jain sites such as Varanasi, Haridwar, Rishikesh, Mathura, Amritsar and Ayodhya. In fact, one of the world's largest religious congregation that is Kumbh Mela, executes in India and is attended by millions of devotees, which gets heightened tourism activity and spiritual experience.Revival of pilgrimage routes and infrastructure projects like Ayodhya Ram Temple and Char Dham connectivity have never been as rewarding or buoyant for faith-based tourism. Moreover, of yoga retreats in Rishikesh and spiritual wellness tourism of Uttarakhands making this market wide also.

| Region | CAGR (2025 to 2035) |

|---|---|

| Northern India | 16.2% |

Religious tourism in western India is a steadily expanding sector, with major pilgrimage sites dedicated to Hinduism, Jainism, as well as Islam. Every year, millions of devotees visit the Sai Baba shrine, Shirdi, Somnath, Dwarka, Dilwara Temples at Mount Abu and Ajmer Sharif Dargah, among several other places in the region. With temple and heritage tourism, and the popularity of spiritual retreats, religious tourism is having a heyday in Maharashtra. The emerging trend of sustainable pilgrimage tours, along with heritage trails and temple restoration initiatives, is also driving growth in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| Western India | 15.8% |

Temple tourism - which includes ancient Dravidian temple architecture, Christian pilgrimage destinations and Ayurveda-fortified spiritual retreats -is the southern half of the country’s glue. The region attracts millions of Hindu devotees to Tirupati Balaji, Madurai Meenakshi Temple and Rameswaram and draws Christian pilgrims to Velankanni and St. Thomas Basilca in Chennai. These food tourism, spiritual wellness programs and eco-friendly pilgrimage routes are gaining momentum and providing a thrust upwards to the faith-based tourism in the region. Kerala’s ashrams and Ayurvedic healing centers also have started attracting foreign tourists in the edit of spiritual detox-type experiences, or wishing to meditate.

| Region | CAGR (2025 to 2035) |

|---|---|

| Southern India | 16.0% |

The growing citation in Buddhism, Hinduism and tribalism make Eastern and North-Eastern state an emerging regional Hub for Spiritual-based Tourism, Despite being rich in culture and tradition, there are those endemic problems and the region also has Bodh Gaya, Puri Jagannath Temple, Kamakhya Temple, Gangasagar and a plethora of others that attract tourism and religious sentiments from all over the country and the world. Bihar, West Bengal and Sikkim are also boosting Sri Lanka, Japan and Thailand footfalls with restoration of Buddhist parikrama marg. North-Eastern India is overwhelmingly under-recognized for its Shakti Peeth temples, natural spiritual tradition and now growing niche tourism including monastic tourism.

| Region | CAGR (2025 to 2035) |

|---|---|

| Eastern and North-eastern India | 15.7% |

Religious & heritage tours & pilgrimage is the biggest segment of India's faith tourism, with local and foreign visitors in pursuit of religious, cultural, and spiritual experience within India's vast geography of sacred places. Religious travel activities are assigned the responsibility of developing local economies, maintaining spiritual heritage, and marketing India as worldwide leader among faith tourism destinations, and are thus strategically significant to tour operators, hospitality, and faith communities.

Pilgrims have been the most frequent religious tourism industry segment, providing pilgrims the facility to draw near to divine temples, mosques, churches, and religion shrines to believers, faith tourists, and culture tourists. Pilgrim differs from the religious tourist as he/she never disrespects his/her religion because pilgrimage tourism greatly depends on religiosity, faith, and spirituality. Pilgrimage tourism is one of the strongest segments of Indian tourism industry visits.

Growing demands for the head pilgrimage centers, such as Vaishno Devi of Jammu & Kashmir, Tirupati Balaji of Andhra Pradesh, Shirdi of Maharashtra, Kashi Vishwanath Temple of Varanasi, and Ajmer Sharif Dargah of Rajasthan, have raised market acceptance with millions of pilgrims looking for blessings, spiritual enlightenment, and religious satisfaction each year. Over 60% of Indian domestic travelers undertake religious or spiritual pilgrimages at least once a year, thus generating sustainable demand for the industry. Senior citizen holiday tours, chartered pilgrim tours, and spiritual pilgrimages have emerged pilgrim tourism forms fueling market growth, thus creating market demand, providing convenience and comfort to pilgrims.

Introduction of digital pilgrimage platforms, temple darshan online booking, and pilgrim itineraries optimized on AI, and digital queue management at temples has also resulted in faster adoption, with improved user experience and automated processing of pilgrimage.

Launch of eco-spiritual and sustainable pilgrimage travel, zero-waste religious travel, river preservation pilgrimage routes (e.g., the Ganga route), and eco-temple retreats has pushed market development to a zenith in terms of direction toward global trends in sustainable travel.

Usage of multi-faith pilgrimage routes like Hindu Char Dham Yatra, Buddhist pilgrimage routes (Sarnath and Bodh Gaya), Sikh heritage tours (Amritsar Golden Temple and Hemkund Sahib), and Christian pilgrimage routes (Velankanni and St. Thomas Church in Kerala) has been the major market growth driver with assured patronage by the respective religious groups.

Though a major contributor to India's economic development, religious heritage, and tradition contribution, the pilgrimage tourism sector is plagued by religio-central saturation, infrastructural bottlenecks, and seasonally behaviorally unpredictable demand patterns. More recent AI-driven innovations of crowd management, blockchain-attached donation trail registration, and adaptive planning in the case of temple pilgrims are introducing higher efficiency, greater ease of access, and holiday convenience to the tourist population for the pilgrimage tourism industry in India, increasing all the larger in size.

Religious & heritage tours were world bestsellers in the market for the most part among history enthusiasts, overseas travelers, and culture tourists because India is still in a position to preserve and market its centuries-old religious and historical heritage through the channels of organized tourism. Religious & heritage tours also differ from complete pilgrimage tourism in that they are more focused on history, architecture, and religion of sacred sites and give tourists rich stories to absorb.

Increased demand for UNESCO heritage religious destinations such as Mahabodhi Temple at Bodh Gaya, Sun Temple at Konark, Meenakshi Temple at Madurai, and Basilica of Bom Jesus at Goa has fueled religious & heritage tour demand with internationally mobile travelers seeking historically and spiritually suitable places. It is realized by research that more than 45% of global tourists who come to India incorporate it into their package for visiting some sacred or heritage spot so that demand is enormous in this segment.

Escorted heritage tour with divine tale, walk at historical places tour, and inquiry-based engagement at temple designs has increased the demand in the market, giving a boost to local as well as global tourists' involvement.

The intersection of tour customization and AI, temple tours by sound, history apps by AI, and virtual reality reconstruction of ancient religious places has facilitated adoption, and this has pushed heritage travelers to require more user experience and immersion on their end.

Creation of interfaith heritage pilgrim circuits like Buddhist pilgrim pilgrimages in Uttar Pradesh and Bihar, Jain heritage pilgrimages in Rajasthan and Gujarat, and Sufi shrine discovery pilgrimages in Delhi and Hyderabad has achieved its highest level of market development in a pluralistic and inclusive faith tourism strategy.

Culture art phobias marketed as religious tourism, such as medieval fresco finds at Kerala temples, Indo-Islamic architectural holidays in the Delhi region, and Ladakh monastery holidays, have seen growth in the market with increased participation by cultural and brain tourists.

Though well-positioned in inter-faith tolerance, heritage conservation, and cultural sensitivity, religious & heritage tours is susceptible to biased tourist infrastructure, financial limitations of protection of age-old monuments, and risks to safety of historical monuments. Yet, new-age upcoming technology for online monitoring of tourists, AI-enabled security patrol, and government-funded heritage restoration schemes is fueling religious & heritage tours even more in India's religion tourism sector.

The in-person booking and online booking segments are two of the prime market drivers since religious travelers are now seamlessly incorporating digital pilgrimage planning into their travel arrangements, alongside on-the-ground experiential decision-making.

The web-based reservation segment has emerged as the most popular platform for religious travel reservations, allowing passengers the convenience of advance bookings for temple tours, guided heritage visits, and religion retreat accommodations in digital space, OTAs, and mobile websites. Compared with phone-based booking, online reservation allows instant verification of availability, immediate confirmation, and AI-led customized religious pilgrimage itineraries.

The growing need for mobile-first pilgrimage planning with app-based temple darshan bookings, AI-optimized travel routes, and digital donation services has driven the adoption of online booking, as pilgrims and faith tourists favour digital ease and planned spiritual experiences. Research shows that more than 65% of religious tourists in India now prefer digital bookings for their sacred travels, assuring robust demand for this segment.

With all its strengths in ease of accessibility, real-time confirmations, and AI-powered personalization, the online booking sector has limitations in terms of cybersecurity threats, poor digital literacy among senior pilgrims, and inconsistent booking availability during peak holy seasons. These, however, are being enhanced by upcoming trends in block chain-supported pilgrimage booking protection, multilingual travel planning platforms, and AI-powered predictive demand management, promoting security, ease of access, and smooth booking processes, for further market growth in online religious travel bookings.

The in-person booking segment has experienced robust market uptake, especially among walk-in pilgrims, local temple-goers, and last-minute spiritual travellers, as religion-based tourists increasingly turn to real-time decision-making and local advice to inform their religious travel. In contrast to pre-booked digital reservations, in-person bookings enable travellers to investigate spontaneous spiritual opportunities on the basis of word-of-mouth recommendations, community-organized religious events, and local information.

The increasing need for flexible, on-the-ground religious experiences, including walk-in temple visits, impromptu spiritual retreats, and heritage site explorations, has fuelled in-person booking adoption, as faith travellers look for immersive and culturally relevant experiences.

With all its strengths in spontaneity, community experience, and flexibility, the face-to-face booking segment has had issues of invariable pricing, extensive wait periods during high pilgrim season, and scarcity of space for well-booked temple visits. That said, novel technologies in AI-based real-time queue monitoring, virtual temple access maps, and multilingual guide tour support are enhancing efficiency, accessibility, and tourist convenience to promote further growth for face-to-face booking within India's religion-tourism value chain.

Growing trend in pilgrimage travel, religious heritage exploration, and spiritual tourism is driving growth in the India faith-based tourism market. Pilgrimage planners, temples, AI companies, and tourism operators are capitalizing on this trend offering AI-based pilgrimage planning, smart temple tourism, and digital religious travel platforms that help pilgrims be smarter, safer, and more culturally aware. Tourism boards, pilgrimage travel agencies, hotel suppliers, and religious organizations make up the market, paving the way for technological progress in digital pilgrimage booking, artificial intelligence-driven crowd management, and virtual temple engagement experiences.

Market Share Analysis by Key Players & Pilgrimage Travel Facilitators

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| IRCTC (Indian Railway Catering & Tourism Corporation) Pilgrim Packages | 20-25% |

| Yatra.com (Religious Tour Packages & Pilgrimage Booking) | 12-16% |

| Thomas Cook India (Faith-Based Travel Division) | 10-14% |

| SOTC Travel (India Religious Tourism Packages) | 8-12% |

| State Tourism Boards (UP, Uttarakhand, Tamil Nadu, Andhra Pradesh) | 5-9% |

| Other Travel Operators & Religious Trusts (combined) | 30-40% |

Key Company & Tour Offerings

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| IRCTC Pilgrim Packages | Provides rail-based pilgrimage packages, AI-powered travel planning, and budget-friendly religious tour bundles. |

| Yatra.com | Specializes in online pilgrimage tour bookings, Char Dham yatra packages, and personalized religious travel itineraries. |

| Thomas Cook India | Offers luxury and budget faith-based travel experiences, integrating smart pilgrimage guides and spiritual retreat bookings. |

| SOTC Travel | Focuses on customized religious tourism, temple visits, and multi-faith heritage travel across India. |

| State Tourism Boards | Develop government-backed pilgrimage tourism initiatives, AI-based temple crowd management, and spiritual tourism circuits. |

IRCTC Pilgrim Packages (20-25%)

IRCTC owns the India faith-based travel space, with religious rail-based travel packages, AI-enabled tour personalization, and scale religious travel infrastructure.

Thomas Cook India (10-14%)

Thomas Cook India offers Journeys of faith for pilgrims and Spiritual retreats and a world of luxury travel experiences for group pilgrims addressing to your spiritual needs and customize itinerary.

SOTC Travel (8-12%)

SOTC is committed to personalized religious tourism, incorporating AI-enabled temple tours, pilgrims on a budget, and tailored religious retreats.

State Tourism Boards (5-9%)

Central government, state governments with their tourism boards create state-level pilgrimage projects of gigantic scales, devising digital crowd control, promotional heritage temple projects, tourism pull (incentives).

Other Key Players (30-40% Combined)

Next-generation faith-based tourism innovations, AI-driven travel planning, and smart religious travel management are contributed by several religious tour operators, online travel platforms, and spiritual institutions. These include:

The overall market size for India Culinary Tourism Market was USD 13.7 Billion in 2025.

The India Culinary Tourism Market expected to reach USD 58.6 Billion in 2035.

The demand for India’s faith-based tourism market will be driven by its rich spiritual heritage, government initiatives promoting religious tourism, improved infrastructure, increasing pilgrim footfall, social media influence, and the growing interest of both domestic and international travellers in experiencing India’s diverse religious and cultural traditions.

The top 5 countries which drives the development of India Faith-Based Tourism Market are USA,UK, Europe Union, Japan and South Korea.

Pilgrimages and Religious & Heritage Tours Growth to command significant share over the assessment period.

Table 1: Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Market Value (US$ Million) Forecast by Tourism Type, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 4: Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 6: Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Figure 1: Market Value (US$ Million) by Tourism Type, 2023 to 2033

Figure 2: Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 3: Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 4: Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 5: Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 6: Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 7: Market Value (US$ Million) by Country, 2023 to 2033

Figure 8: Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 9: Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 10: Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 11: Market Value (US$ Million) Analysis by Tourism Type, 2018 to 2033

Figure 12: Market Value Share (%) and BPS Analysis by Tourism Type, 2023 to 2033

Figure 13: Market Y-o-Y Growth (%) Projections by Tourism Type, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 15: Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 17: Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 18: Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 19: Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 20: Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 21: Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 22: Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 23: Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 24: Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 25: Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 26: Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 27: Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 28: Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 29: Market Attractiveness by Tourism Type, 2023 to 2033

Figure 30: Market Attractiveness by Booking Channel, 2023 to 2033

Figure 31: Market Attractiveness by Tourist Type, 2023 to 2033

Figure 32: Market Attractiveness by Age Group, 2023 to 2033

Figure 33: Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 34: Market Attractiveness by Tour Type, 2023 to 2033

Figure 35: Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

Analyzing India Loyalty Program Market Share & Industry Leaders

India Yoga and Meditation Service Market Trends – Size, Share & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA