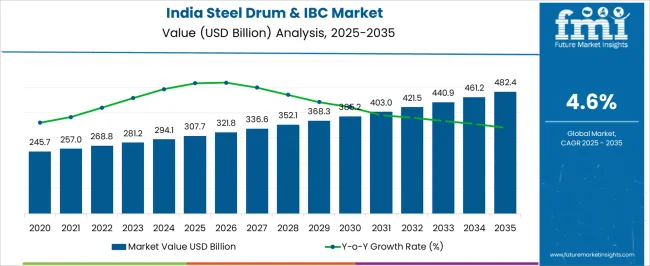

The India Steel Drum & IBC Market is estimated to be valued at USD 307.7 billion in 2025 and is projected to reach USD 482.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| India Steel Drum & IBC Market Estimated Value in (2025 E) | USD 307.7 billion |

| India Steel Drum & IBC Market Forecast Value in (2035 F) | USD 482.4 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The India steel drum and IBC market is experiencing steady development driven by increasing industrialization, rising demand for bulk packaging, and the need for safe storage and transportation of hazardous and non hazardous materials. The market is being shaped by strict regulatory frameworks surrounding packaging safety, supply chain efficiency, and sustainability.

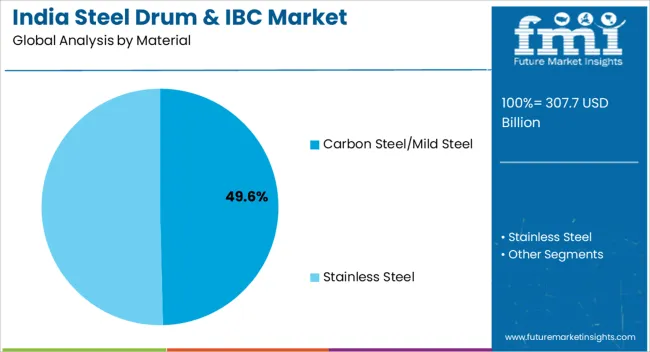

Carbon steel and mild steel materials are being widely adopted due to their durability, reusability, and cost effectiveness. Expanding use across chemicals, petroleum, food, and pharmaceuticals is further enhancing market penetration.

Additionally, the shift toward sustainable bulk packaging solutions is encouraging manufacturers to invest in stronger, recyclable, and reusable designs. With rising emphasis on export quality standards and supply chain optimization, the future outlook remains positive for steel drums and IBCs as preferred bulk packaging formats in India.

The carbon steel and mild steel material segment is projected to contribute 49.60% of total revenue by 2025, making it the leading material type. This growth is supported by their robustness, long lifecycle, and ability to withstand pressure, contamination, and external stress.

The reusability of these materials makes them highly cost efficient for large scale industrial applications.

Furthermore, carbon steel and mild steel drums are extensively used for storing and transporting chemicals, oils, and hazardous substances, reinforcing their leadership in the market.

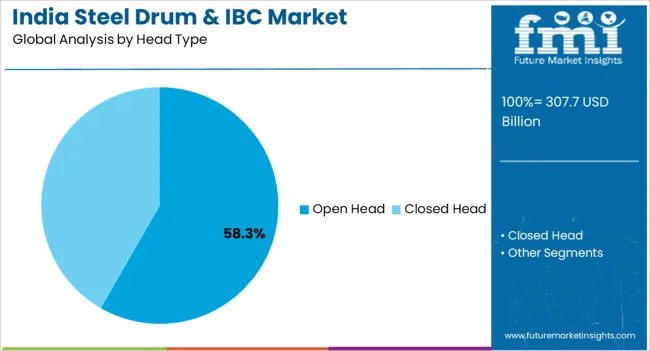

The open head segment is anticipated to hold 58.30% of the total market revenue by 2025, positioning it as the dominant head type. This preference is linked to its versatility in handling both solid and semi solid contents, as well as ease of filling and emptying.

Open head designs provide greater accessibility, making them suitable for industries that require frequent opening, resealing, or cleaning.

Their adaptability across multiple industrial verticals continues to drive their strong adoption.

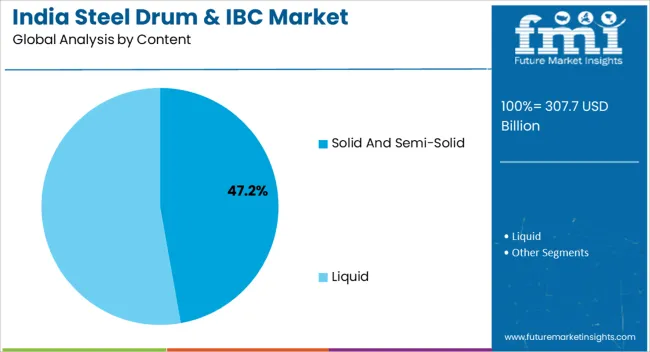

The solid and semi solid content segment is expected to account for 47.20% of the total market revenue by 2025 within the content category.

This growth is driven by rising demand for packaging solutions capable of securely storing and transporting industrial goods such as chemicals, adhesives, food ingredients, and construction materials.

The segment’s prominence is further reinforced by operational requirements for durability, spill prevention, and compatibility with diverse industrial applications.

India steel drum & IBC sales increased at around 3.0% and 2.6% CAGRs respectively during the historic period. Over the next decade, Future Market Insights (FMI) predicts steel drum & IBC demand across India to rise at 4.6% and 3.8% CAGR respectively.

Rising applications of steel drums & IBCs across diverse industries is driving India market forward.

Many industrial items, including chemicals, oils, solvents, and hazardous compounds, are stored and transported in steel drums. These drums are made to last, be strong, and survive the demanding industrial circumstances.

Steel drums are normally constructed of steel that is sufficiently thick to resist the weight of the products they hold as well as any impacts they may experience during storage & transportation.

Little industrial steel barrels that hold a few gallons to big drums that can carry more than 50 gallons are all available in a variety of sizes and capacities. To maintain the security of the goods, they are frequently needed to adhere to particular laws and norms.

IBCs are reusable industrial containers that are used for the transportation and storage of bulk liquids, powders, and granulated materials. They are made with a standardized shape and size that enables them to be conveniently stacked, carried, and handled by forklifts or pallet jacks.

IBCs are designed to have a volume of between 500 and 3,000 liters (132 and 793 gallons). They typically consist of a pallet foundation, a top cover or lid, and a rigid or flexible container.

For the transportation and storage of diverse products, IBCs are frequently used in industries such as agriculture, food and beverage, pharmaceuticals, and chemicals.

Increasing Demand for Industrial Packaging Solutions to Boost the Market

Steel barrels are a practical solution for material storage and transportation because they endure for a long time and have minimal influence on the environment.

Steel drums & IBC are among the industrial packaging items that are more in demand as a result of India's expanding industrialization. India's top steel drum & IBC users include the chemical, pharmaceutical, and food processing industries.

Compared to other materials, steel is stronger and more durable. The growth of industries, such as pharmaceutical, food & beverage, and chemical is expected to scale up steel drum & IBC demand.

Steel drums are more resilient to collisions, leaks, and punctures. This makes it a popular option for transporting hazardous materials and hefty solid objects.

Various industries are using packaging solutions such as barrel drums, steel barrels, metal drums, and metal drum containers to transport hazardous & nonhazardous liquids or semi-liquids. Similarly, popularity of flexitanks or flexi tank containers is rising across India.

Growing usage of industrial steel drums for transporting various products will create lucrative opportunities for steel drum & IBC manufacturers.

Rapid Expansion of FMCG Sector in India to Elevate IBC Demand

One of the leading users of IBCs in India is the FMCG sector, especially for the storage and transportation of liquid and powder products. IBCs can aid in enhancing the effectiveness of logistics processes in the FMCG sector.

IBCs, for instance, can be made to fit onto pallets, which makes them simple to transport and stack. As a result, transporting FMCG goods from one place to another takes less time and money.

IBCs are a perfect choice for the FMCG business because they are made to adhere to high safety and hygiene regulations. They can be created from anti-contamination materials and are simple to clean and sterilize in between usage. This helps stop the spread of germs and other contaminants.

Demand for IBCs from the FMCG sector is predicted to boost the market as the FMCG market in India is anticipated to rise at a CAGR of 14.9% to reach US$ 307.7 billion by 2025.

Rising Usage in Pharma Sector to Create Growth Opportunities for Steel Drums & IBC Manufacturers

Industrial steel barrels are widely used by the pharmaceutical industry. Pharmaceutical products, including both raw materials and finished goods, are stored and transported in these containers.

Several pharmaceutical items include dangerous components that demand unique handling and storage. Such materials are best stored in industrial steel drums because they are made to withstand the corrosive nature of these materials.

Pharmaceutical businesses use industrial steel barrels to assist them to meet regulatory criteria because the pharmaceutical industry is highly regulated. For instance, industrial steel barrels can be used to meet the requirements for airtight storage for some medicinal goods.

Industrial steel barrels offer a barrier against external contamination, which is a necessity for pharmaceutical items that need to be shielded from contamination. The drums are made to be airtight, preventing the entry of impurities such as moisture, dust, and others.

The supply chain for the pharmaceutical business is not complete without industrial steel drums. They contribute to making sure that pharmaceutical items are transported and stored safely and securely, which is essential to ensuring the effectiveness and quality of these medicines. The pharmaceutical business is anticipated to expand, which will benefit the target market's success.

Both Manufacturers and End-users Prefer Steel Drums Made from Carbon Steel

With a safe and secure packaging solution outlook, the carbon steel segment is enjoying astonishing demand in the market. Manufacturers are increasingly using carbon steel for manufacturing steel drums on account of its various benefits.

Carbon steel is a strong and durable material that is often used to store or transport heavy or abrasive products, such as sand, cement, or gravel. The target segment currently holds more than 93% of the market share.

Growing end user preference for steel drums made from carbon steel is another key factor driving growth of the target segment. The same segment is projected to create an incremental opportunity of US$ 179.9 million during the assessment period.

Stainless steel drums demand is also likely to rise at a significant pace across India during the next ten years. This is due to rising adoption of these stainless steel drums across various industries.

Attractive Features of Open-head Steel Drums Aiding Popularity

The open-head steel drums segment is estimated to progress at 6.5% CAGR. It is likely to create an incremental opportunity of US$ 41.4 million in the next ten years. This is due to rising popularity of these open top steel drums on account of their various features.

Open-head steel drums, also known as open-top drums, feature a removable lid. They are commonly used for storing and transporting solids and liquids that require easy access and frequent filling or emptying.

Need for Lightweight, Durable, & Hygienic Packaging Fueling Composite IBC Demand

Composite IBCs are a durable, lightweight, stackable, and hygienic solution for transportation and storage. They are versatile as they can be used for a wide range of applications, including the storage and transport of chemicals, food products, and pharmaceuticals.

As per Future Market Insights (FMI), the target segment is anticipated to hold more than 99.5% share in India IBC industry in 2025. Further, it is expected to create an incremental opportunity of US$ 95.1 million during the forecast period.

Steel Drum and IBC Sales to Remain Highly Concentrated in Industrial Chemicals Sector

In terms of demand and market share, industrial chemicals segment leads the market from the forefront. Industrial chemicals segment is projected to hold around 60.9% of India steel drums industry. Similarly, it is expected to account for 55.1% share of India IBC industry in 2025.

Rising need for highly protective packaging solutions for the safe transport of harmful chemicals is encouraging the adoption of steel drums and IBCs in industrial chemicals sector.

On the other hand, food segment in India's steel drums & IBC markets is projected to register a CAGR of 6.7% and 6.9% in the forecast years respectively.

Leading manufacturers of steel drums and IBCs are focusing on increasing their sales and strengthening their presence across India by employing various strategies. This includes new product launches, mergers, acquisitions, facility expansions, price reductions, collaborations, and agreements.

For instance:

| Attribute | Details |

|---|---|

| Estimated Valuation for Steel Drums Market (2025) | USD 307.7 billion |

| Estimated Valuation for IBC Market (2025) | USD 482.4 billion |

| Projected Market Value (2035) | USD 468.7 million (India Steel Drums Industry) USD 260.5 million (India IBC Industry) |

| Anticipated Growth Rate (2025 to 2035) | 4.6% (India Steel Drums Industry) 3.8% (India IBC Industry) |

| Historical Data | 2014 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Capacity, Content, Head Type, End Use |

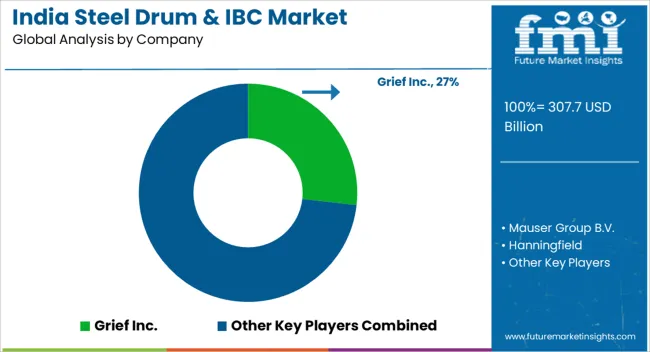

| Key Companies Profiled | Grief Inc.; Mauser Group B.V.; Hanningfield; Pyramid Technoplast Pvt. Ltd; TPL Plastech Limited; Vizag Chemical International; Shree Dwarkesh Chem Industries; Balmer Lawrie & Co. Limited; Metal Seam Co. Pvt. Ltd; The East India Drums & Barrels Mfg. Co.; Sicagen India Limited; Industrial Engineering Corporation; Tripura Containers Private Limited; ABCD Drums & Barrels Industries; Pearson Drums & Barrels Private Limited; Vimal Barrels Pvt. Ltd.; Kumar Containers Pvt. Ltd; Scoya Pharmatech; Agarwal Packaging Pvt. Ltd; Nakoda Containers Private Limited; Gujarat Polythene; Supreme Industries; MAHIMA Drums Manufacturing Co. |

India IBC Market by Category:

The global india steel drum & IBC market is estimated to be valued at USD 307.7 billion in 2025.

The market size for the india steel drum & IBC market is projected to reach USD 482.4 billion by 2035.

The india steel drum & IBC market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in india steel drum & IBC market are carbon steel/mild steel and stainless steel.

In terms of head type, open head segment to command 58.3% share in the india steel drum & IBC market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Steel Drums and IBCs Industry

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Steel Drum Market Share

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel IBC Market Demand and Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Reconditioned Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Reconditioned Steel Drum Providers

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Drum Brake Shoe Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Casino Tourism Market Forecast and Outlook 2025 to 2035

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA