The global reconditioned steel drum market is poised for steady growth, with its value expected to rise from USD 2.64 billion in 2025 to USD 3.62 billion by 2035.

This expansion reflects a CAGR of 3.2%, driven by increasing demand across various industries for cost-effective and sustainable packaging solutions. Steady growth highlights a rising preference for eco-friendly alternatives to new containers, supporting circular economy initiatives worldwide.

Businesses increasingly seek packaging solutions that reduce costs while aligning with their environmental commitments. As a result, reusable steel drums are gaining prominence for their ability to be used multiple times without compromising quality or safety.

Looking ahead, the industry is expected to benefit significantly from advancements in refurbishment technologies and stricter global environmental regulations. As industries prioritize sustainable packaging, demand for high-quality, refurbished steel containers is expected to increase substantially.

Additionally, the focus on reducing carbon footprints and minimizing industrial waste is accelerating adoption, particularly in emerging regions where sustainability practices are evolving rapidly.

Ongoing innovations in reconditioning processes promise longer product lifespans, enhanced safety standards, and reduced refurbishment costs, making these containers an increasingly attractive option for businesses prioritizing sustainability and operational efficiency. Collectively, these factors create a promising outlook through 2035.

Government regulations play a pivotal role in shaping the industry by enforcing strict standards for safety, environmental protection, and waste management. Agencies like the USA.

Environmental Protection Agency (EPA), the European Chemicals Agency (ECHA), and other international bodies mandate rigorous guidelines for the handling, refurbishing, and reuse of steel drums to ensure safety and quality.

These rules require regular inspections, thorough cleaning, and certification to prevent contamination and hazards during the transport of chemicals and hazardous materials.

Moreover, growing government initiatives promoting circular economy principles and waste reduction encourage businesses to adopt refurbished steel containers. Such regulatory frameworks not only ensure compliance but also stimulate growth by fostering sustainable industrial practices globally.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.64 billion |

| Industry Value (2035F) | USD 3.62 billion |

| CAGR (2025 to 2035) | 3.2% |

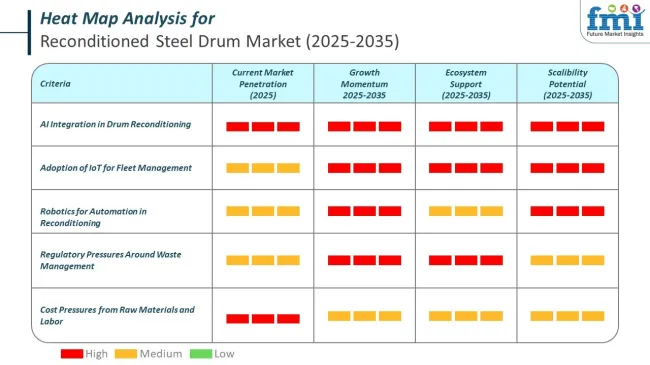

In 2025, the reconditioned steel drum market will be transformed through the integration of artificial intelligence. AI systems are increasingly being used for defect detection during inspection processes, ensuring strict adherence to quality standards. These systems significantly minimize human error and boost the overall safety of drums used in sensitive sectors such as chemicals and pharmaceuticals.

The industry is witnessing a sharp rise in the adoption of intelligent solutions that not only improve operations but also cut costs across the production cycle.

Technologies like IoT and robotics are further pushing the boundaries of efficiency in 2025. IoT sensors embedded in drums enable real-time monitoring of parameters such as pressure, temperature, and wear levels. This data allows better fleet management and reduces the risk of drum failure during transport or storage.

These innovations are increasing demand across sectors that prioritize safety and reliability, such as pharmaceuticals, food processing, and industrial chemicals.

Leading companies in the reconditioned steel drum market are rapidly modernizing their reconditioning operations. Schutz Container Systems has adopted AI-based inspection systems to boost product consistency. Mauser Packaging Solutions is deploying predictive AI to streamline logistics and reduce operational hiccups.

This technological shift is positioning these companies as innovation leaders within the reconditioned steel drum industry, enabling them to meet rising regulatory and environmental standards.

In 2025, heightened environmental awareness is leading industries to seek greener alternatives. Reconditioned steel drums offer a sustainable solution, and this is fueling market growth. Regulatory mandates for waste reduction and safety are reinforcing the need for high-tech drum monitoring and quality assurance in the reconditioned steel drum market.

As demand surges, companies leveraging AI and smart technologies are emerging as frontrunners in this evolving market landscape.

The industry is segmented by material into stainless steel, cold rolled steel, and carbon steel; by head type into tight head and open head; by size/capacity into 10 to 25 gallons, 25 to 40 gallons, 40 to 55 gallons, and 55 gallons and above; by end-use industry into food & beverages, pharmaceuticals & healthcare, building and construction, oils & lubricants, chemicals and solvents, paints & dyes, agriculture & allied industry, and others; and by region into North America, Latin America, East Asia, South Asia and the Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The stainless steel segment is the fastest-growing material in the market, valued at USD 12.4 billion in 2025 and expected to reach USD 24.5 billion by 2035, reflecting a robust CAGR of 7.2%. This growth is driven by increasing demand from sectors such as healthcare, chemical processing, and food manufacturing, where corrosion resistance and durability are essential.

Premium pricing and stringent regulatory standards further support its expansion. Meanwhile, cold-rolled steel experiences moderate growth due to its superior surface finish and dimensional accuracy, making it suitable for automotive and appliance manufacturing; however, it faces pricing volatility from raw material fluctuations.

Carbon steel remains the most widely used material due to its cost-effectiveness and strength, especially in infrastructure and construction across emerging regions. However, its value growth is more conservative, constrained by price sensitivity despite leading in volume.

Overall, stainless steel offers the strongest value growth potential, while cold rolled and carbon steel continue to maintain steady demand driven by their respective industrial applications.

| Material Segment | CAGR (2025-2035) |

|---|---|

| Stainless Steel | 7.2% |

The tight head segment leads growth in the reconditioned steel drum market by head type, with a value of USD 7.8 billion in 2025, expected to grow to USD 14.2 billion by 2035, showcasing a robust CAGR of 6.4%.

This segment's rapid growth is fueled by stringent safety and environmental regulations across the chemical, petroleum, and lubricant industries, which demand leak-proof and secure containers for hazardous liquids. The specialized design of tight head drums, optimized for liquid containment and industrial compliance, has made them a premium choice for customers prioritizing safety and product integrity.

Although the open head segment remains widely used in sectors like food, pharmaceuticals, and paints due to its accessibility and flexibility, its growth is more moderate.

The rapid increase in the value of tight head drums reflects the increasing industry emphasis on mitigating spill risks and enhancing storage safety. As regulatory frameworks tighten worldwide, the tight head segment is poised to continue driving significant value growth in the industry.

| Head Type | CAGR (2025-2035) |

|---|---|

| Tight Head | 6.4% |

The 55 gallons and above size category stands as the fastest-growing segment in the market, valued at USD 15.6 billion in 2025 and projected to reach USD 28.1 billion by 2035, with an impressive CAGR of 5.1%.

This segment’s rapid expansion is largely attributed to its extensive use in bulk industrial applications such as chemical storage, oil transportation, and waste management.

The ability to optimize economies of scale and improve operational efficiencies makes larger capacity drums the preferred choice for industries focused on bulk handling. While mid-size drums (40 to 55 gallons) continue to see steady demand due to their versatility for pharmaceuticals and specialty chemicals, and smaller drums serve niche sectors requiring mobility, these segments grow at comparatively modest rates.

The dominance of the 55 gallons and above category is reinforced by the logistical advantages it offers in large-scale industrial supply chains, which increasingly prioritize cost-effectiveness and regulatory compliance. Its role as a backbone of industrial containment solutions secures its position as the fastest growing size category.

| Size/Capacity Segment | CAGR (2025-2035) |

|---|---|

| 55 Gallons and Above | 5.1% |

The chemicals and solvents segment is the fastest-growing end-use industry in the market, valued at USD 18.3 billion in 2025 and expected to reach USD 33.8 billion by 2035, reflecting a strong CAGR of 6%.

This growth is primarily driven by the escalating demand for safe and efficient containment solutions within the chemical processing and transportation industries. Stringent environmental and safety regulations globally have further fueled the need for reliable packaging that can safely handle hazardous and volatile liquids.

Innovations in drum lining and sealing technologies have enhanced the appeal of reconditioned drums in this sector by improving durability and chemical resistance.

While other segments, such as oils and lubricants, food & beverages, and pharmaceuticals, maintain steady demand with their specific packaging requirements, none match the rapid value expansion seen in chemicals and solvents.

Additionally, sectors like building and construction or agriculture contribute to volume stability but lag behind in growth pace.The chemicals and solvents industry's emphasis on compliance and operational safety positions it as the key growth driver in the landscape.

| End-use Industry | CAGR (2025-2035) |

|---|---|

| Chemicals and Solvents | 6% |

Sales of reconditioned steel drums in the United States are projected to grow from USD 0.73 billion in 2025 to USD 1.22 billion by 2035, registering a CAGR of 4.7%. The countries mature industrial infrastructure supports steady demand for reusable steel containers, particularly across chemicals, pharmaceuticals, and oils & lubricants sectors.

Robust regulatory frameworks featuring stringent environmental and safety standards encourage businesses to adopt sustainable packaging practices. The growing emphasis on the circular economy promotes reuse and recycling, aligning closely with refurbishment solutions. Large enterprises dominate by leveraging their capacity to implement extensive sustainability programs and compliance initiatives.

Meanwhile, rising environmental awareness among mid-sized and smaller firms is gradually driving deeper penetration. Infrastructure investments and increasing focus on reducing industrial waste further contribute to demand stability.

Although slower industrial growth compared to emerging regions tempers expansion rates, ongoing regulatory pressures and sustainability commitments are expected to sustain moderate growth. As a result, the United States remains a significant contributor to the global sector for refurbished steel containers throughout the forecast period.

| Country | CAGR (2025-2035) |

|---|---|

| United States | 4.7% |

Germany reconditioned steel drum market is projected to grow from USD 0.38 billion in 2025 to USD 0.58 billion by 2035, registering a CAGR of 4%.

The countries mature industrial landscape, anchored by strong chemical, automotive, and pharmaceutical sectors, sustains steady demand for reusable steel containers. Germany’s stringent environmental regulations and waste management policies drive the adoption of sustainable packaging and circular economy practices.

A well-established recycling infrastructure supports efficient refurbishment processes, making reuse economically viable. Large multinational corporations dominate by leveraging advanced supply chains and compliance frameworks.

The growing focus on reducing carbon footprints and waste aligns with corporate sustainability goals, further boosting demand. Despite the maturity and limited industrial expansion, continuous regulatory tightening and technological innovations in refurbishment maintain steady growth.

Germany's emphasis on quality, compliance, and sustainability ensures it remains a key player in Europe, with moderate but reliable growth throughout the forecast period.

| Country | CAGR (2025-2035) |

|---|---|

| Germany | 4% |

Japan reconditioned steel drum demand is projected to grow from USD 0.47 billion in 2025 to USD 0.68 billion by 2035, registering a CAGR of 3.9%. The country's advanced manufacturing and pharmaceutical sectors sustain a steady demand for reusable steel containers, particularly for chemical and food-grade applications.

Strict environmental and quality regulations promote the adoption of sustainable packaging aligned with circular economy objectives. Japan's efficient waste management and recycling infrastructure support refurbishment as a cost-effective alternative to new drums. Large corporations lead adoption, encouraged by government policies focused on resource efficiency and reducing environmental impact.

Although the sector faces challenges from slow industrial growth and demographic shifts, ongoing innovation in packaging technology and rising environmental awareness among businesses help maintain demand. Regulatory pressures combined with corporate sustainability commitments ensure steady growth.

Throughout the forecast period, Japan is expected to remain a significant contributor to the industry, balancing mature industrial activity with a strong emphasis on environmental responsibility.

| Country | CAGR (2025-2035) |

|---|---|

| Japan | 3.9% |

Sales of reconditioned steel drum in France are projected to grow from USD 0.30 billion in 2025 to USD 0.48 billion by 2035, registering a CAGR of 4.2%. The country's established industrial sectors, including chemicals, paints, dyes, and agriculture, ensure a steady demand for reusable steel containers. Stringent environmental regulations and government policies promoting sustainability and recycling drive the adoption of eco-friendly packaging solutions.

France's well-developed recycling infrastructure supports efficient refurbishment processes, making drum reuse economically viable and aligned with circular economy goals. Large corporations dominate by leveraging robust compliance frameworks and strong sustainability commitments.

Growing environmental awareness among small and medium enterprises also contributes to expansion. Although industrial growth remains moderate, continuous tightening of regulatory standards and corporate focus on reducing waste and carbon footprints provide strong support for development.

France is expected to maintain steady growth throughout the forecast period, balancing mature industrial demand with progressive sustainability objectives.

| Country | CAGR (2025-2035) |

|---|---|

| France | 4.2% |

The United Kingdom reconditioned steel drum industry is projected to grow from USD 0.21 billion in 2025 to USD 0.32 billion by 2035, registering a CAGR of 4.0%. The UK's industrial sectors, including chemicals, pharmaceuticals, and food processing, drive consistent demand for reusable steel containers.

The country's commitment to environmental sustainability, supported by strict regulations and waste management policies, encourages the adoption of refurbished packaging solutions aligned with circular economy principles. Efficient recycling infrastructure and government incentives facilitate container reuse, helping companies reduce operational costs while meeting regulatory requirements. Large corporations lead with robust sustainability programs while growing awareness among SMEs supports broader adoption.

Economic maturity and relatively slower industrial growth moderate expansion, but regulatory pressure and corporate environmental responsibility sustain steady demand. The UK is positioned for stable growth through the forecast period, driven by a balanced mix of industrial activity and progressive environmental policies.

| Country | CAGR (2025-2035) |

|---|---|

| United Kingdom | 4% |

The top five players in the market collectively control majority of global revenues, indicating a moderately consolidated competitive landscape. Greif, Inc. leads, leveraging its extensive international footprint, advanced reconditioning technologies, and a strong focus on sustainable packaging solutions.

Mauser Packaging Solutions emphasizes eco-friendly practices and strict compliance with evolving regulatory standards. Industrial Container Services (ICS) is driven by customized solutions and strategic expansion into emerging regions. Peninsula Drums commands 8%, benefiting from regional specialization and customer-centric service offerings.

Clouds Drums Dubai LLC rounds out the top five with 7%, distinguished by its agility in the Middle East and innovative drum refurbishment techniques.

Leading companies defend and grow their positions through vertical integration, investments in technology, capacity expansions, and acquisitions.

Greif has heavily invested in automation and lifecycle management to enhance the durability and sustainability of reconditioned drums. Mauser places a strong emphasis on eco-innovation and regulatory compliance to differentiate its product offerings.

ICS pursues strategic partnerships and diversification, focusing particularly on Asia and Latin America to capture emerging demand. These strategies help the leaders maintain competitive advantages and address evolving customer needs.

Smaller-scale players such as THIELMANN, Myers Container LLC, Eagle Manufacturing Company, Sonoco Products Company, and Tielman Group focus on specialized, localized services and cost-effective solutions to compete effectively.

These companies often target niche segments and prioritize flexible customer service. Their ability to rapidly respond to local regulatory requirements and specific industry demands allows them to maintain relevance regionally.

This agility often gives them an edge over larger players in certain applications.

Overall, the industry is characterized by a dynamic mix of large multinational companies and smaller regional players. While the top companies invest in technology, sustainability, and global expansion to maintain dominance, smaller firms focus on niche expertise and localized services.

This competitive landscape fosters innovation and growth, benefiting the sector as a whole through improved product quality and service diversity.

Recent Reconditioned Steel Drum Industry News

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.64 billion |

| Projected Market Size (2035) | USD 3.62 billion |

| CAGR (2025 to 2035) | 3.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020-2024 |

| Projections Period | 2025-2035 |

| Report Parameter | Revenue in USD billion/ Volume in Units |

| By Material | Stainless Steel, Cold Rolled, and Carbon Steel |

| By Head Type | Tight Head and Open Head |

| By Size/Capacity | 10 to 25 Gallons, 25 to 40 Gallons, 40 to 55 Gallons, 55 Gallons and Above |

| By End-use Industry | Food & Beverages, Pharmaceuticals & Healthcare, Building and Construction, Oils & Lubricants, Chemicals and Solvents, Paints & Dyes, Agriculture & Allied Industry, Others (Automotive, Mining, Wastewater Treatment, and Personal Care Products) |

| Regions Covered | North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | China, United States, India, Germany, Japan, South Korea, Brazil, France, United Kingdom, Saudi Arabia |

| Key Players | Greif, Inc., Mauser Packaging Solutions, Industrial Container Services (ICS), Peninsula Drums, Clouds Drums Dubai LLC, THIELMANN, Myers Container LLC, Eagle Manufacturing Company, Sonoco Products Company, Tielman Group |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The reconditioned steel drum market is categorized based on material, including stainless steel, cold rolled steel, and carbon steel.

The market is segmented by head type into tight head and open head variants.

Reconditioned steel drums are classified based on capacity, including 10 to 25 gallons, 25 to 40 gallons, 40 to 55 gallons, and 55 gallons and above.

The market serves various industries, including food & beverages, pharmaceuticals & healthcare, building and construction, oils & lubricants, chemicals and solvents, paints & dyes, agriculture & allied industry (fertilizers/pesticides), and others.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

The industry is expected to grow from USD 2.64 billion in 2025 to USD 3.62 billion by 2035, at a CAGR of 3.2%.

Key industries include chemicals, pharmaceuticals, food and beverages, oils and lubricants, and paints and dyes, all requiring durable and sustainable bulk packaging solutions.

They provide cost savings, reduce environmental impact by promoting reuse and recycling, and comply with regulatory standards for safe transportation and storage.

Drums undergo rigorous cleaning, inspection, testing, and repairs to meet industry safety and performance standards before reuse.

China, the United States, India, Germany, and Japan are the top markets, driven by large manufacturing bases and increasing sustainability regulations.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Head Type, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Head Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Size/Capacity, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Size/Capacity, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 10: Global Market Volume (Units) Forecast by End Use Industry, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Head Type, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Head Type, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by Size/Capacity, 2019 to 2034

Table 18: North America Market Volume (Units) Forecast by Size/Capacity, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 20: North America Market Volume (Units) Forecast by End Use Industry, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Head Type, 2019 to 2034

Table 26: Latin America Market Volume (Units) Forecast by Head Type, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Size/Capacity, 2019 to 2034

Table 28: Latin America Market Volume (Units) Forecast by Size/Capacity, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 30: Latin America Market Volume (Units) Forecast by End Use Industry, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 34: Western Europe Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by Head Type, 2019 to 2034

Table 36: Western Europe Market Volume (Units) Forecast by Head Type, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Size/Capacity, 2019 to 2034

Table 38: Western Europe Market Volume (Units) Forecast by Size/Capacity, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 40: Western Europe Market Volume (Units) Forecast by End Use Industry, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 44: Eastern Europe Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Head Type, 2019 to 2034

Table 46: Eastern Europe Market Volume (Units) Forecast by Head Type, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Size/Capacity, 2019 to 2034

Table 48: Eastern Europe Market Volume (Units) Forecast by Size/Capacity, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 50: Eastern Europe Market Volume (Units) Forecast by End Use Industry, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Head Type, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Head Type, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Size/Capacity, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Size/Capacity, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End Use Industry, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 64: East Asia Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by Head Type, 2019 to 2034

Table 66: East Asia Market Volume (Units) Forecast by Head Type, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by Size/Capacity, 2019 to 2034

Table 68: East Asia Market Volume (Units) Forecast by Size/Capacity, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 70: East Asia Market Volume (Units) Forecast by End Use Industry, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 74: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Head Type, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Units) Forecast by Head Type, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Size/Capacity, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Units) Forecast by Size/Capacity, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industry, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Units) Forecast by End Use Industry, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Head Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Size/Capacity, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 11: Global Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Head Type, 2019 to 2034

Figure 15: Global Market Volume (Units) Analysis by Head Type, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Head Type, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Head Type, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Size/Capacity, 2019 to 2034

Figure 19: Global Market Volume (Units) Analysis by Size/Capacity, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by Size/Capacity, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by Size/Capacity, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 23: Global Market Volume (Units) Analysis by End Use Industry, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 26: Global Market Attractiveness by Material Type, 2024 to 2034

Figure 27: Global Market Attractiveness by Head Type, 2024 to 2034

Figure 28: Global Market Attractiveness by Size/Capacity, 2024 to 2034

Figure 29: Global Market Attractiveness by End Use Industry, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 32: North America Market Value (US$ Million) by Head Type, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by Size/Capacity, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 41: North America Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by Head Type, 2019 to 2034

Figure 45: North America Market Volume (Units) Analysis by Head Type, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Head Type, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Head Type, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by Size/Capacity, 2019 to 2034

Figure 49: North America Market Volume (Units) Analysis by Size/Capacity, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Size/Capacity, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Size/Capacity, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 53: North America Market Volume (Units) Analysis by End Use Industry, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 56: North America Market Attractiveness by Material Type, 2024 to 2034

Figure 57: North America Market Attractiveness by Head Type, 2024 to 2034

Figure 58: North America Market Attractiveness by Size/Capacity, 2024 to 2034

Figure 59: North America Market Attractiveness by End Use Industry, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by Head Type, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by Size/Capacity, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 71: Latin America Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by Head Type, 2019 to 2034

Figure 75: Latin America Market Volume (Units) Analysis by Head Type, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Head Type, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Head Type, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by Size/Capacity, 2019 to 2034

Figure 79: Latin America Market Volume (Units) Analysis by Size/Capacity, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Size/Capacity, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Size/Capacity, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 83: Latin America Market Volume (Units) Analysis by End Use Industry, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Material Type, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Head Type, 2024 to 2034

Figure 88: Latin America Market Attractiveness by Size/Capacity, 2024 to 2034

Figure 89: Latin America Market Attractiveness by End Use Industry, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by Head Type, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by Size/Capacity, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 101: Western Europe Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by Head Type, 2019 to 2034

Figure 105: Western Europe Market Volume (Units) Analysis by Head Type, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Head Type, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Head Type, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by Size/Capacity, 2019 to 2034

Figure 109: Western Europe Market Volume (Units) Analysis by Size/Capacity, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Size/Capacity, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Size/Capacity, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 113: Western Europe Market Volume (Units) Analysis by End Use Industry, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by Material Type, 2024 to 2034

Figure 117: Western Europe Market Attractiveness by Head Type, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by Size/Capacity, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by End Use Industry, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by Head Type, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by Size/Capacity, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 131: Eastern Europe Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Head Type, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Units) Analysis by Head Type, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Head Type, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Head Type, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Size/Capacity, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Units) Analysis by Size/Capacity, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Size/Capacity, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Size/Capacity, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Units) Analysis by End Use Industry, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by Material Type, 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by Head Type, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by Size/Capacity, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by End Use Industry, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by Head Type, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by Size/Capacity, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Head Type, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Head Type, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Head Type, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Head Type, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Size/Capacity, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Size/Capacity, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Size/Capacity, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Size/Capacity, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End Use Industry, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by Material Type, 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by Head Type, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by Size/Capacity, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by End Use Industry, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by Head Type, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by Size/Capacity, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 191: East Asia Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by Head Type, 2019 to 2034

Figure 195: East Asia Market Volume (Units) Analysis by Head Type, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Head Type, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Head Type, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by Size/Capacity, 2019 to 2034

Figure 199: East Asia Market Volume (Units) Analysis by Size/Capacity, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Size/Capacity, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Size/Capacity, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 203: East Asia Market Volume (Units) Analysis by End Use Industry, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 206: East Asia Market Attractiveness by Material Type, 2024 to 2034

Figure 207: East Asia Market Attractiveness by Head Type, 2024 to 2034

Figure 208: East Asia Market Attractiveness by Size/Capacity, 2024 to 2034

Figure 209: East Asia Market Attractiveness by End Use Industry, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by Head Type, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by Size/Capacity, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by End Use Industry, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Head Type, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Head Type, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Head Type, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Head Type, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Size/Capacity, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Size/Capacity, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Size/Capacity, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size/Capacity, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industry, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End Use Industry, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industry, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industry, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Material Type, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Head Type, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by Size/Capacity, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by End Use Industry, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share Analysis for Reconditioned Steel Drum Providers

Reconditioned IBC Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Reconditioned IBC Providers

Reconditioned Packaging Market

Reconditioned Drums Market

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Market Size and Share Forecast Outlook 2025 to 2035

Steel Strapping Market Size and Share Forecast Outlook 2025 to 2035

Steel Studs Market Size and Share Forecast Outlook 2025 to 2035

Steel Rebar Market Size and Share Forecast Outlook 2025 to 2035

Steel Sections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Steel Market Size, Growth, and Forecast 2025 to 2035

Steel Containers Market Analysis by Product Type, Capacity Type, End Use, and Region through 2025 to 2035

Steel Pipe Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Steel Containers Industry

Steel Ring Pull Caps Market

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA