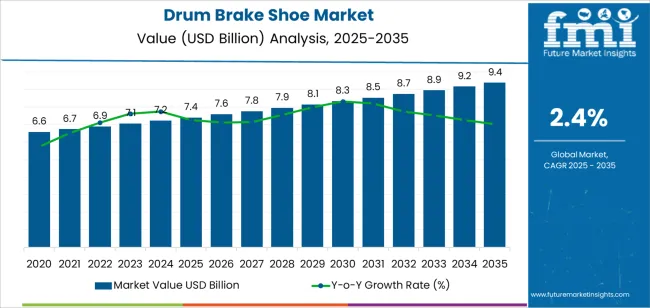

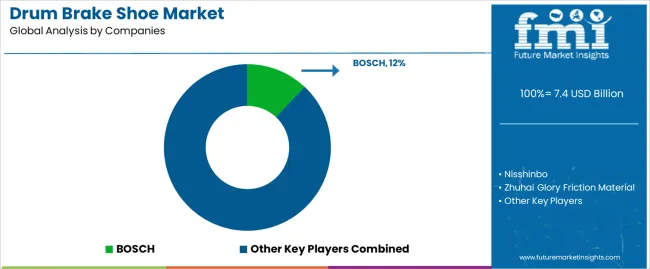

The global drum brake shoe market is valued at USD 7.4 billion in 2025 and is projected to reach USD 9.4 billion by 2035, expanding at a CAGR of 2.4%. The drum brake shoe market is set to create an absolute dollar opportunity of USD 2.0 billion over the forecast period. Rolling CAGR analysis indicates stable and incremental growth, primarily supported by steady vehicle production levels, sustained use of drum braking systems in light commercial and entry-level passenger vehicles, and continued replacement demand from the aftermarket sector.

Manufacturers in the drum brake shoe market are optimizing brake shoe composition through advanced friction materials that offer enhanced wear resistance, temperature stability, and reduced noise during braking cycles. The transition toward low-metallic and non-asbestos formulations remains consistent with environmental compliance standards across major automotive markets. Automation in manufacturing and improved bonding technologies are contributing to uniform product quality and dimensional precision.

Asia Pacific dominates global production and consumption, driven by large automotive manufacturing hubs and a vast aftermarket network. North America and Europe maintain predictable replacement cycles, supported by mature vehicle fleets. Through 2035, material cost stability, component interchangeability, and adherence to braking performance standards will continue to influence competitiveness and operational consistency across the drum brake shoe industry.

Between 2025 and 2030, the Drum Brake Shoe Market is expected to expand from USD 7.4 billion to USD 8.3 billion, creating an absolute dollar opportunity of USD 0.9 billion, which represents 45.0% of the total forecasted growth for the decade. This growth will be driven by the consistent demand for drum brakes in entry-level passenger vehicles, light commercial vehicles, and emerging markets where cost-effective braking systems remain dominant. Rising vehicle production, particularly in Asia-Pacific and Latin America, will further boost aftermarket demand. Manufacturers will continue investing in heat-resistant friction materials and lightweight alloys to meet performance and safety standards.

From 2030 to 2035, the market is projected to increase from USD 8.3 billion to USD 9.4 billion, generating an absolute dollar opportunity of USD 1.1 billion, accounting for 55.0% of the decade’s overall expansion. Growth during this phase will be sustained by the aftermarket replacement cycle, expansion of the electric vehicle segment utilizing drum brakes for rear axles, and advancements in eco-friendly, copper-free friction materials. Strategic partnerships among OEMs and component suppliers will drive innovation in product longevity and cost efficiency, ensuring stable market expansion across both developed and emerging automotive economies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 7.4 billion |

| Market Forecast Value (2035) | USD 9.4 billion |

| Forecast CAGR (2025–2035) | 2.4% |

The drum brake shoe market continues to sustain demand as light commercial vehicles, trucks, and mid-segment passenger cars retain drum brake systems for cost efficiency and durability. Brake shoes play a critical role in generating friction within the drum assembly, offering stable braking performance under variable load conditions. Manufacturers focus on improving friction compounds through advanced ceramic and semi-metallic materials that enhance fade resistance and minimize wear. Consistent vehicle production in Asia-Pacific and the steady replacement cycle in developed regions drive aftermarket sales, while standardization in component dimensions ensures interchangeability across vehicle models.

The market also benefits from continued reliance on drum braking systems in heavy-duty and utility vehicles, where mechanical simplicity and lower maintenance costs remain essential. Automation in production processes enhances shoe balance and lining adhesion, improving braking uniformity. Regulatory trends toward environmentally safe materials are promoting the shift to non-asbestos and copper-free linings, aligning with global emission and safety standards. Although disc brakes dominate high-performance segments, drum systems remain preferred for rear-wheel configurations and low-speed commercial fleets. Expanding road transport infrastructure and fleet renewal initiatives in emerging economies further reinforce market stability, ensuring steady long-term demand for durable, cost-effective drum brake shoe assemblies.

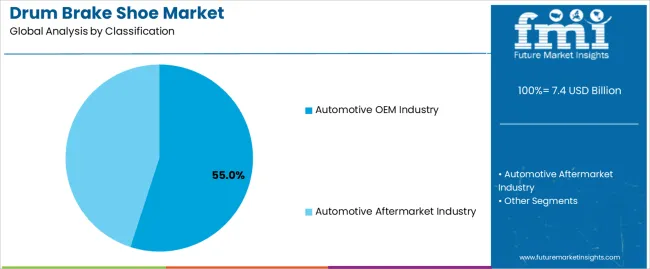

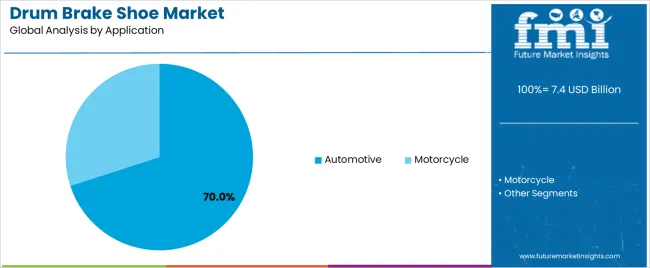

The drum brake shoe market is segmented by classification, application, and region. By classification, the market is divided into automotive OEM industry and automotive aftermarket industry. Based on application, it is categorized into automotive and motorcycle. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions define supply chain orientation, product lifecycle focus, and regional demand variations across global vehicle manufacturing and maintenance markets.

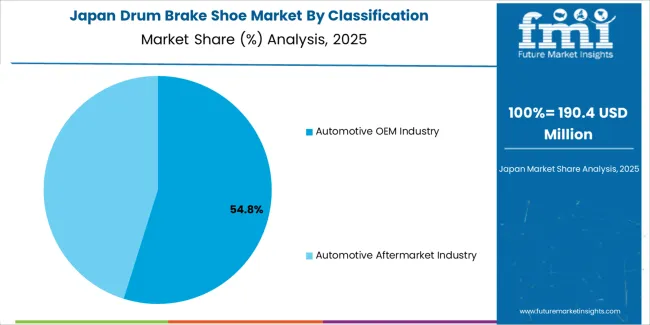

The automotive OEM industry segment accounts for approximately 55.0% of the global drum brake shoe market in 2025, representing the leading classification category. This dominance is attributed to steady demand from original equipment manufacturers integrating drum brake systems into new passenger and light commercial vehicles. Drum brake shoes supplied to OEMs meet stringent quality, performance, and dimensional standards to ensure compatibility with vehicle braking assemblies and safety regulations.

The segment benefits from consistent production volumes, particularly in East Asia, where large-scale vehicle assembly operations sustain procurement cycles. Manufacturers prioritize material uniformity, wear resistance, and friction stability to ensure predictable braking performance under variable operating conditions. The OEM segment is further supported by advancements in brake lining compositions designed to reduce noise, vibration, and environmental impact. As vehicle production expands in emerging economies and cost-effective braking systems remain relevant for entry-level models, OEM demand for drum brake shoes continues to provide stable market growth. The segment’s established position in global automotive manufacturing ensures sustained procurement consistency across both domestic and export-oriented assembly networks.

The automotive segment represents about 70.0% of the total drum brake shoe market in 2025, making it the largest application category. This leadership is driven by the continued use of drum brakes in passenger and light commercial vehicles, particularly for rear-wheel braking systems where cost efficiency and reliability are prioritized. Drum brake shoes remain integral to these configurations, offering effective frictional control and durability under diverse road conditions.

The segment’s growth is reinforced by ongoing vehicle production and the maintenance requirements of existing vehicle fleets. In regions such as East Asia and Europe, drum brake systems are widely installed in compact and mid-sized vehicles due to their lower production cost and simplified maintenance. The automotive segment also benefits from standardized manufacturing processes and high replacement frequency within aftermarket service cycles. Advances in friction materials and corrosion-resistant coatings have further improved brake shoe longevity and performance consistency. Although disc brakes dominate premium and high-performance models, drum brake systems continue to hold a substantial share in volume-driven automotive categories. The automotive segment therefore remains central to overall market demand, reflecting the durability and economic practicality of drum brake shoe applications worldwide.

The drum brake shoe market continues to hold relevance in vehicle segments where cost-effectiveness and simpler maintenance are priorities. Demand is supported by growth in light commercial vehicles, two-wheelers, and aftermarket replacements in regions where drum-brake systems remain prevalent. At the same time, increasing adoption of disc brakes and electrified vehicles creates headwinds. A significant trend is the use of advanced friction materials and better thermal performance in brake shoes to maintain competitiveness. As vehicle ownership expands in emerging regions, the replacement market also remains a stable source of demand.

Growth is largely driven by rising vehicle production and a strong replacement cycle in markets with large populations of two-wheelers, small passenger cars and light commercial vehicles that often employ drum brakes. The aftermarket channel is particularly active as older vehicles require periodic brake-shoe replacement. In emerging markets, the lower cost of drum brake systems compared with disc systems supports their continued use. Additionally, better quality friction materials with longer life are encouraging replacement and upgrade activity among fleet and commercial users.

A major restraint is the gradual shift toward disc brake systems in passenger vehicles and the growth of electric vehicles, both of which reduce the usage of brake shoes. As manufacturers adopt disc brakes for improved cooling and performance, the base for drum-brake shoe demand shrinks in those segments. Another constraint is price pressure and material cost volatility in brake shoe manufacturing. As consumers and fleets seek longer-life, higher-performance solutions, the cost of materials and manufacturing complexity increases, limiting adoption of premium variants in cost-sensitive markets.

One notable trend is the development of brake shoes made with advanced materials, such as ceramic and high-carbon compositions, to improve performance, reduce noise and lower weight. Another trend is increasing focus on the aftermarket channel and emerging regions, where large vehicle populations and wearable parts demand create opportunity. Manufacturers are also aligning products to regulatory demands around emissions and fuel efficiency by reducing unsprung mass and improving friction efficiency. These innovations help brake shoes remain relevant even as disc-brake systems grow.

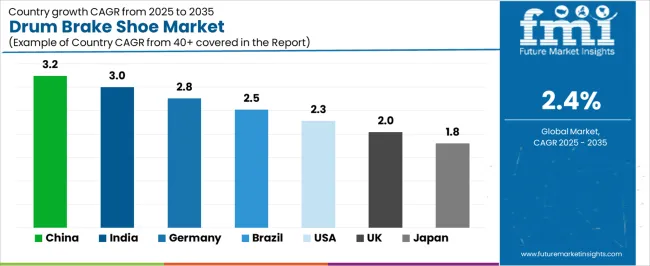

| Country | CAGR |

|---|---|

| China | 3.2% |

| India | 3.0% |

| Germany | 2.8% |

| Brazil | 2.5% |

| USA | 2.3% |

| UK | 2.0% |

| Japan | 1.8% |

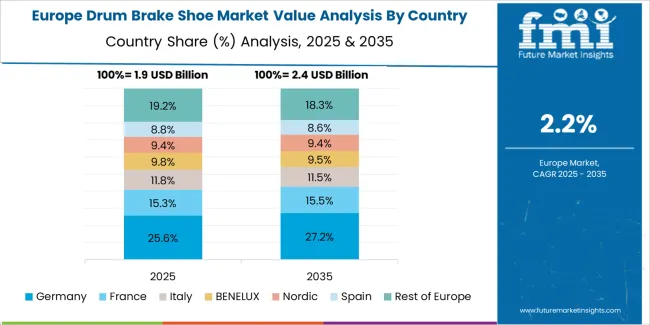

The drum brake shoe market is showing steady global expansion, with China leading at a 3.2% CAGR through 2035, supported by strong vehicle manufacturing output, cost-efficient production, and a growing aftermarket for replacement components. India follows at 3.0%, driven by rising two-wheeler and light commercial vehicle sales and an expanding auto parts distribution network. Germany grows at 2.8%, reflecting advanced automotive engineering and a strong focus on performance and material quality. Brazil records 2.5%, boosted by local assembly growth and aftermarket modernization. The USA, with a 2.3% CAGR, remains stable due to the replacement-driven demand, while the UK (2.0%) and Japan (1.8%) focus on lightweight materials, automation in production, and ongoing brake system technology optimization.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China continues to dominate global drum brake shoe production, with market revenue projected to grow at a CAGR of 3.2% through 2035. Rising vehicle output across passenger and light commercial segments supports strong component demand. Domestic manufacturers are focusing on improving friction material uniformity, heat tolerance, and bonding techniques. Expanding exports of braking components to Southeast Asia further enhance market stability. Government programs promoting supply chain modernization and sustainable production are reinforcing efficiency across the country’s automotive component manufacturing sector.

India is witnessing steady growth in the drum brake shoe market, increasing at a CAGR of 3.0%, supported by domestic production growth and localization of component supply. Expansion in two-wheelers and small commercial vehicles continues to generate consistent demand. Manufacturers are improving cost efficiency and product strength through composite friction material innovation. Rising emphasis on local sourcing and aftermarket development is strengthening the country’s position as a regional hub for affordable brake component manufacturing.

Across Germany, the drum brake shoe market is advancing at a CAGR of 2.8%, supported by engineering excellence and adherence to European safety standards. The focus on dimensional precision, vibration control, and noise reduction continues to guide design refinement. Manufacturers supply advanced braking solutions for small vehicles and industrial machinery applications. Integration of automation and digital inspection systems is ensuring product uniformity, while export partnerships with neighboring European markets strengthen long-term competitiveness.

Brazil is recording stable progress in the drum brake shoe market, expected to grow at a CAGR of 2.5% through 2035. Expansion in vehicle maintenance and refurbishment activities sustains aftermarket demand. Local producers are adopting improved friction compounds suitable for high-temperature performance in tropical environments. Collaborations with international suppliers enhance technology transfer and manufacturing capability. Gradual recovery in light vehicle assembly and aftermarket servicing supports the continued growth of drum brake component utilization.

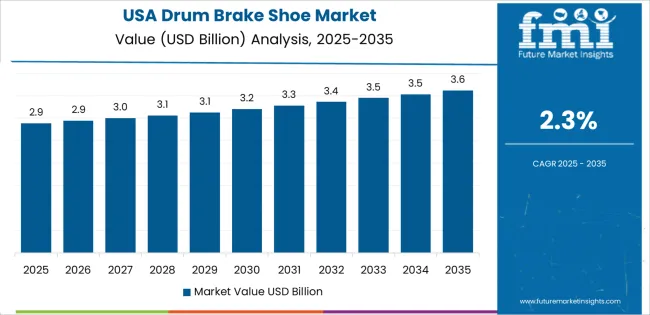

In the United States, the drum brake shoe market is growing at a CAGR of 2.3%, driven by strong aftermarket demand and a large population of older vehicles still using drum systems. Manufacturers emphasize wear-resistant materials, corrosion protection, and consistent friction performance. Development of low-noise, eco-friendly products aligns with environmental regulations. Replacement activity across fleet and passenger vehicle segments maintains consistent product movement through established service networks.

Across the United Kingdom, the drum brake shoe market is advancing at a CAGR of 2.0%, supported by digitalization in automotive parts distribution. Growing reliance on e-commerce platforms for replacement components enhances accessibility for repair workshops. Manufacturers emphasize standardization and compatibility to support fast-moving aftermarket sales. Adoption of copper-free and eco-compliant materials aligns with European environmental objectives. Continuous replacement activity across light vehicle fleets supports market steadiness despite slowing new vehicle production.

Japan is growing steadily in the drum brake shoe market, with revenue projected to increase at a CAGR of 1.8% through 2035. Domestic manufacturers emphasize compact design, consistent friction quality, and noise reduction across passenger and commercial vehicles. Automation in production and inspection processes ensures precision and product reliability. Continuous material research supports the transition toward lightweight and high-durability brake shoes for energy-efficient vehicles. Stable aftermarket demand and export consistency underpin market longevity.

The global drum brake shoe market shows intense competition, led by long-established OEM suppliers and diversified aftermarket manufacturers. BOSCH remains a leading global player, supported by extensive research in braking performance and integration with electronic stability systems. Nisshinbo and Akebono maintain strong OEM partnerships through friction material innovation and standardized manufacturing processes ensuring consistent quality. ZF Aftermarket (TRW), Tenneco (Federal Mogul), and MAT Holdings strengthen distribution coverage through established aftermarket networks across North America and Europe. Brembo, Hitachi, and ADVICS focus on advanced materials and precision engineering for passenger and light commercial vehicles. Sangsin Brake and GM (ACDelco) maintain solid regional presence, offering certified replacement products tailored to global and emerging automotive markets.

Shandong Gold Phoenix, Continental (ATE), Fras-le, Brake Parts Inc, and Knorr-Bremse AG contribute significant production capacity across OEM and aftermarket supply channels. Mid-tier companies such as Double Link, SAL-FER, ABS Friction, Icer Brakes, FBK, and MK Kashiyama compete through cost optimization and adherence to international performance standards. EBC Brakes and TMD Friction (AEQUITA) specialize in high-friction formulations suited for heavy-duty and performance applications. Chinese manufacturers, including Shandong Xinyi Auto Parts, Hangzhou Annaite Industrial, Zhejiang Lamda Technology, Weifang Airui Brake System, Shandong Hengyitong Auto Parts, and Hebei Huahua Friction Material, enhance market accessibility with large-scale production and export focus. Competition in this market centers on friction durability, thermal efficiency, and reduced noise emissions, while strategic differentiation increasingly relies on EV-compatible materials, sustainable manufacturing, and integrated braking performance validation.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Automotive OEM Industry, Automotive Aftermarket Industry |

| Application | Automotive, Motorcycle |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | BOSCH, Nisshinbo, Akebono, ZF Aftermarket (TRW), Tenneco (Federal Mogul), MAT Holdings, Brembo, Hitachi, ADVICS, Fras-le, EBC Brakes, Continental (ATE), Shandong Gold Phoenix, GM (ACDelco), Knorr-Bremse AG |

| Additional Attributes | Dollar sales by classification and application categories; OEM and aftermarket segmentation analysis; regional adoption across Asia Pacific, Europe, and North America; material advancements in friction linings (ceramic, copper-free, and low-metallic); manufacturing automation and bonding technology trends; replacement cycle mapping; competitive benchmarking of key global and regional suppliers; impact of electrification and rear-wheel braking adoption; environmental compliance and sustainability insights. |

The global drum brake shoe market is estimated to be valued at USD 7.4 billion in 2025.

The market size for the drum brake shoe market is projected to reach USD 9.4 billion by 2035.

The drum brake shoe market is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in drum brake shoe market are automotive oem industry and automotive aftermarket industry.

In terms of application, automotive segment to command 70.0% share in the drum brake shoe market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drum Melters Market Size and Share Forecast Outlook 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Drum To Hopper Blends Premix Market Size and Share Forecast Outlook 2025 to 2035

Drum Pump Market Growth - Trends & Forecast 2025 to 2035

Drum Liner Market Analysis - Size, Share & Industry Forecast 2025 to 2035

Breaking Down Market Share in the Drum Liner Industry

Drum to Hopper Blends Market Insights - Precision Mixing & Growth 2025 to 2035

Drum Handling Equipment Market

Drum Pulper Market

Drum Funnel Market

Drum Plugs Market

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Fiber Drums Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Steel Drum Market Share

Examining Market Share Trends in Steel Drums and IBCs Industry

Competitive Landscape of Fiber Drums Market Share

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA