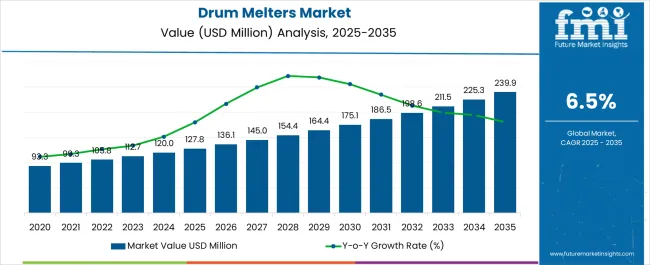

The Drum Melters Market is estimated to be valued at USD 127.8 million in 2025 and is projected to reach USD 239.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Drum Melters Market Estimated Value in (2025 E) | USD 127.8 million |

| Drum Melters Market Forecast Value in (2035 F) | USD 239.9 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Drum Melters market is experiencing strong growth driven by increasing demand for efficient heating solutions in industrial and commercial applications. The future outlook for this market is shaped by the rising need for consistent material processing, particularly in adhesives, coatings, and chemical handling. Technological advancements in drum melter design, including improved temperature control, energy efficiency, and safety features, are enhancing operational reliability and performance.

Growing adoption of automated and semi-automated systems is further supporting market expansion by reducing manual labor requirements and improving process consistency. The market is also benefiting from the increasing emphasis on workplace safety and compliance with industrial regulations, which encourages the replacement of outdated equipment with modern drum melters.

Additionally, the versatility of these systems in handling various materials and capacities supports their adoption across multiple industries As manufacturers prioritize operational efficiency, cost savings, and product quality, the demand for drum melters is anticipated to continue rising steadily, particularly in regions with expanding industrial activity.

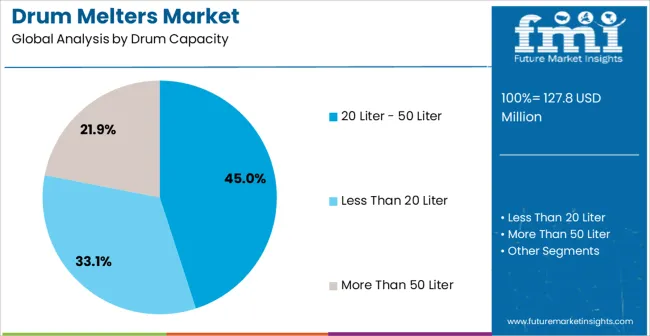

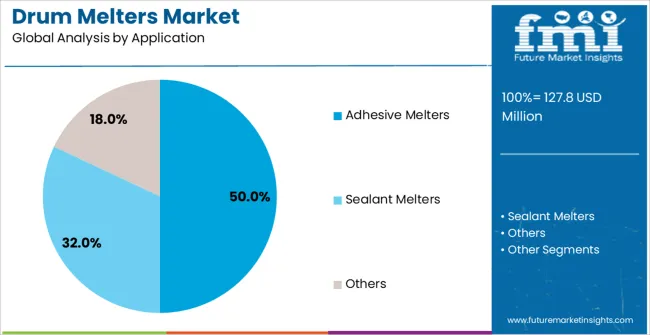

The drum melters market is segmented by drum capacity, application, and geographic regions. By drum capacity, drum melters market is divided into 20 Liter - 50 Liter, Less Than 20 Liter, and More Than 50 Liter. In terms of application, drum melters market is classified into Adhesive Melters, Sealant Melters, and Others. Regionally, the drum melters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 20 Liter - 50 Liter drum capacity segment is projected to hold 45.0% of the Drum Melters market revenue share in 2025, making it the leading capacity range. The growth of this segment has been influenced by its optimal balance between handling moderate material volumes and maintaining ease of operation. This capacity range allows for efficient heating of adhesives and chemicals without excessive energy consumption, making it suitable for a wide range of industrial processes.

The adoption of automated temperature control systems enhances process reliability and ensures consistent material quality. Moreover, this capacity segment is highly compatible with standard production workflows, enabling seamless integration into existing operations.

The demand for versatility and adaptability in material handling has further reinforced the prominence of this segment Operational safety, cost efficiency, and the ability to meet variable production needs continue to drive the adoption of 20 Liter - 50 Liter drum melters in industrial settings.

The adhesive melters application segment is expected to capture 50.0% of the Drum Melters market revenue share in 2025, positioning it as the leading application. The segment’s growth is primarily driven by the increasing use of adhesives in packaging, construction, and manufacturing industries. Software-enabled temperature control and automated dispensing have improved precision and efficiency in adhesive processing, reducing waste and ensuring consistent performance.

The adoption of adhesive melters is also supported by the need for faster production cycles and enhanced operational safety, particularly in high-volume manufacturing environments. Additionally, regulatory compliance and environmental considerations encourage the use of modern adhesive melters with improved energy efficiency and emission control.

The versatility of adhesive melters in handling a range of adhesive types and viscosities further reinforces their demand across industries As production efficiency and product quality continue to be prioritized, adhesive melters remain the dominant application segment in the drum melters market.

Drum melters are modern machines used to melt large amounts of polyurethane (PUR) and polyolefin (POR) hot melt adhesives, butylene, sealants etc. They find application in diverse end-use industries including packaging, automotive, electronics and textiles.

During the last few years, demand for drum melters has witnessed substantial increase across industries that require melting of adhesives on large scales. These drum melters enable adhesive supply units to melt glue in drums or liquefy required amount of adhesive in time. They are easy to install and can significantly reduce cost and time of industries.

Rising adoption of sealants and adhesives across various industries such as automotive, construction, packaging, electronics etc. is anticipated to boost the sales of drum melters over the forecast period from 2025 to 2035. These machines have significantly reduced the time and costs of industries and helped them to melt large quantities of adhesives, butylene and sealants with better efficiency.

Various types of drum melters are used across industries, depending on the required melting capacity and heat conductivity of the melting stock.

Manufactures are increasingly focusing on product design innovations to reduce melting stock (adhesives and sealants) loss during the melting process. This will help them to increase their customer base.

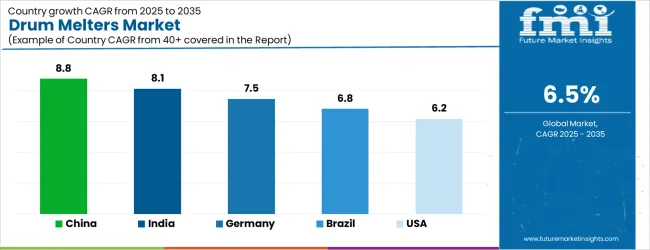

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK | 5.5% |

| Japan | 4.9% |

The Drum Melters Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.9%, yet still underscores a broadly positive trajectory for the global Drum Melters Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Drum Melters Market is estimated to be valued at USD 47.1 million in 2025 and is anticipated to reach a valuation of USD 47.1 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 6.6 million and USD 3.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 127.8 Million |

| Drum Capacity | 20 Liter - 50 Liter, Less Than 20 Liter, and More Than 50 Liter |

| Application | Adhesive Melters, Sealant Melters, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

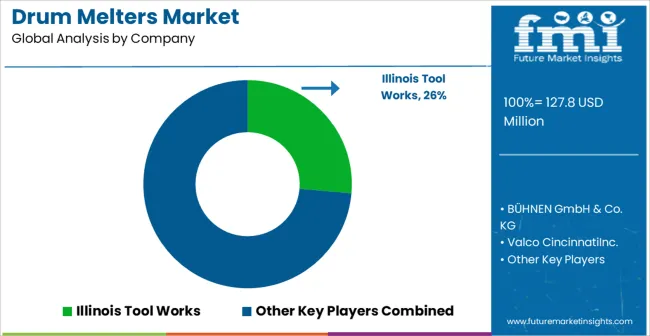

| Key Companies Profiled | Illinois Tool Works, BÜHNEN GmbH & Co. KG, Valco CincinnatiInc., SM Klebetechnik Vertriebs-GmbH, LimTeknikk AS, Hwang Sun Enterprise Co. Beeco, APRO Technologies GmbH, MELER, Delta Wye Electronics SRL, and Norson |

The global drum melters market is estimated to be valued at USD 127.8 million in 2025.

The market size for the drum melters market is projected to reach USD 239.9 million by 2035.

The drum melters market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in drum melters market are 20 liter - 50 liter, less than 20 liter and more than 50 liter.

In terms of application, adhesive melters segment to command 50.0% share in the drum melters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drum Brake Shoe Market Size and Share Forecast Outlook 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Drum To Hopper Blends Premix Market Size and Share Forecast Outlook 2025 to 2035

Drum Pump Market Growth - Trends & Forecast 2025 to 2035

Drum Liner Market Analysis - Size, Share & Industry Forecast 2025 to 2035

Breaking Down Market Share in the Drum Liner Industry

Drum to Hopper Blends Market Insights - Precision Mixing & Growth 2025 to 2035

Drum Handling Equipment Market

Drum Pulper Market

Drum Funnel Market

Drum Plugs Market

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Fiber Drums Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Steel Drum Market Share

Examining Market Share Trends in Steel Drums and IBCs Industry

Competitive Landscape of Fiber Drums Market Share

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA