The global drum pump market is estimated at USD 556.5 million in 2025 and is projected to reach USD 845.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% during the forecast period. This growth is being influenced by the increasing need for safe, compliant, and efficient liquid transfer solutions across industries such as chemicals, pharmaceuticals, food & beverage, and oil & gas-especially where hazardous, viscous, or flammable media are handled.

In 2024, several product developments were reported by key manufacturers. JESSBERGER introduced electrically and pneumatically operated drum pumps engineered for hazardous liquid handling, manufactured with ATEX-certified components. Materials such as polypropylene, PVDF, aluminum, and stainless steel were selected to ensure chemical compatibility. According to the company’s official specifications, universal motors were integrated to offer compatibility with multiple pump tubes, allowing seamless transitions between liquid types and operational environments.

Lutz-Jesco, in the same year, expanded its portfolio with battery-operated and compressed air-driven drum pumps designed with lubricant-free, self-sealing mechanisms to minimize contamination risk. These units were manufactured for acid, base, solvent, and oil applications, with corrosion-resistant wetted parts suited for chemical and food-grade industries.

Micro-Matic’s DP-55G “Ezi-action” drum pump, promoted for 55-gallon containers, was constructed without wearable internal parts and featured FDA-compliant materials. This product was positioned for applications requiring hygienic fluid transfer, such as cleaning agents and beverages.

In parallel, industry growth has been driven by regulatory mandates focused on operator safety and emissions control. Drum pumps have been specified to reduce VOC exposure, cross-contamination, and manual handling risks in compliance with OSHA, EPA, and FDA directives.

Technological advancements have been incorporated into recent models, including sealless impeller designs for liquid isolation, quick-disconnect modules, and explosion-proof housings certified for Zone 1/21 environments. Supplier packages increasingly include flow meters, grounding wires, and stainless-steel couplings to support deployment with 200-liter drums and IBCs. OEMs have also entered retrofit partnerships for hydraulic fluid management in industrial facilities.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 556.5 million |

| Industry Value (2035F) | USD 845.6 million |

| CAGR (2025 to 2035) | 4.3% |

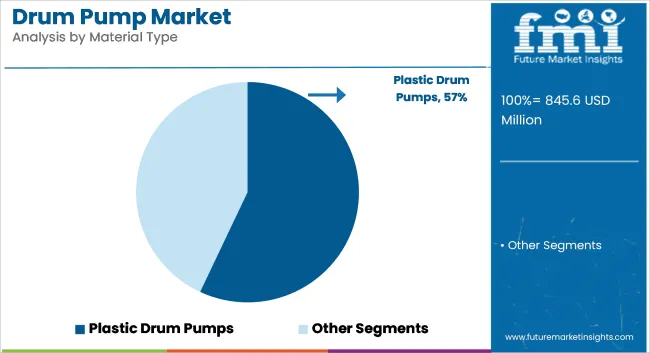

Plastic drum pumps accounted for 57% of the global market share in 2025 and are projected to grow at a CAGR of 4.5% through 2035. Their dominance was driven by strong chemical resistance, low corrosion risk, and ease of handling in environments requiring safe transfer of acids, alkalis, and solvents.

In 2025, plastic pumps made from materials such as polypropylene (PP), PVDF, and polyethylene were widely used across chemical processing units, laboratories, and wastewater treatment plants. Operators preferred plastic variants for light-duty operations involving low-to-medium viscosity liquids and non-flammable substances.

Manual, electric, and air-operated plastic drum pumps were offered in portable formats, supporting flexible deployment across multi-drum storage setups. Manufacturers focused on enhancing flow control accuracy, ergonomic grip design, and leak-proof coupling systems to meet regulatory standards for safe chemical transfer.

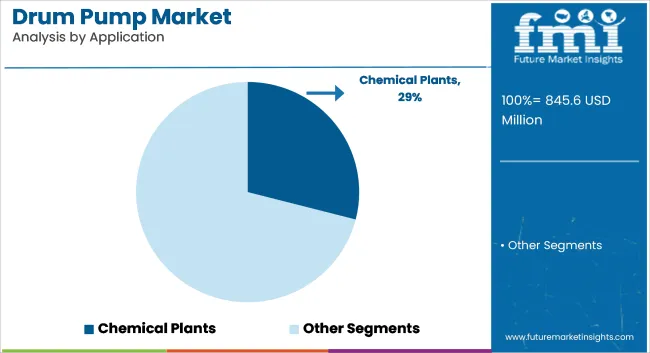

Chemical plants held 29% of the global drum pump market share by application in 2025 and are expected to grow at a CAGR of 4.6% through 2035. These facilities required drum pumps for transferring concentrated acids, solvents, resins, and other process fluids from storage drums into reactors, tanks, and mixing vessels.

In 2025, drum pump selection in chemical plants prioritized material compatibility, explosion protection (ATEX-certified pumps), and operator safety. The use of both plastic and stainless-steel pumps depended on fluid characteristics and regulatory compliance requirements.

Drum pumps were also used in batch production and maintenance tasks where safe, efficient drum emptying was critical. As chemical handling protocols became stricter under REACH, OSHA, and GHS guidelines, manufacturers introduced sealed motor designs, anti-static discharge features, and double containment options to enhance operational safety and reliability in hazardous environments.

High Cost of Advanced Pumping Solutions

The main problem in the drum pump market is the very expensive electric and air-operated pump system. Of course, manually operated drum pumps are budget-friendly, but industries that need more efficiency, free from contamination liquid transfer, and automated operations are often subject to more capital investments.

The expense of special types of materials like chemical-resistant alloys and sanitary-grade stainless steel also affects the total cost of the equipment. In this regard, manufacturers should pursue low-cost production techniques and modular pump designs to offer the economic power as a solution to various industrial needs.

Limited Awareness and Adoption in Emerging Markets

Although drum pumps are very efficient and safe, businesses in small-scale and emerging markets are still not very keen to adopt them. Many small manufacturers and local industries are still stuck in their ways and continue manual fluid transfer using traditional methods, not knowing the potential they have to cut the spills and improve precision and operator safety.

To deal with this problem, the industry should master the art of making the public more aware of the valuable tool through on-site demonstrations, regulatory compliance education, and training programs that allow businesses to learn the long-term benefits of acquiring the drum pump technology.

Expansion of Automated Fluid Handling Solutions

The jump in the use of automation in the handling of industrial liquids is a major factor of growth for drum manufacturers. The combination of the popular sensor-based, remote-controlled, and IoT-enabled pump systems has been enhancing operational efficiency and precision in fluid transfer applications.

As manufacturing plants wish for increased performance, better safety, and lower liquid waste, the need for self-acting smart drum pumps are predicted to go up. Those firms choosing to invest in intelligent fluid management systems that are also entitled to digital monitoring may claim the first place in mthe arket competition.

Rising Demand in Pharmaceutical and Food Processing Sectors

The booming pharmaceutical and food & beverage sectors have been bringing new business to sanitary-grade drum pumps. Due to the rise of regulatory requirements for the transfer of liquid without contamination, industries are more and more inclined to use FDA-approved, stainless steel and high-purity drum pump systems.

Furthermore, the rise of biotechnology and nutraceutical production is the driving force behind the need for specific pumps that comply with the strictest hygiene and safety requirements. The manufacturers that are dealing with custom solutions for high-viscosity and sensitive liquid applications would reap the benefits from the emerging growth opportunities in this sector.

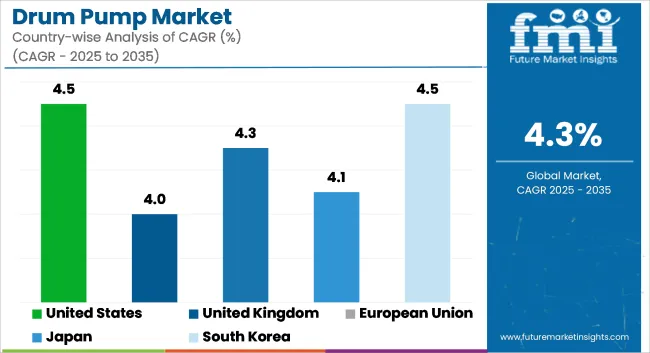

The USA drum pump market is on a constant upward trajectory, propelled by the increasing industrial applications, the rate at which chemical handling is on the rise, as well as the impact of stringent workplace safety regulations. The chemical manufacturing, oil & gas, and food & beverage sectors are the major forces behind the growing acceptance of drum pumps for effective liquid transfer processes.

The OSHA directives concerning the proper handling of toxic liquids have been a motivating factor for companies to embrace ergonomic and spill-proof drum pumps. Furthermore, the heightened realization of environmental sustainability and the imperative to reduce waste have been the drivers for the application of top-performance drum pumps that operate at higher efficiencies and with low fluid losses.

Innovations like electric and battery-operated drum pumps are not only enhancing work efficiency but are also cutting down on the risks involved in manual handling, thus driving market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

The market for drum pumps in the United Kingdom is experiencing steady growth, propelled by the increasing requirement for such pumps in the chemical, pharmaceutical, and food processing industries. One of the main drivers of the market growth is the very stringent directives by the UK regarding chemical safety and workplace handling. Thus, the drum pumps that are being adopted the most are closed-system pumps that prevent spills and exposure.

The surge in environmentally friendly and sustainable industrial practices is another factor causing the rise in the demand for energy-efficient and recyclable drum pump materials. Apart from this, the UK pharmaceutical and bioprocessing sectors are growing, which has resulted in more demand for pump types that are clean and of very high purity for the sake of transporting liquid formulations and solvents.

A further drive for market growth is seen in the increased adoption of electric and air-operated drum pumps in manufacturing, logistics, and hazardous material handling.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.0% |

The growth of the European Union drum pump market is being supported by a number of factors including the imposition of rigorous industrial safety regulations, the necessity of drum pumps related to chemical and pharmaceutical industries, and the progressive implementation of automation in fluid handling processes.

The EU's REACH and workplace safety directives compel industries to adopt drum pumps that are both leak-proof and chemical-resistant for the transfer of hazardous liquids. The rise of the European pharmaceutical sector and the food & beverage sector are triggering the demand for hygienic, electro-polished stainless steel drum pumps that are compliant with EU food safety and Good Manufacturing Practices standards.

Further to that, the acceleration of automation in the manufacturing and chemical processing sectors is leading to more electric and pneumatic drum pump sales. The rise of the focus on sustainability and waste reduction in the sector is driving low-energy, high-efficiency drum pump technologies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

The Japan drum pump market is exhibiting moderate growth, driven by the increasing need in the semiconductor, pharmaceutical, and precision engineering industries. The country\'s commitment to high-purity liquid handling in advanced manufacturing is leading to an increased need for precision drum pumps in chemical and electronic applications.

Japan's stringent workplace safety and environmental regulations are the other side that supports the use of closed-loop and spill-proof manual drums in handling hazardous materials and solvents. In addition, the chicken-and-egg growth of Japan\'s pharmaceutical and biopharmaceutical industries is the main cause of the demand for sterile and corrosion-resistant drum pumps.

Thanks to the advances in robotics and factory automation, the trend is toward IoT-integrated and programmable drum pumps that optimize fluid transfer efficiency in the automated production line.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The South Korean drum pump market is thriving owing to the brisk industrialization, the increasing chemical and semiconductor industries, and the adoption of automated fluid handling systems. Due to South Korea's position as a major player in the electronics and chemical manufacturing industry, there is high demand for high-purity drum pumps in semiconductor and specialty chemical applications.

The government’s emphasis on industrial safety and sustainability is the main driver of the adoption of drum pump solutions that are eco-friendly and spill-resistant. Besides, the expansion of the food and beverage industry is further fuelling the demand for sanitary and corrosion-resistant drum pumps in the processing plants.

Besides this, ongoing factory automation and AI-driven manufacturing are the factors behind the demand for electric and smart drum pumps that minimize manual labor and optimize fluid transfer.

Increase in the use of high-purity drum pumps in South Korea's Semiconductor & Specialty Chemical Manufacturing: The growth of factory automation and AI-driven fluid transfer systems is due to the increase in the development of programmable and smart drum technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

The drum pump market across the planet is showing consistent growth owing to the rising need for energy-efficient liquid transfer solutions, the expansion of industrial applications, and the increased focus on workplace safety. Drum pumps are widely utilized in the chemical, pharmaceutical, food & beverage, oil & gas, and wastewater treatment industries to allow controlled, spill-free fluid handling from barrels, drums, and containers.

The market is also determined by technological progressions in electric and air-operated drum pumps, increased outsourcing of explosion-proof and corrosion-resistant designs, and the growing need for high-viscosity liquid handling solutions. The foremost suppliers concentrate on energy-saving motors, enhanced security features, and robust materials to cater to the demands of transferring hazardous and high-accuracy fluids.

Lutz Pumpen GmbH

High-performance drum pumps are the main products of Lutz Pumpen, which is their leading manufacturer. The solutions are chemical-resistant and are especially designed for handling aggressive, flammable, and viscous liquids. The drum pumps of the company`s B2 Vario and MD Series are ATEX-certified and modularly constructed, and they provide precise flow control.

Lutz Pumpen is growing its electric drum pump family, which, in turn, will optimize automation and energy use in a wide range of industrial applications.

Graco Inc.

As a manufacturer of drum pumps and other associated devices, this company offers solutions that are not only air-operated but also electric, making it easy to pump chemical, oil, and lubricant fluids more efficiently. The Husky and Check-Mate series from the company are equipped with the latest technology, such as precision dispensing, leak-tight designs, and variable speed controls for optimal liquid handling.

Graco is also dedicated to the development of automated drum pump technology featuring real-time flow monitoring and predictive maintenance functions.

Verder International B.V.

Verder International is a supplier of sanitary and industrial drum pumps fabricated by the company, which are mostly used in the food, beverage, and pharmaceutical industry. The Verderair and Verderflex series of the company are not only developed on the concept of hygiene but also offer low-shear transfer mechanisms along with the standards of FDA and EHEDG. The company, Verder, is not only improving its peristaltic drum pump solutions but also sustaining the progress through ensuring the functionalities of the drums in the sterile and contamination-sensitive environments.

Flowserve Corporation

Flowserve is a main company that manufactures durable drum pumps and is focused on heavy-duty and high-viscosity fluid transfer applications. The firm provides the Durco and PolyChem series, which are made with corrosion-resistant materials that can achieve high-flow rates, and they are equipped with advanced sealing technologies.

Flowserve is determined to deliver the best technology. Now it comes with a new generation of intelligent pump monitoring solutions that allows online real-time diagnostics and optimized operational efficiency.

Finish Thompson Inc.

Finish Thompson provides mobile, corrosion-resistant drum pumps that are meant for fast and easy operation for the industrial user. The company's EF and TT Series, in addition to being lightweight, also feature sealed motors and are compatible with aggressive fluids. Finish Thompson focuses on battery-operated and explosion-proof drum pump models, thereby offering better flexibility and alignment to hazardous environment standards.

The global drum pump market is projected to reach USD 556.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.3% over the forecast period.

By 2035, the drum pump market is expected to reach USD 845.6 million.

The chemical plants segment is expected to dominate due to the increasing demand for safe and efficient fluid transfer solutions for handling corrosive and hazardous chemicals in industrial operations.

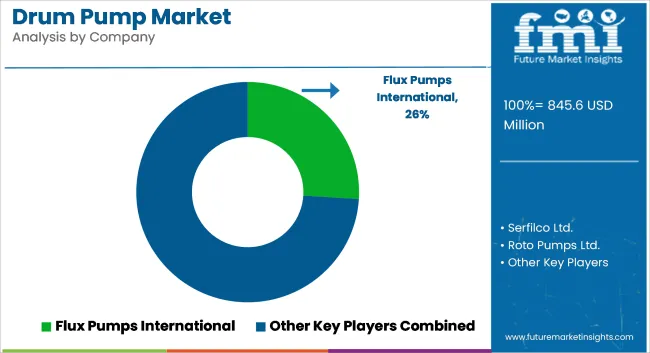

Key players in the drum pump market include Graco Inc., Lutz Pumpen GmbH, Flux-Geräte GmbH, Finish Thompson Inc., and KNF Neuberger Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drum Melters Market Size and Share Forecast Outlook 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Drum To Hopper Blends Premix Market Size and Share Forecast Outlook 2025 to 2035

Drum Liner Market Analysis - Size, Share & Industry Forecast 2025 to 2035

Breaking Down Market Share in the Drum Liner Industry

Drum to Hopper Blends Market Insights - Precision Mixing & Growth 2025 to 2035

Drum Handling Equipment Market

Drum Pulper Market

Drum Funnel Market

Drum Plugs Market

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Trends - Growth, Demand & Forecast 2025 to 2035

Fiber Drums Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Steel Drum Market Share

Examining Market Share Trends in Steel Drums and IBCs Industry

Competitive Landscape of Fiber Drums Market Share

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA