The India casino tourism industry is undergoing steady development, influenced by evolving tourism policies, increasing disposable income, and rising interest in gaming entertainment among domestic and international travelers. Economic surveys and state-level tourism data have indicated that select regions, particularly Goa and Sikkim, have seen an uptick in footfall due to integrated casino resorts offering a combination of gaming, hospitality, and cultural experiences.

While casino operations remain restricted to a few licensed jurisdictions, state tourism boards have continued exploring regulatory reforms to attract high-value tourists through legal and controlled casino environments. The proliferation of air travel, hotel infrastructure expansion, and luxury tourism packages has further positioned casino tourism as a niche but fast-growing segment.

Additionally, collaborations between hotel chains and gaming operators have introduced organized gaming experiences appealing to both casual and frequent players. As the government evaluates offshore and onshore licensing frameworks, future growth is expected from enhanced casino infrastructure, digitization of services, and curated gaming-tourism experiences designed to boost tourist spending. Segmental momentum is currently led by slot machine gaming, commercial casino formats, and a rising base of gambling enthusiasts.

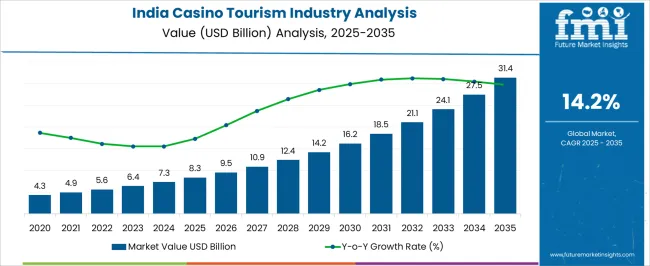

| Metric | Value |

|---|---|

| India Casino Tourism Industry Analysis Estimated Value in (2025 E) | USD 8.3 billion |

| India Casino Tourism Industry Analysis Forecast Value in (2035 F) | USD 31.4 billion |

| Forecast CAGR (2025 to 2035) | 14.2% |

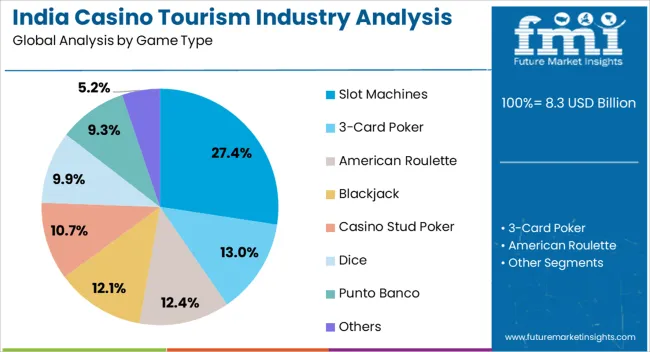

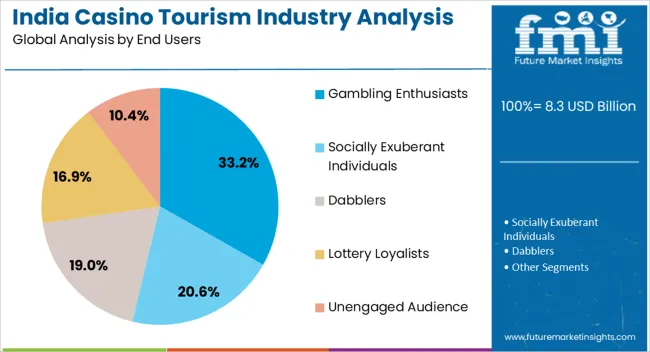

The market is segmented by Game Type, Casino Type, End Users, Age Group, Tourist Type, Consumer Orientation, and Tour Type and region. By Game Type, the market is divided into Slot Machines, 3-Card Poker, American Roulette, Blackjack, Casino Stud Poker, Dice, Punto Banco, and Others. In terms of Casino Type, the market is classified into Commercial, Tribal, Limited Stakes, and I-Gaming. Based on End Users, the market is segmented into Gambling Enthusiasts, Socially Exuberant Individuals, Dabblers, Lottery Loyalists, and Unengaged Audience. By Age Group, the market is divided into 25 to 35 Years, 18 to 25 Years, 35 to 50 Years, 50 to 65 Years, and 65 Years & Above. By Tourist Type, the market is segmented into Domestic and International. By Consumer Orientation, the market is segmented into Men and Women. By Tour Type, the market is segmented into Package Travelers, Independent Travelers, and Tour Groups. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Slot Machines segment is projected to contribute 27.4% of the India casino tourism industry revenue in 2025, positioning it as the leading game type. This segment’s growth has been driven by its simplicity, ease of play, and wide appeal among casual and novice gamers.

Casino operators have prioritized slot installations due to their compact footprint, higher turnover rates, and ability to offer both entertainment and monetary rewards without requiring skilled play. Additionally, modern slot machines have integrated digital interfaces, localized themes, and real-time rewards, increasing their attractiveness in tourist-centric casinos.

State-regulated gaming guidelines have allowed slot-based gaming in controlled environments, giving operators flexibility in deployment. With rising footfall in casino resorts and the increasing popularity of automated gaming formats, the Slot Machines segment is expected to remain dominant, offering a high-yield gaming experience that appeals to a broad demographic.

The Commercial casino segment is forecasted to hold 42.6% of the India casino tourism industry revenue in 2025, maintaining its leadership in terms of operational model. Growth in this segment has been supported by the development of integrated casino resorts in tourist hotspots like Goa, where commercial licenses have enabled larger gaming floors and complementary services such as dining, entertainment, and hospitality.

Reports from tourism boards and hospitality groups have highlighted the role of commercial casinos in boosting state tourism revenue and extending visitor stay duration. Unlike floating or cruise-based casinos, commercial establishments offer a more stable, year-round operating model, with infrastructure investments aimed at scaling gaming and leisure experiences.

As more states consider regulated models based on the Goa and Sikkim framework, the Commercial segment is expected to lead expansion efforts, benefiting from structured regulation, high tourist influx, and growing investor interest in destination-based gaming projects.

The Gambling Enthusiasts segment is projected to account for 33.2% of the India casino tourism industry revenue in 2025, securing its place as the dominant end-user category. This segment’s growth has been driven by increasing awareness of international gaming formats, rising income levels among urban professionals, and a growing culture of experiential travel.

Enthusiasts actively seek destinations offering legal gaming options, with many incorporating casinos into their leisure travel plans. Tourism analytics have shown that this cohort spends more per visit and tends to engage with multiple casino services, including tournaments, loyalty programs, and VIP gaming lounges.

Casino operators have responded by offering personalized gaming experiences, travel incentives, and loyalty-based rewards to attract repeat visits. With ongoing social normalization of gaming entertainment and better regulatory clarity in tourism-centric states, the Gambling Enthusiasts segment is expected to play a key role in shaping casino tourism demand and driving future revenue growth.

High-Roller Focus Boosts Luxury Casino Experiences

The industry of casino tourism in India is changing fast, with more emphasis being put on high rollers. The increasing number of high-end casino resorts, featuring exclusive gaming areas, butler services, and VIP amenities, is fueled by an increased number of the rich in India looking for sophisticated gambling experiences.

Goa Stays Casino Capital, Daman Emerges as Potential Casino Investment

Goa is still unchallenged in the midst of the casino tourism hub of India. Also, Daman is fast developing its infrastructure and bringing in new investments in terms of casinos. This trend shows the potential to create a number of casino destinations in India, in turn attracting different segments of tourists.

Rise of Online Casinos in India

The popularity of online gambling platforms in India is on the rise, and these are the most convenient means for offering a wide variety of games. However, it is a very ambiguous online gambling legal framework that presents the sector with both challenges and opportunities in the shape of regulation and licensing in the future.

MICE Resorts with Casinos are A Great Pull Factor for Business Tourists

An increasing number of casino resorts incorporate MICE facilities into their properties to serve business travelers who want to have a little work with their holiday. Integrating luxury accommodations, convention centers, and entertainment options, gives a wholesome feel of a destination.

Domestic Tourists Fuel the Casino Industry as Travel Patterns Change

There have been international travel patterns that have fluctuated in a strategized way to place India's casino sector in the attention of domestic tourists. This is based on the cultural performances, the regional cuisine options, and other marketing campaigns speaking to the Indian sector. By means of this move, ensures that casinos can keep consistent with the number of visitors.

Casinos Put Responsible Gaming First

The Indian casinos are going in the direction of responsible gambling with everything. This includes employee training to locate and help gamblers at risk for addiction, self-exclusion, and restricting ATM accesses within casinos. All this focus on responsible gambling generates a safe and enjoyable visit for all.

Live Entertainment Enhances Casino Experience for Tourists

An increasing number of live entertainment options are now being offered from musical performances and stand-up comedy shows to theatrical productions. This not only diversifies the casino experience but also can be very attractive for those tourists who would like to have a complete entertainment package from the casino rather than gambling.

Cashless Payment Systems Takes Over India's Casino Tourism Sector

Cashless transaction systems are being adopted rapidly in Indian casinos due to the reasons associated with security, the ease of playing for players, and faster processes of transaction. This also includes the integration possibilities of a mobile wallet, chip-based transactions, and the like in the digital options that make gambling more convenient and safer.

The casino tourism sector in India marked a rise at a CAGR of 13.9% over the past five years. This surge is a confluence of factors. The economic upsurge in India has created a large number of people with extra income, which has led to a new lifestyle where people look out for spending money to enjoy premium experiences like casino tourism.

The very few legal options for gambling here in the country cast a spell on casinos as the new game in town. Furthermore, the existence of integrated casino resorts that combine a package of entertainment, including fine dining, shopping, and live performances, has also contributed to the alluring and appealing nature of the sector.

The future looks promising for the sector, as the forecasting trend indicates a CAGR of 14.2% for the period 2025 to 2035. The industry’s transition towards luring high rollers with VIP services and unique experiences tends to be one of the main factors that lead to rapid growth in revenue.

It is this keen interest in the high-end segment that caters to this specific and highly profitable segment of the sector, keeping the high roller stream continuously flowing. Besides, the fusion of MICE facilities into casino resorts opens wider doors for the masses.

Such facilities are one-stop shops for corporate travelers, integrating work and pleasure activities, thereby helping to transform casino resorts into total destinations.

Lastly, the increasing popularity of ethical gambling rites enhances the feeling of trust and the tourists’ circle. This entails offering more than just gambling for families, as well as attracting other customers and, hence, ensuring the long-term existence of the sector in the future.

The sector is ripe with opportunities but players must overcome certain obstacles and sustain this momentum. New laws and regulations have to be developed to make casino and online gambling more stable in the long run and to ensure investors' trust in the future.

The uncertainty in the law may be a disincentive for investment and an obstacle to long-term growth. Furthermore, the possibility of other countries' regions being casino hubs raises the need for strategic marketing and differentiation.

By age group, the 35 to 50-year segment leads the casino tourism industry with a commanding 29% share in 2025. This generation's financial stability, technological ease, and desire for a well-rounded entertainment experience are transforming the landscape of casino tourism.

Whereas, the slot machine segment reigns supreme by game type in India's casino tourism industry, capturing a significant 31% share in 2025.

| Segment | Slot Machines (Game Type) |

|---|---|

| Value Share (2035) | 31% |

Slot machines dominate the industry as they take a leading share of 31% of the total revenue in 2025. These factors are what have created and sustained their popularity over the years.

Firstly, the slot machine offers simple and clear gameplay, giving an easy opportunity even to those players who have never played before. This convenience of play is a major attraction for both the pro gamers and casual players alike and they enjoy the real casino environment.

Moreover, the diversity of interests is provided by various themes and symbols of slot machines, including classic fruit slots or slots based on movies or television shows. Besides, the possibility of large jackpots imparts an extra level of thrill and then fuels the players with an interest in playing these games.

| Segment | 35 to 50 Years (Age Group) |

|---|---|

| Value Share (2035) | 29% |

The age group of 35 to 50 years will become the leading demographic in 2025 that attracts tourists to the casinos and makes them a leading segment that represents 29% of the sector.

This notion may be due to several causes. First, this generation is well known for having a higher average disposable income level than the younger generations meaning that they can direct more of their resources for leisure activities such as casino tourism.

Also, the millennial generation, being digital natives, are not afraid of technology and hence may find advancing features and interactive elements in the new generation of slot machines more appealing.

Besides this, this age group may be prone to treat casino tourism as a way of entertainment and socializing, which in turn may make them desire and seek integrated resorts that offer a mix of gaming, dining, and live entertainment.

India's casino tourism sector is at a crucial point of transition, its growth being enabled by rising demand for leisure and entertainment. India's diverse cultural heritage and burgeoning economy offer a promising landscape for casino tourism growth. But the sector has quite a tough competition from the numerous existing gaming destinations all over the world, like Macau, Vegas, and Singapore.

That's the case because these localities have a top-notch infrastructure, eminent landmarks, and a long history of gambling regulation, which puts the Indian casino tourism sector in a very competitive position.

To compete with the best, India needs to develop and promote its tourism infrastructure and safe gambling methods and exploit its unique cultural features to attract not only domestic but also international tourists.

India's regulatory framework that hinders the development of the casino tourism sector poses a challenge. The strict gambling laws and different state regulations cause problems for investors and operators, so they are not certain about anything.

As the neighboring countries of the Asia Pacific region, such as Sri Lanka and Nepal, are liberating their gambling laws, India will face increased competition for casino revenue. India should focus on simplifying the regulatory environment, work together in building the partnership between the government departments and the private sector, and develop policies that reinforce green tourism.

Resolving these barriers and utilizing the unique cultural heritage as well as economic prospects of the country, India can become an emerging player in the global casino tourism sector.

Industry Updates

India’s casino tourism sector, segmented by game type, includes slot machines, 3-card poker, American roulette, blackjack, casino stud poker, dice, and punto banco, among others.

Casinos are categorized into commercial, tribal, limited stakes, and I-gaming types, providing diverse experiences for visitors.

Segments include gambling enthusiasts, socially exuberant individuals, dabblers, lottery loyalists, and the unengaged audience.

The sector is also segmented based on age, ranging from 18 to 25 years, 25 to 35 years, 35 to 50 years, 50 to 65 years, 65 years and above.

The sector further gets divided into tourists into domestic and international categories.

By consumer orientation the sector is divided between Men and Women.

Based on tour type, the sector is segmented by independent travelers, package travelers, and tour groups.

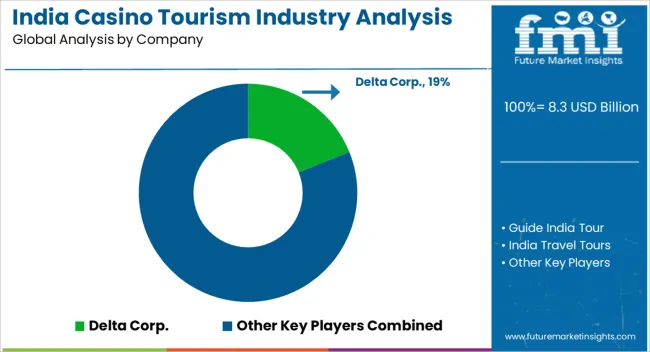

The global india casino tourism industry analysis is estimated to be valued at USD 8.3 billion in 2025.

The market size for the india casino tourism industry analysis is projected to reach USD 31.4 billion by 2035.

The india casino tourism industry analysis is expected to grow at a 14.2% CAGR between 2025 and 2035.

The key product types in india casino tourism industry analysis are slot machines, 3-card poker, american roulette, blackjack, casino stud poker, dice, punto banco and others.

In terms of casino type, commercial segment to command 42.6% share in the india casino tourism industry analysis in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

India Yoga and Meditation Service Market Trends – Size, Share & Growth 2025-2035

Analysis and Growth Projections for India’s Alcohol Industry Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA