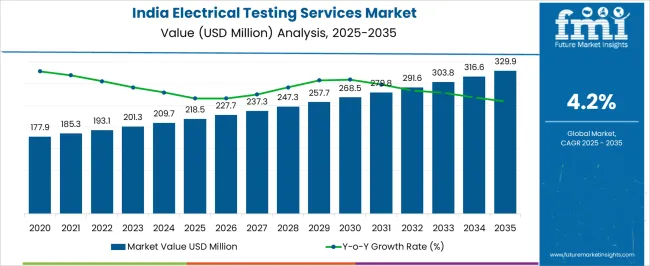

The India Electrical Testing Services Market is estimated to be valued at USD 218.5 million in 2025 and is projected to reach USD 329.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| India Electrical Testing Services Market Estimated Value in (2025 E) | USD 218.5 million |

| India Electrical Testing Services Market Forecast Value in (2035 F) | USD 329.9 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The India electrical testing services market is progressing steadily, supported by the country’s growing power demand, grid modernization initiatives, and increasing investments in renewable energy integration. Industry publications and government reports have highlighted the rising emphasis on preventive maintenance and reliability testing to ensure uninterrupted electricity supply.

With the expansion of transmission and distribution networks, utilities and industrial facilities are prioritizing regular testing services to mitigate equipment failures and extend asset lifecycles. Regulatory mandates from central electricity authorities and state-level boards have reinforced the adoption of certified testing protocols across substations, transformers, and switchgear.

Investor presentations from power sector companies have also emphasized infrastructure upgrades and digital monitoring systems, driving demand for specialized electrical testing solutions. Going forward, the market is expected to benefit from smart grid deployments, rapid industrialization, and ongoing capacity expansions in both conventional and renewable power sectors. The sector’s growth trajectory is being shaped by the increasing reliance on advanced testing technologies to ensure safety, efficiency, and regulatory compliance.

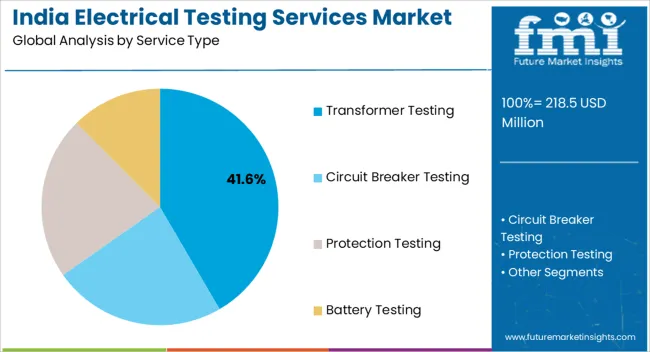

The Transformer Testing segment is projected to hold 41.60% of the India electrical testing services market revenue in 2025, maintaining its dominance within service offerings. Growth of this segment has been fueled by the critical role transformers play in electricity transmission and distribution, where failures can cause substantial outages and financial losses.

Testing services such as insulation resistance, oil analysis, and load tap changer assessments have been widely implemented to ensure operational efficiency. Sector reports have indicated that utilities and industrial users have prioritized transformer testing due to rising power demand and aging equipment across India’s grid infrastructure.

The integration of renewable energy has also increased stress on transformers, creating further need for regular performance validation. With government emphasis on reducing transmission and distribution losses and ensuring reliability, transformer testing has become a cornerstone of preventive maintenance strategies, underpinning its continued market leadership.

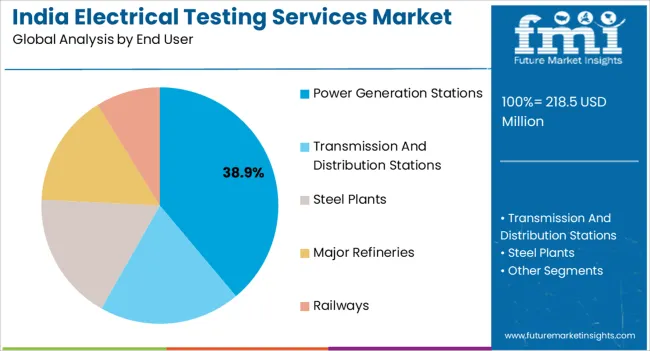

The Power Generation Stations segment is expected to account for 38.90% of the India electrical testing services market revenue in 2025, retaining its position as the leading end user. This growth has been supported by the large-scale deployment of electrical assets within generation facilities, which require routine testing to guarantee reliability and compliance with regulatory standards.

Power stations, both thermal and renewable, have implemented comprehensive testing protocols to prevent equipment malfunctions and improve efficiency. Annual reports from energy companies have underscored the importance of testing high-voltage equipment, circuit breakers, and protective relays in ensuring uninterrupted power supply.

Furthermore, the growing capacity additions in solar and wind generation have driven higher demand for specialized electrical testing services tailored to variable load conditions. As India continues to expand its energy mix and invest in next-generation power infrastructure, testing services at generation stations will remain a critical priority, sustaining this segment’s leading market share.

During the predicted period, the electrical testing services market in India is anticipated to increase due to the country's steadily expanding steel production industry.

The market is growing primarily because steel production is steadily rising nationwide. In fact, India is responsible for the world's third-highest crude steel output, as the World Steel Association (WSA) reported.

According to the same source, production output has been recorded at a 2.6% annual pace in India. That said, the average yearly production output rate since 2006 has been 6.5%. Thus, the current growth rate is slightly below that. Electric arc reactors are a common manufacturing process for creating steel when using electricity as the power source.

Therefore, the expansion of the Indian electrical testing services market is anticipated to be driven by the country's increasing yearly steel production and expanding power market.

India's central government has taken the initiative to wire rural areas with electricity. The expanded distribution and transmission network should generate more electricity in India. Additionally, the Indian government has plans to electrify more than 177.9 million homes by 2020, which should increase electricity demand and, consequently, sales. As a result, the rising demand for electrical power in rural areas is anticipated to fuel market expansion soon.

Presently, businesses outsource electrical testing services to concentrate on their core competencies. While this trend is expected to continue, clients must pay more upfront when they hire an outside company to perform testing. Moreover, businesses are developing their testing divisions, complete with the tools and trained professionals they need to conduct their tests.

Because of this, the cost of using an external service to conduct tests is likely to rise, which might slow the expansion of the Indian electrical testing services market.

The monitoring of electrical components, including circuit breakers, transformers, and other devices, calls for a wide range of instruments. Unfortunately, the extreme nature of the technology these tools evaluate makes them quite pricey. These testing instruments must withstand high voltages, current fluctuations, and extreme circumstances.

Because of this, the initial expenditure required to produce these instruments is quite significant. In addition, these instruments can only be used safely and responsibly in the hands of skilled professionals. Because of this, the future growth of the electrical testing service market in India is anticipated to be hampered by the aforementioned factors.

The electrical testing services market in India is predicted to see significant growth due to the country's emphasis on power generation.

Current electricity generation in India is adequate to meet the needs of all residents. However, only about 55% of Indian households are reached by the country's weak distribution and transmission network.

The analysis concludes that, despite the country's expanding population and number of households, there is no pressing need for new power plants in India for at least the next three years if the country's existing fleet of generators is utilized to its fullest capacity. Electrical testing services market expansion is attributed to this factor.

Market participants can anticipate significant growth thanks to certification testing designed to raise the standard of available products.

Equipment utilized in power plants, steel mills, and other heavy industries is notoriously cumbersome and cumbersome due to its size and weight.When this equipment breaks down, replacing it can take months to years, depending on the requirements set forth by international accrediting bodies.

However, this can be enhanced by employing on-demand testing services that are accredited by organizations like the National Electrical Testing Association (NETA), the Electrical Research and Development Association (ERDA), and the Bureau of Indian Standards (BIS). As a result, it's anticipated that leading companies in the market are expected to be presented with promising expansion possibilities.

Increases in product variety and cutting-edge technological advancements in testing services are anticipated to provide favorable market conditions.

Soon, market participants can anticipate significant growth prospects brought about by the introduction of novel items used in the testing and development of cutting-edge technologies. Recent technological developments have led to increased demand for electrical testing services, as various instruments, such as multimeters, Ohmmeters, Ammeters, Signal Tracers, Logic analyzers, and others, are employed.

An additional market development is the electrification of railways and the advent of proactive measures for the T&D Network.

The government of India has launched several initiatives to improve and expand the country's transmission and distribution network. To achieve this goal, we must address issues like power theft, theft, bureaucracy, and the replacement of outdated machinery. Additionally, India's electrification of its railway lines is another massive undertaking that is making steady progress, with more than 40% of the network now electrified.

Transformer testing, circuit breaker testing, protection testing, and battery testing are all a part of the market's service type subsegment. It is common knowledge that transformers are electrical devices employed to transmit electrical current via electromagnetic induction. The transformer's primary purpose is changing the potential difference between two electrical terminals or potentials.

Market share in India's electrical testing services industry is dominated by transformer testing, which accounts for over 40%. This is followed by circuit breaker testing, which accounts for over 30%. Protection testing, on the other hand, is expected to develop at the fastest rate in the market, with a compound annual growth rate (CAGR) of 5.1%, because end users are keener on conducting regular tests of the protective relays.

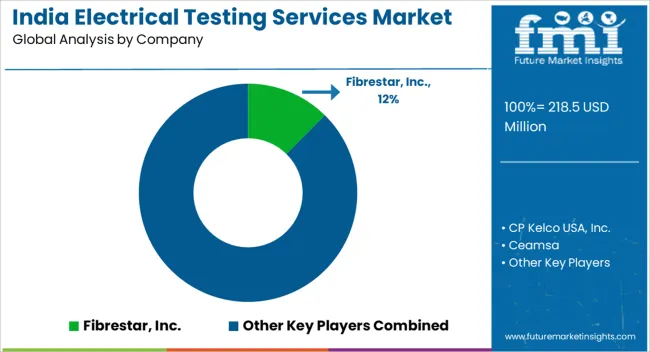

Electrical testing companies in India are highly fragmented, with many players available to provide testing of electrical equipment. A few key dedicated testing service providers identified in the market include Intel Power System Engineers Pvt. Ltd., Technomark Engineers India Pvt. Ltd., Voltech Group, Inser Hitech Engineers Pvt. Ltd., Powertest Asia Pvt. Ltd., Rulka Electricals Pvt. Ltd., Ultra Electric Company India Pvt. Ltd. and JBS Enterprises Pvt. Ltd., among others.

Electrical testing companies around the world are working to broaden the scope of their offerings to suit the needs of their customers better. To do this, they are boosting their spending on research and development.

Electrical testing service providers focus on end users by offering AMC as a means of maintaining positive relationships with customers. Businesses are concentrating on strategic collaborations and partnerships with electrical and electronic equipment makers to broaden their service and testing network. Here are the top three companies defining the market:

| Attributes | Details |

|---|---|

| EpVi | EpVi was established in 2020 and offers an IoT gadget powered by AI and SaaS to monitor real-time electrical consumption. It employs machine learning technology to detect electricity waste and track consumption in real-time. It allows for scheduling and remote access. The company also provides an app for iOS and Android devices that can control the power in smart homes. |

| Technomark Engineers India Pvt. Ltd. | As a private Indian company, Technomark Engineers specializes in energy management. The business provides EPC (engineering, procurement, and construction), T&D (transmission and distribution), O&M (overhaul and refurbishment), and F&S (fire and safety) services for substations operating at very high voltages. |

| Voltech Group | In the field of electrical engineering, Voltech Group is a leading provider. As an electronics supplier, it offers transformers, switchgear, flameproof gear, and more. As a company, we provide services including control and relay panel division, transformer, and more. |

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value and Million. Sq. M. for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; and the Middle East & Africa (MEA) |

| Key Countries Covered | The United States, Brazil, Mexico, Germany, The United Kingdom, China, India, Japan, Australia, and GCC Countries |

| Key Segments Covered | Service Type, End User, Region |

| Key Companies Profiled | Fibrestar, Inc.; CP Kelco USA, Inc.; Ceamsa; Cargill, Incorporated; DuPont de Nemours Inc.; Lucid Colloids Ltd.; Silvateam S.p.a.; Yantai Andre Pectin Co. Ltd.; Herbstreith & Fox Group; Herbafood Ingredients GmbH; Carolina Ingredients; UNIPEKTIN Ingredients AG |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global India electrical testing services market is estimated to be valued at USD 218.5 million in 2025.

The market size for the India electrical testing services market is projected to reach USD 329.9 million by 2035.

The India electrical testing services market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in India electrical testing services market are transformer testing, circuit breaker testing, protection testing and battery testing.

In terms of end user, power generation stations segment to command 38.9% share in the India electrical testing services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Casino Tourism Market Forecast and Outlook 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Decorative Veneer Industry - Size, Share, and Forecast 2025 to 2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

Analyzing India Loyalty Program Market Share & Industry Leaders

India Safari Tourism Market Trends – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA