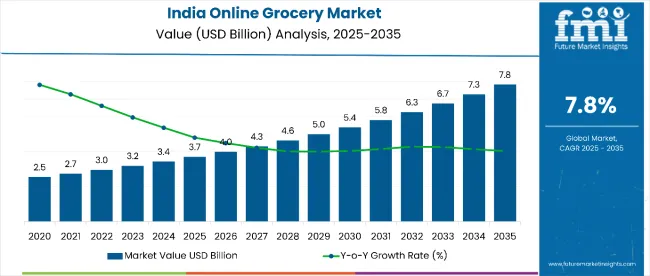

The India online grocery market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 7.8 billion by 2035, registering a CAGR of 7.8% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 4.1 billion during 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.7 billion |

| Forecast Value in (2035F) | USD 7.8 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

This reflects more growth over the forecast period, supported by growing internet penetration, increased adoption of e-commerce platforms for daily essentials, and shifting consumer preference toward convenience-led shopping.

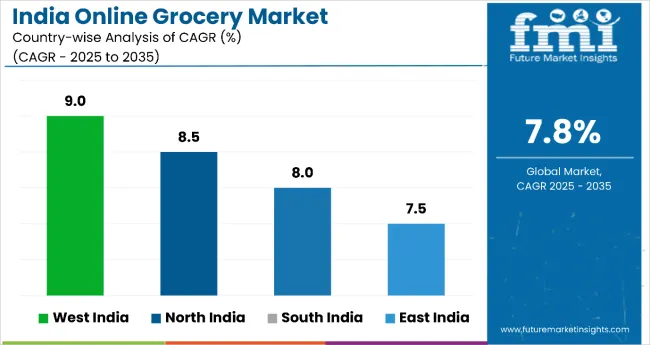

By 2030, the market is likely to reach approximately USD 5.4 billion, accounting for around USD 1.7 billion in incremental value over the first half of the decade. The remaining about USD 2.4 billion is expected during the second half, suggesting a steady yet increasingly adoption-driven growth pattern. Rising demand for quick commerce, expansion of subscription-based grocery delivery services, and aggressive regional penetration in high-growth states such as West India (9.0% CAGR) and North India (8.5% CAGR) are set to shape the market landscape.

Companies such as BigBasket and Blinkit are advancing their competitive positions through investments in advanced supply chain technologies and scalable fulfillment networks. Innovation-led service models are supporting expansion into quick-commerce delivery, subscription-based grocery plans, and premium fresh produce offerings. Market performance will remain anchored in competitive pricing strategies, reliable delivery standards, and responsible sourcing practices.

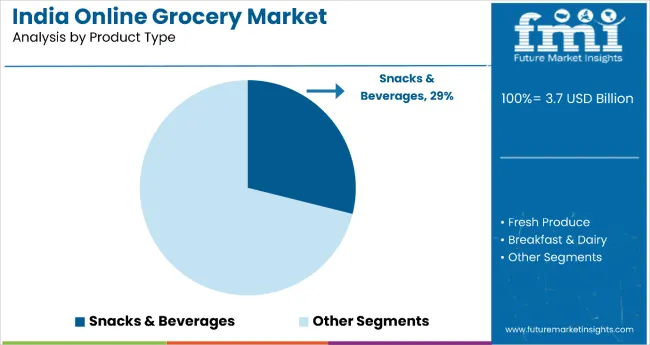

The market accounts for a significant portion of the country’s overall e-commerce retail sector, driven by rising internet penetration, expanding digital payment adoption, and increasing consumer preference for doorstep delivery of daily essentials. The market’s growth is supported by strong demand across diverse product segments, with snacks & beverages holding the largest share at 29%.

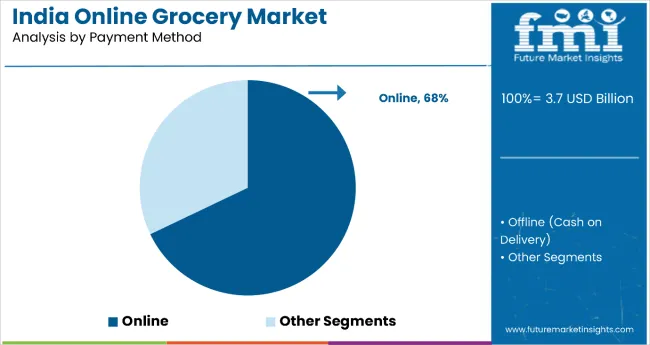

The industry benefits from the integration of quick commerce models, subscription-based delivery services, and omnichannel retail strategies, enabling greater market reach. Digital transformation has been a key growth driver, with 68% of transactions taking place online, supported by UPI payments, e-wallets, and net banking. Offline channels, primarily cash on delivery, continue to serve first-time and rural customers.

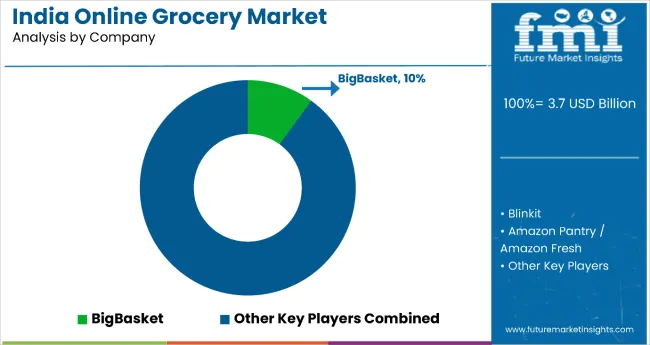

The market is undergoing structural shifts, with leading players like BigBasket (10.0% share), Blinkit, Amazon Pantry/Amazon Fresh, Flipkart Supermart, and JioMart investing in cold-chain infrastructure, AI-based demand forecasting, and last-mile delivery optimization. Partnerships with local farmers, FMCG brands, and logistics providers are enabling fresher product availability and reduced lead times. Government initiatives promoting digital transactions, combined with growing smartphone penetration, are expanding customer bases beyond Tier 1 cities.

The market is expanding rapidly due to rising internet penetration, increasing smartphone adoption, and the growing preference for convenient, doorstep delivery of daily essentials. Urban consumers, in particular, are turning to online platforms for time-saving shopping experiences, while rural and semi-urban areas are witnessing accelerated adoption driven by improving digital infrastructure.

The shift toward contactless transactions, driven initially by the pandemic, has solidified into a long-term behavioral change, boosting demand for online payment methods and quick-commerce delivery models. Competitive pricing, subscription offers, and wider product assortments from fresh produce to household items are making online grocery platforms increasingly attractive.

As awareness of product variety and quality assurance grows, and as logistics networks penetrate deeper into tier-2 and tier-3 cities, market penetration is expected to strengthen further. With leading players investing in AI-powered demand forecasting, cold chain infrastructure, and sustainable sourcing, the India online grocery sector is well-positioned to maintain robust growth through 2035.

The market is segmented by product type, payment method, and region. By product type, the market is divided into fresh produce, breakfast & dairy, snacks & beverages, meat & seafood, staples & cooking essentials, and others (household items, personal care products, pet food, and non-food grocery items). Based on payment method, the market is bifurcated into online and offline (cash on delivery). Regionally, the market is classified into South India, North India, East India, and West India.

Snacks & beverages form one of the fastest-growing segments, holding a 29% share. This category’s growth is fueled by shifting consumer lifestyles, where convenience, indulgence, and on-the-go consumption play key roles. Urbanization, rising disposable incomes, and exposure to food trends have led to increased demand for premium, healthier, and innovative snack and drink options. Quick commerce platforms have further amplified sales by catering to impulse purchases and last-minute needs, often delivering within minutes.

Subcategories such as chips, biscuits, chocolates, carbonated drinks, fruit juices, and ready-to-drink teas and coffees are driving frequency and value growth. Health-focused variants like baked snacks, sugar-free beverages, and plant-based drinks are gaining traction among millennials and Gen Z. Frequent promotional offers, bundled deals, and loyalty programs on leading platforms like BigBasket, Blinkit, and Amazon Pantry enhance repeat buying. As competition intensifies, brands are investing in localized flavors, sustainable packaging, and smaller, affordable pack sizes to deepen market penetration.

The online payment mode holds the largest share of market, accounting for 68% in 2025. Its dominance is driven by the increasing penetration of smartphones, expanding internet access, and the rising adoption of digital wallets and UPI-based transactions. Consumers are increasingly drawn to the convenience, speed, and security offered by online payment systems, which enable instant, contactless transactions without the need for physical cash handling. E-commerce platforms are incentivizing digital payments through cashback offers, reward points, and exclusive discounts, further boosting adoption.

The surge in quick-commerce services, offering delivery in under 30 minutes, has further integrated online payment options as the default mode for transactions. Additionally, advanced fraud detection, two-factor authentication, and real-time transaction tracking have improved consumer confidence in digital payment systems. Government initiatives such as Digital India and the push for a cashless economy have accelerated the transition from cash-on-delivery to digital modes.

From 2025 to 2035, rapid adoption of smartphones, affordable internet access, and expanding digital payment infrastructure are set to be the primary catalysts for online grocery market growth in India. Platforms like BigBasket, Blinkit, and Amazon Fresh are leveraging AI-driven personalization and quick commerce models to improve order frequency and basket value.

Operational and Competitive Challenges Slowing India’s Online Grocery Growth

The market faces persistent challenges that can slow its expansion. High last-mile delivery costs, particularly for small and low-margin orders, strain profitability for players in competitive urban markets. Rural penetration remains limited due to underdeveloped logistics infrastructure, fragmented supply chains, and lower digital literacy among consumers. Perishable categories such as fresh produce and meat require heavy cold-chain investment, adding to operational costs. Intense price wars, fueled by discount-led customer acquisition strategies, further erode margins.

Digital and Sustainability Trends Driving India’s Online Grocery Expansion

Several transformative trends are shaping the growth trajectory of India’s online grocery sector. Quick commerce models, promising deliveries within 10-30 minutes, are redefining convenience and raising consumer expectations. AI-powered personalization and predictive analytics are enhancing product recommendations and order frequency. Voice-assisted and regional language interfaces are broadening accessibility, especially in non-metro markets. Subscription-based delivery plans for staples are fostering customer loyalty and recurring revenues.

| Regions | CAGR |

|---|---|

| West India | 9.0% |

| North India | 8.5% |

| South India | 8.0% |

| East India | 7.5% |

In the India online grocery market, West India leads with the highest projected CAGR of 9.0%, driven by high purchasing power, urban density, and strong quick-commerce adoption. North India follows closely at 8.5% CAGR, supported by rapid urbanization, high internet penetration, and seasonal demand spikes during festivals. South India records an 8.0% CAGR, fueled by its tech-savvy population, advanced logistics, and strong preference for subscription-based deliveries. East India, while growing at a slower 7.5% CAGR, shows promising potential due to improving infrastructure, expanding delivery networks, and competitive pricing attracting first-time shoppers.

Sales of online grocery in West India are recording the highest regional CAGR of 9.0% CAGR in 2025, anchored by strong commercial hubs such as Mumbai, Pune, and Ahmedabad. The region benefits from high consumer purchasing power, dense urban populations, and a growing inclination toward premium and imported grocery products. Quick-commerce models are thriving, with sub-20-minute deliveries becoming a competitive benchmark. Retailers are adopting omnichannel strategies, integrating online platforms with physical stores for faster fulfillment and better customer engagement. High internet and smartphone penetration, coupled with advanced digital payment adoption, is accelerating market growth. Festivals like Ganesh Chaturthi and Navratri see significant demand spikes for both staples and specialty items. Investments in AI-powered demand forecasting, automated warehouses, and temperature-controlled logistics are enhancing operational efficiency.

Sales of online grocery in North India, holding 8.5% CAGR, is projected to grow steadily through 2035, supported by rapid urbanization, rising household incomes, and high internet penetration. Delhi, Chandigarh, and Jaipur are leading cities where quick-commerce services have transformed shopping habits, with deliveries often completed in under 30 minutes. Seasonal festivals like Diwali and Holi trigger surges in online grocery orders, with consumers preferring bulk purchases and special offers. Fresh produce, dairy, and snacks are the most sought-after categories, reflecting diverse culinary traditions. E-commerce players are expanding fulfillment centers and improving cold-chain logistics to reach semi-urban and rural areas efficiently. Digital payment adoption is rising sharply due to the widespread use of UPI and mobile wallets.

Revenue from online grocery in South India stands out for its tech-savvy consumers, accounting for an 8.0% CAGR, advanced logistics, and high smartphone penetration. Cities such as Bengaluru, Chennai, and Hyderabad serve as strong growth hubs, supported by high disposable incomes and a younger demographic open to digital transactions. Demand is led by snacks, beverages, ready-to-cook meals, and premium grocery products. Subscription-based delivery models are especially popular in urban households, ensuring consistent revenue streams for market players. Investments in cold storage facilities are enabling the safe transport of dairy, meat, and seafood, meeting the region’s diverse dietary preferences. AI-driven inventory forecasting is helping retailers maintain efficiency and reduce waste. Local supplier partnerships enhance delivery speed and product freshness. South India’s combination of infrastructure, consumer readiness, and purchasing power positions it as a major pillar of the market’s long-term expansion.

Sales of online grocery in East India, accounting for 7.5% CAGR, is emerging as a promising growth region, driven by improving digital infrastructure and expanding delivery networks. Kolkata, Bhubaneswar, and Patna are key urban centers showing a shift from traditional retail to e-commerce-based grocery shopping. Although adoption rates are slower compared to the southern and western regions, strategic investments in last-mile connectivity are closing the gap. Consumers are beginning to embrace online platforms for purchasing staples, snacks, and personal care products due to competitive pricing and convenience. Seasonal demand spikes during festivals like Durga Puja create significant sales opportunities for online retailers. Government initiatives to improve road networks and encourage digital transactions further enhance the market’s outlook.

The market is moderately consolidated, featuring a mix of large-scale e-commerce platforms, quick commerce disruptors, and regional players with strong localized supply chains. BigBasket leads in overall market share (10.0%), leveraging an extensive product assortment, robust cold-chain infrastructure, and subscription-based delivery models. Blinkit differentiates through ultra-fast delivery in under 20 minutes, targeting urban impulse purchases and convenience-driven consumers. Amazon Pantry/Amazon Fresh combines a vast fulfillment network with Prime-linked incentives, while Flipkart Supermart leverages Walmart’s retail expertise to strengthen grocery penetration.

JioMart focuses on integrating offline kirana stores into its platform, expanding reach into Tier 2 and Tier 3 cities. Regional platforms emphasize hyperlocal sourcing and tailored product mixes to match regional tastes, building customer loyalty through familiarity and trust. Entry barriers are high due to logistical complexities, cold-chain investment needs, and intense price competition. Competitiveness increasingly depends on delivery speed, platform user experience, product availability, and integration of AI-driven personalization to boost order frequency and customer retention.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 3.7 Billion |

| Product Types | Fresh Produce, Breakfast & Dairy, Snacks & Beverages, Meat & Seafood, Staples & Cooking Essentials, Others (Household items, Personal care products, Pet food, Non-food grocery items) |

| Payment Methods | Online, Offline (Cash on Delivery) |

| Regions Covered | North India, South India, East India, West India |

| Key Companies Profiled | Amazon India Pvt. Ltd., Godrej Nature's Basket Ltd., Grofers India Pvt. Ltd., Paytm E-Commerce Pvt. Ltd. (Paytm Mall), Reliance Retail Ltd. (Reliance Fresh), Spencer's Retail, Supermarket Grocery Supplies Pvt. Ltd. (BigBasket), UrDoorstep eRetail Pvt. Ltd., Blink Commerce Private Limited, Aaram Shop Private Limited. |

| Additional Attributes | Dollar sales by product type and payment method, growing adoption of quick commerce and subscription models, increasing digital payment penetration, rising demand for fresh produce and premium grocery categories, investments in cold-chain and last-mile delivery infrastructure, AI-driven personalization improving customer retention and order frequency |

The global India online grocery market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the India online grocery market is projected to reach USD 7.6 billion by 2035.

The India online grocery market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in India online grocery market are fresh produce, breakfast & dairy, snacks & beverages, meat & seafood, staples & cooking essentials and others.

In terms of payment method, online segment to command 68.2% share in the India online grocery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

India Outbound Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Casino Tourism Market Forecast and Outlook 2025 to 2035

India Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

India Ready-to-mix Food Market Size and Share Forecast Outlook 2025 to 2035

India Steel Drum & IBC Market Size and Share Forecast Outlook 2025 to 2035

India Lab Grown Diamond Jewelry Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

India Kaolin Market Analysis - Size, Share, and Forecast 2025 to 2035

India Outbound Meetings, Incentives to Europe Market Size and Share Forecast Outlook 2025 to 2035

India Hydrological and Meterological Equipment Market Size and Share Forecast Outlook 2025 to 2035

India Loyalty Program Market Analysis - Size, Share, and Forecast 2025 to 2035

India Injection Moulders Market – Demand and Growth Forecast 2025 to 2035

India Solar Panel Mounting Structure Market Analysis and Forecast for 2025 to 2035

India Residential Solar Inverter Market Growth – Trends & Forecast 2025 to 2035

India Power Metering Market Insights – Trends & Forecast 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

India Centrifugal Pumps Market Report – Trends, Demand & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA