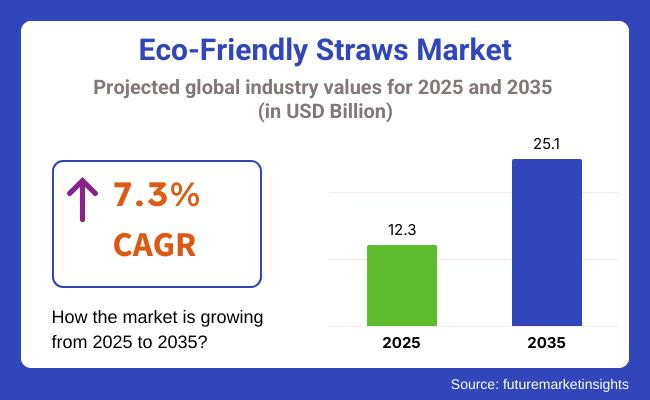

The global eco-friendly straws market is estimated at approximately USD 12.3 billion in 2025, with projections indicating growth to nearly USD 25.1 billion by 2035, representing a compound annual growth rate (CAGR) of 7.3% over the forecast period.

These straws include alternatives such as paper, bamboo, metal, glass, and polylactic acid (PLA), which have gained adoption as sustainable solutions to mitigate plastic pollution. The increasing regulatory restrictions on single-use plastics, especially within foodservice and hospitality sectors, are primary factors driving demand for these biodegradable and reusable products.

Market expansion is supported by stricter legislation targeting plastic use, notably the European Union’s Single-Use Plastics Directive and various USA state-level bans, which have prompted quick-service restaurants and beverage companies to transition toward sustainable straw options. Additionally, investments in organic packaging materials and manufacturing innovations are enhancing product durability and environmental performance.

Technological progress has improved eco-friendly straws’ resistance to moisture and temperature fluctuations through advanced waterproof coatings, making them suitable for both hot and cold beverages. Production innovations have lowered costs and enabled greater customization, further accelerating adoption. Meanwhile, reusable straws crafted from metal, glass, and bamboo have increased market share, driven by their durability and aesthetic appeal.

Consumer preferences for sustainable dining experiences are a significant growth driver, with market surveys showing an increasing number of customers favoring environmentally responsible products. Custom-designed straws also contribute to brand differentiation and adoption rates.

Jennifer Nash, CEO of World Centric, a leading compostable foodservice products manufacturer, stated:"As businesses and consumers demand more sustainable alternatives to plastics, innovations in biodegradable and compostable straws are critical to reducing waste and protecting our environment.”

Straws with diameters of 7-10 mm and 10-15 mm are anticipated to dominate the eco-friendly straws market in 2025. The 7-10 mm straws are widely favored by coffee shops, juice bars, and fast-food outlets due to their ideal balance of strength, usability, and compatibility with both hot and cold beverages. These straws offer greater durability and moisture resistance compared to traditional paper straws, making them a preferred choice among foodservice providers and environmentally conscious consumers.

The 10-15 mm diameter straws have found increasing adoption in bubble tea shops, smoothie bars, and specialty beverage stores, where thicker liquids and inclusions such as fruit chunks and tapioca pearls require wider openings. These straws are commonly manufactured from recyclable paper, reusable bamboo, or biodegradable polylactic acid (PLA), combining sustainability with enhanced drinking experience.

Manufacturers are investing heavily in water-resistant coatings, durable bamboo options, and strengthened paper straws to meet growing market demands. Regulatory initiatives targeting plastic bans in major beverage chains further accelerate the uptake of these wider eco-friendly straws in the foodservice sector.

The paper straw segment is expected to hold a significant share of the eco-friendly straws market in 2025, led by two key materials: virgin kraft paper and recycled paper. Virgin kraft paper straws dominate due to their high purity, superior strength, and smooth texture, accounting for approximately 38% of paper straw sales. Recycled paper straws capture around 22%, favored for their sustainable sourcing and environmental appeal. Both types benefit from advancements in water-resistant coatings that improve durability without compromising biodegradability.

Bamboo straws, valued for their natural appearance and reusability, are anticipated to secure roughly 15% market share. Their robust structure and renewable nature appeal strongly to environmentally conscious consumers seeking long-term sustainable alternatives. Polylactic acid (PLA) straws, made from plant-based bioplastics, are projected to account for about 12% of the market due to their compostability and versatility.

Emerging segments such as pasta-based straws, glass straws, and metal straws collectively account for the remaining share, with pasta straws appealing as a novel edible option, glass straws favored for durability and aesthetics, and metal straws gaining popularity for long-term reuse. Overall, consumer preference shifts and stringent regulations banning single-use plastics drive robust growth and diversification in eco-friendly straw materials.

The eco-friendly straws market in North America has been the most dominant market, thanks to the high consumer awareness regarding sustainability, along with the increasing government regulations banning single-use plastics and investments in biodegradable packaging solutions. North America (United States & Canada) is developing and commercializing next-generation environment-friendly straws that are compostable and resilient and have excellent durability and water resistance.

Market expansion is being driven by increased demand for sustainable foodservice packaging, rising adoption of eco-conscious dining options, and increasing partnerships between restaurants and green packaging manufacturers. Furthermore, this is being driven even more so by the increase in corporate sustainability pledges and plastic-free packaging commitments, among others.

Factors in Europe&rsquos market for drinking straws include rising demand for plastic-free options, favorable government policies for circular economy practices, and technological advancements in the field of compostable materials. Germany, France, and the UK are developing high-performance, fully recyclable, and biodegradable straws for restaurants, cafes, and retail food packaging.

These factors, along with the increasing focus on lessening carbon footprints, rising applications in organic beverage packaging, and exploration of plant-based coatings to enhance durability, are additionally driving the growth of the market. Furthermore, increasing applications in premium sustainable packaging, reusable straw solutions, and home compostable straws are providing a rise in opportunities for manufacturers and suppliers.

Asia Pacific is the fastest-growing region in the eco-friendly straws market mainly due to increasing urbanization, growing consumer inclination towards sustainable beverage packaging, and various government initiatives to control plastic waste. Cost-effective, high-performance, eco-friendly straws are being researched and developed on a large scale in China, India, and Japan using sustainable materials such as bamboo, rice husks, and biodegradable plastics.

Growing demand for sustainable straws generated by quick-service restaurants (QSRs), rapid expansion of food delivery services, and evolving regulatory framework, in addition to government initiatives promoting green manufacturing, is fueling growth across the regional market. Also, growing awareness of compostable tableware coupled with innovation in durable, plant-based materials will foster further market penetration. Domestic eco-packaging manufacturers and collaboration with international food service brands also fuel market expansion.

The market for eco-friendly straws will continue to expand in the years to come as new, improved plant-based materials, compostable packaging technologies, and waterproof biodegradable coatings continue to be developed. For several years, companies have been working on innovations in terms of durable and reusable materials, leak-proof straws, and microwave-safe and freezer-friendly materials to make the product more functional, marketable, and usable.

Future industry drivers are also being shaped by the rising consumer interest in plastic-free dining, digital integration in sustainable food packaging, and changing regulatory standards. Leading packaging innovations with the combination of AI-driven supply chain optimization, bio-based material improvements, and next-generation compostable solutions are continuing to optimize packaging efficiency and provide high-quality, sustainable food packaging for consumers worldwide.

Challenge

High Production Costs and Limited Material Availability

The high cost of sustainable raw materials, including bamboo, paper, metal, and bioplastics, are some of the challenges impacting the growth of the Eco-friendly straws market. Traditional plastic straws are cheap to produce, but eco-friendly straws need to be specially processed and treated to meet food safety standards and ensure they are durable and moisture resistant.

Moreover, the variability of sustainable material supply and reliance on agricultural co-products affect production costs and scaling. These cost barriers would require investments in efficient manufacturing processes, alternative raw materials, and localized supply chains by the companies.

Performance Issues and Consumer Adoption Challenges

It&rsquos common to hear gripes about the performance of eco-friendly straws, the sogginess, the structural weakness, and the changing flavors of drinks.Paper straws can disintegrate when submerged in liquid and create a poor experience for consumers. But metal and bamboo straws also need to be cleaned and maintained, which may get in the way of widespread adoption.

Consumer awareness of the eco-friendly advantages of sustainable straws and innovation in high-performance straws are imperative for sustainable long-term market acceptance. This means that companies will need to support research and development to improve the durability of products, the quality of coatings, and the features of reusable, biodegradable offerings that are age-appropriate for consumers.

Opportunity

Increasing Demand for Plastic-Free and Sustainable Alternatives

Increasing awareness of plastic pollution and government bans on single-use plastics are fueling eco-friendly straws demand. Businesses in the food service, hospitality, and retail sectors are responding by looking for sustainable options to help them stay outside of environmentally-based regulations and achieve more in their corporate social responsibility (CSR) goals.

Emerging green dining trends, zero-waste lifestyles, and a growing consumer preference for biodegradable products all offer significant opportunities. This growing demand will aid firms in developing innovative straw designs, compostable materials, and sustainable branding.

Technological Advancements in Biodegradable and Reusable Straws

Researchers are pushing forward toward new types of straws with increased durability, at the same time as being biodegradable or easily reusable, thanks to advancements in material science and manufacturing methods. In addition, novel materials like seaweed-based straws, rice straws, and PLA (polylactic acid) bioplastics enable stronger implements whilst retaining advantageous sustainability properties.

Moreover, the inclusion of smart coatings, which resist moisture degradation and improve usability, is transforming the market. Hence, firms utilizing AI-based material research, innovation in bio-based polymers, and recycling solutions for packaging would find a leading edge in the changing eco-friendly straws market.

Market Dynamics and Future Prospects Over the last decade, the Eco-friendly straws market has transformed in response to evolving consumer preferences and environmental concerns, reshaping the landscape for the food and beverage industry. Barreira said many businesses turned to paper, bamboo and metal straws as a viable alternative, with vastly improved material durability in some cases and biodegradability of some material types.

But widespread adoption was hindered by high costs, limited availability of materials, and consumer resistance to some kinds of straws. Altering product durability, expanding distribution channels and multi-use straw solutions to fulfill sustainability objectives.

In terms of gross bioengineered materials, AI-fueled sustainable manufacturing, and smart composting technologies, 2025 to 2035 will likely see major advances in the market. Here, the industry will redefine with the innovation of edible straws, reusable smart straws with embedded filtration, and stably home-compostable straws.

Blockchain adoption for supply chain transparency, AI-powered waste reduction analytics, and biodegradable straw subscription services will also drive market growth. The next wave of sustainable straw development will include innovative companies that make eco-innovation, regulatory compliance, and consumer engagement core priorities.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Government bans on plastic straws and single-use plastics |

| Technological Advancements | Growth in paper, bamboo, and metal straw production |

| Industry Adoption | Increased use in restaurants, cafes, and hospitality sectors |

| Supply Chain and Sourcing | Dependence on agricultural byproducts and imported bioplastics |

| Market Competition | Dominance of traditional eco-packaging manufacturers |

| Market Growth Drivers | Demand for plastic-free alternatives and sustainable dining solutions |

| Sustainability and Energy Efficiency | Initial focus on compostable and biodegradable straws |

| Integration of Smart Monitoring | Limited tracking of compostability and waste impact |

| Advancements in Product Innovation | Development of reusable, biodegradable, and compostable straws |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global regulations, AI-driven compliance tracking, and mandatory biodegradability certifications |

| Technological Advancements | Development of bioengineered, edible, and self-decomposing straw materials |

| Industry Adoption | Widespread adoption in smart dining, airline catering, and home-composting consumer products |

| Supply Chain and Sourcing | Shift toward regenerative raw materials, closed-loop manufacturing, and AI-powered supply chain optimization. |

| Market Competition | Rise of sustainable packaging startups, AI-driven material science firms, and innovative zero-waste brands |

| Market Growth Drivers | Growth in circular economy investments, smart packaging solutions, and consumer-driven sustainability movements |

| Sustainability and Energy Efficiency | Large-scale implementation of zero-waste production, carbon-neutral manufacturing, and energy-efficient processing |

| Integration of Smart Monitoring | AI-powered waste analytics, blockchain-based material tracking, and digital sustainability scoring |

| Advancements in Product Innovation | Introduction of smart self-cleaning, filter-integrated, and edible straw solutions |

The United States is the leading consumer of eco-friendly straws owing to the surging laws by the authorities that prohibit single-use plastic straws, rising customer inclination towards the utilization of sustainable products, and robust adoption of bio-based and compostable materials in the food service segment. The growing adoption of zero-waste dining is continuing to spur market growth.

Growing investments in innovative materials, including paper, bamboo, stainless steel, and wheat straw, in addition to developments in durability, heat resistance, and biodegradability, also encourage growth. Moreover, the functions of a toxin-free, reusable and home-compostable are also providing a boost to attract customers.

The companies are also emphasizing on producing flexible, bendable and flavor infused biodegradable straws for different beverage applications. Also, demand in the USA market is further anticipated to be driven by the rising adoption of sustainable dining solutions in cafes, quick-serve restaurants, and corporate catering services.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

In the UK, one of the major markets for biodegradable straws is the strict environmental policies, the ban on plastic straws across the country, and increasing awareness among consumers about sustainable options.

Market growth is also being driven by the demand to reduce single-use plastics in food packaging. Increasing government regulations for the biodegradability and reusability of straws along with the development of edible, compostable and plant-based materials drive growth across the market. In addition, innovative seaweed-based, pasta and silicone straws are becoming increasingly popular.

They're helping fund commercially scalable, lower-cost methods of producing sustainable straws to drive down prices to mass-market levels. Moreover, the introduction of premium design-oriented and high-durability eco-friendly straws in upscale restaurants, bars, and event catering services, among others, continued to drive market adoption in the UK. Also, demand is being driven by the growth of home beverage consumption and e-commerce availability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

Germany, France, and Italy are the three main countries in Europe driving growth for the eco-friendly straws market due to stringent environmental policies, increasing demand for sustainable food packaging, and investments in biodegradable straw alternatives.

Rapid market growth is driven by the European Union's focus on the reduction of plastic waste and investments in technology of bio-based and compostable materials. Moreover, with the growing preference for use of durable, heat-resistant, and tasteless edible straws, the functional capabilities of the products are being increased. The growing demand for biodegradable straws from beverage chains, stadiums, and hospitality venues is also boosting the market.

There is also a significant contribution in terms of increasing adoption across the EU due to the emergence of innovative materials like developers in agave fiber, cornstarch rice husk etc., along with the gradually increasing reusable straw alternatives. Moreover, stringent environmental regulations and growing subsidies for sustainable packaging producers are paving the way for significant innovation in the green straw space.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.2% |

Some of the major factors driving the growth of the eco-friendly straws market in Japan include the country&rsquos growing focus on sustainable packaging, rising adoption of biodegradable and recyclable materials, and increasing demand on high-quality, durable, and fashionable drinking straws. The increased trend of minimal waste and sustainable dining experiences is helping the market to grow.

The National Initiative driving advanced material engineering in the country, along with the inclusion of anti-sogging and high-strength and flavor-enhancing properties with the composites, is a significant driver of innovation. In addition, stringent government measures to reduce plastic waste and encourage eco-friendly foodservice packaging options are contributing to companies in the industry developing high-quality, reusable, and plant-based straw substitutes.

The growing demand for premium, reusable, and custom-branded eco straws from cafes, boba tea shops, as well as fast-food chains is giving the market an additional boost in the food service industry in Japan. In addition, tomorrow&rsquos innovative compostable and biodegradable polymer technology, which derives from sustainable sources, is being developed in Japan and shaping the future of dining accessories.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

Eco friendly straws market is emerging as a key driver in South Korea considering the growing consumer demand particular to sustainable usage and efforts by South Korea government on restrictions on the usage of plastic straws and increasing utilization of biodegradable material in Korea foodservice sector. Market growth is driven by strict environmental laws along with high investment in alternatives like rice straw, sugarcane, and PLA (polylactic acid) straw.

The country is also focusing on eco-friendly straws through material science and smart coatings to boost the durability, water resistance, and biodegradability of the straws, which in turn, will enhance competitiveness. An increase in demand for plant-based, toxin-free, and reusable straws used in coffee chains, juice bars, and convenience stores is also driving the adoption in the market.

Corporations are investing in scalable biodegradable production methods, eco-friendly certifications, and innovations with two reusable straws. The increasing focus on sustainable lifestyles and consumer inclination towards zero-waste products in South Korea is further fueling demand for eco-friendly straws.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

Growing regulations against single-use plastics, increasing consumer inclination toward sustainable alternatives, and rising cognizance pertaining to environmental challenges are expected to propel the global eco-friendly straws market expansion. Companies are developing biodegradable, compostable, and reusable materials for catering to the food service and retail industries. Finishers features straws made from paper, bamboo, metal, and even edible options, as well as plant-based biodegradable innovations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Aardvark Straws (Hoffmaster Group) | 18-22% |

| Huhtamaki Oyj | 14-18% |

| Novolex Holdings, Inc. | 11-15% |

| Biopac UK Ltd. | 8-12% |

| Eco-Products, Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Aardvark Straws (Hoffmaster Group) | Leading provider of durable, biodegradable paper straws made from sustainably sourced materials. |

| Huhtamaki Oyj | Specializes in compostable plant-based straws for the food service industry. |

| Novolex Holdings, Inc. | Develop eco-friendly paper and PLA-based biodegradable straws. |

| Biopac UK Ltd. | Offers innovative, sustainable drinking straws made from compostable materials such as bamboo and wheat. |

| Eco-Products, Inc. | Focuses on plant-based straws, including PLA and compostable alternatives, for environmentally conscious consumers. |

Key Company Insights

Aardvark Straws (Hoffmaster Group) (18-22%)

Aardvark Straws manufactures the leading paper straw brand in the world, offering the highest quality and most reliable biodegradable paper straws on the market. It specializes in FDA-compliant, food-safe materials that decompose rapidly and are non-toxic to the environment. Aardvark's strong brand presence and partnerships with major food service providers contribute to its market leadership.

Huhtamaki Oyj (14-18%)

Huhtamaki has also developed compostable ones, for instance, out of plant-based material, and produces a large variety for the restaurant industry and beverage brands. This focus on sustainable innovation and renewable materials (including molded fiber and bioplastics) reaffirms the company&rsquos commitment to environmental responsibility. Huhtamaki is highly committed to a sustainability-oriented future and continues to broaden its product offering to follow global trends.

Novolex Holdings, Inc. (11-15%)

Novolex makes environmentally friendly paper and PLA-based disposable straws for food service providers and retail consumers. It also stresses sophisticated manufacturing processes that add strength and durability to its products. Novolex&rsquos commitment to innovation and high-volume manufacturing positions it to satisfy escalating worldwide demand for sustainable solutions.

Biopac UK Ltd. (8-12%)

Biopac UK Ltd. is an extensive supplier of compostable and biodegradable straws from alternative materials, including bamboo, wheat, and sugarcane. Specializing in sustainable solutions, the company supports global efforts to reduce the use of plastic. Biopac is well positioned in the eco-friendly packaging market, given its strong presence in Europe.

Eco-Products, Inc. (6-10%)

Eco-Products specializes in making plant-based straws made from renewable resources, such as PLA and compostable paper. The company widely promotes sustainability through waste reduction and partnerships with eco-friendly brands. Eco-Products is leveraging its innovation within the food packaging industry to position itself as a leader in eco-friendly straws.

Other Key Players (30-40% Combined)

The global eco-friendly straws market is comprised of many international and local/UI manufacturers that focus on sustainable, biodegradable, and durable products. Key players include:

The overall market size for eco-friendly straws market was USD 12.3 billion in 2025.

The eco-friendly straws market expected to reach USD 25.1 billion in 2035.

The growing government regulations on plastic straws, rising consumer preference for environmentally friendly alternatives, increased awareness about environmental impact, growing adoption of these solutions in food services, and significant developments in biodegradable and compostable straw materials are fueling the demand for the eco-friendly straws market.

The top 5 countries which drives the development of eco-friendly straws market are USA, UK, Europe Union, Japan and South Korea.

Distributors and retailers strengthen market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Straw Width / Diameter , 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Straw Width / Diameter , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Straw Width / Diameter , 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Straw Width / Diameter , 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Straw Width / Diameter , 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Straw Width / Diameter , 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Straw Width / Diameter , 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Straw Width / Diameter , 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Straw Width / Diameter , 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Straw Width / Diameter , 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Straw Width / Diameter , 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Straw Width / Diameter , 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Straw Width / Diameter , 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Straw Width / Diameter , 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Straw Width / Diameter , 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Global Market Attractiveness by Straw Width / Diameter , 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Straw Width / Diameter , 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Straw Width / Diameter , 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Straw Width / Diameter , 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: North America Market Attractiveness by Straw Width / Diameter , 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Straw Width / Diameter , 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Straw Width / Diameter , 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Straw Width / Diameter , 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Straw Width / Diameter , 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Straw Width / Diameter , 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Straw Width / Diameter , 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Straw Width / Diameter , 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 116: Europe Market Attractiveness by Straw Width / Diameter , 2023 to 2033

Figure 117: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Straw Width / Diameter , 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Straw Width / Diameter , 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Straw Width / Diameter , 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Straw Width / Diameter , 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Straw Width / Diameter , 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Straw Width / Diameter , 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Straw Width / Diameter , 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Straw Width / Diameter , 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 176: MEA Market Attractiveness by Straw Width / Diameter , 2023 to 2033

Figure 177: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Application, 2023 to 2033

Figure 179: MEA Market Attractiveness by End User, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canada Straws Market Size and Share Forecast Outlook 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA