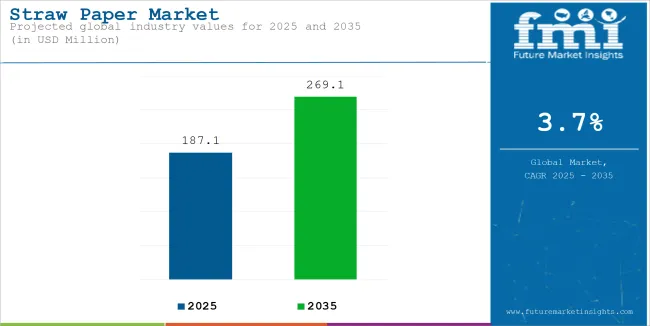

The global straw paper market is estimated to account for USD 187.1 million in 2025. It is anticipated to grow at a CAGR of 3.7% during the assessment period and reach a value of USD 269.1 million by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Straw Paper Market Size (2025E) | USD 187.1 million |

| Projected Global Straw Paper Market Value (2035F) | USD 269.1 million |

| Value-based CAGR (2025 to 2035) | 3.7% |

Straw paper refers to paper generally produced from agro-wastes like straw which is derived from agricultural by-products. It has gained popularity among many people due to its eco-friendly feature since, instead of making it from tree wood pulp as conventional paper, it turns waste products produced from agriculture and usually burned. The process of straw paper involves using a combination of mechanical and chemical treatments to break down the straw fibers and transform them into a usable form of paper.

Growing awareness globally of sustainability is the prime growth factor in the straw paper market. Due to concerns about the increase of plastic waste in food and beverages, companies have taken the straw paper route to their packaging, considering that it is made of agricultural waste. The biodegradable alternative has now come about from straw paper to combat the growing issues with single-use plastics. This is in line with the global efforts to reduce plastic waste, especially in countries that have strict environmental regulations.

| Attributes | Details |

|---|---|

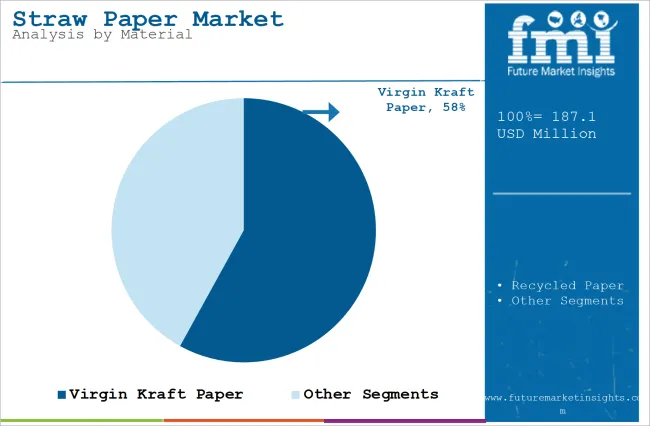

| Top Material | Virgin Kraft Paper |

| Market Share in 2025 | 58% |

In terms of material type, the market is divided into virgin kraft paper and recycled paper. The virgin kraft paper segment is poised to witness a 58% share in 2025. Virgin craft paper is mostly used in making straw paper since it has inherent strength and durability. These are two qualities that a good quality paper product should possess.

Virgin craft paper is 100% wood pulp, offering strong, flexible, and tear-resistant material. This is a perfect base for making straw paper, primarily due to the need for maintaining these properties of packaging, food containers, and wrapping applications.

Virgin craft paper ensures that the final product of straw paper presents to be smooth and uniform in texture, which would be important for printing and branding purposes. Virgin craft paper gives a better ground for incorporating straw, agricultural waste, to prevent the compromise of the performance of the paper. This makes it an attractive option for manufacturers looking to create eco-friendly biodegradable packaging solutions that also meet the functional and aesthetic requirements of food service, retail, and logistics.

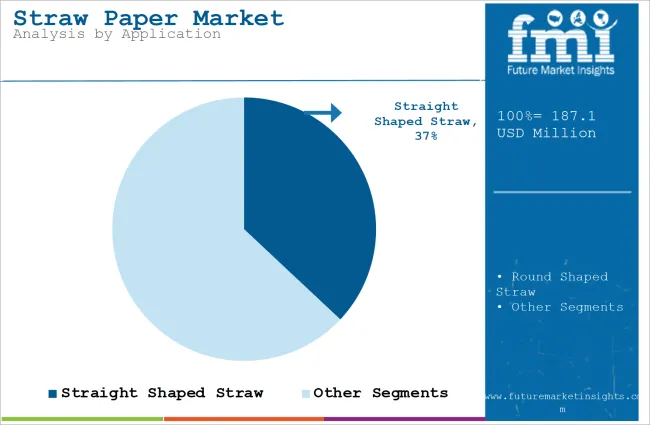

| Attributes | Details |

|---|---|

| Top Material | Straight Shaped Straw |

| Market Share in 2025 | 37% |

With respect to application, the market is classified into straight shaped straw and round shaped straw. The straight shaped straw segment is anticipated to witness a 37% share in 2025.

The plain straw shape sells best primarily on grounds of their ease, light usages, and flexible options. Most conventional and accustomed shapes for any type of straw make it easily available to multiple business applications within food service as well as a sales venue. With an easy method for manufacturing and handling packaged forms, cost savings for quantities also enhance these aspects in many places.

Besides, straight-type straws are regular in their use, as they are easy to insert into any drink and do not require adjustments or specific handling. They also easily fit into an extensive range of beverage containers, from small cups to large bottles, and, thus, can be applied with considerable flexibility across various industries. Another reason why the straight straw has been favored in many respects is because of the simple, neat appearance of a plain straight straw, which gives it more of an upscale appeal.

Government Regulations and Bans on Single-Use Plastics

The widespread implementation of regulations and bans on single-use plastics among governments all over the world has challenged industries to seek alternatives for sustainable packaging. The market is a resultant benefit of these regulations, as it provides a good alternative to plastic straws, plastic bags, and other packaging materials. Authorities such as the European Union have already prohibited or limited the use of various plastic-based products, thus pushing companies toward using biodegradable materials, especially those that are compostable and recyclable.

Growing Raw Material Availability from Agricultural Waste

The raw materials for straw paper are abundant agricultural byproducts such as wheat straw, rice straw, and other crop residues. The increasing availability of these raw materials is a major factor in the growth of the straw paper market. Agricultural waste is usually discarded or burned; using it to make paper products provides an efficient use of resources and reduces environmental waste. This supports sustainable practices but also decreases the cost of raw materials for manufacturers, so straw paper is attractive to businesses that seek an eco-friendly packaging solution.

Move Toward Biodegradable and Environment-Friendly Options

One of the key trends in the market is the increasing demand for biodegradable and eco-friendly packaging solutions. Due to increasing environmental awareness regarding the use of single-use plastics by businesses and consumers, sustainable alternatives such as straw paper are increasingly being sought.

This is very evident in the food and beverage industry, where straw paper is used to replace plastic straws, bags, and food containers. Not only do consumers contribute to the movement, but tougher government regulations in some regions ban or restrict plastic and will push toward increased use of straw paper for packaging and beyond.

Conscious Consumerism and Sustainability

The mega consumer trend in this straw paper industry is conscious consumerism, whereby many consumers today make purchasing decisions guided by the principle of environmental effect. This gives rise to sustainability-based products that use straw paper. With growing awareness of the damage caused by plastic pollution and the depletion of natural resources, there is a strong shift toward supporting brands and products that use eco-friendly, biodegradable materials.

This movement is especially influential in the packaging and food service industries, where consumers are actively seeking out brands that reduce their carbon footprint and offer sustainable alternatives like straw paper. This is changing the market, driving companies to adapt to greener practices and target the environmentally conscious consumer.

Low Production Capacity and Scalability

The straw paper industry is further confined by limited and non-scalable manufacturing processes. Even though straw paper might be a paper alternative with excellent environmental features, the production system for straw-based paper manufacturing will not be almost as wide nor as established as it can be with natural wood pulp paper.

This ultimately results in raising the cost of production, decreasing availability, and making it somewhat challenging to manufacture enough to reach the ever-greater demand for such paper. Moreover, special machinery and operations that would treat the agricultural wastes for paper production further constrict market growth potential as there is limited availability and presence in various regions of production facilities.

The USA market is set to observe a 29.1% share in 2025. As for straw paper in the USA market, increasing demand in response to the shift from conventional plastic or paper, seeking eco-friendly sustainable alternatives by American consumers to a large degree supports this argument.

This rising consciousness is regarding the environmental impact resulting from plastic, and an area where they should have particular vigilance about impact includes the food service and packaging industry. It is made from agricultural waste, such as wheat and rice straw, which is biodegradable and recyclable, making it an attractive option for companies looking to reduce their carbon footprint.

With increasing awareness of the environment, UK consumers prefer products made of renewable and sustainable materials. Growing concern over the harm caused by plastic to the environment is forcing various organizations to take up greener practices. More demand for this is fueled by the positive growth of the UK's circular economy, which uses materials such as straw to create valuable products, including packaging and paper.

Such a combination of drivers of regulatory support, consumer demand for sustainable products, and circular economy makes a perfect boost to the straw paper market in the UK

As of recent years, the growth in straw paper demand has come along with good, solid policies set forth in the German market with a deep influence in this particular sphere by both growing concern toward environmental awareness and new awareness on sustainable ways to achieve everything among consumer habits and companies' activity. This has provided the right climate to adopt sustainable materials such as straw paper in all sectors like food packaging, retail, and consumer goods.

China's focus on a more sustainable environment and waste management translates to an emerging market. China has promoted policies aimed at dealing with pollution and developing plastic waste into more environmentally friendly products. In pursuance of using biodegradable materials, the country has encouraged the use of straw paper in packaging and food service.

The government's environmental regulations, which include a plastic straw ban and plastic packaging limitations, push companies toward the use of alternative products, hence creating a more favorable market for straw paper.

With Japan being a high-ecology-aware country and more and more consumers seeking ecological alternatives to standard packaging and goods, the growing consumer pressure for sustainable options is driving up demand for straws made out of straw paper; these are a sustainable alternative produced from byproducts of the agricultural industry.

As businesses and industries in Japan react to this demand and the country's regulatory push, straw paper is becoming the first choice for packaging and other applications. The fueling of this growth is, therefore, a result of government policy support and consumer demand for sustainability in the straw paper market in Japan.

With growing eco-conscious consumerism, India is experiencing the demand for sustainable products. This is due to the increased awareness of the consumer about the impact of his choice on the environment. As people become more environmentally conscious, they are now turning towards renewable and biodegradable products.

One such attractive option is straw paper, which is made from agricultural byproducts like wheat and rice straw. A combination of the impact of governmental regulations, awareness of environmental concerns, and customer demand for environment-friendly alternatives are leading to a boom in the market size in India.

Established Players Driving Sustainable Packaging Solutions

Key players in the market include Hadi Paper, Kraft Paper Group, and Papeteries de Gennevilliers, who have established themselves by focusing on the sustainable paper production segment. These companies leverage their expertise in manufacturing and converting agricultural waste into functional paper products.

They developed their growth strategy by expanding product lines to cover various types of packaging materials like straws, food containers, and wrapping paper made from straw paper. Such companies are also engaging in research and development to upgrade the quality, strength, and moisture resistance of straw paper for industries in search of alternative sustainable packaging compared to traditional ones.

Emerging players in the straw paper market focus on innovation in eco-friendly paper products. These include growth strategies such as capitalizing on the rising demand for biodegradable and recyclable packaging in the food service, retail, and packaging industries and the like. These startups are differentiating themselves through unique value propositions such as offering custom-designed paper products, exploring new agricultural waste sources, and partnering with eco-conscious brands.

They also focus on expanding their production capabilities and forming strategic alliances with retailers and food manufacturers to strengthen their market presence. These companies are actively promoting the environmental benefits of straw paper to attract a growing segment of eco-conscious consumers.

Eco-conscious Startups Drive Change

Eco-Paper Innovations and GreenStraw Packaging, among other start-ups, are beginning to make niches for themselves in the world of straw paper by targeting sustainability in packaging. Companies believe in the importance of obtaining biodegradable and recyclable paper products from agricultural wastes such as wheat and rice straw.

Their growth strategy is centered around using more advanced production technology to develop higher-quality straw paper that will support the packaging and printing requirements of eco-friendly brands. They are also working on increasing their product lines, from food packaging to eco-friendly straws, to cater to the growing demand for sustainable alternatives in various industries.

Strategic Partnerships and Eco-Friendly Positioning

BioStraw Paper Co. and StrawPapers are other startups that pursue growth through strategic partnerships with food-service chains, retailers, and packaging manufacturers, aiming to give the corporations specific solutions to shift away from plastic and toward more sustainable packaging options.

Their growth strategies include partnerships with companies that place environmental responsibility on the top of their agenda, certification of products (such as compostability and recyclability labels), and direct-to-consumer channels to raise awareness of the environmental benefits of straw paper. Combining product innovation with strong sustainability branding, these startups are positioning themselves at the forefront of a rapidly growing market for eco-friendly packaging.

In terms of material type, the market is divided into virgin kraft paper and recycled paper.

By application, the market is classified into straight shaped straw and round shaped straw.

From the regional standpoint, the market is segregated into Latin America, Asia Pacific, the Middle East & Africa, North America, and Europe.

The market is anticipated to reach USD 187.1 million in 2025.

The market is predicted to reach a size of USD 269.1 million by 2035.

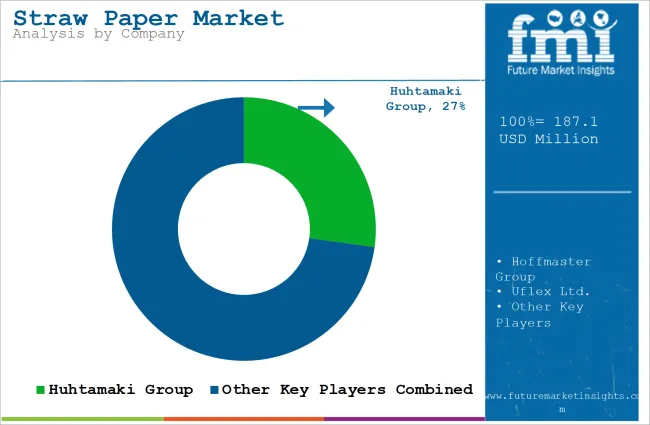

Some of the key companies manufacturing the product include Hoffmaster Group, Uflex Ltd., and others.

The USA is a prominent hub for product manufacturers.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Pulp Type, 2019 to 2034

Table 4: Global Market Volume (Unit pack) Forecast by Pulp Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Unit pack) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End use, 2019 to 2034

Table 8: Global Market Volume (Unit pack) Forecast by End use, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Unit pack) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Pulp Type, 2019 to 2034

Table 12: North America Market Volume (Unit pack) Forecast by Pulp Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (Unit pack) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End use, 2019 to 2034

Table 16: North America Market Volume (Unit pack) Forecast by End use, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Unit pack) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Pulp Type, 2019 to 2034

Table 20: Latin America Market Volume (Unit pack) Forecast by Pulp Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (Unit pack) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End use, 2019 to 2034

Table 24: Latin America Market Volume (Unit pack) Forecast by End use, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Unit pack) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Pulp Type, 2019 to 2034

Table 28: Western Europe Market Volume (Unit pack) Forecast by Pulp Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Western Europe Market Volume (Unit pack) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End use, 2019 to 2034

Table 32: Western Europe Market Volume (Unit pack) Forecast by End use, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Unit pack) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Pulp Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Unit pack) Forecast by Pulp Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Eastern Europe Market Volume (Unit pack) Forecast by Application, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End use, 2019 to 2034

Table 40: Eastern Europe Market Volume (Unit pack) Forecast by End use, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Unit pack) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Pulp Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Unit pack) Forecast by Pulp Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Unit pack) Forecast by Application, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End use, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Unit pack) Forecast by End use, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Unit pack) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Pulp Type, 2019 to 2034

Table 52: East Asia Market Volume (Unit pack) Forecast by Pulp Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: East Asia Market Volume (Unit pack) Forecast by Application, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End use, 2019 to 2034

Table 56: East Asia Market Volume (Unit pack) Forecast by End use, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Unit pack) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Pulp Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Unit pack) Forecast by Pulp Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Unit pack) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End use, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Unit pack) Forecast by End use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Pulp Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End use, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Unit pack) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Pulp Type, 2019 to 2034

Figure 10: Global Market Volume (Unit pack) Analysis by Pulp Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Pulp Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Pulp Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (Unit pack) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End use, 2019 to 2034

Figure 18: Global Market Volume (Unit pack) Analysis by End use, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End use, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End use, 2024 to 2034

Figure 21: Global Market Attractiveness by Pulp Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by End use, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Pulp Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End use, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Unit pack) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Pulp Type, 2019 to 2034

Figure 34: North America Market Volume (Unit pack) Analysis by Pulp Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Pulp Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Pulp Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (Unit pack) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End use, 2019 to 2034

Figure 42: North America Market Volume (Unit pack) Analysis by End use, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End use, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End use, 2024 to 2034

Figure 45: North America Market Attractiveness by Pulp Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by End use, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Pulp Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End use, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Unit pack) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Pulp Type, 2019 to 2034

Figure 58: Latin America Market Volume (Unit pack) Analysis by Pulp Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Pulp Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Pulp Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (Unit pack) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End use, 2019 to 2034

Figure 66: Latin America Market Volume (Unit pack) Analysis by End use, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End use, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End use, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Pulp Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End use, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Pulp Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End use, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Unit pack) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Pulp Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Unit pack) Analysis by Pulp Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Pulp Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Pulp Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: Western Europe Market Volume (Unit pack) Analysis by Application, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End use, 2019 to 2034

Figure 90: Western Europe Market Volume (Unit pack) Analysis by End use, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End use, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End use, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Pulp Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End use, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Pulp Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End use, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Unit pack) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Pulp Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Unit pack) Analysis by Pulp Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Pulp Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Pulp Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Unit pack) Analysis by Application, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End use, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Unit pack) Analysis by End use, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End use, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End use, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Pulp Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End use, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Pulp Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End use, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Unit pack) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Pulp Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Unit pack) Analysis by Pulp Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Pulp Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Pulp Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Unit pack) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End use, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Unit pack) Analysis by End use, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End use, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End use, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Pulp Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End use, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Pulp Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End use, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Unit pack) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Pulp Type, 2019 to 2034

Figure 154: East Asia Market Volume (Unit pack) Analysis by Pulp Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Pulp Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Pulp Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 158: East Asia Market Volume (Unit pack) Analysis by Application, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End use, 2019 to 2034

Figure 162: East Asia Market Volume (Unit pack) Analysis by End use, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End use, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End use, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Pulp Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End use, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Pulp Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End use, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Unit pack) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Pulp Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Unit pack) Analysis by Pulp Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Pulp Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Pulp Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Unit pack) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End use, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Unit pack) Analysis by End use, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End use, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End use, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Pulp Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End use, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Straw Market Size and Share Forecast Outlook 2025 to 2035

Strawberry Seed Oil Market Analysis by Application, End-use, Distribution channel and Region Through 2035

Leading Providers & Market Share in the Straw Industry

Strawless Lids Market

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Straw Market Size and Share Forecast Outlook 2025 to 2035

Canada Straws Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Bamboo Straw Providers

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Eco-Friendly Straws Market Growth - Demand & Forecast 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA